The Thursday Report – 11.6.14 – Fans of Florida Elections Edition

Client Questions and Answers on:

1. Vehicle Planning

2. Portability

3. Whether Tort Liability Can Be Bankrupted Without a Chapter 7 Payment Plan

Life Insurance Company Ratings – What Do They Mean? By Barry Flagg

The Thursday Report Salutes a Dedicated Lawyer Who Does More than Just Legal Compliance Work for All Children’s Hospital – Way to Go, Jackie Crain, J.D., M.B.A.!

Seminar Spotlight – 2015 Florida Tax Institute

Richard Connolly’s World – Using a Charitable Remainder Trust to Turn Bothersome Rentals into Hassle-Free Income

Thoughtful Corner – Budgeting for Unexpected Problems and Helping Yourself to the Helper’s High

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Client Questions and Answers on 1. Vehicle Planning, 2. Portability, and 3. Whether Personal Tort Liability Can Be Bankrupted Without a Chapter 7 Payment Plan

This week, we had three good questions from clients that we would like to share, with answers:

1.) Should a doctor’s car be owned by his professional corporation?

Alan,

I am about to purchase a used vehicle for myself. I will use it for all my traveling, including to and from work. Is this a possible expense that I could use as a deduction through my LLC?

If so, what is the proper way to purchase the car? I was planning on putting about $10K down on a purchase price of approximately $37,000 and financing the rest for possibly 3 years.

Would I have to apply for a loan as John Client, PLLC? If so, without any prior history of income, is this even possible?

I appreciate your input.

John Client

Alan’s Answer:

Typically, the car is owned personally, but sometimes cars are owned by the company. Different CPA’s recommend different results, and car insurance and umbrella coverage (which is a separate policy normally needed for liability exceeding $250,000 per accident) will often be less expensive if the car is owned personally. If others drive the car and it is in an accident, then the owner is normally liable for the damages of the driver. This owner liability is usually limited to $500,000 if the owner is a person and can be covered by insurance if the car is driven in Florida. If the car is owned by the company, you may have to have one umbrella policy for personal vehicles and the house and another for the business car.

Ask your insurance agent and CPA and decide based on these factors. Some CPAs have the attorney draft a lease agreement where the professional owns the car “for the company” and the CPA puts it on the tax return as if it were owned by the company.

2.) A Wall Street Journal article causes a client to believe that he may no longer need a credit shelter trust because of portability

Alan,

I read a WSJ article this weekend on “The New Rules for Estate Planning.” It mentioned that exemption equivalent trusts aren’t needed any more due to the portability of the estate tax exemption between married couples (which we discussed). It went on to say that the trusts may hurt tax-wise due to the loss of step-up in basis at the first death.

What are your thoughts on this, and should we meet to discuss?

James Client

Alan’s Answer:

The portability allowance does not grow with the CPI, and a credit shelter trust formed on the first death can grow as the investments grow. The portability allowance is lost or reduced if the surviving spouse remarries and the new spouse dies before the surviving spouse and leaves no such allowance, leaves a smaller allowance, or has a personal representative that refuses to fill out the necessary estate tax return forms to allow for the allowance.

We do have new language that we use to give the surviving spouse and the Trustees the ability to decide whether to use portability or fund the credit shelter trust after the first death, and to also allow for a stepped-up basis on the second death to allow for capital gains avoidance if the estate tax goes away or is less than the capital gains tax up the road.

It would be easy to add this language to your trusts.

It never hurts to have a sit-down review of where you stand.

3.) A client wonders whether his child’s car accident is considered consumer debt under bankruptcy laws

Alan,

My son was recently in a serious car accident while driving my car. If this matter cannot be settled, will I be able to bankrupt this out, or would this be considered “consumer debt” that would require a payment plan under the Bankruptcy Code?

I appreciate your guidance on this situation.

Jacob Client

Alan’s Answer:

This is somewhat complicated, but to perhaps over-simplify, a person can file a Chapter 7 bankruptcy and discharge all debt without a payment plan if the majority of the debt is not “consumer debt.” The question is whether the tort claim constitutes “consumer debt,” which is defined as “debt incurred by an individual primarily for personal, family, or household purposes.” 11 U.S.C.A. § 101 (West). Whether a debt is considered a consumer debt hinges upon the reasons why the debt was incurred. In re Piazza, 719 F.3d 1253 (11th Cir. 2013).

On the other hand, non-consumer debts are generally those which are incurred for a profit motive. In re Piazza, 719 F.3d 1253 (11th Cir. 2013)

One court has stated that the statute does not define consumer debts, but the cases construing the statue so far have, in effect, defined such debts as being obligations for the purchase of goods or services by individuals for consumption, as opposed to business debts or tort judgments. The result, noted the court, is that a debtor having a personal injury judgment or a debtor having debts primarily related to business activity, is entitled to Chapter 7 relief and discharge of his debts with no questions asked as to his ability to repay, while the consumer debtor is required to establish that he cannot pay off his debts under some extended payment plan before he can obtain the same relief. 101 A.L.R. Fed. 771 (originally published in 1991), citing In re Keniston, 60 B.R. 742, 745 (Bankr. D.N.H. 1986).

Two cases that specifically state that tort liability that results from actionable negligence of a driver causing an automobile accident is not a consumer debt are described below.

The first case states that “to be a consumer debt, the liability must have been acquired first and foremost to achieve a personal aim or objective. An automobile accident liability is not such a debt. Here, the obligation was incurred incidental to and not first and foremost to achieving the personal aim, which was gaining transportation. In re White, 49 B.R. 869, 872 (Bankr. W.D.N.C. 1985).

The second case states that “tort liability as a result of the actionable negligence of a driver causing an automobile accident is not a consumer debt.” In re Alvarez, 57 B.R. 65, 66 (Bankr. S.D. Fla. 1985).

Life Insurance Company Ratings – What Do They Mean?

by Barry D. Flagg, CFP, CLU, ChFC

Barry Flagg is the inventor and founder of Veralytic, Inc., the only patented online publisher of life insurance pricing, performance research, and product suitability ratings. He is a life insurance practitioner consistently ranked in the top 1% of the industry and is a recognized expert in applying Prudent Investor principles to life insurance product selection and portfolio management. Mr. Flagg can be reached at bflagg@veralytic.com.

The following was sent to us by Barry Flagg and comes from a VitalSigns website page.

It shows how different the various reporting agencies rank insurance companies. Financial strength and claims-paying ability ratings of the insurer is one of the five factors of suitability. The obvious reason being that insurance is most simply defined as an agreement for the payment of a premium today in exchange for payment of a claim at some future point, the more time between policy inception and the expected claim date, the more relevant the durable financial strength and long-range claims-paying ability to overall product suitability.

The less obvious reason is that when an insurer’s rating is downgraded, the change often means that either the insurer’s profitability has declined, the insurer’s reserves have deteriorated, or both. The insurer’s most immediate response to a downgrade in its ratings, and its most effective means for restoring profitability and recovering reserves, can be to increase policy costs for cost of insurance (COI) charges and expenses. In other words, when ratings go down, policy charges are more likely to be increased, and thus premiums are likely to (need to) go up.

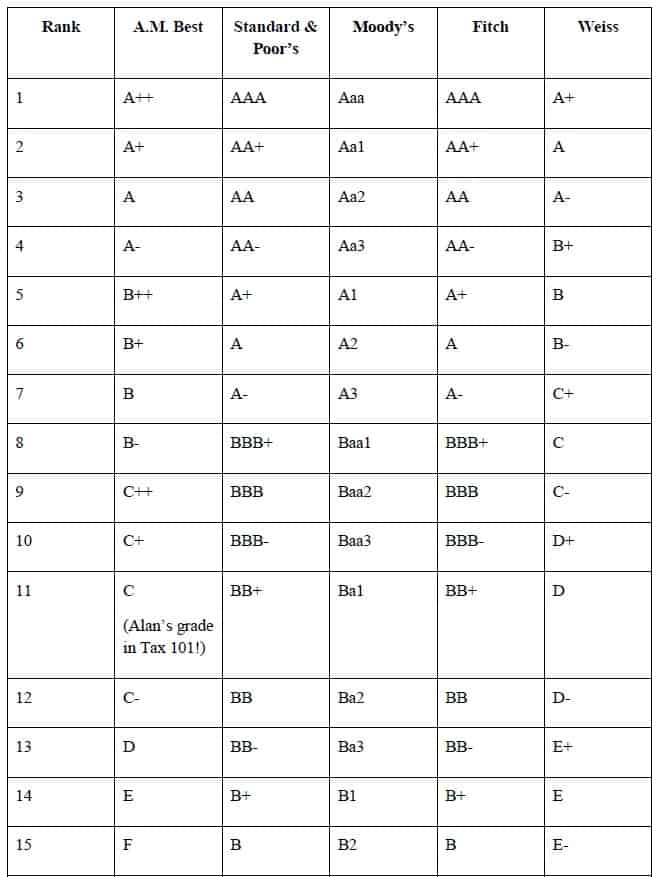

As such, high and stable ratings for financial strength and claims-paying ability are relevant to overall suitability both for the obvious reason of ensuring death benefits will be paid and because low or declining ratings can be an early warning sign for increases in policy charges. Rating services like A. M. Best, Standard & Poor’s, Moody’s, Fitch and TheStreet.com continually evaluate insurance carriers for their financial strength (i.e., the profitability of the insurer’s business operations) and claims-paying ability (i.e., the sufficiency of insurer’s reserves compared with its future claims obligations). While rating services may focus on different key indicators or qualitative factors, all ratings reflect some combination of these two measures.

For a list of the most recent downgrades, click here.

Ratings

There are several firms that provide ratings for life and health insurance companies. VitalSigns includes A.M. Best Company, Standard & Poor’s Corporation, Moody’s Investors Service, Fitch IBCA, and Weiss Rating.

- M. Best provides a financial and operating performance rating on virtually all life and health insurance companies.

- Standard & Poor’s provides financial strength ratings for those insurers who request a rating. S&P also provides financial strength ratings from public information for other insurers.

- Moody’s and Fitch provide ratings for those insurers who request a rating. Therefore, ratings from these two services are not available for all insurance companies.

- Weiss Ratings provides safety ratings on more than 1,700 insurance companies.

- The Comdex Ranking is a composite index based on the ratings received by a company from the ratings services.

Watch List identifiers follow the ratings if the company is on the rating service’s watch list. The identifier indicates a possible upgrade (w+), downgrade (w-), or unknown change (w).

The Numerical Equivalence is the number which is shown in parentheses next to each rating indicating where that particular rating falls in the rating scale. For example, an S&P rating of “AA-“ has a numerical equivalence of “(4)”, meaning “AA-“ is S&P’s fourth highest rating.

The Thursday Report Salutes a Dedicated Lawyer Who Does More than Just Legal Compliance Work for All Children’s Hospital

Way to Go, Jackie Crain, J.D., M.B.A.!

Some lawyers like their jobs, and some love them. Some lawyers work for a cause, and some lawyers live for a cause. Jackie Crain is a good example of an in-house lawyer who has the passion and dedication it takes to rise and be recognized by her organization.

We were, therefore, pleased to see the following announcement this week about Florida Bar Health Lawyer Jackie Crain:

Dear Medical Staff Members:

We are pleased to announce the promotion of Senior Counsel Jackie Crain, J.D., M.B.A., to the new position of Chief Strategy Officer/Senior Counsel for All Children’s Hospital Johns Hopkins Medicine. She will be responsible for strategic business services, including strategic planning, business development initiatives and affiliate programs following Bill Horton’s retirement. In addition, Jackie will continue to oversee legal affairs, corporate governance, and risk management. She will begin this new role as of November 24.

As she expands the scope of her responsibilities during this next step in her career, Jackie will use the business acumen and expertise she acquired during her M.B.A. studies and then honed during legal practice. Jackie has worked closely with Bill on both academic and clinical affiliate programs and physician contracting and has a deep and thorough understanding of these programs.

Jackie’s experience with All Children’s extends back more than a decade, serving first as in-house counsel for ACH as a representative of the law firm retained by the health system. In January 2012, she was named senior counsel with the Johns Hopkins Health System, with oversight responsibility at ACH for legal affairs, corporate governance, risk management, claims management, HIPAA/privacy, licensure/regulatory affairs, and local compliance.

Jackie has been a strong advocate for our patients, their families, and the hospital. She will continue to champion the unique health care needs of children and All Children’s vital role as an essential provider of pediatric services for children from across the state of Florida and beyond.

Please join me in welcoming Jackie to this new role as she continues to guide All Children’s in its journey toward excellence and support our mission of leadership in treatment, education, research, and advocacy.

Sincerely,

Jonathan Ellen, M.D.

President and Physician-in-Chief, All Children’s Hospital

Vice Dean and Professor of Pediatrics, Johns Hopkins University School of Medicine

Congratulations to Jackie on the promotion and a spectacular job well done!

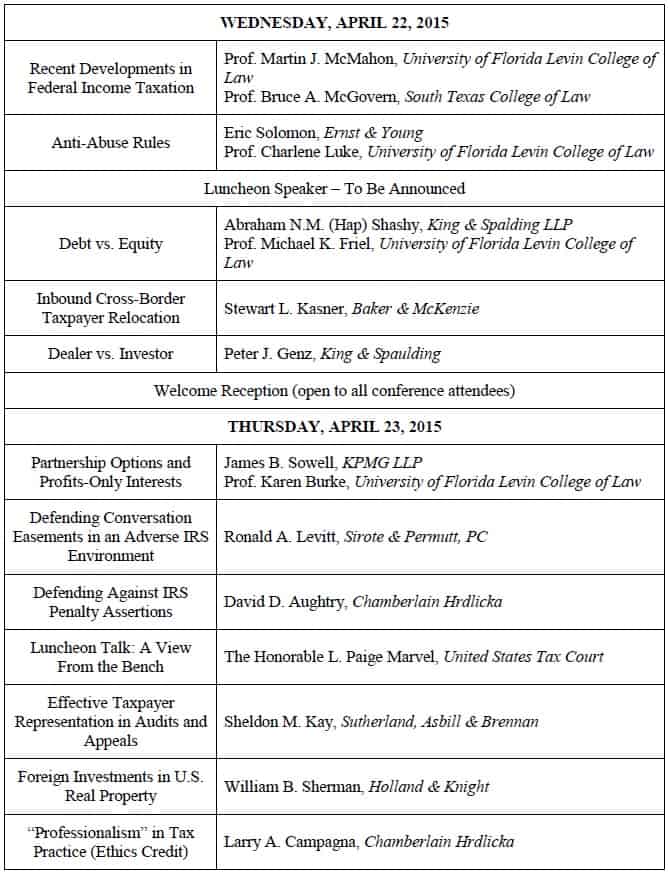

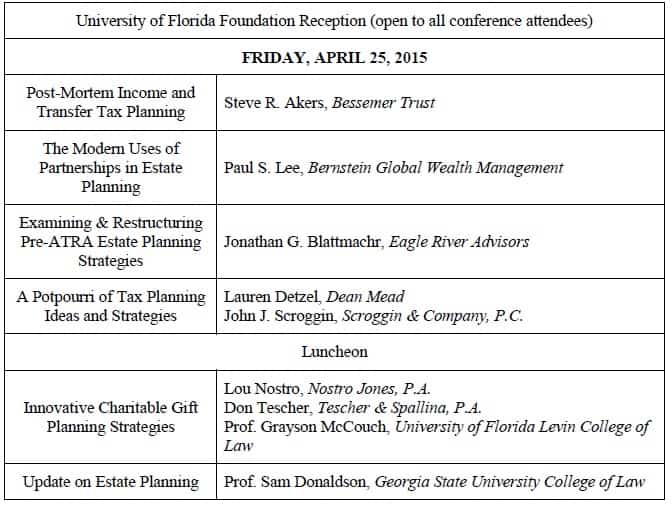

Seminar Spotlight – 2015 Florida Tax Institute

The 2nd Annual Florida Tax Institute, presented by the Florida Tax Education Foundation, Inc. and the University of Florida Levin College of Law Graduate Tax Program, will take place at the Grand Hyatt Tampa Bay on April 22-24, 2015.

This three-day conference features two days of presentations concerning business and individual taxation and one day devoted to estate planning.

The conference agenda is as follows:

To register for this conference and receive a $50 early-bird discount, please click here.

Richard Connolly’s World

Using a Charitable Remainder Trust to Turn Bothersome Rentals into Hassle-Free Income

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature one of Richard’s recommendations with a link to the article.

This week, the article of interest is entitled “Turning Bothersome Rentals into Hassle-Free Income.” It was written by Kelly Kearsley and featured in The Wall Street Journal.

Richard’s description is as follows:

Managing the tenants, maintenance, and repairs on seven rental homes was wearing on the client.

The client’s first thought was just to sell the properties. However, because he’d owned the homes for so long, he would pay steep capital-gains taxes on the proceeds. Mr. Cuprill estimated his client would have owed about $240,000.

But the advisor had another idea. He proposed placing the seven homes into a charitable remainder trust. The client could then sell the homes without paying capital gains taxes, receive steady cash flow for the rest of his life, and get a tax deduction in the process.

Click here to view the full article.

Thoughtful Corner

Budgeting for Unexpected Problems and Helping Yourself to the Helper’s High

by Alan S. Gassman

Budgeting for Unexpected Problems

We all have unexpected and sometimes reoccurring issues that come up in our professions and our businesses. Mistakes are made, and work has to be redone. Clients do not pay their bills. Lightning strikes and breaks our computers. These difficulties don’t have to be cause for panic, however. Careful forethought and budget planning will get you through relatively unscathed.

In your business’s annual budget, have some money set aside for the “unexpected but expected unpleasant surprises.” Set this number fairly high, perhaps higher than you initially think necessary, so that you can feel confident about your ability to handle life’s little (or not so little) problems.

Put this practice into play, and you will feel secure in the fact that the money spent on damage control will not push your business over budget for the calendar year.

Helping Yourself to the Helper’s High

Wikipedia defines the helper’s high as “a euphoric feeling, followed by a longer period of calm, experienced after performing a kind act.”

The encyclopedia goes on to indicate that the sensation results from the release of endorphins, followed by a longer-lasting period of improved emotional well-being and sense of self-worth. These feelings will reduce stress and improve the health of the helper!

When you help someone, make sure to take a moment and enjoy your resulting “helper’s high.”

An addiction to the “helper’s high” is considered by psychologists to be a positive addiction. Therefore, it’s better than shopping, gambling, and many other things that cause a similar release of endorphins.

In short, it’s okay to get high, as long as it’s the helper’s high!

Upcoming Seminars and Webinars

LIVE CLEARWATER PRESENTATION:

TAMPA BAY CPA GROUP

Alan Gassman, Ken Crotty and Christopher Denicolo will be presenting THE MATHEMATICS OF ESTATE PLANNING in a 2 hour session at the Tampa Bay CPA Group Fall 2014 Seminar.

Date: November 7, 2014 | 1:10 – 2:50 p.m.

Location: Marriott Hotel, 12600 Roosevelt Blvd North, St. Petersburg, FL 33716

Additional Information: To see the complete schedule, please click here. For more information please contact Richard Fuller at richardf@fullercpa.com.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

PARALEGAL ASSOCIATION OF FLORIDA – PINELLAS COUNTY CHAPTER

Alan S. Gassman will be presenting Dick and Jane’s Legal Adventure at the Paralegal Association of Florida – Pinellas County Chapter’s November meeting. This program will cover the basics of Wills, trusts, LLCs and coordination thereof for paralegals. The presentation includes a 4 color slide show called “THE LEGAL STORY OF DICK AND JANE”, and all attendees will receive one copy of the Thursday Report, whether they want it or not. Dinner is included, but mashed potatoes are extra.

Date: November 11, 2014 | 6:00 p.m. – 8:00 p.m. (Alan Gassman speaks at 7pm)

Location: The Hangar Restaurant and Flight Lounge, 540 1st Street SE, St. Petersburg, FL 33701

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com

*********************************************************

LIVE UNIVERSITY OF NOTRE DAME PRESENTATIONS:

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Topic #1: PLANNING WITH VARIABLE ANNUITIES AND ANALYZING REVERSE MORTGAGES

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities.

Topic #2: THE MATHEMATICS OF ESTATE AND ESTATE TAX PLANNING

Christopher J. Denicolo, Kenneth J. Crotty and Alan S. Gassman will also be presenting a special Wednesday late p.m. two hour dive into math concepts that are used or sometimes missed by estate and estate tax planners. This will be an A to Z review of important concepts, intended for estate planners of all levels, sizes and ages. Donald Duck has rated this program A+.

Date: November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

LIVE PORT RICHEY PRESENTATION:

Alan Gassman will be speaking to the North Suncoast Estate Planning Council on PLANNING OPPORTUNITIES FOR SAME SEX COUPLES.

Date: Tuesday, November 18, 2014 | 5:30 p.m.

Location: Fox Hollow Golf Club, 10050 Robert Treat Jones Pkwy, Trinity, FL 34655

Additional Information: For more information please contact agassman@gassmanpa.com.

********************************************************

LIVE WEBINAR:

Alan Gassman will be joined by Ron Cohen, CPA for two webinars on POST MORTEM TAX PLANNING.

Date: Tuesday, December 2, 2014 12:30 p.m. or 5:00 p.m. (50 minutes each)

Location: Online webinar

Additional Information: To register for the 12:30 p.m. webinar please click here. To register for the 5:00 p.m. webinar please click here.

********************************************************

LIVE WEBINAR:

Alan Gassman will be presenting a 30 minute webinar on PLANNING OPPORTUNITIES FOR SAME SEX COUPLES

Date: Tuesday, December 9, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will be presenting a 30 minute webinar on LESSONS LEARNED FROM THE HALIFAX CASE

Date: Tuesday, December 16, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE 2015 CLEARWATER PROFESSIONAL ACCELERATION WORKSHOPS:

Alan Gassman will be presenting a year-long Professional Acceleration Workshop that will enable participants to look down from 30,000 feet to supercharge their practices and professional lives.

5-6 hour sessions will be held on the following dates:

- Friday, January 30, 2015

- Friday, March 20, 2015

- Friday, June 26, 2015

- Friday, September 25, 2015

- Friday, December 4, 2015

Location: A Clearwater, Florida hotel to be determined.

Additional Information: For more information or to register for the program please contact Alan Gassman at agassman@gassmanpa.com or at 727-442-1200.

********************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Chris Denicolo will be presenting a webinar on TRUST PLANNING FROM A TO Z with the Florida Institute of CPAs.

Date: January 6, 2015 | 11:00 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org.

*******************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Alan Gassman will be speaking at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Others speakers include D. Michael O’Leary on Really Burning Hot Tax Topics, Radha V. Bachman on Checklists for Purchase and Sale of a Medical Practice, Cynthia Mikos on Dangers of Physician Recruiting Agreements and Marlan B. Wilbanks on How a Plaintiff’s Lawyer Evaluates Cases Brought by Whistleblowers.

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

********************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: January 31, 2015 | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To register for this program please email agassman@gassmanpa.com.

*************************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Jerry Hesch and Alan Gassman will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Jonathan Gopman, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

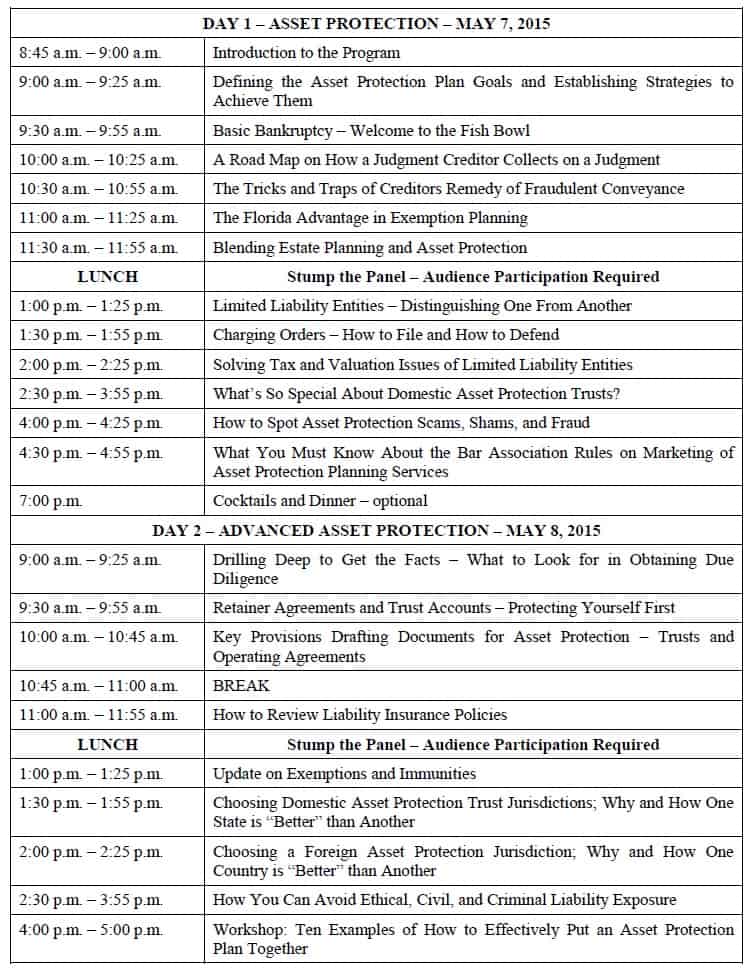

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION, AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Topics and Times are as follows:

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami, 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

NOTABLE SEMINARS BY OTHERS

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott, 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a full list of speakers and presentation descriptions, please click here. For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: To see the conference agenda, or to register for the 2015 Florida Tax Institute, please click here. Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

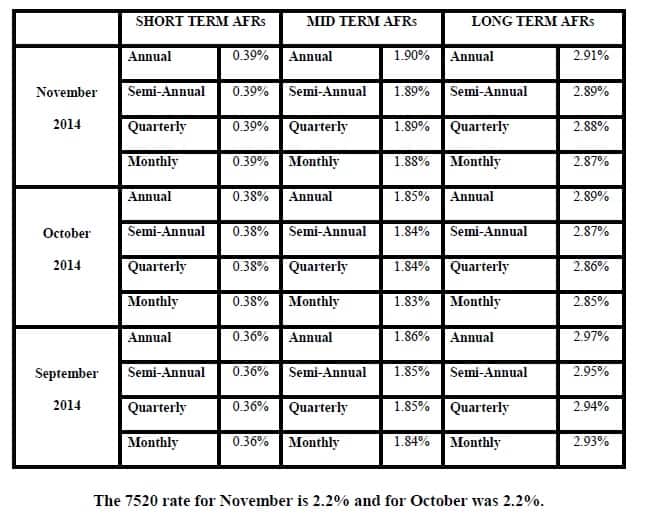

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.