The Thursday Report – 10.27.16 – Live From the Notre Dame Tax Institute

Live From the Notre Dame Tax Institute

Important 2017 Tax Information: The IRS Releases Revenue Procedure 2016-55

Issues Regarding Distributing Regulated Weapons to Beneficiaries of an Estate – Beware the Form 5 Discrepancy by Sean Healy

Florida Supreme Court and “Stock and Bond” Brokerage Accounts

See Srikumar Rao in St. Petersburg, February 2017

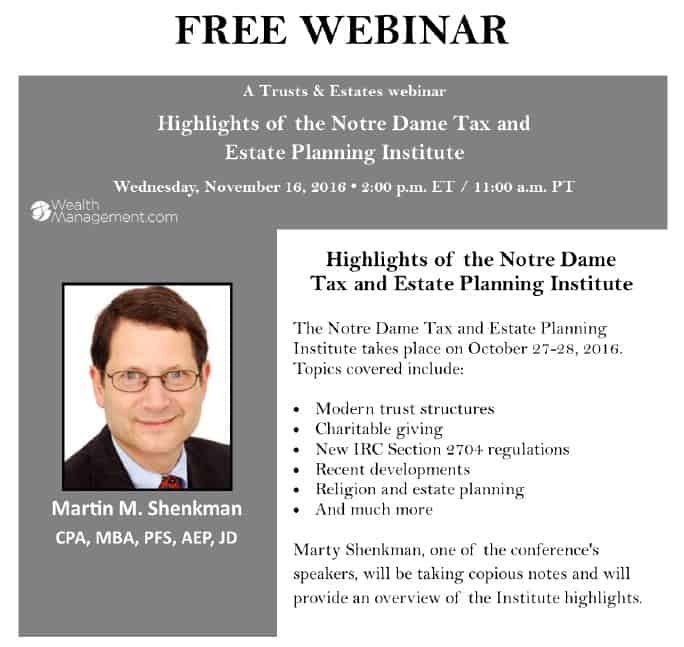

Webinar Spotlight: Highlights of the Notre Dame Tax and Estate Planning Institute with Martin M. Shenkman

Richard Connolly’s World – Gun Trust Loophole Closed, Background Checks for All

Thoughtful Corner – Your Friend Has Just Been Diagnosed with an Illness – What Do You Say? by Linda Chamberlain

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“Believe you can, and you’re halfway there.”

– Theodore Roosevelt

Theodore Roosevelt, Jr. served as the 26th President of the United States from 1901 to 1909. Prior to his presidency, he was the 25th Vice President of the United States under President William McKinley, the 33rd Governor of New York, and the Assistant Secretary of the Navy. At age 42, Roosevelt was the youngest United States President in history, assuming the role after the assassination of President McKinley in September 1901. Roosevelt is credited with leading the country into the Progressive Era. As President, he made conservation a top priority, began construction on the Panama Canal, and won a Nobel Peace Prize for his efforts in ending the Russo-Japanese War. Today marks the 158th anniversary of Theodore Roosevelt’s birth on October 27th, 1858.

Live From the Notre Dame Tax Institute

A Standing Ovation for Jeffery Pennell

Anyone in the estate planning world knows of Professor Jeffrey Pennell and his amazing contributions to our profession as a writer, speaker, and beloved law professor at Emory University. Today, Professor Pennell announced that his Notre Dame presentation will be his last presentation after 15 years at the Institute, and his imminent retirement from the conference circuit so that he can concrete on teaching, updating his books, and pursuing other worthwhile ventures. We hope that Dr. Pennell’s plans change like Eric Clapton’s have, but, if not, then next January’s Heckerling Conference in Orlando may be your last chance to see Professor Pennell speak to a conference. Maybe he will play “Layla (Unplugged)” for an encore.

Some of the highlights from Professor Pennell’s morning presentation are as follows:

- The service has confirmed that the estate tax exemption amount will be $5,490,000 in 2017 and the annual exclusion amount for gifting will remain at $14,000. This is sure to go to $15,000 next year if we have any inflation at all.

- According to the IRS, a “disregarded trust” with net income that is negative will report that income at the trust level. It will not flow through to the grantor.

- FOR YOUR EYES ONLY – Professor Pennell’s email address is j.pennell@emory.edu. He looks forward to hearing from those of us in the field to stay current, stay connected, and give the occasional comment on matters of interest.

The standing ovation for Professor Pennell’s presentation is the longest that we have ever seen at a tax conference. Hats off to this brilliant and giving model for all to follow!

Please set your calendar for next year’s Notre Dame Tax Institute on October 26th and October 27th, 2017. The sneak preview of next year’s speakers and topics shows clearly that you should not miss this event (or eating at KFC at least twice in the next 10 days.)

Important 2017 Tax Information:

The IRS Releases Revenue Procedure 2016-55

by Christopher Denicolo

It is that time of year again- the leaves are changing color, the days are getting shorter, and the IRS has issued the adjusted amounts and tax rates that will apply for 2017.

This week, the IRS released Revenue Procedure 2016-55 to provide the dollar amounts that apply with respect to inflation-adjusted items for 2017, including the federal estate tax exclusion amount, income tax rate tables, and numerous other deductions, credits and other important benchmarks and thresholds.

The Revenue Procedure can be accessed by accessing the following link: https://www.irs.gov/pub/irs-drop/rp-16-55.pdf.

Some items of note are as follows:

- The federal estate tax exclusion amount will be adjusted to $5,490,000 for decedents dying in calendar year 2017. Although it is not stated in the Revenue Procedure, the lifetime gifting exclusion amount also increases to $5,490,000 based upon the lifetime gifting allowance being tied to the estate tax exclusion amount under the Internal Revenue Code.

- The gift tax annual exclusion will remain at $14,000 per person for gifts made in 2017. However, the annual exclusion for gifts made to a non-citizen spouse will be increased to $148,000 in 2016 and to $149,000 in 2017.

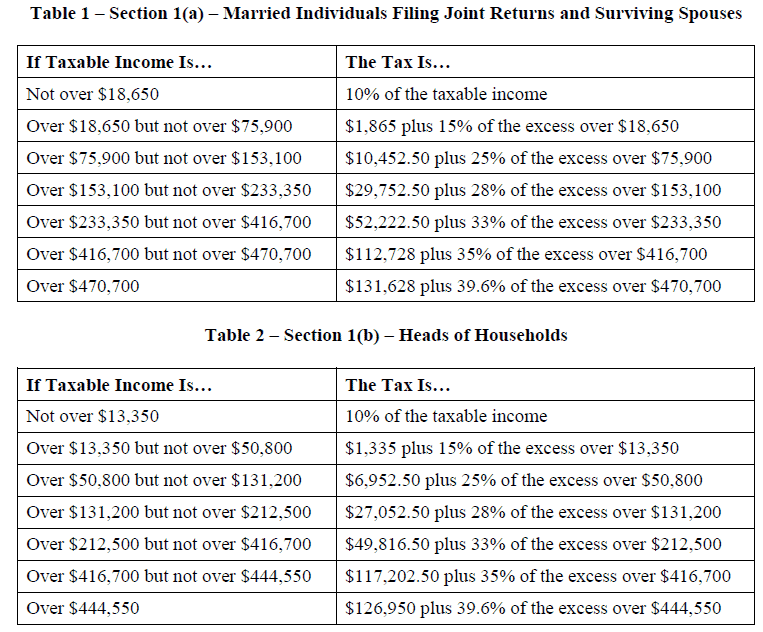

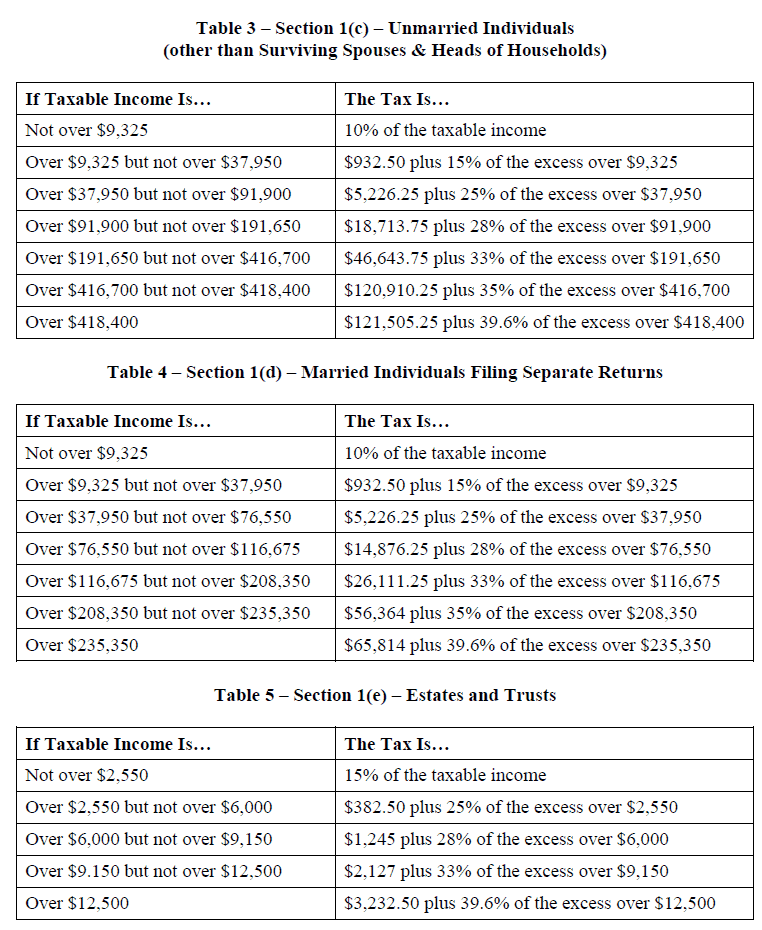

- The following are the new federal income tax rates for individuals and estates and trusts:

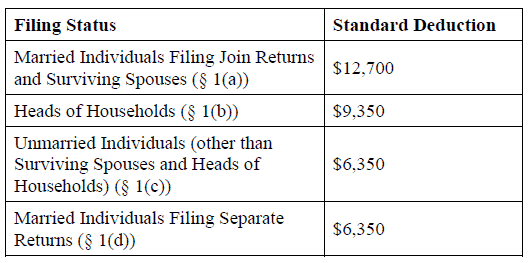

- The standard deduction will increase to the following:

- The personal exemption for 2017 will be $4,500 for individuals, and the annual gross income phase-out amounts for the personal exemption are as follows:

The above are only highlights of the many items that are covered by the Revenue Procedure, and we encourage advisors to review the Revenue Procedure to assure that they are aware of any changes that might affect their clients.

Issues Regarding Distributing Regulated Weapons to

Beneficiaries of an Estate – Beware the Form 5 Discrepancy

by Sean Healy

We were glad to be part of the October 25th presentation entitled “Gun Trust Update: New Rules & Regulations You Need to Know About” with nationally recognized legal expert, gun law author and instructor, Sean Healy. If you would like to see a video replay of this excellent presentation, please click here to watch this presentation on our YouTube channel.

Sean sent us the following excerpt as his write-up on an issue regarding the regulation of 41F and ATF Form 5 for the tax exempt transfer and registration of NFA firearms:

“There is an issue regarding Form 5 transfers from an estate to a beneficiary. ATF published a new Form 5 in May, 2015, a couple of months before 41F became effective. The new Form 5 requires information on Responsible Persons. This includes a completed Responsible Person Questionnaire, fingerprints, and photographs.

It appears that the actual rules do not require that information to be submitted with Form 5.

In contrast, the new rules clearly require Responsible Person information to be provided with Form 1, “Application to Make and Register a Firearm.” 27 CFR § Sec. 479.62(b)(2) requires the name, address, and identifying info for each RP to be provided on Form 1. Section 479.63(b)(2)(ii) requires the Responsible Person Questionnaire to be submitted with Form 1. Section 479.63 (b)(2)(iii) requires the RP’s photos. Section 479.63 (b)(2)(iv) requires the RP’s fingerprints.

The new rules also clearly require Responsible Person information to be provided with Form 4, “Application for Tax Paid Transfer and Registration of Firearm.” Section 479.85(b)(2)(ii) requires the RP Questionnaire to be submitted with Form 4. Section 479.85(b)(2)(iii) requires the RP’s photos. Section 479.85(b)(2)(iv) requires the RP’s fingerprints.

The new rule for estates requires this information for transfers to non-beneficiaries. Section 479.90a(b) requires the executor to file Form 4 in accordance with 479.84. Section 479.84(a) requires all RP information to be provided with every Form 4 application.

The rules do not appear to require this information to be provided for Form 5 transfers. Section 479.90a covers Estates. Subsection 479.90a(a) covers transfers to non-beneficiaries. That subsection requires the personal representative to file Form 5 “in accordance with § 479.90.” Section 479.90 deals with transfers to “Certain governmental entities” (which are also accomplished using Form 5 because no tax is collected). Section 479.90 does not mention “responsible persons” and does not require submission of the Responsible Person Questionnaire, fingerprints, or photographs.

Nowhere in the regulations is there an explicit requirement to submit the Responsible Person Questionnaire, fingerprints, or photographs with Form 5. The fact that the rules explicitly require that information to be provided with Form 1 and Form 4 is evidence that this information is not required to be submitted with Form 5. In other words, ATF rewrote the rules to specifically require information on Responsible Persons with Form 1 and Form 4. If they wanted to require it for Form 5, all they had to do is say so in the rule.

How will this issue be resolved? ATF will undoubtedly require submission of the current version of Form 5, including all the required information. We can expect them to reject any application submitted using the old Form 5, and to reject any Form 5 application which omits the Responsible Person Questionnaire, fingerprint cards, or photos. Therefore this issue will only be resolved if someone files a lawsuit or administrative appeal challenging ATF’s authority to require this information with Form 5 applications. ATF also has the option of publishing another Notice of Proposed Rulemaking to add these requirements for Form 5 applications. Of course that would require ATF to provide another comment period, and to comply with the other rulemaking requirements.”

Thanks to Sean for sharing his insights on this timely topic.

Florida Supreme Court and “Stock and Bond” Brokerage Accounts

by Alan S. Gassman

On April 28, 2016, the Florida Supreme Court confirmed that proceeds from the sale of an asset protected homestead can be put into a “stock and bond” brokerage account at the time of sale and used to purchase a new homestead within a reasonable period of time.

In the April 28 decision of JBK Associates, Inc. v. Still Brothers, Inc., the debtor sold his protected homestead and invested the money in a brokerage account after the closing, and the account assets were later used to purchase a replacement home.

The Supreme Court held that the three requirements for sales proceeds to maintain homestead protection were met: (1) a good faith intention prior to and at the time of sale to reinvest in another homestead within a reasonable time, (2) the funds are not commingled with other monies, and (3) the proceeds must be kept separate and apart to be held for the sole purpose of acquiring another home.

The court also indirectly confirmed that the transfer of funds from the sale of a homestead to an exempt asset other than homestead will not be immune from challenge on the basis of such transfer being for the purpose of avoiding creditors. In other words, the Florida Supreme Court’s 1962 decision in Orange Brevard Plumbing & Heating Co. v. La Croix, to the effect that the transfer of the proceeds from the sale of homestead to an otherwise creditor exempt asset other than homestead will not be immune from fraudulent transfer challenges.

The court specifically stated that for both cash and non-cash proceeds from a voluntary sale of homestead to be continuously protected the three above requirements must be met.

The court also noted that any surplus above and beyond the amount intended and actually used to purchase the replacement homestead will be considered as “general assets of the debtor.”

This case is being add to Gassman and Markham on Florida and Federal Asset Protection Law, which we plan to have updated by the end of the year.

See Srikumar Rao in St. Petersburg, February 2017

SAVE THE DATE!

Please mark your calendars for the Saturday, February 11th, 2017 Professional Acceleration Workshop with Dr. Srikumar Rao and Alan Gassman at the Stetson Law School in Gulfport, Florida. Dr. Srikumar Rao will also host a Development Workshop at Stetson the following Sunday, February 12th.

Dr. Rao, in his celebrated workshop, shows you how to virtually eliminate stress from your life. He has helped thousands of successful entrepreneurs and executives, and his methods are effective because they do not attack stress directly. He shows you how mistaken you might be in your thinking about what really causes stress in your life and how to change your mental models to align with your new understanding.

Don’t miss this powerful workshop! Contact Alan Gassman at agassman@gassmanpa.com for more information or to RSVP.

Webinar Spotlight

Highlights of the Notre Dame Tax and Estate Planning Institute

with Martin M. Shenkman

Please register by visiting the Wealth Management Trusts & Estates Event webpage at http://tinyurl.com/shenkmanwebinar

or email Marty Shenkman at shenkman@shenkmanlaw.com.

Richard Connolly’s World

Gun Trust Loophole Closed, Background Checks for All

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the article of interest is “Gun Trust Loophole Closed, Background Checks for All” by Ashlea Ebeling. This article was featured on Forbes.com on July 13, 2016.

Richard’s description is as follows:

Gun trusts were used primarily to bypass the rule that individuals needed the sign-off of their local police chief to buy NFA firearms like a short barrel shotgun or a silencer. But as of today, under new ATF rules, the same identification and background check requirements that apply to individuals now apply equally to trusts and other legal entities applying to make or transfer an NFA firearm.

Final Rule 41-F, issued by the Bureau of Alcohol, Tobacco, Firearms, and Explosives in January, regarding the making or transferring of a firearm under the National Firearms Act, became effective July 13, 2016. (The ATF just put out a summary and frequently asked questions.) The rule spells out that “responsible persons” of trusts must now file new forms and submit photographs and fingerprints when the trust files an application to make or transfer an NFA firearm.

There’s also a new provision regarding estates. The new rules make it clear that during probate an executor or personal representative handling the estate of a gun owner can lawfully possess the firearm without it being considered a “transfer”—removing liability for possessing an unregistered firearm under the NFA. In addition, the new rules say that the transfer of a firearm to any beneficiary of the estate is free of transfer tax (for non-beneficiaries, the $200 transfer tax per firearm applies).

Please click here http://www.forbes.com/sites/ashleaebeling/2016/07/13/gun-trust-loophole-closed-background-checks-for-all/#40519ce77d8b to read this article in its entirety.

Thoughtful Corner

Your Friend Has Just Been Diagnosed with an Illness – What Do You Say?

by Linda Chamberlain

How do you respect one’s dignity and say the right thing when someone you know is diagnosed with a chronic illness? First Tip: Let the person ask for your advice before you give it!

We are fortunate to be able to help many folks wade through all of the issues of a chronic illness. It is hard to comprehend the emotions of being diagnosed with a chronic disease with no cure and limited treatment options. Medical advances allow us to live longer with chronic disease. Living longer with a chronic disease brings new issues we need to learn to address. What are some of these diseases? Alzheimer’s Disease and Related Dementias, Amyotrophic Lateral Sclerosis (ALS) – Lou Gehrig’s Disease, Parkinson’s Disease, Multiple Sclerosis, Chronic Obstructive Pulmonary Disease (COPD), Scleroderma, Rheumatoid Arthritis (RA), and Diabetes to name a few.

Initially, the client is in shock with the reality of what they may be facing and doesn’t really know the role of being a patient. Your identity often changes as the disease progresses – you may have heard that many healthcare providers treat the disease, not the person. Next is disclosing your diagnosis to your family and friends. Everyone, and I mean everyone, knows someone who has had the disease and has a recommendation for you. Whether a medical center, clinical trials, holistic medical choices, the list of recommendations are endless. It is up to the patient to determine what route they take. When the patient can’t decide, whether due to medical issues or cognitive issues, it may become a family battle.

The problem we see over and over again with our clients is receiving the call for assistance when the family is in turmoil over the disease process, differing opinions over treatment options, and then ultimately concern over the patient’s estate plan and how each person in the family may be affected.

It is easy to get caught up with the $$$$$ and what’s going to happen to it when someone is in a declining health situation. It is much easier to think about the money and argue about the estate plan than what is really happening to the patient as their health declines. If the patient has medical insurance and can afford to travel, the specialized clinics, treatment centers, and clinical trials can leave one running all over looking for the “best” treatment. While it feels good to be doing something, the patient may often wear out before the family is satisfied and feels the right treatment program has been selected.

For patients with limited insurance, Medicaid benefits, and minimal discretionary funds the concern is focused on will they outlive their funds and even worse, will they end up in a nursing home. Utilizing the majority of their assets on their care leaving limited funds for their surviving spouse is often an option the patient won’t consider.

Sometimes the quandary of what medical intervention to utilize becomes an argument with little sensitivity to the patient’s current day to day routine. One great example is the client who is struggling with their ambulation, unable to toilet independently, and the recommended medication, whether prescription or supplemental, causes diarrhea. The patient, trying to keep everyone happy will take the medication and suffer the consequences of the diarrhea as well as the humiliation of frequent toilet incidences. The patient often realizes they are in decline and the only things they are interested in are the human relationships and love and support of the family – even if the family is not in agreement.

Sensitivity and respecting one’s dignity and how to say the right thing often keeps the family from knowing what is really happening. Toilet incidences may be soiling oneself, not being able to clean one’s self appropriately, skin irritation due to uncleanliness, and bladder infections (which often lead to other severe issues). The patient does not necessarily want to discuss this with all members of the family, however, is hoping everyone understands the toll it takes on the patient to deal with their activities of daily living. It is easy to take all activities of daily living for granted when you are healthy.

The next time you meet with someone with a chronic illness please let them share their plan and desires with you before you share your medical and treatment recommendation. Your suggestions may create confusion, mistrust in their medical professionals, or worse – mistrust in their own judgment. Ensure you have been asked for your recommendation before providing it.

Please do not tell the patient you understand what they are feeling if you have not experienced the same situation. They know right away there is no way you can understand what they are going through and it is insulting for you to assume that you do. And definitely do not make your entire conversation all about the disease. The individual still has hopes, dreams, ideas and goals they would love to share.

Our care management team has had the privilege of helping many families through this journey, as a mediator when families are struggling, as an active listener when the patient cannot get their loved ones to hear them, and as an advocate in the medical world. While we personally may not have experienced the disease process we do bring the experience of working with many families with similar struggles and we take the time to listen to the patient and make recommendations that will make life easier for the patient as well as the family. Helping all involved understand the struggles of the patient when the patient is unable to communicate it personally often helps resolve issues. Pulling the professional team together and enabling all to respect the wishes and the dignity of the patient is what we do best.

While court intervention is sought from time to time, a care management assessment, along with information of available services and treatment, their costs and insurance coverage, along with recommendations to assist the patient with their activities of daily living can help a Judge significantly with making decisions and developing a plan that will satisfy all involved.

Negotiating the distribution of assets prior to the patient’s death helps the family members feel like they are doing something at the cost of the patient having to live with their disease process as well as the family turmoil. Those moments are difficult for all involved, with very few happy endings, and an especially challenging situation for the patient.

Linda can be contacted at linda@agingwisely.com. For more information about Aging Wisely and the services Linda offers, please click here http://www.agingwisely.com/ to visit her website.

Humor! (Or Lack Thereof!)

Sign Sayings of the Week

**********************************************************

Alan Gassman’s Away Message – The Notre Dame Edition

If you’ve tried to email Alan Gassman this week, you may have received the following away message:

I’m away right now, but it’s not a shame.

I’m attending the Tax Institute at Notre Dame.

It’s an annual event that I never miss.

I get to see Natalie Choate, Jonathan Blattmachr, and Jerry Hesch.

The dual track presentations give us so much to choose from,

Whether technical, ethical, or learning a new rule of thumb.

Two days is a perfect CLE opportunity.

It fits my attention span, so I don’t have to daydream without impunity.

There is no doubt I will learn much about the science and the art,

And a few lucky clients will have new circles on their chart.

While I’m away in South Bend, Indiana,

Our team plays together beautifully, like Carlos Santana.

Please let us know how we can be of assistance,

And if you want to rhyme back, we may publish your istenc.[1]

([1] “Istenc” is not a word, but it worked well in this poem.)

**********************************************************

Upcoming Seminars and Webinars

Calendar of Events

LIVE SARASOTA PRESENTATION:

Alan Gassman will present a talk at the 2016 Mote Vascular Symposium on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX INSURANCE, AND BUY/SELL PLANNING: THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 29, 2016 | Alan speaks at 3:20 PM

Location: The Hyatt Regency Sarasota | 1000 Boulevard of the Arts, Sarasota, FL, 34236

Additional Information: If you are interested in registering for this presentation, please email Stephanie at stephanie@gassmanpa.com. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY BLOOMBERG BNA WEBINAR:

Sanford J. Schlesinger will be presenting a free, Bloomberg BNA Essential Elements webinar entitled “2016 Developments You Need to Know About.” This presentation will be moderated by Alan Gassman.

Date: Thursday, November 10, 2016

Location: Online webinar

Additional Information: If you are interested in registering for this presentation, please email Stephanie at stephanie@gassmanpa.com. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Howard Fisher, Denis Kleinfeld, and Alan Gassman will be presenting a Bloomberg BNA Practical & Creative Planning webinar entitled “2016 Developments You Need to Know About.”

Date: Tuesday, November 15, 2016

Location: Online webinar

Additional Information: If you are interested in registering for this presentation, please email Stephanie at stephanie@gassmanpa.com. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE MAUI PRESENTATION:

2016 MAUI MASTERMIND WEALTH SUMMIT

Alan Gassman will be speaking at the 2016 Maui Mastermind Wealth Summit with David Finkel and others. This event will connect attendees with many Maui Mastermind Wealth Advisors such as Alan.

During this week-long event, Alan will be speaking on the following topics:

- Getting Out of Bad Financial Partnerships, Joint Ventures, or Strategic Relationships

- Asset Protection and Estate Planning for Business Owners

- The Estate Planning and Asset Protecting “Choose Your Own Ending” Game

- The Language of Investing

- Engineering a Better Investment Deal

Thursday Report attendees will receive a free Mai-Tai with call brand liquor and their choice of a hula hoop or Hawaiian lei. Watch Don Juan sing the greatest hits of Conway Twitty on December 7th at 7:00 PM Hawaiian Time.

Date: December 4th – December 9th, 2016

Location: The Fairmont Kea Lani Maui | 4100 Wailea Alanui Drive, Maui, HI, 96753

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE TAMPA PRESENTATION:

ANNUAL ALEXANDER L. PASKAY MEMORIAL BANKRUPTCY SEMINAR

Alan Gassman will speak on a panel discussion at the American Bankruptcy Institute’s annual Alexander L. Paskay Memorial Bankruptcy Seminar on the topic of THE ETHICS OF ASSET PROTECTION.

Date: Thursday, February 2, 2017 | Time TBD

Location: The Embassy Suites Tampa Downtown Convention Center | 513 S. Florida Avenue, Tampa, FL, 33602

Additional Information: If you are interested in registering for this presentation, please email Stephanie at stephanie@gassmanpa.com. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

REPRESENTING THE PHYSICIAN: IT IS HARDER THAN IT LOOKS

Alan Gassman will present two talks at the 2017 Annual Florida Bar Health Law and Tax Section Representing the Physician Seminar. His topics include:

- A Brief Introduction to Representing the Physician (with Lester J. Perling)

- Structuring Medical Practices and Related Entities for Tax, Creditor Insulation, and Regulatory Compliance Purposes (with Lester J. Perling)

Other speakers at this event include William Eck, Susan Thomas, Melissa Mora, Sachi Mankodi, Kimberly Brandt, Al Gomez, Kathleen Premo, and Radha Bachman.

Other topics at this event include:

- The Brave New World of Medicare Physician Compensation Under MACRA and Beyond

- Office of Civil Rights HIPAA Audits – Preparing Your Clients and Yourself

- The Physician’s Role Under EMTALA and the Florida Access to Emergency Services Act

- Medical Marijuana in Florida – The Highs and Lows of its Regulation

- The Post-Election View from the Hill

- What the Doctor’s Lawyer and the Doctor Need to Know About Bankruptcy and How Creditors Approach Health Industry Related Situations

- Medicare and Other Risk Contracts

- Medical Entities and Rules You Must Know About

To download the complete schedule, please click here.

Date: Friday, February 3, 2017 | Alan speaks at 8:30 AM and 4:10 PM.

Location: Rosen Centre Hotel | 9840 International Drive, Orlando, FL, 32819

Additional Information: If you are interested in registering for this presentation, please email Stephanie at stephanie@gassmanpa.com. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE STETSON LAW SCHOOL PRESENTATION:

Saturday, February 11, 2017

Professional Achievement Workshop with Dr. Srikumar Rao and Alan Gassman

Join Dr. Rao and Alan Gassman for a 6-hour interactive, very interesting workshop to enable recent law school graduates and others to reach new levels of enjoyment and achievement in your business or professions.

This is based on Alan’s workshop materials that have been presented on many occasions at the University of Florida, Ave Maria School of Law, State and City Bar conferences, and elsewhere. This workshop will be free of charge for law and MBA students; a donation will be determined for all other interested participants. This workshop includes free course materials and a subscription to The Thursday Report.

Sunday, February 12, 2017

Srikumar Rao’s Guide to Eliminating Stress and Anxiety for Professionals and Others

This 6-hour workshop will be a private event held by the Rao Institute at the request of Alan Gassman and friends. This will be provided for a limited number of attendees as a cost of $475 per person. Please RSVP now while spaces are available!

See Dr. Rao’s YouTube TED Talk, and you will see why he is so well-regarded and sought out worldwide as a presenter, coach, and author. Meet this gentle and brilliant man who has changed so many lives up close and personal!

You can see his best-selling books, Are You Ready to Succeed? and Happiness at Work on Amazon by clicking here. You can also see his TED Talk that has been viewed by well over 1 million people by clicking here.

EMAIL AGASSMAN@GASSMANPA.COM TO RSVP TO EITHER EVENT.

Date: Saturday, February 11, 2017 and Sunday, February 12, 2017

Location: Stetson Law School, Gulfport Campus | 1401 61st Street South, St. Petersburg, FL, 33707

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE DISNEY WORLD PRESENTATION (HOW MICKEY MOUSE CAN YOU GET?):

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan Gassman will be speaking at the Medical Education Resources (MER) Internal Medicine and Country Bear Jamboree for primary care physicians and other characters. We thank MER for this wonderful opportunity and Walt Disney for having paved all of Osceola County. His topics will include:

- The 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning

- Lawsuits 101

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: Wednesday, March 15, 2017 and Thursday, March 16, 2017

Location: Walt Disney World BoardWalk Inn | 2101 Epcot Resorts Blvd, Kissimmee, FL 34747

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ESTATE PLANNING COUNCIL OF NORTHEAST FLORIDA PRESENTATION:

Alan Gassman will be speaking for the Estate Planning Council of Northeast Florida on March 20, 2018 on the topic of DYNAMIC PLANNING STRATEGIES FOR THE SUCCESSFUL CLIENT. Watch this space, as more details will be forthcoming!

Date: Tuesday, March 20, 2018

Location: To Be Determined

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

Save the Dates!

LIVE ST. PETERSBURG PRESENTATION:

2017 ALL CHILDREN’S HOSPITAL FOUNDATION SEMINAR

Please put Thursday, February 9th, 2017 and on your calendar to enjoy the 19th Annual All Children’s Hospital Estate, Tax, Legal, and Financial Planning Seminar.

Speakers will include Turney Berry, Paul Lee, Sanford Schlesinger, and Jerry Hesch.

Date: Thursday, February 9th, 2017

Location: Johns Hopkins All Children’s Hospital Education and Conference Center, St. Petersburg, FL

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

4th ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Please put Friday, April 28th, 2017 on your calendar to enjoy the 4th Annual Ave Maria School of Law Estate Planning Conference and the weekend that follows in Naples.

Alan Gassman will be speaking at this conference on the topic of THE ETHICS OF AVOIDING TRUSTS AND ESTATE LITIGATION.

Date: Friday, April 28th, 2017

Location: The Ritz-Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE LAS VEGAS PRESENTATION:

AICPA ADVANCED PERSONAL FINANCIAL PLANNING CONFERENCE

Alan Gassman will be speaking at the Advanced Personal Financial Planning Conference, sponsored by The American Institute of CPAs. His tentative topic for this event is LIFE INSURANCE TIPS FOR THE FINANCIAL PLANNING PROFESSIONAL.

This conference is part of the AICPA ENGAGE event, which brings together five well-known AICPA conferences with the Association for Accounting Marketing Summit for one, four-day event. The conferences included in ENGAGE are Advanced Personal Financial Planning, Advanced Estate Planning, Tax Strategies for the High-Income Individual, the Practitioners Symposium/TECH+ Conference, the National Advanced Accounting and Auditing Technical Symposium, and the Association for Accounting Marketing Summit.

Date: June 12th – June 15th, 2017 | Alan’s date and time are to be determined.

Location: MGM Grand | 3799 S. Las Vegas Blvd., Las Vegas, NV, 89109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or click here.

**********************************************************

LIVE PRESENTATIONS:

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan Gassman will be speaking at the following Medical Education Resources (MER) events:

- October 20th – October 22nd, 2017 in New York, New York

- November 30th – December 3rd, 2017 in Nassau, Bahamas

His tentative topics for these events include the 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning, Lawsuits 101, 50 Ways to Leave Your Overhead, and Essential Creditor Protection and Retirement Planning Considerations.

Date: New York: October 20th – 22nd, 2017; Nassau: November 30th – December 3rd, 2017; Specific speaker dates are to be determined.

Location: New York: To be determined.

Nassau: Atlantis Hotel | Paradise Beach Drive, Paradise Island, Bahamas

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

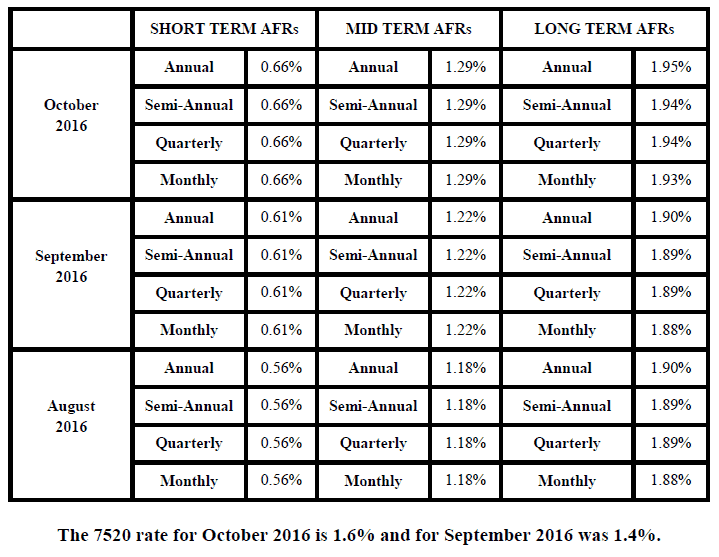

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.