The Thursday Report – Issue 309

|

|

|

EDITED BY: KEN CROTTY Thursday, August 5th, 2021 – Issue 309Having trouble viewing this? Use this link ALWAYS FREE, SOMETIMES PUBLISHED ON THURSDAYS

|

|

|

|

Table of ContentsForbes Corner – TRIPLE PLAYBorrower Friendly PPP Loan Forgiveness Regulatory Changes Provided By The New SBA RegulationBy: Alan Gassman and Brandon Ketron Newly Issued Employee Retention Credit Guidance Punishes Owner Employees if They Have Living Family MembersBy: Alan Gassman and Brandon Ketron New CMS Pronouncement on Parent/Subsidiary Medical Practice and Business EntitiesBy: Alan Gassman and Tina Bhatt ArticleCan Donations to a PAC be Anonymous?By: Grace Paul ArticleKey Takeaways from President Biden’s Non-Compete Executive OrderBy: Brock Exline ArticleCommunity Property Meets TBE: Rock, Scissors, Paper?

|

Forbes Corner – TRIPLE PLAYBorrower Friendly PPP Loan Forgiveness Regulatory Changes Provided By The New SBA RegulationBy: Alan Gassman and Brandon Ketron Aug 5, 2021 The Small Business Administration (SBA) has just made a number of updates to the regulations governing PPP loans that are being welcomed by borrowers and their advisors. These new rules will save tens of thousands of hours for … Continue Reading on Forbes

Newly Issued Employee Retention Credit Guidance Punishes Owner Employees if They Have Living Family MembersBy: Alan Gassman and Brandon Ketron Aug 5, 2021 In a tremendously unpleasant surprise for owners of S-corporations and C-Corporations and their tax advisors, the IRS issued Notice 2021-49 on August 4th which states that the Employee Retention Credit (ERC), made available for businesses suffering from the COVID-19 crisis, will not be available … Continue Reading on Forbes

New CMS Pronouncement On Parent/Subsidiary Medical Practice And Business EntitiesBy: Alan Gassman and Tina Bhatt Aug 5, 2021 The good news and the bad news about the newest Stark Law advisory opinion issue under the Stark Law by the Centers for Medicare & Medicaid Services (“CMS”) (Opinion No. CMS-AO-2021-01 issued June 2021) … Continue Reading on Forbes

|

|||||||||||||||||||||||||||||||||||||||||||

ArticleCan Donations to a PAC be Anonymous?By: Grace Paul Stetson Law Student and Summer Clerk at Gassman, Crotty & Denicolo, P.A.

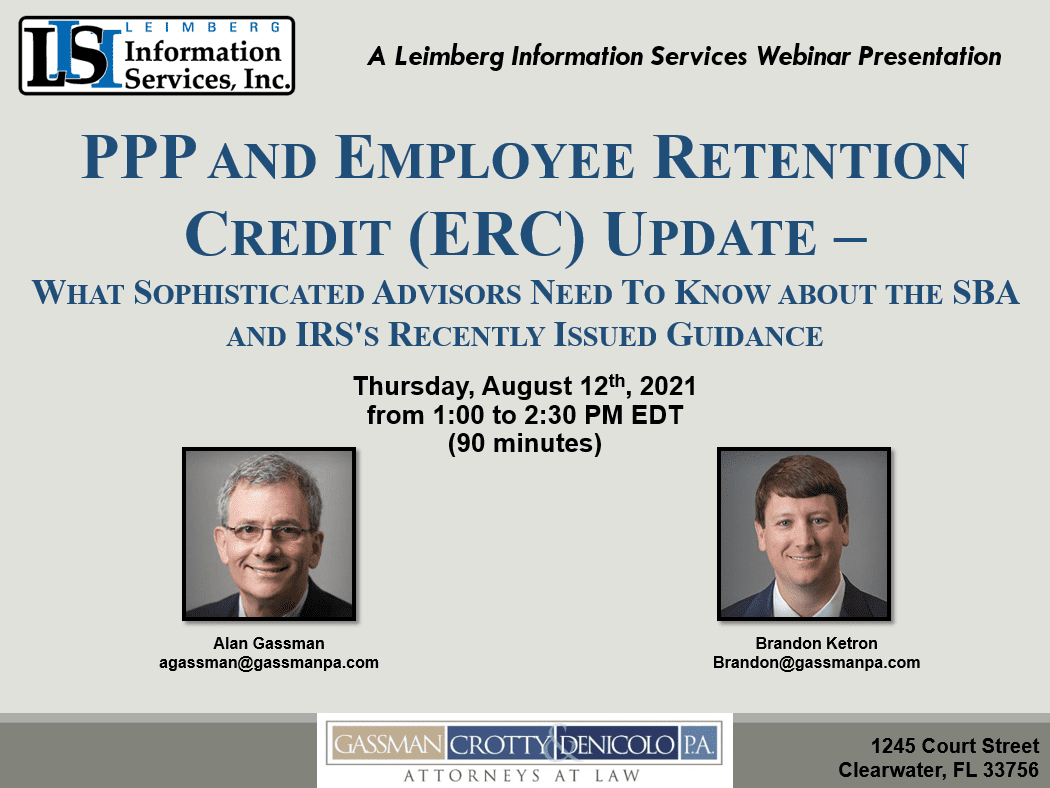

Recent political and international health events have prompted many American citizens to be ardent in their desire to support political candidates, parties, or causes with respect to federal elections. However, not all individuals, partnerships, and limited liability companies desire to have their political leanings and financial contributions disclosed to the public for a multitude of reasons. Whether it’s avoiding an awkward conversation at Thanksgiving dinner, preserving professional relationships, or simply keeping the peace with a particularly passionate neighbor, many people want to keep their political views private. For those who want to keep their proverbial heads down, there are ways to anonymously contribute to a candidate or political party. Another way that individuals can anonymously contribute to a PAC is through an LLC. While the PAC must disclose the LLC information to the IRS and the public, it is possible for the owners and managers of the LLC to remain anonymous depending on the state where the LLC is formed. Individuals can create “anonymous LLCs” in Delaware, Nevada, Wyoming, and New Mexico which allow for the owner’s name to not appear on any public document. These methods of anonymously contributing money to PACs are further discussed below. Can Donations to a PAC be Anonymous? The short answer is no. Political Action Committees are 527 organizations, which must report donors of $200 or more on IRS Form 8872. Donors of $5,000 or more must be reported on IRS Form 990. However, a possible way to contribute to a PAC anonymously is by either finding a related 501(c)(4) organization that also supports the candidate or by forming one, that could then donate to the PAC. 501(c)(4) organizations are not required to report donor information. The federal law requires disclosure of significant contributions over $200 which includes donors’ names, addresses, occupations, and employer information, and that then becomes public record freely available and tracked by the Federal Election Commission. Additionally, anonymous cash contributions are limited to amounts of $50. Any amount over $50 cannot be used for any reason relating to a federal election campaign. Prior to IRS Revenue Procedure 2018-38, all non-profit organizations were required to report donor information as part of their annual tax returns. The 2018 Revenue Procedure relieved 501(c)(4), 501(c)(5), and 501(c)(6) organizations from having to report donor identifying information such as names and addresses to the IRS, but these organizations must still compile and retain donor information so that it is available to the IRS on request for tax administrative purposes. Revenue Procedure 2018-38 does not affect the statutory disclosure requirements of 501(c)(3) and 527 organizations, which still must disclose donor information to the IRS on Schedule B “Schedule of Contributors”. The following chart displays the disclosure requirements for different non-profit organizations: Corporations and unincorporated associations often form section 501(c)(4) “social welfare” organizations, which are created specifically for promoting political activities that will be funded by anonymous contributions from individuals and undisclosed entities. 501(c)(4) Organizations: A Political Loophole? 501(c)(4) organizations were first recognized as federal income tax exempt by the Revenue Act of 1913. In order for an organization to be tax exempt, “an organization must not be organized for profit and must be operated exclusively to promote social welfare.” The Code of Federal Regulations provides the following guidance on 501(c)(4) organizations: §1.501(c)(4)-1 Civic organizations and local associations of employees. (a) Civic organizations— (1) In general. A civic league or organization may be exempt as an organization described in section 501(c)(4) if— (i) It is not organized or operated for profit; and (ii) It is operated exclusively for the promotion of social welfare. (2) Promotion of social welfare—(i) In general. An organization is operated exclusively for the promotion of social welfare if it is primarily engaged in promoting in some way the common good and general welfare of the people of the community. An organization embraced within this section is one which is operated primarily for the purpose of bringing about civic betterments and social improvements. A social welfare organization will qualify for exemption as a charitable organization if it falls within the definition of charitable set forth in paragraph (d)(2) of §1.501(c)(3)-1 and is not an action organization as set forth in paragraph (c)(3) of §1.501(c)(3)-1. (ii) Political or social activities. The promotion of social welfare does not include direct or indirect participation or intervention in political campaigns on behalf of or in opposition to any candidate for public office. Nor is an organization operated primarily for the promotion of social welfare if its primary activity is operating a social club for the benefit, pleasure, or recreation of its members, or is carrying on a business with the general public in a manner similar to organizations which are operated for profit. See, however, section 501(c)(6) and §1.501(c)(6)-1, relating to business leagues and similar organizations. A social welfare organization that is not, at any time after October 4, 1976, exempt from taxation as an organization described in section 501(c)(3) may qualify under section 501(c)(4) even though it is an action organization described in §1.501(c)(3)-1(c)(3)(ii) or (iv), if it otherwise qualifies under this section. For rules relating to an organization that is, after October 4, 1976, exempt from taxation as an organization described in section 501(c)(3), see section 504 and §1.504-1. The language that allows a 501(c)(4) organization to devote at least some activity to nonexempt political purposes is the language that provides that the organization must only be “primarily engaged” in social welfare activities. This word choice is contrasted with the provision for 501(c)(3) organizations which is provided below: § 1.501(c)(3)-1 Organizations organized and operated for religious, charitable, scientific, testing for public safety, literary, or educational purposes, or for the prevention of cruelty to children or animals. (a) Organizational and operational tests. (1) In order to be exempt as an organization described in section 501(c)(3), an organization must be both organized and operated exclusively for one or more of the purposes specified in such section. If an organization fails to meet either the organizational test or the operational test, it is not exempt. (2) The term exempt purpose or purposes, as used in this section, means any purpose or purposes specified in section 501(c)(3), as defined and elaborated in paragraph (d) of this section. The use of the words “primarily engaged” as opposed to “operated exclusively” has allowed 501(c)(4) organizations to participate in political activities that 501(c)(3) organizations cannot while still remaining tax exempt. Because of this language, an organization may meet the requirements of an “action” organization and still be able to qualify as a social welfare organization. Revenue Ruling 81-95 demonstrated this proposition by holding that: “[a]n organization primarily engaged in the promotion of social welfare may participate in lawful political campaign activities involving the nomination or election of public officials without adversely affecting its exempt status. However, the amounts expended for such activities may be treated as political organization taxable income under section 527(b) of the Code.” An organization seeking to qualify or maintain 501(c)(4) status must be careful to not become overly involved in political campaigns so that they are no longer “primarily engaged” in promoting the common good and social welfare. To determine whether an organization is participating or intervening, directly or indirectly, in a political campaign, the IRS typically uses a “facts and circumstances” test. Relevant factors include the amount of funds received from and devoted to particular activities; other resources used in conducting such activities, such as buildings and equipment; the time devoted to activities (by volunteers as well as employees); the manner in which the organization’s activities are conducted; and the purposes furthered by various activities. Social Welfare Organizations Involved in Politics According to the most recent IRS data, there are around 82,000 501(c)(4) organizations registered with the IRS and many conduct political activity and are associated with a parent Political Action Committee (PAC). The following chart lists various tax exempt 501(c)(4) organizations, their associated PACs, and the date (if applicable) that the IRS ruled on the organization’s tax exempt status.

The IRS guidelines provide that, “[s]eeking legislation germane to the organization’s programs is a permissible means of attaining social welfare purposes. Thus, a section 501(c)(4) social welfare organization may further its exempt purposes through lobbying as its primary activity without jeopardizing its exempt status.” For example, House Majority Forward is the nonprofit arm of the House Majority PAC and has recently dedicated to promoting President Biden’s legislative agenda through advertisements. As long as advertisements purchased by a 501(c)(4) organization do not expressly promote the victory or defeat of a specific candidate, the organization will not risk losing its tax-exempt status. What about an LLC? Many small businesses and individuals set up limited liability companies (LLCs) for the favorable tax benefits and asset protection advantages provided to business owners. For political donation purposes, LLCs are divided into corporations and partnerships depending on how the entities file their tax returns. Corporate LLCs cannot contribute to PACs, but LLCs that are characterized as partnerships or disregarded for income tax purposes can donate. Donating through an LLC can offer a certain degree of privacy and anonymity because a PAC will typically only publish the name of the LLC and its address. However, it should be noted that a corporate records search would reveal the manager(s), registered agent, and other relevant information regarding LLCs formed in the majority of states. Individuals wishing to retain a high level of privacy should form an LLC in the few states that allow for the formation of anonymous LLCs. In these states, namely Nevada, Wyoming, Delaware, and New Mexico, after the formation documents are filed, the information is not required to be updated. This allows the true owner to simply list temporary owners, managers, and other required personnel and not update the public documents when the ownership changes over. Through an anonymous LLC, individuals can donate to PACs and remain anonymous even if a corporate records search is conducted. [1] https://www.irs.gov/charities-non-profits/other-non-profits/social-welfare-organizations [2] https://www.irs.gov/pub/irs-tege/eotopicm95.pdf [3] Id. [4] https://www.irs.gov/charities-non-profits/other-non-profits/social-welfare-organizations

|

|||||||||||||||||||||||||||||||||||||||||||

ArticleKey Takeaways from President Biden’s Non-Compete Executive OrderBy: Brock Exline Stetson Law Student and Summer Clerk at Gassman, Crotty & Denicolo, P.A.

As part of a broad sweeping executive order on promoting competition in the American economy, President Biden is asking the Federal Trade Commission (FTC) to ban or limit non-compete agreements. The executive order, signed on July 9, 2021 by President Biden, does not provide specifics as to the breadth of restrictions the Biden Administration seeks. The FTC will likely take a directed approach, restricting the use of non-competes with lower-income employees or certain employment sectors, as opposed to imposing a complete ban on non-competes. While the Executive Order does not cause any immediate changes to the law of restrictive covenants, it is expected to boost employee mobility and lead to future legal change. The relevant language from the Executive Order on non-compete agreements is as follows: To address agreements that may unduly limit workers’ ability to change jobs, the Chair of the FTC is encouraged to consider working with the rest of the Commission to exercise the FTC’s statutory rulemaking authority under the Federal Trade Commission Act to curtail the unfair use of non-compete clauses and other clauses or agreements that may unfairly limit worker mobility. Noteworthy is the fact that the scope of the Executive Order potentially reaches beyond non-compete agreements because the FTC is also encouraged to limit “other clauses or agreements that may unfairly limit worker mobility.” The Executive Order provides the following in support of the call for restriction: Consolidation has increased the power of corporate employers, making it harder for workers to bargain for higher wages and better work conditions. Powerful companies require workers to sign non-compete agreements that restrict their ability to change jobs. And, while many occupational licenses are critical to increasing wages for workers and especially workers of color, some overly restrictive occupational licensing requirements can impede workers’ ability to find jobs and to move between States. The Executive Order is a step by President Biden toward fulfilling campaign promises regarding the promotion of competition and workers’ rights. The Executive Order will also create a White House Competition Council tasked with advancing the Federal Government’s efforts to address overconcentration, monopolization, and unfair competition affecting the American Economy. The concern that non-compete agreements restrict a worker’s ability to bargain for better work conditions is not a novel concept. In 2016, Jimmy John’s stopped enforcing non-compete agreements for workers at their locations. This decision came as part of a settlement to a lawsuit brought by the Attorney General of Illinois in which the legality of Jimmy John’s non-compete agreements were challenged. The Jimmy John’s non-compete agreement prohibited employees during their employment and for two years afterward from working at any other business that sells “submarine, hero-type, deli-style, pita, and/or wrapped or rolled sandwiches” within 2 miles of any Jimmy John’s location. After the settlement was made, Lisa Madigan, the Attorney General at the time, stated “[t]his settlement helps ensure Illinois’ workers have freedom to change jobs in order to seek better wages, further their careers and improve their lives.” Madigan’s office further claimed that these agreements lock low-wage workers into their jobs, giving companies little reason to increase wages or benefits. The regulation of non-compete agreements has historically been left to the states. In any given jurisdiction, a medley of statutory and common law standards govern the enforceability of non-compete agreements. This patchwork system causes unpredictable results in the state courts. California, North Dakota, and Oklahoma already ban non-compete agreements with limited exceptions, and close to a dozen states prohibit the use of non-compete agreements with low wage employees. The states that do allow non-compete agreements regularly assess the legality of the agreements by focusing on the length of time, the geographical limits, and whether the employees had access to trade secrets. Federal action on the issue would likely afford companies and workers a clear and commonly applied set of standards addressing the enforceability of non-compete provisions. The prospect of federal action in this field has been anticipated since the Obama Administration’s initiatives. The new Executive Order is the latest step toward federal regulation of non-compete agreements. In a 2019 Economic Policy Institute report on non-compete agreements, Alexander Colvin and Heidi Shierholz found that although well-paid highly educated workers are more likely to use non-compete agreements, the agreements were not uncommon in sectors dominated by low-wage workers. Colvin and Shierholz also found that somewhere between 36 and 60 million private-sector workers are subject to non-compete agreements. The survey found that roughly 30% of establishments offering an average hourly wage below $13 require non-competes for all workers. Non-compete agreements can be especially burdensome on low-wage workers, many of whom are subject to such agreements that pose no competitive threat to their employer. In the context of low-wage industries, non-compete agreements are often employed to further protect the economic position of the employer by exploiting the limited bargaining power of their employees. Beyond the burdens they place on workers, non-compete agreements also suppress innovation and entrepreneurship. Many entrepreneurs are inspired to start businesses within the sectors in which they work by leveraging existing skills, using industry know-how, and understanding the areas for new opportunity. However, non-compete agreements significantly stifle a worker’s ability to venture out on his or her own. The Covid-19 pandemic reemphasized the problematic nature of non-compete agreements. During the pandemic, with millions of workers laid off, many found it difficult to take advantage of new job opportunities or start entrepreneurial ventures because non-compete agreements remained effective even in the case of layoffs. Several court cases have been initiated in which employees laid off as a result of Covid-19 have asked courts to find their non-competes unenforceable. Non-compete agreements have been a substantial obstacle to the economy’s ability to rebound from the Covid-19 pandemic. While the Executive Order may be beneficial for worker mobility, critics of the Order assert that if a ban on non-competes goes into effect, it will have substantial negative impacts on small and medium-sized businesses. Non-competes are one of the primary instruments that protect the trade secrets and proprietary information of a business. A complete ban on non-competes would put such confidential information at a risk. Although no changes in the law have occurred yet, businesses that have invested millions of dollars and have paid workers more than they would have in order to have the benefit of non-competes may be detrimentally impacted by future legal changes seen as a result of this Executive Order. Leiza Dolghih, a partner and co-chair of the Lewis Brisbois law firm’s trade secrets and non-compete disputes practice, recently weighed in on how she believes a ban on non-compete agreements would affect businesses in a Forbes article titled “How Biden’s Proposed Ban on Non-Compete Agreements Would Impact Companies.” She told Forbes, “if it happens, [a ban on non-competes] will have a huge impact on the ability of small and medium-size businesses to protect their trade secrets.” Dolghih added, “For those businesses whose success is built on trade secrets, such as customer lists, secret recipes, or other proprietary methods and processes, a ban on non-compete agreements will significantly impact their ability to protect that information from being used by former employees and competitors.” If a complete ban on non-compete agreements were to go into effect, businesses which currently rely on such agreements to protect their legitimate business interests would instead have to rely on complex trade secret misappropriation laws to protect their confidential business information. Litigation pursuant to the trade secret misappropriation laws is often quite expensive. While tech giants likely possess the funds to foot the bill on such litigation, many smaller business will not be able to afford it. The signing of the July 9th Executive Order will undoubtedly cause future change to the law of non-compete agreements. Many speculate that the FTC will focus its efforts toward addressing non-compete agreements for low-wage workers rather than looking to initiate a complete ban. Businesses who currently utilize non-compete agreements should take a proactive approach by reviewing the scope and necessity of current and future non-compete agreements before changes in the law can potentially stifle the effectiveness of such agreements. https://www.epi.org/publication/noncompete-agreements/

|

|||||||||||||||||||||||||||||||||||||||||||

ArticleCommunity Property Meets TBE: Rock, Scissors, Paper?

|

|||||||||||||||||||||||||||||||||||||||||||

For Finkel’s FollowersThe Right and Wrong Way to Delegate |

|||||||||||||||||||||||||||||||||||||||||||

Featured Events |

|||||||||||||||||||||||||||||||||||||||||||

LIVE WEBINARSaturday, August 7th, 202110:00 AM to 10:30 AM EDT (30 minutes)CLICK HERE TO REGISTER FOR THE WEBINAR – PPP AND EMPLOYEE RETENTION CREDIT (ERC) UPDATE After registering, you will receive a confirmation email containing information about joining the webinar. The video recording will be emailed to those who register approximately 2-3 hours following the conclusion of the program. This program does not qualify for CLE Credit. Please email your questions and comments to agassman@gassmanpa.com or Brandon@gassmanpa.com. |

|||||||||||||||||||||||||||||||||||||||||||

LIVE WEBINARSaturday, August 7th, 202111:00 AM to 12:00 PM EDT (60 minutes)CLICK HERE TO REGISTER FOR THE SCGRAT, THE JEST, AND THE E STREET SHUFFLE After registering, you will receive a confirmation email containing information about joining the webinar. The video recording will be emailed to those who register approximately 2-3 hours following the conclusion of the program. This program does not qualify for CLE Credit. Please email your questions and comments to agassman@gassmanpa.com. |

|||||||||||||||||||||||||||||||||||||||||||

|

On July 28th, the SBA issued new Interim Final Rules providing a new streamlined process for applying for forgiveness for loans of less than $150,000, and also eliminating the Loan Necessity Questionnaire for loans in excess of $2,000,000. The IRS also issued Notice 2021-49 on August 4th providing guidance on the ERC for the third and fourth quarters of 2021, and whether wages paid to majority owners and their spouse are eligible for the ERC. Join Alan Gassman and Brandon Ketron in their more in-depth LISI Webinar where they will discuss IRS Notice 2021-49 and recent PPP guidance. Alan and Brandon will review the basic foundation of the PPP and ERC programs, how things have changed in the past months, deadlines and checklists for compliance, and recent events, including the following:

There will be no CE for this webinar. For those who have a conflict with the date/time, The session will be recorded. Simply register and you will have unlimited access to the recording. Although they are scheduled for a particular time and date – once purchased – they can be viewed at ANY TIME! |

|||||||||||||||||||||||||||||||||||||||||||

|

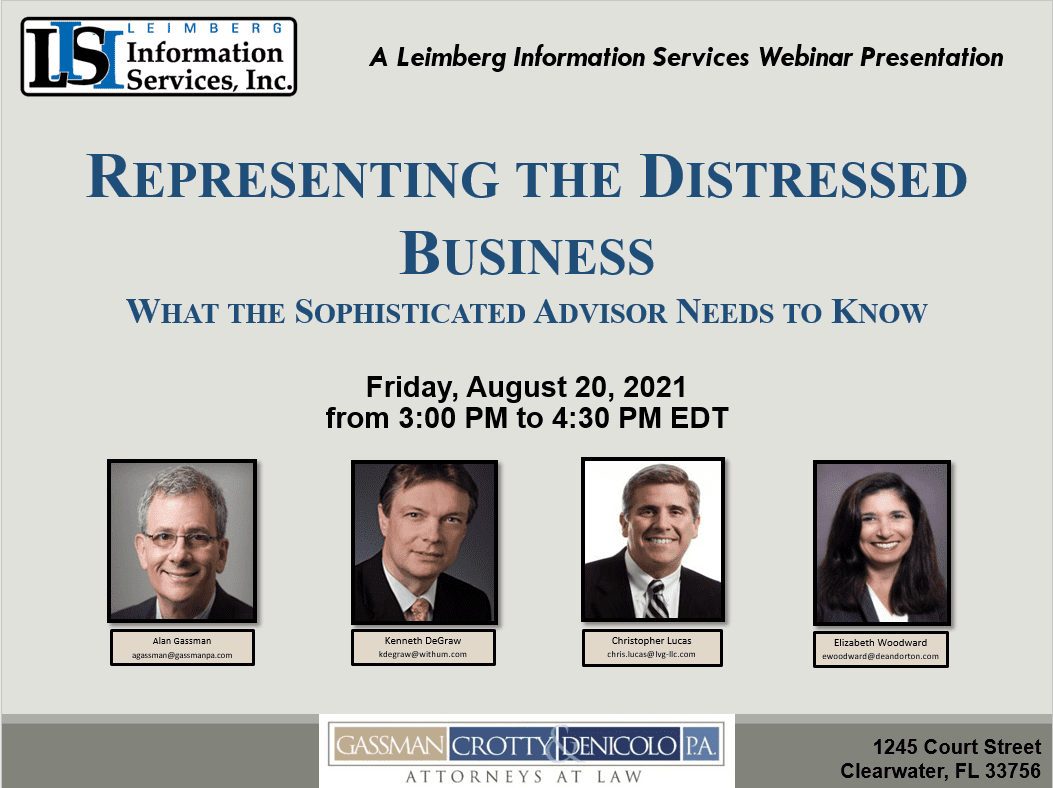

Lawyers, CPAs, and other advisors as well as individuals who own and operate businesses must be aware of important rules, strategies, business and legal practices that can have a tremendous impact on whether a company facing significant challenges may use bankruptcy, negotiations, or state insolvency proceedings in order to best survive, facilitate a sale, or reorganize. This presentation will include important observations and checklists of considerations provided by weathered professionals who have experience in this arena. In their exclusive LISI Webinar, Ken DeGraw, Chris Lucas, Elizabeth Woodward and Alan Gassman will cover the following topics:

Kenneth DeGraw, CPA/CFF CFE CFP® is a leading authority in forensic and bankruptcy topics. Christopher Lucas, CFA, CPA/ABV is a valuation expert who has extensive experience investing in distressed businesses; several of these investments resulted in sale through the bankruptcy process. Elizabeth Woodward, CPA/CFF, CFE is both a forensic CPA and an experienced bankruptcy trustee and receiver. Alan S. Gassman is the lead author of the book “The Estate Planner’s Guide to Bankruptcy”, and will act to moderate this presentation. There will be no CE for this webinar. For those who have a conflict with the date/time, The session will be recorded. Simply register and you will have unlimited access to the recording. Although they are scheduled for a particular time and date – once purchased – they can be viewed at ANY TIME! |

|||||||||||||||||||||||||||||||||||||||||||

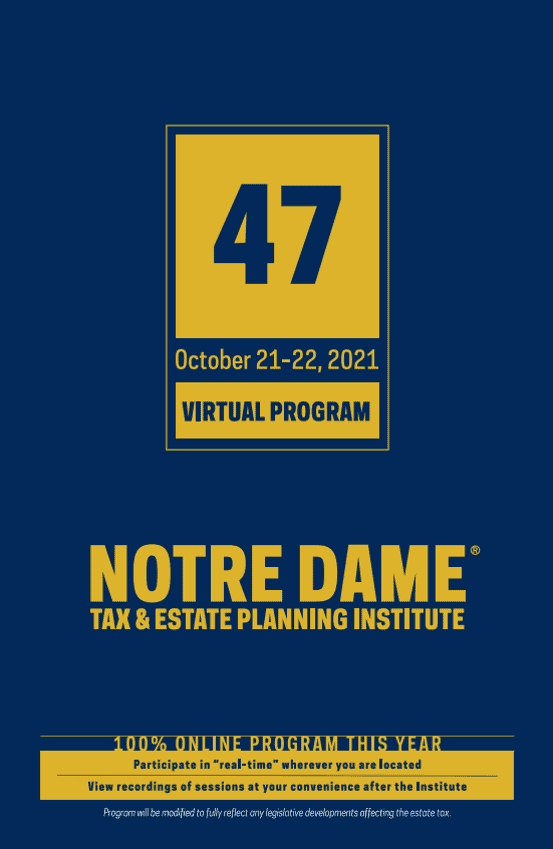

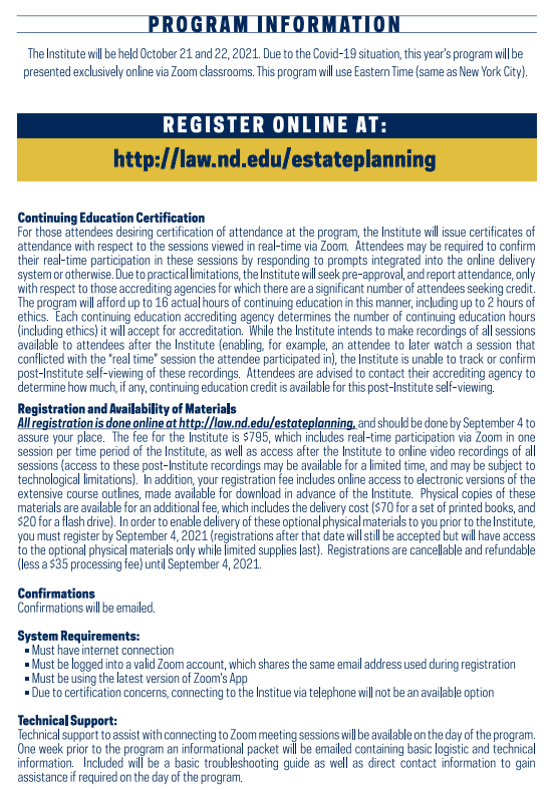

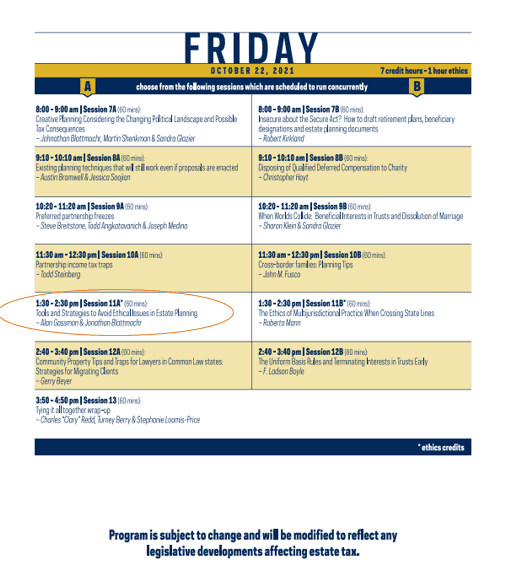

UPCOMING NATIONAL EVENTNotre Dame Tax And Estate Planning InstituteOctober 20th – 22nd, 2021Virtual PresentationCLICK HERE FOR MORE INFORMATION |

|||||||||||||||||||||||||||||||||||||||||||

|

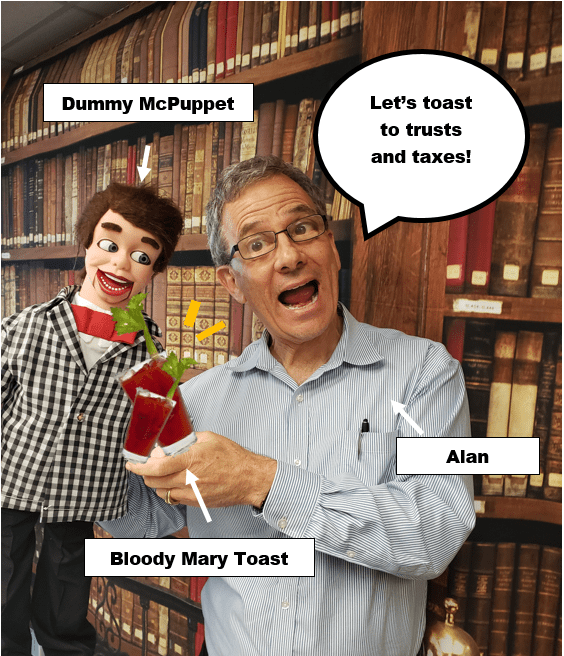

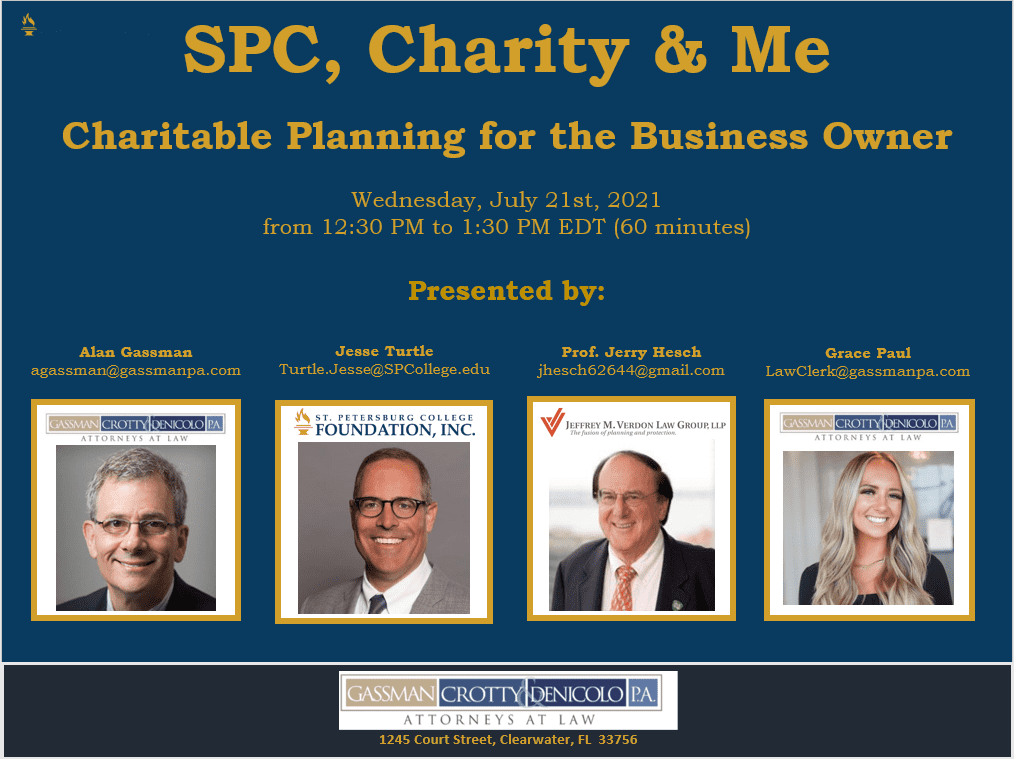

LEARN MORE ABOUT ALAN GASSMAN’S SATURDAY MORNING SERIES: “Toast, Trusts and Taxes with Alan Gassman and Friends”Please consider your Saturday mornings booked for the foreseeable future… Join Alan and his guests for these Saturday morning conversations featuring live attendee interaction for Q and A! Click to Register for all Upcoming Saturday Morning Webinars

The video recording will be emailed to all registrants approximately 1-3 hours after the program. This series does not qualify for CLE Credit. Email topic suggestions to Alan Gassman at agassman@gassmanpa.com. Event details are listed in the table below. Register for free today! Click to Register for all Upcoming Saturday Morning Webinars

|

|||||||||||||||||||||||||||||||||||||||||||

More Upcoming EventsRegister for all future free webinars from Gassman, Crotty & Denicolo, P.A. using this link

|

|||||||||||||||||||||||||||||||||||||||||||

YouTube ChannelVisit Alan Gassman’s YouTube Channel for featured webinars and more. Did you miss a past webinar event? Don’t worry! Watch our webinar recordings to Alan Gassman’s You Tube Library.

What is everyone watching? Click on the playlists below to find out! ESTATE TAX PLANNINGCHARITABLE PLANNING

BUSINESS LAW 101

ASSET PROTECTIONAND MORE!

|

Humor

|

|

|

Gassman, Crotty & Denicolo, P.A.

1245 Court Street

Clearwater, FL 33756

(727) 442-1200