The Thursday Report – 02.20.14 – 2014 What is April 22, 2015?

2014 FLORIDA TAX INSTITUTE EDITION

Quotes from the 2014 Florida Tax Institute

The Jack Freeland Experience

Remembering Michael Keane

Federal Estate Tax Planning for Same Sex Couples – Part 3

Physician Tax Update Series – Sales Tax Applicable to Leasehold Improvements by Michael O’Leary

W. George Allen – A University of Florida and National Hero Who Overcame Racial Obstacles to Succeed in Practicing Law and Helping Others.

What Debtor Creditor Lawyers Need to Know About Student Loans

Seminar and Webinar Announcement – The JEST, the SCGRAT, and the E-Street Software

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Professor Dennis Calfee, Steve Leimberg, and Alan Gassman reflect upon what a great event the Florida Tax Conference is and what a wonderful thing an open bar can be! What a great day for UF!

Conference Chair Lauren Detzel, Alan Gassman, and Professor and Practitioner A. Brian Phillips who practices in Orlando, Florida discuss the Thursday Report and the mitigation of the statute of limitations near the Gassman Law Associates table.

Mark your calendar for Wednesday through Friday, April 22 through April 24, 2015 for the 2nd Annual Florida Tax Institute.

Quotes from the 2014 Florida Tax Institute

“It is a unique opportunity when you can hear tax specialists in academia along with practitioners in the business. Getting the different perspectives is invaluable and keeps you current as to not only prevailing law but also planning strategies that others are utilizing.”

– Steve Rosenbloom, Sheldrick, McGehee and Kohler, LLC, Jacksonville, FL

“This is a well planned, organized and executed conference!”

– Tim Bronza, Business Valuation Analysts, LLC, Maitland, FL

“It is extremely motivating to continue practicing tax law at the highest professional standard.”

– Robert Middleton, Nisen & Elliot, LLC, Chicago, IL

Josh Proper gave us his favorite quote from Professor Calfee:

“Put on your ice skates because then you’ll be ready when hell freezes over!”

“I went to prep school, undergraduate, law school and LL.M. at Florida and Florida is the only place I send a check.”

“Everyone is innocent until proven indigent.”

– A. Brian Phillips, A. Brian Phillips, P.A., Orlando, Florida, Class of 1990 and Professor of Criminal Tax Law

SPECIAL THANKS TO PROSKAUER ROSE, LLP AND DAVID PRATT

The Florida Tax Institute has been a great success. It was estimated that 20 students from the LL.M. program would sign up. In reality 70 signed up. David Pratt and his firm, Proskauer Rose, were kind enough to donate an additional $10,000 to fund the attendance of the extra students so hats off to Proskauer Rose for their very generous donation!

The Jack Freeland Experience

Jack Freeland was a well loved and extremely talented and somewhat eccentric tax law professor at the University of Florida who many believe led the program to the preeminence that it still enjoys.

What follows is Tom Ellwanger’s and Bruce Bokor’s description of the Jack Freeland experience:

Tom Ellwanger’s Story:

For nearly 40 years, taking a tax law course in Gainesville gave you pretty good odds on encountering James J. “Jack” Freeland. If that happened, the odds were even better than you’d consider becoming a tax lawyer, even if such a thought had never previously crossed your mind.

He was the scion of a well-known Miami family. Jackson Memorial Hospital is named after his grandfather; his father owned Byron’s Department Stores, which later became JByron. Jack did everything possible to neutralize his early advantages. As a young man, he led a life which was sufficiently dissolute that his Puritanical father cut his inheritance to $100. His response, he would say, was to dishonor his father’s memory by spending the entire $100 in “one night of riotous living”-this at a time when $100 would buy plenty of riotous living.

He graduated from Duke in 1950, graduated second in his class from the University of Florida College of Law in 1954, and became a graduate fellow at Yale. He then joined the Miami law firm of Hugh F. Culverhouse as a federal tax lawyer.

His career there was short but productive. After a year he was chosen to manage the firm, but by 1957 he had returned to Gainesville to teach tax law. He turned that experience into nearly 40 years of entertaining war stories, with the best ones always told on himself.

He would recount how he got pretty good at tax litigation, to the point where the local IRS District Counsel wasn’t much of a match. One Monday morning, however, he walked into court and found the District Counsel, unaccountably smiling at him. Suddenly the courtroom doors flew open and there entered “two men in bowties carrying briefcases-lawyers sent down from the Chief Counsel’s Office in Washington,” who proceeded to kick Jack around the courtroom, leaving him dazed while they calmly repacked their briefcases and left for the airport.

Ah, yes.

As a tax professor, he defied expectations by being exceptionally entertaining and delightfully unstructured. He disliked teaching from formal notes or an outline. He disliked standing in one place. He strove for spontaneity and achieved it while still making the most abstruse points clear.

He spoke a language all his own. That hated element of trust income tax law, the throwback rule, became “the throwup rule.” And, dollars saved by good tax planning became “real dollars”-real because they aren’t reduced by income tax.

His mentor, good friend, and writing partner was Professor Richard B. Stephens. Professor Stephens was as brilliant and respected as Jack, although two men could hardly differ more. One was dry, orderly, and dignified. The other one wasn’t. The pair collaborated on Fundamentals of Federal Income Taxation, the most widely used textbook, and, with Professor Carr Ferguson of NYU, on Federal Income Taxation of Estates and Beneficiaries, a ground-breaking explanation of one of the more arcane areas of tax law written, so clearly that an English major could understand it.

The two men also collaborated on establishing a graduate tax program at Florida in 1974. The program has produced many of the outstanding tax lawyers in the country. After the retirement of Professor Stephens, Jack was director of that program from 1977 through 1982.

Unfortunately, the creation of the program meant fewer chances for undergraduate law students to experience Jack. Before that, he was recognized as the Outstanding Law Professor at Florida five times. When in 1982 the Florida Bar Tax Section began to recognize an Outstanding Tax Attorney in the State of Florida, Jack was the first recipient. That same year he was named a University of Florida Distinguished Service Professor, thus achieving the highest faculty rank at the school.

He had at least three wives-his private life was somewhat confusing to outsiders, if not to him-but this simply burnished his legend.

Probably the only complaint his students could have is this-through his brilliance, his enthusiasm, and his teaching skill, Jack gave us all the impression that tax law was clear, comprehensive, and above all, fun. I for one feel somewhat misled. But, I consider that was cheap price to pay for a chance to experience a great guy.

Bruce Bokor’s Story:

About 8 of us had Jack for a seminar course, Advanced Corporate Taxation, before there was an LL.M. program.

This course was by invite only for us “tax nerds with good grades in tax”. Jack loved the course and the students, and I think he gave us a final exam, but he told us we were all getting A’s.

He liked us so much that he had a party for us at his home the night all law school finals were over.

When we arrived, Jack was outside in shorts and a T shirt smoking his cigarette with lots of clothes and other personal items laying on the ground next to him. Jack told us there would be no party because his wife had thrown him out of the house, and she was going to file for a divorce on Monday. I do not know which number wife this was, but Jack had no problem finding other wives or women.

Remembering Michael Keane

We are very sad to note the passing of St. Petersburg litigator, Michael J. Keane. Michael was a great friend of almost every client he represented, and had magical powers both in the conference room and the court room.

Michael was always very sympathetic to clients having business, family, and emotional challenges. Michael settled his matters whenever he could, but also would not hesitate to go to court to fight for his clients rights.

Perhaps one in one-hundred or three hundred lawyers has the passion, total dedication and amazing raw talent that Mike Keane had and so freely shared.

Mike had so many close friends in the community including from the time he spent as a great father, a baseball coach and a friend and confidant for many. Almost everyone who practices in St. Petersburg and many of us who practice in the Tampa Bay area have a couple of great stories about Mike. It is time to tell them!

Mike’s amazing partners Shirin Vesely, Brandon Vesely and Charles Gerdes and associates, R. Garrison Mason and Nicole M. Ziegler, along with their wonderful staff will carry the torch to help a great many people in the upcoming years. Let’s wish them and Michael’s family the very best, and remember how privileged we are to carry our own torches to help others in need while serving as platforms to uphold and improve the integrity of our legal, tax and judicial systems.

We welcome any comments and suggestions for further observance of Michael Keane and express our most sincere condolences to his family and friends.

Federal Estate Tax Planning for Same Sex Couples

By: Alan S. Gassman, Esq. and Danielle Creech, Esq.

The following is a continuation of our sharing sections from the book we are writing entitled The Florida Advisors Guide to Counseling Same Sex Couples in 2014. Alan Gassman will be presenting these materials at the Wealth Council Florida Forum on Friday, March 21, 2014 in Orlando, Florida. More details regarding that seminar appear below.

Any questions, comments, and suggestions on these materials would be greatly appreciated:

CATEGORIES OF SAME SEX MARRIAGE RECOGNITION RULES

There are two basic categories of same sex couple recognition rules. The “state of celebration” and the “state or residence.”

1. “State of Celebration”

For some purposes, such as with the IRS and federal income estate and gift tax rules, a same sex couple will be considered as married, as long as their marriage is recognized in the jurisdiction where the ceremony and licensing took place, notwithstanding that the couple may live in a state that does not recognize their marriage, such as Florida.

2. “State of Residence”

For many purposes, however, a same sex married couple will not be considered as eligible to receive married couple rights if they reside in a state that does not recognize their marriage. An example of this is Medicaid eligibility. Presently the Medicaid statutes do not require the states that administer the Medicaid program to recognize a same sex marriage. The same applies for social security and the Family and Medical Leave Act.

DOMESTIC PARTNERSHIPS

Many Florida counties and cities have adopted domestic partnership registration ordinances, which permit same-sex couples to register as a Domestic Partnership to be provided with some or all of the following legal rights:

1. The ability to visit one another and receive confidential healthcare information from facilities and providers.

2. The ability to make healthcare decisions for one another.

3. The ability to receive information from schools and other educational entities with respect to the education of each other’s children.

4. The ability to have priority to serve as one another’s guardian if ever need be.

5. The ability to make funeral and burial decisions.

In order to register as a Domestic Partnership, each partner must normally be at least eighteen (18) years old, and not be married or in another Domestic Partnership relationship and not related by blood. The parties must normally reside together in a mutual residence.

Typically each party must agree to be jointly responsible for each other’s basic food and shelter and for the maintenance and support of the Domestic Partnership. Each partner typically agrees to immediately notify the clerk of court for the county where they reside if the terms of the Domestic Partnership arrangement are no longer applicable.

The registration papers are typically required to be signed by both partners in front of two (2) witnesses and a notary.

The counties that offer this designation will typically issue a Certificate of Domestic Partnership to confirm the registration of the arrangement.

The county ordinances will typically provide for reciprocity so that domestic partners from other counties with similar statutes will bestow the same rights on visiting domestic partners.

The following Florida cities and counties have adopted a Domestic Partnership Registry.

| Florida Counties:

Broward County Leon County Miami-Dade County Monroe County Orange County Palm Beach County Pinellas County Sarasota County Volusia County |

Florida Cities:

Clearwater Gainesville Key West Kissimmee Miami Miami Beach Pensacola Punta Gorda Sarasota South Miami St. Cloud St. Petersburg Tampa Tavares West Palm Beach |

The Pinellas County Domestic Partnership Registration Information and Summary of Rights and Legal Effects can be obtained by emailing agassman@gassmanpa.com

CONFLICT OF INTEREST RULES

Advisors will have to be very careful to not violate ethical and practical rules with respect to conflicts of interest. It is important to educate clients so that they understand that information provided to a lawyer or other advisor under joint representation will be accessible to both clients, and that in the event of a conflict, the common lawyer would not be able to advise either client with respect to general subject matter without mutual consent.

Florida Bar’s Professional Responsibility Rule 4-1.7 provides the following language for regulation of conflict of interests between current clients.

RULE 4-1.7 CONFLICT OF INTEREST; CURRENT CLIENTS

(a) Representing Adverse Interests. Except as provided in subdivision (b), a lawyer shall not represent a client if:

(1) the representation of one client will be directly adverse to another client; or

(2) there is a substantial risk that the representation of one or more clients will be materially limited by the lawyer’s responsibilities to another client, a former client or a third person or by a personal interest of the lawyer.

(b) Notwithstanding the existence of a conflict of interest under subdivision (a), a lawyer may represent a client if:

(1) the lawyer reasonably believes that the lawyer will be able to provide competent and diligent representation to each affected client;

(2) the representation is not prohibited by law;

(3) the representation does not involve the assertion of a position adverse to another client when the lawyer represents both clients in the same proceeding before a tribunal; and RRTFB – May 1, 2013;

(4) each affected client gives informed consent, confirmed in writing or clearly stated on the record at a hearing.

(c) Explanation to Clients. When representation of multiple clients in a single matter is undertaken, the consultation shall include explanation of the implications of the common representation and the advantages and risks involved.

(d) Lawyers Related by Blood or Marriage. A lawyer related to another lawyer as parent, child, sibling, or spouse shall not represent a client in a representation directly adverse to a person who the lawyer knows is represented by the other lawyer except upon consent by the client after consultation regarding the relationship.

(e) Representation of Insureds. Upon undertaking the representation of an insured client at the expense of the insurer, a lawyer has a duty to ascertain whether the lawyer will be representing both the insurer and the insured as clients, or only the insured, and to inform both the insured and the insurer regarding the scope of the representation. All other Rules Regulating The Florida Bar related to conflicts of interest apply to the representation as they would in any other situation.

The Mike O’Leary Physician Tax Update Series – Sales Tax Applicable to Leasehold Improvements

Attorney Michael O’Leary of the Trenam Kemker firm in Tampa, Florida recently lectured on hot tax topics for physicians and physician practices. The following is his section on sales tax applicable to leasehold improvements. His contact information is as follows:

D. Michael O’Leary

Trenam Kemker

101 E. Kennedy Blvd, Suite 2700

Tampa, FL 33602

813-227-7454

moleary@trenam.com

A. Overview. Sales tax is imposed on the periodic payment of commercial rent, even though the lessor and the lessee are related parties.

B. Current DOR Position. Based on Seminole Clubs, Inc., 745 So. 2d 473 (Fla 5th DCA 1999), the Florida Department of Revenue has asserted that the construction of leasehold improvements by commercial tenants is also subject to the Florida sales and use tax if (i) the leasehold improvements are a condition of occupancy so that a failure to construct the leasehold improvements would result in a default under the lease and (ii) the improvements become the property of the landlord either during the term of the lease or at the end of the lease.

C. Seminole Clubs. In Seminole Clubs, the City of Sanford, the landlord, gave Seminole Clubs, Inc, the lessee, the option of expending five percent of gross revenues on capital improvements, in lieu of paying cash “rent,” in order to retain possession of premises. The court held that the Lessee’s capital improvements to the golf course premises represented “rent in kind” subject to sales tax.

D. Ruehl. In Ruehl, Case No. 2009-CA-1503, the landlord required the lessee, a retail mail tenant, to completely refurbish the interior of the store. There was no requirement that the tenant spend a particular amount of money on the improvements. The tenant challenged the position of the Florida Department of Revenue that the leasehold improvements were taxable as “rent in kind.” The Circuit Court of the Second Judicial Circuit in Leon County held that amounts spent by the tenant were not subject to sales tax. The factors cited by the court were as follows:

1. There was no record evidence to suggest that the amount the lessee spent on the improvements for refurbishing of the interior of the leased premises was in lieu of rent;

2. There was no requirement that a particular minimum amount of funds be expended;

3. There was no provision for the lessee to be credited against rental payment for such costs;

4. There was no evidence of record that the amount of rent to be paid was somehow manipulated by this provision. Rather, the court concluded, it was simply an expense which the tenant had to incur to get the premises in a condition that would be suitable for its intended purposes.

E. On January 3, 2012, the First District Court of Appeals affirmed the trial court’s holding that leasehold improvements constructed under two commercial leases were not subject to sales and use tax. Florida Department of Revenue v. Ruehl No. 925, LLC, 76 So.3d 389 (Jan. 3, 2012). The appeals court held that the parties to each of the leases did not “intend for the costs of the leasehold improvements to be part of the total rent charged” and therefore the “costs of the leasehold improvements were not part of the total rent and therefore not subject to tax under section 212.031, Florida Statutes.” The Department did not appeal the decision to the Florida Supreme Court.

F. After hearings DOR issued new proposed rules. The rules were never finalized, and new proposed rules are expected in the next few months. There is a bill to phase out the commercial rentals tax, but probably not much chance of passing due to the amount of revenue from the tax which is well over a billion in revenue raised annually.

W. George Allen – A University of Florida and National Hero Who Overcame Racial Obstacles to Succeed in Practicing Law and Helping Others

By: Alan S. Gassman, Esq. and Dena Daniels

Born on March 3, 1936 in a totally segregated Sanford, Florida, Attorney W. George Allen was the first African-American to receive his J.D. from the University of Florida Law School. Allen grew up working in the celery fields of Sanford, Florida where the county closed down the black schools in the winter and forced every able-bodied black person to work in the fields. Blacks were arrested for not working. Mr. Allen never saw a toilet flush until he was four years old. He grew up in a small house on a dirt road and attended elementary school, middle school, and high school in all black programs.

After graduating with the highest grade point average from his high school, Crooms Academy, in 1954, Allen attended college at Florida A&M University in Tallahassee, FL. While he was a student there, Allen was a high level seeker. He mentions in his book, “Where the Bus Stops,” “I sought out the hardest, most demanding teachers because I learned more from teachers who were demanding and who challenged students to achieve at their highest level.” Allen was extremely active on campus. He became a member of the Alpha Phi Alpha fraternity in 1955. Allen became vice president and was elected president during his senior year of Beta Nu Chapter of Alpha Phi Alpha. He was also a member of the ROTC. While in college, Allen suffered financial hardship, “Also, in my freshman year I did not have funds to buy the required texts, so I borrowed my books, principally from athletes who were mostly uninterested in studying and reading the books. I would read the entire book and go to class to take notes.” Because Allen did not have enough money to afford his books, he had two jobs during his junior year. Without being affected by his hardship, Allen gained popularity at FAMU, “I was popular, smoked a pipe, wore bowties, and engaged in my share of extracurricular activities. I made many trips to Hoffman Restaurant and Bar, which was near the campus and where most of the popular students met to drink Spearman Beer.”

Upon graduation in 1958, he was commissioned as a 2nd Lt. in Army Intelligence. In 1960 Allen applied to four law schools: the University of Florida, Florida A&M University, Harvard, and the University of California at Berkeley. Being accepted to the three of the four schools (he never heard from Florida A&M Law School), he decided to attend the University of Florida after George Starke (a Sanford native and the first black to be admitted to the University of Florida Law School) and Regina Langston (one of the first blacks to attend the University of Florida Medical School) withdrew from these University of Florida graduate schools due to unbearable racial discrimination.

Mr. Allen faced significant racial mistreatment from fellow students, but he had some support from the administration. In his book, “Where the Bus Stops”, Mr. Allen shares one of the many tensed racial moments that he experienced at the University of Florida School of Law. During his second semester of law school, Mr. Allen was standing in line for over 30 minutes to register for courses; the courses were assigned on a first-come, first-served basis. Mr. Allen details in his book:

“When it was my turn to choose courses, Ralph Paul Douglas, whom I did not know, stepped in front of me and said, ‘boy I’m next’. I became incensed about being called boy and his attempt to move in front of me, so I hit him with a right cross on the chin and knocked him out. I stepped over Ralph, spread my list of courses in front of Professor Weyrauch, and said, ‘Sir, I would like to register for these courses.’ The professor signed me up, I turned, stepped over Ralph and left the library with many students whispering about my violent behavior.”

Much to his surprise, years later, Mr. Allen appeared in West Palm Beach, FL for a hearing and the presiding judge was none other than the receiver of his deadly cross, Ralph Paul Douglas. Automatically realizing who each other was, the judge asked Mr. Allen, “Should I duck?” and his response was, “Only if I am insulted.” The two laughed as they both reflected on the once tensed situation, but regardless of their past, Judge Douglas was fair and justice was served.

Throughout his law school career Mr. Allen experienced an insurmountable amount of threats and discrimination. Allen and his wife attended a wedding in Tampa in 1958, and to celebrate they went to the famous Columbia Restaurant. They were not permitted to eat there because of their color. He mentions: “That treatment buttressed my desire to attend law school and fight to end discrimination in public accommodations in all institutions in Florida.” He even got into a few physical altercations. In an interview he stated, “I made it known that I don’t believe in non-violence like Martin Luther King. You bother me, I’m violent.” His no nonsense attitude shaped him to be the perfect individual to successfully handle the rigor of being black in a southern institution of higher learning. Allen graduated from the University of Florida Law School in 1963. He has run a successful practice in Ft. Lauderdale, FL for forty-two years, and he has helped to liberate many minority organizations and individuals from being mistreated. Mr. Allen indicates that there is still a significant amount of discrimination and societal resistance to equal treatment, but he is proud of what he and other black lawyers have accomplished in the past five decades.

Please be sure to read W. George Allen’s autobiography, entitled “Where the Bus Stops.” You will not want to stop until you are completely done with this book.

Dena Daniels is from the small town of Jasper, FL and is the first individual from both sides of her family to receive a bachelor’s degree. Dena Daniels is a second-year law student at Stetson University College of Law. She was amongst the first group of students from Hamilton County High School to complete the dual-enrollment program at North Florida Community College; she graduated high school with 62 college credit hours. Dena graduated with her B.S. in Business Administration from the University of South Florida and her Masters of Business Administration from Valdosta State University. Dena is seeking a concentration in Social Justice Advocacy and is a law clerk at Gassman Law Associates.

What Debtor Creditor Lawyers Need to Know About Student Loans

By: Scott Cornwell

Scott Cornwell is currently a third year law student at Stetson University College of Law and a Law Clerk for Gassman, Crotty & Denicolo, P.A. He expects to graduate in May of 2014 with his J.D. and M.B.A.

Student loan debt has recently reached $1.2 trillion and currently accounts for roughly 6% of the national debt.1 With an influx of students seeking higher education, it is unlikely that this cumbersome debt will abate any time soon. Therefore, practitioners must ensure they remain up to date with the current law governing student debts.

Discharge of Student Loan Debt in Bankruptcy Proceedings

Although many of Americans are encumbered by student loan debt, the bankruptcy courts are not inclined to provide much relief. To get a student loan dismissed, one would need to show “undue hardship”2, a very high standard that is commonly associated with a debilitating illness. Although undue hardship normally involves a debilitating illness, being diagnosed does not guarantee a successful claim. When adjudicating on a claim of undue hardship, the court must use a totality of the circumstances test.3 Essentially, the court looks at every aspect of a debtor’s situation and assesses it on a case-by-case basis.

For instance, In re Hicks, involves a debtor with Multiple Sclerosis, an incurable and degenerative neurological disorder.4 The debtor worked part-time while her husband earned the majority of the family income. The Court looked at the income of both the debtor and her husband when deciding whether or not the debt rose to the level of an undue hardship. The Court asked the question, “Can the debtor now, and in the foreseeable future, maintain a reasonable, minimal standard of living for the debtor and the debtor’s dependents and still afford to make payments on the debtor’s student loans?” In answering the question, the court held that because her husband could work and was likely to maintain his current pay, there would be no undue hardship against the debtor, despite her illness.

More often than not, a client’s situation will not rise to the level of an undue hardship. When making a claim for undue hardship, practitioners will be responsible for ensuring their clients have realistic expectations regarding the claim.

Where the Loan Came From Definitely Matters

Student loans come in two forms, one is backed by the federal government and the other is provided by private lending institutions. The provider of the loan makes a huge difference in regards to collections on delinquent accounts. The largest differences are found in the statutes of limitation, how the creditor can collect the debt, and judgment renewal.

Federal Student Loans

Pursuant to 20 U.S.C.A. § 1091a(a), loans backed by the federal government have no statute of limitations with regards to collections. Furthermore, 20 U.S.C.A. §1091a(b) provides that “… no limitation shall terminate the period within which suit may be filed, a judgment may be enforced, or an offset, garnishment, or other action…” may be taken. The federal government reserves many powers to ensure it can collect on student loan debt.

In the unfortunate circumstance that a student loan enters default, the government can look to withholding money from your wages, withholding money from your tax refund or other federal payments (also known as a treasury offset), or pursue a judgment against your delinquent debt.

A judgment against a debtor sought by the government is governed by 20 U.S.C.A. §3201a. Going further, 20 U.S.C.A. §3201c establishes that the governments lien survives for 20 years and is subject to one renewal of 20 more years.

Private Student Loans

Unlike the federal government, private loan servicers have a statute of limitations to bring a cause of action against a debtor. The statute of limitations depends on the state, but in Florida it is governed by Florida Statutes §95.11 and any actions must be brought within five years. It is important to note that this is five years of non-payment, if a debtor stops payment for a year and then makes a random payment, the term begins all over again.

Private loan servicers cannot affect federal benefits in the same manner as the government, but they can seek to garnish wages, lien property, and pursue other remedies associated with obtaining a judgment in the state of the client’s loan origination.

Every state will be different regarding judgments and the length of time in which they expire. In Florida, judgments are governed by Florida Statutes §55.081 and expire after a term of twenty years. Although the §55.081 provides for only twenty years, Petersen v. Whitson, established that judgments can be extended by filing another suit and, essentially, renewing the judgment.5

Going forward, it is safe to assume that student debt is not going anywhere soon. A wise practitioner will be well versed in the laws governing student debts because many of their clients, current and future, will be encumbered and have as assortment of questions when their education bill comes due.

1 Chris Denhart, How the $1.2 Trillion College Debt Crisis is Crippling Students, Parents and the Economy, Forbes (August 07, 2013, 12:30PM), http://www.forbes.com/sites/specialfeatures/2013/08/07/how-the-college-debt-is-crippling-students-parents-and-the-economy/

2 In re Hicks, 331 B.R. 18 (Bankr. D.Mass. 2005)

3 Id.

4 Id.

5Petersen v. Whitson, 14 So.3d 300 (Fla. 2d DCA 2009)

Seminar and Webinar Announcements

To register for this webinar, please click here.

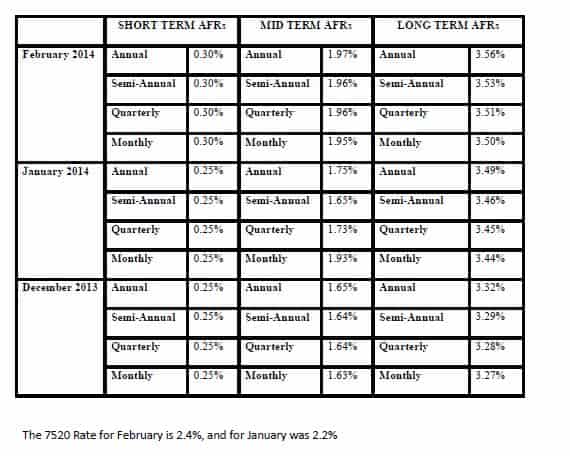

Applicable Federal Rates

Below we have this month’s, last month’s, and the preceding month’s Applicable Federal Rates because for a sale, you can use the lowest of the 3.

Seminars and Webinars

THE CLEARWATER BAR ASSOCIATION 444 SHOW – ASSET PROTECTION, ESTATE PLANNING AND LLC LAW UPDATE

Date: Thursday, February 27, 2014 | 4:00 p.m.

Location: Online webinar.

Speaker: Alan Gassman, Christopher Denicolo and Kenneth Crotty

Additional Information: To register for the webinar please visit www.clearwaterbar.org

******************************************************

THE JEST, THE SCGRAT AND THE E STREET SOFTWARE

Please join Alan Gassman, Ken Crotty and Chris Denicolo for a 30 minute webinar describing 2 new planning techniques and also free beta testing of the EstateView software that was developed by Gassman, Crotty & Denicolo, P.A.

Date: Tuesday, March 4, 2014 | 5:00 p.m.

Location: Online webinar

Additional Information: To register for the webinar please visit https://www2.gotomeeting.com/register/625212018.

******************************************************

FLORIDA BAR HEALTH LAW REVIEW 2014

Alan Gassman will be speaking on What Healthcare Lawyers Need to Know About Tax Law and Business Entities at this excellent annual Florida Bar conference that is attended not only by those who are taking the Board Certification exam but also healthcare lawyers and other advisors.

Other speakers will include Lester Perling who is the co-author of A Practical Guide to Kickback and Self-Referral Laws for Florida Physicians and a number of other books and publications, and Mickey Mouse, Donald Duck and the “dwarf planet” formerly known as Pluto!

Date: March 7 – 8, 2014

Location: Hyatt, Orlando, Florida

Additional Information: We thank Jodi Laurence and Sandra Greenblatt for all of their hard work in making this conference as successful as it is. For more information please contact Jodi at jl@flhealthlaw.com or Sandra at sg@flhealthlawyer.com.

******************************************************

TAX AND ASSET PROTECTION BASICS FOR THOSE WHO REPRESENT PHYSICIANS AND MEDICAL PRACTICES

Alan Gassman and Christopher Denicolo will be speaking at the Hillsborough County Bar Association’s Health Law Section Luncheon on the topic of Tax and Asset Protection Basics for Those Who Represent Physicians and Medical Practices.

Date: March 12, 2014

Location: Chester H. Ferguson Law Center in Tampa, FL

Additional Information: For additional information please contact Co-Chairs Sara Younger (sara.younger@baycare.org) or Thomas Ferrante (tferrante@carltonfields.com).

******************************************************

STRUCTURING JOINT EXEMPT STEP-UP TRUSTS: EMERGING TOOL TO MAXIMIZE STEP-UP IN BASIS

Date: Tuesday, March 18, 2014 | 1:00 – 2:30 p.m.

Location: Online webinar sponsored by Stafford Publications, Inc.

Speakers: Alan S. Gassman, Christopher Denicolo and Edwin P. Morrow, III, Esq.

Additional Information: To register for the webinar please visit https://www.straffordpub.com/products/structuring-joint-exempt-step-up-trusts-emerging-tool-to-maximize-step-up-in-basis-2014-03-18 or email agassman@gassmanpa.com

******************************************************

COMPOUNDING THE PROBLEMS AND OPPORTUNITIES FOR COMPOUNDING PHARMACIES

Date: Wednesday, March 19, 2014 at 12:30 p.m. or Tuesday, April 1, 2014 at 5:00 p.m.

Location: Online webinar

Speakers: Lester Perling and Alan Gassman

Additional Information: To register for the March 19, 2014 webinar please click here. To register for the April 1, 2014 webinar please click here.

******************************************************

COUNSELING SAME SEX COUPLES IN 2014

Date: Friday, March 21, 2014 | 10:30 – 12:00

Location: Holiday Inn at the Orlando Airport

Additional Information: For more information and to register for the program please email agassman@gassmanpa.com

******************************************************

LUNCH TALK – LAW PRACTICE EFFICIENCY TIPS

Date: Monday, April 7, 2014 | 12:30 p.m.

Location: Online webinar

Speaker: Alan S. Gassman

Additional Information: To register for this webinar please visit www.clearwaterbar.org

******************************************************

FICPA SUNCOAST CHAPTER MONTHLY MEETING

Alan S. Gassman will be speaking at the FICPA Suncoast Chapter’s monthly meeting on the topic of THE FLORIDA CPA’S GUIDE TO PLANNING WITH PHYSICIANS AND MEDICAL PRACTICES

Date: Thursday, April 17, 2014 | 4:00 p.m.

Location: Tampa, Florida

Additional Information: For more information on this event please email agassman@gassmanpa.com or mary@clawsonasplus.com

******************************************************

DONOR LUNCHEON AT RUTH ECKERD HALL WITH PROFESSOR JERRY HESCH IN CLEARWATER, FLORIDA

Professor Jerry Hesch will be speaking at a Donor Luncheon on the topic of CHARITABLE TAX SAVINGS: HOW TO MAKE SURE THAT UNCLE SAM CONTRIBUTES HIS SHARE TO MAXIMIZE RESULTS

Sponsored by Gassman, Crotty & Denicolo, P.A. Co-sponsors invited.

Date: Tuesday, April 22, 2014 | TIME TO BE DETERMINED

Location: Ruth Eckerd Hall, Clearwater, Florida

Additional Information: For additional information please contact Suzanne Ruley at sruley@rutheckerd.net or Alan Gassman at agassman@gassmanpa.com

******************************************************

RUTH ECKERD HALL PLANNED GIVING MEETING

Professor Jerry Hesch will be speaking at the Ruth Eckerd Hall Planned Giving Meeting in Clearwater, Florida on the topic of INNOVATIVE CHARITABLE GIVING TECHNIQUES FOR THE WELL TUNED ESTATE PLANNER

Sponsored by Gassman, Crotty & Denicolo, P.A. Co-sponsors invited.

Date: Tuesday, April 22, 2014 | 4:00 p.m.

Location: Ruth Eckerd Hall, Clearwater, Florida

Additional Information: This session qualifies for 1 hour of continuing education credit for lawyers and CPA’s. To attend please email Suzanne Ruley at sruley@rutheckerd.net or Alan Gassman at agassman@gassmanpa.com

******************************************************

1st ANNUAL ESTATE PLANNER’S DAY AT AVE MARIA SCHOOL OF LAW

Speakers: Speakers will include Professor Jerry Hesch, Jonathan Gopman, Alan Gassman and others.

Jerry Hesch and Alan Gassman will cover Buy-Sell Agreements and associated planning.

Date: April 25, 2014

Location: Ave Maria School of Law, Naples, Florida

Sponsors:AveMariaSchool of Law, Collier County Estate Planning Council and more to be announced.

Additional Information: For more information on this event please contact agassman@gassmanpa.com.

******************************************************

THE FLORIDA BAR ANNUAL WEALTH PROTECTION SEMINAR

Date: Thursday, May 8, 2014

Speakers: Speakers will include Barry Engel on Offshore Trust Planning and Developments Over the Past 2 Years in Asset Protection, Howard Fisher and Alex Fisher on “Designer Entities – The Cutting Edge in Asset Protection”, Denis Kleinfeld on The Roadmap to Wealth Protection Planning and Alan Gassman on Structuring Business and Investment Assets and Entities – Wealth Protection 401 for the Dedicated Planner.

Location: Hyatt Regency Downtown, Miami, Florida

Additional Information: For more information please contact agassman@gassmanpa.com

******************************************************

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Date: November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.