The Thursday Report – 2.2.17 – Ground Hog Edition

Re: Groundhog Day Edition

Clearing Up Common Confusion – A Guide to Oft-Misunderstood Tax and Corporate Planning Points

The Inconsistent Basis Rules – Is Basis Consistency a Contradiction of Terms?

Remote Witnessing and Notarization – Are We Ready for the Carnage?

Marketing Physicians? Think Again by Pariksith Singh, M.D.

The Road Map to Scale Your Company by David Finkel

Seminar Spotlight: The Estate Planner’s Update – Tax and Florida Law

Richard Connolly’s World – Death is Inevitable. Financial Turmoil Afterward Isn’t

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Alan at agassman@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Thursday Report readers throughout the country will be dismayed to learn that Punxsutawney Phil saw his shadow this morning in the annual exhibition of “the only true weather forecasting groundhog.” This has been said to lead to 6 more weeks of winter. However, the Washington Post seems to believe that Punxsutawney Phil is all wet, as scientists have found that spring leaves are popping out more than twenty days ahead of schedule in parts of the Southeastern United States. Only time will tell if this is “fake news.”

Quote of the Week

“I am tomorrow, or some future day, what I establish today. I am today what I established yesterday or some previous day.”

– James Joyce

On this day, in 1882, James Augustine Aloysius Joyce was born in Dublin Ireland. Many of Joyce’s writings incorporated a fictional universe that closely resembled his hometown of Dublin, populated with characters that were often quite similar to family, friends, and foes from his short time there. In 1904 Joyce moved to continental Europe where he spent most of his time between Zurich and Paris, rarely returning back to Ireland.

Joyce’s best known work, and arguably the most significant piece of modernist literature, was the novel Ulysses, which is often viewed as a parallel to Homer’s epic poem, Odyssey. Published in 1922, Ulysses takes place in a single day following the main character, Leopold Bloom. The novel has remained in such high regard because of Joyce’s use of nearly every known literary style at the time, including “stream of consciousness technique, careful structuring, and experimental prose—full of puns, parodies, and allusions—as well as rich characterizations and broad humor.”

Clearing Up Common Confusion – A Guide to Oft-Misunderstood Tax and Corporate Planning Points

by Christopher Denicolo & Kenneth Crotty

The world of tax, corporate and estate planning can be complicated and confusing to laymen and practitioners alike. Many terms and concepts apply for different purposes, and words that appear to be interchangeable actually have completely different meanings and legal effects. While these concepts can appear daunting and cumbersome, it can be easy to grasp the distinctions between “alternative facts” and other confusing concepts that are prevalent in the estate planning world.

Common examples of these items of confusion are as follows:

- Thinking an S Corporation Must be a Corporation.

The concept of an “S corporation” is a creature of federal tax law. This is completely different from a type of entity that is created under state law. For example, under Florida law, an individual can form a limited liability company, or a regular (Inc.) corporation. The federal tax law provides that the entity can make an election to be taxed as an S corporation for federal income tax purposes, so as long as the entity and its owners meet certain requirements under the tax law, regardless of whether the entity is structured under state law as a limited liability company, or a regular (Inc.) corporation.

Specifically, an entity which meets the following requirements can elect to be taxed as an S corporation for federal income tax purposes:

(1) The entity is a domestic entity formed in a jurisdiction within the United States;

(2) The entity has fewer than 100 owners;

(3) The owners of the entity are only individuals, estates, exempt organizations that qualify under Section 401(a) or 501(c)(3) and are exempt from tax under §501(a), and certain kinds of trusts;

(4) All owners are United States citizens; or

(5) Aliens who reside in the United States.

The confusion arises from the term “S corporation” having the word corporation in its description. However, it is very common for a limited liability company to be treated as an S corporation for federal tax purposes. There is no concept of an S corporation under Florida law, as this concept relates solely to an entity’s classification under the federal tax law, and perhaps to the entity’s classification under the tax law of states who have income tax.

- Revocable Trusts Provide Creditor Protection Advantages During the Lifetime of the Grantor.

A prominent myth is that a revocable trust can offer creditor protection advantages to an individual during his or her lifetime. Generally, if the grantor has the ability to revoke or modify the trust agreement, then the creditors of the grantor may access and reach the assets held under the trust.

Revocable trusts provide many advantages, such as probate avoidance and protection from undue influence, but assets under a revocable trust are not protected from the grantor’s creditors during his or her lifetime. However, upon the grantor’s death, the trusts established for the benefit of the beneficiaries can be irrevocable and can provide for inheritances to be held in a manner that will be protected from the creditors of the beneficiaries. This type of trust also could be exempt from the federal estate tax, depending upon the grantor’s estate and the future federal tax law.

- Annual Gifts in Excess of $14,000 Per Person Will Cause a Gift Tax.

Frequently, clients will tell us that they understand that there is a $14,000 per person per year gift tax annual exclusion that allows them to transfer up to $14,000 per year to a particular person without incurring any gift tax. However, many clients believe that if you exceed this $14,000 amount, then a gift tax will apply to any excess amounts gifted. This is generally not true, as each person currently has a $5,490,000 lifetime gifting allowance that can be used to make gifts and other gratuitous transfers during their lifetime without causing an actual gift tax to apply.

It is correct that gifts of up to $14,000 per person may be made each without reducing a person’s $5,490,000 lifetime gifting allowance, although for gifts in excess of $14,000 per person no gift tax will apply until the entire $5,490,000 gifting allowance has been exhausted. Any gifts in excess of the $14,000 per person per year gift tax annual exclusion for which there is not sufficient $5,490,000 lifetime gifting allowance remaining are subject to a 40% gift tax under law.

- A Revocable Trust Estate Plan Controls the Disposition of IRAs and Other Retirement Accounts.

Like life insurance, IRAs and other pension accounts are assets that are controlled by contractual rights. This means that the benefits with respect to such assets arise under contracts with the insurance carrier, IRA custodian or pension administrator. These assets generally cannot be transferred on death simply by executing a Last Will and Testament or Revocable Trust, and these assets require additional paperwork such as beneficiary designations to be completed and filed with the applicable carrier or custodian.

Many individuals believe that changes to their desired beneficiaries with respect to such assets occur automatically without the need for any additional steps or documentation. This is incorrect and can lead to disastrous and unexpected results for such individual’s estate plan.

We encourage our clients to assure that all beneficiary designations are properly coordinated with their estate planning documents, and to periodically review such beneficiary designations to confirm that they reflect what is intended.

- A Durable Power of Attorney Remains in Effect After the Principal Dies.

It is often misunderstood that a durable power of attorney allows an agent to act on behalf of a principal after the principal’s death. Under Florida law, the agent’s powers under a durable power of attorney cease upon the principal’s death. A probate proceeding would need to be commenced in order to appoint a personal representative to act on behalf of the principal’s estate, although this is not necessary if the principal’s assets were held under a Revocable Trust that appointed a successor trustee who would serve after the principal’s death. This is another reason it is important to coordinate powers of attorney and testamentary estate planning documents, such as Last Will and Testaments or Revocable Trusts.

The Inconsistent Basis Rules – Is Basis Consistency a Contradiction of Terms?

by Alan Gassman & Brandon Ketron

A review of the new basis consistency rules, which require beneficiaries to respect the date of death values reported on an estate tax return for capital gains basis purposes have some important inconsistencies. It is somewhat confusing when assets that have qualified for the charitable or marital estate tax deduction must nevertheless be considered as having been valued for basis consistency purposes.

Brief highlights of the above are as follows:

Under the proposed regulations, the duty of consistency and requirements to file a Form 8971 and Schedule A do not apply to estates below the estate tax threshold even if an estate tax return is filed to allocate GST exemption or to make a portability election.

The basis consistency rules under new Section 1014(f) only apply to property that increases the estate tax. In other words, property that passes to a spouse or charity and qualifies for the marital/charitable deduction are not subject to the basis consistency rules under code Section 1014(f), because such property does not increase estate tax liability. Prop. Reg. §1.1014-10(b)(2).

Although property qualifying for the marital and charitable deduction is not subject to the basis consistency rules, the property is NOT exempted from the reporting requirements under Section 6035. Under Section 6035, if an estate is required to file an estate tax return the reporting requirements of Section 6035 apply, and a Form 8971 and the applicable Schedules A must also be filed.

As a result, estates over the estate tax exemption but owing no tax because of the marital and charitable deduction are still required to file a Form 8971 and report the basis of all property including property that passes to a surviving spouse or to a charity.

A beneficiary who has inherited an asset is required to use the value reported on the Form 706, as indicated on a new Form 8971, as the starting basis of the asset, as are those who acquire the asset from the beneficiary who would receive that same basis, such as upon receipt of a gift, or contribution to a partnership or S corporation.

The fiduciary required to file the Form 706 must provide notice (via Form 8971) to beneficiaries within 30 days after the return is filed.

The Form 8971 indicates that the beneficiary received the asset, notwithstanding that it may not have been received yet and that if unexpected events occur, it may never be received.

The proposed regulations indicate that an asset not reported on the Form 8971 will have a zero basis, even if the beneficiary was not at fault for omitting to report it.

Each beneficiary can receive a Schedule A that only lists what that beneficiary receives, and does not have to be given the Schedule A’s for other beneficiaries.

If the beneficiary is another trust, it is not clear whether the fiduciary filing the 706 need only inform the Trustee of the recipient trust, or the underlying beneficiaries thereof.

Hopefully, the Treasury will clarify these items of confusion, which we expect given the broad scope of these new rules.

Remote Witnessing and Notarization – Are We Ready for the Carnage?

by Alan Gassman & Seaver Brown

The sanctity of having two witnesses and a notary present in one room to ensure the person signing a will or trust is alert and competent, with the full documents in front of him or her may soon be over according to well informed and caring estate planning practitioners, the legislature will pass a law permitting the witnessing and notarization of a document by video observation, notwithstanding the risks this presents to elderly Floridians.

Big business has apparently caused Florida Senate Bill 206, which is modeled after the Uniform Electronic Transactions Act, to enable Florida to become one of the very first states to authorize video signing. The statute is complicated, and purports to require that an individual or company known as a qualified custodian will assure that the following occurs:

- That an audio and video recording, or separate audio and video recordings are made of the signing ceremony

- That during the time of the recording, the Testator or Testatrix signed the document and was seen on video by the two witnesses and the notary, who were simultaneously watching. The actual signing of the document can be by electronic signature, meaning he or she may simply click a box or type their name in.

- The audio and video recording must be verified as having reasonable quality to facilitate ascertainment of compliance with the statute, and must be stored by the qualified custodian, and accessible to the Testator.

The Thursday Report discourages the enactment of this new law. Please call your State Senators and Representatives if you share our concerns.

Marketing Physicians? Think Again

by Pariksith Singh, M.D.

I have often wondered why there are a different set of rules for physicians than, say, for lawyers, politicians, businessmen or lobbyists. For example, attorneys I know are quite open about getting a fee paid for referrals. Doctors may not do that. And if they even think about doing that, there are a whole bunch of laws such as Stark Law or Anti-Kickback Statutes to contend with. The basic rule in medicine is: No Referral Fee.

But then again, we are doctors, part of a noble profession. We are here to help and save, not think of commissions and referral fees. We also (most of us at least) accept Federal programs such as Medicare and Medicaid and the government would not want us to make money off its back, would it? Then again, how many doctors are part of the legislature compared to lawyers and businessmen (or worse, those who use politics as a business or career-building opportunity in itself)?

We worked very hard to get where we are. Our training is long and hard, laborious and painful. And as soon as we feel we have mastered it all, along comes some new research, a new technology, and we have to educate ourselves all over again. For the same reason though, our degrees and licenses are incredibly valuable, in terms of human lives saved, diseases cured, limbs salvaged and injuries prevented. We would not want to risk our licenses. That is why I cringe when doctors after years of sustained training do things which could jeopardize their biggest asset: their licenses.

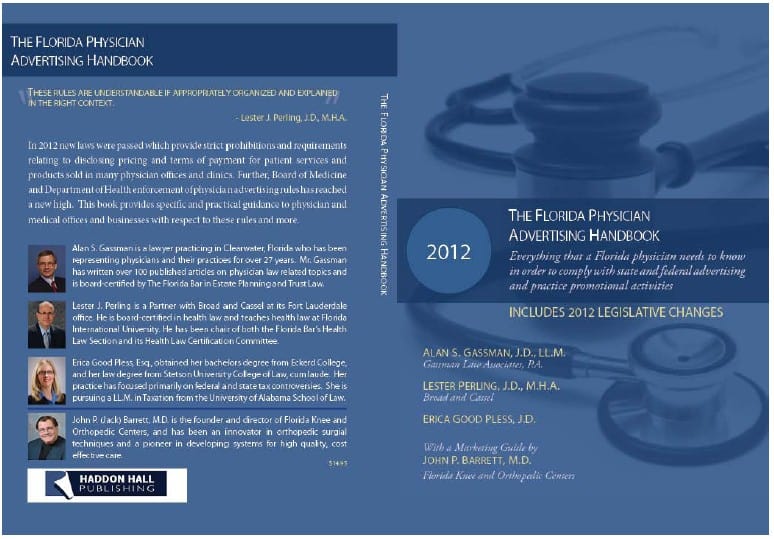

It pays to be cognizant of the law. There is no excuse for not knowing it. Ignorance of the law cannot be used as defense in court. It is critical that providers understand one simple and basic aspect of running the business of medicine and that pertains to marketing. There are some simple rules and suggestions which I have copied from an excellent resource which I recommend to everyone, The Florida Physician Advertising Handbook by Alan Gassman, Lester Perling, and Erica Good Pless (See below for a picture of the book):

- Thou shalt not advertise in a manner that is false, deceptive or misleading. Do not advertise a specialty if you do not have it. Remember, this could be subjectively misconstrued. It is all in the “eye of the beholder”. For example, a chiropractor was fined for displaying a sign in front of his building indicating he was a medical doctor. Always have friends or consultants kick the tires when it comes to implementing your brilliant ideas. A multitude of counsel can sometimes save your precious calling.

- Thou shalt not create an advertisement that misrepresents or misleads. Do not sell snake oil for cures. If you do wish to make a claim about a possible intervention, follow it up with a disclaimer so that the results may not create an unjustified expectation. Keep in mind that if a physician is going to make a claim, for example, about diet remedies and say something to the effect of “Mr. Smith lost 100 pounds,” then the claim can be followed by a disclaimer stating that the results are not typical. This remedies the misleading or deceptive nature of the advertisement because you have removed the possibility of creating an unjustified expectation.

- Thou shalt not state or imply that you have received formal recognition as a specialist unless you have in fact received such recognition and the recognizing agency has been approved by the Board of Medicine or Board of Osteopathic Medicine. Expertise in a specialty or special experience in it does not imply formal certification. Your ads will be scrutinized not only by the government through investigators with the Department of Health (DOH), but also by your competitors.

- Thou shalt not refer to a specialty certification in an advertisement unless you include the name of the specialty board that awarded the specialty certification.

- Thou shalt not state that you have received formal recognition as a specialist from a recognizing agency that has not been approved by the Board of Medicine unless the following disclaimer is included on the advertisement: “The specialty recognition identified herein has been received from a private organization not affiliated with or recognized by the Florida Board of Medicine.”

- Thou shalt not convey the impression that you possess qualifications, skills, or other attributes which are superior to other physicians, other than listing post-doctoral or professional achievements recognized by the Board of Medicine or the Board of Osteopathic Medicine. We see this all too often. Doctors advertising themselves as experts in Esthetic Medicine, Weight-Loss Medicine or Bio-Identical Supplementation put themselves at risk by doing so. Obvious statements like, “Hello, I am Dr. Smith and I am the best physician in the Southeast,” clearly violate this rule. But also more subtle statements can be equally in violation, such as “Hello, I am Dr. Jones. I have had nothing but the best training to be an orthopedic surgeon.” In this example the physician may not be saying he has the best skills, but he is saying he has the best qualifications. You may state facts like “I have performed X number of procedures.” Talk about yourself, but state nothing that can be construed as talking about others.

- Thou shalt always include your name in the advertisement.

- Thou shalt keep exact copies of audio tapes and/or video tapes of advertisements disseminated through the electronic media for at least 6 months (M.D.s) or 90 days (D.O.s) after the advertisement is aired or shown through electronic media. Doctors do not have the luxury of “alternative facts.” Rivals may easily complain to the Board of Medicine as noted above and create difficulties if the marketing consultant is not aware of the rule. Information advertised through social media outlets such as Facebook or Twitter are considered advertised under the law and regulations. It is therefore recommended that copies of any internet advertisements are also kept for the requisite period of time.

- Thou shalt include the following information in the advertisement in legible print if you use a referral service.

- Thou shalt clearly identify yourself as either a Medical Doctor (M.D.), Physician Assistant (P.A.), Anesthesiologist Assistant (A.A.) or Osteopathic Doctor (D.O.). Patients may often think that a P.A. or A.A. is a Medical Doctor. It is incumbent upon the P.A. or A.A. to introduce or present themselves clearly with a clear designation. We know of a P.A. who introduced himself as Doctor L and the patient reported him when the patient realized that the P.A. was not a Medical Doctor. The P.A. promptly lost his privileges at the facility and was lucky not to be reported to the Board of Medicine.

- Thou shalt disclose your licensure status in any of the following manners if you are a M.D., P.A., or A.A.:

- Wearing a name tag identifying the licensee as a M.D., P.A. or A.A.;

- Wearing an article of clothing on the upper body that identifies the licensee as a M.D., P.A. or A.A.;

- Orally notifying a patient in person;

- Providing a patient a business card in-person that properly identifies the status;

- Placing notification in the physician’s lobby, which contains a photo of the licensee and the licensee’s status.

- Thou shalt disclose all the variables affecting a stated fee if you advertise a specific fee for a service. There should be no hidden costs for items like facility fee or anesthesia or assistant’s compensation.

- Thou shalt include the following disclaimer in all capital letters if you offer free or discounted services: THE PATIENT AND ANY OTHER PERSON RESPONSIBLE FOR PAYMENT HAS A RIGHT TO REFUSE TO PAY, CANCEL PAYMENT, OR BE REIMBURSED FOR PAYMENT FOR ANY OTHER SERVICE, EXAMINATION, OR TREATMENT THAT IS PERFORMED AS A RESULT OF AND WITHIN 72 HOURS OF RESPONDING TO THE ADVERTISEMENT FOR THE FREE, DISCOUNTED FEE, OR REDUCED FEE SERVICE, EXAMINATION, OR TREATMENT.

- Thou must publish a schedule of charges if you are an urgent care center. The posting must include the price of services for uninsured persons, must include the 50 most frequently provided services, and must be posted in a conspicuous place in the reception area, and be at least 15 square feet in size. The definition of an Urgent Care Center is very broad. It can easily encompass a physician’s office that accepts walk-ins. Even a scenario where patients call in and receive a same-day appointment may qualify. My recommendation is to post a clearly visible sign in your waiting room with the above in case of any doubt.

- Thou shalt not advertise pain management services unless you register as a pain management clinic. For example, an anesthesiologist may advertise that she perform pain intervention services by asking “Do you have back pain? We can help.” The mere fact that advertisement mentions addressing a patient’s pain makes the practice a pain management clinic and requires registration and compliance with all requirements and regulations.

- Thou shalt update your Florida Department of Health Practitioner Profile if and when you change address, staff privileges, medical malpractice history, or other characteristics. I confess even I did not know that.

One always learns something or the other when talking to Alan Gassman or Lester Perling. This little book is a masterpiece and I recommend it to all marketing entities with health care, here or anywhere in the U.S.

The Road Map to Scale Your Company

by David Finkel

David Finkel is the Wall Street Journal bestselling author of SCALE: Seven Proven Principles to Grow Your Business and Get Your Life Back, which can be viewed by clicking here. As the CEO of Maui Mastermind, he has worked with 100,000+ businesses coaching clients and community members to buy, build, and sell over $5 billion worth of businesses.

I was hosting my radio show, Scale Your Business, when the subject of the lifecycle of a successful business came up, and what the predictable needs were at each stage to scale it were.

Here is a quick summary of the answer I gave on air. Use this level-by-level, stage-by-stage progression to help you accelerate your growth and build a business you can one day, sell, scale, or even own passively.

To be clear, in the early years of your business, you’re naturally the main engine driving your business forward.

You’ll wear all the hats at various times, and you’ll have few formal structures and systems within your organization upon which you can truly rely.

But as time matures, you’ll face a crucial decision point at which you can settle for owning a Level Two job or instead choosing to raise your business to be a strong and independent entity that benefits from your involvement but is ultimately independent of it.

Just like your goal as a parent is raising kids who can eventually stand on their own—independent and self-supporting—so your goal is to create an organization with the systems, team, and controls that allow it to stand on its own.

The traditional Level Two approach is for you the owner to work harder, to do more—to work at the job of your business.

The Level Three solution is for you to do less and get your business to do more.

Click here to read the full article.

Follow David on Twitter: @DavidFinkel.

Seminar Spotlight

For more information please email Alan Gassman at agassman@gassmanpa.com.

Click Here to Register!

Richard Connolly’s World

Death is Inevitable. Financial Turmoil Afterward Isn’t

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the article of interest is “Death is Inevitable. Financial Turmoil Afterward Isn’t” by John F. Wasik. This article was featured in the New York Times on January 13, 2017.

Richard’s description is as follows:

MOST of us do not even want to contemplate the death of a spouse or partner—much less the prospect of having to take care of the financial end of such a loss while still grieving.

There are, however, plenty of details that people can attend to in advance that can avoid some measure of stress when the time comes. Most people tend to ignore or procrastinate over such tasks—for obvious reasons—but planning can certainly ease some avoidable financial sorrows.

Please click here to read this article in its entirety.

Humor! (Or Lack Thereof!)

Sign Sayings of the Week

**********************************************************

In the (Fake) News

by Ron Ross

Things to know about Neil Gorsuch, Supreme Court Nominee:

- He comes from one of those square states out west

- He clerked for two different Supreme Court Justices, who made him pick up laundry—mostly black robes, but also the “Obi Wan” robe when they were feeling especially wise

- The New York Times described his book, “The Future of Assisted Suicide and Euthanasia” as, “the feel good read of the summer”

- He may be somewhat conservative

**********************************************************

Cocktail Party Talk about Neil Gorsuch

Lawyer readers are going to be asked what they know about Justice Neil Gorsuch. The following probably sounds better than saying “absolutely nothing:”

- He is seven years younger than any other current Supreme Court Justice, and at only the age of 49, he will have a significant impact on the United States legal landscape for years to come.

- He received his undergraduate degree from Columbia, a Ph.D. in philosophy from Oxford University, and attended Harvard Law School.

- Many scholars view him as the natural conservative replacement to Justice Scalia.

- In Hobby Lobby Stores v. Sebelius, Gorsuch voted with the majority of the 10th Circuit holding that federal law prohibited the Department of Health from requiring closely-held, for-profit secular corporations to provide contraceptive coverage as part of their employer-sponsored health insurance plans.

**********************************************************

Upcoming Seminars and Webinars

Calendar of Events

**********************************************************

Just Announced

LIVE NEW PORT RICHEY PRESENTATION:

Alan will present AN ESTATE PLANNER’S UPDATE AND HOT TOPICS for the Charitable Consortium.

Date: Thursday, September 14, 2017 | 12:00 p.m. (Eastern)

Location: TBD

Additional Information: For more information, please contact Alan at agassman@gassmanpa.com.

**********************************************************

FREE LIVE WEBINAR:

Alan and Brandon Ketron will present a live webinar on the Estate Planner’s Update – Tax and Florida Law.

Date: February 6, 2017 | 12:30 PM (Eastern)

Additional Information: For more information or to register for this webinar, please contact Alan at agassman@gassmanpa.com.

**********************************************************

REACH YOUR 2017 GOALS A WEEK FROM SATURDAY!

Saturday, February 11, 2017

Professional Achievement Workshop with Dr. Srikumar Rao and Alan Gassman

Join Dr. Rao and Alan for a seven-hour, interactive workshop designed towards law students, recent graduates, and other business professionals to reach new levels of enjoyment and achievement in their business or professional careers. The workshop is approved for two ethical hours, and five general legal hours of continuing legal education.

This workshop is based on Alan’s workshop materials that have been presented at the University of Florida, Ave Maria School of Law, and state & city Bar conferences. Net proceeds will benefit Stetson Law School.

Date: Saturday, February 11, 2017 | 9:00 a.m. – 4:30 p.m.

Location: Stetson Law School, Gulfport Campus | 1401 61st Street South, St. Petersburg, FL, 33707

Cost: Free for all current law students and Alumni out less than one year. $75 for Alumni out one to three years, St. Pete and Clearwater Bar Solo Practice members, and charitable organization employees. $125 for all others. Includes free lunch, but not fried chicken.

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

Sunday, February 12, 2017

The Enjoyment Solution: How to Replace Worry and Stress with Clear Direction and Confidence, for your “In the Groove Experience” at Work and at Home with Dr. Srikumar Rao

This 6-hour workshop will be an intimate private workshop held by the Rao Institute at the request of Alan and friends. This will be provided for a limited number of attendees at a cost of $475 per person. Please RSVP now while spaces are available!

See Dr. Rao’s YouTube TED Talk, and you will see why he is so well-regarded and sought out worldwide as a presenter, coach, and author. Meet this gentle and brilliant man who has changed so many lives up close and personal!

You can see his best-selling books, Are You Ready to Succeed? and Happiness at Work on Amazon by clicking here. You can also see his TED Talk that has been viewed by well over 1 million people by clicking here.

Sarah Palin said that she would not leave Nome without them!

Date: Sunday, February 12, 2017

Location: Stetson Law School, Gulfport Campus | 1401 61st Street South, St. Petersburg, FL, 33707

Cost: $475 per person, or three for $1425

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan will present a live webinar on how FDIC Insurance works with Taylor Binder.

Date: February 14, 2016 | 12:30 PM (Eastern)

Additional Information: For more information, please contact Alan at agassman@gassmanpa.com.

**********************************************************

LIVE TRINITY PRESENTATION

Ken Crotty and Chris Denicolo will present RECENT DEVELOPMENTS AND STRATEGIES FOR ESTATE PLANNERS for the North Suncoast Estate Planning Council.

Date: Tuesday, February 21, 2017 | 5:00 p.m. EASTERN

Location: Fox Hollow Golf Club | 10050 Robert Trent Jones Pkwy, Trinity, FL 34655

Additional Information: For more information, please contact Alan at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO FLORIDA BAR PRESENTATION:

REPRESENTING THE PHYSICIAN: IT IS HARDER THAN IT LOOKS

Alan and Lester Perling will give a panel discussion talk on Structuring Medical Practices and Related Entities for Tax, Creditor Insulation, and Regulatory Compliance Purposes

Other speakers at this event include William Eck, Susan Thomas, Melissa Mora, Sachi Mankodi, Kimberly Brandt, Al Gomez, Kathleen Premo, and Radha Bachman.

Topics include:

- The Brave New World of Medicare Physician Compensation Under MACRA and Beyond

- Office of Civil Rights HIPAA Audits – Preparing Your Clients and Yourself

- The Physician’s Role Under EMTALA and the Florida Access to Emergency Services Act

- Medical Marijuana in Florida – The Highs and Lows of its Regulation

- The Post-Election View from the Hill

- What the Doctor’s Lawyer and the Doctor Need to Know About Bankruptcy and How Creditors Approach Health Industry Related Situations

- Medicare and Other Risk Contracts

- Medical Entities and Rules You Must Know About

Date: Friday, February 3, 2017 | Alan speaks at 8:30 AM and 4:10 PM.

Location: Rosen Centre Hotel | 9840 International Drive, Orlando, FL, 32819

Additional Information: If you are interested in registering for this presentation, please contact Alan at agassman@gassmanpa.com.

**********************************************************

LIVE DISNEY WORLD PRESENTATION (HOW MICKEY MOUSE CAN YOU GET?):

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan will be speaking at the Medical Education Resources (MER) Internal Medicine and Country Bear Jamboree for primary care physicians and other characters. We thank MER for this wonderful opportunity and Walt Disney for having paved all of Osceola County. His topics will include:

- The 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning

- Lawsuits 101

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: Wednesday, March 15, 2017 and Thursday, March 16, 2017

Location: Walt Disney World BoardWalk Inn | 2101 Epcot Resorts Blvd, Kissimmee, FL 34747

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE ESTATE PLANNING DISCUSSION AT FLORIDA STATE UNIVERSITY SCHOOL OF LAW

Alan will appear via Skype with professors Steven Hogan and Bob Pierce to give his views, by interview style, for their estate planning course at Florida State University School of Law on Thursday, March 23, 2017.

Date: Thursday, March 23, 2017 | 1:15 – 3:00 p.m. (EASTERN)

Location: Florida State University School of Law

Additional Information: To receive a live call in code or videotape of this presentation, which we will qualify for continuing legal education credit, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE ESTATE PLANNING COUNCIL OF NORTHEAST FLORIDA PRESENTATION:

Alan will be speaking for the Estate Planning Council of Northeast Florida on March 20, 2018 on the topic of DYNAMIC PLANNING STRATEGIES FOR THE SUCCESSFUL CLIENT. This will be Alan’s third visit to Pensacola, and a welcome treat. Watch this space, as more details will be forthcoming!

Date: Tuesday, March 20, 2018

Location: To Be Determined

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

Please put Friday, April 28th, 2017 on your calendar to enjoy the 4th Annual Ave Maria School of Law Estate Planning Conference and the weekend that follows in Naples.

Alan will be speaking at this conference on the topic of THE ETHICS OF AVOIDING TRUSTS AND ESTATE LITIGATION.

Alan will also appear on a panel of speakers with Jerry Hesch and Lester Law on the topic of TAX PLANNING WITH LIFE INSURANCE PRODUCTS, RECENT LITIGATIONS, AND OTHER HOT TOPICS.

Other speakers and topics include the following:

- Stacy Eastland – Comparing Freeze Techniques

- Jonathan Gopman – Asset Protection Trusts: An Update and Discussion of Planning

- Joan Crain – Challenges for Trustees in Dealing with Millennial Beneficiaries

- Jerry Hesch – Passing a closely-held business on to junior family members or key employees or co-owners: An analysis of the income tax, estate tax and financial impact of business succession planning techniques.

- Jerry Hesch & Alan Gassman – Life Insurance Planning Panel – Techniques, Tax Planning and The Good, the Bad, and the Ugly

- Tae Kelley Bronner – Homestead Planning and Update

- Lester Law – Basis Consistency for Estate and Income Tax Planning Purposes, and Multiple Implications Thereof.

- Marve Ann Alaimo & Dixon Miller – International Estate Planning Rules and Planning Opportunities

- Susan Cassidy, M.D. – What You Need to Know for Your Client’s Medical Issues: Competency, Great Care Versus the Mainstream, What Medicare Recipients Should Seek Outside of the Medicare System, End of Life Communications and Planning and How Will the Above be

- Alan Gassman – Ethical Considerations to Avoid Estate and Trust Litigation and Family Disputes, and the 10 or so Avoidance Techniques You Should Be Actively Using

- Suzy Walsh – Special Needs Trusts Essentials and Well Beyond

Date: Friday, April 28, 2017

Location: The Ritz-Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE PRESENTATION:

ESTATE PLANNING COUNCIL OF NORTHEAST FLORIDA

Please put Tuesday, September 19, 2017 on your calendar to enjoy a dinner conference for the Estate Planning Council of Northeast Florida.

Date: Tuesday, September 19, 2017

Location: TBA

**********************************************************

Save the Dates!

LIVE ST. PETERSBURG PRESENTATION:

2017 ALL CHILDREN’S HOSPITAL FOUNDATION SEMINAR

Please put Thursday, February 9th, 2017 and on your calendar to enjoy the 19th Annual All Children’s Hospital Estate, Tax, Legal, and Financial Planning Seminar.

Speakers will include Turney Berry, Paul Lee, Sanford Schlesinger, and Jerry Hesch.

Date: Thursday, February 9th, 2017

Location: Johns Hopkins All Children’s Hospital Education and Conference Center, St. Petersburg, FL

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE LAS VEGAS PRESENTATION:

AICPA ADVANCED PERSONAL FINANCIAL PLANNING CONFERENCE

Alan will be speaking at the Advanced Personal Financial Planning Conference, sponsored by The American Institute of CPAs. His tentative topic for this event is LIFE INSURANCE TIPS FOR THE FINANCIAL PLANNING PROFESSIONAL.

This conference is part of the AICPA ENGAGE event, which brings together five well-known AICPA conferences with the Association for Accounting Marketing Summit for one, four-day event. The conferences included in ENGAGE are Advanced Personal Financial Planning, Advanced Estate Planning, Tax Strategies for the High-Income Individual, the Practitioners Symposium/TECH+ Conference, the National Advanced Accounting and Auditing Technical Symposium, and the Association for Accounting Marketing Summit.

Date: June 12th – June 15th, 2017 | Alan’s date and time are to be determined.

Location: MGM Grand | 3799 S. Las Vegas Blvd., Las Vegas, NV, 89109

Additional Information: For more information, please email Alan at agassman@gassmanpa.com or click here.

**********************************************************

LIVE PRESENTATIONS:

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan will be speaking at the following Medical Education Resources (MER) events:

- October 20th – October 22nd, 2017 in New York, New York

- November 30th – December 3rd, 2017 in Nassau, Bahamas

His tentative topics for these events include the 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning, Lawsuits 101, 50 Ways to Leave Your Overhead, and Essential Creditor Protection and Retirement Planning Considerations.

Date: New York: October 20th – 22nd, 2017; Nassau: November 30th – December 3rd, 2017

Location: New York: To be determined.

Nassau: Atlantis Hotel | Paradise Beach Drive, Paradise Island, Bahamas

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

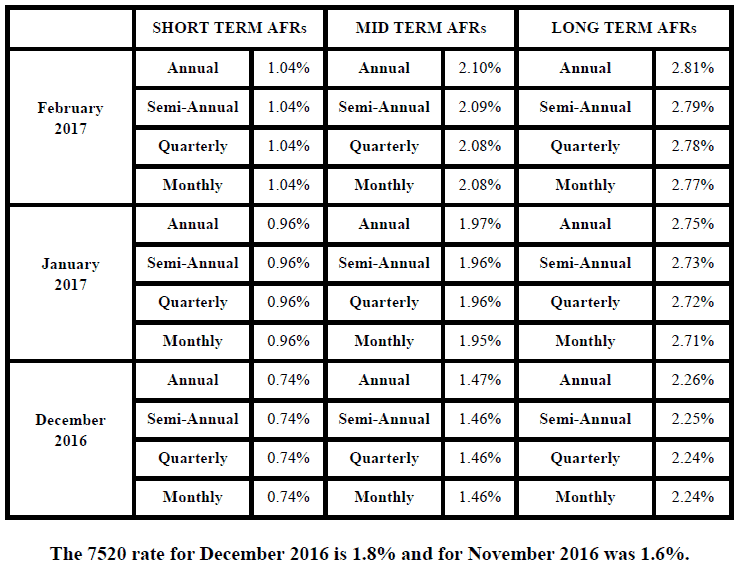

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.