The Thursday Report – Issue 337

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Thursday, May 25, 2023Issue #337Coming from the Law Offices of Gassman, Crotty & Denicolo, P.A. in Clearwater, FL. Edited By: Alan Gassman and Kenneth J. Crotty

Since Florida House Bill 1557 was passed, 441 books have been banned from Florida Schools. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Please Note: Gassman, Crotty, & Denicolo, P.A. will be sending the Thursday Report out during the first week of every month. Article 1Some Benefits of Planning With “Defective” TrustsWritten By: Kenneth J. Crotty, JD, LL.M. and Samuel Brucker, Juris Doctorate Canidate Article 2Could Forgetting a Personal Signature Cost $1.7 Million?Written By: Kenneth J. Crotty, JD, LL.M. and Jared Galaris, Juris Doctorate Canidate Article 3NAACP Issues Travel Advisory for the State of FloridaWritten By: Gary Lopez-Perea, Juris Doctorate Canidate, Stetson Law School For Finkel’s Followers6 Ways to Avoid Being “Ghosted” By a New HireWritten By: David Finkel Free Upcoming WebinarsUnderstanding Spousal Limited Access Trusts (SLATs) from Basic to NuancePresented By: Christopher Denicolo, JD, LL.M. Alphabet Soup: Planning with LLCs, IDGTs, GRATs & Other AcronymsPresented By: Alan Gassman, JD, LL.M. (Taxation), AEP (Distinguished) More Upcoming EventsYouTube LibraryHumor |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1Some Benefits of Planning With “Defective” Trusts

Written By: Kenneth J. Crotty, JD, LL.M. and Samuel Brucker, Juris Doctorate Canidate

An irrevocable defective grantor trust (IDGT) is a trust created by a client for the benefit of

An IDGT is treated as being owned by the grantor for income tax purposes. This allows the

A second benefit of the client owning the IDGT for income tax purposes is that the client is

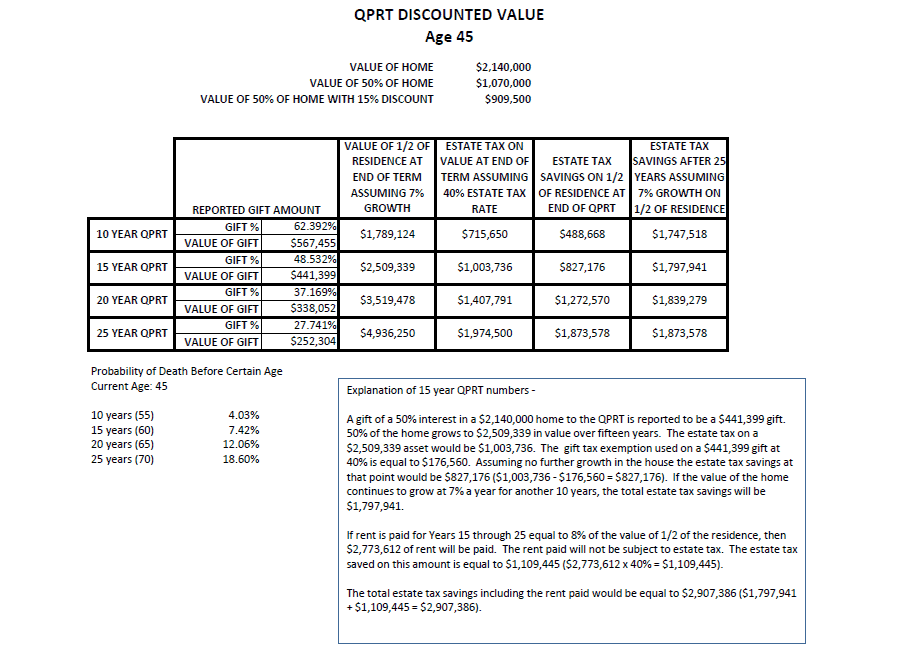

Although the IDGT is owned by the client for income tax purposes, the IDGT is not included For a trust to be treated as an IDGT, the IDGT must contain at least one grantor trust power Commonly, clients sign and fund an IDGT, and then sell assets to the IDGT. The client For the trust to work as intended and have the assets excluded from the client’s gross estate A QPRT is a type of an IDGT that is funded by the client transferring a personal residence The rent paid by the Grantor reduces the estate of the Grantor and increases the value of the Assume that your client is 45 and is willing to gift one-half of a $2,140,000 home into a 50% of the home grows to $2,509,339 in value over fifteen years. The estate tax on a If rent is paid for Years 15 through 25 equal to 8% of the value of 1/2 of the residence, then The total estate tax savings after 25 years, including the rent paid, would be equal to

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Could Forgetting a Personal Signature Cost 1.7 Million? Written By: Kenneth J. Crotty, JD, LL.M. and Jared Galaris, Juris Doctorate Canidate

Could Forgetting a Personal Signature Cost $1.7 Million? On May 10th, 2023, the Federal Circuit Court of Appeals gave everyone a reminder of the importance of filing properly completed (signed) paperwork on time. In Dixon v. United States, the U.S. Court of Appeals upheld the U.S. Court of Federal Claims decision denying Mr. Dixon’s action seeking $1,700,000 in tax refunds. In 2017, Mr. Dixon’s tax preparer filed amended tax returns for Mr. Dixon which were originally denied by the IRS. Mr. Dixon appealed the IRS decision to the U.S. Court of Federal Claims. In the course of that litigation, it became apparent that Mr. Dixon had not signed the amended tax returns. The amended returns had been signed by Mr. Dixon’s tax preparer, but the tax preparer did not have a valid power of attorney allowing the preparer to sign the returns. As a result, the U.S. Court of Federal Claims denied Mr. Dixon’s claim. On appeal, the Federal Circuit Court of Appeals agreed with the U.S. Court of Federal Claims and dismissed the claim. Although the amended tax returns were timely filed, the amended tax returns were not “duly filed” because Mr. Dixon had failed to personally sign them. By the time this failure to sign was corrected, the time limits for filing the amended tax returns with the IRS had passed. As a result, the court concluded that the refund action was properly dismissed. Put simply, Mr. Dixon may have missed out on $1,700,000 because he did not file his paperwork correctly. If Mr. Dixon had personally signed his amended tax returns, he may have been in a very different position today. The court’s decision was based on the relevance of the “too late” principle and the irrelevance of the informal-claim doctrine. This doctrine refers to the ability of the IRS to correct any formal deficiencies in a taxpayer’s filing, to provide the IRS a full opportunity to address the problem administratively if possible. The informal claim doctrine provides that a taxpayer may assert a valid claim for refund by providing the IRS with written notice of the claim of refund, even if the claim is not made by filing a formal amended tax return. The Court concluded that the informal claim doctrine was not applicable in this situation because Mr. Dixon’s signature requirement “ was based on a statute combined with implementing regulations that were not subject to case-specific IRS waiver authority.” The “too late” principle refers to the fact that the IRS loses jurisdiction over – and the taxpayer loses the ability to amend – any refund claim that is allowed, disallowed, or the subject of a suit for refund if such claim is not timely filed correctly. The court concluded that the application of the “too late” principle barred Mr. Dixon’s action. In a slightly different scenario, Mr. Dixon could have had a very different outcome. The moral of the story: file paperwork correctly and on time. Sure, there are plenty of ways to lose $1,700,000, but missing a signature should not be one of them. To avoid these types of issues, tax returns should be filed duly and timely. Dixon v. United States, No. 2022-1564, 2023 U.S. App. LEXIS 11422 (Fed. Cir. May 10, 2023)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Article 3NAACP Issues Travel Advisory for the State of Florida

Written By: Gary Lopez-Perea, Juris Doctorate Canidate, Stetson Law School

Gassman, Crotty and Denicolo, P.A. will be donating a $1000.00 grant and 20 pro-bono law clerk hours to the Pinellas Education Foundation to benefit Black History education. “If a public school were to remove every book because it contains one word deemed objectionable to some parent, then there would be no books at all in our public libraries.” – Peter Scheer “As books were banned during the holocaust in the early 1930’s, ideas were repressed, knowledge was repressed, free speech was repressed, in the name of ideological racist and prejudicial propaganda and beliefs. As society has progressed to 2023, racist and prejudicial ideologies coupled with hypocrisy has taken hold in our schools and homes once again. Banning books is the banning of ideas and a violation of one’s right to a free education. Banning books to erase people and parts of our society that are different from one’s belief is an attempt to erase those very people those books represent. Bigoted and hypocritical ideas have infiltrated our schools in the name of protecting children. Books are not dangerous’, books provide insight to our history, our present, and our future. They provide entertainment and joy. Books offer a person an opportunity to explore the world as an individual with different perspectives from another, and yet see similarities as well. People will seek information through books long after the right attempts to police other people’s children and other people’s homes.” – Anonymous Pinellas County Schools Educator Since Florida House Bill 1557 was passed 441 books have been banned from Florida Schools. On May 20, 2023, the National Association for the Advancement of Colored People (NAACP) issued a formal travel notice regarding the state of Florida.[1] According to the press statement released by the NAACP, the notice is in response to legislative actions taken by Ron DeSantis that have been deemed “aggressive attempts to erase Black History and to restrict diversity equity and inclusion programs in Florida schools.”[2] The NAACP’S notice is the latest advisory from Florida civil rights groups. Similar actions have been taken by both Equality Florida, a gay rights advocacy group that issued a warning last month, and the League of United Latin American Citizens, a civil rights organization that issued one last Wednesday.[3] According to the NAACP president and CEO Derrick Johnson, “failing to teach an accurate representation of the horrors and inequalities that Black Americans have faced and continue to face is a disservice to students and a dereliction of duty to all,”[4] The Chair of the NAACP Board of Directors, Leon Russell, further added “We will not allow our rights and history to be held hostage for political grandstanding. The NAACP proudly fights against the malicious attacks in Florida, against Black Americans. I encourage my fellow Floridians to join in this fight to protect ourselves and our democracy.”[5] The NAACP cites numerous policies that DeSantis has approved that have had an impact on its determination. These policies include stripping schools of AP African American studies, prompting legislation for the concealed carry of guns, and defunding diversity programs in the state’s public universities.[6] The Further advise that “Florida public schools will not teach your children accurate African-American history, which includes a history of enslavement, segregation, racial injustice, and systemic racism…The State of Florida does not welcome the contributions of African Americans and people of color…The State of Florida does not value diversity, equity, and inclusion in Florida schools, colleges, and universities.”[7]

Response Mr. DeSantis’s office was available for comment on the advisory warning this past Monday. DeSantis spokesperson Jeremy T. Redfern said the move by the NAACP was nothing more than a stunt.[8] He further emphasized the governor’s point from the week prior, that Florida at the time was receiving record-breaking numbers in tourism.[9] Whether or not this formal advisory will affect those numbers is yet to be seen. [1] NAACP issues Travel Advisory in Florida. NAACP. (2023, May 23). https://naacp.org/articles/naacp-issues-travel-advisory-florida [3] Jiménez, J. (2023, May 21). N.A.A.C.P. issues Florida Travel Advisory, joining Latino and L.G.B.T.Q. Groups. The New York Times. https://www.nytimes.com/2023/05/21/us/naacp-florida-travel-advisory-desantis.html [4] Woodward, A. (2023, May 23). DeSantis responds to NAACP call for tourists to Boycott florida. The Independent. https://www.independent.co.uk/news/world/americas/us-politics/desantis-naacp-florida-travel-advisory-b2343518.html

The Hill We Climb Poem by Amanda Gorman Banned in Miami-Dade County (Source: “Miami-Dade K-8 bars elementary students from 4 library titles following parent complaint” by Sommer Brugal from the Miami Herald)

When day comes, we ask ourselves, where can we find light in this never-ending shade? The loss we carry. A sea we must wade. We braved the belly of the beast. We’ve learned that quiet isn’t always peace, and the norms and notions of what “just” is isn’t always justice. And yet the dawn is ours before we knew it. Somehow we do it. Somehow we weathered and witnessed a nation that isn’t broken, but simply unfinished. We, the successors of a country and a time where a skinny Black girl descended from slaves and raised by a single mother can dream of becoming president, only to find herself reciting for one. And, yes, we are far from polished, far from pristine, but that doesn’t mean we are striving to form a union that is perfect. We are striving to forge our union with purpose. To compose a country committed to all cultures, colors, characters and conditions of man. And so we lift our gaze, not to what stands between us, but what stands before us. We close the divide because we know to put our future first, we must first put our differences aside. We lay down our arms so we can reach out our arms to one another. We seek harm to none and harmony for all. Let the globe, if nothing else, say this is true. That even as we grieved, we grew. That even as we hurt, we hoped. That even as we tired, we tried. That we’ll forever be tied together, victorious. Not because we will never again know defeat, but because we will never again sow division. Scripture tells us to envision that everyone shall sit under their own vine and fig tree, and no one shall make them afraid. If we’re to live up to our own time, then victory won’t lie in the blade, but in all the bridges we’ve made. That is the promise to glade, the hill we climb, if only we dare. It’s because being American is more than a pride we inherit. It’s the past we step into and how we repair it. We’ve seen a force that would shatter our nation, rather than share it. Would destroy our country if it meant delaying democracy. And this effort very nearly succeeded. But while democracy can be periodically delayed, it can never be permanently defeated. In this truth, in this faith we trust, for while we have our eyes on the future, history has its eyes on us. This is the era of just redemption. We feared at its inception. We did not feel prepared to be the heirs of such a terrifying hour. But within it we found the power to author a new chapter, to offer hope and laughter to ourselves. So, while once we asked, how could we possibly prevail over catastrophe, now we assert, how could catastrophe possibly prevail over us? We will not march back to what was, but move to what shall be: a country that is bruised but whole, benevolent but bold, fierce and free. We will not be turned around or interrupted by intimidation because we know our inaction and inertia will be the inheritance of the next generation, become the future. Our blunders become their burdens. But one thing is certain. If we merge mercy with might, and might with right, then love becomes our legacy and change our children’s birthright. So let us leave behind a country better than the one we were left. Every breath from my bronze-pounded chest, we will raise this wounded world into a wondrous one. We will rise from the golden hills of the West. We will rise from the windswept Northeast where our forefathers first realized revolution. We will rise from the lake-rimmed cities of the Midwestern states. We will rise from the sun-baked South. We will rebuild, reconcile, and recover. And every known nook of our nation and every corner called our country, our people diverse and beautiful, will emerge battered and beautiful. When day comes, we step out of the shade aflame and unafraid. The new dawn blooms as we free it. For there is always light, if only we’re brave enough to see it. If only we’re brave enough to be it.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

For Finkel’s Followers6 Ways to Avoid Being ‘Ghosted’ By a New HireWhy Newly Hired Employees Aren’t Showing Up to Work–and How to Prevent ‘Ghosting’ at Your Company

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Free Saturday WebinarUNDERSTANDING SPOUSAL LIMITED ACCESS TRUSTS (SLATs) FROM BASIC TO NUANCEDate: Saturday, May 27, 2023 Time: 11:00 AM to 12:00 PM EST (60 minutes) Presented by: Christopher Denicolo, JD, LL.M.

REGISTER HERE FOR 1.0 CPA CPE CREDIT REGISTER HERE FOR NON-CPE CREDIT REGISTER HERE FOR FLORIDA CLE CREDIT

Please Note: After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 3-5 hours after the program concludes, the recording and materials will be sent to the email address you registered with. Important: If you are already on the “Register For All Upcoming Free Webinars” list, you will be auto-registered on Friday for non-CPE credit. If you would like 1.0 free CPE Credit for this webinar, please also register above through CPA Academy. If you would like Florida CLE Credit, please register above through the provided link above. Please email registration questions to info@gassmanpa.com. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Free Upcoming Webinars

ALPHABET SOUP: PLANNING WITH LLCs, IDGTs, GRATs & OTHER ACRONYMSDate: Thursday, June 1, 2023 Time: 1:00 PM to 2:00 PM EST (60 minutes) Presented by: Alan Gassman, JD, LL.M. (Taxation), AEP (Distinguished)

Please Note: After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 3-5 hours after the program concludes, the recording and materials will be sent to the email address you registered with. Important: If you are already on the “Register For All Upcoming Free Webinars” list, you will be auto-registered on Friday for non-CPE credit. Please email registration questions to info@gassmanpa.com. EVALUATING ESTATE TAX TECHNIQUESPART 1Date: Saturday, June 3, 2023 Time: 11:00 AM to 12:00 PM EST (60 minutes) Presented by: Alan Gassman, JD, LL.M. (Taxation), AEP (Distinguished)

REGISTER HERE FOR 1.0 CPA CPE CREDIT REGISTER HERE FOR NON-CPE CREDIT REGISTER HERE FOR FLORIDA CLE CREDIT

Please Note: After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 3-5 hours after the program concludes, the recording and materials will be sent to the email address you registered with. Important: If you are already on the “Register For All Upcoming Free Webinars” list, you will be auto-registered on Friday for non-CPE credit. If you would like 1.0 free CPE Credit for this webinar, please also register above through CPA Academy. If you would like Florida CLE Credit, please register above through the provided link above. Please email registration questions to info@gassmanpa.com.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

ALL UPCOMING EVENTS

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

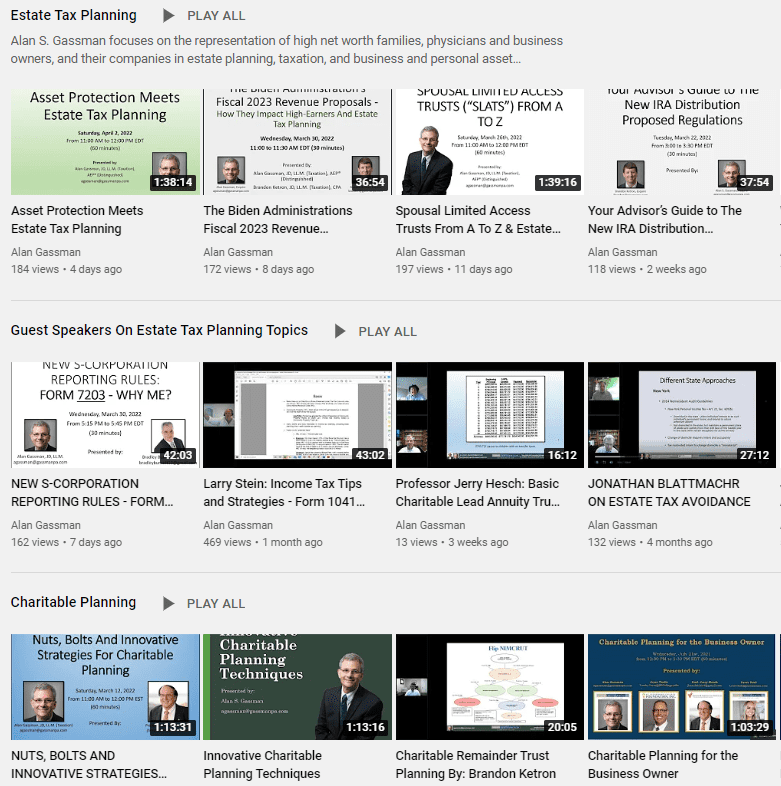

YouTube Library

Visit Alan Gassman’s YouTube Channel for complimentary webinars and more! The PowerPoint materials can be found in the description box located at the bottom of the YouTube recording. Click here or on the image of the playlists below to go to Alan Gassman’s YouTube Library. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

HUMOR

A Sappy Joke

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Gassman, Crotty & Denicolo, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2023 Gassman, Crotty & Denicolo, P.A |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||