The Thursday Report – Issue 325

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Thursday, May 12th, 2022Issue #325

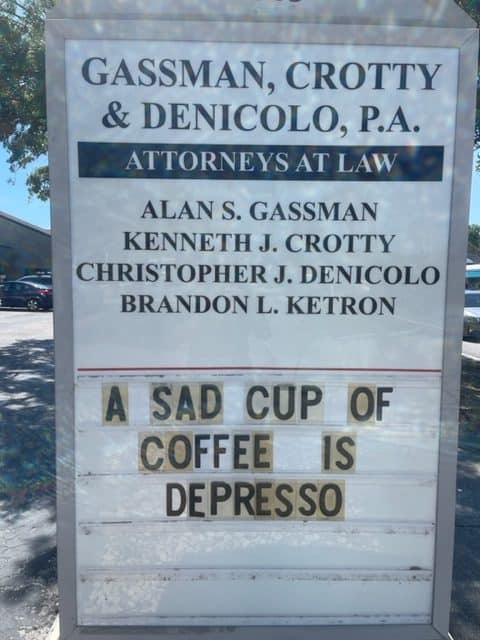

Coming from the Law Offices of Gassman, Crotty & Denicolo, P.A. in Clearwater, FL. Having trouble viewing this? Use this link

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1IRS Clawback Proposed Regulations Put a Tiger in the IRS’s Tank A Leimberg Information Services Article; Written By: Alan Gassman, Esquire and Brandon Ketron, Esquire Article 2A New Qualified Opportunity Fund PLR Written By: Ken Crotty, Esquire Article 3Denial of Innocent Spouse Relief Written By: Ken Crotty, Esquire Article 4Quick Guide To IRA/Pension Plan Distribution Planning Under February 2022 Proposed Regulations: Part One Written By: Mckenzie McAdams, Stetson University Law Clerk Forbes CornerIRS Clawback Proposed Regulation Causes Confusion In The Playing Field Written By: Alan Gassman, JD, LL.M, AEP (Distinguished) Thoughtful CornerTaking Down the Happiness Hurdles Written By Thurston Thursday, III For Finkel’s Followers22 Ways to Motivate Your Team Written By: David Finkel; Author, CEO, and Business Coach Free Saturday WebinarTools And Strategies To Avoid Estate Planning Tragedies Presented by: Alan Gassman, JD, LL.M. (Taxation), AEP (Distinguished) More Upcoming EventsYouTube LibraryHumor

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1IRS Clawback Proposed Regulations Put a Tiger in the IRS’s Tank

Written By: Alan Gassman, Esquire and Brandon Ketron, Esquire This article was originally distributed by Leimberg Information Services. LISI Estate Planning Newsletter #2958 (April 29, 2022) at http://www.leimbergservices.com. Copyright 2022 Leimberg Information Services, Inc. (LISI). EXECUTIVE SUMMARY: The world of estate tax planning is rarely straightforward, clear, or simple. While planners may be able to assist in the difficulties that taxpayers face by way of planning strategies, financial projections and illustrations, aggressive IRS responses to various planning strategies in court cases, Treasury Regulation pronouncements and Proposed Regulations can result in unpredictability, and keep estate tax planners on their toes every day. Planners and taxpayers were under the assumption that gifts made while the exemption was higher than upon the date of death would enable the estate of the donor to use the higher exemption amount that was in existence at the time of each gift, rather than the lower exemption amount that would apply after January 1, 2026 (or earlier, if the exemption amount is reduced sooner) as to all categories of transfers, but we could only dream that it be so simple. For example, Toni Tiger has a $12,060,000 estate tax exemption and may make an $8,000,000 cash gift, reducing his exemption to $4,060,000. If the exemption would be $13,000,000 in 2026 by reason of inflation adjustments and is subsequently reduced to $6,500,000, does this individual have to pay estate tax on $1,500,000? The answer for most will be no under Regulations finalized in 2019. However, if instead of making a complete traditional gift, Toni instead gifts a promissory note payable by him to his significant other, Kitten Clawback, of the same value, and the assets of his estate will be used to satisfy the note, his estate would be unable to benefit from the increased exclusion amount available at the time of the transfer, and instead would only have the availability of the exclusion applicable on the date of death resulting in estate tax being imposed on the $1,500,000 excess under the new Proposed Regulations. FACTS: In 2017, the Tax Cuts and Jobs Act (TCJA) was passed and provided that the exemption amount would be temporarily doubled to $10,000,000 with adjustments for inflation, but go back to $5,000,000 plus inflation adjustments in 2026. The TCJA also provided the Treasury Department (which includes the IRS) with the power to establish regulations to prevent abuse for situations where a gift was made but the taxpayer retained the beneficial use of or control over transferred property as of the death of the taxpayer after the exemption reduction occurs. In the wake of the passage of the TCJA, there was a lack of clarity for situations where the estate tax exemption amount that applied at the time of a decedent’s death was lower than the exclusion amount that applied when the transfer was made (by reason of a reduction in the exemption). The TCJA raised concerns from planners and taxpayers an estate tax could apply to gifts otherwise exempt from gift tax by the temporarily increased exemption amount; the IRS’s response was final regulations released in 2019 to craft a “Special Rule” that allows an estate to calculate its estate tax credit using the higher of the exclusion applicable as of the date of the gift or the exemption amount applicable upon death. Also included in the 2019 Regulations was clarification that the taxpayer would need to “use it or lose it” by making gifts exceeding the historical exemption amount in order to take advantage of the temporary increased exclusion amount. For example, if a taxpayer made a gift of $5,000,000 today when the exemption amount is $12,060,000, and the exemption amount is reduced to $7,060,000 in 2026, the taxpayer would only have $2,000,000 of exclusion remaining. However, if the taxpayer made a gift of $12,060,000 using all of the increased exclusion amount, then there would be no “clawback” of the exemption previously used if the taxpayer died after 2026 when the exemption amount is reduced to only $7,000,000. The question of how to treat gifts that are complete at the time of transfer, but still includible in the gross estate of the decedent upon death has not been determined, and has loomed over taxpayers and estate planners since the promulgation of the “Special Rule”. The Proposed Regulations issued on Tuesday, April 26 make clear that transfers where the donor continues to have title, possession, or other retained rights in the transferred property during life that will be treated as still owned by the donor upon death, which occur under §§2035, 2036, 2037, 2038, and 2042 of the Internal Revenue Code, do not qualify for the Special Rule. For situations like these, the amount includible in the gross estate would only be given the benefit of the exemption amount available on the date of death. The Proposed Regulations provide for exceptions to the Special Rule, and also exceptions to the exception in certain situations. It is noteworthy that Proposed Regulations are not binding upon taxpayers, but are generally binding upon the IRS until they become final, at which time they become binding upon both taxpayers and the IRS. Proposed Regulations are issued to the public, given a brief period of time to make comments; thereafter, the IRS and Treasury Department review public comments and issue Final Regulations, which are usually a bit more taxpayer friendly than the Proposed Regulations that they replace, but not always. The exception to the Special Rule applies to gifts that are includible in the gross estate pursuant to §§2035, 2036, 2037, 2038, or 2042 of the Code, unsatisfied enforceable promises, gifts subject to the special valuation rules of §2701 (related to valuation of intra-family transfers of equity interests in an entity where the senior generation retains certain preferred rights) and §2702 (related to GRATs and QPRTs), and the relinquishment or elimination of an interest in any one of the aforementioned situations that occurs within eighteen (18) months of the date of the decedent’s death. If a transfer falls under one of these categories, the Special Rule will not apply. But, of course, there are exceptions to the exception. The Proposed Regulations further provide that the Special Rule will still apply to allow the exemption amount that was higher when a gift was made, where the assets gifted are includible in the donor’s gross estate, to apply in two types of situations: (1) transfers where the value of the taxable portion of the transfer did not exceed five percent of the total transfer, and (2) transfers where the retained interests were relinquished or terminated by the termination of a durational period described in the original instrument of transfer by either (a) the death of any person, or (b) the passage of time. COMMENT: While 2026 is still more than three years away, it is not unreasonable to think that the exemption could be reduced as early as 2023 if the House of Representatives stays in Democratic hands and the Senate swings by three or four seats further into Democratic control. Since the Biden Tax Plan that was published in March does not make mention of reduction of the exemption amount, one should not worry, yet. As mentioned above, the Special Rule prevents the “clawback” for the use of the higher estate/gift tax exemption amount available on the date of the complete transfer when determining the amount of credit available as of the date of the taxpayer’s death, even if the applicable estate/gift tax exemption is lower as of the date of the taxpayer’s death. This is good news for taxpayers, but the Proposed Regulations provide exceptions to the applicability of the Special Rule. The IRS continues to issue Proposed Regulations, including rules and examples, that are complicated; however, the specific circumstances where a taxable gift may be considered to have occurred are fairly well defined and contained. Thankfully, the Proposed Regulation demonstrate well how the Special Rule and various exceptions apply; two examples loosely based on examples in the Proposed Regulations are discussed below: 1. Example One: Taxpayer’s Gift of Note or Other Obligation. Assume that a taxpayer with a net worth of $12,000,000 gives an $11,000,000 note to his or her children and files a gift tax return showing use of $11,000,000 of his or her $12,060,000 estate tax exemption. The promissory note is to be satisfied with assets of the taxpayer’s gross estate. Assume that the exemption goes up to $13,000,000 through 2025, and then is cut to $6,500,000 on January 1, 2026. The taxpayer dies on January 1, 2027. The taxpayer may at that time have a net worth of $1,000,000, but he or she still has $12,000,000 of assets and has not made any payment on the $11,000,000 promissory note, and therefore the $11,000,000 note is includible in the taxpayer’s gross estate. The limitation to the Special Rule applies and the taxpayer can only receive the benefit of the smaller exclusion amount that is applicable on the date of death, which is $6,500,000, and therefore would pay estate tax on $5,500,000 of assets ($12,000,000 – $6,500,000 = $5,500,000). This limitation on the Special Rule would also apply if the taxpayer, or a third party empowered to act on the taxpayer’s behalf, paid the note within 18 months of the taxpayer’s death. Many planners’ interpretation of the rule was confirmed in this example, which is that the use of a note, or an enforceable promise to pay, will not be effective in using the temporarily increased exclusion amount, if the regulations are made permanent. The increased exclusion amount may be used only if payment actually occurs on the note, and such payment must occur 18 months prior to the taxpayer’s death. 2. Example Two: Death of the Grantor Before the Grantor Retained Annuity Trust Term Ends The Internal Revenue Code explicitly permits the use of what is called the a Grantor Retained Annuity Trust (“GRAT”), whereby assets or ownership interests in investment or business entities can be placed under a trust that pays the Grantor a certain percentage of the day one value of the trust assets each year for a term of years. What remains in the trust after the term of years is not subject to federal estate tax. An example would be that a Grantor would place $2,000,000 of assets into a GRAT that would pay the Grantor 21.34% of the day one value of the trust assets ($426,800) each year for five years. Under this scenario, the Grantor will be not be considered to have made a gift to establish the GRAT (also known as a “Zero’d out” GRAT), and any assets held under the GRAT after the fifth year and satisfaction of the annuity payments would not be subject to federal estate tax on the death of the Grantor. As many planners were already aware of, if the Grantor of a GRAT dies before the end of the GRAT term, some or all of the GRAT assets will be included in the Grantor’s estate due to the retained annuity interest. The new Proposed Regulations confirm that the applicable exclusion amount as of the date of the Grantor’s death would apply and, unfortunately, not the increased exclusion amount that was available at the time of the transfer to the GRAT. The Proposed Regulations highlight the importance of proper planning in addition to properly explaining how taxpayers can take advantage of the increased estate tax exemption. While it is clear that cash gifts, whether outright or in trust, will benefit from the increased exclusion, taxpayers should exercise caution when making gifts of an interest in a Limited Liability Company or other entity. If the taxpayer’s ownership interest includes the ability to determine when a distribution can be made from the entity, or when the entity can be liquidated, then the entire value of the entity can be brought back into the gross estate of the taxpayer upon their death under Section 2036(a)(2). As a result of the entity being included in the gross estate under Section 2036, the exception to the Special Rule would apply and the taxpayer would not have the benefit of the likely higher exclusion applicable to the date of the transfer, but only the benefit of the exclusion amount as of the date of their death. For example, the taxpayer owns a LLC valued at $20,000,000 and makes a completed gift of 40% of the entity to a trust for the benefit of the taxpayer’s descendants in 2022 when the estate tax exemption amount is $12,060,000. Ignoring any applicable discounts that may apply to the transfer, the taxpayer files a gift tax return reporting the use of $8,000,000 of her exemption amount. The taxpayer dies in 2027 when the exemption amount is $7,000,000. The taxpayer as a result of her 60% retained ownership in the entity can control when a distribution can be made from the entity and therefore the entire value of the entity is included in the gross estate even though 40% of the entity was previously transferred. On top of the inclusion, the taxpayer will only receive the benefit of the applicable exemption amount of $7,000,000 as of the date of her death and will not get the benefit of using a portion of the increased exemption amount at the time the transfer was made. Taxpayers need to plan accordingly to prevent 2036(a) inclusion, and this is therefore even more important than before, given the new Proposed Regulations. One effective way to prevent inclusion under 2036(a) is to create a special class of voting interest in the entity to control when a distribution, liquidation, or amendment to the governing documents can be made and transferring such interest more than three years prior to the taxpayers death to an irrevocable trust outside of the taxpayer’s estate with an independent trustee. CONCLUSION: In conclusion the Proposed Regulations confirm what numerous planers thought to be the case as it relates to enforceable promises to make gifts and the treatment of assets held in a GRAT or similar trust. The Proposed Regulations also reaffirm the Treasury’s position on “clawback” and the use of the increased exclusion amount, but also present new traps for the unwary that require appropriate planning on Toni Tiger’s part to prevent inclusion. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 2A New Qualified Opportunity Fund PLR

Written By: Ken Crotty, Esquire On April 29, 2022, the IRS released Private Letter Ruling 202217004 ( the “PLR”), which granted the taxpayer additional time to file a Form 8996. To qualify as a qualified opportunity fund (“QOF”), a taxpayer must file a Form 8996 to self-certify that the taxpayer qualifies as a QOF. Treas. Reg. § 1.1400Z2(d)-1(a)(2)(i). The certification needs to be filed annually and must be filed by the due date of the taxpayer’s timely filed income tax return, including extensions. The certification allows a taxpayer to qualify as a QOF. Without the certification, a taxpayer is unable to qualify as a QOF. The taxpayer that requested the PLR timely filed a Form 1065 partnership income tax return for the first year that the entity existed. The accountant who prepared Form 1065 was aware of the taxpayer’s intent to qualify as a QOF. Both the accountant and the manager of the taxpayer were aware that the taxpayer would need to complete a Form 8996 and file it with the IRS in addition to the Form 1065 so that taxpayer would qualify as a QOF. The manager prepared Form 8996 and provided it to the accountant, because the accountant’s tax software did not have any updates related to the preparation of Form 8996. However, the accountant failed to attach Form 8996 to the taxpayer’s Form 1065. In addition, the accountant did not check the box on Form 1065 which indicates that the taxpayer intended to qualify as a QOF. Because of the failure to self-certify that the entity qualified as a QOF, the taxpayer did not qualify as a QOF in Year 1. When the taxpayer’s Year 2 Form 1065 was being prepared, an employee of taxpayer realized Treas. Reg. §§ 301.9100-1 through 301.9100-3 provide that the Commissioner has the Treas. Reg. § 301.9100-3(b)(1) provides that a taxpayer will be deemed to have acted reasonably and in good faith if the taxpayer: (i) requests relief before the failure to make the regulatory election is discovered by the IRS; (ii) failed to make the election because of intervening events beyond the taxpayer’s control; (iii) failed to make the election because, after exercising due diligence, the taxpayer was unaware of the necessity for the election; (iv) reasonably relied on the written advice of the IRS; or (v) reasonably relied on a qualified tax professional, and the tax professional failed to make, or advise the taxpayer to make the election. Pursuant to Treas. Reg. § 301.9100-3(b)(2), a taxpayer will not be considered to have (i) competent to render advice on the regulatory election; or (ii) Aware of all relevant facts. Treas. Reg. § 301.9100-3(b)(3) states that a taxpayer will not be considered to have acted reasonably and in good faith if the taxpayer — (i) seeks to alter a return position for which an accuracy-related penalty could be imposed under § 6662 at the time the taxpayer requests relief and the new position requires a regulatory election for which relief is requested; (ii) was fully informed of the required election and related tax consequences, but chose not (iii) uses hindsight in requesting relief. If specific facts have changed since the original deadline that make the election advantageous to a taxpayer, the IRS will not ordinarily grant relief. Taxpayer established that taxpayer acted reasonably and in good faith by relying on the While IRC § 6110(k)(3) provides that a private letter ruling cannot be used or cited as precedent by anyone other than the taxpayer requesting the ruling, it is comforting to know that the PLR was issued. If a client has not timely filed a Form 8996 for a year in which the client intended to qualify as a QOF, relief may be available. Although the relief is not automatic, if the client can establish that the client acted reasonably and in good faith with respect to the failure to file Form 8996 and that the interests of the government would not be prejudiced by granting relief, then client may be able to qualify as a QOF notwithstanding that a Form 8996 was not timely filed. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 3Denial of Innocent Spouse Relief

Written By: Ken Crotty, Esquire In Podlucky v. Commissioner, T.C. Memo 2022-45 (May 5, 2022), the Tax Court upheld the fraud and deficiency penalties that the IRS assessed against the Podluckys and found that Mrs. Podlucky was not entitled to innocent spousal relief. In 2009, Mr. and Mrs. Podlucky were indicted on charges of money laundering, tax evasion, and mail fraud related to Mr. Podlucky removing more than $30,000,000 of assets from a corporation that he controlled. Both of the Podlucky’s were found guilty, with Mr. Podlucky receiving a sentence of 20 years and Mrs. Podlucky receiving a sentence of 51 months. After the court proceedings concluded, the IRS initiated a civil examination of the Podlucky’s joint federal income tax returns from 2003 through 2006. The IRS determined a deficiency against the Podlucky’s of $4,781,702 and an additional fraud penalty of $3,586,277 against Mr. Podlucky. Mrs. Podlucky argued that she was entitled to innocent spousal relief. Taxpayers who are married may elect to file a joint Federal income tax return. If a married couple decides to file a joint return, each spouse is generally jointly and severally liable for the income tax due for that year. However, Section 6015 of the Code provides relief from such liability for a spouse that meets certain circumstances. Section 6015(b)(1) of the Code provides that relief is available if the following items are satisfied: A spouse is not able to claim innocent spousal relief if the additional tax is related to such spouse’s erroneous items. Although the understatements arose from Mr. Podlucky extracting the funds from the Company, the Tax Court found that Mrs. Podlucky was involved in the scheme to extract the funds. Specifically, Mrs. Podlucky signed over 100 checks between 2003 and 2006 which totaled over $6,600,000 related to the extraction of the funds. Even if Mrs. Podlucky did not have fraudulent intent, the Tax Court concluded that at least part of the unreported income was attributable to her actions and that Mrs. Podlucky failed to establish the second prong above. Further, the Tax Court also held that Mrs. Podlucky knew or had reason to know that the income tax returns she signed significantly understated their income and tax due. This “reason to know test” is a subjective test and the courts can take into consideration “the existence of expenditures that are ‘lavish or unusual when compared to the family’s past income levels.’” Mrs. Podlucky signed more than $6,000,000 worth of checks to jewelers and contractors working on their mansion that was being constructed. Innocent spousal relief is not available to a spouse who turns a blind eye to the facts that are available to such spouse. As a result, the Tax Court concluded that Mrs. Podlucky knew or had reason to know that the returns significantly underestimated the tax liability. Therefore, Mrs. Podlucky did not satisfy the third prong above. Finally, the Tax Court considered whether it would be equitable to impose liability on Mrs. Podlucky. In making this determination, the courts looks at the following factors: (1) marital status; (2) economic hardship; (3) significant benefit; (4) subsequent compliance with Federal tax laws; (5) legal obligation to pay the outstanding tax liability; (6) knowledge or reason to know about the understatement; and (7) mental or physical health. See Rev. Proc. 2013-34. The Tax Court concluded that Mrs. Podlucky failed to satisfy the third and sixth factor of this test, because she derived a significant benefit from the understatement and that she knew or had reason to know about the understatement. Because of this and that no equitable factor weighed in favor of relief, the Tax Court concluded that Mrs. Podlucky failed to carry the burden of proving that imposition of liability against her would be inequitable. As a result, the Tax Court held that Mrs. Podlucky was not eligible for innocent spousal relief. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

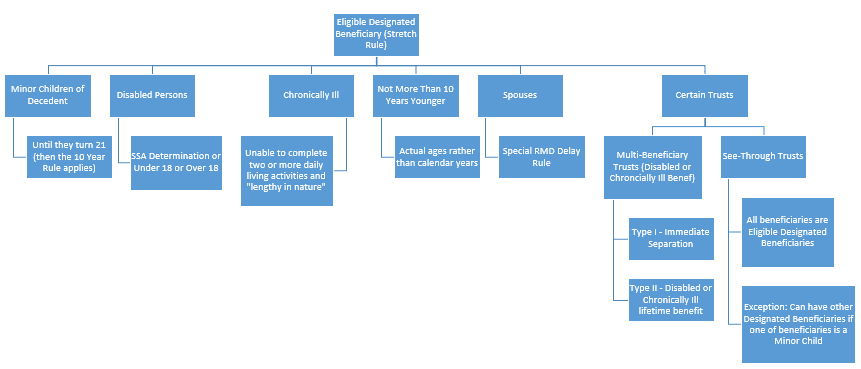

Article 4Quick Guide To IRA/Pension Plan Distribution Planning Under February 2022 Proposed Regulations: Part One

Written By: Mckenzie McAdams, Stetson University Law Clerk, Alligator Wrestler This is a draft article by Mckenzie, which may be ready for Prime Time. Not approved by the National Association of Thursday Report Articles. McKenzie is graduating from Stetson University’s College of Law this Saturday and will be sitting for the New York Bar Exam this summer. In the fall, McKenzie will be pursuing her LL.M. in taxation at Georgetown University College of Law in Washington D.C. By now, you have probably seen a plethora of articles on the Proposed Regulations to the SECURE Act and how they will impact IRA/Pension Plan distribution planning. However, given the multitude of pages and the complexities for which they cover, some articles may have been too dense and quite daunting. [1] If you have been searching for a succinct and basic explanation of the Proposed Regulations, this quick guide is just for you. Although, if you want to take a deeper dive into these Proposed Regulations, or even a particular section, feel free to explore the various articles cited within as they include more detailed explanations and examples of various rules. The taxpayer-friendly aspects of these Proposed Regulations will likely be made permanent before the end of 2022. Some of these provisions include the categorization of beneficiaries and trusts, the creation of a new “determination date”, and the permission to add/remove beneficiaries after the death of the Plan Participant. A brief summary of each is provided below. Categories of Beneficiaries The beneficiary of an IRA/pension plan can be an individual, a trust, estate, charity, or entity. The category into which a beneficiary falls is determined by what kind of beneficiary they are. “Non-individual” beneficiaries, such as estates, charities, and entities, are considered Non-Designated Beneficiaries. Designated Beneficiaries, on the other hand, include individuals and trusts. Similarly, Eligible Designated Beneficiaries can also be an individual or a trust, however, such beneficiaries are of a special nature and qualify for the use of the life expectancy rule. The Eligible Designated Beneficiary category is a creature of the Proposed Regulations. The five types of beneficiaries that fall into this category are: 1. The surviving spouse of the Plan Participant 2. A minor child of the Plan Participant [2] 3. A disabled individual [3] 4. A chronically ill individual [4] 5. An individual who is not more than ten years younger than the Plan Participant [5] If the beneficiary is an individual who falls into one of these categories, the Life Expectancy payout method can be used. This payout method permits the “stretch” of required minimum distributions from an IRA/Plan over the beneficiary’s life expectancy. The Life Expectancy payout method is preferred over the 5 [6] and 10 [7] Year Rules. You can think of these beneficiaries as the “Privileged Ones”. Beneficiaries are further described in the Proposed Regulations by tiers. Tier I includes any beneficiaries of the trust whose benefits are neither contingent upon, nor delayed until, the death of another trust beneficiary who did not predecease the Plan Participant. Tier II includes any beneficiaries of the trust who could receive amounts in the trust that were not distributed to the Tier I beneficiaries, but only if they cannot benefit until after the death of the Tier I beneficiary or beneficiaries. [8] There are multiple situations under the Proposed Regulations in which a beneficiary can be “disregarded” for purposes of determining which payout method applies: 1. Certain events occur prior to the Determination Date [9] 2. An Accumulation Trust beneficiary who can only benefit after the death of Tier I and Tier II Beneficiaries 3. A beneficiary of a See-Through Trust who can only inherit if they survive a minor child 4. A remainder beneficiary of a Conduit Trust [10] The Author regards these beneficiaries as “Phantom Beneficiaries”. Categories of Trusts Two types of trusts were categorized under the Proposed Regulations: Multi-Beneficiary Trusts and See-Through Trusts. A Multi-Beneficiary Trust is a See-Through Trust whereby all the trust beneficiaries are designated beneficiaries and at least one beneficiary is a disabled or chronically ill individual. The Proposed Regulations defined two types of Multi-Beneficiary Trusts: Type I and Type II. A Type I trust is a trust which provides that the amounts in the trust are to be divided immediately upon the death of the Plan Participant into separate trusts for each beneficiary. A Type II trust is a trust that identifies one or more disabled or chronically ill individual who is entitled to benefits during his/her lifetime and the other beneficiaries are not entitled to any benefits during their lifetime. Under the Proposed Regulations, the applicable payout method for a Type II trust is the life expectancy of the disabled or chronically ill beneficiary. As for See-Through Trusts [11], the Proposed Regulations provide different treatments for the two types: Conduit and Accumulation. Conduit trusts require all distributions from the IRA and any pension plan payable to the trust to be immediately paid to the specified beneficiary or beneficiaries. An Accumulation trust is any see-through trust that is not required to pay all IRA and pension amounts it receives to the beneficiaries. Under the Proposed Regulations, both conduit and accumulation trusts that include the child of the Plan Participant as a beneficiary and another beneficiary whose entitlement is contingent upon the death of such child is permitted to utilize the Life Expectancy payout method. In addition, for accumulation trusts only, where a beneficiary’s entitlement is contingent upon the death of a Tier I and Tier II beneficiary, they are disregarded. The Determination Date and Modifications One of the biggest changes made by the Proposed Regulations was the change to the Determination Date. Previously, the date for which the applicable payout method was determined was the date of the death of the Plan Participant. The Proposed Regulations extend this deadline to September 30th of the calendar year following the calendar year in which the Plan Participant died. The Determination Date coincides with the newfound ability to modify/amend the beneficiaries of the trust. Up until the Determination Date, the trust can be modified to remove or add beneficiaries for the purpose of qualifying for certain payout methods.[12] The extension of the Determination Date, combined with the amendment and modification permissions, provides great flexibility in IRA/Pension Planning. TO BE CONTINUED IN OUR NEXT THURSDAY REPORT. ________________________________________________________ [1] However, if you are up for the challenge, the Author have written various articles on the Proposed Regulations. Specifically, Seeing Through the Proposed Regulations on IRA and Pension Distributions – Good News (mostly) for See-Through Trusts; Trust Protectors, Reformation, Decanting, and Other Trust Modification Techniques to Facilitate Flexibility For IRA/Pension Plan Owners Under The Proposed Regulations; Power of Appointment: An Amazing Planning Tool Under New IRA Stretch Trust Regulations. [2] A child of the Plan Participant who has not yet reached the age of 21. The Life Expectancy rule applies, however, once the child reaches the age of 21, the 10 Year Rule applies. [3] While the definition of a disabled individual did not change for individuals over the age of 18, a new definition was provided for individuals under the age of 18. The date of the death of the Plan Participant is the determination date and the required documentation must be submitted no later than October 31st of the calendar year following the calendar year in which the Plan Participant died. Further, a finding of disability by the Social Security Administration is sufficient to confirm disability. [4] The definition of a chronically ill individual was revised under the Proposed Regulations and provides that an individual is chronically ill if they are unable, without substantial assistance, to complete two or more of the activities of living for a period of at least 90 days. The 90-day requirement is a substantial change here. In addition, the determination date and documentation requirements apply to chronically ill individuals as well. [5] Keep in mind that when determining the difference in age of the Plan Participant and beneficiary, the actual age of the individuals is used rather than the calendar year age. [6] The 5 Year Rule provides that beginning on April 1st of the calendar year following the Plan Participant’s death, distributions must be taken out and be paid out completely by the end of the fifth calendar year following the Plan Participant’s death. This rule applies to Non-Designated Beneficiaries. [7] The 10 Year Rule provides that beginning on April 1st of the calendar year following the Plan Participant’s death, distributions must be taken out and be paid out completely by the end of the tenth calendar year following the Plan Participant’s death. This rule applies to Non-Eligible Designated Beneficiaries. [8] If the beneficiary of the See-Through Trust is another trust, the beneficiaries of the second trust are treated as being beneficiaries of the first trust and are considered Designated Beneficiaries. [9] A beneficiary who predeceases the Plan Participant, a beneficiary who is treated as having predeceased the Plan Participant by reason of a simultaneous death provision under applicable state law or via a qualified disclaimer, a beneficiary who receives the entire benefit that the beneficiary is entitled, or if a power of appointment is exercised in favor of one or more beneficiaries, then the other permissible appointees are disregarded. [10] In other words, only beneficiaries that could receive amounts in trust that are neither contingent upon, nor delayed until, the death of another trust beneficiary (Tier I Beneficiaries) must be taken into account. [11] A See-Through Trust is a trust that acts as the beneficiary of a Plan Participant’s retirement account. The Plan Participant makes the beneficiaries of the trust the individuals for whom the Plan Participant wishes to pass such assets. See-Through Trusts get their name because you can “see through” the trust to the underlying beneficiaries. However, to qualify as a See-Through Trust, the underlying beneficiaries must be identifiable. A trust satisfies the identifiability requirement “if it is possible to identify each person eligible to receive a portion of the plan through the trust”. [12] The Proposed Regulations are taxpayer-friendly as they permit the amendment, modification, and reformation of trusts on or before September 30th of the calendar year following the calendar year of the Plan Participant’s death so that trust beneficiaries, creditors, charities, and other entities can be added or removed. [13] Absent the exercise of a power of appointment provided under the trust instrument, there are a four ways to accomplish this outcome: (1) Court Reformation, (2) Decanting, (3) Non-Judicial Agreement among the trustee and the trust beneficiaries, and (4) actions by Trust Protectors (or other amendments permitted by the terms of the trust document). The Proposed Regulation treat all of the above mechanisms identically for the purposes of the determination of which beneficiaries of the trust are to be counted in calculating the RMD payout period. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Forbes Corner

IRS Clawback Proposed Regulation Causes Confusion In The Playing FieldWritten By: Alan Gassman, JD, LL.M, AEP (Distinguished)

The IRS’s assault on various planning strategies in court cases, Treasury Regulation pronouncements and Proposed Regulations can result in unpredictability, and make the day-to-day life of estate tax planners interesting, to say the least…Continue reading on Forbes.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Thoughtful CornerTaking Down the Happiness Hurdles

Written By Thurston Thursday, III Imagine that you are a runner and that you have limited time to run a short-distance race. There are some fairly high hurdles placed in front of you. If you try to jump over them, you will most likely trip, skin your knees, and have to get up on the black asphalt to push through to the next one and the next one. If others in the race end up going around the hurdles, they could get to the prizes well before you are even close enough to see them in the distance. This is what the vast majority of people do with respect to attempting to find happiness; they allow hurdles to be placed in front of them, attempt to jump over the hurdles, and skin their knees in the process. Others view the hurdles differently and simply run by them or take them down in an organized, logical fashion so that they disappear as they proceed through the race. So go the “happiness hurdles,” those hard-to-jump-over boundaries and obstacles that we so often put in front of ourselves for reasons that are typically beyond our understanding and not in our best interests. Can you imagine telling a young child that he or she is not allowed to be happy until learning how to tie his or her shoes before being able and trained to do so? Or until accomplishing other not-yet-mastered skills or goals? This will not only rob the child of self-confidence and the joy of learning and achieving, but it will also reduce that child’s learning and achievement rate. Such restrictions would turn an otherwise happy child into a miserable living being. If you would not do this with your children, why do this to your inner child and to yourself? How many hurdles have you put up recently with respect to your own happiness and sense of well-being? Some examples might include:

Why are you treating yourself so ruggedly when, so often, circumstances are not entirely within your control? How do you re-program yourselves to avoid this phenomenon, which will happen over and over again until you get a handle on the situation? Assuming you do not want to try electric shock therapy or mind-altering and addictive drugs (which would not work!), the answer is to take your time and make reasonable efforts to change your thinking in positive ways. You can be happy if you are taking the right actions to handle the situations at hand without reference to whether you are winning the race. Part of the human experience is that there will always be farther to run, more to achieve, imperfections in what we have put together, and a high price to pay for the lofty goals that we so often set for ourselves. Nevertheless, we all know people who seem to always be happy and act positively and effectively, notwithstanding setbacks that do not seem to bother them nearly as much as others. What is their secret? Appropriate, logical, and positive thinking habits and responses to challenges, goals, and behaviors are clearly the answer. No one is perfect, and our approaches to handling problems, challenging situations, and helping ourselves and others to enjoy life and work in a positive and successful mode of existence is part of what should be a delightful journey and not a painful process. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

For Finkel’s Followers22 Ways to Motivate Your Team

Written By: David Finkel; Author, CEO, and Business Coach How do you retain your top talent? How do you get the best from your team? Here are 22 simple ways to help you motivate your team. 1. Salary: Are you paying your people market rate? While you will never win with money, you need to be in the right neighborhood. If you aren’t paying in the market range, you’ll risk higher turnover with the costs associated with that turnover. 2. Benefits: For many of your team, especially those who are more “security” conscious, the benefits you offer are actually worth more than their true cost to your company. 3. Bonuses: Recognize that any bonus that is regularly paid quickly becomes part of the “base” in the minds of your team, a strategic bonus plan can be a great motivator and retention tool. Ideas range from setting up a semi-annual bonus for qualifying team members that is paid 90 days after the end date, and for which they must still be employed by your company to earn it at that date (by which time they will have earned half of their next semi-annual bonus, making it painful for them to walk away from); to bonuses for generating new business; to bonuses for innovative ways to lower your structural costs. 4. Commissions: For some of your staff, letting them earn “success fees” and “commissions” is a great motivator. The biggest mistake I see with sales compensation plans is to have too high and not enough of the earnings on commission (if in fact, that is how you want to structure your sales team comp.) A sales team that earns too much on base is more concerned with selling you on not firing them than they are on selling more of your products and services. 5. Contests: Set a goal, have a clear way to measure the progress that your team can visually see, and reward the result. The best contests bring a team together, either by setting a team challenge and reward or by being playful enough that they let any competition be healthy competition, not destructive competition. 6. Great work environment: Do people like the feeling and atmosphere of your office? Do they feel good when they are at work? After all, they are spending 8+ hours a day there, giving them a work environment that brings out their best. 7. Flexibility of schedule: Where possible, can you let your team schedule work around family commitments? Or give them the ability to feel in control of their own calendar? Obviously, the job has to get done, and the nature of the work and your business will put some constraints there, but within those constraints, you have a lot of room to be flexible. This costs you nothing and can mean the world to your team. It can also be something they have to earn (as well it should.) 8. Work remotely (all or part-time): This is one of the highest valued perks my team likes with Maui Mastermind. Not only does it cost you nothing, but likely it will reduce your costs as you have the need for less space in your office. Yes, you have to work harder to improve communication and workflow, but this can spark you to increase quality and volume of output by your team. 9. Vacation time: Let your team earn more vacation time based on their performance. Whether this be you reward a team that came through on a big project with a 4-day weekend, or you let any team member who is in their 3rd year with you get the 3rd week of paid time off, vacation time is a sweet perk that many small business owners can use to retain top talent. 10. Unpaid time away: If you can’t afford to pay them for those extra three weeks of vacation you want them to have, perhaps you can give them weeks 3, 4, and 5 off for that once in a lifetime trip, just without pay. Again, be creative here and keep this in your bag of tricks to use with individual situations of your top people. 11. Greater autonomy: This is a huge motivator for your team – letting them earn the ability to self-manage and to do things their way. After all, it’s likely one of the strongest drives that compelled you to start your own business to begin with so why shouldn’t it be as compelling to your team? 12. Greater responsibility: Your team will see that when they earn greater responsibility they are growing professionally. It’s a sign that you trust them more, and that they are creating more value for the company. This is a powerful intoxicant for top producers. Of course, if you give them greater responsibility you need to give them the authority to meet those responsibilities too. 13. Share information: Bringing a team member into the “inside” where you share key information with them is a clear signal that you value and trust them. On a lesser scale, even just sharing more mundane information with your team in an organized and regular way is a motivator as it keeps employees in the “know”. It’s a sign that you respect them. Often this motivator is employed in its opposite—by not sharing information – and the destructive, demotivating message of distrust and disrespect that sends. 14. Ask and value their input — honor their voice: When was the last time you asked for a team member’s opinion? Or confided in them asking for their help to solve a thorny issue? Asking your team for input on how to solve problems or improve the company is a great way to engage your workforce. If you do this, make sure you are serious and not just paying lip service to their ideas. Your staff can smell insincerity a mile away. 15. Cool work: Is the work your team does inherently challenging and absorbing? Do you have the ability to hand off cool projects to your key team? 16. Feeling of growth: Do you have a plan in place to help your staff learn and grow? This can be as simple as taking time each quarter to give your team feedback and help them map out a plan of action to grow professionally. You do this with your managers and encourage your managers to do this with their teams. 17. Let them bring pets into work: From my experience, it is a great reward to bring a pet into work versus the stress of finding a way to care for them while they are at work. 18. Let them bring their kids into work (or work home to their kids): If you can swing the onsite daycare, that can be a huge perk for your people. Obviously, most small businesses can’t afford this. But this can also be letting them bring a child in who has an afternoon off at school or perhaps letting them work from home (mentioned above) if they have a sick kid. It can also have a contract with a local babysitter service and reward your core team with x days of sitting for when they need it during the workday. 19. Aspirational—a path forward: Help your team map out a career with your company, not just a job. The clearer you paint that future picture with them the more committed they will be to doing great work and enhancing their capabilities to fit in with the future you paint for them. 20. A mission to be part of: Does your team move boxes or move the world? Do they feel connected to a higher calling with your business? At Maui Mastermind we “coach business owners” to grow their companies and reduce their reliance on them the owner. But our team all feel part of a company that changes lives – of our clients, of their staff, of their vendors, of their customers, and of the families of all of these groups. We share stories of clients’ success. We start or end many meetings with reminders that we’re not here to coach a business, but to bring humanity back into building a business. (Yes you can grow your business and get your life back! You can build a company that gives opportunities and security to a growing team of employees.) 21. Relationship—a personal connection: Be willing to forge deep personal connections with your team. Take the time to get to know them and their lives. Share about yours. I know that many business owners (myself included) hold themselves back for fear of drama or awkward moments, but in general, we err too often on isolating ourselves from our teams. So take a team member out to lunch, organize a social event, ask them how their son is doing in school, and truly be open to connecting in an authentic way. 22. Identity—how they see themselves: The team at Zappos see themselves in a special way. It’s clear to me every time I order from them over the phone. The more you can get your team to identify with your company, to see their work with you as part of who they are, the more committed they will be and the happier they’ll be working with you. So help shape how your team see themselves. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Free Saturday WebinarTOOLS AND STRATEGIES TO AVOID ESTATE PLANNING TRAGEDIESDate: Saturday, May 14, 2022 Time: 11:00 AM to 12:00 PM EDT (60 minutes) Presented by: Alan Gassman, JD, LL.M. (Taxation), AEP (Distinguished)

For the first time, we are collaborating with CPAacademy.org to offer 1.0 CPE credit to CPAs who watch this webinar through their system. To qualify, you must watch for at least 50 minutes through their portal and answer at least three polling questions during the live webinar. If you are a CPA and would like to earn this credit, then feel free to REGISTER HERE. If you are not already a CPAacademy.org member, you will be prompted to first set up a free member profile. If you are not a CPA or do not want CPE credit through CPAacademy.org, please click the link below to register as usual. REGISTER HERECourse Description: It takes more than knowledge and revocable trusts to facilitate estate tax planning for wealthy families. In addition, the IRS has been regularly attacking certain effective estate tax planning tools because of chinks in the armor that planners must be aware of. This presentation will discuss primary and effective strategies for estate tax avoidance, and how to avoid having “chinks in the armor” that can cause tragedy instead of success. Learning Objective: Identify primary and effective strategies for estate tax avoidance. This is a complimentary webinar program. After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 3-5 hours after the program concludes, the recording and materials will be sent to the email address you registered with. Important: If you are already on the “Register For All Upcoming Free Webinars” list, you will be auto-registered on Friday for non-CPE credit. If you would like 1.0 free CPE Credit for this webinar, please also register above through CPAacademy.org. Please email registration questions to info@gassmanpa.com. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

All Upcoming EventsClick this link to be auto-registered for all upcoming free webinars from our firm (Non-CPE credit).

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

YouTube Library

Visit Alan Gassman’s YouTube Channel for complimentary webinars and more! The PowerPoint materials can be found in the description box located at the bottom of the YouTube recording. Click here or on the image of the playlists below to go to Alan Gassman’s YouTube Library. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Humor

ZORGUN, ZORGUN, AND ZORGUN

Like you, my tentacles got caught in an elevator door, But I never found a law firm to help me out before. Until I spoke to Mr. Zorgun and his brothers, Believe me, this is an office unlike all the others.

Their antennae are tuned to find injustice in the law, No discrimination against our kind escapes from their claw. When you ask help from humans, they turn their back instead, So does Zorgun, but that’s to use eyes in the back of his head.

Discrimination on the job? Your bosses are unfair? You can’t leave your young in the fish tank instead of daycare? Or need help laying eggs, finding a nest for hibernation? If you have three heads, three brothers will prevent discrimination.

Everywhere we go, it seems we get accused of a crime, Their fingers point to us, just because there’s a trail of slime. You may find your kind is denied any kind of bail, The scales of justice are tilted against those covered in scales.

These brothers share a passion, they also share some organs, Find sympathetic ear holes at Zorgun, Zorgun and Zorgun.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Gassman, Crotty & Denicolo, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2021 Gassman, Crotty & Denicolo, P.A

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||