The Thursday Report – 12.22.16 – Make the North Pole Great Again

Re: Make the North Pole Great Again

Planning for Trump’s Tax Law Changes: Part 1

Avoiding the Estate Tax Trap of 2017 – The Flexible Mirror Dynasty Trust Solution

New IRS Mileage Rate Deductions

Lock in Your Rate, Before it is Too Late!

The Raw Talent of Woody Allen – Where is Yours?

The True Secret to Getting More Done in Less Time by David Finkel

Webinar Spotlight: What Physicians and Advisors Can Expect Under the Trump Administration Webinar Series

Richard Connolly’s World – How to Give an IRA to Children Without Giving Up Control

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Alan at agassman@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Planning for Trump’s Tax Law Changes: Part 1

by Alan Gassman

In the coming weeks we will share portions of the Bloomberg BNA Webinar, “What to Expect After the Unexpected: Planning Now for the Probable and Possible Trump Tax Law Changes” presented by Gassman, Crotty & Denicolo, P.A. and Baker & McKenzie LLP. What follows is Part One of this series, which features Alan discussing what to expect with a Trump administration.

On January 20, 2017, Donald Trump will take the Oath of Office on the steps of the United States Capitol Building, the same building where he hopes to initiate significant changes to tax laws that have been in place for many years. Some of these include:

- Reduction in the federal income tax

- Elimination of the 3.8% Medicare tax

- Reduction or elimination of the 0.9% Medicare payroll tax

- Reduction or phase-out of the federal estate tax

- Changes to international law

It will be interesting to see how this plays out politically. Recently, Donald Trump gave a speech in Wisconsin stating that he was going to allow Paul Ryan to handle tax reform and the medical law. One of his spokesmen has indicated that, at least for the wealthy, income tax rate decreases are going to be made up for by losses of deductions, so that the wealthy may end up paying the same income taxes as they have been paying. Only time will tell.

Pursuant to the Balance Budget Act, also known as the Byrd Rule, unless a tax reduction is approved by 60 of the 100 Senators, then any potential tax reduction has to be eliminated ten years after passing. As you may recall, that is what happened with the estate tax elimination bill under George W. Bush in 2001. What we are experiencing now is the pendulum swinging towards a Republican tax reduction, but in four years it may just swing as far back, if not farther.

In an article prepared by the Association for Advanced Life Underwriting, the author states, “Treasury Secretary-designee Steven Mnuchin has identified tax reform as a priority, but he has also stated that there will be no “absolute tax cut” for high income households. This sentiment is hard to square with the current House Republican Tax Reform Blueprint – which repeals the estate tax, drops marginal rates, etc. The sentiment also belies some of the specifics in President-Elect Trump’s plan.”

As planners, we need to be looking at not only the present, but obviously what is going to happen in the next four to six years. Do we forget about the estate tax and tell clients to do nothing? Or do we explain to them that they may want to go forward with their planning?

Reasons to Continue or Accelerate Estate Tax Planning

- The tax may not go away – a compromise might be to increase the exemption and allow the 2704(b) regulations to be promulgated.

- If the estate tax does go away, it may come back later with sharper teeth. What is done now and commonly acceptable may be grandfathered, such as the ability to fund an irrevocable trust in an asset protection trust (“APT”) jurisdiction that could later benefit the grantor. We doubt that the “Bernie Sanders camp” will allow this type of planning in the future, if they take power in 2021.

- The economy seems poised to ramp forward with exploding values for many clients – are we going to leave these exposed to an unpredictable inheritance tax system?

- Where estate tax planning is consistent with asset protection planning, this “dynamic duo” should be linked together, so that there is a solid business reason for establishing and funding APT trusts. If the client is convinced that the estate tax will be gone, why not use up what remains of the $5,490,000 exemption to fund an APT that would likely be grandfathered if the estate tax goes away and comes back with sharper teeth, and can protect assets from potential creditors with a solid business purpose for funding.

- Asset protection trusts for assets that would exceed the amount that can be funded without gift tax implications are typically structured now as “incomplete gifts,” which requires the grantor to retain the right to prevent distributions to those other than the grantor, and to direct how the trust assets pass on the grantor’s death by limited power of appointment according to CCA 201208026. Being able to place unlimited assets into creditor protection trusts that will not have these requirements will be of great benefit to clients who wish to establish these trusts where there are truly independent fiduciaries. The debate will continue as to whether it is best to establish these trusts in domestic versus foreign jurisdictions.

- Repurposing “discount entities” to become creditor protected family wealth preservation entities may be useful as discounting becomes less important and family unity and creditor protection become more important.

- The APT GRAT is probably today’s gold standard mechanism for estate tax planning with large estates. It may be “reversible” by Trust Protectors and there is “zero risk” of gift tax exposure. See Shenkman & Blattmachr Estate Tax Repeal is Not a Temporary or Permanent Certainty: How to Plan Now, Interactive Legal presentation of 12-12-16.

- It is also important to look ahead towards basis planning. Under the Canadian system, only assets passing directly to a surviving spouse are immune from capital gains tax on death. It is possible that QTIP and general power of appointment marital deduction devices will qualify to delay capital gains on death if we end up with this regime.

- Second marriage situations that have favored QTIP trusts for deferral/avoidance of federal estate tax will be retooled significantly if the estate tax is eliminated or exemptions are dramatically increased.

- 2016 marked the 100 Year Anniversary of the modern estate tax, and planners should not overreact to one paragraph in a proposed tax plan on a President-Elect’s campaign website.

- Rearrangement of now existing plans is very likely for a material portion of affluent families who will reposition to take many of the factors discussed today into account.

- It is easiest to have the “middle class” accept a gradual phased-in estate tax elimination program which may be legislated away after four years. For example, estate tax repeal was scheduled to be phased in over ten years under the Bush Tax Cuts, but was reinstated permanently in 2012.

Where planning is not expensive or intrusive, and can easily be reversed if not needed, the safest answer is to go forward with “business as usual,” especially when clients have specific expected transactions, health situations, or opportunities, which may include: a healthy economy, increasing values, and the last months we may see of the lowest interest rates in the history of our modern economy.

Avoiding the Estate Tax Trap of 2017 – The Flexible Mirror Dynasty Trust Solution

by Alan Gassman and Chris Denicolo

Mirror dynasty trust on the wall,

Can you help my clients not take a fall.

If the estate tax stays or even gets worse,

Your magical powers will avoid the curse.

And if gift tax is eliminated for a period of time,

We will be funding you more, and you will work just fine.

When we look back in a year on the unexpected results of the 2016 Presidential Election, and the tendency for clients and advisors to “wait and see” what happens with estate and gift taxes, we may find that the majority of planners and decision makers erred on the side of doing nothing, costing families significant portions of their assets upon the death of loved ones in the future.

Alternatively, when we look back in five years we may find that the estate tax “went away” but came back in harsher form, after a period of time during which those who planned ahead came out much better than those who did not.

While some commentators believe that repeal of the estate tax is a strong possibility, others have pointed out the several likely alternatives that must be considered to stay two or more move moves ahead on the chess board of family wealth planning in this dynamic environment.

By our view it is crucial to give clients options that include flexible methods of taking advantage of present opportunities, while being able to change or reverse what is done, or assure that it would be wanted in a no estate tax world, while also being ahead in the non-basis step up environment that may be coming.

The “Flexible Mirror Dynasty Trust” allows clients to take advantage of presently available and effective estate tax planning opportunities, while providing the flexibility needed to address to the possible uncertainties that might exist the horizon, while also providing asset protection that may greatly exceed what is now otherwise in place.

When Mr. Trump was elected on November 8, the possibility of a repeal, or at least a substantially modified estate tax system, became closer to a reality. Mr. Trump has not formally announced a detailed proposal on the estate tax, but his campaign website offered the following:

The Trump Plan will repeal the death tax, but capital gains held until death and valued over $10 million will be subject to tax to exempt small businesses and family farms. To prevent abuse, contributions of appreciated assets into a private charity established by the decedent or the decedent’s relatives will be disallowed.[1]

It remains to be seen how (or if) this proposal or something similar thereto will be developed into law, and how it will apply from a practical standpoint. During his campaign and since he has been elected, Mr. Trump has discussed many objectives other than estate tax repeal that have received a lot more attention and have generated and likely will continue to generate much debate. Accomplishing these objectives, and being postured for re-election in 2020 will require the expenditure of much political capital, which could limit, delay, or hinder the possibility of significant estate tax law changes, and increase the likelihood that any estate tax law changes will occur only as part of changes to the budget. Further, under the Byrd Rule, any legislation which affects the budget can only be effective for ten (10) years unless a three-fifths (3/5) majority in the Senate (i.e., sixty (60) senators) vote for such legislation.

With the Republicans currently having a slim majority of fifty-two (52) in the Senate, it is unlikely that the sixty (60) senators threshold would be overcome in order to avoid the Byrd Rule from restricting estate tax legislation from sun setting in ten (10) years. Given the amount of political capital that is likely to be expended by Mr. Trump on other issues which were on the forefront in the campaign process, it is unlikely that there will be a standalone estate tax elimination bill that is not tied to the budget.

In short, we cannot be sure if anything is going to happen to the estate tax, or if any such changes to the estate tax will sunset within the next decade or so to cause to the estate tax to come back with a vengeance to apply to a greater fraction of the population than the current law. Accordingly, a sound estate planning structure needs to be fluid and malleable to account for whatever lies beyond the horizon.

The Flexible Mirror Dynasty Trust operates in a conventional way- it is an irrevocable trust established by an individual for the benefit of his or her spouse and/or descendants. It allows for assets to be held thereunder, for the benefit of the grantor’s desired beneficiaries, in a protective manner where the assets can be protected from the beneficiaries’ creditors, and can be exempt from federal estate tax at their levels under current law (and, more than likely, under any new estate tax regime espoused by Mr. Trump’s administration). Also, presumably, the assets can be shielded from a possible capital gains income tax on the death of the grantor or other family members if the Canadian style tax on appreciated property upon death is enacted.

However, a key difference from the conventional dynasty trust is that the Flexible Mirror Dynasty Trust will be established in an asset protection jurisdiction, and the Trust will name a committee of independent trust protectors who have the power to amend the Trust under certain circumstances. Specifically, the trust protectors’ authority will include the power to cause the transfer of the Trust the assets back to the grantor under limited conditions as determined in their discretion, such as if the grantor’s net worth ever drops below a certain level, or if the federal estate law is ever repealed or is no longer considered to be a concern to the family.

It is important that the Trust be drafted as a domestic or offshore asset protection trust, and that it be sitused in a jurisdiction that provides for the protection of the Trust assets from the creditor of the grantor despite the possibility of the grantor becoming a beneficiary of the Trust. Under PLR200944002, assets held under a self-settled trust under which the grantor was a discretionary beneficiary was protected from the creditors of the grantor based upon Alaska law and found to not be includable in the estate of the grantor for federal estate tax purposes. The jurisdiction in question in this PLR was Alaska, and the grantor was a resident of Alaska when the trust was established and when the ruling was given. Some commentators have expressed concern that having the resident of non-APT jurisdiction use a domestic asset protection jurisdiction will not be sufficient because the Full Faith and Credit Clause of the United States Constitution or conflict of law rules may allow a creditor holding a judgment against the grantor in another state to access the assets of the trust. Commentary to the Uniform Voidable Transfers Act supports this hopefully incorrect position, although the Huber[2] case gives planners some pause as to setting up a domestic asset protection trust in a state in which the grantor does not reside. In the Huber case, an Alaska asset protection trust was set up by a Washington resident for the obvious purpose of avoiding creditor claims involving real estate outside of Alaska that was held indirectly via LLCs by the trustee. The grantor’s creditors were able to reach the assets under the trust due to the Bankruptcy Court finding that Washington state law applied to the trust, rather than Alaska law, due to Washington having the most significant relationship to the trust and the trust having minimal contacts with Alaska. This is why the ability of the trustee to benefit the grantor of the trust is best nonexistent unless or until an issue of independent significance exists.

Most planners agree that it is safest to establish the trust in an offshore asset protection jurisdiction, such as Nevis, the Cook Islands, or Belize, which each has well-developed trust law, if the client resides in a non-asset protection trust state and wishes to be a discretionary beneficiary from the beginning.

The Trust also will normally include a committee of independent trust protectors whose powers must be carefully drafted in order to prevent estate tax inclusion of the Trust assets in the estate of the grantor upon creation of the Trust. For example, the grantor should not have any power to remove and replace any of the trust protectors, nor should the grantor have any power or authority to exercise the trust protectors’ powers. Further, the trust protectors’ exercise of power should not be conditioned upon the approval of the grantor or any individual who is related or subordinate to him (such as his or her spouse, children, parents, or siblings), and may be conditioned upon events that are beyond the control of the grantor and the trust protectors.

The trust protectors’ powers should be exercisable only in their sole and absolute discretion, and may include the power to add the grantor as a beneficiary of the trust if his or her net worth drops below a certain level that is unforeseen and independently significant.

Additionally, because the trust protectors will have a wide latitude under the Trust documents, it is important to assure that the parties appointed are trusted individuals or financial institutions with appropriate checks and balances in place between them. The authors typically recommend that the committee consist of at least three trust protectors, and that there is a clearly articulated mechanism for the succession and possible replacement thereof by other trust protectors or by another independent party. Alexander Bove’s wonderful writings on Trust Protectors should be reviewed carefully by anyone drafting trusts of this nature.

In situations where the client has considered or has undertaken the process of making transfers to an irrevocable trust for the benefit of his or her spouse and/or descendants, drafting the trust as a Flexible Mirror Dynasty Trust with trust protectors does not require significant restructuring. The Flexible Mirror Dynasty Trust can have the same dispositive and trusteeship provisions as a pre-existing irrevocable dynasty trust that the client has established, and may be merged into existing trusts if and when it becomes apparent that this is in the best interests of the family.

Further, a client who has considered entering into an installment sale or private annuity sale to a pre-existing irrevocable dynasty trust that has an independent net worth of sufficient assets as ballast capital may instead sell assets to the new Flexible Mirror Dynasty Trust in exchange for the installment note or private annuity. The Flexible Mirror Dynasty Trust can provide for the same beneficiaries as the pre-existing trust, and the pre-existing trust can guarantee the installment or private annuity obligation of the new Flexible Mirror Dynasty Trust which is owed to the client.

The Flexible Mirror Dynasty Trust can be drafted as a grantor trust for federal income tax purposes so the client will be responsible for paying any taxes associated with the trust’s income, and the client can engage in an installment sale transaction with the Trust without causing any adverse income tax consequences. This can allow the Trust’s assets to grow on a tax-free basis, while allowing the grantor to engage in future transactions with the trust (such as installment sale or private annuity transactions) with any income taxes resulting from any such transactions.

A similar approach was articulated by Marty Shenkman and Jonathan Blattmachr in a recent presentation on planning for the possible new estate tax regime. They have discussed the advantages of using a “Hybrid Asset Protection GRAT” as a very desirable planning strategy in light of the uncertainty that is on the horizon. This technique involves a grantor establishing a grantor retained annuity trust (GRAT) in an asset protection jurisdiction where trust protectors would also have the right to directly or indirectly allow assets to pass to or for the benefit of the grantor. By using a zeroed-out GRAT that is drafted to provide that the annuity payments owed back to the grantor are based on a percentage of the initial contribution, and that the trust protectors under the GRAT have the discretion to distribute additional assets to the grantor, flexibility is attained if circumstances change or the estate law materially changes. The Hybrid Asset Protection GRAT is one variety of Flexible Mirror Dynasty Trusts that can help families with significant wealth navigate the present not so calm waters very successfully.

If the estate tax is permanently eliminated, the Flexible Mirror Dynasty Trust could be merged into the pre-existing dynasty trust, or the assets thereof could be distributed back to the grantor by the trust protectors. If the estate tax remains in its current form, or continues to be a concern for the client, then the assets can remain under the Flexible Mirror Dynasty Trust and escape the impositions of federal estate tax on the death of the grantor, and perhaps at the levels of his or her descendants.

A great many planners have clients who have spent a lot of time and money working on their estate plans that are currently in process, or have sales, liquidity, repaid growth in value, high earnings or near death situations that call for conventional planning. Planners are unsure what to tell their clients in light of this uncertainty. It is incumbent upon planners to inform and educate their clients of all options and alternatives, to make them aware of possible risks and downside that could occur if laws do not change, or if the tax law system is different from what is expected. The Flexible Mirror Dynasty Trust provides planners with a tool that can be used effectively in differing estate tax climates to achieve the clients’ planning objectives, tax and otherwise, while also providing significant asset protection opportunities that should not be ignored.

*************************************************

[1] See, https://www.bna.com/trump-plan-repeals-n57982077269/.

[2] Waldron v. Huber (In re Huber), 2013 WL 2154218 (Bk. W.D. Wa., Slip Copy, May 17, 2013).

New IRS Mileage Rate Deductions

by Seaver Brown and Alan Gassman

Last week the IRS released the 2017 optional standard mileage rates that taxpayers use to determine the amount of costs they can deduct from operating a vehicle for a business, charity, or medical or moving purposes.

Beginning January 1, 2017, the mileage rates for cars, vans, pickups, or panel trucks will be:

- 5 cents per mile for business miles driven (54 cents in 2016)

- 17 cents per mile driven for medical or moving purposes (19 cents in 2016)

- 14 cents per mile driven in service of charitable organizations

Remember, taxpayers can also calculate the actual costs of using their vehicle instead of using the standard mileage rates.

Furthermore, “a taxpayer may not use the business standard mileage rate for a vehicle after using any depreciation method under the Modified Accelerated Cost Recovery System (MACRS) or after claiming a Section 179 deduction for that vehicle. In addition, the business standard mileage rate cannot be used for more than four vehicles used simultaneously.”

Lock in Your Rate, Before it is Too Late!

by Alan Gassman

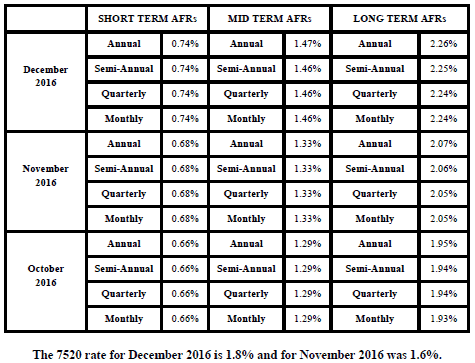

Let’s get right to the point—the Federal Reserve is raising interest rates and the economy looks healthy. The present applicable federal rates may be the lowest that we will ever see during our lifetimes. You can lock in the present December rates, which are shown below on family loans and sales, and you can go back three months to take advantage of the lower October rates for sales that occur this month.

In January, you can take advantage of the November rates, which are significantly lower than the current December rates. Accordingly, plan to finish your transactions in January.

For more information see the article Interesting Interest Questions: Interest Rates for Intra-Family Transactions by Alan Gassman, Jerry Hesch, and Chris Denicolo (who did all the work) by clicking here.

The Raw Talent of Woody Allen – Where is Yours?

In grade school, Woody Allen (a/k/a Allan Stewart Konigsberg) was an extremely shy and high strung student at Midwood High School. He was secretly writing jokes and sending them to newspaper writers under the pseudonym, Woody Allen, so that he would not be embarrassed with his peer group.

He landed his first part-time job writing jokes and averaged fifty jokes a day, seven days a week. That is 350 jokes a week. That is like comparing a race horse to a snail by most standards.

He met show business managers, Charles Joffe and Jack Rollins at age 23, and at that point neither of them had ever managed a writer, so they encouraged him to become a stand-up comedian.

He was a terrible and nervous stand-up comedian during his first months in that business, and often threw up before going on stage. Eventually, however, he became the newest, brightest face in the New York City comedy scene, and from there, went forward to become a writer and director at the Greenwich Village Cafe in Upper State New York, and started writing a new show every Monday, and presented the show Friday and Saturday.

In 1965 Woody began to write, direct, and star in his own movies, which were often depictions of his on-stage persona developed while performing stand-up. Woody’s watershed moment came when he wrote and directed Annie Hall, a film written for and about its leading actress, Diane Keaton. Annie Hall won four Academy Awards in 1977 for Best Picture, Best Actress in a Leading Role, Best Original Screenplay, and Best Director.

Woody Allen’s best one-liners:

- “There are worse things in life than death. Have you ever spent an evening with an insurance salesman?”

- “You want to do mankind a real service? Tell funnier jokes.”

- “What if everything is an illusion and nothing exists? In that case, I definitely overpaid for my carpet.”

The True Secret to Getting More Done in Less Time

by David Finkel

David Finkel is the Wall Street Journal bestselling author of SCALE: Seven Proven Principles to Grow Your Business and Get Your Life Back, which can be viewed by clicking here. As the CEO of Maui Mastermind, he has worked with 100,000+ businesses coaching clients and community members to buy, build, and sell over $5 billion worth of businesses.

If 20 years of coaching business owners to grow their companies has taught me anything, it’s this:

The average business owner is overworked, stressed out, and feels pulled in twenty directions all at once.

Most of all they’re frustrated. Frustrated that they have too many lower value tasks that clutter up their day and make it difficult to focus on those fewer, better things that potentially create the most value for their company.

Sadly, their “solution” is simply to work harder. They increase their hours, work at night and over the weekend. But all this just helps them maintain the status quo, not get ahead.

I want to let you in on a little secret. Working harder is not the answer. It will not get you the results you crave. In fact, the harder you work, chances are the less you’ll accomplish that really matters. I know this sounds easy for me to say, but hang in there with me as I walk through a key concept with you.

You’ve likely heard of “Pareto’s Principle” which states that 80 percent of your efforts produce 20 percent of your results, and that 20 percent of your effort produces 80 percent of your results. Well if this is true (and my experience shows me that it is) then let’s apply this concept more rigorously.

If you take that 20 percent of your actions that generate 80 percent of your results and apply the same distinction, then 20 percent of that 20 percent produces 80 percent of 80 percent of your results. That means that 4 percent of your effort (the 20 percent of 20 percent) generates 64 percent of your results.

And if you can bear with me for another math moment, apply this distinction one more time…

This means that 1 percent (20 percent of 20 percent of 20 percent) generates 50 percent of your results! Think about it—1 percent of your highest leverage work produces 50 percent of all your results!

We use this concept to create the Time Value Matrix (see image below), which is an actual tool my team and I created for our business coaching clients to help them quickly and accurately break their activities down into these four distinct categories of time: A Time, B Time, C Time, and D Time.

Please click here to continue reading this article on the Maui Mastermind website. You can also follow David on Twitter: @DavidFinkel.

Webinar Spotlight:

For more information about this webinar presentation, please email Alan at agassman@gassmanpa.com

What Physicians and Advisors Can Expect Under the Trump Administration Webinar Series

Richard Connolly’s World

Richard Connolly’s World

How to Give an IRA to Children Without Giving Up Control

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the article of interest is “How to Give an IRA to Children Without Giving Up Control” by Paul Sullivan. This article was featured in The New York Times on November 18, 2016.

Richard’s description is as follows:

Most people spend whatever they have saved in their individual retirement accounts in the years after they stop working. If they’re fortunate, they have enough to last.

But the few who have amassed such large retirement accounts that they will never exhaust them have a concern common to many wealthy parents: What happens to the money when they die and their children inherit it?

A trusteed I.R.A. is a relatively easy way for parents to control how, when and why their children receive the distributions from their retirement accounts.

It can accomplish many of the same things as a trust with less work and lower cost. It also makes it simple to extend the distributions to heirs based on their individual life expectancies.

Please click here to read this article in its entirety.

Humor! (Or Lack Thereof!)

Sign Sayings of the Week

**********************************************************

Christmas Movies to Watch on the Lifetime Channel

by Ron Ross

Dangerous Chestnuts

Obsession With Elves

I Killed My Reindeer

Abducted Eggnog

Fatal Holly

The Secret Life of Mrs. Claus

Teenage and Pregnant: The Nativity Story

Lizzie Bordon Christmas: Yule Be Sorry

**********************************************************

In the News

by Ron Ross

Antiochus IV, the King of the Selucids, conquered Israel and imposed Greek Worship. The Maccabee family led the Jewish revolt in 167 BCE. They eventually recaptured Jerusalem, and cleansed the temple of Greek idolatry. According to legend, only enough holy oil was found to light the temple lamp for one night, yet it burned for seven nights.

The Thursday Report reminds you that even though it is Hanukkah, you still have to pay the electric company for all seven days of the week, or they will shut your light off. No miracles. Also, do not leave your dreidels on the floor, people may trip and fall and then sue you for negligence.

Upcoming Seminars and Webinars

Calendar of Events

LIVE LARGO PRESENTATION:

Alan will present a talk to Largo Medical Center Residents & Fellows on The Essential Guide to Money, Creditor Protection, Investments, Trusts, and Business Law for New Physicians – How to Have Great Success or Almost Certain Failure.

Date: Thursday, December 29, 2016 | 12:00 PM (Eastern)

Location: Bilgore Conference Center | Largo Medical Center | 201 14th St. SW, Largo, FL, 33770

Additional Information: For more information, please contact Alan at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

51ST ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING EVENTS

Alan and Jerry Hesch will demonstrate EstateView, an estate tax projection software at InterActive Legal’s display area on Tuesday, January 10 at 8:40 AM, and tell jokes about draft numbers and Triumphs.

The Alan Gassman Channel and EstateView Software will be profiled and demonstrated at the InterActive Legal station Monday through Thursday during conference hours. Please feel free to contact Alan at agassman@gassmanpa.com for an appointment and personal tour of how EstateView works free of charge to those who purchase InterActive products at the Heckerling Institute, or shortly thereafter. All attendees will receive free buckets of fried chicken.

Alan’s Bloomberg BNA moderated webinar series will present live questions and answer opportunities at the Bloomberg BNA booth. Stay tuned for more details!

The schedule for all InterActive Legal speakers and experts during Heckerling is provided below:

- Tuesday, January 10th 8:40 a.m. – Alan Gassman and Jerry Hesch

- Tuesday, January 10th 10:40 a.m. – Natalie Choate

- Tuesday, January 10th 3:40 p.m. – Todd Angkatavanich and David Stein

- Wednesday, January 11th 8:40 a.m. – Michael L. Graham – InterActive Legal CEO

- Wednesday, January 11th 10:40 a.m. – Letha McDowell, CELA – Director of Legal Strategy, InterActive Legal

- Wednesday, January 11th 3:30 p.m. – Howard Zaritsky

- Thursday, January 12th 8:40 a.m. – Martin Shenkman

- Thursday, January 12th 10:40 a.m. – Gideon Rothschild

- Thursday, January 12th 3:30 p.m. – Jonathan Blattmachr – Founder, InterActive Legal

Date: January 9th – January 13th, 2017

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE PASCO PRESENTATION:

Alan will present a live webinar on FDIC Insurance.

Date: February 14, 2016 | 12:30 PM (Eastern)

Additional Information: For more information, please contact Alan at agassman@gassmanpa.com.

**********************************************************

LIVE SAN DIEGO PRESENTATION:

Alan will present ASSET PROTECTION AND ESTATE PLANNING FOR SAVVY BUSINESS OWNERS AND PROFESSIONALS at the 2017 Maui Mastermind Freedom Formula Workshop. You’ll get a “charge” out of this, whether you are a San Diego fan or not.

Date: Friday, January 27, 2017 – Sunday, January 29th, 2017 | Time TBD

Location: Hilton San Diego Mission Valley | 901 Camino del Rio South, San Diego, CA, 92108

Additional Information: For more information, please contact Alan at agassman@gassmanpa.com.

**********************************************************

LIVE TAMPA PRESENTATION:

ANNUAL ALEXANDER L. PASKAY MEMORIAL BANKRUPTCY SEMINAR

Alan, Mike Markham and others will speak on a panel at the American Bankruptcy Institute’s annual Alexander L. Paskay Memorial Bankruptcy Seminar on the topic of THE ETHICS OF ASSET PROTECTION.

Bring your copy of Gassman and Markham on Florida and Federal Asset Protection Law for free autographs.

Date: Thursday, February 2, 2017 | Time TBD

Location: The Embassy Suites Tampa Downtown Convention Center | 513 S. Florida Avenue, Tampa, FL, 33602

Additional Information: For more information, please contact Alan at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

REPRESENTING THE PHYSICIAN: IT IS HARDER THAN IT LOOKS

Alan and Lester Perling will give a panel discussion talk on Structuring Medical Practices and Related Entities for Tax, Creditor Insulation, and Regulatory Compliance Purposes

Other speakers at this event include William Eck, Susan Thomas, Melissa Mora, Sachi Mankodi, Kimberly Brandt, Al Gomez, Kathleen Premo, and Radha Bachman.

Other topics at this event include:

- The Brave New World of Medicare Physician Compensation Under MACRA and Beyond

- Office of Civil Rights HIPAA Audits – Preparing Your Clients and Yourself

- The Physician’s Role Under EMTALA and the Florida Access to Emergency Services Act

- Medical Marijuana in Florida – The Highs and Lows of its Regulation

- The Post-Election View from the Hill

- What the Doctor’s Lawyer and the Doctor Need to Know About Bankruptcy and How Creditors Approach Health Industry Related Situations

- Medicare and Other Risk Contracts

- Medical Entities and Rules You Must Know About

Date: Friday, February 3, 2017 | Alan speaks at 8:30 AM and 4:10 PM.

Location: Rosen Centre Hotel | 9840 International Drive, Orlando, FL, 32819

Additional Information: For more information, please contact Alan at agassman@gassmanpa.com.

**********************************************************

LIVE INTERACTIVE NEW YEAR RESOLUTION ENFORCEMENT WORKSHOP:

Do you need a positive jump start for 2017? Think about making a date with Srikumar Rao’s book Are You Ready to Succeed? followed by participation in one or more InterActive workshops that Professor Rao will lead in St. Petersburg, Florida, which are as follows:

Saturday, February 11, 2017

Professional Achievement Workshop with Dr. Srikumar Rao and Alan Gassman

Join Dr. Rao and Alan for a seven-hour, interactive workshop designed to law students, recent graduates, and other business professionals to reach new levels of enjoyment and achievement in their business or professional careers. The workshop is approved for two ethical hours, and five general legal hours of continuing legal education.

This workshop is based on Alan’s workshop materials that have been presented at the University of Florida, Ave Maria School of Law, and state & city Bar conferences. Net proceeds will benefit Stetson Law School.

Please click here for a schedule of the sessions Dr. Rao and Alan will cover in this workshop.

Date: Saturday, February 11, 2017 | 9:00 a.m. – 4:30 p.m.

Location: Stetson Law School, Gulfport Campus | 1401 61st Street South, St. Petersburg, FL, 33707

Cost: Free for all current law students and Alumni out less than one year. $75 for Alumni out one to three years, St. Pete and Clearwater Bar Solo Practice members, and charitable organization employees. $125 for all others. Includes free lunch.

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

Sunday, February 12, 2017

The Enjoyment Solution: How to Replace Worry and Stress with Clear Direction, Confidence, and In the Groove Life Experience at Work and at Home with Dr. Srikumar Rao

This 6-hour workshop will be a private event held by the Rao Institute at the request of Alan and friends. This will be provided for a limited number of attendees as a cost of $475 per person. Please RSVP now while spaces are available!

See Dr. Rao’s YouTube TED Talk, and you will see why he is so well-regarded and sought out worldwide as a presenter, coach, and author. Meet this gentle and brilliant man who has changed so many lives up close and personal!

You can see his best-selling books, Are You Ready to Succeed? and Happiness at Work on Amazon by clicking here. You can also see his TED Talk that has been viewed by well over 1 million people by clicking here.

Sarah Palin said that she would not leave Nome without them!

Date: Sunday, February 12, 2017

Location: Stetson Law School, Gulfport Campus | 1401 61st Street South, St. Petersburg, FL, 33707

Cost: $475 per person, or three for $1,425

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE DISNEY WORLD PRESENTATION (HOW MICKEY MOUSE CAN YOU GET?):

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan will be speaking at the Medical Education Resources (MER) Internal Medicine and Country Bear Jamboree for primary care physicians and other characters. We thank MER for this wonderful opportunity and Walt Disney for having paved all of Osceola County. His topics will include:

- The 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning

- Lawsuits 101

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: Wednesday, March 15, 2017 and Thursday, March 16, 2017

Location: Walt Disney World BoardWalk Inn | 2101 Epcot Resorts Blvd, Kissimmee, FL 34747

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE ESTATE PLANNING DISCUSSION AT FLORIDA STATE UNIVERSITY SCHOOL OF LAW

Alan will appear via Skype with professors Steven Hogan and Bob Pierce to give his views, by interview style, for their estate planning course at Florida State University School of Law on Thursday, March 23, 2017.

Date: Thursday, March 23, 2017 | 1:15 – 3:00 p.m. (EASTERN)

Location: Florida State University School of Law

Additional Information: To receive a live call in code or videotape of this presentation, which we will qualify for continuing legal education credit, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE ESTATE PLANNING COUNCIL OF NORTHEAST FLORIDA PRESENTATION:

Alan will be speaking for the Estate Planning Council of Northeast Florida on March 20, 2018 on the topic of DYNAMIC PLANNING STRATEGIES FOR THE SUCCESSFUL CLIENT. This will be Alan’s third visit to Pensacola, and a welcome treat. Watch this space, as more details will be forthcoming!

Date: Tuesday, March 20, 2018

Location: To Be Determined

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

4th ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Please put Friday, April 28th, 2017 on your calendar to enjoy the 4th Annual Ave Maria School of Law Estate Planning Conference and the weekend that follows in Naples.

Alan will be speaking at this conference on the topic of THE ETHICS OF AVOIDING TRUSTS AND ESTATE LITIGATION.

Alan will also appear on a panel of speakers with Jerry Hesch and Lester Law on the topic of TAX PLANNING WITH LIFE INSURANCE PRODUCTS, RECENT LITIGATIONS, AND OTHER HOT TOPICS.

Other speakers and topics include the following:

- Stacy Eastland – So Much to Choose From and So Little Time: A Comparison of the Best Freeze Planning Techniques

- Jonathan Gopman – Tax Issues and Tax Compliance for Asset Protection Trusts

- Jerry Hesch – Innovative Business Succession Techniques, and is appearing on the panel Tax Planning with Life Insurance Products, Recent Litigations, and Other Hot Topics

Date: Friday, April 28, 2017

Location: The Ritz-Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE PRESENTATION:

ESTATE PLANNING COUNCIL OF NORTHEAST FLORIDA

Please put Tuesday, September 19, 2017 on your calendar to enjoy a dinner conference for the Estate Planning Council of Northeast Florida.

Date: Tuesday, September 19, 2017

Location: TBA

Save the Dates!

LIVE ST. PETERSBURG PRESENTATION:

2017 ALL CHILDREN’S HOSPITAL FOUNDATION SEMINAR

Please put Thursday, February 9th, 2017 and on your calendar to enjoy the 19th Annual All Children’s Hospital Estate, Tax, Legal, and Financial Planning Seminar.

Speakers will include Turney Berry, Paul Lee, Sanford Schlesinger, and Jerry Hesch.

Date: Thursday, February 9th, 2017

Location: Johns Hopkins All Children’s Hospital Education and Conference Center, St. Petersburg, FL

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE LAS VEGAS PRESENTATION:

AICPA ADVANCED PERSONAL FINANCIAL PLANNING CONFERENCE

Alan will be speaking at the Advanced Personal Financial Planning Conference, sponsored by The American Institute of CPAs. His tentative topic for this event is LIFE INSURANCE TIPS FOR THE FINANCIAL PLANNING PROFESSIONAL.

This conference is part of the AICPA ENGAGE event, which brings together five well-known AICPA conferences with the Association for Accounting Marketing Summit for one, four-day event. The conferences included in ENGAGE are Advanced Personal Financial Planning, Advanced Estate Planning, Tax Strategies for the High-Income Individual, the Practitioners Symposium/TECH+ Conference, the National Advanced Accounting and Auditing Technical Symposium, and the Association for Accounting Marketing Summit.

Date: June 12th – June 15th, 2017 | Alan’s date and time are to be determined.

Location: MGM Grand | 3799 S. Las Vegas Blvd., Las Vegas, NV, 89109

Additional Information: For more information, please email Alan at agassman@gassmanpa.com or click here.

**********************************************************

LIVE PRESENTATIONS:

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan will be speaking at the following Medical Education Resources (MER) events:

- October 20th – October 22nd, 2017 in New York, New York

- November 30th – December 3rd, 2017 in Nassau, Bahamas

His tentative topics for these events include the 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning, Lawsuits 101, 50 Ways to Leave Your Overhead, and Essential Creditor Protection and Retirement Planning Considerations.

Date: New York: October 20th – 22nd, 2017; Nassau: November 30th – December 3rd, 2017

Location: New York: To be determined.

Nassau: Atlantis Hotel | Paradise Beach Drive, Paradise Island, Bahamas

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.