The Thursday Report – Issue 331

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Thursday, November 3, 2022Issue #331Coming from the Law Offices of Gassman, Denicolo & Ketron, P.A. in Clearwater, FL. Edited By: Adriana Ochsner Having trouble viewing this? Use this link

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Please join us for the above seminars on November 7, 2022. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Please Note: Gassman, Crotty, & Denicolo, P.A. will be sending the Thursday Report out during the first week of every month. Article 1Letter to Clients and AdvisorsWritten By: Alan Gassman, Allison Freeman & Michelle Rodenburg Article 2Disaster Planning for a HurricaneWritten By: Alan Gassman Article 3The 501(c)(4) StrategyWritten By: Alan Gassman & Karl Mill Article 4Employment Issues in the Event of a HurricaneWritten By: Colleen Flynn Forbes CornerA Guide To Tax Planning For Victims Of Hurricane Ian And Other DisastersWritten By: Alan Gassman, JD, LL.M. (Taxation), AEP® (Distinguished) For Finkel’s FollowersWhy Time Spent On Yor Business Might Not Be EnoughWritten By: David Finkel Free Saturday WebinarAlphabet Soup: Planning With LLCs, IDGTs, GRATs, & Other AcronymsPresented By: Christopher Denicolo More Upcoming EventsYouTube Library |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1Letter to Clients and Advisors

Written By: Alan Gassman, Allison Freeman and Michelle Rodenburg

Dear Clients and/or Their Advisors: Following every large storm, there are thousands of damaged homes and corresponding insurance claims for property damage. Insurance companies are understandably cautious in approaching claims that are made, with a view towards limiting payments to what is reasonable and necessary in view of insurance policy provisions and the circumstances of each claim. While many insurance carriers and their in-house personnel will pay a great many claims at the full loss value without problem, this is not always the case, and the adjusters who work for the insurance carriers or the agencies that they hire, will often take a conservative, or sometimes unrealistic view of the situation, and attempt to deny coverage, or to offer much less than what is reasonable and appropriate. This happens at a very high frequency for hurricane claims given the following factors: 1. Wear and Tear – Florida roofs wear out and can be damaged by small storms, hail and wind that occur over time before a hurricane. As such, insurance carriers may attempt to claim that a roof has already experienced significant “wear and tear” when taken down by the storm. 2. Interior Damage – Interior water damage that occurs as the result of a failed roof may be significantly more serious and require additional money to be paid by the insurance company. However, interior damage, including damage to insulation, ceilings, walls and other elements, may not be acknowledged or brought to light as the insurance company and/or roofers focus solely on the roof damage itself. 3. “Prompt” Notice – Damage due to a hurricane may not be immediately apparent. This results in what the insurance companies consider “late” or “delayed” claims. 4. Flood Insurance vs. Windstorm/Hurricane Insurance – Insurance companies will indicate that damage is not covered under your policy because it was due to flood (storm surge), not hurricane. This may also occur in the reverse with a flood carrier as pointing to another carrier is an easy way for insurance companies to get out of paying claims. So now that Hurricane Ian has passed, what can you do to deal with these potential factors? 1. Wear and Tear – Shingle roofs have a life expectancy of approximately 15 years while tile roofs are expected to last closer to 30 and metal roofs are expected to last even longer. To prove that your roof was in good working order at the time of the storm and had years left before it required replacement, gather all reports, photographs, maintenance receipts, and repair invoices. A four-point inspection or wind mitigation report can be very persuasive to show that your roof had several years of life left. In addition, maintenance receipts and repair invoices provide support against arguments that your roof was in disrepair before the storm. 2. Interior Damage – Look around your property and document any water stains, cracks, loose tape lines, nail pops, baseboard separation, and anything that may look different from before the storm. In addition, make the interior of your property available to the insurance company when they visit and encourage them to inpect for damage beyond the roof. Do not keep them from inspecting any areas, even if you have not personally seen any damage in that room. Further, if you have seen anything, please make sure you point it out to them and never indicate that there is “no interior damage” unless you are sure. Please note that you may also need to retain experts to perform an engineering study, along with potential mold and water damage remediation, to determine the full amount of repairs needed to return the home or property to its pre-loss condition. You do not have to rely solely on experts retained by the insurance company. 3. “Prompt” Notice – To a lay person who is not trained, it may be difficult to see hurricane damage as it does not all look the way that you expect. For example, cracks, separations, land that has pulled away from the property, electronics that no longer function, and indentations may be evidence of hurricane damage. In addition, lifted, loose or displaced roof tiles and shingles are very difficult to spot from the ground and sometimes you cannot even tell they exist without further exploration. In fact, there have been properties where a hurricane has lifted the entire roof and placed it right back in the same spot. As such, there was no visible damage until an expert looked at the trusses in the attic to see what had occurred. For these reasons, many homeowners and property owners may not discover they have hurricane damage until much later when a bigger issue occurs, such as a significant water leak. Thus, you must be extremely diligent in determining whether wind, fallen trees or other phenomenon may have occurred that resulted in damage to your property that requires filing of an insurance claim. As soon as you notice anything that may be considered damage, please be sure to notify your insurance company right away and if you are not sure, please reach out to someone who can investigate for you. 4. Flood insurance vs. Windstorm/Hurricane Insurance – Storm surge and/or flooding usually leaves an interior water line that may be more difficult to see as time goes on, and water as high as 12 feet outside does not mean that water got up to 12 feet inside. As such, it is important to take photographs, make lists and document all damage above and below that line while you can still see it. This is also true for any personal and business property (contents). Please do not move any of these items until you are able to document where they were located. Keep in mind that whether a particular item was on level one or two of a property can make a significant difference in coverage when it comes to flood, so documentation is key. In addition, please do not personally decide whether your damage is covered under flood or windstorm/hurricane. If you have policies for both and experienced water inside your property, file claims under both and allow the insurance companies to determine who covers what damage. If you only have coverage for windstorm/hurricane, still file a claim with that carrier and allow them to determine whether the damage is covered. You can then deal with whatever they decide and determine your next steps accordingly. You pay insurance premiums for a reason and do not want to miss out on a covered claim because you were not sure. Our firm is working with with another Florida firm, Constable Law, P.A. and their attorneys James Constable and Allison Freeman in order to provide representation to those impacted by Hurricane Ian. Mr. Constable’s and Ms. Freeman’s biographies can be found here: https://www.constable-law.com/about-us. Constable Law, P.A. devotes its practice to assisting homeowners, commercial property owners, and community associations with claims against their insurance companies when those insurance companies fail to provide fair pay-outs to policy holders after they have suffered damage from disasters such as Hurricane Ian. We are happy to be partnering with Constable Law, P.A. as they provide comprehensive and supportive representation for those in need of someone on their side when dealing with their insurance company. They work to provide adequate settlements with insurance companies, and are equipped to take insurance companies to court in instances where they refuse legitimate claims. Constable Law, P.A. is prepared to work on your behalf in the insurance claim process. This includes providing a free consultation and inspection of your property, and handling all aspects of the insurance claim process for you. With all the questions and pitfalls of the often-complicated insurance claim process, Constable Law, P.A. will take care of things to allow you to focus on other aspects of the rebuilding process. If you have already hired a public adjuster to assist you on your insurance claims, Constable Law, P.A. is happy to work with your adjuster to ensure you receive full value of your claim. Constable Law, P.A. is willing to undertake representation at the same low rate as a public adjuster, with the added benefit of being a law firm with years of experience in litigating insurance claims. We are hosting a local in-person seminars regarding the rebuilding process and insurance claims, as well as the services we can provide, at the following date and location: Monday, November 7, 2022 6:30 PM to 7:30 PM ET & 7:45 to 8:35 PM ET

Holiday Inn Ft. Myers Town Center We hope to see you at our seminars. If you cannot make it, the seminar will be recorded and accessible at any time, along with a transcript of the information provided. We will also be holding a weekly update webinar for questions and answers. If you have any questions, please reach out so that we can provide it in our upcoming weekly webinars, A webinar in which we discuss the insurance claim process can be found here. One of our newest lawyers, Michelle E. Rodenburg, has lived on Sanibel for many years and is located in the Southwest Florida area. She is available to communicate and visit with clients in this area and to assist in the insurance claim process in conjunction with Constable Law, P.A. As a fellow member of the Southwest Florida community, Michelle is greatly looking forward to assisting you in the handling of insurance claims alongside Constable Law, P.A. While we hope that this article finds you safe and that your property was not impacted by Hurricane Ian, we also hope it provides some helpful information and answers any questions you may be having at this time. Best personal regards, Alan S. Gassman

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 2Disaster Planning for a Hurricane

Written By: Alan Gassman

Estate and financial planners commonly counsel clients on wills, trusts, insurances, and financial asset ownership and disposition. Notwithstanding recent experience in the United States with fires, shootings, and hurricanes, planners typically do not provide information on what clients can do to be better protected in the event of an unexpected disaster. The following Memorandum may be used to provide basic information so that disaster planning can be put on a client’s checklist.

Dear Client, In the aftermath of Hurricane Ian, I wanted to make sure to cover a few of the things that can be done to put you and your family in a safer position incase of a natural or medical disaster or emergency. You may want to fill in some of the blanks below and let us have a copy of this form, which we can scan to your directory in our computer system which is saved to “the cloud” so as to be accessible if ever needed. You may want to also email a scanned copy of the fully or partly completed document to us, one or more of your children, or anyone else who you believe might be available and may need this information in the event of an emergency. In addition, you may want to set your calendar for a day that you might remember, such as a public holiday or the birthday of you or a loved one and remember on that day to go through the ANNUAL CHECKLIST provided below. 1. Who will know what medications you are taking, doses, and other medical related information in the event of an emergency? B. Doctor or Doctors _________________________________

_________________________________ _________________________________ _________________________________ E. Emergency contact outside of your household Name: _________________________________ Phone: _________________________________ Address: _________________________________ F. Emergency contact outside of your general vicinity (or relatives out of town) Phone: _________________________________ Address: _________________________________ 2. Would the same people also be your contacts for financial emergencies or situations concerning your personal belongings? This would typically be who you would have appointed under a Durable Power of Attorney to act as your agent, but does anyone else come to mind both in town and out of town? First Choice: _________________________________ Second Choice: _________________________________ Third Choice: _________________________________ 3. Do you have a Living Will and Health Care Power of Attorney and where can the originals or copies be found? We store the originals for most clients in our fire-proof vault system and maintain copies, when they are provided to us or signed in our office, on our cloud based data system. _________________________________ 4. If electronic systems go down credit cards may not work and ATM machines may not be functional. You may want to check annually to make sure that you have a reasonable amount of cash in a well secured safe or other place that is convenient to you. Bank safe deposit boxes are probably the safest place to keep cash and valuables, but may not be accessible, such as when the bank itself is closed or not able to open. Perhaps consider investing in a fire and water proof safe. 5. When a disaster strikes, the damage can be catastrophic. Homes and vehicles may be destroyed and people may be hurt or even killed. You should not wait until you suffer a loss or injury to get your insurance information together. You should also keep recent photos and videos of your home and vehicles and set your calendars to update these annually. This will help to facilitate the insurance claim process if a loss happens to occur. A. Homeowners, Renters, Flood Insurance Information _____________________________________ _____________________________________ B. Car Insurance Information _____________________________________ _____________________________________ C. Health Insurance Information _____________________________________ ____________________________________ A. Life Insurance Information _____________________________________ _____________________________________ 6. In emergency situations you may not have time to collect important documents that will later become necessary. If possible, you should make copies of important documents such as drivers licenses, passports, bank account information, and insurance polices and store them in a safe and secure location that can be quickly accessed such as a fire and water proof safe. 7. Even if stored properly, natural disasters can destroy important documents. It is a good idea to periodically scan and upload essential documents on to some form of cloud storage. This will allow you to access these documents even if the physical documents are destroyed. It is important the method of storage is safe, secure, and accessible from another location. For example, if you have an iPhone, you are eligible for 5Gb of free iCloud storage. Along with important documents, consider also uploading meaningful photos and videos into the cloud to help prevent loss. 8. Certain natural disasters such as floods, fires and hurricanes require that individuals evacuate their homes to escape potential danger. You should familiarize yourself with evacuation routes to guarantee you are using the safest and fastest route to avoid danger.

9. After a disaster hits it is possible that help may not arrive immediately. This means that you may be required to live without electricity, running water, or grocery stores for several days. Because of this, it would be wise to create an emergency kit. While needs may vary depending on location, most supply kits should include the following: While Spam is not the most popular food, the shelf life of Spam is “infinite.” 10. Pets also need food, water, medication, etc. Therefore, if you have a pet at home, it is important to prepare for them just as you would for your family. A pet’s disaster kit should include the following: There are many dogs that do not know how to swim so is important to teach them how to swim if you live in Florida. Please let us know if you have any question in respect to this. While we hope that this article was helpful in getting you started on your disaster preparation, it is not meant to be an exhaustive list on how to prepare for an emergency. Different locations have different needs so it is important to check with your local authorities on how to better prepare for disasters in your area. Ready.gov is a great resource to consult when creating a disaster preparation plan.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 3The 501(c)(4) Strategy

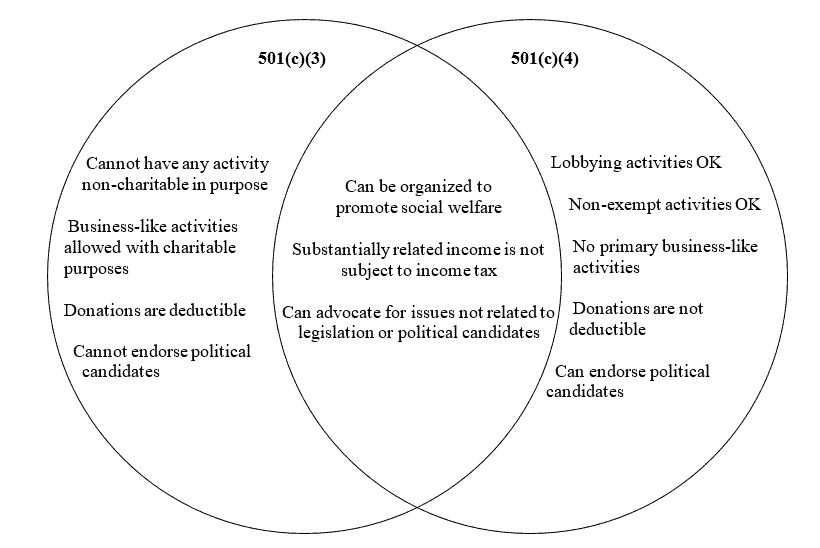

Written By: Alan Gassman & Karl Mill Recent news of a $1.6 billion donation of a company to a 501(c)(4) Social Welfare Organization that will be used at least in good part to pay for political campaigns, political contributions, and political activities brings to light the opportunity that people have to allow otherwise taxable income to support their political aims. An entity qualifies under IRC 501(c)(4) if it constitutes an “organization[] not organized for profit but operated exclusively for the promotion of social welfare” and “no part of the net earnings of such entity inures to the benefit of any private shareholder or individual.”[1] This private inurement language is identical to the private inurement language found in IRC § 501(c)(3) and has been construed in the same manner. Treasury Regulation § 1.501(c)(4)-1(a)(2)(i) provides that, “[a]n organization is operated exclusively for the promotion of social welfare if it is primarily engaged in promoting in some way the common good and general welfare of the people of the community.” When interpreting the “primarily engaged in” requirement, many advisors use a 60%/40% rule—60% or more of the organization’s expenditures must be for activities that promote social welfare and 40% or less may be for political campaign contributions. There is some indication, though not binding, that the IRS considers the 60%/40% rule to satisfy the “primarily engaged in” requirement. Due to a backlog of 501(c)(4) tax-exempt applications, the IRS published Fact Sheet 2013-8 in June 2013, which announced the creation of a “safe-harbor” option for certain organizations (starting with 80 groups in particular at the time that the Fact Sheet was released) that had their applications for 501(c)(4) status pending for more than 120 days as of May 28, 2013: This “safe-harbor” option will provide certain groups an approved determination letter granting them 501(c)(4) status within two weeks if they certify they devote 60 percent or more of both their spending and time on activities that promote social welfare as defined by Section 501(c)(4). At the same time, they must certify that political campaign intervention involves 40 percent or less of both their spending and time.[2] While this Fact Sheet did not establish a binding 60%/40% rule for determination of 501(c)(4) tax-exempt status because it applied only to applicants with applications pending more than 120 days as of May 28, 2013, it does indicate that the IRS generally considers a 60%/40% split between social welfare and political activities to qualify an organization for 501(c)(4) tax-exempt status. The promotion of social welfare can include politicizing, advertising, and propaganda for such topics as pro- and anti-abortion and pro- and anti-immigration. So, although the $1.6 billion donation mentioned above cannot be spent primarily on political causes, it could be primarily used for issue-related advertisements during a political campaign and partially for political campaign intervention. Tax Issues No income tax deduction is permitted for a contribution to a 501(c)(4) organization, but no income tax is triggered when an appreciated or non-leveraged income-producing asset is contributed to a 501(c)(4) organization. Therefore, a donor that is selling assets and will pay significant income tax on the sale may want to contribute the appreciated asset or assets to a 501(c)(4) organization before there is a binding obligation to sell in order to avoid federal income tax on the appreciation. Gifts made by individuals to 501(c)(4) Social Welfare Organizations and to certain dedicated political organizations are not subject to federal gift tax, but are subject to federal estate tax for decedents who die leaving more than the amount that can pass estate-tax-free. For this reason affluent individuals who wish to support political causes and specific candidates may form or contribute to Section 501(c)(4) Organizations, but should also take care to not retain a degree of control over such organizations that would cause the Organization’s assets to be considered as owned by the donor under I.R.C. § 2036(a)(2). This section provides that if a donor makes a gift and retains the right—even if exercisable only in conjunction with others—to direct how the asset(s) gifted may be enjoyed then the value of the gifted property is includable in the donor’s gross estate. An easy mistake to make is set up a 501(c)(4) Organization identically to how one would set up a family foundation (for example, by making themselves the directors) and end up with a very large estate tax bill when the assets of the 501(c)(4) Organization are included in the donor’s estate with no corresponding deduction. To avoid this problem, the donor must either trust a third party to run the 501(c)(4) Organization or provide that the 501(c)(4) Organization auto-convert on death to a 501(c)(3) so that the amount donated qualifies for a deduction under I.R.C. § 2055. Most forms of income earned by a Section 501(c)(4) Organization will not be subject to federal income tax, in generally the same way that applies to a Section 501(c)(3) Charitable Organization, even though a Section 501(c)(4) Social Welfare Organization may expend a significant portion of its resources on “legislative and partisan activities” in addition to lobbying. For example, in Revenue Ruling 68-656 the I.R.S. indicated that a Social Welfare Organization that was funded to educate the public on a “practice that is not presently legal” and to lobby in favor of legalizing the practice was exempt under Section 501(c)(4). As another example, a radio broadcasting company was found to be exempt with respect to conducting free public radio programs to disseminate liberal and progressive social views.[3] On the other hand, there are limits to the extent that a 501(c)(4) Organization can benefit or fund a particular candidate and the exact boundaries or percentages with respect to such support has not been determined. A donor who wishes to have extensive publicity and lobbying with respect to an area of political activity, such as educating the public and lobbying for or against abortion rights, school educational and communication rights and legislation, or pro- or anti-same-sex viewpoints and incidental support of political parties and politicians associated therewith may work well under a Section 501(c)(4) Organization. One final word of caution to philanthropists looking to move the family business out of the estate (assuming they solve the § 2036 problem): a 501(c)(4) Organization cannot be a holding company with the occasional political donation. The general principle applies that activities need to be commensurate in scope with the entity’s assets. The 501(c)(4) Organization needs a plan to use the assets or income for 501(c)(4) purposes in a meaningful way. Comparisons to Other Organizations

Although both 501(c)(4) and 501(c)(3) organizations can be organized to promote social welfare, there are several important differences between the two types of organizations, as illustrated by the following diagram: 501(c)(4) Organizations are not subject to the excess business holding rules or self-dealing rules, but are subject to the excess benefit transaction rules under I.R.C. § 4958. It is also important to differentiate a 501(c)(4) Organization from a Section 527 Political Organization. Section 527 Political Organizations can directly benefit any one or more candidates or engage in any political activity that is legal, but will be subject to income tax on investment income in the same way that applies to a corporation (presently at the 21% tax bracket on net income). This is referred to in Section 527(b) as “political organization taxable income” and is defined as “gross income, other than ‘exempt function income,’ minus deductions that are directly connected with the production of such includable gross income.” The “exempt function income” that is not considered to be taxable includes amounts received as (1) contributions of money or property from donors, (2) membership dues, (3) the proceeds from certain bingo games described in I.R.C. § 513(f)(2), and (4) proceeds from political fundraising or entertainment events or the sale of political campaign materials “other than amounts received in the ordinary course of a trade or business” as defined in I.R.C. § 527(c)(3). Extensive rules exist for the separate accounts and accounting necessary to qualify fundraising, entertainment, and sale of political campaign materials as being non-taxable as opposed to having been “received in the ordinary course of a trade or business.”[4] Summary The following attributes of 501(c)(4) organizations create planning opportunities for political and charitable giving:

For example, a taxpayer receiving $10,000 a month from an oil and gas interest must pay $3,700 a year in income taxes and is left with $6,300 for donations to political parties. On the other hand, if the taxpayer puts the oil and gas interest into a 501(c)(4), he or she will pay no income taxes and the 401(c)(4) can directly donate the $10,000 of income each month to political causes.

We hope that the information presented has been helpful to you as a reader. We welcome any questions, comments, or suggestions. [1] Emphasis added. [2] Emphasis added. [3] DEBS Memorial Radio Fund, Inc. V. Commr’, 148 F. 2d 948 (2nd Cir. 1945). [4] It is noteworthy that the purchase of meals for campaign staff and the payment of financial benefits and assets to individuals can be taxable to those individuals.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Article 4EMPLOYMENT ISSUES IN THE EVENT OF A HURRICANE

Written By: Colleen M. Flynn Hopefully no hurricanes will impact The Tampa Bay Area this summer, but in the event of a hurricane (or other disaster resulting in a business closure) Florida employers need to be mindful of their wage and hour obligations to their employees. Also important is for businesses to have emergency plans in place before a hurricane occurs. Employers should have contact information on hand for employees and a pre-determined method for contacting employees in the event of a hurricane. Business needs will dictate whether employees are vital to operations during a hurricane or helping a business resume operations after a hurricane or if the employees can work from home while business operations are recovered. In the event of a business closure due to a hurricane, Florida employers covered by the Fair Labor Standards Act (“FLSA”) must continue to pay employees in accordance with the FLSA. Whether an employer has to pay an employee if the business is closed due to a hurricane depends on whether the employee is “exempt” or “non-exempt” under the FLSA. Employers do not have to pay non-exempt employees when no work has been performed as non-exempt employees must only be paid for hours actually worked. However, employers must continue to pay exempt employees if they work at any time during a workweek and are available to work the remaining days regardless of whether they actually work. If the business is closed for less than a workweek and an exempt employee has worked part of the week, then the exempt employee must be paid for the entire workweek. If the business is closed for an entire workweek and the exempt employee did not work at anytime during that workweek then the business is not required to pay the employee any part of their salary for that week. Employers must be mindful of employees working from home during a business closure and should have a policy in place that requires non-exempt employees to track and report all time worked as non-exempt employees must be paid for all time worked and must be paid at the proper overtime rate for hours worked over 40 in a workweek. Employers who place employees “on-call” during a hurricane or at any time must determine whether the on-call time must be paid. If employees are not able to use the time for their own purposes then the call time will be deemed compensable. Employers should talk with their employment lawyers to determine if their employees must be paid for on-call time. Hurricanes and other business closures pose significant challenges to employers in order to maintain compliance with wage and hour laws. Please remember that this article is written for Florida employers and that out of state employers may have additional or different state law wage and hour obligations. If you have questions about your wage and hour obligations during a business closure please do not hesitate to contact us. Exempt employees are those employees who are not entitled to be paid overtime pay pursuant to the FLSA when they work more than 40 hours in a work week. Generally, exempt employees must meet one of the duties tests set forth in the FLSA and be paid on a guaranteed salary basis per workweek of not less than $684.00 Non-exempt employees are those employees who must be paid overtime pay pursuant to the FLSA when they work more than 40 hours in a work week. Generally, non-exempt employees are hourly paid employes. Colleen Flynn is a partner with Johnson Pope and focuses her practice on Labor and Employment issues. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Forbes Corner

Tax Smart Disaster Relief For Your Employees And FamiliesWritten By: Alan Gassman, JD, LL.M, AEP (Distinguished)

Many employers and for profit companies are willing and able to provide financial assistance and services to those who have been harmed or dislocated by hurricane… Continue Reading on Forbes. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

For Finkel’s FollowersWhy Time Spent On Your Business Might Not Be Enough |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

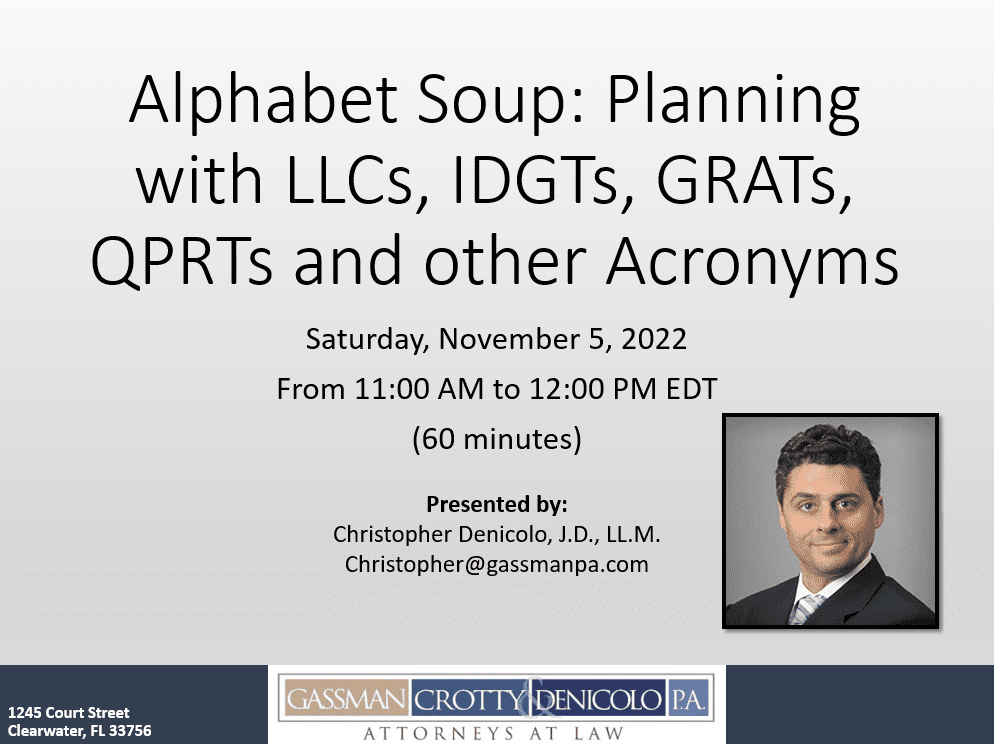

Free Saturday WebinarAlphabet Soup: Planning With LLCs, IDGTs, GRATs, & Other Acronyms

Date: Saturday, November 5, 2022 Time: 11:00 AM to 12:00 PM EDT (60 minutes) Presented by: Christopher Denicolo, J.D., LL.M. Please Note: This is a complimentary webinar program. After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 3-5 hours after the program concludes, the recording and materials will be sent to the email address you registered with. Please email registration questions to info@gassmanpa.com.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

All Upcoming Events

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

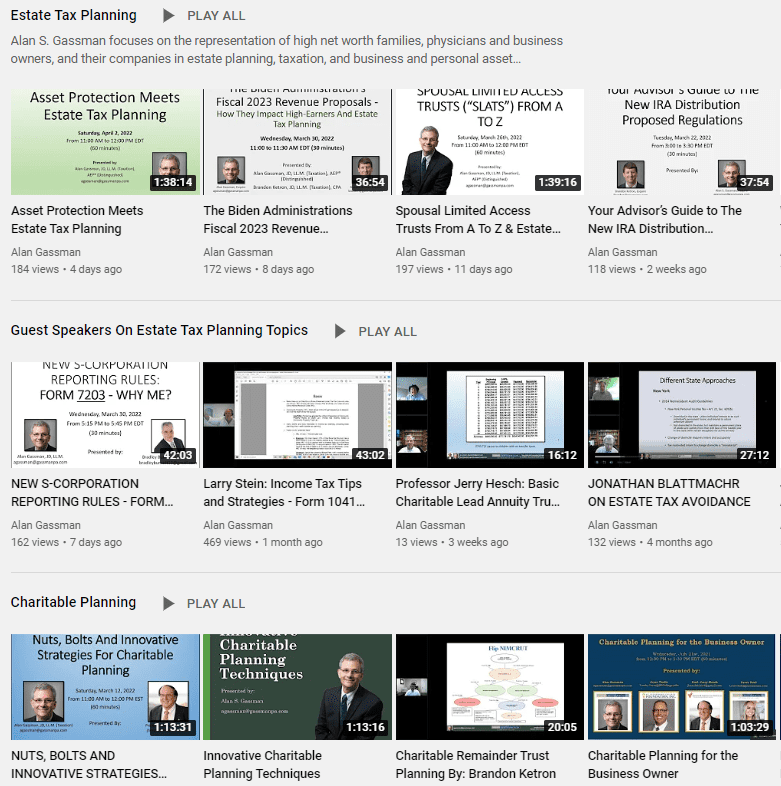

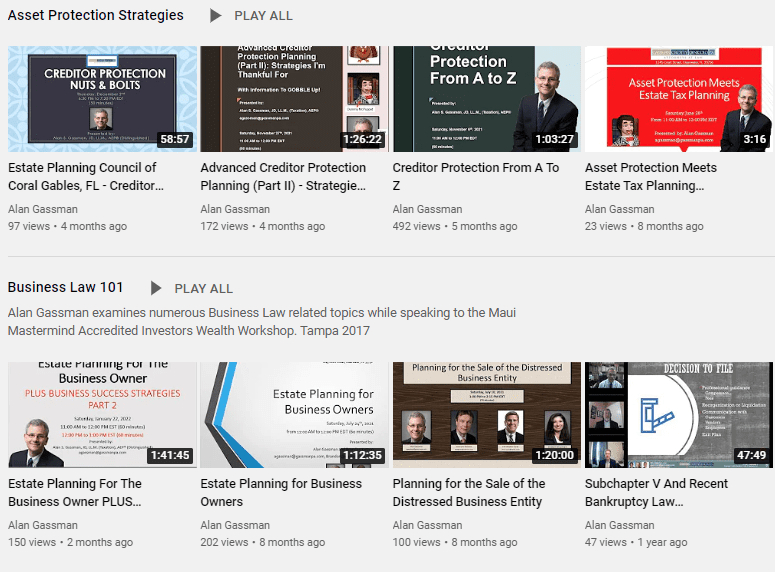

YouTube Library

Visit Alan Gassman’s YouTube Channel for complimentary webinars and more! The PowerPoint materials can be found in the description box located at the bottom of the YouTube recording. Click here or on the image of the playlists below to go to Alan Gassman’s YouTube Library. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Gassman, Denicolo & Ketron, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2021 Gassman, Crotty & Denicolo, P.A

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||