The Thursday Report – Issue 317

|

|

||||||||||||||||||||||||

|

Thursday, December 2, 2021Issue 317Having trouble viewing this? Use this link From the Law Offices of Gassman, Crotty & Denicolo, P.A.

|

||||||||||||||||||||||||

|

Table of ContentsArticle 1The COVID19 Non-Vaxxer Right to Work LawWritten By: Johnson Pope Lawyers Joan Vecchioli, Colleen Flynn and Rachael Wood Article 2IRS Signals That Limited Partnership Income May Be Subject To Self-Employment TaxKudos to: James C. Counts II, CPA CTFA Article 3The Estate Tax Is A Voluntary Tax.Written By: Alan Gassman Article 4Hesch on Heckerling – Learning from History and Dedication to the Education of Estate PlannersA Q&A Between Professor Jerry Hesch and Alan Gassman Article 5Charitable Planning for Real Estate Investors and DevelopersSections From 52nd Annual Sid Kess UJA-Federation Estate, Tax, & Financial Planning Conference Outline Written by: Alan Gassman and Ian MacLean For Finkel’s FollowersStruggling To Finish Your To-Do List?Written by: David Finkel Forbes’ CornerTax-Smart Gifts For The Remaining Days Of HanukkahWritten By: Alan Gassman Recent Tax Court Case Has Important Lessons On How To Do Estate Tax Planning Right!Written By: Martin Shenkman Florida Law On Tug-Of-War Between Beneficiaries Of A Will In FluxWritten By: Alan Gassman Florida Court Sheds Light On Piercing The Corporate VeilWritten By: Alan Gassman The IRS’s Thanksgiving Gift To PPP BorrowersWritten By: Alan Gassman and Brandon Ketron The Death Of The Fourth Quarter Employee Retention CreditWritten By: Alan Gassman and Brandon Ketron Featured EventAll Upcoming EventsYouTube LibraryHumor

|

||||||||||||||||||||||||

|

Article 1The COVID19 Non-Vaxxer Right to Work Law

Written By: Johnson Pope Lawyers Joan Vecchioli (left), Colleen Flynn (middle) and Rachael Wood (right) Joan M. Vecchioli is a partner in the Clearwater office and is Board Certified in Labor and Employment Law by the Florida Bar. Colleen M. Flynn is a partner in the Clearwater office whose practice focuses on Labor and Employment Law. Rachael L. Wood is a senior associate in the Clearwater office whose practice focuses on Labor and Employment Law. We thank Johnson Pope Lawyers Joan Vecchioli, Colleen Flynn and Rachael Wood for giving us permission to re-print their excellent article located on the Johnson Pope Bokor Ruppel & Burns firm website that can be read directly by clicking HERE, or as reprinted below. Employees will now be able to be unvaccinated if they agree to comply with periodic testing at the employer’s cost no more than once a week and agrees to comply with an employer’s “reasonable written requirements” to use PPE in the presents of other employees or other persons when the PPE is provided by the employer. The Florida Department of Revenue will create exemption statement forms to be used by employees. Employees are dying to find out how this will work. Read more about it below: FLORIDA ENACTS NEW LAW AFFECTING MANDATORY VACCINE POLICIES IN THE WORKPLACE “On November 18, 2021, Governor Ron DeSantis signed into law House Bill No. 1-B, which immediately prohibited all governmental entities and educational institutions in the state of Florida from imposing mandatory workplace COVID-19 vaccine policies. While private employers may still require employees to receive a COVID-19 vaccine, they must provide certain exemptions, which far exceed the current requirements of federal anti-discrimination laws that require reasonable accommodations for disabilities or sincerely held religious beliefs. Specifically, Florida Statute §381.00317 (“Statute”) prohibits any private employer from imposing “a COVID-19 vaccination mandate for any full-time, part-time, or contract employee without providing individual exemptions that allow an employee to opt out of such requirement”. The five (5) categories of exemptions are as follows: Medical Reasons. The Statute does not define “medical reason” or limit the definition to a disability and includes “pregnancy or anticipated pregnancy”. Rather, the Statute states that an employee must present an exemption statement signed by a physician, physician assistant, or advanced practice registered nurse that states that, in their opinion, “COVID-19 vaccination is not in the best medical interest of the employee”. The Emergency Rule entered by the Department of Health to clarify the Statute (“Emergency Rule”) explains that “anticipated pregnancy” means 1) the employee intends to become pregnant and 2) is of childbearing age. The employer must accept the employee’s representation that it is the intent of the employee to become pregnant. The Emergency Rule can be found at Standards and Forms for Exemption from Private Employer Covid-19 Vaccination Mandates. Religious Reasons. To claim this exemption, the employee must present to the employer an exemption statement indicating that the employee declines COVID-19 vaccination because of a sincerely held religious belief. The Emergency Rule prohibits an employer from inquiring into the veracity of the employee’s religious beliefs. COVID-19 Immunity. An employee may claim this exemption by presenting an exemption statement showing that the employee has immunity to COVID-19, documented by a valid laboratory test, which can be either a diagnostic or antibody test, that has received full approval or emergency use approval by the U.S. Food and Drug Administration (“FDA”). Periodic Testing. If an employee agrees to comply with regular testing by presenting an exemption statement, the testing must be provided at no cost to the employee. An employer may test the employee no more than weekly or upon evidence of COVID-19 symptoms using a diagnostic test that has received approval from the FDA. While the Statute and Emergency Rule are silent on at-home tests, an at-home test that is approved by the FDA would likely meet the testing requirement. Employer-Provided Personal Protective Equipment (“PPE”). As with testing, if an employee agrees to comply with an employer’s reasonable written requirement to use PPE in the presence of other employees or other persons, then the PPE must be provided by the employer. The Statute does not define PPE or differentiate between cloth face coverings and face masks. The Statute requires the Florida Department of Health to create the exemption statement forms to be used by employees in requesting one of the foregoing exemptions. Employers must use these forms or forms that are substantially similar for employees to submit exemption statements. The exemption forms can be found at the following links: Medical Reasons, Religious Reasons, COVID-19 Immunity, Periodic Testing, and Employer-Provided PPE. If an employer receives a completed exemption statement, the employer must allow the employee to opt-out of the employer’s COVID-19 vaccination mandate. This requirement is much broader in scope than the narrow analysis currently used for disability and sincerely held religious beliefs under anti-discrimination laws and leaves employers no room to challenge an asserted exemption to a COVID-19 vaccine policy, provided the employee submits a completed exemption statement form. If an employer improperly applies or denies an exemption offered under the Statute, which results in an employee being terminated or constructively terminated, the employer may be subject to a $10,000.00 fine per violation (for employers with fewer than 100 employees) or a $50,000.00 fine per violation (for employers with 100 or more employees). It is important to note that the Statute applies to all private employers regardless of size or number of employees. As such, this Statute provides the prevailing law for private employers in Florida with fewer than 100 employees. If a private employer currently has a vaccine policy and is not subject to a federal vaccine mandate, then the employer should immediately revise its vaccine policy to comply with the requirements of the Statute. Additionally, while OSHA’s COVID-19 Vaccination and Testing Emergency Temporary Standard (“Vaccination ETS”) is stayed by the U.S. Court of Appeals, Florida employers with 100 or more employees must also comply with the Statute. Although we anticipate that the Vaccination ETS will continue to be highly litigated, we cannot predict whether the Vaccination ETS will ultimately be enforced or permanently stayed. If the Vaccination ETS becomes effective, it will preempt Florida law to the extent of any inconsistencies with the Statute. As of right now, however, Florida employers with 100 or more employees should be governed by the Statute. For Florida employers who are subject to either the Centers for Medicare & Medicaid Services’ (“CMS”) vaccine mandate or Executive Order 14042’s federal contractor vaccine mandate, there are also no clear answers. As of November 30, 2021, a federal court has stayed the CMS vaccine mandate for all states. As with the Vaccination ETS, it is unknown whether the federal government will ultimately be able to enforce the CMS vaccine mandate requirements or whether it will permanently stay. While the federal contractor vaccine mandate has been challenged and stayed in other states, there is currently no stay in place in Florida. Thus, Florida employers must balance complying with the requirements of the federal contractor vaccine mandate against running afoul of the Statute and should craft policies to meet the needs of both state and federal law while awaiting legal guidance as to whether and how the federal contractor vaccine mandate will preempt the Statute. As with the federal vaccine and/or testing mandates, we anticipate that the Statute will be subject to legal challenges, and we will keep you updated on the outcome of those cases. We also know that these are trying times as the laws and requirements for businesses continue to change almost daily. As always, we are here to guide you through that process and wish you a happy and healthy holiday season.” FREE WEBINAR FROM OUR FIRM

REGISTER NOW |

||||||||||||||||||||||||

|

Article 2IRS Signals That Limited Partnership Income May Be Subject To Self-Employment Tax

Kudos to: James C. Counts II, CPA CTFA The December 1, 2021 TaxTalkNews Daily Report by James C. Counts II, CPA CTFA for Leimberg Information Services made note that the IRS published instructions to the Form 1065 – Partnership Tax Return now provides that a limited partner may be subject to employment taxes if he or she is actively participating in the partnership’s businesses activities as opposed to being a passive investor. This is a gray area of the law that we will cover in detail in a future Thursday Report, giving you yet another reason to wake up early on Thursdays although The Thursday Report is rarely published before 7 p.m. The following can be found on page 39 of the instructions for the Form 1065, for those readers who do not already know page 39 by heart. We thank James for this excellent update. “Limited partners. Generally, a limited partner’s share of partnership income (loss) isn’t included in net earnings (loss) from self-employment. Limited partners treat as self-employment earnings only guaranteed payments for services they actually rendered to, or on behalf of, the partnership to the extent that those payments are payment for those services. However, whether a partner (including a member of an LLC treated as a partnership for federal income tax purposes) qualifies as a limited partner for purposes of self-employment tax depends upon whether the partner meets the definition of a limited partner under section 1402(a)(13); whether a partner is a limited partner under state limited partnership law is not determinative. Relevant to this determination is whether the partner merely invested in the partnership and is not actively participating in the partnership’s business operations; a partner who is performing services for a partnership in their capacity as a partner and that is, based on the facts and circumstances, acting in the manner of a self-employed person is not a limited partner for self-employment tax purposes. See Renkemeyer, Campbell & Weaver, LLP v. Commissioner, 136 T.C. 137, 150 (2011). Link to draft instructions; LISI TaxTalkNews Email Newsletter Archive Message #39 (Nov. 31, 2021) at http://www.leimbergservices.com Copyright 2019 Leimberg Information Services, Inc.

|

||||||||||||||||||||||||

Article 3The Estate Tax Is A Voluntary Tax.

Written By: Alan Gassman Wealthy individuals and their families can completely avoid the tax with relatively little effort if they are willing to use planning strategies that are widely available. The strategies which all good estate tax planners should be familiar with are included below. 1. For the Charitable or Somewhat Charitable Client. A) The Charitable Lead Annuity Trust The lifetime or testamentary Charitable Lead Annuity Trust permits the affluent client to gift or leave assets into a trust that can pay money or transfer assets over a term of years to a Family Foundation or other 501(c)(3) organization, with the remainder to be held for the family. Further, a lifetime Grantor CLAT can deliver a check from the IRS by generating an income tax deduction for the discounted value of the assets placed in the CLAT. B) The Administrative Note Arrangement. I leave my business to my son, John, provided that if he disclaims such inheritance in whole or in part, then it will pass to the Pinellas Community Foundation. My son will have the option of purchasing the company from the Pinellas Community Foundation for a 25-year note bearing interest at the long-term Applicable Federal Rate. This provides John with the choice of whether to pay federal estate tax on the value of the company or to own the company estate tax-free and owe a long-term interest-only promissory note to a friendly charity. If the business is worth $100 million dollars and the interest rate is 2%, then John can decide whether to pay $40,000,000 in federal estate tax (over a 14-year payment period), or $2,000,000 a year in interest to a public charity that may apply the funds as reasonably requested by John. Better yet, if the family forms a charitable organization that qualifies as a school, a medical research organization, a hospital/clinic, or a church/house of worship, then the note can be owed to the family-controlled 501(c)(3) organization and can be renegotiated at arm’s-length. C) Layer In Charitable Remainder Trusts to get income tax deductions now while deferring income or avoiding income that can be diverted to charity. 2. Fully Funding a Credit Shelter Trust as Opposed to Relying Upon Portability. This may involve using a Power of Appointment Trust or a Joint Exempt Step-Up Trust (“JEST”) to fully fund a Credit Shelter Trust on the first death can make a significant difference. Under a JEST Trust, the couple can allocate ownership in shares of the JEST in any combination desired. The neurosurgeon spouse may have 3%, and the homemaker or executive spouse might have 97%. Nevertheless, up to all of the assets of the Trust (not exceeding the estate and gift tax exemption amount of the first dying spouse) can be used to fund a Credit Shelter Trust on the first death, while also receiving a new income tax basis (in the opinion of the presenter. and many others). 3. Maximize Annual Gifting. The annual gifting exclusion will go to $16,000 per person/per year in 2022. Annual exclusion gifts can be placed in trusts using Crummey powers to include children, grandchildren, nephews and nieces, and other legitimate potential discretionary beneficiaries of a trust. This can be doubled with gift-splitting. Discounted gifting involves the transfer of non-voting or minority interest LLC or limited partnership interests. Over time, this can make a big difference. 4. Gift Now to Exclude Growth from the Estate. 5. Installment Sales For Low-Interest Long-Term Promissory Notes. Use installment sales to facilitate discounts, freezing the value of assets, and locking in a low-interest long-term rate of return while the Grantor pays the income tax. 6. Grantor Retained Annuity Trust – Use a GRAT instead of an Installment Sale if there is a significant concern of a possible taxable gift. Example – Client has $300 million in assets – places $10,000,000 into a Dynasty Trust, and $150 million into an LLC. Sells the 99% non-voting LLC interest to the Dynasty Trust for a $100 million dollar note. Places the other $100 million dollars in a separate LLC, and contributes 99% non-voting LLC interest to GRAT that pays back over ten years. Almost zero chance of the GRAT arrangement being considered to be a taxable gift. 7. Using GRATs and Installment Sales for family businesses and professional practices. 8. Using Self-cancelling Installment Notes (“SCINs”) and Private Annuities. 9. Allow business and income opportunities to go to lower-generation family members or estate tax-exempt entities. 10. Use Irrevocable Life Insurance Trusts and Split-Dollar Loan Funding. |

||||||||||||||||||||||||

Article 4Hesch on Heckerling — Learning from History and Dedication to the Education of Estate PlannersA Q&A Between Professor Jerry Hesch and Alan Gassman In January of 2019, Alan Gassman interviewed Jerry Hesch on the early years of the University of Miami Institute on Estate Planning and how it gradually evolved into the leading continuing education program in the country devoted exclusively to estate planning. A videotaped discussion of the history of the University of Miami Institute on Estate Planning, now known as the Heckerling Institute on Estate Planning, can be found on YouTube HERE (43:12). Professor Hesch describes how Philip Heckerling first came up with the idea for a program devoted exclusively to estate planning shortly after he joined the University of Miami Law School faculty, why the Institute would be especially attractive to practitioners if it was held in Miami Beach during the first part of January and some of Phillip Heckerling’s objectives for the Institute that were not being addressed by existing CLE programs in the 1960s. As background, Professor Hesch will describe why Phil Heckerling ended up moving to Miami Beach from Brooklyn and how he became interested in estate planning. Several of the objectives the Institute accomplished, revolutionary for that time, are now well-accepted today. The Heckerling Institute is now the largest and most impactful estate tax and estate planning conference in the country, based in good part upon Philip Heckerling’s vision for the Institute and what he did from its inception in 1966 until his death in 1983. For questions, comments or feedback, feel free to email Jerry Hesch (jhesch62644@gmail.com) or Alan Gassman (agassman@gassmanpa.com). MIAMI LAW 56TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING – ONLINE REGISTRATION Learn more about the Heckerling Institute on Estate Planning by clicking HERE. Orlando World Center Marriott Resort January 10-14, 2022

|

||||||||||||||||||||||||

Article 5Charitable Planning for Real Estate Investors and DevelopersSections From 52nd Annual Sid Kess UJA-Federation Estate, Tax, & Financial Planning Conference Outline

Written by: Alan Gassman and Ian Maclean (not pictured) Basic Principles of Transferring Real Estate to Charities While most charitable contributions consist of cash and marketable securities, many donors have and will prefer to give direct ownership of real estate or ownership of entities that own real estate. When the real estate is owned directly by the taxpayer or a limited liability company (“LLC”) that is disregarded for income tax purposes, the rules are fairly simple. The unencumbered real estate or the ownership of an LLC that owns such real estate can be transferred to the 501(c)(3) charitable organization, and the donor can receive an income tax deduction based upon the fair market value of the property given, to the extent that the donor would have had long term capital gain treatment if the property had been sold. Alternatively, if the property was not held for a full year, and therefore would have received short term capital gain treatment on sale, or if the property was depreciated by the taxpayer using an accelerated depreciation method that would cause depreciation recapture to be recognized upon sale, then the charitable income tax deduction will be limited to the basis of the property, instead of being based upon fair market value. Many buildings have been subject to component depreciation upon acquisition, which will be recaptured upon sale. Therefore, the physical aspects of the property that were subject to component depreciation will have to be separately valued at the time of donation, and those portions such as plumbing, electrical, and other systems will not be deductible except possibly to the extent of any remaining basis thereon. Some interesting dynamics apply with respect to variations to the above rules, which can be explained as follows: A. Appreciated real estate donated to a Private (Non-Operating) Foundation will only be deductible based upon the income tax basis of the asset (which is normally cost minus depreciation taken) up to 20% of the adjusted gross income for the taxpayer in the year of donation, with any excess deduction being able to be carried forward annually for up to five additional tax years. Appreciated securities donated to a Private Non-Operating Foundation will be deductible based upon fair market value if this exceeds the taxpayer’s basis, subject to the 20% of adjusted gross income limitation. B. When the donation of appreciated property is to a Private Operating Foundation or a Public Charity, then the limitation for the deduction of the fair market value of the property cannot exceed 30% of the donor’s adjusted gross income for the year of the gift, and then will carry forward for up to five consecutive years thereafter. C. The donation of non-appreciated assets to a Private Operating Foundation or Public Charity can be based upon up to 50% of adjusted gross income. D. A taxpayer donating appreciated property may elect to have a tax deduction equal to the basis of the property, in lieu of the fair market value, in order to use the 50% of adjusted gross income limitation. E. A taxpayer may also donate a percentage ownership in real estate in lieu of a 100% interest. Possible Benefits to be Derived from Charitable Real Estate Related Activities The following are examples of possible benefits that can be incidentally enjoyed by real estate developers from working with 501(c)(3) organizations: Example #1: A developer supports a lending company which is registered as a 501(c)(3) organization that will loan money to individuals who would like to buy a condominium or single-family homes from the developer or affiliates of the developer and would not be able to qualify for funding. The 501(c)(3) loans are provided to give the borrower a 20% down payment to the borrower at closing and subordinates to the bank or financial institution that provides first mortgage financing and private mortgage insurance (“PMI”). Under the loan arrangement, the 501(c)(3) will recoup the amounts that it has advanced, with interest, and a percentage of the excess of the eventual sales price of the home over what the 501(c)(3) organization has advanced. Interest income received by a charity actively engaged in the business of lending to help needy borrowers may be excluded from being taxable as income. In Revenue Ruling 79-349, 1972-2 C.B. 233, a charity that was actively making mortgage loans and receiving interest income was able to confirm that the interest income would be excluded from UBTI under IRC § 512(b)(1). It is important to note that charging interest is permitted, as well as requiring profit-sharing from the eventual sale. The interest rate should be relatively low or zero to show charitable intent, and it is important that the 501(c)(3) balance factors such as whether the person could have afforded the home, what their income/resources were to qualify for the loan, etc. The organization assures that homeowners supported by it have financial needs, and follows all federal, state, and Treasury Regulation guidelines with respect to not discriminating, and record keeping. The developer has an incidental yet substantial economic benefit by being able to sell units to individuals who would otherwise not have been able to afford them. The developer receives a tax deduction for its contributions to the entity. Example #2: A real estate developer and landlord who owns a building adjacent to a hospital campus would like to donate the building to receive a charitable deduction for the fair market value of the building, which has been completely depreciated over the last forty (40) years. The building is leased at arm’s length to for-profit tenants that are not affiliated with the hospital or any 501(c)(3) organizations. The landlord/donor also has a small office in the building. The landlord/donor establishes a 501(c)(3) Private Operating Foundation that will engage in interviewing and selecting non-licensed employees of the system who wish to become licensed nurses, and providing them with scholarships so that they may take classes on the hospital campus that are given by a separate 501(c)(3) school that is operated by a local community college. The donor receives a donation for the full amount of the contribution. The leases in the building must all be structured so that the landlord does not provide any significant services to the tenants other than repairs of the exterior spaces and common areas, normal maintenance, landscaping, and payment of taxes and insurances that are the responsibility of the landlord in a typical lease agreement. The Foundation has rent-free use of an office in the building, which may be shared by the landlord/donor, with pro rata sharing of expenses for utilities, janitorial services, and other amenities, and the landlord/donor and his for-profit organization will not have further use of the office. The landlord/donor’s daughter will manage the property and receive arm’s-length management fees or salary. The net rent income of the 501(c)(3) will generally not be taxable because of the exception for passive income under the UBTI rules, assuming that there is no debt on the building, or that one of the exceptions to the unrelated business income tax for leveraged properties applies. Treas. Reg. § 1.512(b)-1(c) is provided, in relevant portion, below: (c) Rents—(1) Taxable years beginning before January 1, 1970. For taxable years beginning before January 1, 1970, rents from real property (including personal property leased with the real property) and the deductions directly connected therewith shall be excluded in computing unrelated business taxable income, except that certain rents from, and certain deductions in connection with, a business lease (as defined in section 514(f)) shall be included in computing unrelated business taxable income. See subparagraph (5) of this paragraph for rules governing amounts received for the rendering of services. (2) Taxable years beginning after December 31, 1969—(i) In general. For taxable years beginning after December 31, 1969, except as provided in subdivision (iii) of this subparagraph, rents from property described in subdivision (ii) of this subparagraph, and the deductions directly connected therewith, shall be excluded in computing unrelated business taxable income. However, notwithstanding subdivision (ii) of this subparagraph, certain rents from and certain deductions in connection with either debt-financed property (as defined in section 514(b)) or property rented to controlled organizations (as defined in paragraph (l) of this section) shall be included in computing unrelated business taxable income. (ii) Excluded rents. The rents which are excluded from unrelated business income under section 512(b)(3)(A) and this paragraph are: (a) Real property. All rents from real property; and (b) Personal property. All rents from personal property leased with real property if the rents attributable to such personal property are an incidental amount of the total rents received or accrued under the lease, determined at the time personal property are an incidental amount service by the lessee. Example #3: A developer wishes to have a world-class aquatics and community center within the border lines of the general area that the developer and affiliates own and develop. The recreational center will cost more than $20 million, and it has the support of the county government. It has given assurances that individuals who do not reside within the boundaries of the development will have equal access to the center, and that the center will have special programs for children, teenagers, and adults to provide swimming lessons in the State (“Florida”) where most drownings occur, and air conditioned recreational space in a Mid-Florida city that often has average summer temperatures in the high 90s and large portions of the population that do not have air conditioning or would “hang out with bad influences otherwise.” The developer is also providing pools and recreational centers separate and apart from the 501(c)(3)-owned and operated facility in its community, and one of them is only approximately 1/5th of a mile from the 501(c)(3) center. The application for tax-exempt status makes mention that it is believed that most of the residents, who live in “over-55″ sections of the community will prefer to use their nearby pool and recreational center as opposed to making use of the busier and commonly integrated 501(c)(3) center. The 4.25% of value annual minimum distribution requirement will be satisfied in the first years by the spending of money to build the recreational center and improvements. Thereafter the value of the recreational center will not be included in the 4.25% expenditure requirement, and amounts spent to operate and maintain the recreational center can count towards the 4.25% expenditure requirement, while revenues from admissions, support from the government, and grants from other organizations do not enter into the calculation. The fact that the sole donor to the Private Operating Foundation has common ownership with the developer company and owns significant properties within the vicinity of the center does not necessarily cause disqualification of the charitable deduction or of the 501(c)(3) organization approval under the private inurement rules. Under IRC § 4946(a)(1)(G), the trustee of a trust that provides that no more than 35% of its beneficial interests will be held for any person or persons will not be considered to be held by a Disqualified Person if certain requirements are met. Therefore, a family wishing to control an entity partly owned by charity can place all of the voting stock or interests in the investment or business entity under a trust that may provide up to 35% of its holdings as benefits for family members or others, with 65% of the holdings of the trust to benefit charitable or quasi-charitable organizations. Under Section 4946(a)(1)(G), an individual or individuals who are considered to be “Disqualified Persons” can serve as the trustees of a trust that benefits individuals or entities, as long as the possible benefits to be paid to family members do not exceed 35% of the cumulative benefits paid from the trust holding such voting interest. In order to prevent such a “voting stock trust” from being treated as a separate charitable organization, which would cause the trust itself to be treated as a Private Foundation. Ideally all, or at least some of, the beneficiaries should be individuals or organizations that are not considered to be charities as defined in IRC § 170(c)(2)(B). This can include close friends or employees who are not related by family relationship to the donor’s family under IRC § 267(b), IRC § 501(c)(4) social wealth organizations and cemetery associations, or other non-charitable entities that the grantor of the trust may wish to benefit. It is noteworthy that S corporation stock may be held under a trust that benefits individuals and 501(c)(3) charities. The actual language of IRC § 4946(a)(1)(G) is as follows: (a) Disqualified Person (1) For purposes of this subchapter, the term “disqualified person” means, with respect to a Private Foundation, a person who is — (G) a trust or estate in which persons described in subparagraph (A), (B), (C), or (D) own more than 35 of the beneficial interest. Author and lawyer Turney Barry has discussed the possible use of a IRC § 501(c)(4) organization to own the voting stock of a for-profit company where the non-voting stock may be owned by a Private Foundation, Private Operating foundation or Public Charity in the same manner. What he has said specifically about this is as follows: A section 501(c)(4) organization does not appear to fit within the definition of “disqualified person,” because it is:

No cases or rulings appear to establish that a section 501(c)(4) organization would be a disqualified person. This may create a useful opportunity to use section 501(c)(4) organizations to avoid excess business holdings and self-dealing issues that could arise from transfers of closely-held business interests to a private foundation. Section 4943 would preclude a private foundation from long-term ownership of more than 20 percent of the voting stock of a corporation or other business enterprise in combination with all disqualified persons. However, if a section 501(c)(4) organization is not a disqualified person, it could own a “business enterprise” with one or more private foundations in a manner than would avoid violating the prohibition against excess business holdings under section 4943. If an owner transferred interests in a closely-owned business to a private foundation in conjunction with a transfer to a section 501(c)(4) organization, it may be possible to avoid excess business holdings. To Illustrate,

If a section 501(c)(4) organization is not a disqualified person (even if it is controlled by one or more disqualified persons) it would be permissible for a private foundation and the section 501(c)(4) organization to enter into transactions that ordinarily would be treated as self-dealing. For example, a section 501(c)(4) organization could:

[1] In reference to the Mueller Foundation which is based in Texas. Information about the Mueller Organization comes from the whitepaper and their website. [2] Applications will typically, at least indirectly, allude to the possibility that residents of a community may consider the presence of economically disadvantaged individuals to be a negative attribute of living in a gated or similar community. [3] Renting property to a Private Foundation by a Disqualified Person could be considered self-dealing, even if the lease is for below fair market value rent. See IRC § 4941(d)(1)(C). In order for a disqualified person to rent property directly to a Private Operating Foundation under the zero-rent lease exception to the prohibited transactions rules, the Disqualified Person landlord is not allowed to receive any rent, but may receive reimbursement of certain costs, and may require the Private Operating Foundation to pay insurances, taxes, and maintenance costs. These restrictions are strictly enforced by the IRS with the interpretation that any benefit received by a Disqualified Person results in a prohibited transaction. [4] IRC § 512(b)(1) and Treas. Reg. § 1.512(b)-1(c) exclude from UBTI rents from real property (where personal property does not make up a significant portion of the rental amount). There are exceptions to this exception, so care must be taken with any form of passive income. [5] Treas. Reg. §§1.514(c)-1(b)(3)(ii)-(iii).

|

||||||||||||||||||||||||

|

For Finkel’s FollowersStruggling To Finish Your To-Do List?Here Is A Better Way To Organize Your Day |

||||||||||||||||||||||||

Forbes’ Corner

Warning: If you click on the Forbes’ titles featured below and Alan Gassman publishes 5 Forbes articles in one month then we will receive 1/2 of 1 cent, unless you subscribe in which he will receive 5 cents.Tax-Smart Gifts For The Remaining Days Of HanukkahNov 30, 2021 The following tax opportunities can be considered for the remaining 6 days of Hanukkah, and of course, Christmas and other gifting…Continue reading on Forbes.

Written By: Alan Gassman Recent Tax Court Case Has Important Lessons On How To Do Estate Planning Right!Nov 22, 2021 A recent case provides lots of valuable lessons on how to do estate planning right: observe legal formalities; assure economic substance to each step; reflect the plan on your tax returns; and more.

Written By: Martin Shenkman Florida Law On Tug-Of-War Between Beneficiaries Of A Will In FluxNov 30, 2021 In the 1971 Florida case of In re Carpenter’s Estate, The Supreme Court of Florida held that an individual who has helped to facilitate an estate plan will be presumed to have exercised undue influence in effectuating the plan, and will therefore have the burden of proof in defending a plan that …Continue reading on Forbes.

Written By: Alan Gassman Florida Court Sheds Light On Piercing The Corporate VeilNov 27, 2021 In the 2021 3rd District Court of Appeals case of Segal v. Forastero, Inc., an investor who bought and sold real estate used an LLC he had to enter into a purchase agreement and then walked away from the deal, claiming that he had no personal liability because it was the LLC and not him who signed…Continue reading on Forbes.

Written By: Alan Gassman The IRS’s Thanksgiving Gift To PPP BorrowersNov 24, 2021 The generosity of Congress extended to tax treatment, by providing in the Consolidated Appropriations Act of 2021 that the forgiveness of the PPP loans did not constitute taxable income, and that the expenses paid with the borrowed monies would still be tax-deductible…Continue reading on Forbes.

Written By: Alan Gassman and Brandon Ketron The Death Of The Fourth Quarter Employee Retention CreditNov 23, 2021 The Employee Retention Credit (“ERC”) was established under the March 27, 2020 CARES Act as a dollar-for-dollar credit against employment taxes available to certain employers as reimbursement for “qualified wages” paid to employees during periods of economic hardship or when a business is closed …Continue reading on Forbes.

Written By: Alan Gassman and Brandon Ketron

|

||||||||||||||||||||||||

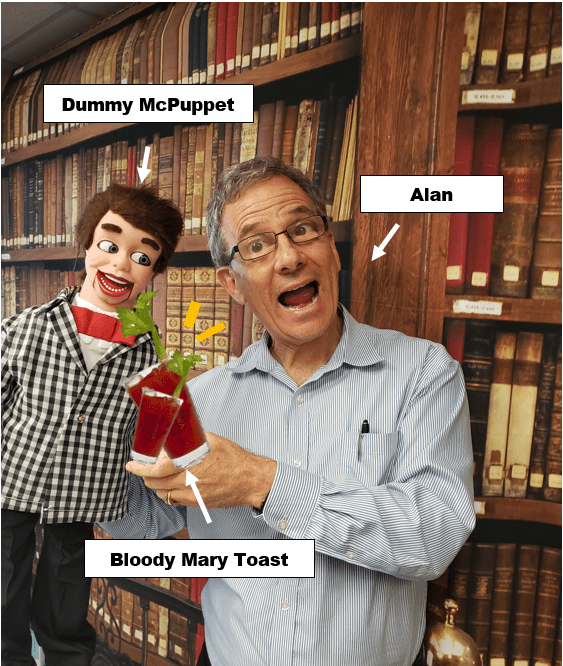

Featured EventFREE WEBINAR FROM OUR FIRMComing from the Law Offices of Gassman, Crotty & Denicolo, P.A. REGISTER NOWFrom basics, practicalities, and Holy Smokes Wowities! After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 3-5 hours after the program concludes, the video recording and PowerPoint presentation will be emailed to all those who register. This program does not qualify for CLE/CPE Credits. Please send your questions and comments to agassman@gassmanpa.com. Join Alan Gassman and Dummy McPuppet for more of our firm’s Saturday Morning Estate And Gift Tax Planning Webinar Series!

|

||||||||||||||||||||||||

FREE WEBINAR FROM OUR FIRM

REGISTER NOW |

||||||||||||||||||||||||

|

More Upcoming EventsRegister for all future free webinars from Gassman, Crotty & Denicolo, P.A. using this link

|

||||||||||||||||||||||||

YouTube LibraryVisit Alan Gassman’s YouTube Channel for complimentary informational webinars and more!

|

||||||||||||||||||||||||

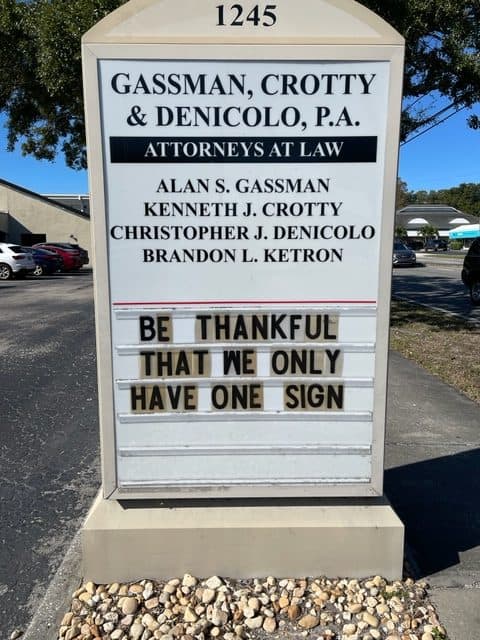

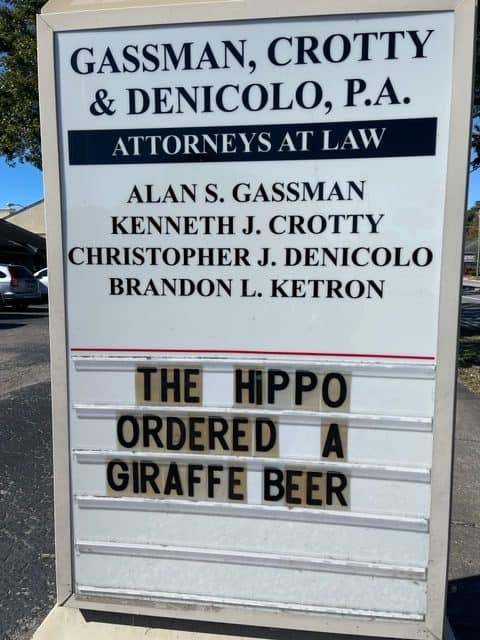

Humor |

||||||||||||||||||||||||

|

Gassman, Crotty & Denicolo, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2021 Gassman, Crotty & Denicolo, P.A

|

||||||||||||||||||||||||

|

|

||||||||||||||||||||||||