The Thursday Report – 12.18.14 – New Creditor Law Cases

Way Down Upon the Bifani River: Setting Aside Fraudulent Transfer into Homestead – A New Doctrine

Why the Four-Year Fraudulent Transfer Statute May Not Apply

Will the January 6th Same-Sex Marriage Law Change Apply Only in Washington County or in Every County of the State? by Dena Daniels

The Florida LLC Act: Tips, Tidbits, and Tricks by Ken Crotty and Chris Denicolo

Medical Billing 501: Quick Tips to Enhance an Already Efficient Billing Operation – Employee Incentive Plans by Colin Shalin

Richard Connolly’s World – The 10 Biggest Celebrity Estate Stories of 2014 and What You Can Learn

Visit our Friends and Heckle Us at Heckerling!

Thoughtful Corner – How to Make a Great Litigator Even Better – Take Off the Weekends! By Jay Fleece

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Way Down Upon the Bifani River: Setting Aside Fraudulent Transfer into Homestead – A New Doctrine

by Travis Arango

The Florida Supreme Court found in 2001 that the homestead protection accorded under the Florida Constitution trumps the Florida Fraudulent Transfer Statute, and therefore an individual who has a judgment against him or her can use monies to purchase or pay down the mortgage on a homestead owned by the transferor, with the creditor having no remedy against the homestead unless or until the transferor files for bankruptcy by reason of the provisions of the 2005 Bankruptcy Act.

What if the debtor, knowing that he or she may be going into bankruptcy, gives the monies to a close friend who puts them into a homestead and then intends to hunker down and remain judgment proof and outside of bankruptcy so that the creditor is not able to recover the funds? The debtor is then able to live with the close friend and enjoy the benefits of the home.

This exact factual pattern occurred more than once, making it necessary for the courts to attempt to find a way to reach the home equity and prevent this type of conduct, as opposed to waiting for Congress to endorse an appropriate remedy by amending the Bankruptcy Code.

Judge Michael Williamson, bankruptcy judge of the Middle District Bankruptcy Court sitting in Tampa, came to the conclusion that a fraudulent transfer directly or indirectly into a close friend’s homestead before filing bankruptcy arises to the level of being considered as “ill-gotten gains” under the Florida case law, saying specifically that:

Here, LaMarca’s Sarasota house was acquired with ill-gotten proceeds. LaMarca used the nearly $670,000 from the sale of the Golden Eagle Road property to purchase her Sarasota house. It would be inequitable and unjust to allow the Debtor to fraudulently transfer property to LaMarca to keep it from his creditors.1

The Federal District Court sitting in Tampa disagreed with Judge Williamson and overturned the decision, but the Eleventh Circuit Court of Appeal agreed with him, finding that:

Under Florida law, homestead property purchased with funds obtained by fraud is not exempted from equitable lines. See Havoco, 790 So.2d at 1028. The facts of this case do not fall within Havoco’s exception because the funds used to purchase the Sarasota property were obtained through Bifani’s fraudulent transfers.2

It is doubtful that the U.S. Supreme Court will have any interest in hearing this case, and the Florida Supreme Court will not be able to hear the case because bankruptcy court cases pass to the federal system, and not the state system.

The Eleventh Circuit Court of Appeal could have requested guidance from the Florida Supreme Court by certifying the issue as a certified question but apparently chose not to do so.

Floridians and their advisors will now most likely need to wait for a number of years before similar factual patterns occur in Circuit Courts and become subject to Circuit Court decisions that are appealed to District Courts of Appeal, and then eventually to the Florida Supreme Court.

Stay tuned for more about these interesting and somewhat frustrating cases, which show that conventional knowledge will often be turned on its ear, without warning, and that clients and advisors should not rely upon any one creditor protection technique when multiple techniques may be available.

*************************************************

1 In re Bifani, 493 B.R. 866, 871 (Bankr. M.D. Fla. 2013)

2 In re Bifani, 580 F. App’x 740, 747 (11th Cir. 2014)

Why the Four-Year Fraudulent Transfer Statute May Not Apply

by Brandon Ketron

In this December 12th, 2014 decision the First DCA has surprised many by applying a 1950 Florida Supreme Court Opinion (Young v. McKenzie) that will have a very large impact on creditor planning in Florida.

While most advisors and practitioners have understood the 4 year Fraudulent Transfer Statute to mean that a judgment creditor cannot pursue a transferee or the transferred property once 4 years has passed from the date of the transfer, the First, Fifth, and Third DCA have concluded that if the judgment is received within the 4 year period it can be enforced under the proceedings supplementary statute for the life of judgment (20 years). The judge presiding in the action that resulted in the judgment will sit as a Court of Equity under the proceedings supplementary statute, Florida Statute Section 56.29, which includes the following language:

(5) The judge may order any property of the judgment debtor, not exempt from execution, in the hands of any person or due to the judgment debtor to be applied toward the satisfaction of the judgment debt.

(6) (b) When any gift, transfer, assignment or other conveyance of personal property has been made or contrived by defendant to delay, hinder or defraud creditors, the court shall order the gift, transfer, assignment or other conveyance to be void

Is it appropriate to construe the proceedings supplementary statute to have this effect, when the Florida Fraudulent Transfer Statute, Section 727, reads as follows?:

A cause of action with respect to a fraudulent transfer is extinguished unless action is brought within 4 years after the transfer was made, or if later within one year after the transfer or obligation was or could reasonably have been discovered by the claimant

The First DCA determined that despite the fact that proving and defending fraudulent transfer claims brought under § 56.29 borrow substantively from the UFTA (Section 727), this fact does not require the adoption of the UFTA’s much shorter limitations period. Instead § 56.29’s contrary scheme and precedent establish that proceedings supplementary can be initiated at any time during the life of the judgment, when a valid, unsatisfied execution exists.1

This will doubtlessly be the subject of future litigation in the other districts.

For a copy of the First DCA and other referenced Court opinions please contact agassman@gassmanpa.com.

Additionally the oral argument can be viewed by clicking here.

*************************************************

1 The court relied upon the following cases as precedent in determining that a proceeding supplementary could be initiated for the life of the judgment. Young v. McKenzie, 46 So. 2d 184, 185 (Fla. 1950); Zureikat v. Shaibani, 944 So.2d 1019, 1022–23 (Fla. 5th DCA 2006); Ferre v. City Nat’l Bank of Miami, 548 So.2d 701 (Fla. 3d DCA 1989)

Will the January 6th Same-Sex Marriage Law Change Apply Only in Washington County or in Every County of the State?

by Dena Daniels

The Greenberg Traurig Law Firm, representing the 67 Clerks of Court, has been reported to have opined that the Federal District Court decision that same sex couples could marry in Florida beginning January 6th will only apply in the county where that suit was filed, which is Washington County. Based on the its legal counsel, the clerks association notified its members on Tuesday, December 16, 2014 that they could be guilty of a criminal act if they issue marriage licenses to same-sex couples pending the expiration of the stay on January 5th. The notice provides:

Florida’s Court Clerks & Comptrollers’ duty is to act in accordance with Florida law,” the association said in a statement. “Florida Statutes are unique in regard to prohibiting the issuance of a marriage license to a couple that is not a man and a woman, in that it provides that a Clerk who violates this prohibition is guilty of a criminal act and subject to a fine and/or imprisonment.

This gray area arose from an order issued by Judge Robert Hinkle, District Judge in the U.S. District Court for the Northern District of Florida. Judge Hinkle opined that the state’s ban on same-sex marriage is unconstitutional, however, he issued a stay on granting same-sex marriages until there was an opportunity for an appeal. The opinion concludes:

The Supreme Court has repeatedly recognized the fundamental right to marry. The Court applied the right to interracial marriage in 1967 despite state laws that were widespread and of long standing. Just last year the Court struck down a federal statute that prohibited federal recognition of same-sex marriages lawfully entered in other jurisdictions. The Florida provisions that prohibit the recognition of same-sex marriages lawfully entered elsewhere, like the federal provision, are unconstitutional. So is the Florida ban on entering same-sex marriages.

In response to the stay, Pam Bondi, the Attorney General of Florida, filed a request in the 6th Circuit Court of Appeal for an extension of the stay issued by Judge Hinkle. The 6th Circuit denied the request to extend the stay, resulting in the expiration of the stay issued by the District Court on the close of business on January 5, 2015.

As the year draws to an end and the January 5th expiration date rapidly approaches, it will be interesting to see how this plays out.

The Florida LLC Act: Tips, Tidbits, and Tricks

by Ken Crotty and Chris Denicolo

WHAT DOES IT TAKE TO AMEND AN LLC’S OPERATING AGREEMENT AND ARTICLES OF ORGANIZATION UNDER THE NEW LLC ACT

We also have received a few questions as to the voting threshold necessary for the members of a Florida LLC to amend the LLC’s Operating Agreement or Articles of Organization under the new Florida LLC Act. There is some confusion as to whether a majority vote or unanimous vote of the Members is required to cause such an amendment, and as to whether the same voting threshold applies to an amendment of an LLC’s Operating Agreement and Articles of Organization.

As with other statutorily based “Acts” (such as the old Florida LLC Act and the Uniform Commercial Code), the new Florida LLC Act provides for a set of default rules that will apply if the LLC does not otherwise modify such rules in its Operating Agreement or Articles of Organization, subject to certain default rules espoused by the new LLC Act being non-modifiable. The default rules that may not be modified by an LLC’s Operating Agreement are provided in Florida Statute § 605.0105(3).

Florida Statutes § 605.04073 provides the default rule that would apply in the event that the Operating Agreement or the Articles of Organization are silent on the degree of vote needed to amend the Operating Agreement or the Articles of Organization. Specifically, subsections (2)(d) and (3)(e) state that the Operating Agreement and the Articles of Organization may be amended only with the affirmative vote or consent of all members. However, this rule seems only to apply to the extent that the Operating Agreement or the Articles of Organization do not provide otherwise.

Florida Statute § 605.0105(1)(d) expressly allows an Operating Agreement to specify the means and conditions for amending the Operating Agreement. Further, nothing in subsections (3) or (4) of this Statute prevents an LLC Operating Agreement from specifying a methodology for amending the Operating Agreement different from the unanimous vote default rule described above under § 605.04073. Based on this, the LLC Operating Agreement can specify that a majority vote of the members (or some other action or threshold) is all that is required to amend the LLC’s Operating Agreement.

Additionally, it appears that Section 605.0105 does not preclude stating in the Operating Agreement that a specified action or voting threshold other than the unanimous vote of members may amend the Articles of Organization. Subsection (1) specifically provides that “[e]xcept as otherwise provided in subsections (3) and (4), the operating agreement governs the following: (a) relations among the members as members and between the members and the limited liability company.” Neither subsection (3) or (4) provides anything that would prohibit the amendment of the Articles of Organization by a majority vote of the members or by some other specified action.

Therefore, an LLC’s Operating Agreement or Articles of Organization may provide for the applicable action or voting threshold that is necessary to amend the LLC’s Operating Agreement or Articles of Organization, and if the Operating Agreement or Articles of Organization are silent, then a unanimous vote of the LLC’s members would be required to effectuate any such amendment.

Medical Billing 501: Quick Tips to Enhance an Already Efficient Billing Operation – Employee Incentive Plans

by Colin Shalin

Colin Shalin is a Practice Management Consultant specializing in A/R and financial management with an emphasis on billing and collection process and performance improvement. Contact him by phone at (727) 244-1179 or by emailing consultcolin@gmail.com. © 2014

Implementing an employee incentive plan can provide the collection performance boost you have been missing at a fairly low cost. Utilization of this tactic can be especially beneficial when there is a large amount of aged A/R, which is still deemed reimbursable, but your Collectors can never seem to “get to it.” To be fair, most employers will implement a reward structure including eligibility for employees within all aspects of the billing process, including the Front Desk staff. Before attempting to develop an all-encompassing model, test a scaled-down version to be sure it will be a good fit for your practice. Here are some tips to consider when implementing your plan:

Eligibility

Start small & focused when implementing an employee incentive program. Determine the volume and amount of uncollected A/R by Payer including the amounts due from patients. Next, determine a tiered reward level for every 25% increase in your Insurance collections separate from your Patient collections. Include a team reward and an individual reward for each level achieved.

Be sure to set a timeframe for each level to be attained and limit the entire plan to no more than 4 months in duration. Try to set fair goals, but also ensure the first 2 tiers can be met. Raise the reward substantially for the last 2 tiers. Establish your monitoring program to ensure you can quickly determine the results to give immediate feedback at selected intervals throughout the plan’s duration and immediately upon reaching your tiers.

Start with your Collection staff, including anyone who works denials. Announce the plan – which is best accomplished by a pizza party – and include parameters regarding interference with regular work duties, special hours allowed including overtime, or other guidelines to ensure normal operations continue as expected. Make sure you put a tracking schedule up on the wall and update it at least weekly to keep a high level of interest in the project.

Gauge the success of your plan during the implementation phase and feel free to modify it as needed to maintain the staff focus and efforts required to meet your goals.

Upon completion of this initial plan testing, determine your ongoing reward structure by functional area throughout the billing process. Remember your Front Desk area is the best place to collect patient due balances (prior to treatment) so consider this area an extension of your collection department when developing your future plan.

Rewards

The best reward systems include both monetary and non-monetary benefits. Cash, of course, is a great motivator, but it should not be the only one. Team rewards tend to work best when they are non-cash items. In addition to the plan kick-off event, pizza parties or other group events such as lunches, ice cream socials, breakfast snacks, tea time, afternoon walks, in-office massages, or other creative activities are best.

Individual “non-cash” rewards can include movie passes, theatre tickets, restaurant gift cards, dinner parties, grocery store or other store gift cards, spa treatments, out-of-town travel weekends, or other purchased items.

Remember, time off is a valuable reward, especially if you have a PTO system. Rewarding employees with an extra “holiday” will please most employees, but be sure to check your employee manual or with your benefits expert prior to using this method.

All rewards should be announced at the plan kick-off. Be sure to modify them if you do not receive positive feedback or results. No more than one or two rewards should be a surprise.

Don’t be afraid to be creative and make the experience fun for your employees. Remember, you want them to succeed as that means you will have collected on accounts before they have no value!

Get moving now! The sooner your plan is implemented, the quicker the collection results can be realized.

Richard Connolly’s World

The 10 Biggest Celebrity Estate Stories of 2014 and What You Can Learn

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature one of Richard’s recommendations with a link to the article.

This week, the article of interest is “The 10 Biggest Celebrity Estate Stories of 2014 and What You Can Learn” by Danielle and Andy Mayoras. It was featured on Forbes.com on December 4, 2014.

Richard’s description is as follows:

When the proper estate planning isn’t done, it’s the family members left behind who pay the price, often with ugly, expensive, and bitter probate court battles. They happen to families all across the country on a daily basis, from those of modest wealth to the very rich.

This article shares 10 of the top celebrity estate stories of 2014 and how they highlight important lessons in estate planning.

Click here to view the full article.

Visit Our Friends and Heckle Us at Heckerling!

With the 49th Annual Heckerling Institute on Estate Planning coming up in just a few short weeks, three friends of Gassman, Crotty & Denicolo, P.A. have been kind enough to allow us to display our books and software at their tables.

Management Planning, Inc. (MPI) has graciously agreed to allow our books to be sold at their table, with all profit going to the charity of your choice or to purchase buckets of Kentucky Fried Chicken. Hats off to Joe Gitto for all that he does for the estate planning professional community.

Veralytic, and its brilliant founder and dynamo, Barry Flagg, have also graciously agreed to provide us with space, which is very much appreciated. Veralytic is the only credible system to enable trustees and other professionals to evaluate life insurance policies and historical and comparable product and carrier data. Take a look at a sample report and you will learn a great deal about how insurance products work and what to look for in evaluating products and carriers.

Phil’s Ultimate Estate Planner will also have a booth at Heckerling that will feature our JEST forms and instructional webinar. Howard Zaritsky and Lester Law will be covering JEST trust planning in the Monday morning Fundamentals section. We will be sitting in the front row!

Please plan to stop by these tables and say hello to each of these fine companies. Give them your card for the opportunity to win four buckets of Kentucky Fried Chicken, three copies of an old Thursday Report, four AAA batteries, and a Colonel Sanders Gardening Club membership!

Thoughtful Corner

How to Make a Great Litigator Even Better

Take Off the Weekends!

by Jay Fleece

Jay Fleece of the Baskin and Fleece law firm in Mid-Pinellas County (North St. Petersburg) has taken off about every weekend since March of 2014 after years of working just about every weekend.

The result is resoundingly positive. Jay will rarely, if ever, review his business emails after late Friday and before Monday morning and reports much better business and personal relationships and much higher productivity Monday through Friday.

Jay’s write-up on this important phenomenon, which many of us should consider, is as follows:

TIME – IT’S A LAWYER’S CURRENCY AND A LAWYER’S CURSE

Lawyers are obsessed with time. The more hours we bill, the more money we make. The more work we do, the more deadlines we create, and so it goes – a perpetual hamster on a treadmill lifestyle. Many lawyers work six and seven days a week at their office. There are many reasons why. They want to make as much money as possible, deadlines have to be met, or they think they would be bored by not working. I used to be guilty of all of the above. I paid my dues. I am a reformed workaholic, and I admit it. But I still covet time: my weekend time.

The Jewish theologian Abraham Joshua Heschel wrote that the Sabbath is a cathedral in time rather than in space. “Six days a week, we wrestle with the world, wringing profit from the earth; on the Sabbath, we especially care for the seed of eternity planted in the soul.” The British essayist Pico Iyer picks up on this theme. To paraphrase him, the 48 hours we take off for the weekend is our “cathedral in time” and “becomes a vast empty space through which we can wander, without agenda, as through the light-filled passageways of Notre Dame.”

My wife and I decided that we didn’t want to grow old and only have memories of hard work to show for it. So we decided to buy a house on the water, which we did, and a boat. I haven’t worked a weekend since. Most weekends I now worship at the altar of Tampa Bay – fishing the flats off of Weedon Island or the mangrove coast line or its reefs and jetties. I get to spend the weekends with my wife fishing or just cruising around the water watching the dolphins play or the manatees plodding along. Just being on the water works wonders.

My life has become richer and more fulfilling, and I actually accomplish more at work by doing less. I am sure there are many studies which analyze and corroborate my new found belief, but let me speak from experience. Clarity in thought and in expression is what we seek. I have found that by not working on the weekend, I come back into the office on Monday morning refreshed, re-charged, and raring to go.

Many times the perplexing problems that were doing calisthenics in my head on Friday have resolved themselves in a quite orderly fashion in my subconscious mind during the weekend, and the solution on Monday seems clear as day. I do not check work email from Friday when I leave the office until Monday morning. The world survives. The clients and the work are still there, but I have gained the most precious commodity there is – time: time to disengage, to be still, to go fishing, to experience the awesome power of nature, and to be with friends and family.

After a weekend, I am ready to hit it hard again Monday morning. It is amazing how your thinking becomes clearer and more focused, and, for the rest of the week, I gladly deal with the deadlines and pressures of time knowing that the weekend will be here before I know it.

In addition, my relationships are much better. My wife Cynthia, too, is beginning to cut digital ties on the weekend, but being in health care, her job does require her to be available by telephone. She has dealt with many a crisis now with a fishing pole in her left hand and a cell phone in her right. She is very adept!

If you aren’t taking weekends off, try two in a row and then decide if you will ever go back! Your family, your personal self, your staff, and your wallet will all thank you for taking the plunge and taking some time off.

Upcoming Seminars and Webinars

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Chris Denicolo will be presenting a webinar on TRUST PLANNING FROM A TO Z for the Florida Institute of CPAs.

Learn how to plan, structure, and protect wealth using revocable and irrevocable trusts and trust systems to effectuate wealth preservation and inheritance planning in a tax-efficient manner.

This course is designed for both new and experienced accountants. Many past attendees have expressed significant praise for this presentation, indicating that it is both dynamic and interesting, while providing a fresh new look at both time tested and new strategies and planning considerations with an emphasis on the numbers, practical application and an accountant’s role in planning and implementation. Includes valuable materials, free use of estate tax projection software, client explanation letters and a number of useful Excel spreadsheets that can be used on client matters.

Date: January 6, 2015 | 11:00 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

*******************************************************

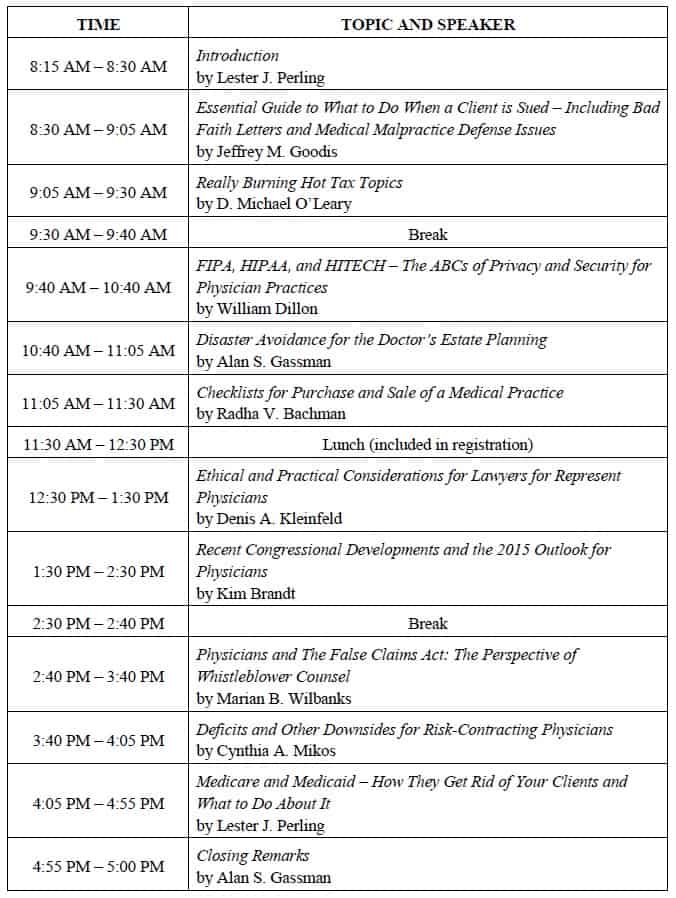

LIVE FORT LAUDERDALE PHYSICIAN LAW CONFERENCE:

Alan Gassman will be speaking at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Please consider attending the Florida Bar 2015 Representing the Physician Seminar at the beautiful Renaissance Fort Lauderdale Cruise Port Hotel in Fort Lauderdale on Friday, January 16, 2015.

Start a great weekend there and then work yourself down to South Beach or stay at The Breakers in West Palm.

The topics (and speakers) are unbeatable. The schedule includes:

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or click here to download the registration package.

********************************************************

LIVE TAMPA PRESENTATION:

Alan Gassman will be speaking at the Tampa Bay Estate Planning Council Dinner Program on the topic of PLANNING WITH RETIREMENT ACCOUNTS.

Date: January 21, 2015 | 5:30 p.m. – 7:30 p.m.; Alan Gassman will be speaking from 6:45 to 7:15.

Location: The Tampa Club, 101 E Kennedy Boulevard, 41st Floor, Tampa, FL

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

***********************************************************

LIVE NEWPORT BEACH PRESENTATION:

Jerry Hesch will present THE MATHEMATICS OF ESTATE PLANNING at the Society of Trust and Estate Practitioners 4th Annual Institute on Tax, Estate Planning, and the Economy. This conference is a collaboration between STEP Orange County and the University of California, Los Angeles, School of Law.

Professor Hesch’s presentation will make use of the materials that Alan Gassman, Ken Crotty, and Chris Denicolo presented to the 40th Annual Notre Dame Tax & Estate Planning Institute on November 14, 2014.

Date: January 22 – 24, 2015

Location: California Marriott Hotel and Spa at Fashion Island, Newport Beach, CA

Additional Information: For more information, please email agassman@gassmanpa.com or visit http://www.step.org/4th-annual-institute-tax-estate-planning-and-economy.

**************************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: February 21, 2015 | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To see the official program for this workshop, please click here. To register for this program please email agassman@gassmanpa.com.

***********************************************

LIVE ORLANDO PRESENTATION:

THE ADVANCED HEALTH LAW TOPICS AND CERTIFICATION REVIEW 2015

Alan Gassman will speak at The Advanced Health Law Topics and Certification Review 2015. Topic is To Be Announced.

Date: March 6, 2015

Location: Hyatt Regency Orlando International Airport, 9300 Jeff Fuqua Blvd., Orlando, FL 32827

Additional Information: For more information, please email agassman@gassmanpa.com.

***********************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Alan Gassman, Jerry Hesch, and Richard Oshins will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins on 11 Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION, AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami, 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Chris Denicolo will be presenting a webinar on A PRACTICAL TRUST PLANNING CHECKLIST AND PRACTITIONER COMPLIANCE GUIDE FOR FLORIDA CPAs for the Florida Institute of CPAs.

Review a practical planning checklist and practitioner tax compliance guide to facilitate implementing a comprehensive overview of practical planning matters and tax compliance issues in your practice. This presentation will cover over 20 common errors and missed planning opportunities that accountants need to understand and counsel their clients on.

This course is designed for practitioners who wish to assure that trust planning structures and compliance are both aligned with client objectives and that common catastrophic errors and misconceptions can be corrected.

Past attendees have indicated that this is an interesting and practical presentation that offers a great deal of practical information for both compliance and planning functions, based upon an easy to follow checklist approach. Includes valuable materials.

Date: May 21, 2015 | 10:00 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

*********************************************************

LIVE PRESENTATION:

2015 MOTE VASCULAR SEMINAR

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

NOTABLE SEMINARS BY OTHERS

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott, 8701 World Center Drive, Orlando, Florida

Additional Information:

Don’t miss Howard M. Zaritsky and Lester B. Law’s January 12th morning discussion of Basis – Banal? Basic? Benign? Bewildering?, which will include mention and some commentary and advice on the use of our JEST trust system. Don’t leave home without it!

When browsing the tables, be sure to stop by Management Planning, Inc. or Veralytic for a chance to purchase one of our books or check out our EstateView software! Phil’s Ultimate Estate Planner will also be featuring our JEST forms and instructional webinar.

For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE CLEARWATER PRESENTATION:

RUTH ECKERD HALL PLANNED GIVING ADVISORY COUNCIL MEETING

Ruth Eckerd Hall’s next Planned Giving Council Meeting will be a spectacular two-part event, featuring an educational presentation at 4:30 p.m. and a networking session at 5:30 p.m.

“Improve with Improv: Using Humor and Immediate Responses to Enhance Client, Professional, and Social Interaction” will be led by Jack Halloway, a well-known improvisational coach and actor. This workshop will cover the basic and effective methods of improvisation in order to increase participants’ ability to think quickly, listen closely, and feel more comfortable responding to situations.

The presentation will be followed by a social networking and information session led by Ruth Eckerd Hall’s President and CEO Zev Buffman.

Call Ruth Eckerd Hall, learn improvisation, get an hour of credit, a glass of wine, and a great time!

Date: Tuesday, January 20, 2015 ǀ 4:30 p.m.

Location: Ruth Eckerd Hall’s Margarete Heye Great Room

Additional Information: For more information, or to RSVP, please contact Alan Gassman at agassman@gassmanpa.com or Suzanne Ruley at sruley@rutheckerdhall.net.

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a full list of speakers and presentation descriptions, please click here. For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

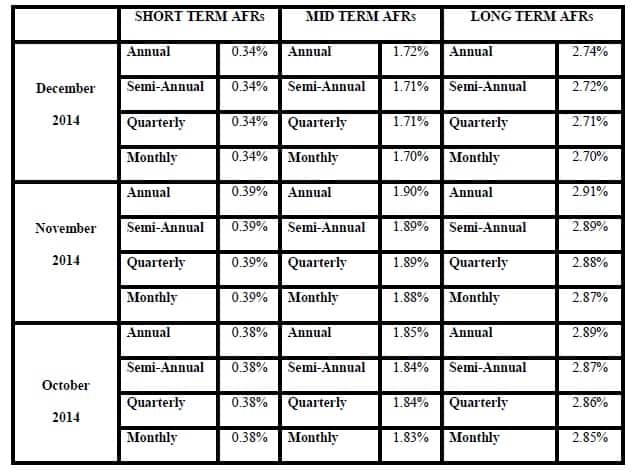

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.

The 7520 rate for December is 2.0% and for November was 2.2%.