The Thursday Report – 3.30.17 – Clapton is Thursday

Re: Clapton is Thursday

Using Lifetime Powers of Appointment in Trusts to Limit the Number of Qualified Beneficiaries

Basic Constitutional Principles That May Now be Litigated

Family Limited Partnership (FLP) Victory by Martin Shenkman

Is Your Life Private? by Bill Kahn

Avoid the 5 Biggest Management Mistakes by David Finkel

Richard Connolly’s World – Temper Your Trump Tax-Cut Hopes

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Alan at agassman@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

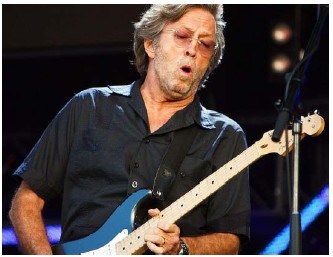

“It’s been up to me to inspire me.”

– Eric Clapton

Eric Clapton was born on March 30, 1945, in Surrey, England. He has been inducted into the Rock and Roll Hall of Fame three-times, once as a solo artist, and twice as a member of the bands Yardbirds and Cream. Clapton also spent a lot of time in the studio recording with The Beatles, and is the only guitarist to have played on a Beatles song (“While My Guitar Gently Weeps”), and individually on official studio recordings by John Lennon, Paul McCartney, George Harrison, and Ringo Starr.

Clapton often credits his blues and rock style of play to influences such as Muddy Waters, B.B. King and Buddy Guy, and often ranks as one of the five best and most influential guitarists of all time. If you are interested in reading more about Eric Clapton we strongly recommend reading his bestselling autobiography, which is creatively entitled Clapton: The Autobiography.

Florida readers are strongly recommended to watch this YouTube video of Eric Clapton playing with the Allman Brothers In Memory of Elizabeth Reed, which is 14:27 long, also known as 3/10 of a billable hour and can be great background music when cleaning your office.

Eric Clapton Trivia:

- He was the musical director of the “Concert for George” in November 2002 held on the one year anniversary of whose death? This event was at the Royal Albert Hall in London, and was attended by many celebrities including Alan Gassman.

- George Washington

- George Harrison

- George Costanza

- George Best

- He played alongside John Mayall between the years 1965 and 1966 as part of the group known as:

- John Mayall & the Treesplitters

- John Mayall & the Nutcrackers

- John Mayall & the Mugsmashers

- John Mayall & the Bluesbreakers

- He and other famous members, Ginger Baker & Jack Bruce, formed this rock band that played from 1966 to 1968:

- Half-and-Half

- Skim

- Cream

- Kefir

- Eric Clapton was a member of this band, along with four other members of Delaney & Bonnie and Friends from the years 1970 to 1971:

- Derek and the Hungry Howies

- Derek and the Dominos

- Derek and the Cicis

- Derek and the Papa Johns

- The album Layla and Other Assorted Love Songs was originally titled which of the following:

- Thursday Love Songs

- Layla’s Favorite Day is Thursday

- Thursday’s are for Lovers

- All of the Above

- The most famous song from Layla and Other Assorted Love Songs was “Layla”, which was inspired by Clapton’s then unrequited love for Pattie Boyd, the wife of his friend and fellow musician George Harrison. In 1979 Clapton and Boyd eventually married, but later got divorced on this day in 1988.

- Monday

- Tuesday

- Wednesday

- Thursday

Answers:

- B

- D

- C

- B

- D*

- D*

Using Lifetime Powers of Appointment in Trusts to Limit the Number of Qualified Beneficiaries

by Ken Crotty & Christopher Denicolo

Pursuant to Florida Law, the trustees of an irrevocable trust have an obligation to provide accountings to the trust’s qualified beneficiaries. As defined in Florida Statute §736.0103(16), a “qualified beneficiary” of a trust is a living beneficiary who, on the date the beneficiary’s qualification is determined: (1) is a distributee or permissible distributee of trust income or principal; (2) would be a distributee or permissible distributee of trust income or principal if the interests of the distributees described in clause (1) above terminated on that date without causing the trust to terminate; or (3) would be a distributee or permissible distributee of trust income or principal if the trust terminated in accordance with its terms on that date.

Florida Statute §736.0306 provides that designated representatives can be nominated under the trust document to have the power to represent the qualified beneficiaries and to receive the accountings on behalf of the qualified beneficiaries or waive the right to receive such accountings. Sometimes, however, it is difficult for the grantor to name a designated representative because a person may not be a designated representative if the person is serving as trustee, and a grantor might not have another individual available for this role.

For example, assume that upon the death of the grantor an irrevocable trust is established for the benefit of the grantor’s daughter and a separate irrevocable trust is created for the benefit of the grantor’s son, who does not speak to the daughter. If the daughter is serving as the co-trustee of the trust or as sole trustee of the trust, then the daughter may not serve as designated representative. If no designated representative is appointed, the daughter would need to provide accountings to all of the qualified beneficiaries of the trust, because any person named as a permissible distributee of income or principal would be entitled to receive such accountings.

To restrict the number of qualified beneficiaries, the grantor may want to consider providing the daughter with a lifetime power of appointment over the trust assets.

Assume that the daughter does not have descendants and is married. Further assume that (1) the grantor has provided that on the daughter’s death, the trust assets will be held for the benefit of the daughter’s spouse, (2) no designated representative is named under the trust, and (3) the grantor would like the daughter, as Trustee, to have the ability to make distributions from the trust for the benefit of the charities and also the daughter’s nieces and nephews who are the children of the siblings of the daughter’s spouse.

If the charities, nieces, and nephews are permissible beneficiaries, then they all would be entitled to receive trust accountings.

One way to avoid this result would be to provide the daughter with a lifetime power of appointment over the trust assets. If she exercises this power, she could appoint some of the trust assets to the charities, her niece, and/or her nephew. The trust would function as the grantor had intended, and the charities, nieces and nephews would not be qualified beneficiaries.

Sample language that could be used in the Trust is as follows:

The Primary Beneficiary shall have a limited Lifetime Power of Appointment (as defined in Section ____ of this Trust Agreement) with respect to his or her separate trust, provided that the Primary Beneficiary must exercise such power, if at all, by making specific reference to such power in a written document signed in the presence of two witnesses and a notary and delivered to the Trustee. Upon receipt of such document, the Trustee shall pay such principal or a portion thereof over which said power is exercised, as the Primary Beneficiary directs pursuant to the exercise of such power.

It is important that the holder of the power of appointment not be the sole trustee, as the applicable Florida Statute §736.0302 does not allow the holder of a power of appointment who is also the sole trustee to present and bind the possible appointees and takers in default. However, if the holder of the power of appointment is not the sole trustee, then such person, under said Florida Statute §736.0302, may represent and bind persons whose interests as permissible appointees, takers in default, or otherwise, are subject to the power.

This bit of creative drafting can help a client achieve certain privacy and other trust administration objectives.

Basic Constitutional Principles That May Now be Litigated

by Alan Gassman and Seaver Brown

These Are the Times That Try Men’s Souls.

Notwithstanding your political beliefs, it will be of interest to see the further definition of US Constitutional Law that will result from present positions being taken by the President and those who oppose him.

The framers of the Constitution could not think of everything, and what they meant by certain words will need to be carefully considered by courts in upcoming months.

Here are some of the key Constitutional provisions, with background on questions raised by the present political situation.

- Emolument from foreign entities controlled by foreign governments. The clause in question specifically states that “no Person holding any Office of Profit or Trust under them, shall, without the Consent of the Congress, accept of any present, Emolument, Office, or Title, of any kind whatever, from any King, Prince, or foreign State.” Article I, section 9, clause 8 of the United States Constitution.The word “emolument” comes from the Latin word emolumentum, which means “profit” or “gain.” As used in the United States Constitution, the purpose of the emolument clause is to prevent those in office from receiving gifts or profits from other governments. The Supreme Court has not yet directly addressed the emolument clause in any of its decisions, but its language has been cited in at least three Supreme Court cases for other reasons.

- Advice and consent of the Senate is one of the many checks built into the Unites States Constitution in an attempt to balance the powers given to each branch of government. The phrase appears in Article II, Section 2, Clause 2 or the United States Constitution.Specifically, this “power” is granted to the Senate and states that they must be consulted with and approve of treaties signed, and appointments to public positions made by the President, including Cabinet secretaries, federal judges, Supreme Court justices, U.S. Attorneys, and ambassadors.

According to one prominent conservative constitutional scholar, John O. McGinnis, “the Senate possesses the plenary authority to reject or confirm the nominee, although its weaker structural position means that it is likely to confirm most nominees, absent compelling reasons to reject them.”

- The President’s power to engage in military exercises without a declaration of war. The War Powers Resolution Act, 50 U.S.C. § 1541-1548, define the parameters by which the President can order military action. The President, when acting in capacity as the Commander-in-Chief, has limitations under this act, Subsection (c) of 50 U.S.C. § 1541 states that “only pursuant to (1) a declaration of war, (2) specific statutory authorization, or (3) a national emergency created by attack upon the United States, its territories or possessions, or its armed forces” may the President utilize military force.

- The ability of a President to withhold information, known as the Executive Privilege, is a judicially borne, implied power claimed by the President and other high ranking officials of the executive branch who advise the President. Specifically, it allows these individuals to keep communications private that would otherwise disrupt the functions or decision-making processes of the executive branch. It allows the President and his aides to ignore certain subpoenas and other interventions of the legislature and judicial branches.The official creation of this power is credited to the Supreme Court in the decision United States v. Nixon, but has been invoked by the executive branch since the time of George Washington. Even though Nixon was unable to withhold the White House recordings during the Watergate investigation, the Supreme Court noted “the valid need for protection of communications between high government officials and those who advise and assist them in the performance of their manifold duties.” It remains a contentious subject that many understand the importance of, but ultimately struggle with when attempting to balance the President’s need of candid advice and Congress’ right to information.

- The power to pardon criminal acts can be found under Article II, Section 2 of the United States Constitution, which states that the President “shall have power to grant reprieves and pardons for offenses against the United States, except in cases of impeachment.” The President cannot pardon those offenses that occur under state criminal laws, but only for those offenses recognizable under federal law. Most recently, in 2017, President Obama commuted the sentences of Chelsea Manning and Oscar Lopez Rivera.

Family Limited Partnership (FLP) Victory

by Martin Shenkman

Martin Shenkman, CPA, MBA, PFS, AEP, JD is an attorney in private practice in Fort Lee, New Jersey and New York City. His practice concentrates on estate and tax planning, planning for closely held businesses and estate administration. Mr. Shenkman is a prolific author and has published over 40 books and 1,000 articles. We thank Mr. Shenkman for allowing us to include this valuable piece of information in the Thursday Report.

For detailed articles on using FLPs in estate planning and other estate or tax planning topics, please click here.

FLPs have been a staple of estate planning so understanding when they work, like in the recent Purdue case is helpful. Don’t discard this knowledge even if the estate tax is Trumped as FLPs and LLCs will remain staples for asset protection and all the other reasons cited in this case.

The IRS challenged the transfer of assets to the FLP as not meeting the adequate and full consideration requirement. They also challenged gifts of FLP interests as not meeting the preset interest requirement for gift tax purposes. The FLP held marketable securities in separate accounts managed by different firms. There was also an interest in a net leased rental property.

The business purpose argued by the taxpayers was consolidation of assets and aggregation to meet qualified investor requirements.

The Court held for the taxpayers noting that there was no commingling of personal and entity assets, assets were properly transferred to the entity, the entity formalities were adhered to, and the taxpayers were in good health when the entity was created.

The case also involved a Graegin loan which was upheld even though there were assets outside the entity that might have been used to pay estate tax. With a Graegin loan, a loan is made to the estate which cannot by its terms be prepaid so that the estate can deduct all of the interest to be paid over the life of the loan thereby saving estate taxes.

To read the Estate of Purdue v. Comissioner case (TC Memo 2015-249) in its entirety, please click here.

Is Your Life Private?

by Bill Kahn

Bill Kahn has given hundreds of lectures on automation and electronic communications at both academic and other venues. He is credited with inventing an early, large-scale digital cellular telephone system that led to today’s modern systems. We at the Thursday Report thank him for his contribution this week with the following article that addresses the ever-increasing issue of privacy in the digital world.

If you thought the clamp-down on National Security Agency telephone spying was over, think again. There are a whole host of government programs available to local, state and federal authorities that expose who you are, where you’re traveling, who you’re meeting with and what you’re saying.

These programs are conducted under the cloak of secrecy. Ostensibly, they’re used to target individuals under surveillance for sound reasons. Unfortunately, the equipment can’t tell the good guys from the bad guys, so many individuals may be unwittingly caught up in its web.

As reported by KXTV in Sacramento, Calif., and other news organizations, one such government surveillance program is called Stingray. This program simulates a cellphone tower and tricks nearby mobile phones into connecting to it, rather than standard commercial towers. The system collects the cellular telephone number; incoming or outgoing status; number dialed; date, time and duration of the call; and its location.

Another federal program called Triggerfish, when combined with Stingray, exposes the actual content of the cellphone conversations. It allows law enforcement agencies to intercept up to 60,000 different cellular conversations over a targeted area. Add a few more features and it can be used as a phone listening device to hear oral exchanges even when the phone is thought to be turned off. All of this equipment is so mobile it can be located in planes, cars and boats.

There is also related equipment that can track the location of a cellphone — which is not really hard to do even with commercial equipment. However, here’s one you probably never thought of, tracking without a cellphone. Cameras at street intersections take pictures of a license plate when a car goes through a red light. But they also take pictures of everyone’s license plate, digitize them and make it possible to track the movement of every car. Add to that facial recognition software used in conjunction with security cameras in stores or on the street, and a person can also be tracked on foot.

Federal agencies have tried to meddle with public requests for information on Stingray. When the American Civil Liberties Union of Northern California submitted a Freedom of Information Acts request to the Department of Justice on the use of Stingray, it ignored the request.

ARS Technica reported in 2015 that a new Department of Homeland Security policy comes after federal agencies, most notably the FBI, have tried to tightly control information about Stingrays for years. The FBI and the Harris Corp., one of the primary manufacturers of the devices, had refused to answer specific questions.

Unfortunately when Stingray passes itself off as a legitimate cell tower, it can jam associated commercial networks when signal levels become alike at fringe areas.

The device is used by the FBI, Drug Enforcement Agency, Secret Service, National Security Agency, U.S. Marshals Service, Immigration and Customs Enforcement; Bureau of Alcohol, Tobacco, Firearms and Explosives; Homeland Security; police and the list goes on.

Unfortunately when Stingray passes itself off as a legitimate cell tower, it can jam associated commercial networks when signal levels become alike at fringe areas.

In 2014 CNET reported that police in Florida have offered a startling excuse for having used a controversial Stingray cellphone tracking gadget more than 200 times without telling a judge. The police’s excuse for not informing the judge was the device’s manufacturer made them sign a non-disclosure agreement that they say prevented them from telling the courts. The revelation came during an appeal of a 2008 sexual battery case in Tallahassee.

Rep. Jason Chaffetz, R-Utah, has introduced a bill in Congress that would prohibit government agencies from using Stingray type simulators without a warrant in most circumstances. Sens. Chuck Grassley, R-Iowa, and Patrick Leahy, D-Vermont, have asked the Department of Homeland Security to enact a policy on cell phone surveillance devices, such as Stingrays, but the request has gone nowhere.

Avoid the 5 Biggest Management Mistakes

by David Finkel

David Finkel is the Wall Street Journal bestselling author of SCALE: Seven Proven Principles to Grow Your Business and Get Your Life Back, which can be viewed by clicking here. As the CEO of Maui Mastermind, he has worked with 100,000+ businesses coaching clients and community members to buy, build, and sell over $5 billion worth of businesses.

Here are the 5 biggest management mistakes and how you can avoid making them.

- MicromanagementWe’ve all seen it, the business leader who hovers over his or her direct reports smothering them with a real time barrage of corrections and “suggestions.” The result is a frustrated and impotent team who grow to become dependent on that leader to direct their daily actions.

When you hand off a task, project, or ongoing responsibility to a team member, I suggest you give them:

- A clear picture of what success looks like, and why it matters to your company.

- The resources they’ll need to get the job done (budget, team, and/or tools).

- A clear picture of how and when you want them to report on progress and results to you (including what status would require you to get involved again).

- And the authority and responsibility to get the necessary job done.

If you’ve done this, then you have to let them get on with the job.

Remember, while you may have a suggestion that could improve things by 10 percent, you’ll lower their sense of ownership and learning by 50 percent or more if you aren’t careful how you share it. There is a time and place to direct or coach your team. Pick your moments wisely. When in doubt, let the “suggestion” go, it likely won’t help.

Click here to read the full article, not doing so would be a huge mistake.

Follow David on Twitter: @DavidFinkel.

Richard Connolly’s World

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the article of interest is “Temper Your Trump Tax-Cut Hopes” by Karen Hube. This article was featured in Barron’s on March 25, 2017.

Richard’s description is as follows:

President Donald Trump and most Republican lawmakers want the same thing: broad tax cuts that slash individual and corporate tax rates and provide a simplified tax code. But head-butting over details—such as how imports and exports should be taxed, and limits on itemized deductions for individuals—is raising questions about whether tax overhaul will happen this year, or even next.

What should you do? Be patient and temper your hopes, tax advisors say. While cuts are likely, they may not end up as deep and sweeping as current proposals suggest.

At best, notes a Brown Brothers Harriman advisor, the wealthy should hope for a temporary repeal of the estate tax.

Please click here to read this article in its entirety.

Humor! (Or Lack Thereof!)

**********************************************************

Sign Sayings of the Week

**********************************************************

In the News

by Ron Ross

Most Dangerous Professions of 2017:

- Lumberjack

- Construction Worker

- Coal Miner

- US Attorney

***************

“Knock, knock”

“Who’s there?”

“Another escaped cobra”

“Another escaped cobra who?”

“It’s not a joke, I said ‘knock knock’ because I don’t have any arms, open the door!”

Floridians, be sure your exotic, illegal pets have a good immigration lawyer!

**********************************************************

Upcoming Seminars and Webinars

Calendar of Events

**********************************************************

Just Announced!

LIVE TAMPA PRESENTATION

Alan, along with Dr. Singh, David Finkel and Kevin Bassett will present a one-day seminar on how to Scale Your Medical Practice.

Date: Sunday, June 4, 2017 | Check In 7:45 a.m. | Starts 8:30 a.m. | Ends ~5 p.m. | Hosted cocktail social with appetizers to follow.

Location: Tampa Westshore Marriott 1001 N Westshore Blvd, Tampa, FL 33607

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE LINCOLN NEBRASKA PRESENTATION

Alan will speak at the Nebraska Medical Association’s Annual Meeting in Lincoln, Nebraska. His topics include: Top 10 Mistakes Physicians Make with Investments/Business & Lawsuits 101.

Date: Friday, September 8, 2017 | 1:30 p.m. & 4:30 p.m.

Location: TBA

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE NEW PORT RICHEY PRESENTATION

Alan will be speaking at the New Port Richey Charitable Consortium on new estate planning issues and hot topics.

Date: Thursday, September 14, 2017 | 12:00 p.m. (eastern)

Location: Spartan Manor 6121 Massachusetts Avenue, New Port Richey, FL 34653

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE FLORIDA BAR CLE SEMINAR

Alan will be speaking at the 2017 Annual Wealth Protection Program presented by the Florida Bar and the Continuing Legal Education Committee. Alan will discuss EXEMPTION AND FLORIDA PLANNING 2016 – MORE THAN WHAT YOU THOUGHT, AND LESS THAT WHAT YOU WISH FOR.

Additional topics and speakers include:

- Key Asset Protection Strategies Integrations & Estate Planning Techniques and Wealth Management Products – Denis Kleinfeld

- Important Recent Developments and trends in Debtor Creditor Law – Including Discussion of the Uniform Voidable Transfers Act – Michael Markham & Arthur Neiwirth

- The Secrets to Avoiding the Tricks and Traps in Partnership Tax Planning – Jerry Hesch

- Critical Factors Every Florida Planner Must Know in Using Offshore Asset Protection Strategies – Les Share

- Trends in Practice – The Growing Oppurtunties for Skilled Wealth Protection Professionals Important Wealth Protection Cases, Law and Trends of Practice – What Happened and Where Are We Going?

Date: Friday, April 7, 2017 | 8 a.m. to 5 p.m.

Location: Hyatt Regency Downtown Miami – 400 SE Second Avenue, Miami, FL 33131

Additional Information: For more information, please email Alan at agassman@gassmanpa.com. To register, visit www.floridabar.org/CLE and use the Course Number: 2332R. A webcast will be available by clicking here.

**********************************************************

LIVE NAPLES PRESENTATION:

Alan will be speaking at the STEP Chapter Meeting in Naples, Florida. His topic for this event is FLORIDA CREDITOR EXEMPTION LAW PLANNING UPDATE. He will speak on April 19 from 12:00 to 12:45 p.m.

STEP is a global professional association for practitioners who specialize in family inheritance and succession planning. STEP members help families plan for their futures, from drafting a will to advising on issues concerning international families, protection of the vulnerable, family businesses and philanthropic giving.

Date: Wednesday, April 19, 2017 | 12:00 – 12:45 p.m. (Eastern)

Location: McCormick & Schmick’s Restaurant in Naples, Florida

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

Please put Friday, April 28th, 2017 on your calendar to enjoy the 4th Annual Ave Maria School of Law Estate Planning Conference and the weekend that follows in Naples.

Alan will be speaking at this conference on the topic of THE ETHICS OF AVOIDING TRUSTS AND ESTATE LITIGATION.

Alan will also appear on a panel of speakers with Jerry Hesch and Lester Law on the topic of TAX PLANNING WITH LIFE INSURANCE PRODUCTS, RECENT LITIGATIONS, AND OTHER HOT TOPICS.

Other speakers and topics include the following:

- Stacy Eastland – Comparing Freeze Techniques

- Jonathan Gopman – Asset Protection Trusts: An Update and Discussion of Planning

- Joan Crain – Challenges for Trustees in Dealing with Millennial Beneficiaries

- Jerry Hesch – Passing a closely-held business on to junior family members or key employees or co-owners: An analysis of the income tax, estate tax and financial impact of business succession planning techniques.

- Jerry Hesch & Alan Gassman – Life Insurance Planning Panel – Techniques, Tax Planning and The Good, the Bad, and the Ugly

- Tae Kelley Bronner – Homestead Planning and Update

- Lester Law – Basis Consistency for Estate and Income Tax Planning Purposes, and Multiple Implications Thereof.

- Marve Ann Alaimo & Dixon Miller – International Estate Planning Rules and Planning Opportunities

- Susan Cassidy, M.D. – What You Need to Know for Your Client’s Medical Issues: Competency, Great Care Versus the Mainstream, What Medicare Recipients Should Seek Outside of the Medicare System, End of Life Communications and Planning and How Will the Above be

- Alan Gassman – Ethical Considerations to Avoid Estate and Trust Litigation and Family Disputes, and the 10 or so Avoidance Techniques You Should Be Actively Using

- Suzy Walsh – Special Needs Trusts Essentials and Well Beyond

Date: Friday, April 28, 2017

Location: The Ritz-Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE LAS VEGAS PRESENTATION:

AICPA ADVANCED PERSONAL FINANCIAL PLANNING CONFERENCE

Alan will be speaking at the Advanced Personal Financial Planning Conference, sponsored by The American Institute of CPAs. His topic for this event is LIFE INSURANCE TIPS FOR THE FINANCIAL PLANNING PROFESSIONAL. He will speak on June 14 from 10:50 to 11:40 a.m.

This conference is part of the AICPA ENGAGE event, which brings together five well-known AICPA conferences with the Association for Accounting Marketing Summit for one, four-day event. The conferences included in ENGAGE are Advanced Personal Financial Planning, Advanced Estate Planning, Tax Strategies for the High-Income Individual, the Practitioners Symposium/TECH+ Conference, the National Advanced Accounting and Auditing Technical Symposium, and the Association for Accounting Marketing Summit.

Date: June 12th – June 15th, 2017 | Alan’s speaks on June 14 from 10:50 to 11:40 a.m.

Location: MGM Grand | 3799 S. Las Vegas Blvd., Las Vegas, NV, 89109

Additional Information: For more information, please email Alan at agassman@gassmanpa.com or click here.

**********************************************************

FREE LIVE WEBINAR FOR THE AAA-CPA STUDY GROUP

Alan and Marty Shenkman will present a free one and one-half hour webinar concerning a practical model for rendering asset protection planning services to more clients, more efficiently and more effectively using a construct called the “Asset Protection Planning Continuum.”

The program is intended for practitioners with moderate asset protection planning knowledge so that they can expand that knowledge in a practical way that will assist them to better help their clients, whatever the nature and focus of their practice may be.

Date: Thursday, June 22, 2017 | 2:00 – 3:30 p.m. (Eastern)

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PROFESSIONAL ACCELERATION WORKSHOP

Alan will present a Professional Acceleration Workshop at Ave Maria School of Law.

Date: Friday, August 25, 2017 | 10:00 a.m. Eastern

Location: Ave Maria School of Law, Naples, FL.

Additional Information: For more information, please contact Alan at agassman@gassmanpa.com. More details will be provided in the future, but please plan to attend.

**********************************************************

LIVE NEW PORT RICHEY PRESENTATION:

Alan will present AN ESTATE PLANNER’S UPDATE AND HOT TOPICS for the Charitable Consortium.

Date: Thursday, September 14, 2017 | 12:00 p.m. Eastern

Location: TBD

Additional Information: For more information, please contact Alan at agassman@gassmanpa.com.

**********************************************************

LIVE PRESENTATION:

ESTATE PLANNING COUNCIL OF NORTHEAST FLORIDA

Please put Tuesday, September 19, 2017 on your calendar to enjoy a dinner conference for the Estate Planning Council of Northeast Florida.

Date: Tuesday, September 19, 2017

Location: TBA

**********************************************************

LIVE PRESENTATIONS:

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan will be speaking at the following Medical Education Resources (MER) events:

- October 20th – October 22nd, 2017 in New York, New York

- November 30th – December 3rd, 2017 in Nassau, Bahamas

His tentative topics for these events include the 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning, Lawsuits 101, 50 Ways to Leave Your Overhead, and Essential Creditor Protection and Retirement Planning Considerations.

Date: New York: October 20th – 22nd, 2017Nassau: November 30th – December 3rd, 2017

Location: New York: To be determined.

Nassau: Atlantis Hotel | Paradise Beach Drive, Paradise Island, Bahamas

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE ESTATE PLANNING COUNCIL OF NORTHEAST FLORIDA PRESENTATION:

Alan will be speaking for the Estate Planning Council of Northeast Florida on March 20, 2018 on the topic of DYNAMIC PLANNING STRATEGIES FOR THE SUCCESSFUL CLIENT.

Date: Tuesday, March 20, 2018

Location: To Be Determined

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

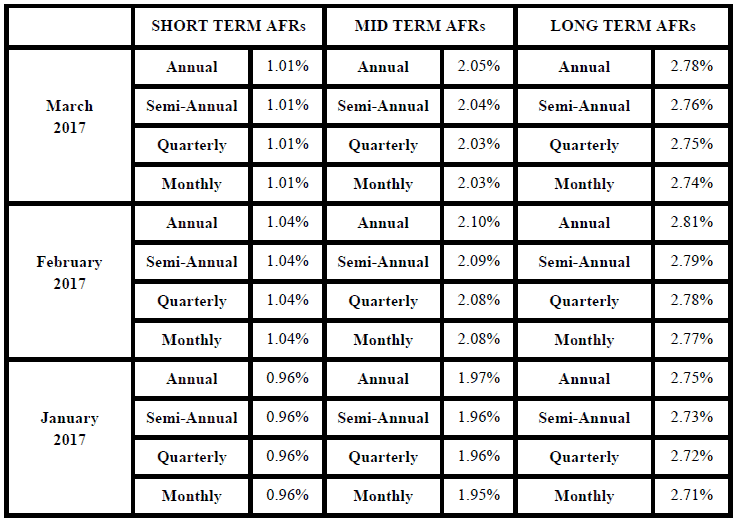

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.