The Thursday Report – 11.20.14 – Serving Thursdays Throughout the Week

Stop in the Name of Love: 6th Circuit Court of Appeals Breaks the Streak and Upholds State Laws Banning Same-Sex Marriage

Explaining Practice Termination and Patient File Access Responsibility to a Retiring Physician

Gregory Gay’s Corner – Medicare, Part One

Richard Connolly’s World – Beyond a Parent’s Reach: When a Child Legally Becomes an Adult

Seminar Spotlight – 2015 Dates to Remember

Thoughtful Corner – The Women’s Guide to Dressing for Success for First Year Lawyers and Others by Dena Daniels, MBA, J.D. Candidate

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Stop in the Name of Love: 6th Circuit Court of Appeals Breaks the Streak and Upholds State Laws Banning Same-Sex Marriage

On November 6, 2014 the United States Court of Appeals for the Sixth Circuit issued a ruling completely contrary to how the trend that had been set in the other circuits; the 6th Circuit upheld state laws in Kentucky, Michigan, Ohio, and Tennessee that banned same-sex marriage in those aforementioned states.

The Plaintiffs in the case represent the four states in the 6th Circuit and they all have different “situations” that cover practically every dilemma same-sex couples face regarding marriage.

Michigan

The state defines marriage as “inherently a unique relationship between a man and a woman.” Nearly 59% of Michigan voters decided to constitutionalize the State’s definition of marriage in an amendment vote stating that, “to secure and preserve the benefits of marriage for our society and for future generations of children, the union of one man and one woman in marriage shall be the only agreement recognized as a marriage or similar union for any purpose.”

The representatives from Michigan are a lesbian couple that stood to challenge the constitutionality of the State’s definition of marriage. The plaintiffs had adopted children as single parents and they both wanted to serve as adoptive parents for the other partner’s child. Their initial complaint was regarding the State of Michigan’s adoption laws and how it violated the Equal Protection Clause, lacking standing, the complaint was dismissed, however, the plaintiffs were urged to amend the complaint by challenging the State’s laws in denying them a marriage license.

Kentucky

With the approval of 74% of Kentucky voters, the state constitutionally defines a valid or recognized marriage in the State as being between one man and one woman. Two groups of plaintiffs challenge this definition. One group challenges the State’s marriage-licensing law contending that the 14th Amendment prohibits the State from denying them a marriage license.

The second group challenges the State’s ban on recognizing out-of-state same-sex marriages. The group consists of four same-sex couples who were married outside of Kentucky, and they contend that the denial of recognition violates their due process and equal protection rights.

Ohio

In 2004, 62% of Ohio voters approved the legislature’s Defense of Marriage Act which stated that, “marriage may only be entered into by one man and one woman. Any marriage entered into by persons of the same-sex in another jurisdiction shall be considered and treated in all respects as having no legal force or effect.” The Ohio Constitution provides that the State only recognizes a union between one man and one woman as a valid marriage.

There were two groups of plaintiffs that challenged these Ohio laws. One group focuses on the application of the law, arguing that the State’s refusal to recognize their out-of-state marriages on Ohio-issued death certificates violates due process and equal protection. The second group contends that the State’s refusal to recognize out-of-state marriages between same-sex couples violates the 14th Amendment no matter what benefit is affected.

Tennessee

In 2006, 80% of Tennessee voters approved the legislative constitutional amendment defending marriage by stating that, “the legal union in matrimony of only one man and one woman shall be the only recognized marriage in this State. Any policy, law, or judicial interpretation that purports to define marriage as anything other than the historical institution and legal contract between one man and one woman is contrary to the public policy of Tennessee.”

The plaintiffs that challenged the State’s ban are comprised of three same-sex couples that were legally married in other states.

Circuit Judge Jeffrey Sutton delivered the majority opinion of the court and began the opinion by stating:

This is a case about change—and how best to handle it under the United States Constitution. From the vantage point of 2014, it would now seem the question is not whether American law will allow gay couples to marry; it is when and how that will happen.

In the opinion, the court recognizes that the traditional outlook on marriage has become obsolete, however, the court does not believe that it is their position to change what the legislature and the voters of that state put in place. In its conclusion, the court stated:

This case ultimately presents two ways to think about change. One is whether the Supreme Court will constitutionalize a new definition of marriage to meet new policy views about the issue. The other is whether the Court will begin to undertake a different form of change—change in the way we as a country optimize the handling of efforts to address requests for new civil liberties.

If the Court takes the first approach, it may resolve the issue for good and give the plaintiffs and many others relief, but we will never know what might have been. If the Court takes the second approach, is it not possible that the traditional arbiters of change – the people – will meet today’s challenge admirably and settle the issue in a productive way? In just eleven years, 19 states and a conspicuous district, accounting for nearly 45 percent of the population, have exercised their sovereign powers to expand a definition of marriage that, until recently, was universally followed going back to the earliest days of human history. That is a difficult timeline to criticize as unworthy of further debate and voting.

When the courts do not let the people resolve new social issues like this one, they perpetuate the idea that the heroes in these change events are judges and lawyers. Better in this instance, we think, to allow change through the customary political processes, in which the people, gay and straight alike, become the heroes of their own stories by meeting each other not as adversaries in a court system but as fellow citizens seeking to resolve a new social issue in a fair-minded way.

In a rather irate and frustrated tone, Circuit Judge Martha Craig Daughtrey provided the dissent, stating that:

The author of the majority opinion has drafted what would make an engrossing TED Talk or, possibly, an introductory lecture in Political Philosophy. But as an appellate court decision, it wholly fails to grapple with the relevant constitutional question in this appeal: whether a state’s constitutional prohibition of same-sex marriage violates equal protection under the Fourteenth Amendment. Instead, the majority sets up a false premise – that the question before us is “who should decide?” – and leads us through a largely irrelevant discourse on democracy and federalism.

Several media outlets have offered opinions on the ruling of the 6th Circuit; however, very few are as powerful as an article published in Michigan Live that was written by Douglas Meeks, a lawyer who married Republican strategist Greg McNeilly. In the very passionate article entitled “Sixth Circuit Court’s Punt on Gay Marriage is a Failure of Justice”, Meeks discussed the effect that the 6th Circuit’s decision has on people and how the court had the power to set the tone for the rest of the lingering states that still have a ban on same-sex marriage, and rather than address the issue at hand, the court completely ignores it and manages to encourage discrimination amongst the LGBT community. Meeks states:

The Court’s failure impacts real people: families who, on an everyday basis, are living their lives, raising children, paying bills, and engaging to improve their community. They are regular Americans who are denied the freedom to marry who they love, protect their families, and be treated equally by their government who doles out benefits to marriages of those it has chosen as “winners.”

Michigan is now, once again, in the minority of states who refuse to allow its LGBT families to be recognized by law. While waiting for the highest Court to resolve this injustice of the democratic process, LGBT families continue to be saddled with inequality of benefits, second-class stigma, and, in too many cases, a lack of protection for their children and families.

The delay of justice one minute continues to harm the LGBT community for a lifetime. Gays and lesbians are no different from the rest of the public. We all want to live life to its fullest. We all will die, and we all don’t know how many more days we will be on this Earth.

The Sixth Circuit thinks we should just wait more time, wait for the Supreme Court, and wait for the democratic process to work itself out. Thankfully, this judicial panel did not sit in review of Brown v. Board of Education. Time is precious and not infinite. Why should the LGBT community’s life, liberty, and happiness be deprived one more day?

It will be interesting to see how this abrupt halt in the progression of marriage equality plays out if and when it reaches the U.S. Supreme Court. We must question whether Douglas Meeks is right in his article. Did the Court really opt to punt at 4th & 1 in the red zone, or did it take the less-risky argument and settle for a field goal?

Explaining Practice Termination and Patient File Access Responsibility to a Retiring Physician

Unlike other professions, physicians do not have the luxury of just closing up their medical practice without any lingering responsibility. Because of HIPPA laws, physicians as record owners maintain a duty to their patients to ensure the confidentiality of medical records. Florida Statute §§456.057-456.058 sets forth the requirements and duties of a physician when the doctor dies, retires, relocates or terminates their medical practice.

§456.057 identifies these physicians as “record owners”, which is defined as any health care practitioner who has conducted a medical examination and has generated a medical record after such examination. §456.057(12) requires these record owners to place an advertisement in the local newspaper or notify the patients, in writing, when they are terminating their practice, retiring, or relocating, and are no longer available to patients. The record owners must also give the patients an opportunity to obtain a copy of their medical records.

§456.057(13) requires the record owners to also notify the Florida Board of Medicine when they are terminating their practice, retiring, or relocating, and no longer available to patients. The Board must also be informed as to who the new record owner is and where the medical records can be found.

The Florida Administrative Code provides more detailed instructions for the physicians and their requirements for preserving medical records and patient notification. F.A.C. Rule 64B8-10.002(4) provides that:

When a licensed physician terminates practice or relocates and is no longer available to patients, patients should be notified of such termination, sale, or relocation and unavailability by the physician’s causing to be published once during each week for four (4) consecutive weeks, in the newspaper of greatest general circulation in each county in which the physician practices or practiced and in a local newspaper that serves the immediate practice area, a notice which shall contain the date of termination, sale, or relocation and an address at which the records may be obtained from the physician terminating or selling the practice or relocating or from another licensed physician or osteopathic physician. A copy of this notice shall also be submitted to the Board of Medicine within one (1) month from the date of termination, sale, or relocation of the practice. The licensed physician may, but is not required to, place a sign in a conspicuous location on the façade of the physician’s office or notify patients by letter of the termination, sale, or relocation of the practice. The sign or notice shall advise the licensed physician’s patients of their opportunity to transfer or receive their records.

Below is an example of an advertisement that was published in a Florida newspaper providing notice to the patients.

The Florida Administrative Code provides that the physician must keep the written medical records related to his practice for a period of at least five years from the last patient contact.

Failure to Comply

The State of Florida has provided clear and concise rules regulating the disclosure and record-keeping requirements for physicians who wish to closed down their medical practice for whatever reason, but what happens if the doctor does not follow the established protocols? On October 28, 2011, the Department of Health Prosecution Services Unit filed an administrative complaint against a Miami physician. The doctor closed his practice and removed the patient’s medical records and placed them in storage. The physician failed to publish the closing of his practice nor did he send notification of the closure to the Department of Health or the Florida Board of Medicine; his patients were not notified either. As a result of his noncompliance, the Department of Health requested that the Florida Board of Medicine enter an order imposing one or more of the following penalties:

- Permanent revocation or suspension of the physician’s license;

- Restriction of practice;

- Imposition of an administrative fine;

- Issuance of a reprimand;

- Placement of the physician on probation;

- Corrective action;

- Refund of fees billed or collected;

- Remedial education; and/or

- Any other relief that the Board deems appropriate

The Board ordered the following:

- The payment of fines totaling the amount of $4,083.23;

- The physician must document completion of the Laws and Rules Course sponsored by the Florida Medical Association within one year from the date the Final Order is filed; and

- The physician was issued a letter of concern by the Board

Gregory Gay’s Corner – Medicare, Part One

Gregory G. Gay, Esquire is an attorney from Tarpon Springs who specializes in meeting the special needs of senior citizens and the disabled. He is Board Certified in Wills, Trusts & Estates and in Elder Law by the Florida Bar. He has also been named a Certified Advanced Practitioner by the National Elder Law Foundation.

Mr. Gay is the author of the Florida Senior Legal Guide, the 8th edition of which can be purchased by clicking here. In the coming weeks, we will be profiling some of the best chapters from this excellent publication. Our deepest thanks to Mr. Gay for making this content available to Thursday Report readers!

We began this series with a discussion of many facets of the national Social Security program, including taxes, earning limits, numerous benefits, and how everything can be influenced by the age at which a worker retires. This week, we begin a discussion of the national Medicare system, including Medicare Part A coverage, hospital care, home health care, and hospice.

An Overview of the Medicare Program

Congress approved Medicare in 1965 to pay some of the cost of health care services for the aged. In order to receive this assistance with the current cost of health care, a person must be 65 years of age or older and entitled to Social Security retirement insurance or Railroad Retirement cash benefits. A person who has received Social Security disability benefits or Railroad Retirement Disability Income for 24 months or longer is also entitled to receive Medicare assistance regardless of his or her age. However, an application to enroll in Medicare must be filed by this disabled person. An application for Medicare can be filed after receiving 21 months of disability benefits. Persons of any age who have end-stage renal disease or amyotrophic lateral sclerosis can also apply for this coverage.

There are three basic threshold criteria for Medicare coverage:

- The care and supplies to be provided must be medically reasonable and necessary for diagnosis or treatment of illness or injury or to improve the functioning of a malformed body part.

- The care and supplies must be prescribed by a doctor.

- The services and the supplies must be obtained through a Medicare-certified

Medicare seldom pays all the costs of health care. In many areas of coverage, the patient is required to pay a specified deductible amount each year or during each illness. In addition, the patient may have to pay for a portion of the cost. Medicare calls this a coinsurance payment or co-payment.

The present Medicare program provides two separate packages of benefits, Part A and Part B. A person who is 65 years of age and who is entitled to Social Security or Railroad Retirement benefits is automatically enrolled in Medicare Part A and will be deemed to have enrolled in Medicare Part B. A person who is not receiving Social Security or Railroad Retirement Benefits must enroll for Medicare Part A during the initial enrollment period. This period begins in the third month before the person attains age 65 and extends for the next seven months. A person who takes early Social Security retirement is automatically enrolled in Medicare when he or she attains age 65.

A person aged 65 and older (or a person under age 65 who is disabled) who has not received credit from Social Security for 40 quarters of coverage may enroll in Medicare Part A, but he or she may have to pay a $441 per month premium in 2013 if the individual has 29 or fewer quarters of Social Security credits. Eligible individuals with 30-39 quarters of Social Security credits must pay a $296 per month premium in 2013.

Medicare Part A

Medicare Part A covers acute hospital care, a limited number of skilled nursing facility days, home health care and hospice care.

Hospital Care

Hospital coverage is available when the care and treatment needed can only be rendered on an inpatient basis at a hospital or a critical access hospital. Hospital coverage can be extended if a patient who would otherwise be discharged requires a skilled nursing facility level of care and no appropriate placement in a Medicare-certified skilled nursing facility is available.

The spell of illness concept is central to coverage for hospital and skilled nursing facility care. A spell of illness begins on the day a patient first receives inpatient care. It ends when a Medicare beneficiary has not been in a hospital or skilled nursing facility as an inpatient for 60 consecutive days, or has not received a Medicare-covered level of care for 60 days. There can be more than one spell of illness in a given calendar year. This will give rise to a second deductible, new co-insurance amounts and a new set of hospital days.

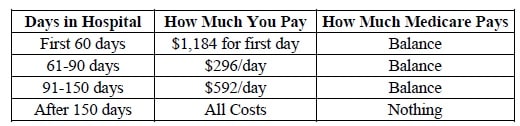

Medicare Part A will pay for inpatient hospital care that is medically necessary for treatment or diagnosis after the patient meets the initial first day deductible, which is $1,184 in 2013. Benefits cover 90 days of inpatient hospital care for each spell of illness. There is a $296 per day deductible for the 61st through 90th day in the hospital during the same spell of illness in 2013. In addition, a patient is allowed a maximum of 60 lifetime reserve days with a $592 per day deductible in 2013. Each year, there is an adjustment to the initial deductible, coinsurance amount and lifetime reserve daily amount. This adjustment is normally published in October of the year preceding the new calendar year in which the new deductible will apply.

Maximum Coverage for Hospital Care (2013)

Medicare covers a lifetime maximum of 190 days of inpatient psychiatric hospital care. This is in addition to the coverage for hospital care described above. However, a person can only use 150 of these days for this care in one benefit period. Also, this care is subject to the same deductibles and co-insurance, which is described above for other forms of hospitalization.

Coverage under Part A includes the hospital room on a semiprivate basis, nursing services, operating room costs, prescriptions and medical supplies, laboratory tests and x-rays provided by the hospital as part of its services. While in a hospital, physician services are not covered under Part A. The physician services provided while in a hospital will be billed under Medicare Part B. Certain luxury items (private rooms, private duty nurses, television, and telephone) are not covered by Medicare. Medicare does not pay for the first three units of blood that are received in a hospital in any calendar year. This blood deductible is in addition to the deductibles and co-insurance described above. However, the Part B blood deductible may apply.

LIFE SITUATION #4

Joseph, who is over 65, was hospitalized for 20 days, received 30 days of skilled care in a nursing facility, and went home for 62 days before being readmitted to a hospital. The first “spell of illness” ended 60 days after the expiration of Joseph’s stay in the nursing facility. A new spell of illness will be triggered by the second hospitalization. New in-patient hospital deductibles must be paid.

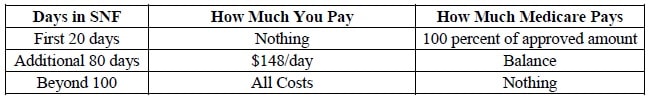

Skilled Nursing Facility Care

There are many restrictions that apply to Medicare coverage for skilled nursing facility care. Skilled nursing care requires that the care must be provided by or requires the supervision of skilled nursing personnel or other skilled rehabilitation services, which as a practical matter can only be provided in a skilled nursing home facility on an inpatient basis. Medicare never extends coverage to a patient who needs custodial care only. For each spell of illness, Medicare Part A will pay all the costs for a covered skilled nursing home stay for the first 20 days and all but $148 per day in 2013 for up to an additional 80 days as long as all of the following conditions are met:

- The individual was a patient in a hospital for three consecutive days not including the day of discharge. In addition, the patient must be admitted to the skilled nursing facility within 30 days of discharge from the hospital. (Note: there are a few limited exceptions to the requirement that the admission must occur within 30 days of discharge from the hospital).

- A doctor must certify that the patient needs skilled nursing home care.

- The services the patient needs must include either daily skilled nursing or skilled rehabilitation services (or a combination of these services).

- The services are provided by or under the supervision of a trained individual.

- The services are received on a daily basis, which means therapy services at least 5 days per week and/or nursing care 7 days per week.

- The services are provided by a Medicare-certified skilled nursing facility.

- The skilled services must be provided on an inpatient basis.

A Medicare beneficiary is entitled to receive coverage for skilled care in a nursing home (subject to the following co-payments in 2013):

Home Health Care

A Medicare home health benefit can be available under Medicare Part A or Medicare Part B. However, Medicare Part A home health care benefits are limited to 100 visits and must follow a prior hospital or skilled nursing facility stay. The threshold criterion for home health care is as follows:

- The patient must be generally confined to the home. This means that this individual’s condition must be such that the patient requires assistance to leave home (such as crutches, cane, walker, or assistance of another person, etc.) or that leaving the home without assistance is not advisable, and that leaving home requires a considerable effort. This is often known as the homebound requirement.

- The home health care must be included in a plan of care by a doctor.

- The patient must require skilled care. This means speech or physical therapy service or intermittent skilled nursing care. Occupational therapy will count toward the required skilled care, if it had been originally provided in conjunction with physical therapy, speech therapy, or skilled nursing.

- The services rendered must be medically reasonable and necessary.

- The services must be provided by, or under arrangements with, a Medicare certified home health agency.

Once these criteria have all been met, several medical services are fully paid for by Medicare, including the following:

- Part-time or intermittent nursing care provided by or under the supervision of a registered professional nurse.

- Physical, occupational, and speech therapy.

- Medical social services under the direction of a physician.

- Part-time home health aide services.

Hospice

To be entitled to Medicare hospice coverage, a person must be certified as terminally ill. This means that a physician must state that in his or her clinical judgment, the person’s life expectancy is six months or less if the illness follows its expected course. In addition, the patient must waive all rights to Medicare payments for the duration of the hospice care for any regular Medicare services related treatment of the terminal illness. Instead, the patient elects to receive palliative services provided under the arrangement of the hospice or provided by an attending physician, if the attending physician is not an employee of the hospice.

The primary advantage of hospice Medicare is that a terminal patient’s broad needs can be met with a hidden array of services for a longer period of time. Hospice care provides the terminally ill patient with a holistic approach that concentrates on the patient’s pain management, offers specialized care, and attempts to meet the spiritual and emotional needs of the patient and his or her family. The hospice patient is liable for coinsurance amounts only for respite care and drugs. However, the co-insurance cannot exceed $5 per prescription. It is important to remember that only medications for palliative purposes are covered under the hospice benefit.

Medicare hospice is often more economical to the patient and the patient’s family than hospital, home health, and nursing home care. This is because the increased care allowed the hospice patient is provided regardless of the patient’s ability to pay. For instance, the hospice provider pays for all of the cost of the hospice patient’s prescriptions that are necessary for the patient’s control of the pain at home and the related symptoms associated with the terminal illness. However, in some instances, the regular home health benefit may provide equal or better coverage.

Medicare hospice provides physician services, nursing services, social services, counseling services to the terminally ill and family members, short-term inpatient care provided in a hospice inpatient unit or in a hospital or skilled nursing facility, medical appliances and supplies, drugs, home health aid services, homemaker services and physical therapy provided for symptom control or to help the patient maintain activities of daily living.

The hospice benefit is divided into periods. The first two benefit periods are 90 days, followed by an unlimited number of 60-day periods. A person may designate another hospice one time in each election period.

In addition, a person may opt out of, and return to, Medicare hospice coverage at any time. Medicare Part A coverage that was waived when the Medicare hospice benefit was elected is automatically resumed with the effective cancellation date. To opt back into hospice, a new election form and physicians certificate is necessary.

It is important to remember that Medicare Advantage plans may provide, but are not required to provide, hospice care to their beneficiaries. A beneficiary may change the designation of the particular hospice from which the care will be received once each election period.

Next week, Gregory Gay’s series will continue his look at the Medicare system in the United States with a discussion of Medicare Part B, Medicare Part D, and Medicare beneficiaries. If you would like to read the Florida Senior Legal Guide in its entirety, please visit http://www.seniorlawseries.com. Mr. Gay can be reached at gregg@willtrust.com.

Richard Connolly’s World

Beyond a Parent’s Reach: When a Child Legally Becomes an Adult

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature one of Richard’s recommendations with a link to the article.

This week, the article of interest is “Beyond a Parent’s Reach: When a Child Legally Becomes an Adult” by Alina Tugend. It was featured in The New York Times.

Richard’s description is as follows:

A college freshman walked to a hospital emergency room at midnight and said she feared that she was going to harm herself.

Twelve hours later, after it was determined that she was no longer in danger, she decided to call her parents – but only after a long conversation with a nurse at the hospital about whether she wanted to talk with family members about her experience.

“It was initially a shock to realize that if this had happened the day before, we would have been called immediately,” said her mother, who asked to be identified only by her middle name, Jo, to protect her daughter’s privacy.

Why the difference? The daughter turned 18 at midnight that night and, by law, had the right to keep the episode private – even from her own parents and even though they would ultimately pick up the bill.

Most parents know – in theory, at least – that their children are no longer children when they turn 18. But the full significance may not be apparent until something happens that drives that reality home.

Click here to view the full article.

Seminar Spotlight – 2015 Dates to Remember

The following is a list of important upcoming seminars that we hope you will consider attending or at least putting on your calendar in case you would like to attend:

FLORIDA BAR – REPRESENTING THE PHYSICIAN SEMINAR

This all-day seminar will take place in Fort Lauderdale, Florida on Friday, January 16, 2015. Alan S. Gassman will be presenting a talk on Disaster Avoidance for the Doctor’s Estate Planning. Mr. Gassman will also be presenting the Closing Remarks at the end of the day. Other talks include Lester Perling on Medicare and Medicaid – How They Get Rid of Your Clients and What to Do About It and Cynthia Mikos on Deficits and Other Downsides for Risk-Contracting Physicians.

Click here for the full program and click here to sign up.

There are still spaces open to attend the speaker/health section dinner the evening before the seminar. The Dalai Lama has been invited and has not yet RSVP’d one way or the other.

TAMPA BAY ESTATE PLANNING COUNCIL DINNER PROGRAM

This dinner will include Alan S. Gassman and Christopher J. Denicolo speaking on Understanding Minimum Distribution, Stretch Trust, and Creditor Protection for Pension and IRA Accounts in 20 Minutes – A System of Learning that You Will Never Forget.

The presentation will occur at The Tampa Club on Kennedy Boulevard on January 21, 2015 from 5:30 to 7:30 PM.

PROFESSIONAL ACCELERATION PROGRAM AT AVE MARIA LAW SCHOOL

On Saturday, January 31, 2015, Alan S. Gassman’s Professional Acceleration Program will be given for third year law students, alumni, and other professionals at the Ave Maria School of Law in Naples, Florida.

There will be a nominal admission fee to cover the cost of lunch and the printing of materials.

The program will be preceded by a talk on “Estate Planning in the Real World” from 8:00 to 9:00 AM.

ALL CHILDREN’S ONE-DAY ESTATE AND TAX PLANNING CONFERENCE

The live presentation will take place on February 12, 2015 in St. Petersburg, Florida featuring Steve R. Akers, Richard Oshins, and many other nationally-known speakers.

Live video simulcasts with the opportunity to spend time with colleagues will occur in Lakeland, Tampa, Clearwater, New Port Richey, and Sarasota.

Join with hundreds of other estate planners for the 16th annual program.

Thanks to Lydia Bailey, Jerome Hesch, Byron Smith, Holger Gleim, Michael O’Leary, Tami Conetta, and many others for years of support of this program and All Children’s Hospital.

FUNDAMENTALS OF ASSET PROTECTION

This program is intended for those who have asset protection practices and those who would like to learn from scratch. This 2-day seminar is sponsored by the Florida Bar Tax Section and co-chaired by Denis A. Kleinfeld and Alan S. Gassman. It will take place on May 7 and 8, 2015 in Miami, Florida.

Thursday, May 7, 2015 will be a day for Asset Protection. The next day, May 8, will be Advanced Creditor Protection Planning for both experienced creditor protection planning professionals and newcomers who have attended the Thursday program.

Please also feel free to join us for the speaker’s dinner on Thursday, May 7th. Dutch treat if you are not a speaker or are from Holland.

AVE MARIA LAW SCHOOL TWO-TRACK ESTATE AND TAX CONFERENCE

Taking place in Naples, Florida on Friday, May 1, 2015, this seminar will feature Jerome Hesch and Alan S. Gassman on The Mathematics of Estate Planning, Jonathan Gopman on Asset Protection Planning, and many others in a dual-session system allowing for a personalized conference experience.

Support Florida’s newest and most beautiful law school and campus by attending this fantastic conference!

For more information on any of the experiences listed above, please contact Alan S. Gassman at agassman@gassmanpa.com.

Thoughtful Corner

The Women’s Guide to Dressing for Success for First Year Lawyers and Others

by: Dena Daniels, MBA, J.D. Candidate

When it comes to business dress, men have it easy: suit, shirt, tie, slacks, polo shirts. Their choices are rather limited. However, as women, we have to walk the fine line between being professional and “trendy”. It is important that our daily attire reflects the environment of the workplace whether it be business professional or business casual. Hopefully this guide will offer some insight in the hazy world of fashion in the professional world.

Business Professional Dress

The Suit

The start of any professional dress is a well-fitting suit. The suit should be comprised of a blazer and either slacks or a skirt. It is imperative that both the blazer and the chosen bottom match in color and fabric. Stick to neutral, conservative colors such as: black, navy blue, or dark grey. These colors have the ability to be versatile and can be paired with an array of shirts.

The most important factor in achieving a clean, tailored professional attire is the fit of the suit. When choosing a blazer, you must pay attention to the length of the sleeves and how the blazer fits on your shoulders. An ill-fitting blazer can appear unprofessional and is uncomfortable.

If you decide on a skirt bottom, the skirt should be knee-length. Pay close attention if the skirt has a slit in the back, especially when sitting down, walking or wearing heels. Also, be sure to pull out the pantyhose if you are going to go with the skirt option.

When opting to wear pants, the length of the pant is imperative, especially depending on whether you decide on wearing a heel or flats. The cuff of the pant should hit at the midway-point of your shoe.

When deciding on a shirt to wear under your suit, this is where your personal style can be expressed. Colors, materials, patterns, design are completely up to you, however, the only requirement is that the shirt be a buttoned-up shirt with a collar.

Accessories and Make-up

Closed-toe, leather pumps or flats are the staple shoes for business professional dress. The shoe should be stylish yet comfortable and be a neutral color. If you decide to wear a pump, the heel should not exceed 3’’.

Pearls are the ultimate conservative accessories and one cannot go wrong with a string of pearls and a pair of pearl earrings.

Makeup should be kept minimal and natural. Dramatic eye shadow and lipstick are not appropriate for business professional dress.

Business Casual Dress

Dress Pants & Skirts

Slacks and skirts that are bought separately from a suit will become a staple in your business casual wardrobe. The cut of the pants: boot cut, wide leg, straight leg- depends on your personal style and preference.

Skirts should be knee-length and you should avoid overly form-fitting skirts. Pencil skirts and A-line skirts are most appropriate for a business casual environment. Pantyhose are optional.

The pants and skirts should be kept in the neutral color, however, if your office culture permits patterned, textured, or colored pants and skirts, feel free to spice up your business casual attire through this, however, neon colors and loud print pants are a “no-no”.

Blouses

In general, usually any type of blouse is appropriate for the workplace, however, the blouse should have sleeves. If you would like to wear a sleeveless top wearing a cardigan or blazer over it will make it workplace appropriate.

Accessories & Shoes

Jewelry is a way for you to add your own personal flare to your business casual attire. Statement necklaces and earrings are appropriate for the workplace as long as the jewelry is not distracting by making a lot of noise when you move.

Personality may be displayed through your shoes when wearing business casual. Business casual permits shoes to vary in color and style. For instance, a peep toe or a wedge heel is appropriate for business casual.

We hope this guide has been helpful. We are confident that if you stick to these cardinal basics, then you will impress your bosses and colleagues alike in your workplace. Your attire should enhance who you are as a person, not overshadow it. In the words of the fashion icon, Sophia Loren, “A woman’s dress should be like a barbed-wire fence: serving its purpose without obstructing the view.”

Humor! (Or Lack Thereof!)

Kentucky Fried Tokyo

Do you ever go to your local KFC and feel like something’s missing? What might be missing, you ask? The Colonel himself! In Japan, each KFC restaurant has a Colonel Sanders statue to call their own, placed just outside or just inside of the restaurant’s doors.

Many restaurants make a game of dressing up their Colonel Sanders for special occasions or just because! Tourists and Japanese locals mark seeing the decoratively dressed Colonel Sanders statues as a highlight of their tours of Tokyo and Japan.

To see the Colonel’s stylish outfits, please click here.

Upcoming Seminars and Webinars

LIVE WEBINAR:

Alan Gassman will be joined by Ron Cohen, CPA for two webinars on POST MORTEM TAX PLANNING.

Date: Tuesday, December 2, 2014 12:30 p.m. or 5:00 p.m. (50 minutes each)

Location: Online webinar

Additional Information: To register for the 12:30 p.m. webinar, please click here. To register for the 5:00 p.m. webinar, please click here.

********************************************************

LIVE WEBINAR:

Alan Gassman will be presenting a 30 minute webinar on PLANNING OPPORTUNITIES FOR SAME SEX COUPLES

Date: Tuesday, December 9, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar, please click here.

********************************************************

LIVE CLEARWATER PRSENTATION:

Alan Gassman will be hosting a workshop for lawyers and other professionals who are interested in improving their futures both personally and professionally. Topics to be explored include goal setting, overcoming frustrations, problem solving, and strategies to help attract and retain the type of clients that will help grow your practice.

This workshop will be followed by a tour of the Gassman Law Associates office.

Date: December 14, 2014 | 9:00 a.m. – 3:00 p.m.

Location: 1245 Court Street, Ste 102, Clearwater, FL

Additional Information: For more information, or to register for this workshop, please email Alan Gassman at agassman@gassmanpa.com.

*********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will be presenting a 30 minute webinar on LESSONS LEARNED FROM THE HALIFAX CASE

Date: Tuesday, December 16, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Chris Denicolo will be presenting a webinar on TRUST PLANNING FROM A TO Z with the Florida Institute of CPAs.

Date: January 6, 2015 | 11:00 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org.

*******************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Alan Gassman will be speaking at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Others speakers include D. Michael O’Leary on Really Burning Hot Tax Topics, Radha V. Bachman on Checklists for Purchase and Sale of a Medical Practice, Cynthia Mikos on Dangers of Physician Recruiting Agreements and Marlan B. Wilbanks on How a Plaintiff’s Lawyer Evaluates Cases Brought by Whistleblowers.

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

********************************************************

LIVE TAMPA PRESENTATION:

Alan Gassman will be speaking at the Tampa Bay Estate Planning Council Dinner Program on the topic of PLANNING WITH RETIREMENT ACCOUNTS.

Date: January 21, 2015 | 5:30 p.m. – 7:30 p.m.; Alan Gassman will be speaking from 6:45 to 7:15.

Location: The Tampa Club, 101 E Kennedy Boulevard, 41st Floor, Tampa, FL

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

***********************************************************

LIVE NEWPORT BEACH PRESENTATION:

Jerry Hesch will present THE MATHEMATICS OF ESTATE PLANNING at the Society of Trust and Estate Practitioners 4th Annual Institute on Tax, Estate Planning, and the Economy. This conference is a collaboration between STEP Orange County and the University of California, Los Angeles, School of Law.

Professor Hesch’s presentation will make use of the materials that Alan Gassman, Ken Crotty, and Chris Denicolo presented to the 40th Annual Notre Dame Tax & Estate Planning Institute on November 14, 2014.

Date: January 22 – 24, 2015

Location: California Marriott Hotel and Spa at Fashion Island, Newport Beach, CA

Additional Information: For more information, please email agassman@gassmanpa.com or visit http://www.step.org/4th-annual-institute-tax-estate-planning-and-economy.

**************************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: January 31, 2015 | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To register for this program please email agassman@gassmanpa.com.

***********************************************

LIVE ORLANDO PRESENTATION:

THE ADVANCED HEALTH LAW TOPICS AND CERTIFICATION REVIEW 2015

Alan Gassman will speak at The Advanced Health Law Topics and Certification Review 2015. Topic is To Be Announced.

Date: March 6, 2015

Location: Hyatt Regency Orlando International Airport, 9300 Jeff Fuqua Blvd., Orlando, FL 32827

Additional Information: For more information, please email agassman@gassmanpa.com.

***********************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Jerry Hesch and Alan Gassman will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Jonathan Gopman, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman are the co-chairs for this year’s FUNDAMENTALS OF ASSET PROTECTION AND ADVANCED STRATEGIES WORKSHOP. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami, 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

NOTABLE SEMINARS BY OTHERS

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott, 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a full list of speakers and presentation descriptions, please click here. For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

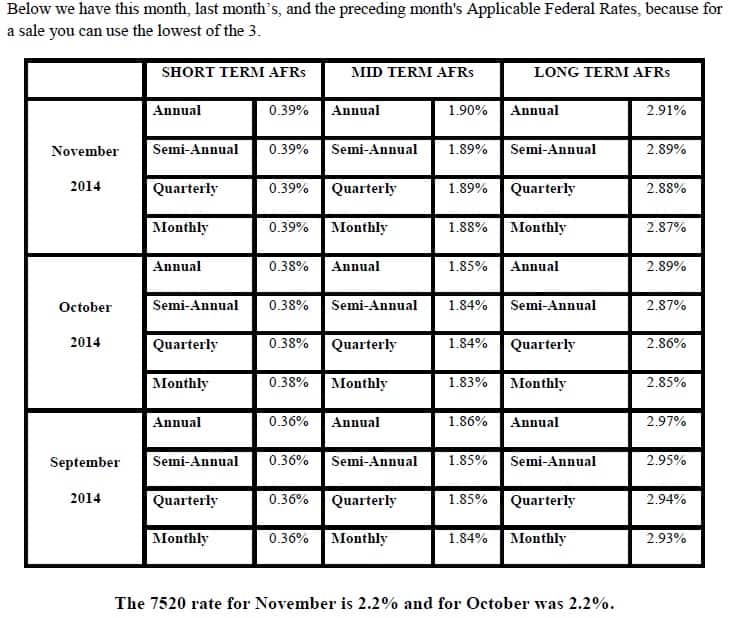

Applicable Federal Rates