The Thursday Report 12.26.13 – Tonto, Toto and a Poem

Twas the Thursday After Christmas Poem

Residential Borrower’s Rights to a Three Day Rescission Notice – What If This Notice is Not Given in a Family Situation?

Long Term Care: Expecting the Unexpected

Medical Practice Wisdom by Dr. Pariksith Singh – Part 3 – The Medical Home: A Position Paper

Seminar Announcements – Heckerling 2014 and Dates Announced for Notre Dame 2014

Larry Katzenstein’s Leimberg Article on How the Medicare Tax Impacts Charitable Trusts and Arrangements

Basic Asset Protection for Doctors: Getting Sued for Malpractice, Malpractice Insurance and All That Jazz – Part 2 of a 3 Part Series by Alan S. Gassman

Do You Remember Alfred E. Neuman?

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Twas the Thursday After Christmas

Twas the Thursday after Christmas

And all through the Report,

Not a creature was amused,

And there was much retort!

The stock market was hung,

At over 16,000 with care,

In hopes that next week,

The Thursday Report will still be there.

While the editors of the Thursday Report,

Were shopping offshore,

To find new content,

And articles of allure.

So have a great New Year’s,

And toast with good cheer,

We’ll see you next Thursday,

And also next year!

Residential Borrower’s Rights to a Three Day Rescission Notice – What If This Notice is Not Given in a Family Situation?

Many estate planners, family and tax attorneys, and advisors are asked for assistance in putting mortgages into place between related parties. As a result, residential mortgage laws are of great importance. The three day rescission notice is a law that easily falls through the cracks, but can have great repercussions when families no longer get along.

Federal law requires lenders who take mortgages on the principal dwelling of a consumer to give the borrower three (3) business days after becoming obligated on the debt to rescind the transaction. Further, the lender is required to clearly and conspicuously disclose this right to the consumer and provide the appropriate documents. Lenders are required to deliver two copies of the Notice of the Right Rescind and one copy of the disclosure statement to each consumer entitled to rescind. The lender does not need to disburse monies to the borrower or to pay for recording, stamp, or other expenses until the three days has run.

The specific language of the federal law is found in 15 U.S.C. Section 1635(a) and is expressed as follows:

Except as otherwise provided in this section, in the case of any consumer credit transaction (including opening or increasing the credit limit for an open end credit plan) in which a security interest, including any such interest arising by operation of law, is or will be retained or acquired in any property which is used as the principal dwelling of the person to whom credit is extended, the obligor shall have the right to rescind the transaction until midnight of the third business day following the consummation of the transaction or the delivery of the information and rescission forms required under this section together with a statement containing the material disclosures required under this subchapter, whichever is later, by notifying the creditor, in accordance with regulations of the Bureau, of his intention to do so. The creditor shall clearly and conspicuously disclose, in accordance with regulations of the Bureau, to any obligor in a transaction subject to this section the rights of the obligor under this section. The creditor shall also provide, in accordance with regulations of the Bureau, appropriate forms for the obligor to exercise his right to rescind any transaction subject to this section.

Transactions that are covered by the Right of Rescission are:

∙ Home-equity loans

∙ Home-equity lines of credit; and

∙ Refinances of existing mortgages in which the transaction is not performed by the lender who holds the current mortgage.

Transactions that are not covered are:

∙ A mortgage for the purchase of a home

∙ A refinance transaction with the existing lender, state agency mortgages, or loans on second homes or investment properties.

∙ The other exceptions listed at the bottom of this article

Borrowers can only waive the three day rescission period if there is a “bona fide personal financial emergency.” The emergency must be documented by a signed and dated waiver statement that describes the emergency and specifically waives the right and is signed by all borrowers who would be entitled to rescind the transaction.

A borrower who has not received proper notice of the 3-day right of rescission will have three years from the date of the loan to rescind the arrangement and repay the principal owed in order to get a refund of all interest and fees paid. A written recision notice must be sent before the end of the three year period. Nothing else needs to happen within the three year term, according to a Third Circuit case, before the borrower is required to pay back the loan, but the Statute states in 15 U.S.C. Section 1635(b) that the “procedures prescribed by this subsection shall apply except when otherwise ordered by the Court.”

When the borrower gives notice, it is therefore important that the lender consider going to court to change the order of the repayment procedure in order to avoid giving up the mortgage position and having the borrower simply refuse to repay or file bankruptcy.

For a consumer to rescind a transaction, the consumer must notify the lender in writing by midnight of the third business day after the latest of three events: 1) consummation of the transaction; 2) delivery of material TILA disclosures; or 3) receipt of the required notice of the right to rescind. If a borrower prevails in exercising his/her right to rescission and they have enough cash to repay the loan principal, borrowers can get a refund of their interest and fees.

Within twenty (20) days of receiving a rescission notice, the creditor is required to return all monies and property that the borrower gave in connection with the transaction and to terminate the creditor’s mortgage on the property. By the letter of the law, the lender must give up its mortgage before the borrower is required to give back the amounts borrowed.

If the order of remedies is not changed then not only would a creditor have to sue the borrower to try to get the money back without having a mortgage on the borrower’s property, but a borrower with other creditors might file bankruptcy or be forced into bankruptcy, and the borrower might thereby be able to discharge their obligation to pay the creditor.

Section 1635(e) lists exemptions from this right. The following transactions are exempt:

1) a residential mortgage transaction, as defined in Section 1602(w) as “a transaction in which a mortgage… is created or retained against the consumer’s dwelling to finance the acquisition or initial construction of such dwelling.”

2) a transaction constituting a refinancing or consolidation (with no new advances) of the principal balance then due and any accrued and unpaid finance charges of an existing extension of credit by the same creditor secured by an interest in the same property;

3) a transaction in which an agency of a State is the creditor; or

4) advances under a preexisting open end credit plan if a security interest has already been retained or acquired and such advances are in accordance with a previously established credit limit for such a plan.

Life becomes more complicated, but someday our smartphone will enable us to comply with just about everything we do, including automatic payment of the smartphone bill!

Long Term Care: Expecting the Unexpected

What are the chances that you or a client or your loved ones will need long term care – is it worth paying the premiums on expensive long term care policies?

We had our law clerks look at a number of articles to try to determine what the probability of needing long-term care will be, and how long the care will be needed for.

The vast majority of Americans can continue to rely upon Medicaid to provide long term care under the present system and are not able to afford to pay the premiums on any sort of long-term care policy that would have a substantial positive impact if they were to become disabled.

Affluent Americans typically have more than enough assets to pay for a typical nursing home visit, which may now cost as much as $8,000 a month plus supplemental expenses.

Long-term care is a range of services and supports a person may need to meet their health or personal needs over a long period of time. While long-term care can mean medical care, most long-term care is basic assistance with the personal tasks of everyday life. Two types of non-medical long-term care services are Activities of Daily Living (ADLs), such as bathing, dressing, or eating, and Instrumental Activities of Daily Living (IADLs), such as housework, paying bills, or taking medications. Needless to say, the cost of long-term care services can be extremely high and financially burdensome on elderly clients.

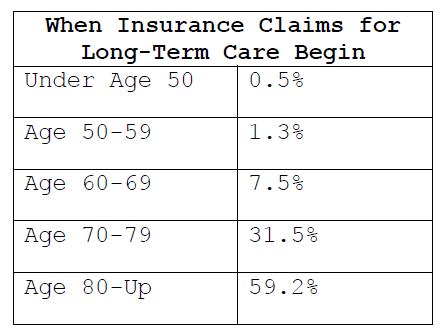

While it would be nice for planning purposes to know if an individual will need long-term care (“LTC”) in the future, the harsh reality is that no one knows for sure. However, statistics do show that the longer a person lives, the higher their chances are that they will need LTC.

When planning for a loved-one or client’s future the following facts should be weighed to make a sound decision:

• In general: Women have a higher risk of needing LTC than men and face a greater risk of lengthy periods of need for LTC. Furthermore, singles are more at risk because they usually do not have someone that can properly take care of them. While 1/3 of today’s population may never need LTC, 20% will need LTC for over five years. Furthermore, the average person’s lifetime expenditures for long-term care are estimated to be an average of $55,000 in 2012 ($47,000 in 2005).

• Ages 18-64: While most individuals think that long-term care cost only impact seniors, younger individuals are also in need of these services. According to the Long Term Care survey by Genworth Financial, 40% of the individuals receiving long-term care are from ages of 18-64.

• Ages 65-Up: It is also projected that 70% of 65-year-olds will need some sort of long-term care during the remainder of their lives. There were 37 million Americans age 65 or older with LTC needs in 2005, and there is an expected number of 81 million in 2050. See chart above for projected LTC need by gender.

• Ages 85-Up: Around 97% of the people that are over the age of 85 will at least require assistance for the last year of their life.

It seems that making a decision about long-term care needs means weighing the probabilities and risks. All in all, odds seem to favor that the average American will evidentially need long-term care. Thus, these high statistics should be kept in mind when either opting for long-term care insurance or self-insurance.

For more information on long-term care planning please see: www.longtermcare.gov.

Medical Practice Wisdom by Dr. Pariksith Singh – Part 3

Medical Home: A Position Paper

Some advisors are not aware of what a “Medical Home” is.

This is a residence where patients can live and receive medical treatment without having to be in a hospital or a formal nursing home.

It seems that the time of Medical Homes has come and gone. The buzzwords now are ACO, bundled-payments, or Health Information Networks. No longer are Medical Homes the hot topic of discussion or debate nor has there been any movement on greater payment for accredited practices from Medicare or Commercial plans recently. Yet, in some ways, Medical Homes are the keystone that supports all these grand structures of Accountable Care Organizations, Managed Care, or Health Information Networks.

Without there being medical practices that are state of the art, and using advanced technology and the principles of Medical Homes, there can be no compliance, no quality, no coordinated care and no patient involvement. It may be worthwhile to review the concept of a Medical Home and see if this understanding sheds light on the trends in health care. While buzzwords may come and go, patient care will remain central. The relationship between the provider and patient is the axis around which any super-structure (whether ACO or HMO or PSN or PPO) erected to solve the present impasse in health care will revolve.

It may well be that all other architectural concepts will fail if the tipping point is not found. It is my opinion that the area which can use the most improvement is the doctor’s office.

What is a Medical Home?

Simply speaking, I like to think of a Medical Home as the patient’s second home, with all the same comfort, security, familiarity, constancy, satisfaction and reliability. To paraphrase Dorothy from ‘The Wizard of Oz’, one might say that for a patient “There is no place like Medical Home.”

A Medical Home is a facility where patients can live and receive medical treatment without having to be in a hospital or a formal nursing home. The ultimate goal of these facilities is to keep patients, particularly patients with chronic illnesses, healthy enough to avoid expensive hospital visits. Medicare will be providing physicians with extra incentives by providing a monthly care-management fee in addition to their normal Medicare fee-for-service.

In my opinion the most critical elements of a successful Medical Home are as follows:

1) Comprehensive care: This means not just primary care, but all aspects of the patient’s health, including but not limited to his social, cultural and familial circumstances. This should not just be limited to when the patient is sick but also when the patient is healthy, and not just primary but pre-primary, prophylactic, or preventive health care.

2) Coordinated Care: This should be between all specialties, facilities, modalities, and health affiliates. The staff at the Medical Home is a team that ensures that all clinical interventions are communicated to the primary care provider and the patient, that the care is integrated, and that a coherent plan is adopted rather than taking a sporadic approach to health care.

3) Compliant Care and Quality of Care: Compliance is the means, and quality is the end. Here, as in most things in life, the means define the end, and results are not separate from the means. A practice that rewards the constant vigilance and out-of-the-box thinking among the employees who question any activity that is not in sync with the vision of quality will always be ahead in providing the best care to the patient.

4) Communication of Care: Advanced IT systems and a way to communicate with patient both to and from the provider and Medical Home team is mandatory. The patients need to be educated and involved in clinical decision-making with an objective evidence-based approach to medicine. This will ensure buy-in from those who are at the receiving end of health care.

5) Cost-Effective Care: Finally, the best medicine is the most cost-effective medicine, e.g. a myocardial infarction saved in time or a diabetic foot infection prevented will end up saving several-fold more money, reduce mortality and morbidity, and lower the liability of the practice. The Medical Home is uniquely positioned to provide the best managed or accountable care to a whole population.

Infra-structure for a Medical Home:

In my opinion, these elements are the sine qua non for Medical Home:

1) State of the Art technology, EMR, HER, and e-prescribing;

2) Advanced data systems and analysis;

3) A full-fledged compliance program and inculcation of a culture of compliance in the entire practice along with adoption of the best practices;

4) Emphasis on the best customer service and care;

5) Aggressive case management and coordination;

6) Team-based approach to patient care with the primary care center as the nodal point of health care;

7) Self-review and audit programs as part of the quality initiative; and

8) Improved access, enhanced services on weekends, walk-in services, etc.

Advantages of a Medical Home:

1) A sudden evolution and a radical leap in systems, processes, and philosophy of practice;

2) Segue to ACO (Once a Medical Home is set up, it is ideally paced to fulfill all the requirements of an ACO if part of similarly structured and functioning practices joined in a network or group);

3) As Meaningful Use is adopted to take advantage of the financial incentivization, this is an ideal time for the practice to advance to a new level of functioning. Thus, the required expenditure in information technology will be partly paid for, and the improved technological integration of the practice will make the transition to Medical Home easier with better data collection and analysis;

4) Less liability due to better customer satisfaction, improved communication with patients, and better coordination of care seems to be an obvious and necessary outcome of improved services and systems. Care will improve, errors will be reduced and mortality and morbidity will be reduced as mentioned earlier;

5) Increased patient satisfaction;

6) Increased provider satisfaction and less burn-out;

7) Focus from disease to health;

8) Takes advantage of latest IT technology which makes the practice nimble and adaptable;

9) Compliant care;

10) Better case management, disease management, utilization management and care management;

11) Increased payment from Medicaid with Medicaid HMOs and PSNs;

12) Outside review makes the practice stronger, more objective and with less deficiencies which may be missed on a purely subjective approach; and

13) Marketing advantages.

Disadvantages of a Medical Home:

1) Initial cost to create the infra-structure;

2) Long application process and paper work;

3) No increase in profits for practices restricted to commercial and Medicare products at present;

4) Lack of awareness among patients and lack of adoption by patients of advanced technology;

5) Requires extra effort, research and constant vigilance; and

6) Constant training of staff.

It is the author’s opinion that the Medical Home approach is here to stay. Practices which wish to be on the cutting edge of medicine must adopt the principles and objectives of Medical Home as soon as possible despite any short-term disadvantages or increased expenditure. Not only is accreditation of advantage competitive, but it helps to sharpen the skills, processes and organization of the practice.

Seminar Announcements:

See us at Heckerling

Notre Dame 2014 Dates Announced

SEE US AT HECKERLING!

We are continuing to develop and improve our Estate View estate tax planning software. For Notre Dame last October we debuted our installment sale feature, which includes analysis and numerical illustration for self-cancelling notes and both defective and complex grantor trusts.

We are now updating our life insurance trust module so that clients can see the difference between using and not using irrevocable life insurance trusts on each spouse’s life and for second-to-die life insurance policies.

Please join the Estate View beta testers core by visiting Booth 430 and also check out our books and most importantly the Thursday Reports that we will hand out.

Alan Gassman, Ken Crotty and Chris Denicolo will all be spending time at the booth to say hello, especially during lunch and during breaks.

Notre Dame Tax Institute Dates Announced

Thursday and Friday, November 13 and 14, 2014, followed by the Notre Dame vs. Northwestern football game on Saturday, November 15.

The Notre Dame Tax Institute is pleased to announce that the 2014 program will take place on November 13 and 14 in South Bend, Indiana at the Century Center, which is conveniently located in downtown South Bend, directly across the street from the Doubletree Hotel.

This year’s program theme is business succession planning, and as with prior years will feature the very best speakers and outline materials, with the vast majority of sessions being the attendee’s choice between two or more presentations that will be offered each hour.

We are also very pleased to announce that the attendee reception will be held at the Convention Center itself for attendees and their spouses or significant others and will feature cocktails and hors d’oeuvres on the beautiful waterside view of the convention center. The 2014 program will also feature more opportunities for attendees to mingle and be able to meet one another.

The complimentary late Wednesday afternoon additional two hour session topic and speaker will be announced in the near future.

Please make your plans to attend this excellent program, and please let Jerry Hesch or the Thursday Report know of any suggestions you might have. Alan Gassman will serve on the Board of Advisors of the Notre Dame Institute, but don’t tell anyone.

We welcome any and all questions, comments and suggestions for this year’s conference.

Let’s also congratulate Jerry’s daughter, Erin on her admission to Northwestern University. Coincidentally, the Fighting Irish will be playing Northwestern on Saturday, November 15, 2013!

Larry Katzenstein’s Leimberg Article on How the Medicare Tax Impacts Charitable Trusts and Arrangements

Last week the LISI Network released Larry Katzenstein’s excellent write up on how the new Medicare tax regulations impact the following entities:

1. Charitable Purpose Trusts

2. Charitable Remainder Trusts

We thank Steve Leimberg and Larry for giving us permission to make this newsletter available to readers of the Thursday Report.

Click here for your complimentary copy.

Basic Asset Protection for Doctors: Getting Sued for Malpractice, Malpractice Insurance and All That Jazz– Part 2 of a 3 Part Series

by Alan S. Gassman

It can be a very cruel world for physicians, and no part is crueler than our tort “justice” system.

The unfortunate fact is that every doctor, whether perfect or imperfect, faces the possibility of a multi-million dollar judgment being imposed upon both the doctor and the medical practice entity. Just as bad, perhaps, is the number of years that a doctor being pursued has to endure worrying about these types of situations. Experience tells us that all doctors survive the ordeal financially if they have done proper planning in advance. Not all doctors survive the psychological effects of having to deal with worry over loss of substantial assets and their entire practice entity, particularly when advance planning has not been implemented in an appropriate manner.

Most physicians have many strategies that can be followed to assure that they can survive a multi-million dollar malpractice judgment, and have reasonable certainty during the litigation process to allow some degree of peace of mind.

Strategy #1 – Have good malpractice insurance.

Many clients ask us if they should go bare, especially once their “asset protection planning” has been completed. Going bare, or using a substandard carrier (as described in the first part of our article) can be a huge mistake.

Most doctors are not mentally or financially prepared to pay the defense costs that are required in a malpractice action. These can easily amount to $30,000 to $40,000 in the initial stages of investigation, depositions, and witness selection and preparation, and then climb well past $100,000 to be prepared for and to go through a trial. Imagine paying anywhere from $6,000 to $15,000 per month to defend a malpractice claim!

Secondly, where there is malpractice insurance we often do see the plaintiff’s lawyer make a mad rush to settle for the coverage limits. While we far prefer $1,000,000/$3,000,000 limits to $250,000/$750,000 limits, it is true that most of the time the plaintiff lawyer will accept policy limits where the doctor’s individual and practice assets have a good degree of protection.

The advantages and disadvantages of having small versus large limits of liability for malpractice insurance are covered in one of the Exhibits to this article.

Finally, and most important for catastrophic multi-million dollar verdicts, most of the time in these situations the carrier has an obligation to pay the entire verdict. Most smart plaintiff lawyers will offer to settle within policy limits, and if a carrier refuses to settle within policy limits and an excess verdict occurs, then most of the time the carrier is going to be responsible for paying the entire judgment if the doctor and the doctor’s legal counsel have communicated appropriately with the carrier.

This is one reason why it can be very important to have a lawyer independent of the attorney hired by the insurance carrier involved in helping to defend a doctor in a medical malpractice case.

Strategy #2 – Being “creditor-proof”.

A plaintiff lawyer and his or her client must look at what is available to satisfy their claims in a lawsuit. While it is simplest and easiest to settle for policy limits, a plaintiff lawyer does not want to be sued later by his or her own client for not having pursued whatever assets or items of value might have been available to settle a claim.

This may include determining whether there were transfers made after the claim came into existence that could be pursued as “fraudulent transfers.”

The personal creditor protection rules will be reviewed in a subsequent part of this series, but the very basic concepts are as follows:

a) Yes, it may be too late to protect assets once the patient has a bad result. The primary question under the fraudulent transfer statute is whether the purpose of the transfer was to avoid exposure of assets to a claim. There is no exact moment where that intention would or would not be proven. The best answer to when a clients asks me whether it is too late to transfer assets into a protective mode is that “if you having to ask that question, it may be too late.” DO YOUR CREDITOR PROTECTION PLANNING BEFORE ANY PATIENT HAS A BAD RESULT – IN FACT DO IT IMMEDIATELY AND MAINTAIN IT CONSISTENTLY.

b) Understand the categories of ownership and the types of assets that are creditor protected, and follow guidelines provided by qualified advisors to help assure that personal assets are protected. The categories of assets include assets owned by one’s spouse, assets owned by one’s spouse’s revocable trust, tenancy by the entireties assets, annuity contracts when properly structured, life insurance contracts when properly structured, IRAs, pension and 401(k) plans, homestead (up to half an acre within the city limits), 529 college savings plans, and certain other items. MANY MISTAKES ARE MADE BASED UPON ASSUMPTIONS OR ERRORS RELATING TO THE CREDITOR PROTECTION RULES AND PLANNING. BE CAREFUL, AND USE THOROUGH AND QUALIFIED ADVISORS. DO NOT BE LED INTO THINKING YOU NEED ONE PARTICULAR TYPE OF ASSET OR TECHNIQUE, PARTICULARLY WHEN THAT IS TOUTED BY A PROFESSIONAL WHO SELLS ONLY THAT TYPE OF ASSET OR TECHNIQUE. FOREIGN AND DOMESTIC “ASSET PROTECTION TRUSTS” AND OFFSHORE “TAX SAVINGS” ARRANGEMENTS SHOULD BE PARTICULARLY SCRUTINIZED, AS SHOULD THE PROFESSIONAL RECOMMENDING THEM.

Strategy #3 – Protecting medical practice assets.

Under the legal doctrine of respondent superior, the employer of a doctor will be legally responsible for the medical malpractice verdict against the doctor. The plaintiff lawyer therefore needs to scrutinize not only the doctor but also his or her practice entity to determine whether there are assets that can be used to satisfy a potential judgment.

To cut to the chase, the very best way to help assure that a plaintiff lawyer will not assume that there are significant practice assets is to (a) have any significant equipment and furnishings owned by a separate entity and/or being subject to bank debt exceeding its value, and (b) have significant bank debt as a lien against the accounts receivable of the medical practice. A future issue of this article will review techniques for protecting accounts receivable, none of which are perfect.

Strategy #4 – Proper Conduct During Litigation

A fourth leg of the table for the protection of physicians who are or will be the defendant of a medical malpractice lawsuit is to make sure that appropriate actions are taken with respect to the matter. These include the following:

a) Carefully preserve the entire medical record and make sure that any requests for copies of records are absolutely accurate and do not omit any pages or include pages from other patient’s files that might inadvertently be in the subject file folder.

b) Do not alter or backdate the medical records, except for the possibility of notations and clarifications that would be appropriately dated and approved in advance by a qualified defense lawyer. Juries have no mercies on doctors who backdate or “forge” medical records.

c) Prepare a memorandum marked “Attorney/Client Privileged Communication” providing anything and everything that comes to memory about the case, including any communications within the staff and with third parties. This can be invaluable as memories fade away over time.

d) Do not discuss the case with anyone but the attorney or attorneys representing you. Any discussions you have with any other party may be discoverable in depositions or otherwise.

e) Especially do not discuss the case with the patient, the family of the patient, or the lawyer for the patient. Anything you say can and often will be used against you.

f) Do not instruct your lawyer not to settle the case. It may be in your best interest to get the case settled early, and there may be an opportunity to do so, before the plaintiff lawyer has to expend a lot of money on experts. The plaintiff lawyer may be able to use a small settlement from one defendant doctor to fund the experts needed to pursue other doctors and institutions in the case. You may want to get out early while you can.

g) Update your creditor protection planning in a careful manner. Certain “moves” may be deemed to be “fraudulent transfers” that cast a negative appearance, while some transfers may be essential to preserve assets and income.

During the tendency of a serious lawsuit it can be important to review the Florida Statutes on wage protection and to make sure that monies received for services rendered in the practice are classified as wages (as opposed to dividends), and that the doctor is the head of a household providing more than fifty percent of the support of at least one person other than the doctor.

h) Most importantly, when an offer is made to settle within policy limits strongly consider making a strong demand upon the carrier to settle at that time. Once that has occurred the doctor may have very little exposure, since the carrier should be responsible for any excess verdict.

If you are dealing with a small or out of state malpractice carrier, then it is prudent to periodically review the financial health of the carrier. If the carrier goes under then the doctor may be “bare” and unable to receive monies to help defend the claim or to pay a judgment. The plaintiff lawyer may be much more willing to settle within policy limits, and even at a significant discount if he or she can be shown that the malpractice insurance carrier may go under.

Do You Remember Alfred E. Neuman?

Those of us who were fortunate enough to grow up with Mad Magazine understand parody, sarcasm, and good old low class humor.

Alfred E. Neuman was a great hero in the 1960’s and early 1970’s.

The Familiar Smile Loved by Generations

Alfred E. Neuman, popularly known as the lovable, jug-eared icon of Mad Magazine, is still adored by America to this day, over fifty years after his creation. His gapped toothy grin and carefree familiar slogans have brought joy to generations of children and adults alike, and have become a centerpiece of pop-culture.

Alfred’s character, briefly appearing under the alias “Mel Haney,” has starred on the cover of Mad Magazine for over fifty years, appearing in a majority of the magazine’s 500 issues. Alfred is no stranger to disguises, as he has frequently appeared on the cover dressed in a variety of guises over the years, including Barack Obama, Darth Vader, Bart Simpson, Barbara Streisand, Bruce Springsteen, and Abraham Lincoln. Most notably, he is known for his satirical presidential candidacies and his slogan “You could do worse…and always have!”

The Mysterious Origins of Alfred E. Newman

Despite Alfred’s continuing popularity, his creation is still a mystery to this day. The name Alfred E. Neuman was borrowed from Alfred Newman, a music arranger from the 1940s and 1950s. When Al Feldstein, editor of Mad Magazine in 1956, hired artist Norman Mingo to create the official portrait of Alfred, Norman Mingo was initially less than pleased to hear where he would be working. Unsurprisingly, Feldstein was able to convince Mingo to stay with Mad Magazine by offering a few rough sketches of Alfred’s lovable face. The name Alfred E. Neuman was first paired with the face in the 29th issue of Mad, released in 1955.

The origins of Alfred’s character have been so frequently questioned that in 2012, when current editor Nick Meglin was again asked about Alfred’s identity, he was quoted as saying, “Does the average Playboy reader care about where the rabbit came from? It’s just a symbol that lets you know what’s on the inside.”

Alfred’s goofy smile and “what, me worry?” attitude have made him a pop-culture icon in American society. He has transcended generational boundaries, while his growing popularity is enjoyed by children and grandchildren of original readers of Mad Magazine. There is no question that Alfred’s goofy grin will not be disappearing from the newsstands anytime soon.

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.

|

SHORT TERM AFRs |

MID TERM AFRs |

LONG TERM AFRs |

||||

| December 2013 | Annual | 0.25% | Annual | 1.65% | Annual | 3.32% |

| Semi-Annual | 0.25% | Semi-Annual | 1.64% | Semi-Annual | 3.29% | |

| Quarterly | 0.25% | Quarterly | 1.64% | Quarterly | 3.28% | |

| Monthly | 0.25% | Monthly | 1.63% | Monthly | 3.27% | |

| November 2013 | Annual | 0.27% | Annual | 1.73% | Annual | 3.37% |

| Semi-Annual | 0.27% | Semi-Annual | 1.72% | Semi-Annual | 3.34% | |

| Quarterly | 0.27% | Quarterly | 1.72% | Quarterly | 3.33% | |

| Monthly | 0.27% | Monthly | 1.71% | Monthly | 3.32% | |

| October 2013 | Annual | 0.32% | Annual | 1.93% | Annual | 3.50% |

| Semi-Annual | 0.32% | Semi-Annual | 1.92% | Semi-Annual | 3.47% | |

| Quarterly | 0.32% | Quarterly | 1.92% | Quarterly | 3.46% | |

| Monthly | 0.32% | Monthly | 1.91% | Monthly | 3.45% | |

The 7520 Rate for December is 2.0% and for November was 2.01%.

Seminars and Webinars

THE FLORIDA BAR – REPRESENTING THE PHYSICIAN

Date: Friday, January 17, 2013

Location: The Hyatt Hotel, Orlando, Florida

Additional Information: The annual Florida Bar conference entitled Representing the Physician is designed especially for health care, tax, and business lawyers, CPAs and physician office managers and physicians to cover practical legal, medical law, and tax planning matters that affect physicians and physician practices.

This year our 1 day seminar will be held in the Hyatt Hotel near Walt Disney World.

A dinner for the Executive Committee of the Health Law Section of The Florida Bar and our speakers will be held on Thursday, January 16, 2013. Anyone who would like to attend (Dutch treat or bring wooden shoes) will be welcomed. Your tax deductible hotel room to start a fantastic week near Disney, Universal, Sea World and most importantly Gatorland, can include a room at the fantastic Hyatt Hotel for a discounted rate per night, single occupancy.

PINELLAS COUNTY CHAPTER OF THE FLORIDA ASSOCIATION OF WOMEN LAWYERS SEMINAR

Alan Gassman will be speaking on Same Sex Marriage and Associated Laws We Should All Know About Anyway.

Date: January 30, 2014 | 5:30 p.m.

Location: Stetson Law School, Gulfport, Florida

Additional Information: For more information on this event please contact agassman@gassmanpa.com.

FLORIDA BAR HEALTH LAW REVIEW 2014

Alan Gassman will be speaking on What Healthcare Lawyers Need to Know About Tax Law and Business Entities at this excellent annual Florida Bar conference that is attended not only by those who are taking the Board Certification exam but also healthcare lawyers and other advisors.

Other speakers will include Lester Perling who is the co-author of A Practical Guide to Kickback and Self-Referral Laws for Florida Physicians and a number of other books and publications.

Date: March 7 – 8, 2014

Location: Hyatt, Orlando, Florida

Additional Information: We thank Jodi Laurence and Sandra Greenblatt for all of their hard work in making this conference as successful as it is. For more information please contact Jodi at jl@flhealthlaw.com or Sandra at sg@flhealthlawyer.com.

HILLSBOROUGH COUNTY BAR ASSOCIATION HEALTH LAW SECTION LUNCHEON

Alan Gassman and Christopher Denicolo will be speaking at the Hillsborough County Bar Association’s Health Law

Section Luncheon on the topic of Tax and Asset Protection Basics for Those Who Represent Physicians and Medical Practices

Date: March 12, 2014

Location: Chester H. Ferguson Law Center in Tampa, FL

Additional Information: For additional information please contact Co-Chairs Sara Younger (sara.younger@baycare.org) or Thomas Ferrante (tferrante@carltonfields.com).

1st ANNUAL ESTATE PLANNER’S DAY AT AVE MARIA SCHOOL OF LAW

Speakers: Speakers will include Professor Jerry Hesch, Jonathan Gopman, Alan Gassman and others.

Date: April 25, 2014

Location: Ave Maria School of Law, Naples, Florida

Sponsors: Ave Maria School of Law, Collier County Estate Planning Council and more to be announced.

Additional Information: For more information on this event please contact agassman@gassmanpa.com.

THE FLORIDA BAR ANNUAL WEALTH PROTECTION SEMINAR

Date: Thursday, May 8, 2014

Speakers: Speakers will include Barry Engel on Offshore Trust Planning and Developments Over the Past 2 Years in Asset Protection, Howard Fisher and Alex Fisher on “Designer Entities – The Cutting Edge in Asset Protection”, Denis Kleinfeld on The Roadmap to Wealth Protection Planning and Alan Gassman on Structuring Business and Investment Assets and Entities – Wealth Protection 401 for the Dedicated Planner.

Location: Hyatt Regency Downtown, Miami, Florida

Additional Information: For more information please contact agassman@gassmanpa.com

NOTRE DAME TAX AND ESTATE PLANNING INSTITUTE

Date: November 13 and 14, 2014

Speakers: TBA

Location: Century Center, South Bend, Indiana

Additional Information: Don’t miss this year’s Notre Dame Tax and Estate Planning Institute. Rooms will sell out fast so book yours now. We will let you know when registration details become available. If you have any questions please email agassman@gassmanpa.com

NOTABLE SEMINARS PRESENTED BY OTHERS:

48th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING SEMINAR

Date: January 13 – 17, 2014

Location: Orlando World Center Marriott, Orlando, Florida

Sponsor: University of Miami School of Law

Additional Information: For more information please visit: http://www.law.miami.edu/heckerling/

16th ANNUAL ALL CHILDREN’S HOSPITAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

Date: Wednesday, February 12, 2014

Location: All Children’s Hospital Education and Conference Center, St. Petersburg, Florida with remote location live interactive viewings in Tampa, Sarasota, New Port Richey, Lakeland, and Bangkok, Thailand

Sponsor: All Children’s Hospital

THE UNIVERSITY OF FLORIDA TAX INSTITUTE

Date: February 19 – 21, 2014

Location: Grand Hyatt, Tampa, Florida

Presenters: Martin McMahon, Jr., C. Wells Hall, III, Abraham N.M. Shashy, Karen L. Hawkins, Lawrence Lokken, Stephen F. Gertzman, James B. Sowell, John J. Rooney, Louis Weller, Ronald Aucutt, Karen Gilbreath Sowell, Herbert N. Beller, Peter J. Genz, Stephan R. Leimberg, John J. Scroggin, Lauren Y. Detzel, David Pratt and Samuel A. Donaldson

Sponsor: UF Law alumni and UF Graduate Tax Program

Additional Information: Here is what UF is saying about the program on its website: “The UF Tax Institute will provide tax practitioners and other leading tax, business and estate planning professionals with a program that covers the most current issues and planning ideas with a practical, informative, state-of-the-art approach. The Institute’s schedule will devote separate days or half days to individual income tax issues, entity tax issues and estate planning issues. Speakers and presentations will be announced as the program date nears to ensure coverage of the most timely and significant topics. UF Law alumni have formed the Florida Tax Education Foundation, Inc., a nonprofit corporation, to organize the conference.”