Thursday Report – 10/17/2013 – Welcome Back Government, Same Sex Marriage, USAA & a Manatee

An Update from the Notre Dame Tax and Estate Planning Institute

4 Dangerous Initials – USAA Does Not Allow TBE

Counseling Same Sex Couples in a Post-DOMA America, an article by Alan Gassman, J.D., LL.M., and Danielle Creech, J.D.

Catch-22

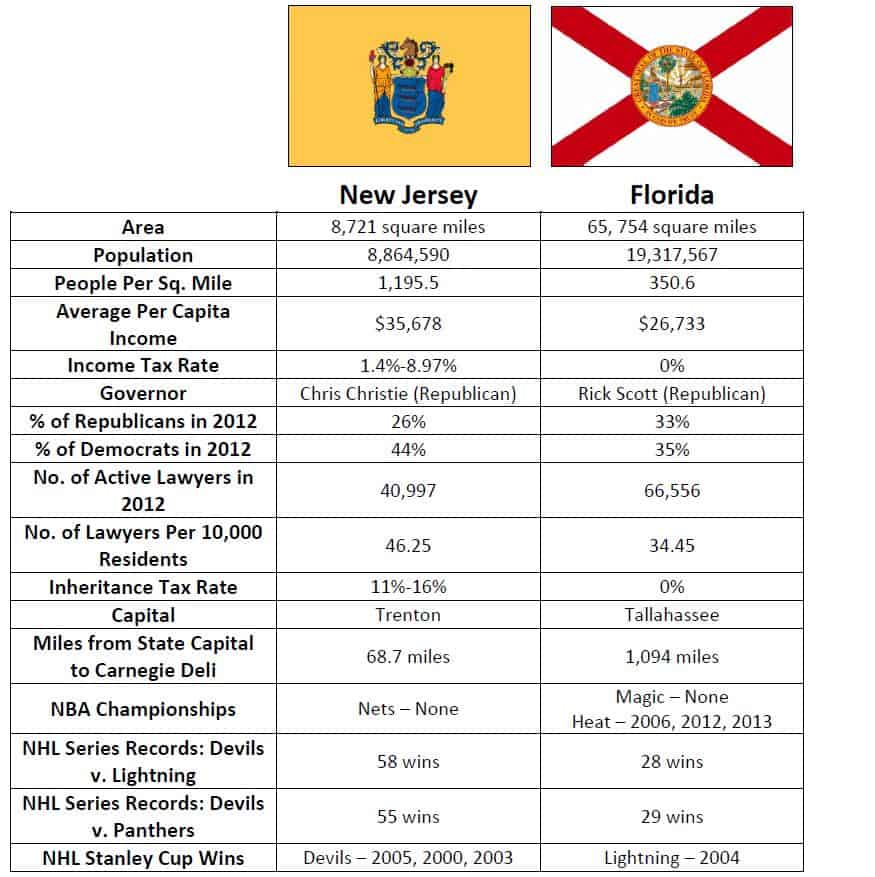

New Jersey v. Florida – Fun Facts

Phil Rarick’s Client Blog: Florida Probate Attorney Fees

Seminar Spotlights of the Week

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

An Update from the Notre Dame Tax and Estate Planning Institute

Things are tame at Notre Dame!

Alan Gassman, Ken Crotty and Christopher Denicolo joined Professor Jerry Hesch is a session last night on Interesting Interest and planning with annuity contracts. If you would like to receive our outlines, please email agassman@gassmanpa.com.

Also, our new software program now includes installment sales to Grantor trusts and self-cancelling installment sales. Notre Dame Institute attendees are receiving free 15 month subscriptions. Let us know if you would like to be a beta tester.

One portion of the talk spoke about income tax planning with annuities. Another part included a nutshell on annuity taxation.

Next week we will feature the nutshell and the planning strategy section, to be followed by other portions of our materials.

The charts that we shared can be viewed by clicking here.

“A splendid time was had by all!”

Those of you who are with us in Indiana are welcome to come to the Gassman Law Associates table to pick up a free 15 month subscription to our new estate tax planning software, which now covers installment sales and self-cancelling installment sales.

If you are not at the Notre Dame Tax & Estate Planning Institute, get on a plane tonight and we can see you tomorrow!

4 Dangerous Initials – USAA Does Not Allow TBE

While most banks and brokerage firms that our clients work with allow TBE accounts, USAA does not.

USAA is headquartered in Texas, and we have received confirmation from them in the past that their accounts are not considered to qualify as Tenancy by the Entireties accounts.

Excerpts from a letter that we wrote to a married couple last week about how to handle ownership of their USAA account is as follows:

A tenancy by the entireties account is a joint account between a husband and a wife that has certain characteristics available for accounts opened in Florida, Delaware, and other states that recognize tenancy by the entireties.

I would therefore either move the USAA account to John’s living trust, or set up a simple Florida limited liability partnership which costs approximately $25 a year to maintain. I would then place the USAA account into that partnership.

It would be a bit safer from a creditor protection standpoint to instead form a Florida limited liability company.

A limited liability partnership would prevent creditors of one spouse from reaching into the joint asset while the other spouse is living, but would not provide any protection for the surviving spouse if one spouse dies.

The limited liability company would provide some creditor protection for Jane if John were to die.

If the USAA account is moved to John’s revocable trust, then it will be exposed to potential creditor claims against John, which will notably include the risk of a car accident claim.

If you have a $5,000,000 umbrella liability insurance policy then this may not be of as much concern.

If John were to die first and this trust owns 5% of the LLC and Jane thereafter owns 95% (the 95% that was owned jointly by TBE) then creditors of Jane would not be able to reach into the LLC, but would instead only receive what is called a “charging order” that would permit them to be paid whatever Jane owes them if and when there is a distribution from the LLC.

The judges cannot force a distribution, so Jane would be in a “stalemate” with the creditor because she could continue to control the LLC, but would not be able to make any significant withdrawals without paying the creditor.

Counseling Same Sex Couples in a Post-DOMA America, an article by Alan Gassman, J.D., LL.M., and Danielle Creech, J.D.

|

Recognizes Same Sex Marriage |

Allows Same Sex Marriage if Married Elsewhere |

Prenuptial Agreements Upheld |

Tenancy by the Entirety Allowed for Same Sex Couples |

Prohibits Workplace Discrimination due to Sexual Orientation |

Will Spouse Have Rights to Homestead |

Permits Joint Adoption |

|

|

California |

Yes |

Yes |

Yes |

No |

Yes |

Yes |

Yes |

|

Florida |

No |

No |

No |

No |

No |

No |

No[1] |

|

Nevada |

No |

No |

No |

No |

Yes |

Yes[2] |

Yes |

|

North Carolina |

No |

No |

No |

No |

No |

No |

No |

|

Texas |

No |

No |

No |

No |

No |

No |

No |

|

New Jersey |

No[3] |

No[4] |

Yes |

Yes |

Yes |

Yes |

Yes |

|

New York |

Yes |

Yes |

Yes |

Yes |

No |

Yes |

Yes |

The U.S. Supreme Court’s U.S. v. Windsor and Hollingsworth v. Perry decisions, the IRS’ pronouncement of equality for income, estate and gift tax purposes, and Pope Francis’ comment that the Catholic Church should not interfere in the lives of gays and lesbians have made 2013 a banner year for gay rights and marital, tax, government and employer benefit, creditor, and estate planning for same sex couples. Individuals who are in same sex relationships must now determine whether they would like to be married if they are not married, where to live, whether to have prenuptial agreements in place, how to handle beneficiary designations, whether they can adopt, and many other things.

While these decisions have tremendously expanded gay rights in the United States, the differences between state and federal laws still hold back the gay rights movement to some degree. Thus, attorneys should prepare to start counseling their same sex clients with respect to their legal rights (or lack thereof) in various jurisdictions.[5]

Same-Sex Marriage Throughout the United States

About 43% of the United States population live in a state that has some sort of protection for same sex couples. Thirteen states recognize same sex marriage in the United States (Massachusetts, California, Connecticut, New York, Iowa, Vermont, New Hampshire, Maryland, Maine, Washington, Delaware, Rhode Island and Minnesota) along with the District of Columba and certain Native American tribes. Nevada, Wisconsin, and Oregon have created a limited legal same sex marriage recognition while Colorado, Hawaii, Illinois, and New Jersey recognize civil unions[6] for same sex couples.

The other 35 states either have a constitutional or statutory ban on same sex marriage. This becomes an issue when a same sex couple gets married in a state allowing same sex marriage but then moves to a state that has an outright ban on same sex marriage.

Estate Planning and Tax Advantages

On Thursday, August 29, 2013, the IRS ruled that same sex couples will be considered as married for federal income, estate and gift tax purposes. Any same sex marriage legally entered into in one of the 13 states that allow same sex marriages (see chart below) the District of Columbia, or a foreign jurisdiction having legal authority to sanction same sex marriages is covered under this ruling; notwithstanding whether the spouses live in a state or other jurisdiction that recognizes their marriage legally.

Before the IRS issued Revenue Ruling 2013-17, a same sex couple would not receive full married couple benefits under the estate and gift tax laws unless they were (1) married in a state that recognizes same sex marriages and (2) resided in a state that also recognizes same sex marriages.

The above interpretation is consistent with the Supreme Court’s decision in the United States v. Windsor case as discussed in our Leimberg Newsletter #2123, which was entitled Many Affluent Same-Sex Couples Will Be Leaving Florida and Where They Should Go. This piece was premised upon the Court’s decision that a same sex couple would not be considered married for tax purposes if the state where they resided did not recognize the marriage. That changed very quickly!

The rules and implication thereof were very thoroughly explained by George Karibjanian in Steve Leimberg’s Estate Planning Email Newsletter Archive Message #3137 that was published on September 3rd and can be viewed by clicking here.

As the result of Rev. Ruling 2013-17, affluent married couples now have the option to move to states that may not recognize same sex marriage to avoid state inheritance taxes, state estate taxes, and state income taxes. For example, a same sex couple could go to New York to get married and move to Florida to avoid income taxes and inheritance taxes. Florida does not recognize same sex marriage, however, so they would not have the advantage of the creditor protection accorded to tenancy by the entireties assets as they would if they decided to live in Delaware instead. Not to mention it is also a pretty darned neat place to live (when it is not 100 degrees outside with 100% humidity and the power is not working because of a lightning storm).

Revenue Ruling 2013-17 provides that Internal Revenue Code Section 6511 gives same sex married couples the option of amending their prior tax returns, going back 3 years from the time the return was filed or 2 years from the time the tax was paid, whichever is later. Same sex couples may also choose to leave the prior returns in tact or to amend one or more prior tax years. This gives same sex couples some very good choices for income tax planning purposes. Almost all affluent same sex couples (or couples where one spouse is affluent) will want to go to a good income tax advisor with the right software to help determine what years they should amend and what years they should not amend.

Any gift tax return that involved a transfer to a spouse that used up any portion of the donor spouse’s estate tax exemption should probably be amended to regain the exemption amount, unless there are other items on the gift tax return that are best not re-opened, such as large gifts with questionable values to non-spouse individuals.

Amending a gift tax return will give the IRS three years after the date of the amendment to revisit all aspects of the gift tax return amended.

An increase in federal protections also means that same sex couples residing in states that don’t recognize same sex marriage will not be as negatively impacted by the state’s lack of recognition of gay marriage. Rev. Ruling 2013-17 will largely benefit gay and lesbian’s who are serving in the military or working for the federal government. A spouse recognized by the military or federal government will receive benefits from the federal government, and state laws will not apply.

However, same sex couples should be mindful that some limitations still exist to the federal protections. For example, veteran benefits do not apply in the same way as benefits to active duty service members. If a same sex couple gets married in a recognition state and then moves to Florida, it is unlikely that the Department of Veterans Affairs will recognize the marriage. But if a same sex couple lives in a recognition state when benefits take effect and later moves to a non-recognition state, then the VA will likely continue dispensing the benefits. This same scenario will likely be true for both Social Security and Medicare benefits, but a further analysis of the Social Security Administration (“SSA”) rulings is provided below.

| State | Does the State Recognize Same Sex Marriage? | Does the State Recognize Tenants by the Entireties (with pure protection?) | Does the State have an estate tax or inheritance tax? | Exemption Amount; Highest Estate and/or Inheritance Tax Rate (if applicable) | Does the State have an Income Tax? | Highest Income Tax Rate (if applicable) |

| California | Yes | No | No | N/A | Yes | 13.30% |

| Connecticut | Yes | No | Estate Tax (and state Gift Tax) | $2,000,000; 12% | Yes | 6.70% |

| Delaware | Yes | Yes | No (repealed for deaths after June 30, 2013) | N/A | Yes | 6.75% |

| District of Columbia | Yes | Yes | Estate Tax | $1,000,000; 16% | Yes | 8.95% |

| Iowa | Yes | No | Inheritance Tax (but spouses and descendants are exempt) | No exemption; 15% | Yes | 8.98% |

| Maine | Yes | No | Estate Tax | $2,000,000; 12% | Yes | 7.95% |

| Maryland | Yes | Yes | Estate Tax and an Inheritance Tax (but spouses and descendants are exempt from the Inheritance Tax) | $1,000,000 (estate only); 16% (estate); 10% (inheritance) | Yes | 5.75% |

| Massachusetts | Yes | No | Estate Tax | $1,000,000; 16% | Yes | 5.30% |

| Minnesota | Yes | No | Estate Tax (and state Gift Tax) | $1,000,000; 10% | Yes | 7.85% |

| New Hampshire | Yes | No | No | N/A | Only on dividend or interest income | 5.00% |

| New York | Yes | No | Estate Tax | $1,000,000; 16% | Yes | 8.82% |

| Rhode Island | Yes | No | Estate Tax | $910,725; 16%` | Yes | 5.99% |

| Vermont | Yes | Yes | Estate Tax | $2,750,000; 16% | Yes | 8.95% |

| Washington | Yes | No | Estate Tax | $2,000,000; 19% | No | N/A |

“Pure Protection” refers to those state laws which protect Tenants by the Entireties assets from the creditors of only one spouse.

Same sex couples who are not formally married in one of the recognition states should consider whether the estate and gift tax and income tax advantages of getting married outweigh potential disadvantages. These disadvantages can include;

- having to leave qualified plan benefits to a surviving spouse who will not sign a waiver associated therewith,

- having alimony and property settlement rights vest in a new spouse if the new spouse will not sign a binding prenuptial agreement as requested by the other spouse,

- having to have the new spouse on the healthcare plan of an employed spouse whose employer requires this,

- having to inform an employer that a same sex marriage exists in order to comply with personnel, office and associated requirements (which may occur in states that do not prevent discrimination against gays and lesbians, such as Florida. However many cities and counties in Florida have enacted ordinances prohibiting sexual orientation discrimination in the workplace),

- having to decide who to invite to the ceremony and who is going to pay for it or,

- whether to go to Justice Ginsberg’s house since she will probably not charge because it would have to be disclosed on her income disclosure form.

Advisors who represent one or more members of an affluent same sex couple will need to reach out to let them know that if and when they are married they can have a new estate tax plan that includes marital deduction planning, Qualified Terminable Interest Property trust planning, and associated rights and responsibilities.

Medicaid.

Many elderly Americans rely upon medicaid to pay for nursing home care after their limited Medicare benefits run out. When one spouse needs to have Medicaid nursing home benefits and the other spouse has assets, the assets have to be spent down in many cases before Medicaid will apply. The spouse whose assets have to be spent down even though he or she does not need nursing home care is called the “community spouse.” Individuals who are concerned about Medicaid eligibility will want to think about this, and possibly purchase long term care insurance to make this issue less of a factor.

Liability for Medical and Other Expenses of a Spouse.

Some states require one spouse to be responsible for medical and other liabilities incurred by the other spouse. Other states, including Florida, do not unless there has been an explicit guarantee signed. This is another factor that many same sex couples will consider in determining whether to marry.

Sexual Orientation and Gender Identity Protection in the Workplace.

Protection of gay clients in the workplace due to sexual orientation is also an issue to consider when counseling same sex couples.

Federal law protects federal employees from discrimination due to sexual orientation, but they have not yet successfully passed a law that outlaws discrimination based on sexual orientation in private workplaces. Thus, state law continues to govern in this particular area.

However, this may all change after the Senate votes on the Employment Non-Discrimination Act later this year. If passed, this bill will provide comprehensive protections against employment discrimination on the basis of sexual orientation and gender identity to lesbian, gay, bisexual, or transgender (“LGBT”) workers in all 50 states!

While twenty-one (21) states have banned sexual orientation discrimination in the workplace, many states have failed to follow this growing trend. However, many of the cities and counties in states that don’t provide sexual orientation protection have enacted local ordinances that prohibit sexual orientation discrimination in private workplaces. This is illustrated in the chart below. These jurisdictional ordinances do vary as to degree of protection, i.e. not all permit workers to file private lawsuits against employers and some only regulate workplaces having more than a certain minimum number of employees, thus it is important to specifically look at the specific jurisdiction’s degree of protection when filing a suit for workplace discrimination.

US Counties and Cities with Sexual Orientation and Gender Identity Protection – 2013

Prenuptial Agreements

When a same sex couple that is validly married in another state lives in a non-friendly state, it is probably also useful to have them consider a prenuptial agreement. In some states, if a same sex married couple lives in a state that does not recognize their marriage, they are not provided the option of obtaining a divorce. Thus, if the partners have a disagreement of how to split up the marital assets the court will have no available remedy.

However, if a couple has a prenuptial agreement, the contract between the partners may provide a court a way to divide up the marital assets. Keep in mind that there is no guarantee that a court in a state hostile to same sex marriage will uphold same sex prenuptial agreements, but it does not hurt to draft one as a safety net.

This divorce prohibition in certain states could change in the not too distant future, and, if so, alimony and property settlement rights might date back to when the couple was originally married, as opposed to dating back to when the state legislature and governor might sign such legislation into existence.

Powers of Attorney

Furthermore, same sex couples should carry Powers of Attorney just in case the state they are domiciled in does not recognize their marriage. Since a Power of Attorney is contractual in nature and not dependent on relationship status, a gay individual can appoint their partner to make financial and medical decisions for them in certain circumstances.

Any hospital receiving federal funding, including Medicare/Medicaid, is required to honor any valid Powers of Attorney, even if it is between same sex partners. President Barack Obama, Presidential Memorandum – Hospital Visitation (April 15, 2010) (available at http://www.whitehouse.gov/the-press-office/presidential-memorandum-hospital-visitation). This order was the result of a Florida lawsuit, Langbehn v. Jackson Memorial Hospital, in which the hospital refused to acknowledge the Plaintiff’s valid Health Care Power of Attorney over her dying lesbian partner.

Planning for Same Sex Couple’s Children

When planning for same sex couple’s children, more things need to be considered than just establishing a will and trust.

For instance, it is also important to consider that in all 50 states, same sex parents who are not the birth parent MUST obtain second-parent adoptions for their children to be actually recognized as a legal parent. Dan Ebner, Roundtable, LGBT Litigator (American Bar Association, Sept. 12, 2013) (copy of transcript on file with Gassman and Associates). Neither a marriage license of the parent’s nuptials nor a birth certificate signed by the non-biological parent are enough to give a same sex partner parental rights to their child. Id. Thus, a court order of adoption is required. Id.

This was the major issue of the Ohio Supreme Court case In re Mullen. Kelly Mullen and Michelle Hobbs decided that they wanted to have a child. In re Mullen, 953 N.E.2d 302, 304 (Ohio 2011). Mullen got in contact with a male friend to be a sperm donor (he signed away any legal rights to the baby), and she gave birth in July 2005.Id. However, the couple began having problems and Mullen moved out with their child. Id. Hobbs filed an action to obtain visitation rights, but the Ohio Supreme Court ruled that Hobbs had no rights due to the fact that “Mullen did not create an agreement to permanently relinquish sole legal custody of her child in favor of shared legal custody with Hobbs.” Id at 309.

However, an issue arises in states that do not allow for second-parent adoption. In these states, same sex parents should execute a co-parenting or joint custody agreement to ensure custody if a dispute arises. It is not certain that these agreements will be upheld in every state’s court; however, having same sex parents draft and sign these agreements help prove intent to a court during a custody dispute. In “Estate Planning for Children of Same-Sex Couples”, Joan Burda encourages planners to stray away from using “joint parenting agreement” and rather title the agreement “joint custody agreement.” Joan Burda, Estate Planning for Children of Same-Sex Couples, Vol. 3, No.2 (September 2013). Furthermore, when drafting wills or trusts be careful when using the word “parent” because sometimes this can be construed to mean biological parent. Id.

Some factors to address in a co-parenting or joint custody agreement are:

- Who will the child live with?

- Who will make major decision such as health care and schooling decisions for the child?

- Will the child spend part of the week (month or year) living with one parent and part of the week (month or year) with another? And will both parents share in making major decisions?

- How will both parents provide for their child’s medical and educational needs?

- In what religion, if any, will the child be raised?

- What financial, familial, or other resources will each parent offer?

- How each parent resolve disputes?

- What each parent will do if either parent moves?

- What will be done if one of the parents violates the agreement?

Human Rights Campaign, Second Parent Adoption, http://www.hrc.org/resources/entry/second-parent-adoption (accessed Oct. 1, 2013).

Legal Practice Etiquette

| Socially Acceptable Terminology For Same Sex Couple Conversations | NOT SO Socially Acceptable Terminology for Same Sex Couple Conversations |

| “Partner”[8] | “Husband” or “Wife” |

| “Special Rights” | “Equal Rights” |

| “Gay” or “Lesbian” | “Homosexual” |

| “Relationship” or “Couple” | “Homosexual Couple” |

| “Sexual Orientation” | “Sexual Preference” |

With the prospect of more same sex couples, advisors will also want to be wary of proper etiquette. According to the GLAAD Media Reference Guide which advises journalists on using appropriate terms, preferred terms include “gay,” “gay man,” “lesbian,” or “gay person/people” rather than “homosexual.” In addition, “sexual orientation” or “orientation” is preferred, while “sexual preference” is considered offensive. Steven Petrow, a New York Times contributor addressing questions on gay and straight etiquette, suggests that the most practical approach is to listen to how a couple introduces themselves or refers to each other, since this will vary from couple to couple. This is an important matter to consider, and advisors should be careful to avoid “downgrading” a couple’s status. As Petrow explains, “[w]ith all the work that it took for [same sex couples] to make their relationship legal in New York, my pal was not about to settle for ‘friend’ to describe the man he’s been partnered with for nearly three decades.” When in doubt, Petrow advises that you should not be shy to ask the couple directly how they would like to be referred to. “It’s not a nosy question–it’s a respectful one,” he says.

Other Considerations

Also consider some advantages vs. disadvantages of marriage shown below.

| Advantages of Marriage | Disadvantages of Marriage |

| Savings with sharing a single health insurance plan: While the rules vary by state and employer, many health insurance companies already offer benefits to domestic partners and same-sex unions; others require marriage for shared coverage. | Responsibility of health care: Depending on which state you live in, if your spouse cannot pay their health care bills, then you may be held liable for the cost. |

| Security benefits go to the surviving spouse: Widowed spouses are entitled to their spouses’ Social Security benefits if they are greater than their own. | Loss of benefits if you get remarried: If you are a widow or widower receiving a deceased spouse’s retirement benefits or social security benefits you may lose those benefits if you get remarried before the age of 60. |

| No Employer Taxes: If you work for your spouse, they do not have to pay social security taxes or unemployment taxes on your behalf. | Spousal debt responsibility: In community property states, most debt incurred by either spouse during marriage are owed jointly by the couple, even if only one spouse signed for the debt. |

| “Being Married” – Dr. Phil | “Being Married” – Rodney Dangerfield |

While Post-DOMA America is still not providing same sex couples with complete equality, the federal and state governments are working tirelessly to achieve this goal. One thing is for certain: as the landscape continues to grow more inclusive, lawyers can anticipate a wide array of new considerations and techniques for same sex couples.

Social Security Benefits and Taxation – We are hopeful that the Social Security Administration (“SSA”) will announce this year that same sex couples who had marriage ceremonies and registration in states that recognize same sex marriage will be treated as married for social security tax purposes, but that is not always a good thing.

Our draft language with respect to social security benefits and taxation that will be adapted once we know where the SSA is heading is as follows:

While Medicare and the IRS officials are using the “place of celebration” standard to determine if a same sex couple is eligible for benefits, the SSA is using a “place of residence” standard in determining spousal benefits. This means that for Medicare and IRS determinations as long as the couple is legally married, it doesn’t matter where they may live, but for SSA benefits a same sex married couple living in a non-recognition state will not receive benefits as a couple. For example, a same sex couple in Florida may not receive the same social security benefits as a same sex couple in Massachusetts until final determinations are made by the SSA.

However, the SSA is working on fixing this “kink”, and there is an expectation that this will be resolved soon to ensure uniformity throughout the states. Once the Social Security Administration resolves this issue, same sex couples will be offered more financial benefit options for their spouse and family, such as surviving spouse benefits after their spouse dies.

The SSA has started processing spousal claims for same sex couples. They encourage same sex couples to start applying right away, even if they are not eligible, it will preserve the filing date used when determining the start of benefits.

It is important to note to clients that entering into a same-sex marriage may cause a loss of or a lowering of their existing social security income (“SSI”) benefits. Marriage can not only effect eligibility for SSI, but benefits can change from an individual rate to a couple rate and social security income is taxed differently. However, marriage will not affect retirement or social security disability insurance (“SSDI”) benefits.

Social security income may be taxable, depending upon the amount of other income a same sex couple receives. If a taxpayer only receives social security income or railroad retirement benefits, the benefits are generally not taxable and the taxpayer may not need to file a federal income tax return.

If a taxpayer receives income in addition to social security income, and one half of the social security benefits plus other income exceeds a “base amount,” then up to 85% of the social security income can be taxable. The 2012 base amount for single filers is $25,000 and for married taxpayers filing a joint return is $32,000.

There is a complicated sliding scale formula under Code § 86 to determine how much of social security benefits are taxable. Generally, gross income includes 50% of social security benefits but no more than 85% depending upon the amount of other income a taxpayer receives during the year. IRS Publication 915 contains a Worksheet that is helpful in determining the amount of social security income that is subject to income tax.

Example:

John and Sam, a same sex married couple, receive annual social security income of $10,000 each, for a total of $20,000. John also receives taxable pension income of $8,000. None of the social security income is taxable because their income of $28,000 is less than the $32,000 base amount that applies for married joint filers.

If John receives taxable pension income totaling $25,000 then $1,500 of their Social Security income will be taxable.

If John receives taxable pension income totaling $50,000 then 85% of their Social Security income will be taxable.

Social Security income is included in the calculation of Modified Adjusted Gross Income for purposes of calculating the Medicare contribution tax. Therefore, taxpayers having significant net investment income will have more reason to defer Social Security benefits.

Assuming a reasonable or long life expectancy, it is generally beneficial for an individual who is eligible to receive Social Security on or after age 62, to delay receipt of payments until he or she reaches full retirement age. If an individual’s full retirement age is 65 and he or she elects to receive Social Security benefits at age 62, the benefit amount is reduced by 20%. The reduced benefit amount decreases to 13.3% at age 63 and 6.66% at age 64. The reduction takes into account that a person is receiving benefits over a long period of time. Therefore, an individual can either receive lower monthly amounts over a longer period of time or receive higher monthly amounts over a shorter period of time.

If an individual delays receiving Social Security benefits after full retirement age, he or she may be eligible for a delayed retirement credit. The following chart, available at http://www.ssa.gov/retire2/delayret.htm shows the percentage increases when an individual delays receipt of retirement benefits.

|

Increase for Delayed Retirement |

||

|

Year of Birth* |

Yearly Rate of Increase |

Monthly Rate of Increase |

|

1933-1934 |

5.5% |

11/24 of 1% |

|

1935-1936 |

6.0% |

1/2 of 1% |

|

1937-1938 |

6.5% |

13/24 of 1% |

|

1939-1940 |

7.0% |

7/12 of 1% |

|

1941-1942 |

7.5% |

5/8 of 1% |

|

1943 or later |

8.0% |

2/3 of 1% |

The chart below, available at http://www.ssa.gov/OACT/ProgData/ar_drc.html demonstrates the advantages of delaying Social Security benefits. The “Primary Insurance Amount” is the amount an individual would receive at his or her normal retirement age. As the chart shows, a person born between 1943-1954, whose normal retirement age is 66 can receive a 32% increase in benefits by delaying receipt of benefits until they reach age 70. Further information on this topic can be found on Social Security Administration website, www.ssa.gov.

| YearofBirth | Normal | Credit for each year of | Benefit, as a percentage of PIA, beginning at age | ||||||

| Retirement | delayed retirement | ||||||||

| Age | after NRA (percent) | 62 | 63 | 64 | 65 | 66 | 67 | 70 | |

| 1924 | 65 | 3 | 80 | 86 2⁄3 | 93 1⁄3 | 100 | 103 | 106 | 115 |

| 1925-26 | 65 | 3 1⁄2 | 80 | 86 2⁄3 | 93 1⁄3 | 100 | 103 1⁄2 | 107 | 117 1⁄2 |

| 1927-28 | 65 | 4 | 80 | 86 2⁄3 | 93 1⁄3 | 100 | 104 | 108 | 120 |

| 1929-30 | 65 | 4 1⁄2 | 80 | 86 2⁄3 | 93 1⁄3 | 100 | 104 1⁄2 | 109 | 122 1⁄2 |

| 1931-32 | 65 | 5 | 80 | 86 2⁄3 | 93 1⁄3 | 100 | 105 | 110 | 125 |

| 1933-34 | 65 | 5 1⁄2 | 80 | 86 2⁄3 | 93 1⁄3 | 100 | 105 1⁄2 | 111 | 127 1⁄2 |

| 1935-36 | 65 | 6 | 80 | 86 2⁄3 | 93 1⁄3 | 100 | 106 | 112 | 130 |

| 1937 | 65 | 6 1⁄2 | 80 | 86 2⁄3 | 93 1⁄3 | 100 | 106 1⁄2 | 113 | 132 1⁄2 |

| 1938 | 65, 2 mo. | 6 1⁄2 | 79 1⁄6 | 85 5⁄9 | 92 2⁄9 | 98 8⁄9 | 105 5⁄12 | 111 11⁄12 | 131 5⁄12 |

| 1939 | 65, 4 mo. | 7 | 78 1⁄3 | 84 4⁄9 | 91 1⁄9 | 97 7⁄9 | 104 2⁄3 | 111 2⁄3 | 132 2⁄3 |

| 1940 | 65, 6 mo. | 7 | 77 1⁄2 | 83 1⁄3 | 90 | 96 2⁄3 | 103 1⁄2 | 110 1⁄2 | 131 1⁄2 |

| 1941 | 65, 8 mo. | 7 1⁄2 | 76 2⁄3 | 82 2⁄9 | 88 8⁄9 | 95 5⁄9 | 102 1⁄2 | 110 | 132 1⁄2 |

| 1942 | 65, 10 mo. | 7 1⁄2 | 75 5⁄6 | 81 1⁄9 | 87 7⁄9 | 94 4⁄9 | 101 1⁄4 | 108 3⁄4 | 131 1⁄4 |

| 1943-54 | 66 | 8 | 75 | 80 | 86 2⁄3 | 93 1⁄3 | 100 | 108 | 132 |

| 1955 | 66, 2 mo. | 8 | 74 1⁄6 | 79 1⁄6 | 85 5⁄9 | 92 2⁄9 | 98 8⁄9 | 106 2⁄3 | 130 2⁄3 |

| 1956 | 66, 4 mo. | 8 | 73 1⁄3 | 78 1⁄3 | 84 4⁄9 | 91 1⁄9 | 97 7⁄9 | 105 1⁄3 | 129 1⁄3 |

| 1957 | 66, 6 mo. | 8 | 72 1⁄2 | 77 1⁄2 | 83 1⁄3 | 90 | 96 2⁄3 | 104 | 128 |

| 1958 | 66, 8 mo. | 8 | 71 2⁄3 | 76 2⁄3 | 82 2⁄9 | 88 8⁄9 | 95 5⁄9 | 102 2⁄3 | 126 2⁄3 |

| 1959 | 66, 10 mo. | 8 | 70 5⁄6 | 75 5⁄6 | 81 1⁄9 | 87 7⁄9 | 94 4⁄9 | 101 1⁄3 | 125 1⁄3 |

| 1960 and later | 67 | 8 | 70 | 75 | 80 | 86 2⁄3 | 93 1⁄3 | 100 | 124 |

A spouse can also elect to receive one-half of his or her spouse’s benefit if they start receiving benefits at their full retirement age. A spouse who is eligible for a spousal benefit and his or her own benefit, can elect to take the spousal benefit and delay receiving his or her own benefit. This may result in a higher benefit due to the delayed retirement credits.

PLANNING TIP

Defer receiving Social Security benefits until reaching full retirement age. This increases the monthly benefit amount and also minimizes the Medicare 3.8% contribution tax because Social Security benefits are included in the calculation of Modified Adjusted Gross Income for purposes of the 3.8% tax calculation.

Conclusion.

There is a tremendous opportunity for financial tax and legal advisors to help same sex couples to decide whether to marry, where to live, and how to handle their estate planning, creditor protection planning, tax planning, and other situations.

This will take a great deal of study and consideration, and will not be an “one size fits all” analysis.

The biggest social adjustment in our country so far this century is an exciting time for those of us in the counseling professions.

[1] Florida’s Third District Court of Appeals ruled that a statute from 1997 which prohibited “homosexuals” from adopting was unconstitutional. Florida Dept. of Children and Families v. Adoption of X.X.G., 45 So. 3d 79 (Fla. 3d Dist. App. 2010).

[2] Will receive rights to Homestead if registered with the state as domestic partners.

[3] Recognizes same sex civil unions. Office of the Attorney General: Formal Opinion No. 3-2007 (February 16, 2007).

[4] Recognized as having same legal force as civil union or domestic partnership.

[5]While there are some instances when joint representation of same sex couples is acceptable, it is always a good idea to suggest that one party retain separate legal representation. See your state Bar rules for applicable rules on client joint representation.

[6]The decision in Windsor made it clear that the federal government will not recognize civil union marriages. Thus, someone who has exercised their right in these states to enter a civil union or domestic partnership are in a state of limbo for federal rights. Helen Casale, Roundtable, LGBT Litigator (American Bar Association, Sept. 12, 2013) (copy of transcript on file with Gassman and Associates)

[8] Steven Petrow, Is it Gay Husband? Lesbian Wife? Or What?, New York Times (November 27, 2012).

Catch-22

Many of our readers missed the opportunity to read Catch 22, which explains a lot about real life and the law.

All you have to do is turn to page 42 and read our favorite excerpt, which is as follows: and then it’s… there was only one catch and that was Catch 22 and then agreed”.

Joseph Heller did a great job with this book, and thereafter wrote a play called “We Bombed in New Haven” and books that included Something Happened, Good as Gold, I think, and something else.

Heller was a fantastic humorist, but one of our favorite quotes, which was written down by a friend when they were visiting a billionaire’s penthouse in New York was as follows:

Heller: I have something this person doesn’t have.

Friend: What is it?

Heller: Enough.

How many of us have enough? Read Catch 22 and see if you have enough, or if you have had enough!

There was only one catch and that was Catch-22, which specified that a concern for one’s own safety in the face of dangers that were real and immediate was the process of a rational mind. Orr was crazy and could be grounded. All he had to do was ask; and as soon as he did, he would no longer be crazy and would have to fly more missions. Orr would be crazy to fly more missions and sane if he didn’t, but if he was sane, he had to fly them. If he flew them, he was crazy and didn’t have to; but if he didn’t want to, he was sane and had to. Yossarian was moved very deeply by the absolute simplicity of this clause of Catch-22 and let out a respectful whistle.

“That’s some catch, that Catch-22,” he observed.

“It’s the best there is,” Doc Daneeka agreed.

New Jersey v. Florida – Fun Facts

We are really looking forward to our talks in New Jersey on November 1st on WHAT HEALTH LAWYERS NEED TO KNOW ABOUT FLORIDA LAW and November 2nd on WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW – A 3 HOUR OVERVIEW

It is interesting to compare the 2 states:

Phil Rarick’s Client Blog: Florida Probate Attorney Fees

This quick guide is designed to inform lay persons who may be named the personal representative (or executor) in a will of the engagement options for a probate attorney and presumptive Florida probate attorney fees. Click here to read the block post.

Seminar Spotlights of the Week

Seminar 1

Alan Gassman will be speaking at a Estate Planning Council of Manatee County Seminar on Thursday, November 21, 2013. His topic is “AN ESTATE AND TAX PLANNER’S YEAR END PLANNING CHECKLIST – PRACTICE SYSTEM STRATEGIES IDEAS AND TECHNIQUES”.

The seminar takes place at the Bradenton Country Club from 12:00 – 1:00 p.m. To register for this event please visit the Estate Planning Council of Manatee County’s website here.

Seminar 2

Alan Gassman and John Goldsmith will be presenting a seminar next Wednesday, October 23, 2013 on BP Calculations for CPAs – Tricks & Traps.

The seminar will be at the Holiday Inn Express at 4750 N. Dale Mabry in Tampa. To register for the event please click here.

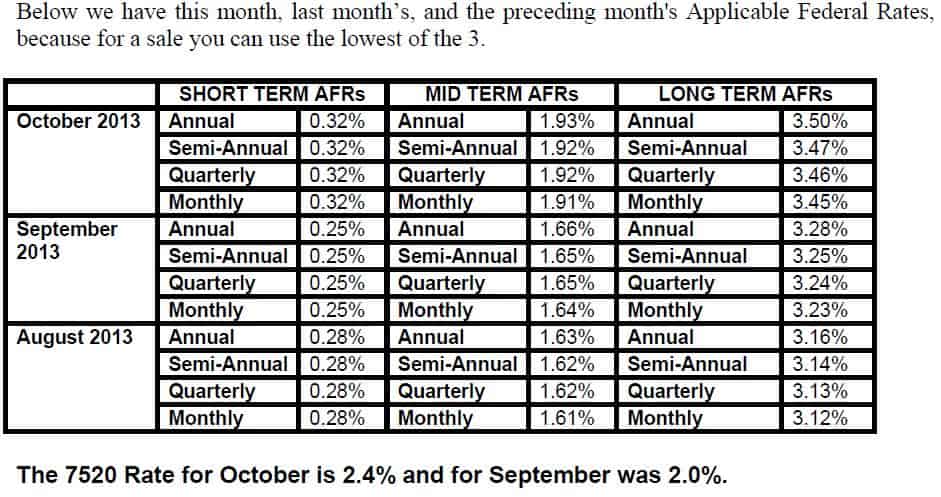

Applicable Federal Rates

Seminars and Webinars

PINELLAS COUNTY ESTATE PLANNING COUNCIL HALF-DAY SEMINAR

Alan Gassman will be speaking on the topic of HOT TOPICS FOR ESTATE PLANNERS, including same sex marriage, estate tax planning software (with all attendees to receive a free beta version of our new software), and other important topics.

Sandra Diamond will speak on the new Florida laws that impact estate planning, amending of decanting existing irrevocable trusts, and other recent Florida law developments.

Barry Flagg will speak on insurance and estate planning.

Sean Casey of Fifth-Third Bank will give an economic update.

Date: Wednesday, October 23, 2013 | 8:00 am – 12:00 p.m. (60 MINUTE PRESENTATION)

Location: TBD

Additional Information: To attend the meeting or to receive information on joining the Council please click here or email agassman@gassmanpa.com

BP CALCULATIONS FOR CPAS: TRICKS & TRAPS SEMINAR WITH JOHN GOLDSMITH AND ALAN GASSAMAN

Date: Wednesday, October 23, 2013 | 6:00 p.m.

Location: Holiday Inn Express, 4750 N. Dale Mabry, Tampa, FL

Additional Information: Each attendee will receive written materials and a wine tasting and light hors d’ oeuvres will be served. To register for the event please click here.

2013 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: October 25 – 27, 2013 | Alan Gassman is speaking on Sunday, October 27, 2013

Location: TBD

Additional Information: Please contact agassman@gassmanpa.com for additional information.

DECODING HEALTHCARE SYMPOSIUM IN TAMPA

Alan Gassman will be moderating the Decoding Healthcare Seminar hosted by Fifth Third Bank.

Speakers will include Jason Altmire, Senior Vice President of Public Policy, Government and Community Affairs, Florida Blue, Coretha Rushing, Chief Human Resources Officer, Equifax, Inc., Stephen Mason, CEO Of BayCare Health System and Dr. Jay Wolfson, DrPH, JD, Associate Vice President of USF Health.

We sincerely thank Fifth-Third Bank, President Brian Lamb, Ryan Sloan and the Tampa Bay Business Journal for hosting this important public “town hall” discussion that will hopefully lead to improvement of our healthcare systems in the Tampa Bay area.

Date: Tuesday, October 29, 2013

Location: Grand Hyatt, 2900 Bayport Drive, Tampa, Florida

Additional Information: For more information on this event, please email agassman@gassmanpa.com

Bloomberg BNA – Estate, Estate and Gift Tax, and Trust Year-End Planning Webinar

Date: October 30, 2013

Time: 12:30 – 1:30

Location: Online Webinar

Additional Information: For more information on this event, please email agassman@gassmanpa.com

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE) HEALTH LAW SYMPOSIUM – AN ALL DAY SEMINAR

Alan Gassman will be speaking on the topic of WHAT HEALTH LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Date: Friday, November 1, 2013 | 9am – 5pm (Mr. Gassman speaks from 1:10 pm until 2:10 p.m.)

Location: Seton Hall Law School, Newark, New Jersey

Additional Information: Seton Hall University in South Orange, New Jersey was founded in 1856, and they have remodeled since. Today, Seton Hall has over 10,000 students in its undergraduate, graduate and law school programs and is in close proximity to several Kentucky Fried Chicken locations.

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE)_SPECIAL 3 HOUR SESSION

Alan Gassman will be speaking on the topic of WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW – A 3 HOUR OVERVIEW BY ALAN S. GASSMAN

Date: Saturday, November 2, 2013

Location: Wilshire Grand Hotel, West Orange, New Jersey | 9am – 12pm

Additional Information: Please tell all of your friends, neighbors and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information please email agassman@gassmanpa.com

SALT LAKE CITY ESTATE PLANNING COUNCIL’S FALL ONE DAY “TAX AND DEDUCTIBILITY OF YOUR SKI TRIP” INSTITUTE

Alan Gassman will be speaking on the topic of PRACTICAL ESTATE PLANNING, WITH A $5.25 MILLION EXEMPTION AMOUNT, ESTATE TAX PROJECTION PLANNING, AND WHY DENTISTS ARE DIFFERENT

Date: Thursday, November 7, 2013

Location: Hilton Downtown Salt Lake City, Utah

Additional Information: Please support this one day annual seminar conveniently located near skiing and tourism opportunities. If you would like to attend this event or receive the materials please email agassman@gassmanpa.com

ESTATE PLANNING COUNCIL OF MANATEE COUNTY SEMINAR

Alan Gassman will be speaking to the Estate Planning Council of Manatee County on “AN ESTATE AND TAX PLANNER’S YEAR END PLANNING CHECKLIST – PRACTICE SYSTEM STRATEGIES IDEAS AND TECHNIQUES”.

Date: Thursday, November 21, 2013 | 12:00 p.m – 1:00 p.m.

Location: Bradenton County Club, 4646 9th Avenue W, Bradenton, FL 34209

Additional Information: To register for this event please visit the Estate Planning Council of Manatee County website at http://www.estateplanningcouncilofmanateecounty.org/events/event/10036

MEDICAL EDUCATION RESOURCES CONTINUING EDUACTION PRIMARY CARE CONFERENCE

Alan Gassman will be speaking on the topic of LEGAL, TAX AND FINANCIAL BOOT CAMP FOR THE MEDICAL PRACTICE – A SPECIAL TAX, ESTATE PLANNING AND LAW CONFERENCE FOR PRIMARY CARE PHYSICIANS

Date: December 13, 2013 – 12:00 pm – 4:40 pm and December 14, 2013 8:00 am – 3:00 pm

Topics and Meeting Times:

Friday, December 13, 2013

- 12:00 – 1:00 pm – 2013 Tax Changes

- 1:00 – 2:00 pm The 10 Biggest Mistakes that Physicians Make in their Investments and Business Planning

- 2:10 – 3:10 pm Lawsuits 101

- 3:10 – 3:40 pm – Essential Estate Planning

- 3:40 – 4:40 pm – Deductions for Physicians

Saturday, December 14, 2013

- 8:00 – 9:00 am – Medical Practice Financial Management

- 9:00 – 10:00 am – Physician Compensation

- 10:10 – 11:10 am – Asset Entity Planning for Creditor Protection and Buy/Sell Arrangements

- 11:10 – 11:40 am – Tax Structures for Medical Practices

- 12:00 – 1:00 pm – 50 Ways to Leave Your Overhead

- 1:00 – 2:00 pm – Retirement Plan Options for Physicians

- 2:00 – 3:00 pm – Stark Naked or Well Prepared? (Please do not come to this session naked.)

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, Florida

Additional Information: For more information please visit www.MER.org Please note that the program qualifies for continuing education credit for physicians.

THE FLORIDA BAR – REPRESENTING THE PHYSICIAN

Date: Friday, January 17, 2013

Location: The Peabody Hotel, Orlando, Florida

Additional Information: The annual Florida Bar conference entitled Representing the Physician is designed especially for health care, tax, and business lawyers, CPAs and physician office managers and physicians to cover practical legal, medical law, and tax planning matters that affect physicians and physician practices.

This year our 1 day seminar will be held in the Peabody Hotel near Walt Disney World, which is world famous for its daily “march of the ducks” through the lobby (wear easy to clean shoes) and maybe we will have peking duck for dinner.

A dinner for the Executive Committee of the Health Law Section of The Florida Bar and our speakers will be held on Thursday, January 16, 2013, whether formally or informally. Anyone who would like to attend (dutch treat or bring wooden shoes) will be welcomed. Your tax deductible hotel room to start a fantastic week near Disney, Universal, Sea World and most importantly Gatorland can include a room at the fantastic Peabody Hotel for a discounted rate per night, single occupancy.

1st ANNUAL ESTATE PLANNER’S DAY AT AVE MARIA SCHOOL OF LAW

Speakers: Speakers will include Professor Jerry Hesch, Jonathan Gopman, Alan Gassman and others.

Date: April 25, 2014

Location: Ave Maria School of Law, Naples, Florida

Sponsors: Ave Maria School of Law, Collier County Estate Planning Council and more to be announced.

Additional Information: For more information on this event please contact agassman@gassmanpa.com.

NOTABLE SEMINARS PRESENTED BY OTHERS:

48th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING SEMINAR

Date: January 13 – 17, 2014

Location: Orlando World Center Marriott, Orlando, Florida

Sponsor: University of Miami School of Law

Additional Information: For more information please visit: http://www.law.miami.edu/heckerling/

16th ANNUAL ALL CHILDREN’S HOSPITAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

Date: Wednesday, February 12, 2014

Location: All Children’s Hospital Education and Conference Center, St. Petersburg, Florida with remote location live interactive viewings in Tampa, Sarasota, New Port Richey, Lakeland, and Bangkok, Thailand

Sponsor: All Children’s Hospital

THE UNIVERSITY OF FLORIDA TAX INSTITUTE

Date: February 19 – 21, 2014

Location: Grand Hyatt, Tampa, Florida

Sponsor: UF Law alumni and UF Graduate Tax Program

Additional Information: Here is what UF is saying about the program on its website: “The UF Tax Institute will provide tax practitioners and other leading tax, business and estate planning professionals with a program that covers the most current issues and planning ideas with a practical, informative, state-of-the-art approach. The Institute’s schedule will devote separate days or half days to individual income tax issues, entity tax issues and estate planning issues. Speakers and presentations will be announced as the program date nears to ensure coverage of the most timely and significant topics. UF Law alumni have formed the Florida Tax Education Foundation, Inc., a nonprofit corporation, to organize the conference.”

Thank you to our law clerks that assisted us in preparing this report.