The Thursday Report – Issue 321

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1New Proposed Regulations for Retirement Plan Distributions – What Does This Mean for Clients With IRAs and Other Retirement Plans?“NEW REGULATIONS FOR IRA AND PENSION PLAN TRUSTS” WEBINAR Written and Presented By: Christopher Denicolo, Brandon Ketron and Alan Gassman Article 2IRS Fires Shot Over the Bow of Grantor Retained Annuity Trust Situations Where Aggressively Low Valuations Are UsedWritten By: Alan Gassman, Esq. Article 3HOW TO GO TO JAIL FOR 3 YEARS – “MANY PEOPLE DO THIS” IS NOT A VIABLE DEFENSEWritten By: Samuel Craig, Law Clerk Article 4RUSSIA-UKRAINE CONFLICT: TAKEAWAYS FOR INVESTORSWritten By: Resource Consulting Group Article 57520 and Other Key Rates – February And March 2022Written By: Alan Gassman With Help From Leimberg Information Services (LISI) For Finkel’s FollowersIncrease Employee Retention With These 4 TipsWritten by: David Finkel; Author, CEO, and Business Coach Professionalism CornerFirst-Year Lawyer Success ChecklistWritten By: Alan S. Gassman, Esquire Saturday WebinarMore Upcoming EventsYouTube LibraryHumor

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1New Proposed Regulations for Retirement Plan Distributions – What Does This Mean for Clients With IRAs and Other Retirement Plans?

Written By: Christopher Denicolo, Brandon Ketron and Alan Gassman See webinar invitation below. On February 23, 2022, the IRS issued over 275 pages of proposed regulations regarding IRAs and other Retirement Plans in the wake of the SECURE Act that was enacted effective January 1, 2020. The proposed regulations function as a restatement of the prior regulations relating to distributions from Retirement Plans and contain discussion of the rules that apply for determining annual required minimum distributions for individuals and trusts named as beneficiaries of IRAs and other types of Retirement Plans. The proposed regulations are effective beginning on January 1, 2022, but do not have the force and effect of law. Nevertheless, the Preamble states that compliance with the proposed regulations will be deemed to satisfy the requirement that taxpayers must take into account a reasonable, good-faith interpretation of the Secure Act changes to the required minimum distribution rules. While the proposed regulations largely are favorable to taxpayers, the biggest and most unpleasant surprise relates to required minimum distributions following the death of an IRA owner or Retirement Plan Participant (called a “Plan Participant” for the purposes of this article), who dies after reaching age 72. Specifically, the proposed regulations state that a beneficiary who inherits an IRA or Retirement Plan from such a deceased over 72 Plan Participant, and who is subject to the 10-Year Rule espoused by the SECURE Act, will be required to take distributions beginning on the first calendar year following the year of the decedent’s death, each year until the 10th year following the calendar year of the decedent’s death when all assets in the IRA or Retirement Plan would have to be distributed outright to such beneficiary. This is a departure from the “10-Year Rule” under the statute as understood by many practitioners and commentators, where the beneficiaries of the deceased Plan Participant’s Retirement Plan who are subject to the 10-Year Rule would not be required to take any distributions following the death of the decedent until December 31 of the tenth year following the calendar year of the decedent’s death (regardless of the decedent’s age at death). Many practitioners and commentators find this IRS interpretation to be shocking, as a parallel “5-Year Rule” has been in effect under the Internal Revenue Code and Treasury Regulations regarding Retirement Plans for nearly 40 years, and such 5-Year Rule has never been interpreted or construed to require distributions to be made from the Retirement Plan before December 31 of the fifth year following the deceased Plan Participant’s death. Nevertheless, authorities in this area have expressed concern that taxpayers and trusts may be severally penalized for failure to take distributions under rules that are very difficult to understand. Given this situation, trustees of trusts may wish to err on the side of caution and take minimum distributions during the initial ten years if this will not have a significant tax impact. All is not bad, however. The Proposed Regulations also provide much favorable guidance on the effects of the SECURE Act, which was enacted effective January 1, 2020. This includes addressing items that were not clear when the SECURE Act was initially released, and also possibly expanding the scope of the SECURE Act in a taxpayer-friendly manner. Most notable is that the Proposed Regulations appear to permit the use of the “life expectancy rule” payout of required minimum distributions when an IRA or Retirement Plan is made payable to an accumulation trust established for the benefit of an Eligible Designated Beneficiary who is not disabled or chronically ill (i.e. the decedent’s surviving spouse, minor child, or a beneficiary who is no more than ten years younger than the decedent). When the SECURE Act was released, it generally was thought that, where an IRA or Retirement Plan was made payable to a “see-through trust”, all assets had to be paid out of the IRA or Retirement Plan no later than December 31 of the tenth year following the decedent’s death under the “10-Year Rule” described above, unless (a) the IRA or Retirement Plan was payable to a “Conduit Trust” for the benefit of an Eligible Designated Beneficiary (a trust that is required to pay all of its annual required minimum distributions and any other distributions from the IRA to an individual beneficiary); or (b) the IRA or Retirement Plan was payable to an “Accumulation Trust” for the benefit of a disabled or chronically ill beneficiary (i.e., a trust that allows the trustee thereof to accumulate distributions from an IRA or Retirement Plan without paying such distributions to a beneficiary of the trust). However, examples in the Proposed Regulations demonstrate that the life expectancy rule will apply where a deceased Plan Participant’s entire IRA or Retirement Plan is made payable to an accumulation trust for the sole benefit of the decedent’s surviving spouse, the decedent’s minor child or children, a disabled or chronically ill beneficiary, or a beneficiary who is no more than ten years younger than the decedent. Additionally, the Proposed Regulations provide favorable guidance with respect to the determination of “designated beneficiaries” of an IRA or Retirement Plan, including where one of the beneficiaries is an Eligible Designated Beneficiary. Further, the Proposed Regulations give practitioners helpful guidance on the effects that a court reformation, trust decanting, and exercise of powers of appointment can have on the required minimum distributions, as well as definitions for “minor child” and “disabled or chronically ill”. As an example to illustrate the impact of the Proposed Regulations on required minimum distributions payable after the death of a Plan Participant who is age 73 dies in 2022, if the deceased Plan Participant leaves his IRA as follows: (1) 25% outright to his surviving spouse; (2) 25% to a Conduit Trust for his surviving spouse; (3) 25% to an Accumulation Trust for the lifetime benefit of the spouse and adult descendants; and (4) 25% to an Accumulation Trust for the health, education, maintenance and support solely for a minor child until 10 years after the child reaches the age of majority when all assets of the IRA must be distributed outright to the child from the Trust, then under the Proposed Regulations, the annual required minimum distributions appear to be based upon the following: 1. The surviving spouse can roll over the IRA that is left outright to her own IRA, and can postpone taking the required minimum distributions until she reaches the age of 72. 2. The trustee of the Conduit Trust must take required minimum distributions each year from the IRA based upon the surviving spouse’s life expectancy in accordance with the recently updated IRS actuarial tables. The trustee of the Conduit Trust then must immediately pay distributions outright to the surviving spouse as the “Conduit beneficiary” of the Trust. The surviving spouse is an “Eligible Designated Beneficiary” which means that the required minimum distributions from the IRA to the Conduit Trust established for her benefit are based upon her life expectancy, rather than the 10-Year Rule that would apply if the IRA was made payable to or for the benefit of a non-Eligible Designated Beneficiary. The proposed regulations confirm the law enacted as a result of the SECURE Act effective January 1, 2020. 3. The trustee of the Accumulation Trust for the benefit of the surviving spouse and adult descendants would be required to take required minimum distributions from the IRA beginning with the calendar year after the death of the decedent and each year thereafter based upon the surviving spouse’s life expectancy, until the tenth year following the decedent’s death when all assets of the IRA must be distributed to the trustee of the Accumulation Trust no later than December 31 of such year. The requirement that the trustee of the Accumulation Trust take required minimum distributions in years 1-9 following the decedent’s death is a departure from what was expected as a result of the statutory language of the SECURE Act. 4. The trustee of the Accumulation Trust for the minor child is required to take annual minimum distributions following the decedent’s death. It seems that the Proposed Regulations permit required minimum distributions to be made pursuant to the life expectancy of the minor child until 10 years after the minor child has reached the “age of majority” which may be age 21. After such 10-year period expires, all assets of the IRA must be paid out from the Trust to the minor child. Those of us who are structuring estate plans that have significant IRA and/or pension benefits going to children or other descendants may consider the Tea Pot Trust arrangement whereby all or substantially all of the IRA and pension benefits would be payable to one trust for multiple beneficiaries, and the trustee of that trust can “sprinkle” the income among beneficiaries in the most tax-advantageous way. In the meantime, a separate trust can be funded on the death of the IRA/Pension account holder and funded with traditional non-IRA assets so that the trustee who “sprinkles” income on the lower tax bracket beneficiaries from the Tea Pot Trust can also sprinkle non-taxable income to the higher tax bracket beneficiaries to even things up after the eleventh year. We will be covering these and many other issues and positive developments that arise under the new Proposed Regulations this coming Saturday, March 5, 2022, at 9:00 a.m. Eastern time. Please join us live by clicking the “Register Here” link below or register to receive the recording of the Webinar, whether you want it or not.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

FREE WEBINAR FROM OUR FIRM“NEW REGULATIONS FOR IRA AND PENSION PLAN TRUSTS“Presented by:

Alan Gassman, Christopher Denicolo and Brandon Ketron REGISTER HERESaturday, March 5th, 2022 From 9:00 AM to 9:35 AM EST (35 minutes) This is a free program. This program does not qualify for CLE/CPE Credits. After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 3-5 hours after the program concludes, the recording and materials will be sent to the email address you registered under.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 2IRS Fires Shot Over the Bow of Grantor Retained Annuity Trust Situations Where Aggressively Low Valuations Are Used

Written By: Alan Gassman, Esq. The Grantor Retained Annuity Trust (GRAT) has long been touted as a vehicle of choice because a gift made to a “zeroed-out GRAT” will not be subject to federal gift tax.[1] As great of a vehicle as it is, the requirements to qualify as a GRAT must be met with strict compliance. A Chief Counsel Advice (CCA) memorandum recently advised that the undervaluation of assets conveyed to a GRAT following its creation will disqualify the trust as a GRAT. The purpose of this article is to caution practitioners to be mindful of such operational failures and demonstrate ways to avoid such issues. In CCA 202152018, the IRS reviewed a situation where the founder of a “very successful business” transferred ownership of shares in his company to a grantor retained annuity trust in exchange for the right to receive payments from the GRAT over a period of two years.[2] The taxpayer intentionally utilized a valuation that was outdated by six months and reasoned such use was appropriate because “business operations had not materially changed during the 6-month period”.[3] The CCA indicates that the valuation was inappropriate because it failed to consider the pending merger. As such, the taxpayer relied upon an “outdated and misleading appraisal of [the] Company” and did not satisfy the “fixed amount” requirement under §2702 because the amount that was paid out of the GRAT did not relate to the initial fair market value of the property transferred to the trust.[4] As opposed to subjecting the taxpayer to undervaluation penalties and requiring large sums be returned to the grantor, the IRS found that the trust did not qualify as a GRAT due to its “operational failure” and resulting inability to comply with §2702. The IRS relied upon Atkinson v. Commissioner, a Tax Court case where a charitable remainder trust was disqualified from inception because the Atkinson family did not comply with the charitable remainder trust rules. In Atkinson, despite the requirement that quarterly distributions be made to the designated person, no payments were ever made during the lifetime of the grantor.[5] The issue before the Tax Court in Atkinson was whether the trust qualified as a Charitable Remainder Annuity Trust from its creation. The failure of the trust to make any quarterly distributions, the court reasoned, completely disqualified the trust under IRC §664(d)(1) and no income tax deduction was received. Section 664(d)(1) provides that a trust will only qualify as a Charitable Remainder Annuity Trust (“CRAT”) if it meets several listed requirements. These requirements must be met at the time of creation and must continue throughout the trust’s lifetime. One of these requirements provides the trust must make payments to an individual in a sum no less than five percent (5%) of the initial fair market value of the trust’s assets, annually or more frequently, for the individual’s lifetime or for a term of years.[6] In Atkinson, the terms of the trust met the statutory requirements of §664(d)(1) by providing for distribution equal to five percent (5%) of the initial fair market value of the trust’s assets to be distributed in equal quarterly payments to the decedent until her death.[7] However, such terms were not followed. Prior to the decedent’s death, at least seven quarterly payments should have been distributed to the decedent. The Tax Court found, however, that no payments were actually made to the decedent from the trust’s account during her lifetime.[8] Although the terms of the annuity trust met the mandatory distribution requirement under §664(d)(1), the trust did not operate in accordance with those terms because no transfers occurred. Thus, the trust could not qualify as a CRAT and was not entitled to the deduction. Atkinson was subsequently affirmed by the United States Court of Appeals, holding that the CRAT regulations were not scrupulously followed through the life of the trust, so a charitable deduction is not appropriate.[9] Unlike Atkinson, the taxpayer in the CCA determined a value for the GRAT on the first day of formation and made annual payments based upon that value. The result in the CCA might have been different if there was a safety provision in the GRAT which would have indicated that the trustee would set aside an undivided portion of the trust assets that should have been distributed and would consider that portion of the trust assets to be owned for and withdrawable by the grantor. While the author does not believe that an appellate court would be likely to uphold the conclusion of this CCA, advisors who are involved in structuring Grantor Retained Annuity Trusts should be careful to document the valuations are reasonable and do not omit material information that is available at the time that the GRAT is funded. The recent Michael Jackson case and other case law indicate that events that occur after the valuation date may be considered by a court to the extent that they are evidence of what would be expected to have occurred as of the date of valuation. An article published this week in Leimberg Information Services by Marty Shenkman, Ashley Case, Joy Matak and Matthew Rak also discusses this CCA approach and can be viewed by clicking here. [1] Obtaining a zeroed-out structure for a GRAT requires that the value of the grantor’s annuity payments equal that of the property transferred to the GRAT. The rate of interest provided in IRC §7520 are used to account for the anticipated appreciation of the property. The great benefit of a GRAT is that the property outperforms the §7520 rate, the remainder that is left in the trust is transferred to the beneficiary free of taxation. However, as this article will explore, problems will arise if the valuation that the rate is applied to is incorrect. [2] IRS CCA 202152018 (2021). We can assume that this was a GRAT that had very little, if any, gift element, because the normal formula clause was used which indicated that the grantor would receive annual payments in cash or kind of a sufficient value over a term of years so that the value of the gift would be negligible or zero (0). [3] Id. [4] Id. [5] Estate of Atkinson v. C.I.R., 115 T.C. 26, 27 (2000). [6] IRC §664(d)(1) (2018). [7] Atkinson at 27. [8] Atkinson at 28. [9] Estate of Atkinson v. C.I.R., 309 F.3d 1290, 1296 (2002).

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 3HOW TO GO TO JAIL FOR 3 YEARS –“MANY PEOPLE DO THIS” IS NOT A VIABLE DEFENSE

Written By: Samuel Craig, Law Clerk Summary Unfortunately, it is not unusual for businesses strapped for cash to pay general creditors with monies owed to the IRS, or to tell white lies or exaggerate the truth to their 401K administrator to receive hardship withdrawals. Nevertheless, this conduct is illegal and can cause jail time for the individual, and sanctions and loss of the license to practice law or as a certified public accountant or enrolled agent. In 2020, Teresa Barringer, the former executive vice president of J&R Manufacturing in Bluefield, Virginia, was sentenced to serve three years in federal prison for failing to pay taxes and making false statements.1 Barringer was convicted of wire fraud and transmitting a fraudulent hardship withdrawal form to her company’s 401(k) plan provider to obtain a distribution from her account.2 On February 2, 2022, the Fourth Circuit Court of Appeals affirmed the trial court’s judgment. According to court documents, Barringer failed to pay more than $175,000 in payroll taxes withheld from employees. In July 2019, Barringer allegedly lied to federal agents when questioned about her employment and forms she falsely completed to make 401(k) withdrawals. At sentencing, the District Court found that Barringer lied under oath when testifying during her trial. Case Background As an executive at J&R Manufacturing (“J&R”), Teresa Barringer was responsible for collecting and paying federal payroll taxes, namely using IRS Form 941, where taxes are withheld from employees’ paychecks and paid quarterly to the IRS along with a matching contribution from the employer (collectively, “941 taxes”). In 2014, J&R was experiencing financial difficulties due to a downturn in the coal market and became delinquent on paying their 941 taxes. Fearing personal liability, Barringer sought access to her account in the company’s 401(k) retirement plan as a source of funds from which to pay the 941 taxes. To withdraw funds from a 401(k) plan before retirement age, the participant must be vested and must establish that a distributable event has occurred. Reaching retirement or leaving employment is such a distributable event, as are certain types of hardships including prevention of foreclosure on a primary residence. In November 2014, Barringer faxed a Hardship Withdrawal Request Form requesting $311,859.04 from her 401(k) plan “to prevent eviction from a principal residence or . . . a foreclosure of the mortgage on [her] principal residence” and received the funds which were subsequently deposited into the J&R account to pay the delinquent 941 taxes. Unfortunately for Barringer, evidence at trial showed that she was actually ahead on her mortgage payments. After receiving the distribution from her 401(k) account, Barringer used the money to pay company vendors and reimburse herself for the prior loans she had made to the company, rather than pay the required payroll taxes. These decisions led to the payroll taxes not being paid for the first three quarters of 2016. On September 2, 2016, Barringer sought to withdraw the remainder of her 401(k) account. She did not claim a hardship withdrawal as previously, but instead claimed that she had left her job at J&R on August 31, 2016. However, in fact, she continued to work at the business until October 28, 2016. After federal officers investigated this situation, Barringer repeated the false statements made on the applications to withdraw funds from her 401(k) account and allegedly lied in telling the agents that she had not gotten paid after August 31, 2016, when she had actually received checks from the company after that date. Conclusion False statements on a 401(k) hardship withdrawal application might be fraud – but the determining variable to a fraud conviction in these cases is whether or not the funds the Defendant withdrew are plan assets rather than assets owned by Defendant (that is, monies are “owned” by the fund itself and not contributors to the fund). At the time of writing, there appears to be only one other case, U.S. v. Patel, that has reviewed this type of issue.3 In Patel, the court noted that it was only aware of “one other federal court that has addressed this issue”, and that “while the facts in Barringer are directly comparable to the facts of this case, the difference in procedural posture is significant as the court in Barringer ruled after the evidence was submitted at trial.” In Patel, the Government presented evidence to support the wire fraud charges against the Defendant as to support a question of fact for the jury and accordingly denied the Defendant’s Motion to Dismiss as to the wire fraud charges. It is notable that both Barringer and Patel are the only two federal court cases that we could find discussing the misuse of hardship withdrawal applications to a company 401(k) retirement program to use the funds for impermissible purposes, such as personal expenses and paying a company’s 941 taxes, respectively. While it may be self-evident that misuse of a 401(k) withdrawal is illegal, it is almost certain that the defendants in the above-mentioned cases are not the only ones doing this. So, how does one avoid this issue? It is actually a very simple two-step process: 1. Do not lie on a hardship withdrawal application for your company’s 401(k). 2. If you fail to abide by Step 1, and you are subsequently subject to a federal investigation, do not lie to the federal officers. 1 U.S. v. Barringer, 481 F. Supp. 3d 596 (W.D. Va. 2020), aff’d, 20-4584, 2022 WL 301854 (4th Cir. Feb. 2, 2022) 2 The court granted the defendant’s motion for judgment of acquittal on the wire fraud conviction, finding the government failed to prove “the defendant’s deceit deprived another of a property interest.” The plan provider’s contractual interest did not qualify as a property interest for purposes of 18 U.S.C. § 1343, and although it was “possible” the trustee may have held a property interest in the 401(k) plan, at trial the government failed to introduce any evidence as to that relationship. 3 U.S. v. Patel, 1:21-CR-12, 2022 WL 110842 (S.D. Ohio Jan. 12, 2022)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

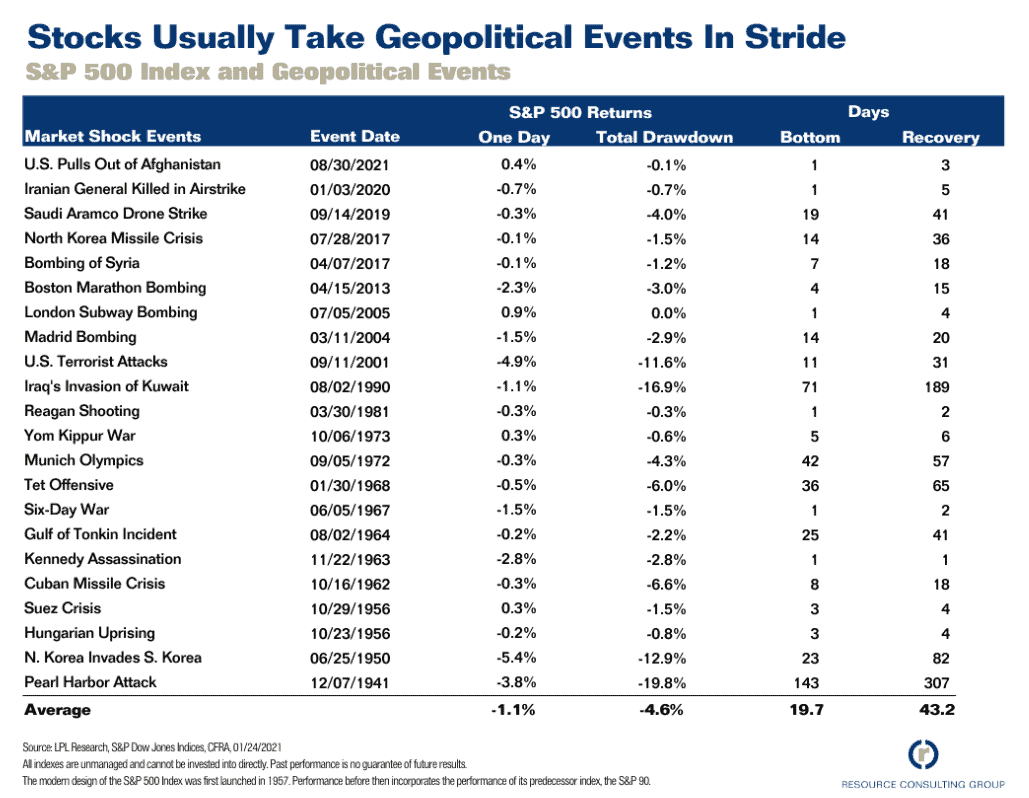

Article 4Market Data From Wars Show Prompt Recovery – Don’t Sell Low And Buy HighFollowing events like a possible war in Europe clients will often tell us that they sold their stock positions and will repurchase when things “get safer”. This has turned out to be a huge mistake, both practically and statistically. We thank Resource Consulting Group of Orlando, FL for allowing us to share the following newsletter, and note that the best thing that an investment advisor may tell clients is “don’t do anything”. By these statistics, it is time to buy more and not sell off! RUSSIA-UKRAINE CONFLICT: TAKEAWAYS FOR INVESTORSWritten By: The Resource Consulting Group As COVID-19 headlines give way to Russia’s invasion of Ukraine, the news has triggered an emotional response from people, including investors, worldwide. For our clients, we know these developments can be stressful. Russia’s assault on February 24 represents an aggressive escalation of long-simmering tensions between the two countries. The attack is an important reminder that geopolitical risk is a part of investing in global markets. The reaction has been immediate, with fixed-income and equity indexes experiencing volatility while oil and gas prices have surged. While there is still much unknown regarding the extent and outcome of the Russia-Ukraine conflict, markets have prior experience with geopolitical clashes. From a historical perspective, markets tend to brush aside geopolitical events with relatively minimal declines (see the chart below). The average total drawdown has been less than 5%, and recoveries have been swift, with the average being 43 days. As many would expect, the more severe the event, the greater the impact on the market. For example, the S&P 500 was down a total of 11.6% in 11 days after the 9/11 terrorist attacks. However, the market fully recovered to prior highs in a total of 31 days. While no two situations are alike, geopolitical selloffs are usually short-lived. Although this conflict is complicated, we do not believe it should influence investment decision-making. We have lived through many geopolitical crises, and capital markets have rewarded the disciplined investor. Adjusting your portfolio frequently in response to current events may—counterintuitively— introduce more stress, which can affect your overall investment experience. We can never be sure how a single event will impact the markets, and that’s why we believe it’s essential to take a long-term view during uncertain times. Even though the financial aspect remains unclear, the human toll is certainly more concerning. We hope for a peaceful resolution quickly. Should you have any questions, please don’t hesitate to reach out to your Resource Consulting Group advisor. We’re here to help. Resource Consulting Group Website: https://www.resourceconsulting.com/ Email: info@ResourceConsulting.com This article was originally published on the Resource Consulting Group website and can be found here. Special thanks to Resource Consulting Group for granting us permission to redistribute this content.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

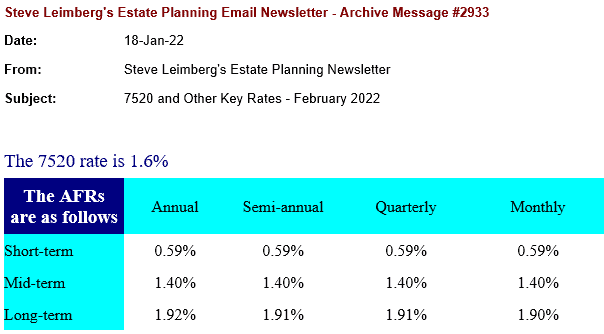

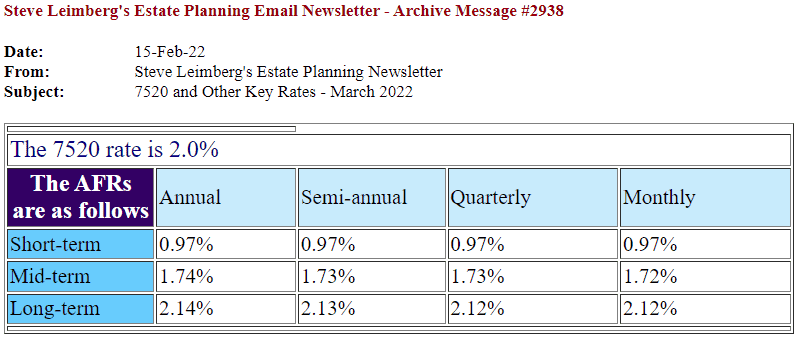

Article 57520 And Other Key Rates – February And March 2022

Written By: Alan Gassman with help from Leimberg Information Services (LISI) Please note that the long-term applicable federal rate is heading upward, and the Section 7520 rate may soon follow. Now is the time to set the interest rate on long-term notes, long-term self-canceling installment notes, and to enter into lifetime annuities and use Grantor Retained Annuity Trusts, Charitable Lead Annuity Trusts, and other techniques that are advantageous when interest rates are low. This is also an opportune time to value stocks and bonds that may have gone down, hopefully on a temporary basis, for those engaged in active planning. Please note that installment sales to trusts the taxpayer can use the lower of the applicable federal rate for the month of the transaction for either of the two months before the transaction, so a March sale can use 1.91% on a note that is for more than 9 years. Please note that even though payments are to be made annually the semi-annual rate is the one that applies. An article that we helped write entitled “Interesting Interest” which reviews many implications of low-interest notes and structuring can be viewed by clicking here. For a complete history of AFRs and 7520 Rates and for information on NumberCruncher Estate and Financial Planning Software, go to http://www.leimberg.com. HELP US HELP OTHERS! TELL A FRIEND ABOUT OUR NEWSLETTERS. JUST CLICK HERE. Leimberg Services | MEMBERS HOME PAGE

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

For Finkel’s FollowersIncrease Employee Retention With These 4 Tips |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Professionalism CornerFirst-Year Lawyer Success Checklist

Written By: Alan S. Gassman, JD, LL.M, AEP (Distinguished) 1. Always show up with a legal pad and two pens in hand. 2. Answer questions as concisely as possible and see whether more information is requested. Do not try to explain anything beyond the absolute minimum information that the person needs when that person is a lawyer that you are working with. They will ask you what they need to know in addition to that. 3. Show up with a memo that you wrote on the topic and hand it to the lawyer you prepared it for. Bring an extra copy so that you have one too. They can glance through it and ask you what they need to know. 4. Smile and be cheerful. If there is a serious situation be serious, but in overall everyday interaction be as friendly and enjoy humor as much as you can. 5. Say hello when you see someone first thing during the day and say goodbye at the end of the day. 6. Become the organizer of anything and everything that you are involved with, with checklists, progress reports, and reminders. Once you manage a project you “own it” and will become the go-to person. Always have your checklists and the latest progress on each item you are working on with you for meetings or otherwise in case you are asked about them. 7. Consider sending anyone in the office that you have a project in progress with an email every evening at 7:00 p.m. enclosing your progress or anything they may want to see so that they are (1) reminded that you are working on this, and (2) know that they can go to their 7:00 p.m. emails to access what you have been working on lately. You can of course send this using a delay system but the 7:00 p.m. space on their email can always belong to you! 8. Work constantly to improve yourself beyond the law and what you do as a lawyer. Concentrate on what you like to do and do best to the extent that it is productive. 9. Always accept new work willingly and enthusiastically, but never restrain from mentioning that you will need to have it prioritized if there are other things that may not be done on time where the assignor is possibly not aware of what this might delay. 10. Consider always having a list of tasks in progress with an extra copy that you can hand to your supervising lawyer and go over whenever they might ask. 11. Ask for periodic feedback, and in particular “what would you like for me to change in the way that I am doing things to improve your use of me and my productivity for the firm?”. 12. Always sincerely compliment as many people as you can as often as you can within the firm and outside of the firm. What goes around comes around, and you need all of the good karma you can get! 13. Draw up charts whenever you can to simplify matters, for purposes of memory, and for purposes of explanation. Charts with squares, circles and lines can help significantly towards Confucius’s observation that a picture is worth a thousand words. Learn how to make charts in Excel and bring charts to meetings whenever you can with all key information that needs to be remembered for each particular client. 14. Consider carrying your Dictaphone recorder with you at all times and offer to record any instructions or explanations that anyone is giving you to help make sure that you get it right. This allows people to talk faster and to provide you with assignments, knowing that you will review every word of what they have said. 15. Enter your time contemporaneously onto a written time slip and/or computer and make sure that all of your time is entered by the end of the day. Enter all tasks, including time that you have wasted, and perhaps make separate entries for time that you know is billable and the time you might suggest that might be reduced or not billed for at all. Let the senior lawyer make this decision. There may be more of the time that is usable than you think. Firms expect to write a lot of time off, and if you are spending significantly more time than they expect it is good for you to know and for them to know earlier rather than later. 16. You can have brief discussions periodically when you feel that your wheels have been spinning or that you wasted a lot of time. You can use an apologetic tone. This is part of the mentoring process. The senior-most lawyer in your firm also writes off a lot of time. It is a lifelong experience so do not be bashful about it.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Saturday Webinar“PLANNING WITH 199A, 678 TRUSTS AND COMPLEX TRUSTS”Saturday, March 5th, 2022From 11:00 AM to 12:00 PM EST (60 minutes)REGISTER HERE

Presented by: Alan Gassman, JD, LL.M. (Taxation), AEP® (Distinguished) This is a free program. This program does not qualify for CLE/CPE Credits. After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 3-5 hours after the program concludes, the recording and materials will be sent to the email address you registered under. Please email your comments, suggestions and feedback to agassman@gassmanpa.com.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

All Upcoming Events

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

YouTube Library

Visit Alan Gassman’s YouTube Channel for complimentary informational webinars and more! The PowerPoint materials can be found in the description box located at the bottom of the YouTube recordings. Click on the playlist below to watch the recordings.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

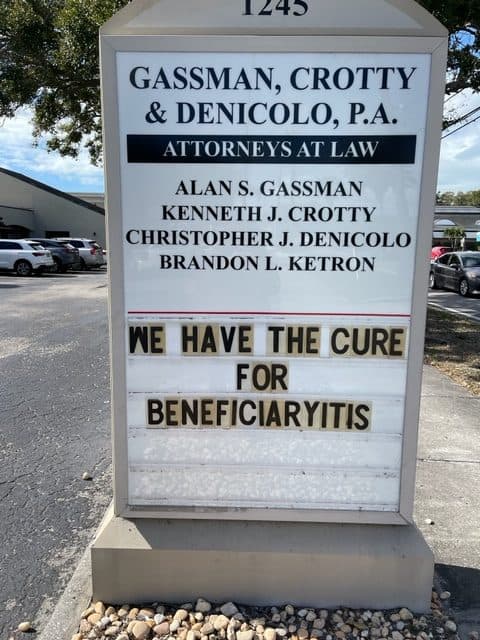

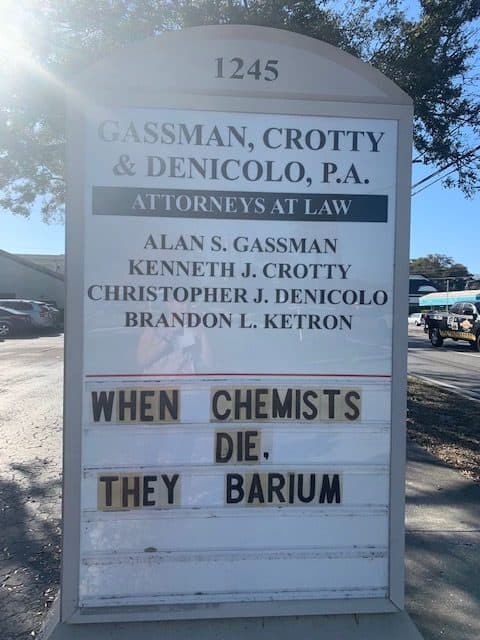

Humor Me

DON’T DESPAIR By: Ron Ross

Don’t despair if all seems lost,

It would be fun to create a new you,

Are you scared of Covid infection?

Considering this, or any lifestyle journey?

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Gassman, Denicolo & Ketron, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2021 Gassman, Crotty & Denicolo, P.A

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||