Great Quotes, LLC Notes and Dolphins with Boats

Ken Crotty’s LLC Clinic – Interest Exchanges

Physician Owned Distributorships

Checker’s Chief Operating Officer Super-Sizing His Jail Time: Theft of Over $300,000 in Sales Taxes

Dan Sullivan Quotes

Questions and Answers About the Thursday Report

Phil Rarick’s Client Blog Entries: Moving to Florida: Tips on How to Avoid the Tax Traps

Seminar Spotlight – BP Calculations for CPAs – Tricks & Traps Seminar

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Ken Crotty’s LLC Clinic – Interest Exchanges

The new LLC Act provides that the majority in interest of an LLC can force minority members to participate in sales.

Proper language to accommodate this statute is essential.

We thank Gary Teblum for explaining this provision to us.

Here is more detail:

If a person or entity wants to purchase 100% ownership of an LLC and this has been approved by a majority of members, then objecting members can be required to participate in the sale, and dissenting members will be entitled to be paid based upon the appraisal right procedure described below.

The new LLC Act authorizes interest exchanges in Sections 605.1031 through 605.1036.

The new Act applies the interest exchange concept from corporate law to LLCs. Under the old Act, the concept of interest exchanges did not apply to LLCs. In an interest exchange, the separate existence of the acquired entity is not affected and the acquiring entity receives some or all of the interests. An interest exchange also allows for an indirect acquisition through consideration from another or related entity.

Under Section 605.1031, a domestic LLC may acquire interests of another domestic or foreign entity in exchange for interests, securities, obligations, money, other property, or rights to acquire interests or securities. Additionally, 605.1031 also allows for the acquisition obtained to be a combination of interests, securities, obligations, money, other property, or rights to acquire interests or securities. A foreign entity may also be party to an interest exchange if authorized by the organic law in the foreign entity’s jurisdiction of formation.

Section 605.1032 provides that a plan of interest exchange must be in a record and must contain:

1. The name of the acquired entity;

2. The name, jurisdiction of formation, and type of entity of the acquiring entity;

3. The manner and basis of converting the membership interests of each acquired LLC into interests, securities, obligations, money, other property, rights to acquire interests or securities, or any combination of the foregoing;

4. If the acquired entity is a domestic LLC, any proposed amendments or restatements of its Articles of Organization or Operating Agreement to become effective as of the date of the interest exchange;

5. The other terms and conditions of the interest exchange; and

6. Any other provision required by law or in the acquired and acquiring entities’ jurisdictions of formation.

In addition to the requirements above, a plan of interest exchange may contain other provisions not prohibited by law.

A plan of interest exchange is not effective unless it has been approved pursuant to the rules stated in Section 605.1033(1). Written notice of meetings must be given to all members who have a right to vote not less than 10 days and not more than 60 days before the date of the meeting. Such notice may be waived in writing.

A domestic acquired LLC in the interest exchange must have approval by a majority-in-interest of its members and approval of each member that will have interest holder liability unless an exception applies. Such approval by each member is not necessary if the Operating Agreement of the company provides for the approval of an interest exchange in which some or all of its members become subject to interest holder liability by the vote or consent of fewer than all the members.

Amendments to a plan of exchange may be made only with consent of each party to the plan unless the rules of the LLC provide otherwise. An amendment must be approved in the same manner the plan was approved. A plan of interest exchange may be abandoned after it was approved as provided in Section 605.1034(3) and (4).

After a plan has been approved, articles of interest exchange must be signed and delivered for filing. When an interest exchange becomes effective, the interests in the acquired company cease to exist or are converted or exchanged, and the acquiring entity becomes the interest holder. The members holding the acquired interests are entitled only to the rights provided under the plan and any appraisal rights under the new LLC Act.

Physician Owned Distributorships

Public Policy Prohibiting Physician Owned Distributorships

Many physician advisors are surprised to hear that the law may permit a surgeon or other doctor to request that the hospital or surgery center order a medical implant or device from a company that the physician has an ownership interest in.

This would not be considered a referral that would be prevented under the Stark Law if the device is not considered a designated health service, and may not violate the anti-kickback statute if the purchase of the device is not considered to be a payment in consideration of the referral of the patient to the hospital, or the health care facility.

Nevertheless, these arrangements have been studied by and commented upon both legislatively and by the Office of Inspector General, and significant risk can apply.

The following memorandum by recent Stetson law school graduate, Sydney Smith, who is now an associate with Laird A. Lile, P.A., in Naples, does a great job of describing the present situation.

Typically, a manufacturer sells implantable medical devices directly to a hospital or surgical center and often provides other services such as order and delivery, stocking and re-stocking, sterilization, selection, and assistance to surgeons in the operating room.1 The creation of physician owned distributorships (PODs) has drastically changed the manner in which medical devices are supplied by allowing physicians to act as middle-men in the supply chain. These POD agreements often do not offer the extent of services offered by traditional manufacturing agreements.

A basic POD is created when a small group of investors, typically consisting of physicians, creates a company that manufactures or distributes surgical implant devices. Individuals invited to invest in the company are primarily physicians who have the ability to generate referrals for the company and will potentially use the products in their own surgeries. Because physicians operating at hospitals and surgical centers have wide discretion in determining which implants or devices will be used, legislators are concerned that physician investors, in an attempt to boost the profits of the POD, will use products of lower quality or products that are not appropriate for the procedure. [senate report]. Hough investors will their ability to generate referrals for hospitals or surgical centers to induce hospitals or surgical centers to use medical devices from their PODs.2

Because physicians have wide discretion in selecting medical devices for their patients, and because physicians participating in PODs are often acting as manufacturers, buyers, and sellers of their own medical devices, these POD arrangements have been called into question under the federal kick-back laws governing payments made under federal health care programs, such as Medicare or Medicaid.

Indicia of a Suspect Contract

The Office of the Inspector General has issued numerous Special Fraud Alerts regarding the legitimacy of physician owned distributorships, and has also issued numerous guidance documents on the general subject of physician investments in referral entities, including the 1989 Special Fraud Alert on Joint Venture Arrangements. According to the OIG’s 1989 report, “a joint venture may take a variety of forms: it may be a contractual arrangement between two or more parties to cooperate in providing services, or it may involve the creation of a new legal entity by the parties, such as a limited partnership or closely held corporation, to provide such services.” [Emphasis added.]3

The 1989 Special Fraud Alert on Joint Ventures, was amplified by a 2006 advisory opinion from the Department of Health and Human Services, gives a non-exhaustive list of suspect features of joint ventures tending to show a violation of federal Law. According to the 2006 opinion, these features, as applied to “joint ventures” in the 1989 report, are currently applicable to physician investments in medical device manufacturing and distribution entities, such as PODs.4

Accordingly, the following arrangements should be avoided when creating a POD:5

I. Choice of Investors:

a. Physicians who are expected to make a large number of referrals are offered a greater investment opportunity in the joint venture than those anticipated to make fewer referrals.

b. Physician investors are actively encouraged to make referrals to the joint venture, and are encouraged to divest their ownership interest if they fail to sustain an “acceptable” level of referrals.

c. The joint venture tracks its sources of referrals, and distributes this information to the investors.

d. Investors are required to divest their ownership interest if they cease to practice in the service area, for example, if they move, become disabled or retire.

e. Investment interests are nontransferable.

II. Financing and Profit Distribution

a. The amount of capital invested by the physician is disproportionately small and the returns on investment are disproportionately large when compared to a typical investment in a new business enterprise.

b. Physician investors invest only a nominal amount, such as $500 to $1500.

c. Physician investors are permitted to “borrow” the amount of the “investment” from the entity, and pay it back through deductions from profit distributions, thus eliminating even the need to contribute cash to the partnership.

d. Investors are paid extraordinary returns on the investment in comparison with the risk involved, often well over 50 to 100 percent per year

In 2003, the OIG issued a Special Advisory bulletin addressing the legitimacy of joint ventures between physicians and physician owed entities. According to this report, a joint venture typically exists when the owner of a business expands into a related line of business, which is dependent on referrals from the owner’s original business.6 Although this report specifically addresses joint ventures and does not mention PODs, the suspect characteristics applicable to joint ventures should be considered when considering investment in a POD. According to this report, captive referral bases, where the newly created business predominantly or exclusively serves the owner’s existing patient base, are inherently suspect. Further, scrutiny is heightened when the owner does not intend to expand the newly created business to serve new customers, and makes no bona fide efforts to do so.7 Additionally, where there the owner’s primary contribution to the joint venture is referrals and the owner makes very little financial investment, there is indicium of a suspect relationship.8

The most recent Special Fraud Alert, issued March 26, 2013, emphasizes that PODs are “inherently suspect” and should be strictly construed under the anti-kickback law, 1128B(b)(1 – 2).9 According to 1128B(b)(1 – 2):

(1) Whoever knowingly and willfully solicits or receives any remuneration (including any kickback, bribe, or rebate) directly or indirectly, overtly or covertly, in cash or in kind—

(A) in return for referring an individual to a person for the furnishing or arranging for the furnishing of any item or service for which payment may be made in whole or in part under a Federal health care program, or

(B) in return for purchasing, leasing, ordering, or arranging for or recommending purchasing, leasing, or ordering any good, facility, service, or item for which payment may be made in whole or in part under a Federal health care program, shall be guilty of a felony and upon conviction thereof, shall be fined not more than $25,000 or imprisoned for not more than five years, or both. [Emphasis added]

(2) Whoever knowingly and willfully offers or pays any remuneration (including any kickback, bribe, or rebate) directly or indirectly, overtly or covertly, in cash or in kind to any person to induce such person—

(A) to refer an individual to a person for the furnishing or arranging for the furnishing of any item or service for which payment may be made in whole or in part under a Federal health care program, or

(B) to purchase, lease, order, or arrange for or recommend purchasing, leasing, or ordering any good, facility, service, or item for which payment may be made in whole or in part under a Federal health care program, shall be guilty of a felony and upon conviction thereof, shall be fined not more than $25,000 or imprisoned for not more than five years, or both. [Emphasis added]

The Office of the Inspector General began to closely scrutinize physician owned distributorships specifically after the June 2011 report from the U.S. Senate Finance Committee entitled “Physician Owned Distributors (PODs): An Overview of Key Issues and Potential Areas for Congressional Oversight. This report heavily criticizes PODs and states that “the very nature of PODs seem to create financial incentives for physician investors to use those devices that give them the greatest financial return and that, in the process, patient treatment decisions may be based on personal financial gain.”10

In its 2013 report, the OIG specifically lists questionable features in physician investment contracts. These are as follows:11

I. Selecting investors because they are in a position to generate substantial business for the entity;

II. Requiring investors who cease practicing in the service area to divest their ownership interests;

III. Distributing extraordinary returns on investment compared to the level of risk involved;

IV. The size of the investment offered varies with the expected or actual volume of value of devices used by the physician;

V. Distributions are not made in proportion to ownership interest, or physician-owners pay different prices for their ownership interests, because of the expected or actual volume or value of devices used by the physicians;

VI. Physician-owners condition their referrals to hospitals or ASCs on their purchase of the POD’s devices through coercion or promises, for example, by stating or implying they will perform surgeries or refer patients elsewhere if a hospital or an ASC does not purchase devices from the POD, by promising or implying they will move surgeries to the hospital or ASC if it purchases devices from the POD, or by requiring a hospital or an ASC to enter into an exclusive purchase arrangement with the POD;

VII. Physician-owners are required, pressured, or actively encouraged to refer, recommend, or arrange for the purchase of the devices sold by the POD or, conversely, are threatened with, or experience, negative repercussions (e.g., decreased distributions, required divestiture) for failing to use the POD’s devices for their patients;

VIII. The POD retains the right to repurchase a physician-owner’s interest for the physician’s failure or inability (through relocation, retirement, or otherwise) to refer, recommend, or arrange for the purchase of the POD’s devices;

IX. The POD is a shell entity that does not conduct appropriate product evaluations, maintain or manage sufficient inventory in its own facility, or employ or otherwise contract with personnel necessary for operations;

X. The POD does not maintain continuous oversight of all distribution functions; and

XI. When a hospital or an ASC requires physicians to disclose conflicts of interest, the POD’s physician-owners either fail to inform the hospital or ASC of, or actively conceal through misrepresentations, their ownership interest in the POD.

It is important to note that the factors above create a non-exhaustive list of considerations that should be analyzed on a case-by-case basis, and should not be used as a blueprint for how to structure a lawful POD. Because federal law requires that a physician knowingly or willingly solicit or receive remuneration, intent may be found using the above factors.

The OIG has also indicated that disclosures to patients regarding the physician’s financial interest in a POD may not be sufficient to avoid liability. The OIG states that the following preamble to the safe harbor provision relating to ASC referrals is applicable to PODs:

“…disclosure in and of itself does not provide sufficient assurance against fraud and abuse…[because] disclosure of financial interest is often part of a testimonial, i.e., a reason why the patient should patronize that facility. Thus, often patients are not put on guard against the potential conflict of interest, i.e., the possible effect of financial considerations on the physician’s medical judgment.”12

Conclusion

This appears to be a very risky area for physicians who are in small arrangements that appear exposed under the factors enumerated by the OIG.

1 Physician Owned Distributors (PODs): An Overview of Key Issues and Potential Areas for Congressional Oversight (April 2011).

2 Id.

3 The 1989 Special Fraud Alert was reprinted in the Federal Register in 1994. See 59 FR 65372 (December 19, 1994). The Special Fraud Alert available at: http://oig.hhs.gov/fraud/docs/alertsandbulletins/121994.html.

4 Letter from Vicki Robinson, Chief, Industry Guidance Branch, Department of Health and Human Services, OIG, Response to Request for Guidance Regarding Certain Physician Investments in the Medical Device Industries (Oct. 6, 2006).

5 The 1989 Special Fraud Alert, 59 FR 65372 (December 19, 1994).

6 The 2003 Special Fraud Bulletin (April 2003). http://oig.hhs.gov/fraud/docs/alertsandbulletins/042303SABJointVentures.pdf

7 Id.

8 Id.

9 42 C.F.R. 1128B(b)(1 – 2).

10 Physician Owned Distributors (PODs): An Overview of Key Issues and Potential Areas for Congressional Oversight (April 2011).

11 Special Fraud Alert: Physician-Owned Entities (March 26, 2013). http://oig.hhs.gov/fraud/docs/alertsandbulletins/2013/POD_Special_Fraud_Alert.pdf

12 See 64 Fed. Reg. 63,518, 63,536 (Nov. 19, 1999).

Checker’s Chief Operating Officer Super-Sizing His Jail Time: Theft of Over $300,000 in Sales Taxes

By: Danielle Creech, J.D.

What are you doing to help make sure that your clients are not having monies embezzled by financial officers? Quite likely if this company had had a good checks and balances arrangement with their CPA firm this would have never happened.

Mark Williams, the Chief Operating Officer of Jaxchex, Inc., was arrested on September 5, 2013. He has been charged with the theft of over $300,000 in sales taxes owed to the state of Florida from 2010 to 2011.

Jaxchex, Inc. owns and operates nine Florida Checkers in Clay, Duval, and Flagler counties. According to investigators, Williams failed to send the state any sales taxes collected from these locations during the past two years. If convicted, Williams will face up to 30 years in prison and $10,000 worth of fines plus repayment of tax, interest, and penalty costs.

Theft of sales tax in Florida is an ongoing problem faced by the Florida Department of Revenue. Marshall Stranburg, Executive Director of the Florida Department of Revenue, commented, “It is an honor to serve the vast majority of Florida business who comply with state tax requirements. For those that don’t, it is our job to enforce the law and ensure honest businesses are not placed at a competitive disadvantage by those who ignore the law or intentionally collect and steal taxpayer dollars.”

Under Florida law, sales tax is the property of the state the moment it is collected and is due the beginning of each month. Fla. Stat. Ann. § 212.15 (West). A person that intentionally deprives or defrauds the state by failing to remit these tax funds is criminally punishable. The severity of the crime charged is based on the amount of stolen revenue. See Fla. Stat. Ann.§§ 775.082-775.084 (West). Furthermore, the Florida Department of Revenue is entitled to issue a warrant for the full amount of the taxes due.

It seems that Florida Checkers’ Franchise Chief Operating Officer has successfully super-sized his order of criminal sanctions with a side of fines.

Click here to see the Florida Department of Revenue’s news release.

Dan Sullivan Quotes

Many professionals and entrepreneurs are well aware of entrepreneurial coaching guru Dan Sullivan, who is the founder and leader of the Strategic Coach program.

Dan has some fantastic original thoughts and techniques for developing professional and personal achievement and enjoyment of the experience.

Some of our favorite Dan Sullivan quotes, and brief commentary thereon, are as follows:

- Always make your future brighter than your past.

It is very easy to get caught up in things from the past that may disappoint or be of concern, but what good does that do you? We live to make the most of the now and the future. Exciting and feasible goals, and taking the proper steps to achieve them will bring a much better peace of mind.

Can clients be nudged that way in the conference room? Absolutely!

- The problem is never the problem. The problem is that you don’t know how to think about the problem.

“Problems analysis” is a process that many people are completely unaware of. The “problem” itself is usually not the real issue.

If you take a few minutes to write down the obstacles that have caused the problem, and possible solutions to each obstacle you might be amazed at how quickly the problem can be solved.

Taking this brief written analysis to someone uninvolved with the situation will often provide a quick solution.

Oftentimes the problem is not the problem – the way the person looks at the situation is the problem.

Dan Sullivan also says that “if you can afford to pay for the problem to go away then you don’t have a problem – you just have an expense.”

- Frank Sinatra did not move pianos.

Are you doing what you do best and what you really like to do 80% of the time? If not, how can you increase that ratio?

If you write down 4 things that you love to do and 4 things that you do a lot but should not be doing you can then begin to think through how to change your interactions with others to enhance the enjoyability and productivity of your work and personal life.

Dan Sullivan has also said that “if you like to make messes you will find someone who likes to clean them up.” While modern computers, cell phones and other devices allow us to become a “one-man band”, we have to try to be very cognizant of what we are spending our time and energy on, and whether that is in the best interest of all concerned.

Dan has dozens of great quotes and amazing thoughts. A super book that he has written is called The Dan Sullivan Question. You can buy it on Amazon by clicking here.

Questions and Answers About the Thursday Report

1. Why Thursday?

This was going to be the Tuesday Report but the first edition was not ready until Thursday of the following week.

2. Where do you buy your content from?

Our content is 100% original, unless otherwise indicated.

3. How do you send the Thursday Report?

We use Constant Contact, which is a web-based contact system that gives us feedback on how many of these reports are opened and how many people click on which items. The humor items always get the most clicks, followed by recent developments.

4. How long does it take to produce the Thursday Report each week?

Don’t ask! But 90% of our content either comes directly from a client letter or memorandum, something we are adding to a chapter of one of the books or articles that we publish, or something we enjoy working on.

5. Where does this humor come from?

You call this humor?

6. Why all the Kentucky Fried Chicken jokes?

Why not?

7. What do you like best about the Thursday Report?

The great comments we get and the positive energy that is obviously radiated by this report – please keep those letters, cards and expensive gifts coming.

Phil Rarick’s Client Blog Entries: Moving to Florida: Tips on How to Avoid the Tax Traps

A common over-sight of persons moving to Florida is failing to take their trust. They may have packed their trust and taken it with them, but the trust situs remains in their original state. This is usually a mistake because . . . .

Read More: Moving To Florida: Tips On How To Avoid The Tax Traps

Seminar Spotlight

On Wednesday, October 23, 2013 at 6pm John Goldsmith, Dean Kent and Alan Gassman are hosting a free seminar for CPAs on BP Calculations for CPAs – Tricks and Traps for the Unwary.

Each attendee will receive written materials.

There will be a wine tasting and light hors d’oeuvres.

To attend the seminar please email Janine Gunyan at Janine@gassmanpa.com

Compliments from last night’s Meet & Greet Cocktail Hour with Dr. Srikumar Rao

We had a party last night at the Meet & Greet with Dr. Rao. Cynthia Touchton of Stifel Investment Services wrote us this email today:

Alan, so nice having a chance to speak with you and being able to attend your event! Dr. Rao will change many lives… thanks to you. I can’t wait to begin change with his book and workbook! Again, thank you for sharing Dr. Rao with others.

Warmest Regards

Cynthia V. Touchton

Join us and Dr. Rao this Saturday for an interactive workshop on the subject of ENHANCED EFFECTIVENESS AND ENJOYMENT OF YOUR PROFESSIONAL AND PERSONAL LIFE – 5 TOOLS YOU CAN START USING IMMEDIATELY at the Holiday Inn Express in Clearwater from 1:00pm – 6:00pm, with an optional question and answer session from 7:00pm – 8:00pm.

Please click here to register for this event.

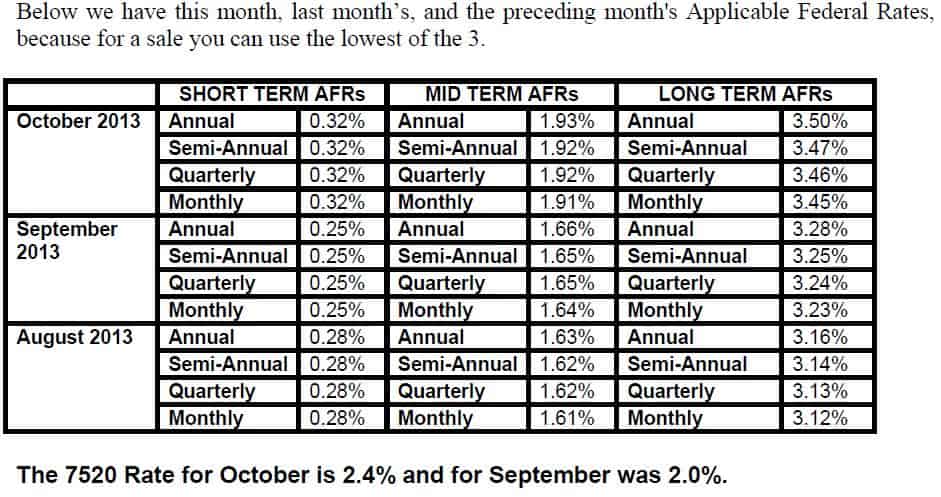

Applicable Federal Rates

Seminars and Webinars

INTERACTIVE HALF-DAY WORKSHOP WITH DR. SRIKUMAR RAO

On Saturday, October 12, 2013 we are co-hosting an interactive workshop with Dr. Srikumar Rao on the subject of ENHANCED EFFECTIVENESS AND ENJOYMENT OF YOUR PROFESSIONAL AND PERSONAL LIFE – 5 TOOLS YOU CAN START USING IMMEDIATELY.

Date: Saturday, October 12, 2013 | 1:00 – 6:00 pm with an optional 7:00 – 8:00 p.m. question and answer session.

Location: Holiday Inn Express, U.S. 19 & Gulf-to-Bay Blvd, Clearwater, Florida

Additional Information: To register for the event please click here.

NOTRE DAME TAX INSTITUTE

Jerry Hesch and Alan Gassman will be speaking on the topic of INTERESTING INTEREST QUESTIONS, PLANNING WITH LOW INTEREST LOANS, PRIVATE ANNUITIES, DEFECTIVE GRANTOR TRUSTS, AND PRIVATE AND COMMERCIAL ANNUITIES

Date: Wednesday, October 16 through Friday, October 18, 2013

Location: Notre Dame College, South Bend, Indiana

Additional Information: Professor Jerry Hesch’s Notre Dame Tax Institute will once again emphasize the importance of income tax planning and implications in addition to estate, estate tax, and related concepts. Also Paul and attorney Barry will be discussing stepped-up basis tools and techniques, including our JEST Trust.

We welcome questions, comments and suggestions for the presentation that we are assisting Jerry in preparing and presenting.

PINELLAS COUNTY ESTATE PLANNING COUNCIL HALF-DAY SEMINAR

Alan Gassman will be speaking on the topic of HOT TOPICS FOR ESTATE PLANNERS, including same sex marriage, estate tax planning software (with all attendees to receive a free beta version of our new software), and other important topics.

Sandra Diamond will speak on the new Florida laws that impact estate planning, amending of decanting existing irrevocable trusts, and other recent Florida law developments.

Barry Flagg will speak on insurance and estate planning.

Sean Casey of Fifth-Third Bank will give an economic update.

Date: Wednesday, October 23, 2013 | 8:00 am – 12:00 p.m. (60 MINUTE PRESENTATION)

Location: TBD

Additional Information: To attend the meeting or to receive information on joining the Council please click here or email agassman@gassmanpa.com

BP CALCULATIONS FOR CPAS: TRICKS & TRAPS SEMINAR WITH JOHN GOLDSMITH AND ALAN GASSAMAN

Date: Wednesday, October 23, 2013 | 6:00 p.m.

Location: Holiday Inn Express, 4750 N. Dale Mabry, Tampa, FL

Additional Information: Each attendee will receive written materials and a wine tasting and light hors d’ oeuvres will be served. To register for the event please email Janine Gunyan at Janine@gassmanpa.com.

2013 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: October 25 – 27, 2013 | Alan Gassman is speaking on Sunday, October 27, 2013

Location: TBD

Additional Information: Please contact agassman@gassmanpa.com for additional information.

DECODING HEALTHCARE SYMPOSIUM IN TAMPA

Alan Gassman will be moderating the Decoding Healthcare Seminar hosted by Fifth Third Bank.

Speakers will include Jason Altmire, Senior Vice President of Public Policy, Government and Community Affairs, Florida Blue, Coretha Rushing, Chief Human Resources Officer, Equifax, Inc., Stephen Mason, CEO Of BayCare Health System and Dr. Jay Wolfson, DrPH, JD, Associate Vice President of USF Health.

We sincerely thank Fifth-Third Bank, President Brian Lamb, Ryan Sloan and the Tampa Bay Business Journal for hosting this important public “town hall” discussion that will hopefully lead to improvement of our healthcare systems in the Tampa Bay area.

Date: Tuesday, October 29, 2013

Location: Grand Hyatt, 2900 Bayport Drive, Tampa, Florida

Additional Information: For more information on this event please email agassman@gassmanpa.com

Bloomberg BNA – Estate, Estate and Gift Tax, and Trust Year-End Planning Webinar

Date: October 30, 2013

Time: 12:30 – 1:30

Location: Online webinar

Additional Information: This new practical webinar from Bloomberg BNA, presented by Alan S. Gassman, Kenneth J. Crotty and Christopher J. Denicolo, concentrates on year-end planning techniques which practitioners need to consider for their clients. This includes techniques that are available to utilize the clients’ lifetime gift exemption, to structure clients’ planning to reduce or eliminate possible income tax exposure, and the potential pitfalls and traps that need to be considered. Practitioners should not miss this program. For more information on this event, please email agassman@gassmanpa.com

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE) HEALTH LAW SYMPOSIUM – AN ALL DAY SEMINAR

Alan Gassman will be speaking on the topic of WHAT HEALTH LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Date: Friday, November 1, 2013 | 9am – 5pm (Mr. Gassman speaks from 1:10 pm until 2:10 p.m.)

Location: Seton Hall Law School, Newark, New Jersey

Additional Information: Seton Hall University in South Orange, New Jersey was founded in 1856, and they have remodeled since. Today, Seton Hall has over 10,000 students in its undergraduate, graduate and law school programs and is in close proximity to several Kentucky Fried Chicken locations.

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE)_SPECIAL 3 HOUR SESSION

Alan Gassman will be speaking on the topic of WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW – A 3 HOUR OVERVIEW BY ALAN S. GASSMAN

Date: Saturday, November 2, 2013

Location: Wilshire Grand Hotel, West Orange, New Jersey | 9am – 12pm

Additional Information: Please tell all of your friends, neighbors and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information please email agassman@gassmanpa.com

SALT LAKE CITY ESTATE PLANNING COUNCIL’S FALL ONE DAY “TAX AND DEDUCTIBILITY OF YOUR SKI TRIP” INSTITUTE

Alan Gassman will be speaking on the topic of PRACTICAL ESTATE PLANNING, WITH A $5.25 MILLION EXEMPTION AMOUNT, ESTATE TAX PROJECTION PLANNING, AND WHY DENTISTS ARE DIFFERENT

Date: Thursday, November 7, 2013

Location: Hilton Downtown Salt Lake City, Utah

Additional Information: Please support this one day annual seminar conveniently located near skiing and tourism opportunities. If you would like to attend this event or receive the materials please email agassman@gassmanpa.com

MEDICAL EDUCATION RESOURCES CONTINUING EDUACTION PRIMARY CARE CONFERENCE

Alan Gassman will be speaking on the topic of LEGAL, TAX AND FINANCIAL BOOT CAMP FOR THE MEDICAL PRACTICE – A SPECIAL TAX, ESTATE PLANNING AND LAW CONFERENCE FOR PRIMARY CARE PHYSICIANS

Date: December 13, 2013 – 12:00 pm – 4:40 pm and December 14, 2013 8:00 am – 3:00 pm

Topics and Meeting Times:

Friday, December 13, 2013

- 12:00 – 1:00 pm – 2013 Tax Changes

- 1:00 – 2:00 pm The 10 Biggest Mistakes that Physicians Make in their Investments and Business Planning

- 2:10 – 3:10 pm Lawsuits 101

- 3:10 – 3:40 pm – Essential Estate Planning

- 3:40 – 4:40 pm – Deductions for Physicians

Saturday, December 14, 2013

- 8:00 – 9:00 am – Medical Practice Financial Management

- 9:00 – 10:00 am – Physician Compensation

- 10:10 – 11:10 am – Asset Entity Planning for Creditor Protection and Buy/Sell Arrangements

- 11:10 – 11:40 am – Tax Structures for Medical Practices

- 12:00 – 1:00 pm – 50 Ways to Leave Your Overhead

- 1:00 – 2:00 pm – Retirement Plan Options for Physicians

- 2:00 – 3:00 pm – Stark Naked or Well Prepared? (Please do not come to this session naked.)

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, Florida

Additional Information: For more information please visit www.MER.org Please note that the program qualifies for continuing education credit for physicians.

THE FLORIDA BAR – REPRESENTING THE PHYSICIAN

Date: Friday, January 17, 2013

Location: The Peabody Hotel, Orlando, Florida

Additional Information: The annual Florida Bar conference entitled Representing the Physician is designed especially for health care, tax, and business lawyers, CPAs and physician office managers and physicians to cover practical legal, medical law, and tax planning matters that affect physicians and physician practices.

This year our 1 day seminar will be held in the Peabody Hotel near Walt Disney World, which is world famous for its daily “march of the ducks” through the lobby (wear easy to clean shoes) and maybe we will have peking duck for dinner.

A dinner for the Executive Committee of the Health Law Section of The Florida Bar and our speakers will be held on Thursday, January 16, 2013, whether formally or informally. Anyone who would like to attend (dutch treat or bring wooden shoes) will be welcomed. Your tax deductible hotel room to start a fantastic week near Disney, Universal, Sea World and most importantly Gatorland can include a room at the fantastic Peabody Hotel for a discounted rate per night, single occupancy.

1st ANNUAL ESTATE PLANNER’S DAY AT AVE MARIA SCHOOL OF LAW

Speakers: Speakers will include Professor Jerry Hesch, Jonathan Gopman, Alan Gassman and others.

Date: April 25, 2014

Location: Ave Maria School of Law, Naples, Florida

Sponsors: Ave Maria School of Law, Collier County Estate Planning Council and more to be announced.

Additional Information: For more information on this event please contact agassman@gassmanpa.com.

NOTABLE SEMINARS PRESENTED BY OTHERS:

48th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING SEMINAR

Date: January 13 – 17, 2014

Location: Orlando World Center Marriott, Orlando, Florida

Sponsor: University of Miami School of Law

Additional Information: For more information please visit: http://www.law.miami.edu/heckerling/

16th ANNUAL ALL CHILDREN’S HOSPITAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

Date: Wednesday, February 12, 2014

Location: All Children’s Hospital Education and Conference Center, St. Petersburg, Florida with remote location live interactive viewings in Tampa, Sarasota, New Port Richey, Lakeland, and Bangkok, Thailand

Sponsor: All Children’s Hospital

THE UNIVERSITY OF FLORIDA TAX INSTITUTE

Date: February 19 – 21, 2014

Location: Grand Hyatt, Tampa, Florida

Sponsor: UF Law alumni and UF Graduate Tax Program

Additional Information: Here is what UF is saying about the program on its website: “The UF Tax Institute will provide tax practitioners and other leading tax, business and estate planning professionals with a program that covers the most current issues and planning ideas with a practical, informative, state-of-the-art approach. The Institute’s schedule will devote separate days or half days to individual income tax issues, entity tax issues and estate planning issues. Speakers and presentations will be announced as the program date nears to ensure coverage of the most timely and significant topics. UF Law alumni have formed the Florida Tax Education Foundation, Inc., a nonprofit corporation, to organize the conference.”

Thank you to our law clerks that assisted us in preparing this report.