The Thursday Report – Issue 307

|

|

|

Friday, July 9th, 2021 – Issue 307Having trouble viewing this? Use this link ALWAYS FREE, SOMETIMES PUBLISHED ON THURSDAYS

|

|

|

Table of ContentsFlorida Community Property Trusts By: Alan Gassman and Christopher Denicolo Social Security Questions? Why to Always Get an Answer From a Social Security Employee and Document It By Alan Gassman and Grace Paul MIB – Medical Information Bereau By: David Howell Swiss Life Companies Enter Into Deferred Prosecution Arrangement For Abusive Private Placement Life Insurance Policies By: Jay Adkisson Hillsborough Sales Tax Lawsuit Move on From Pizza to Banana Splits By: Ralph Fisher Florida Bar Rule 4-7.18 Amendment Regarding Misleading Law Firm Search Terms Pending at Florida Supreme Court By: Joseph Corsmeier Enterprenuers May Be Particularly Susceptible to Shiny Object Syndrome: Here’s How To Cure It By: David Finkel

|

Article 1Florida Community Property TrustsRethinking Client Trust Logistics With A New Powerful Catalyst.

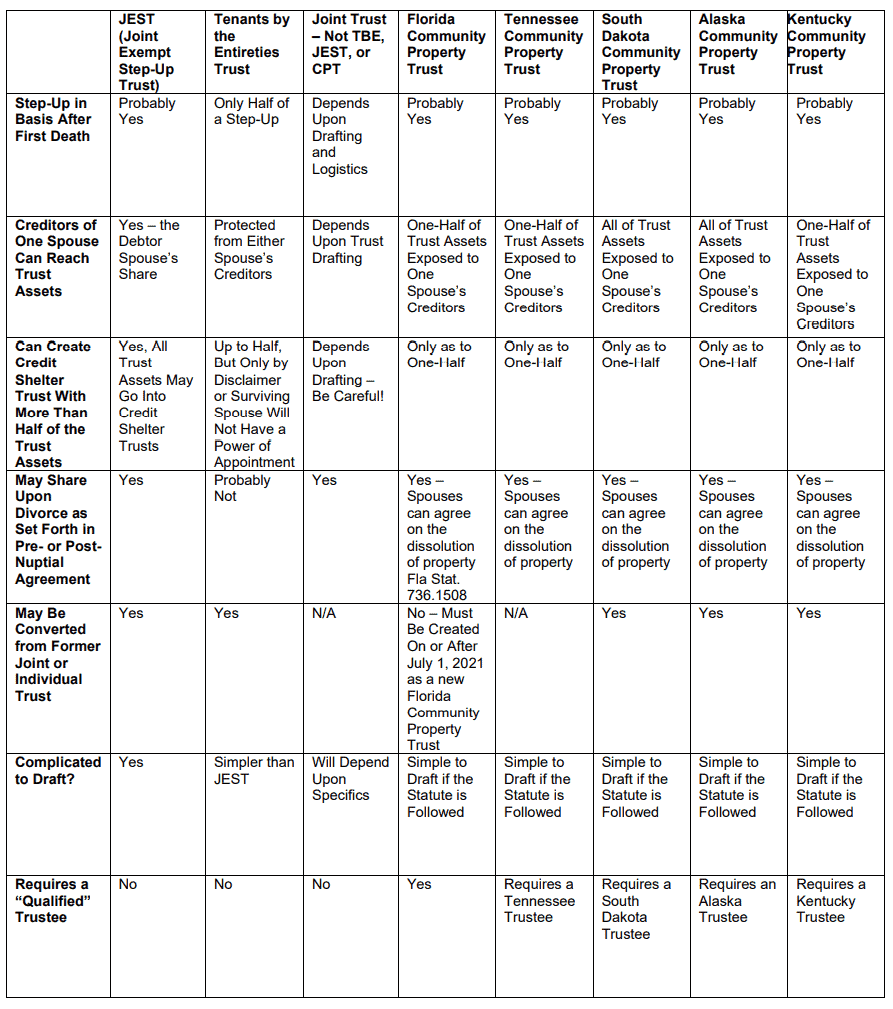

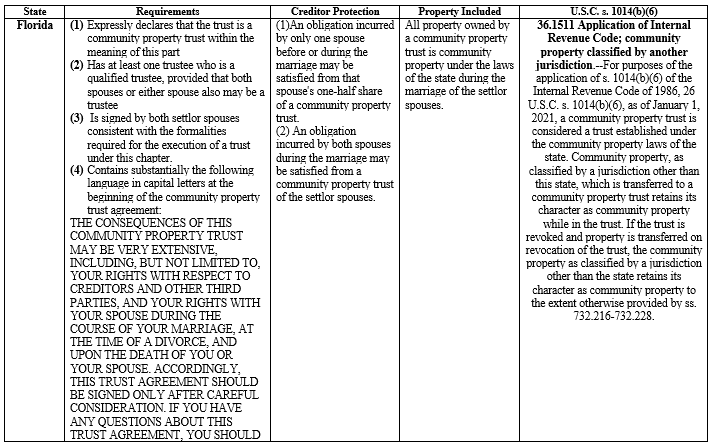

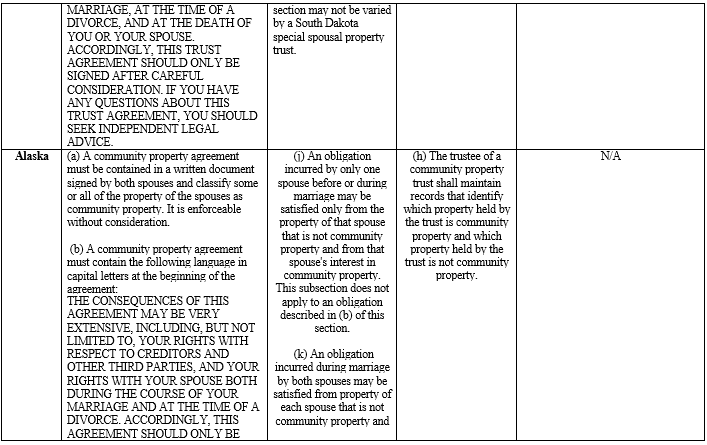

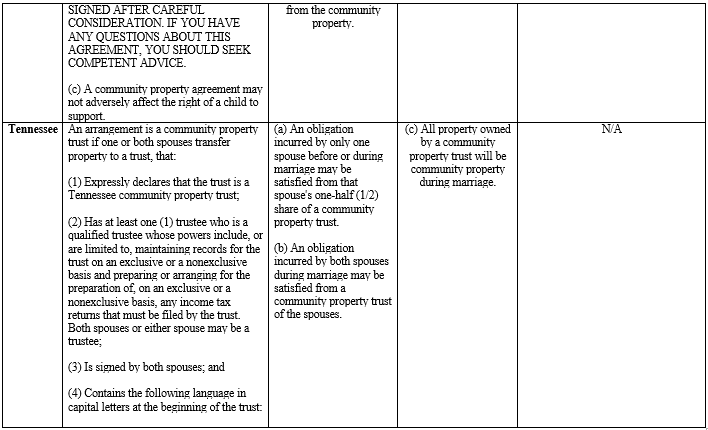

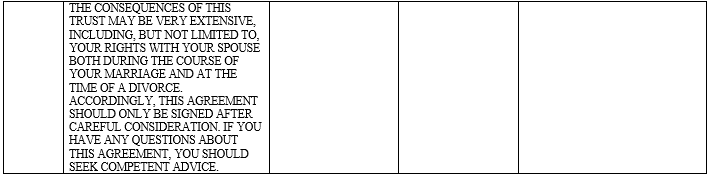

By: Alan Gassman and Christopher Denicolo Steve Leimberg’s Estate Planning Email Newsletter Archive Message #2893 JUL 8, 2021 Alan S. Gassman, Esquire and Christopher J. Denicolo, Esquire provide members with commentary that examines the planning implications of Florida’s Community Property Trust Act. Alan S. Gassman, J.D., LL.M., is a partner in the law firm of Gassman, Crotty & Denicolo, P.A. and practices in Clearwater, Florida. He is a frequent contributor to LISI and has published numerous articles in publications such as BNA Tax & Accounting, Estate Planning, Trusts and Estates, and Interactive Legal. Mr. Gassman is also co-author of Gassman and Markham on Florida and Federal Creditor Protection and several other books on tax and estate planning. His email is alan@gassmanpa.com. Christopher Denicolo, J.D., LL.M., is a partner at the Clearwater, Florida law firm of Gassman, Crotty & Denicolo P.A., where he practices in the areas of estate tax and trust planning, taxation, physician representation, and corporate and business law. He is Board Certified in Wills, Trusts and Estates by the Florida Bar. He has co-authored several handbooks that have been featured in Bloomberg BNA Tax & Accounting, Steve Leimberg’s Estate Planning and Asset Protection Planning Newsletters and the Florida Bar Journal. Mr. Denicolo is also the author of the Federal Income Taxation of the Business Entity Chapter of the Florida Bar’s Florida Small Business Practice, Seventh Edition. Mr. Denicolo received his B.A. and B.S. degrees from Florida State University, his J.D. from Stetson University College of Law, and his LL.M. (Estate Planning) from the University of Miami. His email address is christopher@gassmanpa.com. Here is their commentary: EXECUTIVE SUMMARY: Effective July 1, 2021, Florida has enacted a Community Property Trust Act that allows for married couples to “opt-in” to community property treatment for assets held in a trust that meets certain requirements. As described below, community property can have considerable income tax planning benefits on the death of the first spouse due to Internal Revenue Code Section 1014(b)(6), which provides for all community property assets (including the surviving spouse’s interest in community property) to receive a full step-up in basis upon the death of the first dying spouse. Hats off to the Judiciary Committee of the Real Property, Probate and Trust Law Section of the Florida Bar and countless others for working with State Senator Berman and State Representative Diamond to design, draft, and implement what we believe to be the best Community Property Trust legislation in the Country. Community Property: An Overview Some of the key information regarding this community property overview has been derived from an excellent article written by Steve R. Akers as part of his ACTEC 2013 Fall MeetingMusings,whichcan be found at https://www.naepcjournal.org/journal/issue16d.pdf. What is Community Property? There are two primary types of legal regimes concerning the ownership of property by legally married couples – community property law states and common law states (also known as separate property states). Under a community property system, all property of the spouses is considered to be either “community” or “separate” property. All property acquired during the marriage is generally presumed to be community property unless clear and convincing evidence demonstrates that the property is the separate property of one spouse only. For example, property received by one spouse as a gift or inheritance as his or her “sole and separate property” generally becomes the sole and separate property of that spouse. (See, Steve R. Akers, ACTEC 2013 Fall Meeting Musings, November 2013, pg. 3). In the United States, there have historically been eight community property states and two territories that have applied community property law: • Arizona • California • Idaho • New Mexico • Louisiana • Texas • Nevada • Washington (state) • Guam • Puerto Rico The laws in these states generally evolved from Spanish law, except that Louisiana’s community property law came from France. It is worth noting that in Louisiana, married couples who have assets characterized as community property can modify or terminate community property characterization only upon joint petition and a finding by a court that this serves their best interests. (La. Civ. Code Ann. art. 2329) In the other community property states, couples can simply enter into matrimonial agreements during marriage (without petitioning a court) that modify or terminate (“transmute”) their community property characterization of assets, and may be required to record such agreements to transmute real estate. Wisconsin became the ninth member of the “community property state” club in 1986 when it became the first state to adopt the Uniform Marital Property Act, which is a community property system developed by the National Conference of Commissioner on Uniform State Laws. In 1998, Alaska also enacted the Uniform Marital Property Act on an elective basis so that couples who reside in Alaska have the choice of having the community property law apply or not apply. While the nine community property states discussed above are all considered “community property states,” it should be noted that there are differences among the laws of the community property states. Exhibit 25.18.1-1 of the IRS Manual details many of these differences. As noted by Steve Akers, Oklahoma and Oregon had opt-in community property systems briefly, but quickly repealed them less than a year after enactment of the Revenue Act of 1948. This was shortly after Abraham Lincoln invented the internet and Jonathan G. Blattmachr considered an installment sale to a Defective Grantor Trust. (Steve R. Akers, ACTEC 2013 Fall Meeting Musings, November 2013, pg. 3.) Alaska adopted an innovative “opt-in” Community Property Trust law in 1998, which is described below, and Tennessee, South Dakota, and Kentucky also adopted “opt-in” community property systems in 2010, 2016, and 2020. The Kentucky and Tennessee statutes are very similar. Alaska’s Community Property Act, which was enacted in 1998 under the leadership of Jonathan G. Blattmachr, provides that non-Alaskans can hold assets in Alaska Community Property Trusts, with the expectation that all assets of the trust will receive a step-up in basis upon the death of the first spouse. Likewise, the Tennessee Community Property Trust law that was enacted in 2010 allows for non-Tennessee residents to hold assets in Community Property Trusts. Under the Tennessee Community Property Trust law, the obligation of one spouse incurred before or during the marriage can be satisfied only from that spouse’s one-half of the trust. On a spouse’s death, half of the value of the trust reflects the deceased spouse’s share and the other half reflects the surviving spouse’s share. These provisions are similar to Florida’s new rules, which are discussed below. In March of 2020, Kentucky followed suit and enacted their own Community Property Trust legislation that allows non-resident married couples to place assets in Community Property Trusts. While the Alaska, Tennessee, and Kentucky Acts seek to provide non-residents with the ability to “opt-in” to the advantages of community property, commentators have pointed out concerns about whether the trusts will be afforded such tax treatment, and that creating such trusts can potentially forfeit valuable creditor protection benefits. Effective July 1, 2021, Florida has joined the ranks of the “opt-in” Community Property Trust jurisdictions by enacting the Florida Community Property Trust Act, which is described in more detail below…Continue reading the article PDF here. Married Couple’s Trust Decision Chart

|

|||||||||||||||||||||||||||||||

Article 2Social Security Questions?Why to Always Get an Answer From a Social Security Employee and Document ItBy Alan Gassman and Grace Paul Many people depend on Social Security benefits in order to continue to live comfortably in retirement, after the passing of a loved one, or when an unexpected injury or medical condition prevents them from working. As important as Social Security benefits are, they can be equally difficult for taxpayers to navigate. Individuals may have questions about when they should file and how to ensure that they will receive the maximum amount of benefits. Many people’s first reaction is to immediately contact their financial advisors and accountants for advice regarding Social Security benefits, but this is not necessarily the best course of action based on the Code of Federal Regulations. Individuals who rely on third party advice run the risk of not being able to retroactively recover any missed benefits that were not claimed due to misinformation. According to the Code of Federal Regulations and relevant case law, a taxpayer will only be able to recover retroactive benefits if the taxpayer can produce evidence that they relied on information given to them by a Social Security Administration (SSA) employee while that employee was acting in his or her official capacity as an SSA employee. Per the guidelines, “misinformation” is “information which we consider to be incorrect, misleading, or incomplete in the view of the facts which you gave to the employee, or of which the employee was aware of or should have been aware, regarding your particular circumstances, or the particular circumstances of the person…”. The guidelines further state that “the misinformation must have been provided to you in response to a specific request by you to us [the Social Security Administration]. The preferred evidence to satisfy such a claim is written evidence, such as a notice, letter, or the Social Security Administration’s record of the phone call. In the absence of such preferred evidence, the SSA will also consider statements from the individual that detail the “date and time of the alleged contact(s), how the contact was made, the reason(s) the contact was made, who gave the misinformation, the questions you asked and the facts you gave us, and the questions we asked and the information we gave you at the time of contact, and statements from others who were present when you were given the alleged misinformation”. The SSA will not consider certain kinds of evidence to be satisfactory proof. Examples of this type of evidence include “general informational pamphlets that we issue to provide basic program information, general information that we review or prepare but which is disseminated by the media…, and information provided by other governmental agencies”. The federal statutes do not allow for people to recover missed benefits if they relied on misinformation given by personal financial advisors, accountants, or any other sources. Our Advice Based on the above information, it seems that a taxpayer’s best course of action is to direct any questions to the Social Security Administration employees and keep a detailed record of any and all interactions. We recommend writing down the date of the inquiry, the name and title of the SSA employee, the specific questions asked, and the corresponding answers given. By taking detailed notes on all correspondence, individuals essentially create their own insurance in case the Social Security Administration provides any misinformation regarding eligibility.

|

|||||||||||||||||||||||||||||||

Article 3MIB – Medical Information Bereau

By: David Howell Hi Alan, I am a great fan of your webinars and enjoyed the one yesterday. Good stuff, as always. It would be easier, and perhaps wiser, for me to stop at this point. However, I decided to let you know that the information regarding the Medical Information Bureau, a/k/a the MIB, was not entirely factual. The view your source gave you, while incorrect, is commonly held, by the way. Since I know you want to provide only factual information, I decided to take a few minutes to provide some more info on the MIB. Attached is a little piece I use on this subject, entitled “MIB De-Mystified.” Here are some points: The MIB exists to provide insurance carriers with “alerts” to possible errors, omissions and misrepresentations made during underwriting. “Codes” are used by insurance carriers and the MIB. A carrier would, for example, inform the MIB that the applicant has a history of diabetes, cancer or coronary artery disease. Actual medical records are not provided to the MIB. Only codes representing significant medical, non-medical (e.g. race car driving) and financial (e.g. bankruptcy) are part of the MIB database. A carrier cannot make an underwriting decision based solely on MIB codes. The codes are meant to serve as an alert to the carrier, who can then dig deeper into the matter. If the applicant, for example, does not disclose that he or she has coronary artery disease but there is a CAD code in the applicant’s database, the carrier would then further investigate. As you can imagine, in all the years I’ve been underwriting life insurance cases, I have occasionally been surprised – disappointed – to learn (because of a MIB code alert) that my client failed to give me the whole truth. I think you and I discussed another resource used by carriers to ensure accuracy re medical issues during the underwriting process: The “Rx Report” a/k/a “Script Check.” If an applicant takes, for example, medication for high blood pressure, that fact will be in the Rx Report. If the applicant fails to disclose this in the application process, it raises a concern. If I know it in advance, I have to opportunity to dig deeper and provide the carrier with details gathered from the applicant and perhaps the applicant’s physician, in my cover letter to the carrier. I’ll paste a little blurb on Script Check below. Because of the MIB and Script Check I always have a serious conversation with clients at the very beginning of the underwriting process. I encourage them to tell me everything because when I know “stuff” in advance, I can be pro-active. This is much better than trying to do damage control later. By the way, as you can imagine, it is not only the MIB and Script Check: Carriers routinely “Google” applicants for information. Oh, the stories I could tell….. All the best. David

|

|||||||||||||||||||||||||||||||

Article 4Swiss Life Companies Enter Into Deferred Prosecution Arrangement For Abusive Private Placement Life Insurance PoliciesSwiss Life enters into a deferred prosecution agreement for its PPLI products sold to U.S. persons and agrees to cooperate with the DOJ in providing documents and information about potential tax evasion by those U.S. persons.

By: Jay Adkisson Jay Adkisson is licensed to practice law in Arizona, California, Nevada, Oklahoma and Texas. His practice is in the areas of creditor-debtor law and captive insurance. He is the author of books on asset protection, captive insurance, charging orders, and others. Jay has twice been an expert witness to the U.S. Senate Finance Committee, and am a member of the American Bar Association having served as the Chair of the Committee on Captive Insurance and the Chair of the Committee on Insurance & Financial Services. A private placement life insurance (PPLI) policy is a form of life insurance that is individually negotiated with a life insurance company, as opposed to an investor buying an off-the-shelf product such as are commonly sold. Such PPLI policies are usually very large life insurance policies, with total premiums paid usually in the $5 million range and up, and are frequently used in the estate planning for very wealthy individuals. Because they are negotiated individually with the life insurance company, PPLI policies can sometimes be more efficiently used than similar off-the-shelf products in estate planning scenarios. Nearly all PPLI policies are of the variable universal life (VUL) type, which means that the premiums received by the insurance company are deposited into an investment account that defines the cash value of the policy, less the insurance company and death benefit expenses, and then the money in the policy is further divided into various sub-accounts, almost always some investment fund, where the real investment activity takes place. If the investment experience in the sub-accounts is good, then the cash value of the policy will increase; if that experience is bad, then the cash value will decrease. PPLI has been around since the mid-1990s, so going on 30 years. It was a very hot product in the late 1990s as a tax shelter that sought to place a taxfree wrapper around hedge funds investments that can throw off a great deal of taxable income due to their short-term arbitrate investments. Around the turn of the century, however, new guidance was promulgated which had the effect of preventing PPLI policies from investing directly into ordinary hedge funds that were generally available to everybody (or, at least, all sophisticated investors), and that basically killed off the PPLI market for some years. As investment companies slowly started offering investments that were only and exclusively available to PPLI policies, and otherwise navigated around the guidance, PPLI slowly started to come back to life around 2010 and is somewhat commonly used today for wealthy individuals in estate planning scenarios. From a tax viewpoint, most PPLI policies can be parsed into two categories, being benign and malignant. In the benign category are those PPLI products that basically function like ordinary VUL policies, but can be more efficient. Negotiating a PPLI policies allows the investor to dial down commissions (i.e., reduce the commissioners paid to the selling broker) and sometimes the expenses paid to the life insurance company which thus allows for more of the investor’s money to be working money. With very large policies, this is no small benefit ⸺ it is also why ordinary life insurance agents detest PPLI as every PPLI policy sold basically represents the loss of a rare “whale” policy with oversized commissions. Another benign benefit of PPLI policies is that those policies sometimes have access to certain investments that are not commonly available to of the-shelf VUL products, including sometimes investment funds that have exotic investments or exotic trading strategies. Just like ordinary VUL policies act as basically a sponge to soak up the otherwise taxable gains from investments, the investments within a benign VUL policy are not taxable to the investor. Further, the first-in, first out (FIFO) accounting rules means that an investor can borrow the cash value of the PPLI policy tax-free up to the amount of the initial investment into the policy, just like an ordinary VUL policy. Finally, at death the proceeds paid to policy beneficiaries are tax-free. As good as all this is, no VUL policy ⸺ including PPLI policies ⸺ are a free lunch, and whether they are a good investment or a bad investment depends largely upon when one dies. If one dies early, then the policy will turn out to be a great investment; however, if one lingers deep into old age, then the insurance cost of the death benefit (which is inherently very large with a PPLI policy) will substantially eat away at the policy value and they can become a pretty lousy investment. This is true of all life insurance. Moreover, if the investment performance is not at least minimally as expected, as one lingers into old age the cash value of the policy can be wiped out entirely and the policy will fail for the inability of the policy to sustain the insurance cost of the death benefit, which happens a lot more frequently than insurance companies would like for folks to know. But if one dies early enough, then there can be a substantial windfall to the policy beneficiaries. We now turn to the malignant version of PPLI (one might use the alternate adjectives of “aggressive” or “abusive”) that is the subject of today’s discussion. One such transaction that went around involved the selling of an operating business interest into the PPLI policy, such that the bulk of the profits of the business were upstreamed into the tax-free investment account of the policy so that the business owner avoided the tax on that income. With this transaction, the PPLI policy became little more than a tax-free wrapper for the income of the operating business, and other contrivances were implemented so that the owner could soon take back the money via policy loans or otherwise without taxes on that income ever being paid…continue reading on Forbes.

|

|||||||||||||||||||||||||||||||

Article 5Hillsborough Sales Tax Lawsuit Move on From Pizza to Banana SplitsThe legal claims say businesses collected an 8.5 percent tax after the Florida Supreme Court voided the transportation surtax.

By: Ralph Fisher Ralph Fisher is a law school friend of Alan’s who he is occasionally allowed to spend time with. Ralph has a very interesting legal practice in Lutz, Florida and rental properties in North Carolina. Ralph gives discounts to Thursday Report Readers who rent his properties in North Carolina.

A lawyer has dropped his suit against Pizza Hut over charging an 8.5 percent sales tax after the Florida Supreme Court had voided the Hillsborough transportation surtax. However, similar suits are pending over sales taxes paid by customers purchasing banana splits and oil changes at separate businesses. The legal fight over a 12-cent surcharge on a pizza has ended, but a banana split battle is now pending in Hillsborough Circuit Court. The desserts’ disputed cost? Eight cents. The allegations are the same. The lawsuits contend businesses in Hillsborough County continued to charge an 8.5 percent sales tax rate after a Florida Supreme Court order voided a penny-on-the-dollar tax for transportation. “There was a lot of money collected illegally,” said attorney Ralph Fischer of Lutz. Fisher sued the Pizza Hut chain after a restaurant in Lutz charged the higher sales tax rate on a $12 pepperoni and mushroom pizza he purchased March 22. Fischer said he pointed out the discrepancy and asked for the difference to be refunded. An employee told him “they were required to charge the improper 8.5 percent sales tax by the corporate office,” according to the suit. But Fisher dropped the claim May 24, saying it wasn’t worth pursuing the case because of U.S. Bankruptcy Court entanglements involving former Pizza Hut franchisee NPC International Inc. Businesses collected the voter-approved sales tax for transportation beginning Jan. 1, 2019, and should have ceased March 15, when the state Supreme Court order became final. On March 16, the state Department of Revenue instructed approximately 35,000 businesses in Hillsborough County to stop collecting the tax. But some were slow to comply. The Tampa Bay Times reported March 23 that some businesses still charged the incorrect sales tax rate. At the time, the county’s consumer protection office said it had forwarded three cases to the state Department of Revenue after customers complained the businesses were charging excessive sales tax. Fischer and attorney Jay P. Lechner now represent two other clients suing businesses over the sale tax charges. In one case, a man named Ronald B. Harrison said he paid too much tax after purchasing two banana splits at a DQ Grill & Chill in Riverview on April 26. The restaurant’s attorney, Derek Kantaskas, said he could not comment without conferring with his client, but said the disputed transaction totaled eight cents. In another suit, plaintiff Michael Nunez sued the North Carolina-based corporate office of Take 5 Oil Change after he said he paid 8.5 percent sales tax on an April 8 oil change service at a branch on Gunn Highway. Nunez, according to the suit, noticed the improper tax amount after he left the service station. When he called seeking a refund an employee told him to “take it up with corporate.” The unspent sales tax revenue collected by businesses for nearly 27 months totaled more than $521 million by mid-April. Its fate is subject to separate litigation.

|

|||||||||||||||||||||||||||||||

Article 6Florida Bar Rule 4-7.18 Amendment Regarding Misleading Law Firm Search Terms Pending at Florida Supreme Court

By: Joseph Corsmeier JACPA Ethics Alert Hello everyone and welcome to this Ethics Alert, which will discuss the Rule 4-7.18 amendment pending before the Florida Supreme Court which states that a “statement or implication that another lawyer or law firm is part of, is associated with, or affiliated with the advertising law firm when that is not the case, including contact or other information presented in a way that misleads a person searching for a particular lawyer or law firm, or for information regarding a particular lawyer or law firm, to knowingly contact a different lawyer or law firm” is deceptive or inherently misleading.” As background, in and about 2013, upon the request of the Florida Bar’s Board of Governors (BOG), the Bar’s Advertising Committee issued Proposed Advisory Opinion A-12-1 which stated that the purchase of a law firm competitor’s name to gain an advantage in search rankings was unethical. In December 2013, the BOG voted 23-19 to withdraw Proposed Advisory Opinion A-12-1, stating that the purchase of AdWords was permissible, as long as the resulting advertisements or sponsored links are clearly advertising based on their placement and wording. The BOG’s rationale at the time was that hidden text and meta tags have become so outdated that search engines penalize rather that reward them. The BOG later revisited the issue and, on May 24, 2019, the BOG approved proposed amendments to 4-7.18 on a voice vote without objection. The BOG approved the following amendment to 4-7.18: Examples of Deceptive or Inherently Misleading Advertisements (12) A statement or implication that another lawyer or law firm is part of, is associated with, or affiliated with the advertising law firm when that is not the case, including contact or other information presented in a way that misleads a person searching for a particular lawyer or law firm, or for information regarding a particular lawyer or law firm, to knowingly contact a different lawyer or law firm. The proposed amendment was filed with the Supreme Court of Florida by The Florida Bar on October 5, 2020 and is still pending before the Court. The case is: In re: Amendments to the Rules Regulating The Florida Bar – Biennial Petition, Case No. SC20-1467. The docket has an Order dated 6/30/21 stating that the matter has been submitted to the Supreme Court without oral argument and is now being reviewed. Bottom line: The Supreme Court will issue an opinion regarding the proposed amendment to Rule 4-7.18. Regardless, the BOG’s approval of the proposed amendment makes it clear that the BOG believes that the purchase of another law firm’s name solely to gain an advantage in internet searches would be deceptive and would potentially be violation of Florida Bar Rule 4-8.4(c), which prohibits lawyers from engaging in conduct in connection with the practice of law involving dishonesty, fraud, deceit, or misrepresentation. Be careful out there. As always, if you have any questions about this Ethics Alert or need assistance, analysis, and guidance regarding ethics, risk management, or other issues, please do not hesitate to contact me. My law firm focuses on review, analysis, and interpretation of the Rules Regulating The Florida Bar, advice and representation of lawyers in Bar disciplinary matters, advice and representation of applicants for admission to The Florida Bar before the Board of Bar Examiners, defense of all Florida licensed professionals in discipline and admission matters before all state agencies and boards, expert ethics opinions, and practice management for lawyers and law firms. If there is a lawyer or other Florida professional license involved, I can defend the complaint or help you get your license. If you have any questions or comments, please call me at (727) 799-1688 or e-mail me at jcorsmeier@jac-law.com. You can find my law firm on the web at www.jac-law.com. In addition to handling individual cases, matters, problems and issues for my clients, I also am on retainer to provide ethics advice to numerous lawyers and law firms throughout the state of Florida. I also provide legal assistance and advice to numerous individuals and non-legal entities to help insure compliance with the law and rules related to UPL and other issues.

|

|||||||||||||||||||||||||||||||

Forbes Corner |

|||||||||||||||||||||||||||||||

For Finkel’s FollowersEnterprenuers May Be Particularly Susceptible to Shiny Object Syndrome: Here’s How To Cure It |

|||||||||||||||||||||||||||||||

Featured Events

This event does not qualify for CLE Credit. Please email your questions to info@gassmanpa.com. The video recording will be emailed to all registrants approximately 1 hour after the program – whether you attend live or not. REGISTER for More Mathematics of Estate Tax Planning

|

|||||||||||||||||||||||||||||||

|

CHECK OUT THIS NEW SATURDAY MORNING SERIES!

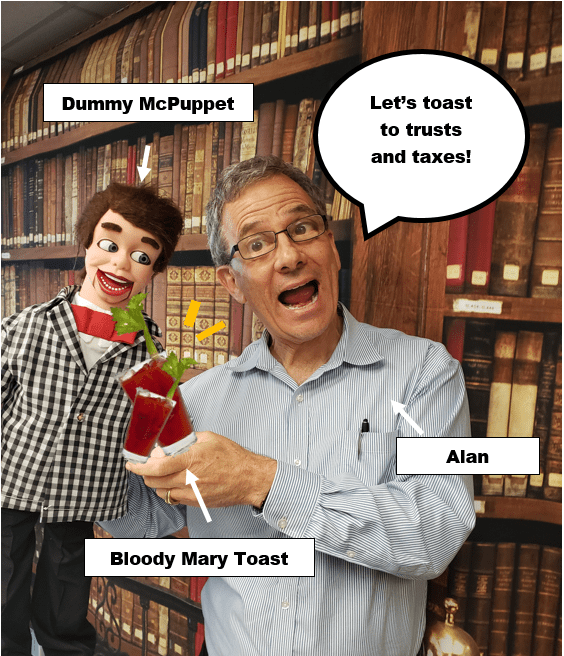

Toast, Trusts and Taxes with Alan Gassman and FriendsPlease consider your Saturday mornings booked for the foreseeable future… Join Alan and his guests for these Saturday morning conversations featuring live attendee interaction for Q and A! Please email your questions to info@gassmanpa.com. Click to Register for all upcoming Saturday Morning webinars

The video recording will be emailed to all registrants approximately 1 hour after the program – whether you attend live or not. This series does not qualify for CLE Credit.

|

|||||||||||||||||||||||||||||||

|

SATURDAY MORNING SERIES PROGRAM DETAILS

Click to Register for all upcoming Saturday Morning webinars

|

|||||||||||||||||||||||||||||||

|

All Upcoming Events

Register for all future free webinars from Gassman, Crotty & Denicolo, P.A. using this link

|

|||||||||||||||||||||||||||||||

|

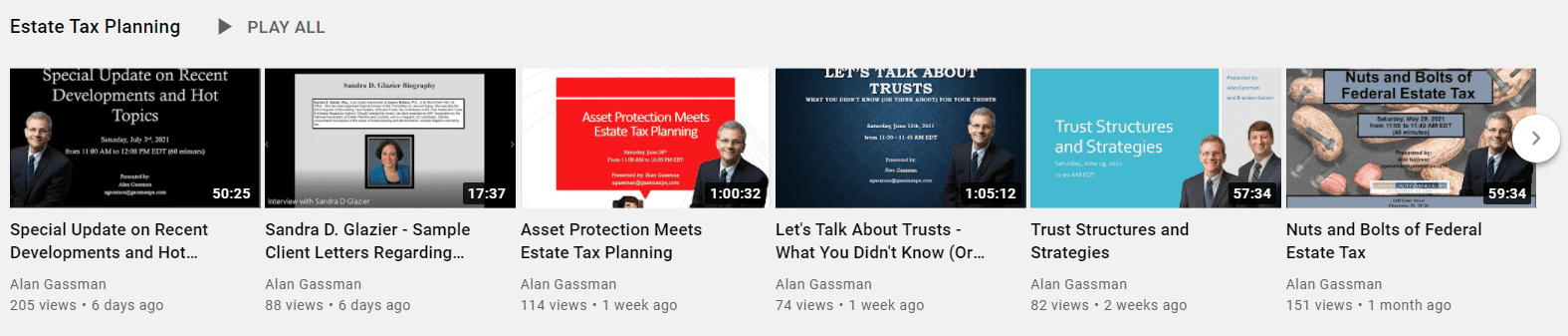

You Tube ChannelVisit our You Tube Channel for featured webinars and more.Did you miss a past webinar event? Don’t worry! Watch our webinar recordings to Alan Gassman’s You Tube Library. What is everyone watching? Click on the playlists below to find out!

|

Humor

|

|

Comments on Alan’s Puppet From Recent Performance

“Sounds good puppet – from Michigan.” “Loud and clear and LOL thanks for the smile!” “Good afternoon Alan and Brandon ! Where’s the dummy?” “He is a hoot!” “Enjoyed the humor.” “Complicated subject presented clearly . . . with a bit of humor to keep it entertaining. Definitely looking forward to Part II. “ “Yep can see you and the puppet in Palm Springs.” “I hear that puppet loud and clear. “Yes this was very well presented and the puppet LOL.” “The puppet was irritating and distracting and made the entire presentation less professional than it should have been.” “Get rid of the puppets.”

Do you have a comment on Alan’s puppets being a part of the show? Email your feedback to info@gassmanpa.com.

|

|

D-I-V-O-R-C-EBy: Ronald Ross Bill Gates worked in his garage for years,

|

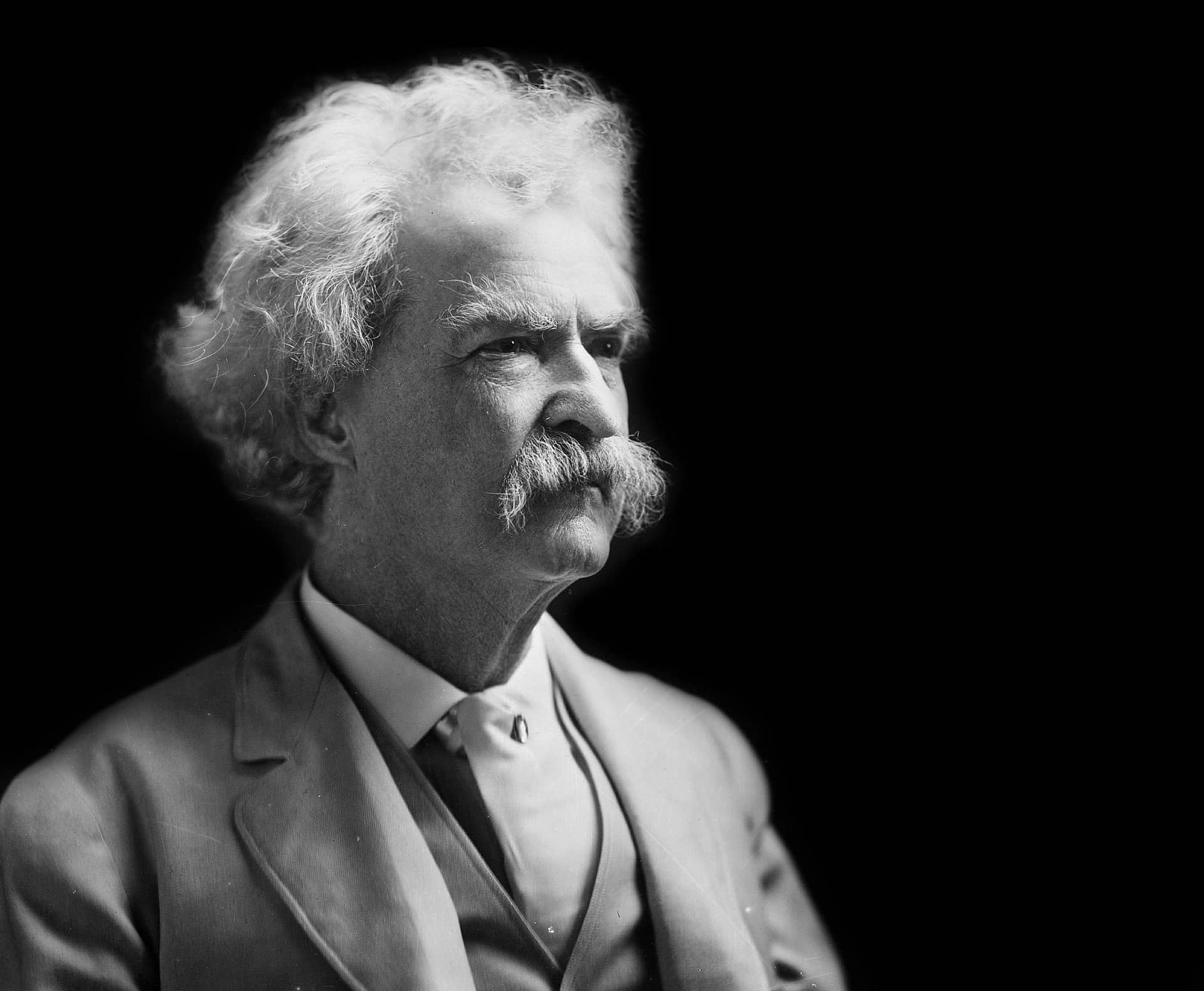

Younger Readers may not have heard of Samuel Clemens, who was a Broadway actor in the 1970s and became a popular comedian in the 1980s.

Here are some of our favorite Samuel Clemens quotes.

“I have never let my schooling interfere with my education.” “Kindness is the language which the deaf can hear and the blind can see.” “The two most important days in your life are the day you are born and the day you find out why.” “Wrinkles should merely indicate where the smiles have been.” “Courage is resistance to fear, mastery of fear— not absence of fear.” “There is no unhappiness like the misery of sighting land (and work) again after a cheerful, careless voyage.”

“I have found out that there ain’t no surer way to find out whether you like people or hate them than to travel with them.”

“When we remember we are all mad, the mysteries disappear and life stands explained.”

|

|

5 Star Reviews from Readers like You!

“It’s a good edition Alan! I love them…” – P. Martin

Great newsletter and courses. I’m not always able to attend but it looks like you’re having fun! – Anonymous

As always, Alan is entertaining and generous with his knowledge. I’m happy to be able to call him my friend! – Sandy

Did you enjoy reading the Thursday Report? Send your thoughts and comments to info@gassmanpa.com for a chance to be our next featured 5 star review!

|

Gassman, Crotty & Denicolo, P.A.

1245 Court Street

Clearwater, FL 33756

(727) 442-1200