The Thursday Report – 1.5.17 – Planning for Old McDonald’s Farm

Re: Planning for Old McDonald’s Farm

Old McDonald Had a Farm – But How Did He Title It?

Can I Use my IRA to Start a Business? Maybe but Don’t Try This at Home

The Best Ways to Ruin Tenancy by the Entireties Creditor Protection

From the Alan Gassman Channel at InterActive Legal – Language to Limit Monthly Distributions to Beneficiaries Below Retirement Age

30 “Must Ask” Questions Before You Form Any Partnerships by David Finkel

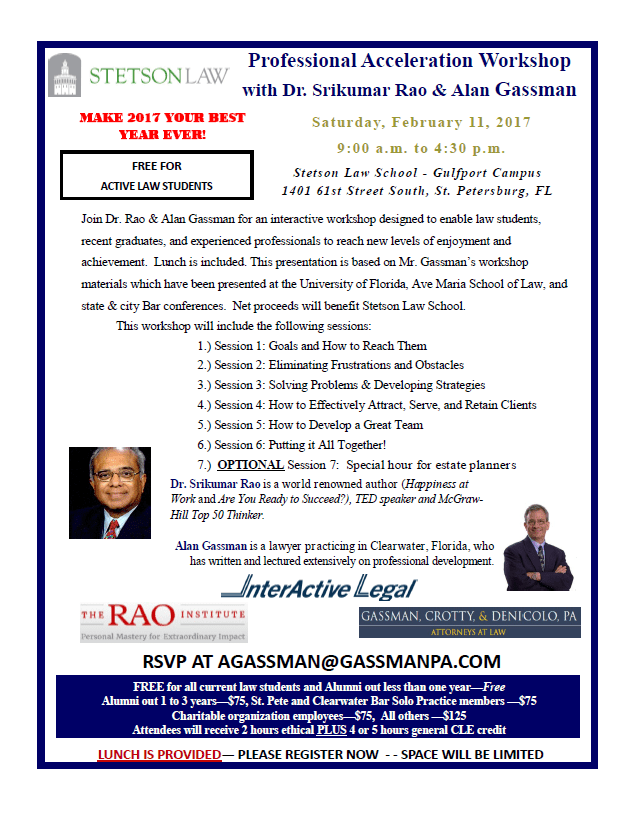

Seminar Spotlight: Professional Acceleration Workshop with Dr. Srikumar Rao & Alan Gassman

Richard Connolly’s World – The IRS Leaves a Lump of Coal for Syndicated Conservation Easements in Notice 2017-10

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in

making a contribution as a guest writer, please email Alan at agassman@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

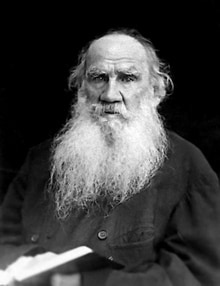

Quote of the Week

“Everybody thinks of changing humanity, and nobody thinks of changing himself.”

– Leo Tolstoy

Leo Tolstoy was a Russian writer most notably known for his masterpieces, “War and Peace” and “Anna Karenina.” He was born into a family of old Russian nobility, and as a young adult attended Kazan University where he studied Oriental languages. Later, he switched his focus to law, but ultimately dropped out and returned to his family’s estate in Yasnaya Polyana. In 1851, after incurring a significant amount of gambling debt, Tolstoy joined the Russian army and fought in the Crimean War of 1853. Four years later, he left the army to travel through Europe and upon his return to Yasnaya Polyana founded a school for young peasant children. He remained in Yasnaya Polyana with his wife and thirteen children until he died in 1910 at the age of 82. In his later years, Tolstoy envisioned himself more as a spiritual/moral leader rather than a writer. Many believe that his theory of non-violent resistance influenced other notable figures such as Mahatma Gandhi and Martin Luther King, Jr.

Old McDonald Had a Farm – But How Did He Title It?

by Alan Gassman and Seaver Brown

The song, “Old McDonald Had a Farm” was officially published in 1917, but the earliest recorded instance of this style of song is from a 1720 opera called The Kingdom of the Birds, at that time most farms were titled in the name of either a man, who was typically a husband and father, or as tenants by the entireties between a man and a wife, because women were not permitted to own property.

My how things have changed!

How would Old McDonald own his farm today?

This is a good question in Florida, where limited liability, homestead and agricultural tax advantages, and federal estate tax all have a big impact on how a farm is owned.

This is further influenced by the significant flux that presently exists among estate planners, in that many are holding onto a “two revocable trust” estate plan as applied “back in the day” when most “millionaire” clients would need separate revocable trusts to assure that a credit shelter trust could be formed on the first death to facilitate avoidance of estate tax on the second death. On the death of the surviving spouse, the Golden Arches could then be melted into bullion and sold in Switzerland.

This normal plan was important to put into place so that the $600,000 (for years 1987 – 1997) unified credit of the first dying spouse could be used. We certainly came a long way to have a $5,000,000 per spouse exemption in 2010, and portability, which allows a surviving spouse to have use of the estate tax exemption that is not used on the first dying spouse’s death, under certain less-than-ideal (but better than nothing) circumstances.

Setting aside that Old McDonald and his possibly younger Wife, Leggs McMuffin McDonald, known as “Leggs” for short, would have had separate revocable trusts in 2010 when the estate tax exemption was $5,000,000 per person, if the farm is presently worth $2,000,000 and the McDonalds are in their mid to late 70’s (in 1917, the average life expectancy for a male in the United States was reportedly 49 years, so old McDonald might have been 40 years old and lucky to be alive). Now the average life expectancy for a male in the United States is 79 years, so Old McDonald might be 70 years old and own a McHarley.

If Mr. and Mrs. McDonald want to reduce the income taxes that their children (Big Mac- and Frilly Fries- McDonald) would pay when they sell the farm to have enough money to put the surviving spouse into a high quality ACLF, then Old McDonald and Leggs should consider a JEST (Joint Exempt Step Up Trust) or updating their separate revocable trusts, so that the first dying spouse will have a power to appoint trust assets to creditors of his or her estate in order to receive a new stepped up income tax basis on the first death. This can ease the pain of losing the first spouse and being lonely, but with less tax liability and more flexibility to go find another spouse such as the Hamburglar, (which Professor Donaldson of the University of Georgia refers to as an “upgrade”) to help the surviving spouse live longer and have a happier remaining lifetime.

Their lawyer, Ronette McPlanner, can amend and restate the two existing revocable trusts to constitute two separate subtrusts under a JEST, so that nothing has to be retitled.

Before the separate revocable trusts were amended and restated, the death of either spouse would have left the revocable trust of the surviving spouse “flapping in the wind” if the surviving spouse had potential incompetency, undue influence, or general lack of intelligence and ability to make appropriate decisions.

With the JEST Trust (or a well drafted separate revocable trust of a surviving spouse, which can provide equivalent language), all of the assets held in trust may be subject to protective provisions which can require the surviving spouse to select a qualified co-trustee from choices provided in the Trust Agreement, and to operate the trust in a conservative and conventional manner for the surviving spouse, descendants of the couple, and such other persons and purposes as the Trust Agreement may permit.

This could include providing limited but substantial support for a surviving spouse who contributes meaningfully to the welfare of the surviving spouse (or is simply like an Egg McMuffin hot off the griddle).

If the farm is Florida homestead, which can be up to 160 acres outside of the city limits for creditor protection purposes, and can be used commercially and protected (unlike property within the city limits, which is subject to a 1/2 acre limitation and will not be protected unless primarily used as a residence), the personal ownership required to qualify for immunity from creditors of Mr. and Mrs. McDonald requires personal ownership, or ownership under a revocable trust.

If Mr. and Mrs. McDonald placed the property under a limited liability company to limit their personal liability for activities of the farm, then they will not qualify for the homestead creditor protection, but if the LLC is owned by them jointly as tenants by the entireties, a creditor of one of them will not be able to reach the tenancy by the entireties ownership unless the creditor has a judgment against both spouses, and ownership interests in LLCs can also be owned by trusts for children, asset protection trusts sitused in other jurisdictions, and can be situated as multiple member entities that a judgment creditor would normally not be able to reach into even if there was outright part-ownership by a debtor who has a judgment against him or her.

Mr. and Mrs. McDonald could maintain their state law homestead exemption, which may save $1,000 a year in property taxes in addition to limiting the value of the property under the “3% annual increase cap” (which is in reality the lesser of 3% or the Consumer Price Index each year) by leasing the property back from the LLC on a 98-year or longer lease, which might expire upon the terms set forth therein.

The Greenbelt Exemption would also need to be considered with respect to this planning.[1]

So Mr. and Mrs. McDonald may end up with a JEST holding majority ownership of an LLC, which would in turn own the farm and lease it back to Mr. and Mrs. McDonald for residential use. The other portion of the LLC may be owned by a trust for their children, Mac and Cheese that would be disregarded for income tax purposes and held for the future education, and maintenance of the descendants of Old McDonald.

In next week’s Thursday Report we will discuss some issues Old McDonald may face when seeking to sell medical marijuana from the McMunchie Pharmacy. The Department of Health has started drafting the rules, however, those individuals who will be eligible to use the plant continues to remain hazy.

****************************

[1] There is no reference to the term “Greenbelt Exemption” in the Florida Statutes, but the term refers to lands receiving an Agricultural Classification by the Property Appraisers officer as defined in Florida Statute §193.461. Florida Statute §193.461(3)(b) provides that: “Subject to the restrictions specified in this section, only lands that are used primarily for bona fide agricultural purposes shall be classified agricultural. The term ‘bona fide agricultural purposes’ means good faith commercial agricultural use of the land.” Factors such as: the length of time the land has been used for commercial agriculture, whether the use has been continuous, the purchase price paid, amount of acreage used for agriculture, care for the land, and whether the land is under lease, are all taken into consideration when determining whether the use is for bona fide agricultural purposes.

Can I Use my IRA to Start a Business? Maybe But Don’t Try This at Home

by Brandon Ketron and Alan Gassman

One potential way for an entrepreneur to fund a new business is with his or her retirement plan assets. This is known as a Rollover as Business Start Up Plan (ROBS).

A typical ROBS plan involves forming a new C-Corporation and adopting a simple 401(k) plan. The entrepreneur can then roll over his or her IRA account into the new 401(k) plan. The 401(k) plan then purchases stock in the new corporation. This results in the funding of a new corporation with the entrepreneur’s former IRA account.1

While ROBS Plans do not violate the prohibited transaction rules per se, the IRS heavily scrutinizes these plans to ensure their compliance with these complex rules. If a Plan Participant engages in a prohibited transaction, the plan will be disqualified and result in a deemed taxable distribution of the entire account balance which will also be subject to the 10% excise tax if the Plan Participant is under the age of 59 ½.

It is important to note that while a ROBS plan may satisfy the retirement plan rules initially, any failure to comply with the rules during the life of the plan will also result in a deemed distribution of the entire retirement plan.

The following are some potential traps for the unwary involved with establishing and maintaining a ROBS Plan.

- Personal Guarantees of Corporate Loans

In James E. Theissen et ux. v. Comm’r and Peek v. Comm’r, the Tax Court held that a personal guarantee of a corporate loan when the Plan Owner’s IRA owned stock in the corporation was a prohibited transaction. As a result, the taxpayers’ IRAs ceased to be IRAs as of the first day of the taxable year in which the guarantee occurred, and were deemed to have received distributions on that first day of the entire fair market value of their IRA assets.2

These cases involved IRA’s and not 401(k)s or ESOPs. It is unclear whether the same reasoning would apply to a ROBS Plan, but entrepreneurs should avoid personal guarantees of loans to be safe.

- Payment of reasonable compensation to Entrepreneur

Unlike a self-directed IRA, a 401(k) or ESOP may pay reasonable compensation to the owner of the Plan, provided that the compensation is reasonable.

In Ellis, et ux. v. Comm’r, the IRA owner purchased a used-car dealership inside of his IRA, and ran the day-to-day operations of the business. The dealership paid the IRA owner reasonable compensation for his role as the manager of the business. The Tax Court held that the payment of compensation to the IRA owner was a prohibited transaction and resulted in the indirect use of plan assets for the benefit of the individual. Accordingly, the IRA was deemed distributed to the owner and the owner was immediately liable for taxes on the entire value plus the 10% excise tax and other applicable penalties and interest.3

Natalie Choate points out that this is particularly problematic for IRA-owned businesses. She states that “if your IRA-owned business cannot pay you compensation, you really cannot run a small business inside your IRA. If you work with no compensation, there is a risk of an “assignment of income problem.” 4

Had Mr. Ellis rolled over his IRA into a 401(k) using a ROBS Plan, Mr. Ellis may have been able to avoid the prohibited transaction rules. The ERISA rules do not prevent an employee from taking a reasonable salary from a 401(k) owned business, however the IRS may argue that the immediate payment of compensation to the Entrepreneur results in the indirect use of plan assets for the benefit of the individual. Entrepreneurs may consider only taking a salary from the profits of the company in order to avoid this characterization.

- Providing Direct or Indirect Services to an IRA

Leimberg and Jones caution that providing any kind of service to an IRA-owned business may constitute furnishing of services to the IRA by a disqualified person.5 This rule does not apply to a 401(k) or ESOP, therefore it is important to rollover the funds into an employer sponsored plan prior to providing any services to the company.

- Lack of notification of plan existence

If current or future employees are not notified of the existence of an ESOP or 401(k) plan, then it would cause a violation of the rule that a retirement plan must “be a definite, written program communicated to employees.”6

If employees are not notified the Plan will be disqualified resulting in a taxable distribution of the entire Plan.

The IRS has cautioned against Entrepreneurs using independent contractors to avoid offering stock ownership to employees.7 If an independent contractor is reclassified as an employee this could disqualify the entire Plan in addition to the other problems caused by this reclassification.

- Plan assets used for personal expenses

A plan was disqualified when a corporation bought an RV for the business owner using some of the money it received in exchange for the stock of the corporation in a ROBS plan.8 The use of corporate money for personal expenses also presents other problems, so appropriate corporate formalities must be followed.

- Stock sale must be a transaction for adequate consideration

ERISA exempts a plan’s acquisition of employer stock from the prohibited transaction rules only if the purchase was for adequate consideration.9 Therefore, a valuation of the business may need to be completed to justify that the stock sale as part of the ROBS plan was for adequate consideration.10

- Improper use of funds to pay promoter fees

The IRS stated that when a corporation uses part of the cash it raised from the stock sale to pay the fee of a promoter it may result in the indirect use of plan assets in a prohibited transaction.11

- Discrimination in favor of highly compensated employees

Natalie Choate states that this is the IRS’s best argument, but that it is only useful against ROBS plans that have employees other than the plan owner and that do not in fact offer employer stock to rank and file employees.12

- Failure to issues a Form 1099-R when the assets are rolled over into the ROBS plan

- Failure to file 5500’s

In conclusion, the IRS heavily scrutinizes these types of arrangements, and has issued literature as to the technical reasons why they might be seen as problematic. The IRS has not issued any specific adverse rulings related to ROBS plans, but do target ROBS plans for other violations of retirement account rules. Entrepreneurs should consult with the appropriate advisors in order to comply with the complex rules involved with a ROBS Plan. If a ROBS plan is undertaken it will be important to make sure that all your i’s are dotted and your t’s crossed due to the fact that one mistake will result in a termination and taxable distribution of the entire retirement account.

******************

1 For a more detailed discussion see Choate, LISI Employee Benefits and Retirement Planning Newslettter # 471.

2 For further discussion see Leimberg and Jones, LISI Employee Benefits and Retirement Planning Newsletter #654 (April 4, 2016)

3 Id.

4 See Choate, What Goes in Your IRA? None of Your Small Business! (September 11, 2015)

5 Leimberg and Jones, LISI Employee Benefits and Retirement Planning Newsletter #654 (April 4, 2016)

6 See Choate, LISI Employee Benefits and Retirement Planning Newslettter # 471

7 Michael D. Julianelle Guidelines Regarding Rollovers as Business Startups

8 Id.

9 IRC § 4975(d)(13)

10 Michael D. Julianelle Guidelines Regarding Rollovers as Business Startups

11 Id.

12 Id.

The Best Ways to Ruin Tenancy by the Entireties Creditor Protection

by Alan Gassman

Florida is one of the very few states that recognizes and protects tenancy by the entireties property from creditors of a spouse.

We cover this topic extensively in the book entitled “Gassman Markham on Florida and Federal Asset Protection Law”, but a short list of the common culprits for loss of tenancy by the entireties protection is as follows:

- Incorrectly titling an account by checking the box for right of survivorship instead of tenancy by the entireties (“TBE”) when TBE is offered.

- Attempting to fix or retitle an existing account, because TBE only works if properly established from inception of the account.

- Having a creditor that is owed monies by both spouses.

- Owning LLC or corporate interests where agreements are inconsistent with the six (6) TBE unities. The six (6) unities of TBE are: (1) unity of possession, (2) unity of interest, (3) unity of title, (4) unity of time, (5) survivorship, and (6) unity of marrige. A qualified lawyer should carefully review all agreements because of this.

- When one spouse moves away from Florida, files for a divorce, or dies.

- When there is joint debt, other than on the homestead, that may cause the TBE assets to be drawn into the bankruptcy of a spouse who ends up in bankruptcy.

- By titling assets otherwise unprotected into TBE where a creditor problem already exists so that the creditor may set the transfer aside and get a judgment against the recipient spouse under Florida Statute §726.

Because of these issues, well advised couples will often establish an LLC owned in whole or in part as TBE to, in turn, own assets and investments that might otherwise be candidates for the exceptions described above.

From the Alan Gassman Channel at InterActive Legal – Language to Limit Monthly Distributions to Beneficiaries Below Retirement Age

We often ask clients who have large estates whether they would like to limit what a particular child would receive monthly for support, in order to have the child, and the child’s spouse and descendants, motivated to work and support themselves, so as not to interrupt or do harm to their “life journey.”

The following language, from the Alan Gassman Channel materials at InterActive Legal may be considered:

(e) Generation Skipping Trust Provisions. The Trustee shall divide the Generation Skipping Trust, which shall consist of the property remaining in the Family Trust upon the death of my spouse if my spouse survives me, or the amount passing to the GST Share under subsection (b) upon my death if my spouse does not survive me, into separate equal shares for each of my children, per stirpes, and each share shall be held as a separate trust. The descendant for whom a separate trust is established shall be the Primary Beneficiary of such separate trust for the purposes of this subsection, and each separate trust shall be held, managed and distributed as follows:

(1) Income and Principal. During the lifetime of the Primary Beneficiary, the Trustee may pay to or for the benefit of the Primary Beneficiary and/or such Beneficiary’s descendants, at any time and from time to time, such sums from income and/or principal as are reasonably necessary for their health, education, maintenance and support, provided that no distribution to or for the benefit of any descendant of the Primary Beneficiary shall be in satisfaction of any legal obligation, including obligation of support of any Trustee or any beneficiary hereunder.

Notwithstanding the preceding sentence, it is my intention that each of my children who have been educated and are functioning as independent and useful members of society shall receive the following amounts, unless more is justified by extraordinary circumstances, and as adjusted for inflation that occurs after January 1, 2018, net of taxes that may be incurred as the result of such distributions, and in addition to funds needed to provide appropriate education and conventional learning and personal growth related extracurricular activities for my descendants;

$7,000 per month until such child reaches the age of 50.

$8,000 per month when such child is between the ages of 50 and 54.

$9,000 per month when such child is between the ages of 55 and 57.

$10,000 per month for life after such child has reached the age of 57.

If such child has received a graduate degree from an accredited state university or a well respected private university approved by a regional accreditation organization recognized by the United States Department of Education and the Council for Higher Education Accreditation and is working full-time, then the payment specified above shall be increased by $1,500 per month.

For purposes of the above, a descendant of mine who is a “homemaker and parent” for other descendants of mine who are up to age 16 may be considered to be working full-time, depending upon circumstances, the use of time, and dedication, and might be best advised to work part-time, while being a dedicated parent, in order to receive the above benefits.

It is my intention that the Trustee distribute such amounts as necessary so that each child of mine shall receive the amounts described above, unless otherwise herein provided, or unless the Trustee determines that such payments will be subject to a creditor of such beneficiary, or to possible misuse, loss or mismanagement due to undue influence or other circumstances that might exist. In the event that the Trustee determines that the beneficiary has a creditor, divorce, or other situation, or if such beneficiary is subject to undue influence or that other circumstances exist which cause possible misuse, loss or mismanagement of the trust assets, then there shall be no mandatory distribution of trust income or principal for the benefit of the beneficiary from this Trust, and any distributions from this Trust for the benefit of such beneficiary shall be made by the Trustee in the Trustee’s sole discretion for such beneficiary’s health, education, maintenance and support as described above.

Notwithstanding the above, in the event that the Trustee determines that the Primary Beneficiary and/or one or more of the Primary Beneficiary’s descendants has an addiction or special needs situation, then the distribution standard described above shall not apply for such beneficiary and the distribution standard described in Section 5.02 below shall apply for any beneficiary having a special needs situation as determined by the Trustee and the distribution standard described in Section 5.03 shall apply for any beneficiary having an addiction situation as determined by the Trustee. Any distributions shall come first from income and then from principal. Any undistributed income shall be added to principal. The Trustee shall exhaust the remaining property in any separate share of the Children’s Trust held for the benefit of the Primary Beneficiary before making any distribution to such Primary Beneficiary from his or her separate share of this Generation Skipping Trust. In lieu of making cash distributions to or for the benefit of the beneficiaries, the Trustee is specifically authorized to purchase assets (including one or more residences) and hold such assets in trust for the use and benefit of any beneficiary of such separate trust for his or her health education, maintenance or support. The Trustee is further authorized to make loans to a beneficiary and to purchase assets to be used by a beneficiary as a home, for establishing a trade or business, provided that any such expenditure or use must be related to the beneficiary’s health, education, maintenance or support, and may not be in satisfaction of any legal obligation, including support obligation, of any beneficiary or Trustee.

30 “Must Ask” Questions Before You Form Any Partnerships

by David Finkel

David Finkel is the Wall Street Journal bestselling author of SCALE: Seven Proven Principles to Grow Your Business and Get Your Life Back, which can be viewed by clicking here. As the CEO of Maui Mastermind, he has worked with 100,000+ businesses coaching clients and community members to buy, build, and sell over $5 billion worth of businesses.

Are you thinking of bringing in a partner? Or formalizing a strategic relationship?

Over the years I’ve moved into and out of literally dozens of joint ventures and partnerships. And over this time these partnerships and joint ventures have created millions of dollars of market value. But with any partnership, be it long term or a one-off, the stakes are high.

Here are the most important questions I urge you to ask before you finalize any partnership arrangement.

Follow David on Twitter: @DavidFinkel.

Seminar Spotlight:

For more information about this webinar presentation, please email Alan Gassman at agassman@gassmanpa.com.

Professional Acceleration Workshop with Dr. Srikumar Rao & Alan Gassman

Richard Connolly’s World

The IRS Leaves a Lump of Coal for Syndicated Conservation Easements in Notice 2017-10

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the article of interest is “The IRS Leaves a Lump of Coal for Syndicated Conservation Easements in Notice 2017-10” by Jay Adkisson. This article was featured on Forbes.com on December 27, 2016.

Richard’s description is as follows:

This tax shelter season, the IRS left a lump of coal in the sock of the folks who have used (or were planning to use) pre-packaged conservation easements to lower their taxes. The IRS did so by making those deals a “listed transaction” (a/k/a “presumed tax shelter”) in Notice 2017-10.

By waiting until the very end of the year to issue this guidance, the IRS also acts as an mischievous Santa who will send promoters and clients scrambling to unwind these deals for tax year 2016, and of course it is probably too late for the clients to look for some other tax shelter this year.

Please click here to read this article in its entirety.

Humor! (Or Lack Thereof!)

Sign Sayings of the Week

Win a free book! See the squirrel below

**********************************************************

The Thursday Report’s New Year’s Resolutions

- To not waste time reading The Thursday Report

- To not waste time pledging not to waste time reading The Thursday Report

- To travel forward in time as opposed to travelling back in time to relive reading past editions of The Thursday Report

- To try and find some humor for a change

- To find change for a dollar to pay our writers

**********************************************************

Upcoming Seminars and Webinars

Calendar of Events

LIVE ORLANDO PRESENTATION:

51ST ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING EVENTS

Alan and Jerry Hesch will demonstrate EstateView, an estate tax projection software at InterActive Legal’s display area on Tuesday, January 10 at 8:40 AM, and tell jokes about draft numbers and Triumphs.

Click here for a video of what you can expect at the InterActive Legal exhibit booth, including experts, product demonstrations, and the chance to win an Amazon Echo!

When visiting us at our booth give a business card to each Tina, Maribeth, and Christina and you will receive a free book from us. Their scheduled appearances are as follows:

- Monday: Tina from 7 a.m. – 7 p.m.

- Tuesday: Tina from 7 a.m. – 6 p.m.

- Wednesday: Christina from 7 a.m. – 6 p.m.

- Thursday: Maribeth from 7 a.m. – 6 p.m.

- Friday: Maribeth from 7 a.m. – Closing

The Alan Gassman Channel and EstateView Software will be profiled and demonstrated at the InterActive Legal station Monday through Thursday during conference hours. Please feel free to contact Alan at agassman@gassmanpa.com for an appointment and personal tour of how EstateView works free of charge to those who purchase InterActive products at the Heckerling Institute, or shortly thereafter. All attendees will receive free buckets of fried chicken.

Alan’s Bloomberg BNA moderated webinar series will present live questions and answer opportunities at the Bloomberg BNA booth. Stay tuned for more details!

The schedule for all InterActive Legal speakers and experts during Heckerling is provided below:

Tuesday, January 10th at 10:40 a.m. – Natalie Choate at the Interactive Legal booth.

Tuesday, January 10th at 3:40 p.m. – Alan will introduce Stacy Eastland to discuss What he Can’t Say in Public about Freeze Techniques at the Bloomberg BNA booth.

Tuesday, January 10th at 3:40 p.m. – Todd Angkatavanich and David Stein at the Interactive Legal booth.

Wednesday, January 11th at 8:40 a.m. – Michael L.Graham at the Interactive Legal booth.

Wednesday, January 11th at 10:40 a.m. – Letha McDowell, CELA – Director of Legal Strategy at the Interactive Legal booth.

Wednesday, January 11th at 3:30 p.m. – Howard Zaritsky at the Interactive Legal booth.

Wednesday, January 11th at 3:40 p.m. – Alan, Ken Crotty and Christopher Denicolo will introduce JEST Trusts and Creditor Protection Planning at the Bloomberg BNA booth.

Thursday, January 12th at 8:40 a.m. – Martin Shenkman at the Interactive Legal booth.

Thursday, January 12th at 10:40 a.m. – Gideon Rothschild at the Interactive Legal booth.

Thursday, January 12th at 3:30 p.m. – Jonthan Blattmachr at the Interactive Legal booth.

Thursday, January 12th at 3:30 p.m. – Alan and Jerry Hesch will discuss the new Bloomberg BNA Webinar series at the Bloomberg BNA booth.

Date: January 9th – January 13th, 2017

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE INTERACTIVE NEW YEAR RESOLUTION ENFORCEMENT WORKSHOP:

Do you need a positive jump start for 2017? Think about making a date with Srikumar Rao’s book Are You Ready to Succeed?

Sunday, February 12, 2017

The Enjoyment Solution: How to Replace Worry and Stress with Clear Direction, Confidence, and In the Groove Life Experience at Work and at Home with Dr. Srikumar Rao

This 6-hour workshop will be a private event held by the Rao Institute at the request of Alan and friends. This will be provided for a limited number of attendees as a cost of $475 per person. Please RSVP now while spaces are available!

See Dr. Rao’s YouTube TED Talk, and you will see why he is so well-regarded and sought out worldwide as a presenter, coach, and author. Meet this gentle and brilliant man who has changed so many lives up close and personal!

You can see his best-selling books, Are You Ready to Succeed? and Happiness at Work on Amazon by clicking here. You can also see his TED Talk that has been viewed by well over 1 million people by clicking here.

Sarah Palin said that she would not leave Nome without them!

Date: Sunday, February 12, 2017

Location: Stetson Law School, Gulfport Campus | 1401 61st Street South, St. Petersburg, FL, 33707

Cost: $475 per person, or three for $1425

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan will present a live webinar on FDIC Insurance with Taylor Binder.

Date: February 14, 2016 | 12:30 PM (Eastern)

Additional Information: For more information, please contact Alan at agassman@gassmanpa.com.

**********************************************************

LIVE SAN DIEGO PRESENTATION:

Alan will present ASSET PROTECTION AND ESTATE PLANNING FOR SAVVY BUSINESS OWNERS AND PROFESSIONALS at the 2017 Maui Mastermind Freedom Formula Workshop. You’ll get a “charge” out of this, whether you are a San Diego fan or not. For Maui Mastermind members only.

Date: Friday, January 27, 2017 – Sunday, January 29th, 2017 | Time TBD

Location: Hilton San Diego Mission Valley | 901 Camino del Rio South, San Diego, CA, 92108

Additional Information: For more information, please contact Alan at agassman@gassmanpa.com.

**********************************************************

LIVE TAMPA PRESENTATION:

ANNUAL ALEXANDER L. PASKAY MEMORIAL BANKRUPTCY SEMINAR

Alan, Mike Markham and others will speak on a panel at the American Bankruptcy Institute’s annual Alexander L. Paskay Memorial Bankruptcy Seminar on the topic of THE ETHICS OF ASSET PROTECTION.

Bring your copy of Gassman and Markham on Florida and Federal Asset Protection Law for free autographs.

Date: Thursday, February 2, 2017 | Time TBD

Location: The Embassy Suites Tampa Downtown Convention Center | 513 S. Florida Avenue, Tampa, FL, 33602

Additional Information: If you are interested in registering for this presentation, please contact Alan at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

REPRESENTING THE PHYSICIAN: IT IS HARDER THAN IT LOOKS

Alan and Lester Perling will give a panel discussion talk on Structuring Medical Practices and Related Entities for Tax, Creditor Insulation, and Regulatory Compliance Purposes

Other speakers at this event include William Eck, Susan Thomas, Melissa Mora, Sachi Mankodi, Kimberly Brandt, Al Gomez, Kathleen Premo, and Radha Bachman.

Other topics at this event include:

- The Brave New World of Medicare Physician Compensation Under MACRA and Beyond

- Office of Civil Rights HIPAA Audits – Preparing Your Clients and Yourself

- The Physician’s Role Under EMTALA and the Florida Access to Emergency Services Act

- Medical Marijuana in Florida – The Highs and Lows of its Regulation

- The Post-Election View from the Hill

- What the Doctor’s Lawyer and the Doctor Need to Know About Bankruptcy and How Creditors Approach Health Industry Related Situations

- Medicare and Other Risk Contracts

- Medical Entities and Rules You Must Know About

Date: Friday, February 3, 2017 | Alan speaks at 8:30 AM and 4:10 PM.

Location: Rosen Centre Hotel | 9840 International Drive, Orlando, FL, 32819

Additional Information: If you are interested in registering for this presentation, please contact Alan at agassman@gassmanpa.com.

**********************************************************

LIVE DISNEY WORLD PRESENTATION (HOW MICKEY MOUSE CAN YOU GET?):

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan will be speaking at the Medical Education Resources (MER) Internal Medicine and Country Bear Jamboree for primary care physicians and other characters. We thank MER for this wonderful opportunity and Walt Disney for having paved all of Osceola County. His topics will include:

- The 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning

- Lawsuits 101

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: Wednesday, March 15, 2017 and Thursday, March 16, 2017

Location: Walt Disney World BoardWalk Inn | 2101 Epcot Resorts Blvd, Kissimmee, FL 34747

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE ESTATE PLANNING DISCUSSION AT FLORIDA STATE UNIVERSITY SCHOOL OF LAW

Alan will appear via Skype with professors Steven Hogan and Bob Pierce to give his views, by interview style, for their estate planning course at Florida State University School of Law on Thursday, March 23, 2017.

Date: Thursday, March 23, 2017 | 1:15 – 3:00 p.m. (EASTERN)

Location: Florida State University School of Law

Additional Information: To receive a live call in code or videotape of this presentation, which we will qualify for continuing legal education credit, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE ESTATE PLANNING COUNCIL OF NORTHEAST FLORIDA PRESENTATION:

Alan will be speaking for the Estate Planning Council of Northeast Florida on March 20, 2018 on the topic of DYNAMIC PLANNING STRATEGIES FOR THE SUCCESSFUL CLIENT. This will be Alan’s third visit to Pensacola, and a welcome treat. Watch this space, as more details will be forthcoming!

Date: Tuesday, March 20, 2018

Location: To Be Determined

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

4th ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Please put Friday, April 28th, 2017 on your calendar to enjoy the 4th Annual Ave Maria School of Law Estate Planning Conference and the weekend that follows in Naples.

Alan will be speaking at this conference on the topic of THE ETHICS OF AVOIDING TRUSTS AND ESTATE LITIGATION.

Alan will also appear on a panel of speakers with Jerry Hesch and Lester Law on the topic of TAX PLANNING WITH LIFE INSURANCE PRODUCTS, RECENT LITIGATIONS, AND OTHER HOT TOPICS.

Other speakers and topics include the following:

- Stacy Eastland – So Much to Choose From and So Little Time: A Comparison of the Best Freeze Planning Techniques

- Jonathan Gopman – Tax Issues and Tax Compliance for Asset Protection Trusts

- Jerry Hesch – Innovative Business Succession Techniques, and is appearing on the panel Tax Planning with Life Insurance Products, Recent Litigations, and Other Hot Topics

Date: Friday, April 28, 2017

Location: The Ritz-Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE PRESENTATION:

ESTATE PLANNING COUNCIL OF NORTHEAST FLORIDA

Please put Tuesday, September 19, 2017 on your calendar to enjoy a dinner conference for the Estate Planning Council of Northeast Florida.

Date: Tuesday, September 19, 2017

Location: TBA

Save the Dates!

LIVE ST. PETERSBURG PRESENTATION:

2017 ALL CHILDREN’S HOSPITAL FOUNDATION SEMINAR

Please put Thursday, February 9th, 2017 and on your calendar to enjoy the 19th Annual All Children’s Hospital Estate, Tax, Legal, and Financial Planning Seminar.

Speakers will include Turney Berry, Paul Lee, Sanford Schlesinger, and Jerry Hesch.

Date: Thursday, February 9th, 2017

Location: Johns Hopkins All Children’s Hospital Education and Conference Center, St. Petersburg, FL

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE LAS VEGAS PRESENTATION:

AICPA ADVANCED PERSONAL FINANCIAL PLANNING CONFERENCE

Alan will be speaking at the Advanced Personal Financial Planning Conference, sponsored by The American Institute of CPAs. His tentative topic for this event is LIFE INSURANCE TIPS FOR THE FINANCIAL PLANNING PROFESSIONAL.

This conference is part of the AICPA ENGAGE event, which brings together five well-known AICPA conferences with the Association for Accounting Marketing Summit for one, four-day event. The conferences included in ENGAGE are Advanced Personal Financial Planning, Advanced Estate Planning, Tax Strategies for the High-Income Individual, the Practitioners Symposium/TECH+ Conference, the National Advanced Accounting and Auditing Technical Symposium, and the Association for Accounting Marketing Summit.

Date: June 12th – June 15th, 2017 | Alan’s date and time are to be determined.

Location: MGM Grand | 3799 S. Las Vegas Blvd., Las Vegas, NV, 89109

Additional Information: For more information, please email Alan at agassman@gassmanpa.com or click here.

**********************************************************

LIVE PRESENTATIONS:

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan will be speaking at the following Medical Education Resources (MER) events:

- October 20th – October 22nd, 2017 in New York, New York

- November 30th – December 3rd, 2017 in Nassau, Bahamas

His tentative topics for these events include the 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning, Lawsuits 101, 50 Ways to Leave Your Overhead, and Essential Creditor Protection and Retirement Planning Considerations.

Date: New York: October 20th – 22nd, 2017; Nassau: November 30th – December 3rd, 2017

Location: New York: To be determined.

Nassau: Atlantis Hotel | Paradise Beach Drive, Paradise Island, Bahamas

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

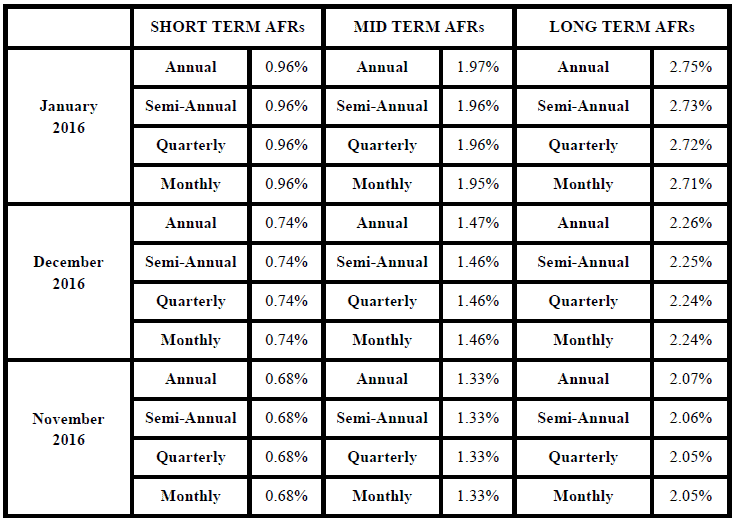

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.