The Thursday Report – 10.2.14 – The Young, the Innocent, and the E-Street Fresca

Background on the “Boss (Bross)” and “Fresca (Friscia)”

MSA Homestead Rights Nixed by Florida Constitution: Friscia’s Make for Uncola Decision: MSA Provision MIA According to DCA Opinion That Is Supported by a Prior DCA Opinion. A Real Case (16 cans) to Review.

Bross Trucking: Set Up, Like a Bowlin’ Pin. Knocked Down, it Gets to Wearin’ Thin. They (the IRS) Just Won’t Let You Be, Oh No.

The Reverse Side of Reverse Mortgages, Part 1

Everything You Always Wanted to Know About Reverse Mortgages but Forgot to Ask, Part Three

Jason Havens, Esq. Joins Holland & Knight

Quote of the Week

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Background on the “Boss (Bross)” and “Fresca (Friscia)”

Now more than ever, and for reasons unknown, Fresca and Bruce Springsteen are fighting for their hallowed positions as 60s-created phenomena, now united by the common bond of court cases released in September which have nothing to do with either of them. Thus, it became absolutely clear to the editorial board of the Thursday Report that this issue be dedicated to their interaction, similarities, and differences.

Having found very few of these, but it being too late to convert this edition to anything else, we have nevertheless unleashed all (well, a small amount maybe) of our talent, and most especially wish to share these two new cases, which point out a major trap for the unwary, and a major opportunity for certain families.

On a side note President Lyndon B. Johnson was a big fan of Fresca and had it installed in the soda fountain while in the White House!

Most importantly, our case summaries are short (and sweet- though artificially so).

“This is the best Thursday Report ever. Even though I have not seen it yet and always allow you to quote me, I wanted to tell you that I was really glad that you quoted me on this one. I really enjoyed this Thursday Report, or at least will when I get around to reading it.”

-Craig Hirsch, Esquire

MSA Homestead Rights Nixed by Florida Constitution: Friscia’s Make for Uncola Decision: MSA Provision MIA According to DCA Opinion That Is Supported by a Prior DCA Opinion. A Real Case (16 cans) to Review

Note–Fresca® is a carbonated beverage that was introduced in 1966. Advertised as the UNCOLA, this grapefruit-based, sugar-free soft drink enjoyed great popularity in the 1970s. It was so popular that the author’s grandmother drank 8 or more Frescas a day. It was so popular, in fact, that Lyndon B. Johnson had a soda fountain that dispensed Fresca installed in the Oval Office. Fresca eventually succumbed to the likes of Diet 7-Up, but still remains on the market, unlike Mrs. Friscia Two.

In Friscia v Friscia, Mr. Friscia tasted the real UNCOLA by divorcing Mrs. Friscia One and signing a Marital Settlement Agreement under which he owned one-half of the house, without right of survivorship, and Mrs. Friscia One (presumably unsweetened) had the right to live in the other half with their minor son (“Little Friscia”) until he graduated from high school. After the child’s graduation, the residence was to be listed for sale and the proceeds divided equally between the former spouses.

Mr. Friscia then married a slightly sweeter Mrs. Friscia Two and they lived happily, but not ever after, close to a grocery store that stocked plenty of Diet 7 Up, in the event that Mrs. Friscia Two got tired of Mr. Friscia.

Mr. Friscia apparently tired of Mrs. Friscia Two first; he kicked the can and died intestate. Mrs. Friscia Two wanted to have the value of the residence included in determining her elective share, and wanted to stake a claim for control of the former marital residence as an asset of the estate.

Mr. Friscia’s estate had creditors who weren’t so sweet, and filed claims exceeding the value of the other estate assets.

The probate court and the 2nd DCA (“Desweetening Commission and Authority”) determined that the Florida Constitution trumped the MSA (Marital Sweetness Agreement). The court concluded that because the decedent died intestate the protected homestead interest descended to the second wife as a life estate with a vested remainder in the two sons. The first wife can continue to live there until the son graduates, then the home must be sold or the first wife has the option to buy out the interest owned by the second wife. This is because of Article X, Section 4 of the Florida Constitution (some wonder if they were drinking Coca-Cola with cocaine in it while drafting it, however Coca-Cola did not come out until 1892), which states that:

(a) There shall be exempt from forced sale under process of any court, and no judgment, decree or execution shall be a lien thereon,…the following property owned by a natural person:

(1) a homestead, if located outside a municipality, to the extent of one hundred sixty acres of contiguous land and improvements thereon…; or if located within a municipality, to the extent of one-half of contiguous land, upon which the exemption shall be limited to the residence of the owner or the owner’s family;

(b) These exemptions shall inure to the surviving spouse or heirs of the owner.

Mrs. Friscia Two thus owns her half plus her choice of (1) a life estate in Mr. Friscia’s half, and his children have a remainder interest, or (2) a half interest in his half and his children own the other half. A guardian will have to be appointed by the probate court to hold the minor child’s interest if it is to be sold or mortgaged or traded for a few kegs of root beer.

So when drafting MSAs for sweet Mrs. Friscia One, or representing Mrs. Friscia Two, or Mr. Friscia, or artificially sweetened children, make sure to take into account the FL Constitution, and hold the aspartame.

Even a six-pack of Mrs. Friscias would not have overcome the Florida Constitution, and thus there was no Southern Comfort to be added to this mix for the creditors or Mrs. Friscia Two.

Solutions (without Aspartame):

Next time: (1) have Mr. Friscia’s homestead interest placed in an LLC or other homestead device if you represent Mrs. One; and/or (2) give her a recorded lease on the home to enforce her rights; or (3) have the child adopted by its stepfather (Dr. Pepper) after Mr. Friscia gives up parental rights.

Also, during his life, Mr. Friscia could have mortgaged his half, with Mrs. Friscia One’s permission, to a friendly creditor (like Aunt V-8 or Uncle Sanka) who was not sweet but may have helped liquefy his financial position.

Specific case language that helped to carbonate and ice this case and its result are as follows:

The final judgment of dissolution did not operate to transfer the Decedent’s interest and the former marital home had not been deeded when the Decedent died. Thus, the Decedent and the Former Wife still owned the former marital home as tenants in common at the time of his death.1

The Decedent’s interest retained its homestead protection because the Decedent’s sons, whom he still supported financially, continued to live on the property.2

Because the Decedent died intestate and was survived by a spouse and lineal descendants, the probate court properly determined that the Decedent’s protected homestead interest descended to the Second Wife as a life estate with a vested remainder in Nicholas and Thomas.3

The Personal Representative argues that, by agreeing to these [MSA] provisions, the Decedent waived his homestead rights in his interest in the former marital home. The rights at issue in this case are the Decedent’s homestead rights in his own property, not in the property of the Former Wife. Thus, these waiver provisions are inapplicable.4

Hope that this helps you to help other bubbly families prevent calamities.

***********************************************************************

1Friscia v. Friscia, 2D13-412, 2014 WL 4212689 (Fla. 2d Dist. App. 2014).

2 Id.

3Friscia v. Friscia, 2D13-412, 2014 WL 4212689 (Fla. 2d Dist. App. 2014).

4 Id.

Bross Trucking: Set Up, Like a Bowlin’ Pin. Knocked Down, it Gets to Wearin’ Thin. They (the IRS) Just Won’t Let You Be, Oh No.

The Tax Court cleared up some issues with respect to the transferring of goodwill from a corporation in Bross Trucking, Inc. V. Commissioner1 where the IRS hit Mr. Bross with a $883,800 corporate income tax deficiency and a $1,015,293 gift tax deficiency. The relevant facts are as follows: Chester Bross owned Bross Trucking as well as a number of other construction related businesses. After receiving an unsatisfactory motor carrier safety rating in 1998, Bross decided to cease operations. This was due to the negative attention the company received because of the rating, and the possibility that the Department of Transportation may issue a cease and desist to them. Bross’ attorney suggested that Mr. Bross’ sons start a new trucking business, which they did, called LWK Trucking. The sons were never involved with Bross trucking. This company provided more services than Bross Trucking, including ownership in One Star Midwest, LLC, which sells GPS products. LWK Trucking independently got all of its insurance and licenses instead of getting them from Bross Trucking. About 50% of LWK’s employees had previously worked for Bross Trucking.

LWK signed a vehicle lease with CB Equipment, the same company that leased vehicles to Bross Trucking. The lease allowed LWK to use the equipment that was leased to Bross Trucking. Some equipment still had the Bross Trucking logos. LWK used magnetic logos to cover up the Bross Trucking labels so that the company did not receive any negative association from the Bross Trucking brand.

As with any tax related issue, the facts can be rather convoluted. In the interest of preserving your sanity, a time line has been produced:

1966– Mr. Bross enters road construction industry

1972– Mr. Bross organized Bross Construction

April 19, 1982-Mr. Bross organized Bross Trucking

September 30, 1998– Bross Trucking received an unsatisfactory Motor Carrier Safety Rating

July 2003– Attorney recommends that Bross sons start new trucking business due to rating

October 1, 2003– LWK Trucking was organized

December 31, 2003– Bross Trucking had $263,381.38 of assets

2004– LWK Trucking started One Star Midwest, LLC, which provided GPS products to construction contractors

January 14, 2011– Commissioner sent Bross Trucking notice of deficiency of $883,800 for corporate income tax

June 16, 2011– Chester Bross was sent a notice of deficiency for $1,015,293 gift tax deficiency and Mary Bross was sent a $59,044 gift tax deficiency notice

The Commissioner contended that Bross Trucking Inc. gave intangible assets to Chester Bross who then made a gift of those assets to his three sons who owned LWK Trucking Co. The Court interpreted the Commissioner’s contentions as being that Bross Trucking transferred goodwill to Mr. Bross who then gave it to his sons. The Court noted that: “Section 311(b)(1) generally provides that if a corporation distributes appreciated assets to a shareholder, the corporation recognizes gain as if the property were sold to the shareholder at its fair market value.”2

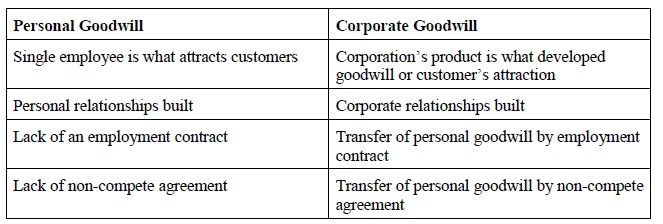

Goodwill is “the expectation of continued patronage.”3 The Court made it clear that a corporation cannot distribute intangible assets that are clearly owned by its shareholders. The Court analyzes two different cases on this topic, Martin Ice Cream Co.4 and Solomon.5 In Martin, an ice cream company sold products to stores and its controlling shareholder had developed relationships with these stores. The Court held that these relationships were the shareholder’s personal assets and not the corporation’s assets. In contrast to Martin, the Court in Solomon held the goodwill was developed by the corporation. The Court stated: “the success of the business was not solely attributable to the relationships and goodwill held by the shareholders but rather to the company’s processing, manufacturing, and sale of pigments.”6

These two cases show that there are two types of goodwill: 1. Personal goodwill created and owned by shareholders; and 2. Corporate goodwill created and owned by the company.7 In Bross, the Court held that all of the goodwill was owned by Mr. Bross and that the company could not have transferred any goodwill to Mr. Bross and that the Bross Trucking corporation had likely lost any potential corporate goodwill through its regulatory infractions.

This lack of corporate goodwill was demonstrated by LWK Trucking trying to stay separate from Bross Trucking by covering up the logos on the leased trucks. If LWK wanted to use the corporate goodwill of Bross it would have tried to associate itself with Bross instead of actively try to avoid confusion between the two.

Almost all of Bross Trucking’s goodwill was from Mr. Bross’ relationships. All of its revenue was from Mr. Bross’ work in the road construction industry, which is what attracted the customers. Just like the customers in Martin, Bross Trucking customers chose the company only because of the relationships between them and Mr. Bross. “A company does not have any corporate goodwill when all of the goodwill is attributable solely to the personal ability of an employee.”8

Mr. Bross’ goodwill could have been transferred to Bross Trucking. However, there was not a transfer here because there was no employment contract or non-compete agreement. Personal goodwill can be transferred by an employee through employment contracts or non-competes.

The only corporate asset that could have been transferred would be Bross Trucking’s workforce. The facts clearly showed that only about 50% of LWK’s employees had worked for Bross Trucking. The Court held that this did not constitute a transfer of the workforce. There was no evidence to show that the employees were transferred but instead were hired on their own choosing.

Bross Trucking did not transfer its customer base or revenue to LWK either. The customers chose LWK on their own.

No cash was transferred between Bross Trucking and LWK. In 2003, Bross Trucking’s assets had a value of $263.381.38. In addition, LWK attained its own licenses and insurances. Also, Mr. Bross stayed with Bross Trucking and was not involved with LWK. “The fact that Bross Trucking could have resumed its hauling business supports the view that it retained any corporate intangibles. Since a business can’t distribute personal assets but can only distribute corporate assets, there was no transfer here.

What does this all mean?

If you are going to use this case as an estate planning tool, there are some factors you may want to consider. Consider creating the new company to be a separate entity from the original in all ways possible (staying disassociated like LWK did with Bross Trucking). Having a reason for the new company would be helpful as well (LWK did not want the negative image Bross had attained from the negative ratings).

Another factor to consider would be to grow your client’s original business around personal goodwill. This doubles as both an estate planning tool and a life lesson. Build your client’s business around relationships with their customers so that they are patrons of your client and not of your client’s business. Also, avoid non-compete agreements and employment agreements as these could indicate a transfer of your client’s personal goodwill to the corporation.

Be careful of transferring some employees from one company to the other. Perhaps the best way to deal with this would be to let the employees go and hint that there is another company hiring that happens to be doing the same business.

With customers, you probably do not want to tell them to all go over to this new company as that may be a transfer of customers or revenue stream. Perhaps let them know that services are no longer being rendered here but that there are alternatives in the area including the new business.

Any licenses or insurances associated with your client’s first business should remain with that business. The new entity should get its own licensing and insurances to avoid any transfer. The controlling shareholder should stay with the original company (like Mr. Bross did with Bross Trucking). Make sure the original company has the ability to resume business at any time to support the view that it did not transfer corporate intangibles.

Factors chart:

To quote the Grateful Dead:

Truckin’, I’m a goin’ home. Whoa whoa baby, back where I belong,

Back home, sit down and patch my bones, and get back truckin’ on.

Hey now get back truckin’ home.

***********************************************

1 T.C. Memo. 2014-107.

2 T.C. Memo. 2014-107.

3 Id.

4110 T.C. 189, 209 (1998).

5 T.C. Memo. 2008-102.

6 Id.

7 T.C. Memo. 2014-107.

8T.C. Memo. 2014-107.

The Reverse Side of Reverse Mortgages, Part 1

Last week’s write up on reverse mortgages attracted some healthy and constructive criticism from a number of readers.

Two of these were James Flick, Esq. and Elena Katsulos who is a “Reverse Mortgage Specialist” with 360 Mortgage Group, LLC in Palm Harbor, Florida.

Jim Flick wrote the following:

Alan,

For many years I have attended or purchased your Florida Bar course materials and I am a big fan of your LISI articles, Thursday newsletters, and webinars. Recently, you included an outline on reverse mortgages and asked for comments. I am writing to tell you that I think you are being far too critical of them.

Since 2009, I have been a member of the Board of Directors for the FPA of Central Florida. As a result of my involvement with the FPA, I have had access to publications intended for financial advisors that an estate planning attorney would not normally be aware of. This includes articles on reverse mortgages written by top financial advisors who are highly educated and well respected. Attached is a list of seven such articles and two of the cited articles. Contrary to your belief, properly used, reverse mortgages can be a valuable planning tool. There is no doubt that, in the past, HECMs have been used inappropriately by unscrupulous or under informed financial advisors. However, that is equally true of many of the legitimate estate planning and asset protection strategies you and I use in our practices every day.

After reading these articles you may decide to soften your outspoken condemnation of reverse mortgages or acknowledge that they may be a more valuable planning tool that you portray in your outline. I hope this information is useful.

Jim Flick

Flick Law Group, P.L.

Estates, Trusts & Business Planning

3700 S. Conway Road, Suite 100

Orlando, FL 32812

(407) 273-1045

jim@flicklawyer.com

James J. Flick is an attorney, chartered life underwriter, chartered financial consultant, and former certified public accountant, with a law practice concentrating in the areas of estate planning and asset protection planning, compensation planning, and tax and business planning for physicians, business owners, professionals, and high net worth individuals.

Mr. Flick is certified as a specialist in Wills, Trusts and Estates law by the Florida Bar’s Board of Legal Specialization and Education.

Mr. Flick uses his unique educational and professional background to provide his clients with complete planning that considers the overall financial and tax impact of issues, in addition to focusing on the legal aspect of those issues and their resolution. Also, his training in accounting, insurance, and financial planning enables him to more effectively communicate with clients and their professional advisors.

Jim will be providing us with more information for later editions of the Thursday Report.

Elena Katsulos sent us the following:

Good morning Alan,

There is so much information I can share with you on reverse mortgages. Here is a snap shot of a few reverse mortgages that I have closed, or I am currently working on:

In the past 9 ½ years I have not met anyone who was not happy after their reverse mortgage closed. During the process it is common for borrowers to be a bit uncertain and to ask questions.

Scenario #1: John and Theresa: Ages 63 and 66

John and Teresa have a conventional mortgage on their property; the reverse mortgage will pay it off and eliminate their mortgage payment and provide them with additional cash flow. Over time the additional cash flow can be significant and can provide them with the security of knowing they have a line of credit available to them.

The borrowers understand that they are responsible for the taxes and insurance on their home. John and Theresa’s mortgage payment was originally $900.00 per month and they were unable to refinance their mortgage. Their financial advisor suggested a reverse mortgage to eliminate their mortgage payment, and provide them with additional cash flow. In a 12 month period their cash flow from the reverse mortgage was $10,800, which grew to $32,400.00 in just 3 short years.

Scenario #2 – John and Lucy: Ages 74 and 79

John and Lucy owned their home outright. They wanted to do a reverse mortgage to secure cash flow in later years in case they should need home healthcare. They loved that the line of credit would grow and when they were ready to tap into it for home health care it was already in place.

Their home value is $160,000 and the estimated line of credit that they have access to is $88,975 (see attached example).

Scenario #3 – Hazel: Age 72

Hazel had a small mortgage with a payment of $400 per month. By paying off the mortgage and closing on a reverse mortgage she now has the necessary funds for dental work that will be quite expensive. She is without dental insurance and the reverse mortgage helped her pay for the dental work she would have otherwise been unable to afford.

Scenario #4 – Tom and Betsy: Ages 81 and 85

Tom and Betsy closed on a reverse mortgage several years ago. Their home is in Dade County where property values have not only recovered, but have soared in value in recent years. They are in the process of refinancing their reverse mortgage which will pay off the existing reverse mortgage, and provide them with a line of credit of $73,000. This will provide them with extra money security for the future. When they originally did their first reverse mortgage it was to eliminate a large mortgage payment. In doing so they were provided with $15,000 in additional funds from the reverse mortgage.

Tom and Betsy are so happy with their reverse mortgage and to have the ability to take out additional funds if it is needed. Their homeowners insurance has gone up significantly and they are able to pay it due to the reverse mortgage. Like John and Theresa they are allocating some of these funds for home health care in the future. They are both in great health but enjoy the knowledge that should home health care be required for either of them, they will be covered financially.

Differences Between a Traditional Mortgage vs Reverse Mortgage

Age of borrower: 76

Value of home: $610,000; free and clear

The biggest difference between a traditional mortgage and a reverse mortgage is that there are no monthly payments with a reverse mortgage. There is a credit line that has a growth rate in a reverse mortgage, whereas with a conventional mortgage you are making payments for 15 or 30 years and interest is included.

I have been approached by many affluent people in our community that are being advised by their financial advisor to take out a reverse mortgage so that they are not being hit with taxes on their IRA’s and 401Ks at the end of the year. Once clients see how this works they usually ask why they did not do this sooner.

I have attached an example of a borrower that will be closing in the next week or so. Their home value is $610,000 and they will be able to tap into a line of credit once the reverse mortgage is in place.

I am also currently working with a couple and their divorce attorney. They are going to do a reverse mortgage to pay one spouse for their share of the home and the other spouse will be able to stay in the home.

There are so many avenues a reverse mortgage can be used for and as you can see I have a passion for working with older adults and this product.

Warm regards,

Elena Katsulos

Reverse Mortgage Specialist

360 Mortgage Group, LLC

3025 Landmark Blvd., #708

Palm Harbor, FL 34684

813-394-4693

ekatsulos@gmail.com

Elena Katsulos grew up in Tarpon Springs and has lived in North Pinellas County for most of her life. In 1996 she relocated to Manhattan for a career in the technology sector working with a variety of financial service companies providing hardware, software and educational solutions.

After returning to Pinellas County in 2004, Elena’s passion and expertise has been specializing in Reverse Mortgages. She has helped hundreds of individuals and families age 62 and older to determine if a Reverse Mortgage is a good fit for them. Elena deals with many elder law attorneys, financial planners, geriatric care manager and health care providers to help in the decision making process as well.

We have also received the following comment from Janet Nichols, CFP, Managing Director and Senior Vice President, Investments, at Nichols Green King Family Wealth Advisors of Raymond James in Tampa, Florida:

Alan, this is a very good analysis of reverse mortgages. I seldom give you feedback, but you have one of the best professional newsletters out there, and I always read it with interest.

Janet Nichols, CFP

Nichols Geegan King Family Wealth Advisors of Raymond James

100 North Tampa Street, Suite 2400

Tampa, FL 33602

Phone: 813-202-1108

Email: Janet.Nichols@RaymondJames.com

Janet Nichols, CFP has more than 30 years of experience as a financial services professional. She holds licenses for securities, commodities, life and health insurance and specializes in comprehensive financial planning, including retirement income planning, estate and tax planning, education funding and risk management. She has completed Raymond James’ Institute of Investment Management Consulting. In addition, since 1988, Janet has been a CERTIFIED FINANCIAL PLANNER™ practitioner, a credential that demonstrates her commitment to professionalism. CFP® certification is a rigorous, voluntary process that includes highly demanding education, examination, experience and ethical requirements.

Everything You Always Wanted to Know About Reverse Mortgages but Forgot to Ask, Part Three

We continue our coverage of reverse mortgages with a discussion of new legislation, as well as protection and oversight regarding reverse mortgages.

Protection and Oversight:

The decision to tap home equity should not be taken lightly and should not be presented as anything other than an expensive loan. These loans are not risk free or cost free and should not be presented as such. While it is appropriate to inform and educate the public about the availability of reverse mortgage loans, mass marketing of reverse mortgage loans should not be misleading or deceptive. Reverse mortgages are not appropriate for every homeowner over the age of 62. At a minimum, it should be clear that celebrities are paid spokesmen. Despite guidance in this area from the Reverse Mortgage Lenders Association, that is not always clear in the advertisements.[1]

- Consumer Financial Protection Bureau. In 2012, the Consumer Financial Protection Bureau issued a report to Congress regarding its research on reverse mortgages and the risks associated therewith for borrowers over age 62.

Once a loan has been declared due and payable, the borrower or the borrower’s estate has 6 months to repay the loan, typically by selling the home. If the balance of the loan is greater than the sales proceeds (subject to FHA procedures to ensure that the sales proceeds reflect the value of the home), the borrower or the estate does not have to pay the difference. If the borrower or the estate fails to sell the property or otherwise repay the loan within 6 months, the lender is required to start foreclosure proceedings.

In early 2012, investors in Ginnie Mae HECM securities were willing to pay between 10% and 12% of the loan balance as a premium on fixed-rate HECMs. Adjustable-rate HECMs were commanding premiums of 6% to 9% of the loan balance. HECM Saver pools were on the lower end of those ranges. In contrast, typical premiums in the traditional mortgage market for market-rate loans are in the 1% to 4% range.

Reverse mortgage consumers receive various documents at the time an application is provided. The specific disclosure documents depend on whether a reverse mortgage is open- or closed-end. Generally, fixed-rate reverse mortgages are structured as closed-end loans, while adjustable-rate reverse mortgages are structured as open-end loans, though future product innovation could produce other combinations.

On September 24, 2010, the Board finalized a rule amending Regulation Z to implement the Truth In Lending Act (TILA) with respect to mortgage loan originator compensation for all closed-end mortgages, including both traditional mortgages and closed-end reverse mortgages. The rule sets forth the manner in which mortgage loan originators may be compensated. For closed-end reverse mortgages, which are synonymous with fixed-rate, lump-sum reverse mortgages, a mortgage loan originator may not receive compensation based on the reverse mortgage transaction’s terms and conditions. For example, an originator of a closed-end reverse mortgage may be compensated based on a fixed percentage of the credit extended, but not based upon the terms and conditions of the mortgage itself, so that mortgage brokers are not specifically rewarded for encouraging consumers to make specific decisions above and beyond how much is being borrowed. Further, mortgage brokers may receive compensation from only one source – either the consumer or the lender – for closed-end loans.

Research has found that consumers often focus on short-term costs and underestimate long-term costs. This bias, coupled with the sheer complexity of the product’s pricing, may result in an inaccurate perception of how much it costs to take out a reverse mortgage. To the extent that consumers underestimate the costs of a reverse mortgage, they are at risk of choosing to pursue a reverse mortgage when another option might be a better financial choice. Borrowers who underestimate the effects of compounded interest may also be more likely to choose a reverse mortgage product option that is poorly suited to their situation.

The most common misperception counselors reported was the presumption that a reverse mortgage is a government entitlement program similar to Medicare. Counselors often find themselves explaining to clients that a reverse mortgage is in fact a loan. This confusion echoes concerns expressed in the 2009 GAO report about advertising suggesting that a reverse mortgage is a government benefit. Counselors recommended that misleading marketing should remain a focus for regulators. Other HECM clients come to counseling with fears that a reverse mortgage will allow the federal government to confiscate their homes.

Cross-selling means providing a reverse mortgage for the borrower, and also selling them a financial product or service that they purchase with proceeds from the reverse mortgage loan. Cross-selling can harm consumers if they are required or persuaded to purchase products that are overly expensive or otherwise inappropriate for their needs. Cross-selling can not only result in consumers being persuaded to purchase a product they do not need, but also in consumers paying far more for the product than they would if they purchased it outside of a reverse mortgage context. When a borrower uses reverse mortgage proceeds to purchase another financial product, the fees for the products compound. Consumers pay fees and interest to take out a reverse mortgage and then pay fees to purchase the other product. The cross-selling of annuities is particularly harmful to consumers because an annuity-like monthly payment stream is one of the payment options available with a reverse mortgage. A consumer who uses a reverse mortgage to purchase an annuity pays a hefty fee for the annuity and receives no additional benefit, since the reverse mortgage itself could have been set up to provide an annuity-like stream of payments. Cross-selling can also be particularly harmful when borrowers are tapping a large portion of their home equity with a lump-sum draw. If borrowers then funnel most or all of their proceeds into an illiquid investment or insurance policy, borrowers lose the flexibility of being able to access the equity in their home when they need it.

- Truth in Lending Act. The Truth in Lending Act, also known as Regulation Z, was created to promote the informed use of consumer credit by requiring disclosures about the terms and cost. [2]

According to the various salespeople we interviewed, borrowers do not receive a copy of the Truth in Lending Act disclosure until they complete an application and pay the applicable application fee.

12 CFR §226.33 of the Truth in Lending Act discusses the disclosure requirements for reverse mortgages. Subsection (b) of the section states that:

In addition to other disclosures required by this part, in a reverse mortgage transaction the creditor shall provide the following disclosures in a form substantially similar to the model form found in paragraph (d) of appendix K of this part, which is indicated below:

(1) Notice. A statement that the consumer is not obligated to complete the reverse mortgage transaction merely because the consumer has received the disclosures required by this section or has signed an application and paid the application fee for a reverse mortgage loan.

(2) Total annual loan cost rates. A good-faith projection of the total cost of the credit, determined in accordance with paragraph (c) of this section and expressed as a table of “total annual loan cost rates,” using that term, in accordance with appendix K of this part.

(3) Itemization of pertinent information. An itemization of loan terms, charges, the age of the youngest borrower and the appraised property value.

(4) Explanation of table. An explanation of the table of total annual loan cost rates as provided in the model form found in paragraph (d) of appendix K of this part.[3]

This section also discusses what exactly must be reflected in the projected total costs of the loan, which are as follows:

(1) Costs to consumer. All costs and charges to the consumer, including the costs of any annuity or any other financial products that the consumer might purchase with the proceeds from the reverse mortgage loan.

(2) Payments to consumer. All advances to and for the benefit of the consumer, including annuity payments that the consumer will receive from an annuity that the consumer purchases as part of the reverse mortgage transaction.

(3) Additional creditor compensation. Any shared appreciation or equity in the dwelling that the creditor is entitled by contract to receive.

(4) Limitations on consumer liability. Any limitation on the consumer’s liability (such as nonrecourse limits and equity conservation agreements).

(5) Assumed annual appreciation rates. Each of the following assumed annual appreciation rates for the dwelling:

(i) 0 percent.

(ii) 4 percent.

(iii) 8 percent. (8 PERCENT, ARE THEY KIDDING? HOMES WENT DOWN BY OVER 30% IN 2008!!)

(6) Assumed loan period.

- AARP Involvement. For years the AARP was rather quiet on the issue of reverse mortgages, until it issued a general report about the risks and benefits of these loans in 2008. AARP’s Public Policy Institute is officially in favor of having reverse mortgages available for senior citizens, but it is notable that AARP does not specifically endorse any third mortgage product, and maintains literature pointing out the many risks that are not pointed out in advertising and otherwise. This is somewhat surprising to the authors, because AARP is in support of the reverse mortgages and the continuation of these loans. AARP specifically endorses a number of investments, insurances, and services for its members, for which it is very handsomely compensated. According to AARP IRS Form 990, in 2012 the AARP received $723,333,181 of endorsement income; yes, that is $723,231,181 – giving AARP the incentive to influence the behavior of its members, who are not explicitly informed that it derives profits from their purchases of endorsed products. Maybe the author can talk about that next year!

In June of 2013, Lori Trawinski, Ph.D., CFP, on behalf of the Senior Strategic Policy Advisory AARP Public Policy Institute, testified before the Subcommittee on Insurance, Housing and Community Opportunity, U.S. Committee on Financial Services, on some of the challenges and risks associated with seniors utilizing reverse mortgages. She recommended putting more consumer protections in place to help decrease the number of defaults on reverse mortgages. Consumer protections could include more intense counseling, fraud protection, loss mitigation in the event of foreclosure, and strict regulation of the advertising and marketing of reverse mortgages so as not to mislead borrowers about the benefits of these products.

The actual testimony on May 9, 2012, included the following statement:

However, AARP continues to believe that older Americans should have a means by which to access their home equity without having to sell their homes or take out a home equity loan, and that a reverse mortgage can be an appropriate financial product for some people. AARP urges HUD to act in a timely manner to provide guidance in areas where there is uncertainty, such as: promulgating rules that prohibit cross-selling; and promulgating rules for financial assessments of borrowers. In addition, we support the development of a wider reaching program to assist borrowers who are in default, before the loan reaches the foreclosure stage. AARP also urges the following statutory changes: removal of the statutory limit on the number of loans that can be insured by HUD; and appropriation of sufficient funds to make sure that borrowers have access to the housing counselors they require and to the capital they need. AARP supports the continuation of the HECM program and we look forward to working with you and other stakeholders to ensure that older Americans can tap their home equity with safe, affordable, government-insured reverse mortgage loans that enhance their financial security.[4] (Emphasis added).

New Legislation: On April 25, 2014, HUD issued new regulations in Mortgagee Letter 2014-07, which protects surviving spouses who would like to stay in the home of the borrower spouse. The new regulations require that lenders treat the spouse of a borrower as a co-borrower for purposes of determining actuary discussions, maximum loan amounts, and with respect to underwriting. As a result, the surviving spouse of a borrower who takes out a reverse mortgage after September 4, 2014 will be able to stay in the home for his or her remaining lifetime after the death of the borrower, as long as the surviving spouse or someone else keeps up the taxes, insurances, and maintenance of the home.

While this change is necessary to protect many surviving spouses, one consequence is that annual lending limits will now be reduced as if both spouses were borrowers on an “only the survivor pays” basis. This will reduce the amounts that can be borrowed under a number of scenarios. Another consequence is that some borrowers will get divorced so that they can receive higher lifetime payments under tenure mortgages, and as a result of this, the spouse that they divorce but continue to cohabitate with will be moved out of the house when the borrower dies. This new legislation will not protect individuals who marry a reverse mortgage borrower after the loan has been taken.

What happens if the couple decides to get divorced, but neither of them have the financial wherewithal to pay off the loan, and they need to live in separate, smaller houses? Once divorced, will the non-borrowing spouse lose protection under the law?

The new regulations follow the filing of a Federal Court District of Columbia Class Action Suit in February of 2014 that was prepared by legal counsel for the AARP Foundation Litigation and a public interest law firm claiming that the previously effective regulations required the same protection for a non-borrowing spouse, notwithstanding that the lenders have not been interpreting the regulation that way.[5]

_______________________

[1] Oversight of the FHA Reverse Mortgage Program for Seniors. Written Testimony of Lori A. Trawinski, Ph.D., CFP, Senior Strategic Policy Advisory AARP Public Policy Institute. Hearing before the Subcommittee on Insurance, Housing and Community Opportunity. U.S. Committee on Financial Services. May 9, 2012. Page 6.

[2] 12 CFR §226.1(b)

[3] 12 CFR §226.33(b)

[4] Oversight of the FHA Reverse Mortgage Program for Seniors. Written Testimony of Lori A. Trawinski, Ph.D., CFP, Senior Strategic Policy Advisory AARP Public Policy Institute. Hearing before the Subcommittee on Insurance, Housing and Community Opportunity. U.S. Committee on Financial Services. May 9, 2012. Page 7.

[5] Plunkett v. Donovan, No. 14-cv-326 (D.D.C. 2014).

Jason Havens, Esq. Joins Holland & Knight

Jason Havens is a north and west Florida estate tax and trust lawyer who has done a great deal for our profession as a writer, a software and technology expert, and as a leader in charitable giving law development.

Besides having a successful law practice in Destin, Florida, Jason has served as Vice President, General Counsel and Editor-in-Chief of Wealth Counsel® for a number of years.

Jason and Holland & Knight have recently announced that he has joined the firm’s Private Wealth Services Group as senior counsel in the Jacksonville and Tallahassee offices.

Jason is an absolute pleasure to work with and high up on our heroes list. He is an excellent writer, thinker and dedicated servant and developer for our profession. We wish him the best with Holland & Knight and congratulate our colleagues there for seeing fit to bring him aboard.

Jason’s contact information is as follows:

Jason Havens

Senior Counsel

Holland & Knight

Email: jason.havens@hklaw.com

Jacksonville

50 North Laura Street

Suite 3900

Jacksonville, FL 32202

Phone: 904-798-5489

Facsimile: 904-358-1872

Tallahassee

315 South Calhoun Street

Suite 600

Tallahassee, FL 32301

Phone: 850-425-5655

Facsimile: 850-224-8832

Quote of the Week

“Busy is good but sometimes I like to just hang around my house……” – Kathy Rawls

Upcoming Seminars and Webinars

LIVE CLEARWATER PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will be joined by several experienced attorneys during a full day workshop for lawyers and other professionals who wish to enhance their practice and personal lives.

Date: Sunday, October 5, 2014 | 8:30am – 5pm

Location: Clarion Hotel, 20967 US 19 N., Clearwater

Additional Information: To register for this program please email agassman@gassmanpa.com

********************************************

FREE LIVE WEBINAR

THE BCA’s OF REVERSE MORTGAGES

Alan Gassman will be presenting a webinar about reverse mortgages.

Date: Wednesday, October 8, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE NEW JERSEY PRESENTATION – WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW TO REPRESENT SNOWBIRDS AND FLORIDA BASED BUSINESSES:

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE) SPECIAL 3 HOUR SESSION

New Jersey song trivia: What song includes the words “Counting the cars on the New Jersey Turnpike, they’ve all gone to look for America”? What year was it recorded and who wrote it?

Alan S. Gassman will be the sole speaker for this informative 3 hour program entitled WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Here is some of what the New Jersey Bar Invitation for this program provides:

New Jersey residents have always had a strong connection to Florida. We vacation there (it is our second shore), own Florida property (or have favored relatives that do) and have family and friends living there. Sometimes our wealthiest clients move to Florida and need guidance, and you need background in order to continue representation.

There are real and significant differences between the two states that every lawyer should be cognizant of. For example, holographic wills are perfectly legitimate in New Jersey and anyone can serve as an executor of an estate, which is not the case in Florida. Also, Florida=s new rules regarding LLCs are different, and if you are handling estates of New Jersey decedents who owned Florida property, there are Florida law issues that must be addressed. Asset protection differs significantly in Florida too.

Gain the knowledge you need to assist your clients with Florida matters including:

- Florida specific laws involving businesses, trusts, and estates

- Florida tax planning

- Elective share and homestead rules

- Liability Insulation and Planning

- Creditor Protection and Strategies

- Medical Practice Laws

- Staying within Florida Bar Guidelines that allow representation of Florida clients

Comments from past attendees of this program:

- Excellent seminar and materials!!!

- This was one of the best ICLE seminars yet!

- One of the best seminars I have attended.

- Better than mashed potatoes and gravy. Glad he didn’t serve grits!

Date: Saturday, October 11, 2014

Location: New Jersey Law Center, 1 Constitution Square, New Brunswick, NJ 08901

Additional Information: This is a repeat of the same program that we gave last year, but our book is now updated for the new Florida LLC law and changes in estate and trust law. Please tell all of your friends, neighbors, and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information, please email agassman@gassmanpa.com

********************************************************

LIVE NEW PORT RICHEY PRESENTATION:

Alan S. Gassman, Kenneth J. Crotty and Christopher J. Denicolo will address the North FICPA Group on Financial Analysis and Tax Planning for Investment Products, Including Variable Annuities, Fixed Annuities, Life Insurance Contracts, and Mutual Funds – What Should the Tax and Financial Advisor Know and Advise?

Be there or be an equilateral triangle!

Date: Wednesday, October 15, 2014 | 4:30 p.m.

Location: Chili’s Port Richey, 9600 US 19 N, Port Richey, Florida

********************************************************

LIVE MIAMI LAKES PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman and Phil Rarick will be presenting a free half-day workshop for lawyers and other professionals who wish to enhance their practice and personal lives.

Date: Sunday, October 19, 2014 | 1pm – 5pm

Location: Shula’s Hotel, 6842 Main Street, Miami Lakes, FL 33014 | Boardroom

Cost: $35 per person

Additional Information: To register for this program please email agassman@gassmanpa.com

********************************************************

LIVE CLEARWATER PRESENTATION

Alan Gassman will be speaking at the Pinellas County Estate Planning Council Fall Seminar on PLANNING FOR SAME GENDER COUPLES.

Date: Thursday, October 23, 2014 | Program begins at 7:30 am. Mr. Gassman speaks at 9:00 am.

Location: Ruth Eckerd Hall, 1111 N. McMullen Booth Road, Clearwater, FL

Additional Information: To register for this event please email agassman@gassmanpa.com

********************************************************

LIVE PASCO COUNTY PLANNED GIVING (AND DRINKING!) COCKTAIL HOUR AND PRESENTATION

Alan S. Gassman and Christopher J. Denicolo will be speaking at the Pasco-Hernando State College’s Planned Giving Consortium Luncheon on Planning for Inherited IRA’s in View of the Recent Supreme Court Case – and Demystifying the “Stretch in Trust” IRA and Pension Rules

Date: Thursday, October 23, 2014 | 4:30 p.m.

Location: Spartan Manor, 6121 Massachusetts Avenue, Port Richey, Florida

Additional Information: For more information, please contact Maria Hixon at hixonm@phsc.edu

**********************************************************

LIVE SARASOTA PRESENTATION

2014 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: October 25 – 26, 2014 | Alan Gassman is speaking on Sunday, October 26, 2014

Location: TBD

Additional Information: Please contact agassman@gassmanpa.com for additional information.

**********************************************************

FREE ONLINE WEBINAR:

Leslie A. Share will be joining Alan S. Gassman for a 30 minute webinar entitled THE FLIP SIDE – US TAX AND COMPLIANCE ISSUES AFFECTING AMERICANS ABROAD – YOU CAN RUN, BUT YOU CAN’T HIDE.

Date: Monday, October 27, 2014 at 5:00 p.m. (30 minutes)

Additional Information: To register for this webinar, please click here.

*********************************************************************

FREE ONLINE WEBINAR:

Leslie A. Share and Alan S. Gassman will be presenting Part II of Demystifying US Tax and Estate Planning Considerations for Foreign Investors and Multi-National Families – Concepts that You Can Clearly Understand and Explain to Clients in a new webinar entitled DOOR #7 – PLANNING TECHNIQUES FOR NON-RESIDENT ALIENS WHO INVEST IN FLORIDA REAL ESTATE.

Date: Monday, October 27, 2014 at 5:30 p.m. (20 minutes)

Additional Information: To register for this webinar, please click here.

******************************************************************

LIVE CLEARWATER PRESENTATION:

TAMPA BAY CPA GROUP

Alan Gassman, Ken Crotty and Christopher Denicolo will be presenting THE MATHEMATICS OF ESTATE PLANNING in a 2 hour session at the Tampa Bay CPA Group Fall 2014 Seminar.

Date: November 7, 2014

Location: Marriott Hotel, 12600 Roosevelt Blvd North, St. Petersburg, FL 33716

Additional Information: For more information please contact Richard Fuller at richardf@fullercpa.com.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

PARALEGAL ASSOCIATION OF FLORIDA – PINELLAS COUNTY CHAPTER

Alan Gassman will be presenting 8 STEPS TO A SUCCESSFUL TRUST AND ESTATE PLAN at the Paralegal Association of Florida – Pinellas County Chapter’s November meeting.

Date: November 11, 2014

Location: The Hangar Restaurant and Flight Lounge, 540 1st Street SE, St. Petersburg, FL 33701

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com

*********************************************************

LIVE UNIVERSITY OF NOTRE DAME PRESENTATION:

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Topic #1: PLANNING WITH VARIABLE ANNUITIES AND ANALYZING REVERSE MORTGAGES

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities.

Topic #2: THE MATHEMATICS OF ESTATE AND ESTATE TAX PLANNING

Christopher J. Denicolo, Kenneth J. Crotty and Alan S. Gassman will also be presenting a special Wednesday late p.m. two hour dive into math concepts that are used or sometimes missed by estate and estate tax planners. This will be an A to Z review of important concepts, intended for estate planners of all levels, sizes and ages. Donald Duck has rated this program A+.

Date: November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

LIVE PORT RICHEY PRESENTATION:

Alan Gassman will be speaking to the North Suncoast Estate Planning Council on Planning Opportunities for Same Sex Couples.

Date: Tuesday, November 18, 2014 | 5:30 p.m.

Location: Fox Hollow Golf Club, 10050 Robert Treat Jones Pkwy, Trinity, FL 34655

Additional Information: For more information please contact agassman@gassmanpa.com.

********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Alan Gassman will be speaking at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Others speakers include D. Michael O’Leary on Really Burning Hot Tax Topics, Radha V. Bachman on Checklists for Purchase and Sale of a Medical Practice, Cynthia Mikos on Dangers of Physician Recruiting Agreements and Marlan B. Wilbanks on How a Plaintiff’s Lawyer Evaluates Cases Brought by Whistleblowers.

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Jerry Hesch and Alan Gassman will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Jonathan Gopman, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

NOTABLE SEMINARS BY OTHERS

(We aren’t speaking but don’t tell our mothers!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott, 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a full list of speakers and presentation descriptions, please click here. For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

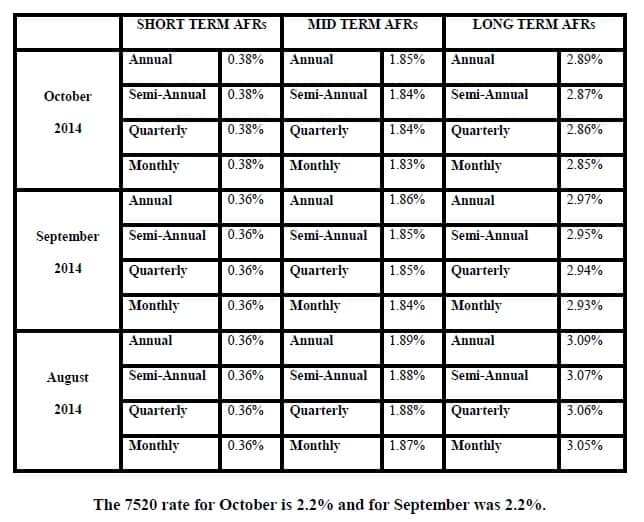

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.