The Thursday Report – Issue 318

|

|

|||||||||||||||||||||||||||||||||||||||||

|

Thursday, December 23rd, 2021Issue #318Happy Holidays from the Law Offices of Gassman, Crotty & Denicolo, P.A.

EDITED BY: ADRIANA OCHSNER Having trouble viewing this? Use this link

|

|||||||||||||||||||||||||||||||||||||||||

|

Table of ContentsArticle 1The Biden 3rd Step – What To Do With The Promissory Note Owed to the Grantor of an Intentionally Defective Grantor Trust(PART 1 OF 2) Written By: Alan S. Gassman, JD, LL.M, AEP (Distinguished), Brandon Ketron, CPA, JD, LLM and Dakotah Flint Article 2New Stark Law – Will Doctors Be Caught NakedWritten By: Alan S. Gassman, JD, LL.M, AEP (Distinguished) and Irine Plantenberg Korte Article 3A Christmas Carol of Louis P. SmaldinoWritten By: Alan S. Gassman, JD, LL.M, AEP (Distinguished) and Matt Giovenco Article 4What Your Giving Strategies Could Be MissingWritten By: Jonathan Gassman, CPA/PFS, CFP®, CAP® For Finkel’s FollowersStruggling To Finish Your To-Do List?Written by: David Finkel; Author, CEO, and Business Coach Forbes’ CornerTax-Smart Gifts For The Remaining Days Of HanukkahWritten By: Alan S. Gassman, JD, LL.M, AEP (Distinguished) Featured EventAll Upcoming EventsYouTube LibraryHumor

|

|||||||||||||||||||||||||||||||||||||||||

|

Article 1The Biden 3rd Step –

|

|||||||||||||||||||||||||||||||||||||||||

|

Article 2New Stark Law – Will Doctors Be Caught Naked |

|||||||||||||||||||||||||||||||||||||||||

Article 3A Christmas Carol of Louis P. Smaldino

Written By: Matthew Giovenco, with a little help from Alan Gassman Matthew is currently a third-year law student at Stetson University College of Law and a Law Clerk at Gassman, Crotty, & Denicolo, P.A.

‘Twas the night before Christmas, when all through the (Smaldino) house, Not a creature was stirring, not even a mouse; The ownership units of the LLC had been listed on his return with care, In hopes that a tax-free gift was too there;

The children were nestled all snug in their beds; While visions of their very own rental properties danced in their heads, And Mama in her ‘kerchief, and him in his cap, Had just settled down for a long winter’s nap—

When out on the lawn there arose such clatter, An IRS auditor, appeared from energy and matter; Away to the door, Smaldino flew like a flash, To find out that his empire now had a bad rash.

In 2013, that IRS auditor said, The tax law should have been more carefully read; Because that taxpayer named Louis Smaldino, Unsuccessfully swang for the fences like The Great Bambino.[1]

He had tried using gift tax avoidance tactics, And the IRS despised his mathematics: He had used over $4,000,000 of his $5,200,000 estate tax exemption; His wife had not used any of hers, which got his attention.

He had 10 rental properties in California And put them into an LLC, but let us warn ya: The LLC was owned by him in the end, And his second wife was a very true friend.

He hired an appraiser who determined a 36% discount, Through which Smaldino planned his mount; He transferred 8% in trust for his kids and 41% to his wife, Who transferred it immediately to the kids’ trust—love is blyth.

His gift tax return reported the 8%, but did not report the marital gift, A blunder that got the IRS miffed. Smaldino thought he had a way, gave his attorney a whistle, And away to Tax Court they flew, hoping to avoid dismissal.

The IRS applied the “Step Transaction Doctrine”[2] And said that Smaldino made a 49% gift therein— His gift tax return was thus a bit lean-a, And Mr. Smaldino’s tax deficiency made the IRS mean-a.

In fact the Tax Court held that his wife made no gift at all, Because she agreed to transfer it immediately based on a plan from last fall; The court found a lack of LLC paperwork less than commendable, But the fact that no penalties were imposed is quite memorable.

The end result for Mr. Smaldino was a very large gift, The looming gift tax may cause a tiff; Soon you’ll see an opportunity missed, Something the Tax Court might not have dismissed.

We are sorry that this next part doesn’t rhyme, What the Mr. Smaldino wished that he thought of in time: A husband and wife may consent to “split gifts” for a given calendar year so that all gifts that they both make are considered as having been transferred one-half by each spouse, if each of the following three conditions are met: (1) both spouses must be US Citizens or residents on the date of the gift, (2) both spouses must consent to having all gifts made by each of them treated as having been made one-half each, and (3) the spouses must be married on the date of all gifts made during the year, and cannot remarry during the remainder of the calendar year. I.R.C. § 2513(a). Generally, the IRS will let either spouse signify consent on the later of (1) April 15th of the year following when the gifts are made or (2) when the donor spouse files the gift return. This is so the taxpayers can’t make the gift and wait to see if the return is audited before electing gift splitting. See Alan Gassman, 9 Common Mistakes Related to Spousal Gift Splitting, Gassman, Crotty, & Denicolo, P.A., https://gassmanlaw.com/wp-content/uploads/2013/04/

Mrs. Smaldino missed the deadline to file a gift split, By not consenting on her return before an IRS audit; [3] Too bad the tax code won’t allow Mr. Smaldino to act again, Because a gift split would have been a sure win.

A $7.8 million dollar gift the Tax Court found, At that amount, Mr. Smaldino frowned, Thus, his advisors failed to see, A split-gift with the Mrs. Smaldino, where less taxes were almost a guarantee.

Hypothetically, a split of the gift by the CPA and his wife, That $7.8 million dollar gift swiftly halved by a knife, Turn that gift to $3.9 million dollars by each, To reduce the gift tax payment well within reach.

Then $10 million dollars of real estate plus income and growth removed from his estate, Would make the IRS lose 60% of the estate tax revenue at the 40% rate,[4] And please don’t forget that the estate tax is tax-exclusive, The calculation of which can be quite elusive:

If I leave my children $10,000,000 on death, They will pay $4,000,000, at most, 9 months after my final breath. However, if 3 years before death and $4,000,000 by lifetime transfer I shift; If my exclusion has been totally used, I will pay $1,600,000 in taxes on that gift.

Then I die with $4,400,000 above and beyond my other assets instead $1,000,000 times ten— My heirs will be happy because the $1,600,000 doesn’t get taxed again; So paying gift taxes can be your descendants’ best friend, Just make sure it is 3 years before your life does end.[5]

Mr. Smaldino was the officer of a successful business, And took a gamble with lots of riches; Although he lost the audit lottery, He is not without tax savings that can buy a lot of pottery.

Of course, there are many lessons to learn, Perhaps even better ways to minimize taxes on what you earn, But don’t be exactly like Mr. Smaldino, And take the chances that would work better in Reno.

Allow your tax advisor to design a plan careful-ee, So your descendants can be filled with glee; Decide with your advisors in advance what to do, And more likely you can have a better result, and not catch the “audit adjustments flu.”

And for the tax experts out there, In addition to the footnotes, which may be more than you can bear; Please understand the step transaction doctrine, Because surviving it will take much more than 30 days and oxygen.

The court in Senda says this doctrine is impliedly included in the gift tax statute, Where formally distinct steps are classified as one same root; At the entire transaction, the court does look, Rather than each separate entry in the taxpayer’s book.[6]

In Holman v. our good friend the Commish,[7] Estate tax avoidance was the retired Dell employee’s wish: He funded a partnership with Dell stock, and after 6 days elapsed, He transferred a partnership interest reporting a discount, alas.

The IRS claimed that no discount applied, But the Tax Court said the Holman was not in a pickle, on rye, 6 days was long enough between funding and gifting: Thus, Mr. Holman found a good way for shifting.

This whole concept is rather confusing, And a tax issue that some of you may find amusing; A way to ensure that a gift is discounted, Even if it’s made shortly after an entity is with volatile stock funded.

What is written above may be quippy and smart, There is an important lesson you should take to heart: The Holman situation is separate and apart, From the step transaction doctrine, which is somewhat science and somewhat art.

Don’t think that 30 days will avoid the doctrine, Or your client will quickly run out of oxygen, The Tax Court and the IRS will explain without reluctance That they “hate hate hate”[8] transactions that lack economic substance.[9]

This is different than the normal case law on step transactions— Timing and intent could cause 6 months or even 6 years to elicit the same reaction:[10]

The case of Whiteley v. Commisioner is another example,[11] Where the IRS left a taxpayer in shambles; The time between transactions in this case didn’t matter, Which caused the taxpayers’ heads to shatter.

The Tax Court will focus on rights retained by the grantor, And the IRS has a very strong hammer, Be careful not to leave strings attached, Lest you subject yourself to an estate tax.

Assets resulting from a gift, May be taxed to the donor under IRC section 2036, Where the grantor is still considered to be the owner; And thus from his estate, the assets not gone-r.[12]

So be careful if one spouse funds a Spousal Limited Access Trust, a SLAT, With the assets that are jointly owned—check the plat; If Spouse 1 (S1) funds a trust for Spouse 2 (S2), using S2’s assets, Then estate tax savings may be few—heed the IRS’s threats.

S1 may give S2 consideration in exchange for assets transferred back, But make sure the consideration is sufficient, Jack; Assume S1 has widgets and S2 has Blackacre, At least for the next example on this paper:

S1 can exchange equally-valued widgets for Blackacre and then give Blackacre to the SLAT, That should work fine for Amy and Matt.

This may bring you to tears, That not 6 or 7 days but even if there are steps separated by 3 years, A court challenge of the transaction can cause the gavel to drop, And the step transaction doctrine can put your plan to a stop.[13]

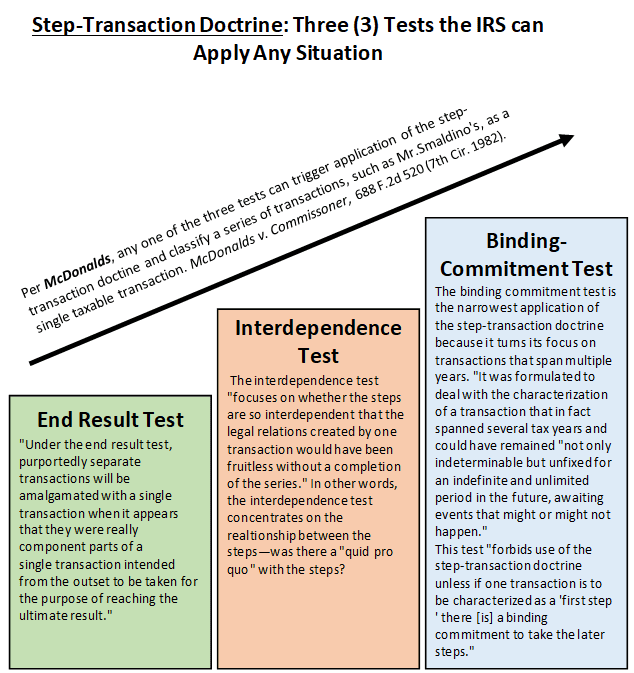

And there are variations of the step transaction doctrine that you will see, Three arrows in the quiver that fill the IRS with glee; The end result test, the interdependence, and the binding commitment test, Cause the IRS to beat their chest.

‘Twas the night before Christmas, as you sit in your house, Reading this poem, your head a madhouse; The chart below might help you make sense,[14] So hopefully your confusion is past tense.

Under any test, the doctrine acts to make any transaction difficult If in substance they are integrated, interdependent, and aimed at a particular result; The courts will look at each test, And see which one is better than the rest.

With the binding commitment test, after a taxpayer takes a first step, If a contract or other commitment makes him take a later step, Those transactions must be combined, At least that’s how the U.S. Supreme Court opined.[15]

Second, courts might look at the end result, To throw “clever” taxpayers into a state of tumult, Classifies as single, a series of formally separate transactions, Intended from the outset to be a part of the same interaction.

Third, courts look at test of interdependence, Which is when a transaction has anything but independence; Because based on a reasonable interpretation of objective facts, Transactions are so interrelated and would not work without a specific series of acts.

Under any one test devised, Even if the taxpayers tried, The transactions may be stepped together; Leaving the taxpayer to wish for better weather.

The IRS looks at substance over form, At least that appears to be the norm, Taxpayers are encouraged to take legally permissible means to their maxes, So long there is another reason to avoid paying taxes.

We are presently at a loss for words with a better combination, Mr. Smaldino or his advisors messed up the documentation.[16] Nevertheless, a discount of Thirty-Six (36) percent, Is where a lot of taxpayers would like to have went.

Mr. Smaldino thought he’d made Santa’s list, But instead it turned out that he got the IRS pisXXed; But those of us that do the tax planning right, Can enjoy a happy Christmas, and to all a good night.

we hope that this helps you help others. even if they gift via wives who are not their children’s mothers. [1] George Herman “Babe” Ruth, also known as The Great Bambino and The Sultan of Swat, was an iconic American Baseball player known for his ability to swing for the fences, finishing his career with a record-setting 714 career home runs. Ruth was the most popular athlete of the 20th century, and may have been the most talented one as well. He was also a very colorful character who liked to visit children in hospital wards, drink heavily, and dated frequently. No baseball player has ever been so highly referred in the sport. Ruth also struck out a lot, which was necessary to have a lot of home runs. Mr. Smaldino also took a big risk, and hit a double instead of a homerun by the authors’ estimation. As the Great Bambino once said, “[n]ever let the fear of striking out get in your way.” This was appropriate because Ruth held the professional baseball record for the most strikeouts (1,330) over his 20 year career. The Babe Ruth candy bar was initially released in 1921 and is still very popular. It is sweet and nutty, like the Great Bambino himself. Babe Ruth, Wikipedia (last updated Dec. 12, 2021), https://en.wikipedia.org/wiki/Babe_Ruth. For more on the life of Babe Ruth, consider watching the following documentary: https://www.youtube.com/watch?v=qoG5Xb5oJBs. [2] Under the step transaction doctrine “a series of transactions designed and executed as parts of a unitary plan to achieve an intended result…will be viewed as a whole regardless of whether the effect of doing so is imposition of or relief from taxation.” FNMA v. Commissioner, 896 F.2d 580, 586 (D.C. Cir. 1990), cert denied, 499 U.S. 971 (1991) (citing Kanawha Gas & Utilities Co. v. United States, 214 F.2d 685, 691 (5th Cir. 1954). [3] IRC § 2513 states that “[s]uch consent may be so signified at any time after the close of the calendar year in which the gift was made, subject to the following limitations— (A) [t]he consent may not be signified after the 15th day of April following the close of such year, unless before such 15th day no return has been filed for such year by either spouse, in which case the consent may not be signified after a return for such year is filed by either spouse[; or] (B) the consent may not be signified after a notice of deficiency with respect to the tax for such year has been sent to either spouse in accordance with section 6212(a).” [4] If the Smaldino’s elected to split the gift so that they were considered to have gifted $3,910,004 worth of LLC interests, then their gift tax exposure would have been reduced greatly. Instead of paying a 40% gift tax on $10,000,000, the undiscounted value of the assets transferred, under the split, the Smaldino’s would have only paid $1,564,002 in tax, 40% of 3,910,004, Mr. Smaldino’s split portion of the gift. Note that Mrs. Smaldino’s $3,910,004 could have passed free of gift tax, as long as she used her lifetime exemption. [5] IRC § 2035. [6] Senda v. Commissioner, 433 F.3d 1044 (8th Cir. 2006) (“In some situations, formally distinct steps are considered as an integrated whole, rather than in isolation, so federal tax liability is based on a realistic view of the entire transaction . . . . [the] step-transaction doctrine is “impliedly included in the gift tax statute itself. [7] Holman v. Commissioner, 601 F.3d 763 (8th Cir. 2010) [8] The Grinch: “So whatever the reason, his heart or his shoes, he stood outside his cave, hating the Whos . . . . ‘Hate Hate Hate, Hate Hate Hate, Double Hate, LOATHE ENTIRELY.’” Dr. Seuss’ How the Grinch Stole Christmas (Universal Pictures & Imagine Entertainment 2000) (emphasis added). [9] A US District court has explained that: The economic substance doctrine allows courts to enforce the legislative purpose of the Internal Revenue Code by preventing taxpayers from reaping tax benefits from transactions lacking in economic reality. Klamath, 568 F.3d at 543 (citing Coltec, 454 F.3d at 1353-54). Taxpayers undoubtedly have the right to decrease or avoid taxes by legally permissible means. See Gregory v. Helvering, 293 U.S. 465, 469, 55 S. Ct. 266, 79 L. Ed. 596 (1935). “The doctrine of economic substance becomes applicable, and a judicial remedy is warranted, where a taxpayer seeks to claim tax benefits, unintended by Congress, by means of transactions that serve no economic purpose other than tax savings. Yosha v. Comm’r, 861 F.2d 494, 498-99 (7th Cir. 1988). The application of this well-established doctrine is nevertheless murky: “The casebooks are glutted with [economic substance] tests. Many such tests proliferate because they give the comforting illusion of consistency and precision. They often obscure rather than clarify.” Collins v. Comm’r, 857 F.2d 1383, 1385 (9th Cir. 1988). Southgate Master Fund v. United States, 651 F. Supp. 2d 596 (N.D. Tex. 2009). [10] A transaction spanning multiple years can still be characterized as a single transaction under the step transaction doctrine. McDonald’s Rests. of Ill., Inc. v. Commissioner, 688 F.2d 520, 525 (7th Cir. 1982). The “‘binding commitment’ test is the most [narrow application] on the step-transaction doctrine because it was formulated to deal with the characterization of a transaction that in fact spanned several tax years and could have remained ‘not only indeterminable but unfixed for an indefinite and unlimited period in the future, awaiting events that might or might not happen.’’ Id. (citing Commissioner v. Gordon, 391 U.S. 83, 96 (1968)). In other words, the binding commitment test is targeted towards multi-step transactions that happen over a longer period of time, and combines transactions when there is a binding commitment, usually contractual, to take later steps upon taking a first step. McDonald’s, 688 F. 2d at 525. In McDonald’s the transaction spanning 6 months was stepped together because the taxpayer was contractually obligated to take additional steps and actually did take those steps 6 months later. Another case, Gordon stepped together a 3 year transaction because the taxpayer had a clause in the contract that gave the taxpayers stock options 3 years after the initial purchase of the stock. 391 U.S. at 97–98. “Accordingly, we hold that the taxpayers, having exercised rights to purchase shares of Northwest from Pacific in 1961, must recognize ordinary income in that year in the amount of the difference between $16 per share and the fair market value of a share of Northwest common at the moment the rights were exercised.” Id. [11] Whiteley v. Commissioner, 42 B.T.A. 402 (1940), aff’d, 120 F.2d 782 (3d Cir. 1941), cert. denied, 314 U.S. 657 (1941). In Whiteley, there were approximately 7 days between the creation of a trust and a $200,000 gift which became a main issue in the case. The Whiteley court, however, did not touch on the short passage of time in its analysis and instead focused on the rights retained by the taxpayer after the transfer. [12] Under Section 2036(a) assets that are the result of a gift will be considered as owned by the grantor if the grantor retains certain rights over the assets, unless the transfer made by the decedent was considered to be a “bona fide sale for adequate and full consideration.” Alan Gassman et al., The Thursday Report Issue 306, Gassman, Crotty, & Denicolo, P.A. (June 17, 2021), https://gassmanlaw.com/thursday-reports/9247/. Generally, Section 2036(a) is implicated when (1) the grantor retains income from or possession of the property for life or (2) the grantor reserves the right to change beneficial enjoyment over the property. [13] Commissioner v. Gordon , 391 U.S. 83, 88 S. Ct. 1517 (1968). [14] Ray A. Knight and Lee G. Knight, A Walk Through the Step-Transaction Doctrine, The Tax Adviser (May 1, 2021), https://www.thetaxadviser.com/issues/2021/may/step-transaction-doctrine.html. [15] Commissioner v. Gordon, 391 U.S. 83, 96 (1968) [16] On another matter, effective dating versus back dating documents, Martin M. Shenkman et al. had some great guidance, excerpted below: The legal document used to transfer the LLC interests from Mr. Smaldino to Mrs. Smaldino said that it was “Effective: April 14, 2013” but it did not include a section for each individual signing the document to indicate when that individual actually signed it. (1) There is nothing inherently wrong with indicating a date a document should be effective (as long as the effective date is not contradictory to the facts). However, legal documents could indicate the date they were actually signed even if there is a different effective date. Having a transaction present a clear timeline of how steps proceeded may help prevent an alternative, and adverse to the client, sequence of events being asserted during an audit or other challenge. (2) The problem with dates of legal documents in the Smaldino case was significant. The effective date of Mrs. Smaldino’s gift to the Dynasty Trust was a mere one day after the transfer of the interests in the LLC to her by Mr. Smaldino. (3) The Court felt that the taxpayers were disingenuous in regard to the dates of the documents. The Court noted that the appraisal report that valued the LLC was dated August 22, 2013. The Court believed that the documents were actually signed after the appraisal, months after their effective dates.[xx] (4) The fact that key documents did not reflect dates that they were signed lead the Court to suspect that they were really signed much later than their claimed effective date, several months later when the family got the appraisal they needed to consummate the transfer. Worse yet, consider that in the Smaldino situation, if the documents were actually signed long after the supposed gift to Mrs. Smaldino, she could not have had any opportunity to exercise her ownership over the LLC interests Mr. Smaldino gave her. According to the Court’s position, by the time the family signed the legal documents, the effective dates already had the Dynasty Trust owning the LLC interests.[xxi] The inability for Mrs. Smaldino to exercise any control over the LLC interests she was purported to have received undermines the planning steps the family attempted to take and contributed to the adverse result for the family. Practitioners should focus on the accuracy of the timing and dating of legal documentation and that clients understand the effects that failures to follow dating sequences in transactions can have. Martin M. Shenkman et al., Smaldino: Lessons to Consider on Structuring and Implementing Estate Planning, LISI Newsletter #2924 (Nov. 30, 2021)

|

|||||||||||||||||||||||||||||||||||||||||

Article 4What Your Giving Strategies Could Be Missing |

|||||||||||||||||||||||||||||||||||||||||

|

For Finkel’s Followers6 Emotional Intelligent Skills Your Executive Team Should Possess |

|||||||||||||||||||||||||||||||||||||||||

Forbes’ Corner

Tax-Smart Gifts For The Remaining Days Of HanukkahNov 30, 2021 The following tax opportunities can be considered for the remaining 6 days of Hanukkah, and of course, Christmas and other gifting…Continue reading on Forbes.

Written By: Alan Gassman

|

|||||||||||||||||||||||||||||||||||||||||

Featured EventsFREE 2020-21 WEBINAR REPLAY FROM OUR FIRM*Please note that this was presented in 2020 and is therefore not completely up-to-date. Please note that Brandon Ketron is not more intelligent than Alan Gassman notwithstanding that he may appear to be. He is not always taller depending upon camera angles. |

|||||||||||||||||||||||||||||||||||||||||

FREE 2020-21 WEBINAR REPLAY FROM OUR FIRM*Please note that this was presented in the Summer of 2021 and is therefore not completely up-to-date. Please note that Brandon Ketron is not always taller depending upon camera angles. |

|||||||||||||||||||||||||||||||||||||||||

FREE LIVE WEBINAR FROM OUR FIRM“HOW TO MAKE YOUR OFFICE OR BUSINESS MORE EFFECTIVE AND ENJOYABLE”Presented by: Alan Gassman, Esq. REGISTER NOWSaturday, January 8th 11:00 AM to 12:00 PM EST (60 minutes) After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 3-5 hours after the program concludes, the video recording and PowerPoint presentation will be sent to the email address you registered with. This program does not qualify for CLE/CPE Credits. Please send your questions and comments to agassman@gassmanpa.com.

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||

More Upcoming Events

|

|||||||||||||||||||||||||||||||||||||||||

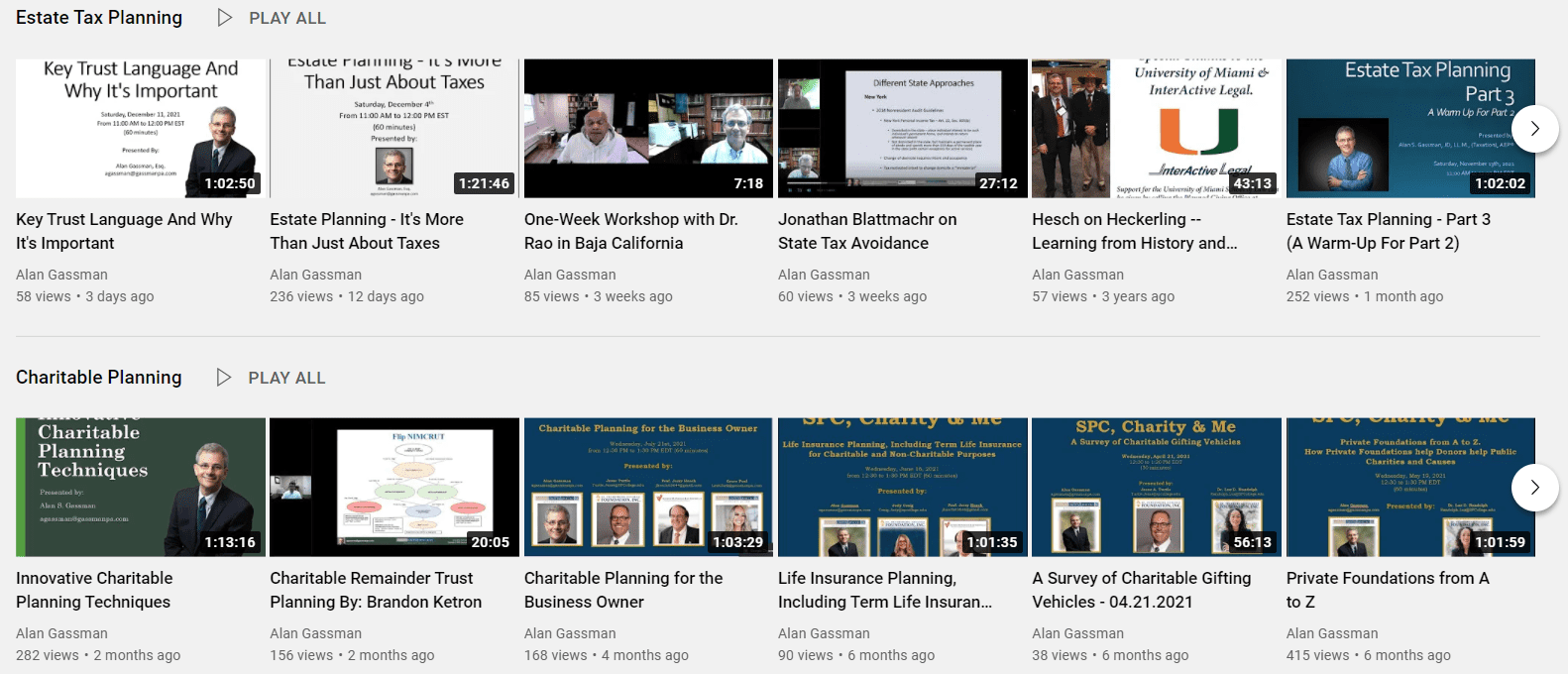

YouTube LibraryVisit Alan Gassman’s YouTube Channel for complimentary informational webinars and more!The PowerPoint materials can be found in the description box located at the bottom of the YouTube recordings.

|

|||||||||||||||||||||||||||||||||||||||||

Humor

A FAMILY PRESENTPoem Written By: Ron Ross

MyDNA, Helix, 23 and me, ~ Your father gave you one ear bigger than the other, ~ Grandma Maw Maw gave you that twitch in the neck, ~ From an ancestor named Moshe you got an embarrassing itch, ~ It’s the greatest gift for Christmas, they gave you more than your name,

|

|||||||||||||||||||||||||||||||||||||||||

|

Gassman, Crotty & Denicolo, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2021 Gassman, Crotty & Denicolo, P.A

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||