The Thursday Report – Issue 305

|

|

|

ALWAYS FREE, SOMETIMES PUBLISHED ON THURSDAYSMaking Thursday a Better Day for Most of HumanityThursday, May 20th, 2021 – Issue 305Having trouble viewing this? Use this link

|

Table of ContentsArticle 1Morrissette 2: The Sequel We’ve All Been Waiting ForArticle 2“MATHING OUT” ESTATE TAX PLANNING STRATEGIESArticle 3The Dark Side to Non-Reciprocal SLATsArticle 4Revocable Trust Execution Requirements: A Notary is Not NeededFeatured EventsAll Upcoming EventsForbes CornerFor Finkel’s FollowersHumorYouTube ChannelReviews |

Article 1Morrissette 2: The Sequel We’ve All Been Waiting ForDraft Article by Grace Paul, Brock Exline, and Dixon Kwok Please note that this article has not been proofread or approved for distribution except for mature audiences, which we were not able to find. Grace Paul is in her second year of law school at Stetson University College of Law and earned her Bachelor’s Degree in Sociology with a minor in Accounting from Stetson University. Brock Exline is in his second year of law school at Stetson University College of Law and earned his Bachelor’s Degree in Political Science from Stetson University. Dixon Kwok is entering his third year of law school at Stetson University College of Law and earned his Bachelor’s Degree in Philosophy from the University of South Florida. On May 13, 2021, a Tax Court Memorandum decision made history last when the U.S. Tax Court released a 120 page opinion that will be known as Morrissette 2. In the first Morrissette case, the Tax Court ruled that the advancement of funds Mrs. Morrissette made to the irrevocable dynasty trusts created for her sons with the purpose of purchasing life insurance policies was considered to be a legitimate split-dollar arrangement under the economic benefit regime. The first Morrisette case did not answer how the courts will value such arrangements, and when and how estate planners should offer split-dollar arrangements to their clients. According to Howard Zaritsky’s Estate Planning Newsletter #2886, the Morrissette 2 opinion has three major holdings concerning intergenerational split-dollar life insurance agreements that advisors should be aware of. First, life insurance policy proceeds are not includible in the gross estate of the deceased grantor of the revocable trust because those proceeds are considered a bona fide sale under Internal Revenue Code Sections 2036 and 2038. Second, the special valuation rules under Internal Revenue Section 2703 do not require that the cash surrender value of the policies in the decedent’s gross estate be included. Third, the fair market value of the decedent’s split-dollar rights can be calculated by using the discounted cash value methodology. The court concluded its analysis by stating that a 40% gross misvaluation misstatement penalty was appropriate. Many practicioners are concluding that equity split-dollar is no longer safe, because of the severe apparent business purpose/not a devise to avoid taxes burden that appears to be imposed by the court in this decision. As the result of this, many practicioners will convert economic benefit split-dollar arrangements into loan regime split dollar arrangements, and will no longer reccomend economic benefit arrangements to their clients if and when estate tax exposure is an issue. Howard Zaritsky in Estate Planning Newsletter #2886 suggests another alternative to economic benefit split-dollar agreement. “In light of the current low applicable federal rates (AFR), one could also consider replacing an economic benefit split-dollar agreement with a simple promissory note, providing for annual payments of interest at the relevant AFR, until the death of the insured, and for repayment of the entire principal at that time”. Zaritsky acknowledges that “arrangements would have to be made for paying the interest on the loan currently. Such arrangements could involve additional gifts, withdrawals from the policy cash values, or annual deemed gifts of the unpaid interest. The discount for the promissory note is likely to be less than comparable to that for a split-dollar agreement, but it should still be significant because (a) the term of the note is both uncertain (the death of Facts Clara M. Morrissette lived in Virginia until her death on September 25, 2009. She was married to Arthur E. Morrissette in 1933 and had three sons named Buddy, Don, and Ken. Mr. Morrissette bought a truck in 1943, and started a moving company that would eventually become Interstate Group Holdings, Inc. (Interstate). Interstate is now comprised of 32 companies that operate moving, relocation, and storage businesses. Mr. and Mrs. Morrissette wanted the company to stay within the family and had their three sons working in the company from childhood. The sons all had executive positions with the company. Buddy was the CEO and president and presided over a successful expansion of Interstate. Eventually, Don and Ken wanted to leave the company and had their father buy their ownership interests. Don and Ken would later return to work for Interstate, but their temporary departure resulted in significant tension among the sons. Despite fragile familial relations, the Morrissettes still desired to keep the company within the family. To help ensure continued family ownership, Mr. and Mrs. Morrissette implemented an estate plan that included the creation of two revocable trusts; the Clara M. Morrissette Trust (CMM trust) and the Arthur E. Morrissette Trust (AEM trust). The CMM trust held all of Mrs. Morrissette’s Interstate stock and the AEM trust held all of Mr. Morrissette’s Interstate stock. The trusts held Interstate stock as well as real estate and marketable securities. After Mr. Morrissette died in 1996, the AEM trust became irrevocable and distributed its assets to the three trusts therein established for the benefit of Mrs. Morrissette. Interstate stock and other assets held under the AEM trust and the CMM trust were to be included in Mrs. Morrissette’s gross estate upon her death. However, the family still lacked a definite plan on how to pay the estate tax upon Mrs. Morrissette’s death. The brothers originally anticipated use of a 10 year payment deferral plan under Internal Revenue Code 6166 to pay Mrs. Morrissette’s estate tax with Interstate’s profits. The deferral plan allows for interest to be paid for only 4 years followed by 10 equal annual payments when a business entity makes up more than 35% of the decedent’s gross estate. Unfortunately, Mrs. Morrissette’s assets included significant passive real estate investments that did not qualify for a partial payment deferral under section 6166. In addition, Buddy’s two sons, J.D. and Bud (grandchildren of Mr. and Mrs. Morrissette), had also become Interstate executives and opposed using Interstate profits to pay the estate tax. The foregoing circumstances combined with Mrs. Morrissette being diagnosed with Alzheimer’s disease and dementia in 2005 led the sons to seek help from Jim McNair, a tax and estate planning attorney. While presenting various estate tax saving strategies, McNair suggested purchasing life insurance on Buddy, Don, and Ken through split-dollar arrangements. McNair indicated that the estate might be able to save $9.4 million in estate taxes by use of a split-dollar arrangement. The Morrissette brothers decided to go forward with McNair’s suggested estate plan that called for the purchase of life insurance on each of their lives to finance potential buyouts for their children using portions of the death benefits from each policy. The life insurance would be paid for under a split-dollar arrangement where the CMM trust would pay the insurance premiums on behalf of the irrevocable dynasty trusts that would be set up for each brother. The 2006 estate plan also restructured the real estate holdings of the CMM and AEM trusts in order to qualify for a partial payment deferrel under section 6166. The irrevocable dynasty trusts were established on September 15, 2006 by the CMM trust with an initial contribution of $10,000 to each of the trusts. Each son was cotrustee of his respective dynasty trust and the other cotrustee was the CFO of Interstate. Under the conditions of the dynasty trusts, the CFO had no independent authority and was only able to sign documents. The dynasty trusts were authorized to purchase life insurance policies on the lives of the brothers, and required the dynasty trusts to be the owners of the policies. Each dynasty trust purchased life insurance on the other two brothers, so that on the death of one brother, the dynasty trusts of the other two brothers would receive a death benefit and could use the benefit to buy the deceased brother’s Interstate stock or his trusts. The plan provided an estate tax free dynasty trust for each brother that would eventually own the stock purchased by the other brothers. It was the allowance for discretion and the post death transfer of such repayment rights to the dynasty trusts that resulted in the court to concluding that happened on Mrs. Morrissette’s death was equivalent of a transfer of the amounts owed under the split-dollar plan, as opposed to what a willing buyer would pay a willing seller for the right to be paid when the brothers died. Split-Dollar Agreement Under the 2006 Estate Plan Under the 2006 estate plan, the CMM trust advanced funds to the dynasty trusts, which used the funds to pay the premiums on the life insurance policies. Upon the death of one of the brothers, the dynasty trust would have the duty to repay the greater of the premiums paid by the CMM trust or the cash value of the policy back to the CMM trust. Therefore, unless one of the brothers either died before Mrs. Morrissette or terminated the agreement, the repayment was not due until after the estate tax return for Mrs. Morrissette would have been due. This would have allowed the brothers to claim a discount in estate tax as the value of the future rights to repayment the CMM trust possesses would be lower than the amount the trust originally provided for the policies. As mentioned above, the dynasty trusts each purchased two policies, one for each brother. For example, Buddy’s dynasty trust purchased life insurance policies on Don and Ken. The six policies had a death benefit of $1 million. Each policy included a rider for additional death benefits of $8.73 million. Under each policy, exercise of the rider would require additional premiums of $5 million. Therefore, after exercising the riders, the six policies had premiums of approximately $30 million and total death benefits of $58.2 million. It was estimated that at the time of the agreement, the AEM and CMM trusts owned approximately $26.3 million worth of stock. In order to pay the premiums, the AEM trusts distribited $8 million to the CMM trust. The CMM trust then liquidated $18.5 million from an investment account. On November 2, 2006, the CMM trust took a $4 million dollar loan from Interstate, executed a promissory note, and provided collatreral for a 3 year term loan at 4.89% interest. The dynasty trusts purposely chose policies with a high cash value to help pay for the monthly fees, while having a low death benefit which allowed for a higher rate of return from the cash value. At the time the split-dollar agreements were executed, the life expectancies of the brothers ranged from 14.6 to 18.6 years, and the policies were expected to earn annual rates of return between 4.75% and 5.4%. Upon the death of the insured, the dynasty trust that owned the policy would receive the death benefit after paying the amount owed to the CMM trust, which is the greater of the amount of premiums it paid or the cash value of the policy. The agreement expressly barred the CMM trust from canceling the policies, thus giving the dynasty trusts the sole right to cancel the policies and receive the cash value. The CMM trust was also not allowed to receive payment directly from the insurance policy. The CMM trust could only receive its payment from the dynasty trust if and when the dynasty trust chose to terminate the policy. Each dynasty trust could terminate its policies and repay the CMM trust with the proceeds of liquidation if it chose to do so. For the convenience of the reader, we have provided Table 2001 at the end of the article, which shows the assumed gift that occurs each year under a split dollar endorsement arrangement per million of life insurance coverage. The IRS challenged the split-dollar agreements on the grounds that they did not qualify under the economic benefit regime and that the total $29.9 million advanced in premiums should be taxable as gifts. However these arguments contradicted the tax court’s 2016 opinion in Morrissette 1 where the court ruled that the split-dollar agreements did qualify as an economic benefit regime, and that the premiums were not taxable gifts and only the economic benefit needed to be reported. Roughly a month after Mrs. Morrissette passed away… Continue reading. |

|||

Article 2“MATHING OUT” ESTATE TAX PLANNING STRATEGIESBy: Alan Gassman and Grace PaulThere is a well-known saying, “the map is not the territory,” that metaphorically illustrates the differences between belief and reality. Through our perception of the world, we create a ‘map’ of what we perceive to be reality. However, reality, or the “territory”, exists independent of our subjective experiences. We see as far as getting to the places where we want to go and do not always understand boundaries and directions that our senses do not perceive. We find a similar conundrum in the estate tax planning world. Well-meaning advisors and their studious clients are not always running the numbers to help ensure the strategies and techniques they are using will provide the best-expected results. Their maps unfortunately leave a great deal of uncharted territory that can result in negative repercussions in the future. We have found from years of experience that there is no substitute for taking out a calculator or spreadsheet and reviewing the most probable scenarios (as well as possible and unexpected situations) to determine the expected and non-expected outcome of any given technique in order to produce the most accurate map possible of the estate planning territory. Mistake #1 – I Don’t Have Enough to be Concerned. Many individuals and married couples believe that because the total value of their assets is under the $11,700,000 per person exemption, they do not have any need to plan for or have a concern about federal estate taxes. More commonly, individuals or married couples who have approximately one-half or less of the exemption amount in assets and life insurance believe that they do not need to do any long-term planning.

These individuals often do not recognize the Time Value of Money and the fact that they continue to save even if they are not actively saving large sums.

While the New York Times has reported that it was not Albert Einstein who said, “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” Einstein likely recognized this principle, notwithstanding that he was reportedly not very materialistic. The average rate of return for an appropriately allocated investment portfolio in the past 10 years has been approximately 7.28%, after taxes, according to credible literature.

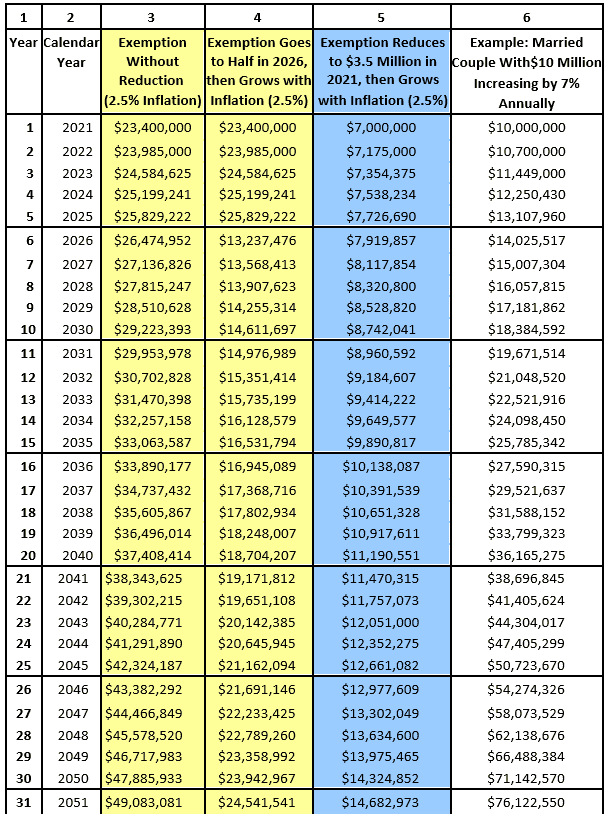

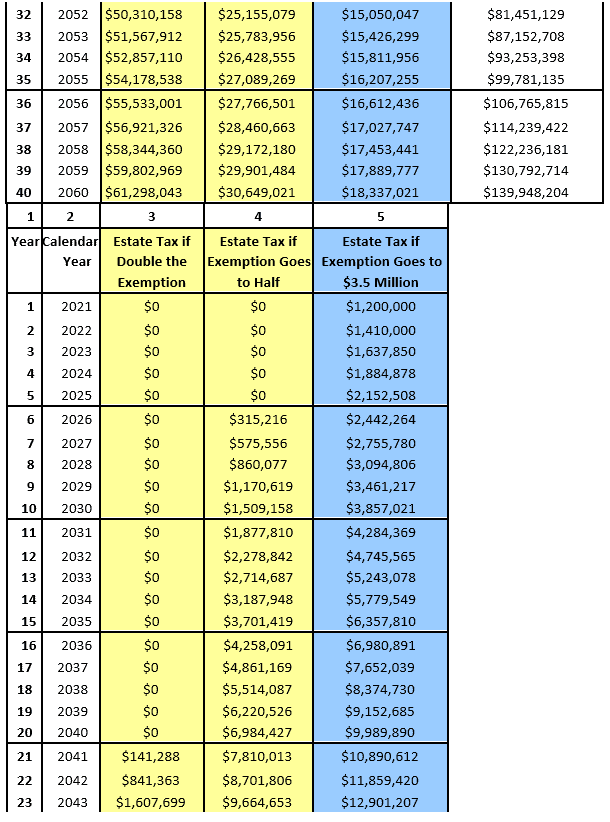

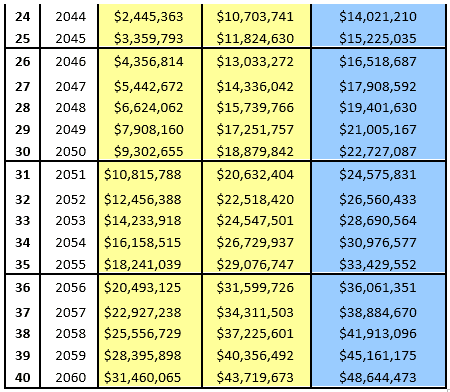

$1 million invested at 7% compounded annually reaches $1,967,151.36 in 10 years, $ 3,869,684.46 in 20 years, $6,612,255.04 in 30 years, and $14,974,457.84 in 40 years. At an average rate of growth of around 10%, $1 million invested today would turn into $2,593,742.46 in 10 years, $6,727,499.95 in 20 years, $17,449,402.27 in 30 years, $45,259,255.57 in 40 years. Based upon the above, a married couple in their early 70s, who have a combined net worth of $10 million, and who will spend 2% of the value of their assets, may realize a 5% after-tax rate of return on their investments. This is in addition to social security, which averages approximately $35,000 a year for a married couple when at least one spouse was a higher earner plus any pension or other benefits and earnings from continuing to work. So, after ten years, assuming no further savings, their net worth will be $16,288,946.27 million, and if the estate tax exemption grows at 2.5% a year, based upon the chained inflation index that applies to the estate and gift tax exemption. The chained inflation index does not include taxes not directly associated with the purchase of goods and services or investment items, such as stocks, bonds, real estate, and life insurance. The chained inflation index typically grows at approximately two-thirds of the average consumer price index – all items, which has been rising at 45.7% (for the consumer price index all items) and 39.7% open (for the chained inflation index) in the last 50 years. There are three main possibilities that the author cautions clients to be aware of regarding the current federal estate tax exemption. The current estate tax exemption of $11,700,000 per person may continue to grow at 2.5% per year. It may be slashed to one-half of its expected level on January 1, 2026, and then continue to grow at 2.5% a year. Lastly, the exemption may be reduced to $3.5 million in 2021 and grow with inflation. An illustration of how these different situations would affect a married couple with $10 million dollars saved is illustrated below.

For example, assuming chained inflation will increase the exemption amount by 2.5% per year and the couple has $10 million dollars that will increase in value by 7% a year, the estate tax in year 15 will be $6,357,810 if the estate tax exemption goes to $3,500,000 per person, or $3,701,419 if the estate tax exemption is reduced by half in 2026. This couple would not have an estate tax issue until after the year 2041 if the $11,700,000 exemption is not reduced before then. Under the Sanders Plan introduced in the Senate with some support in March of 2021, the exemption would go to $3,500,000 effective January 1, 2022. Taking a look at the above chart, which should probably be shared with all married couples with net worths expected to well exceed $7 million, there is certainly a possible cause for concern. However there are fairly easy ways to handle the planning that does not have to be expensive or restrict the assets that may be needed to support the married couple, and then the surviving spouse, in a reasonable manner. How Much to Give and When?

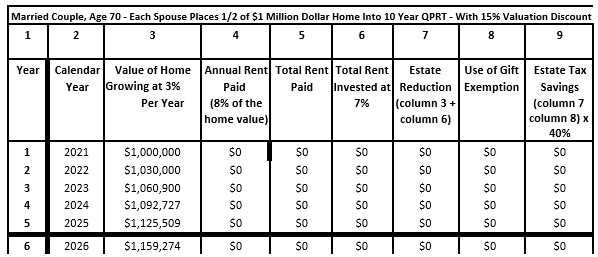

Seeing the above numbers can be a sobering experience, and while pessimistic clients may indicate that this result is not likely for a myriad of reasons, it should be recognized that the result is not unlikely. Things will be worse from a tax standpoint if the economics are better. Other low-hanging fruit can include a Qualified Personal Residence Trust because the couple can continue to live in their present home without paying rent until many years up the road when less active and more able to afford rent. Included could be a home purchased with the proceeds from the sale of their current home that can be used in part to support one of the spouses. This is with the assumption that each spouse forms a QPRT, and that one QPRT is for the health, education, and maintenance of the spouse who has a longer life expectancy and will be funded with ownership of one-half of the home. After the possessory term, the other half of the home can transfer to a separate QPRT for the prime benefit of the descendants. Still, the other spouse may be added as a beneficiary to such a second QPRT if formed in an asset protection jurisdiction. And if formed and administered from an asset protection jurisdiction, and the grantor spouse has an unexpected financial need after establishing the trust, as verified by Trust Protectors acting in a non-fiduciary manner. However, it is noteworthy that homes generally grow in value at a rate much lower than appropriately managed investment portfolios. While the median home may grow in value at a 3-3.5% rate on a national average, Your Home gets one year older every year and is not always 20 years old.

Approximately 80% of the average home consists of the physical structure, which typically has a useful life of 60 years. Therefore, a $1 million home loses 1.67% of $900,000 of value, growing each year geometrically, and may be growing at only 2% per year.

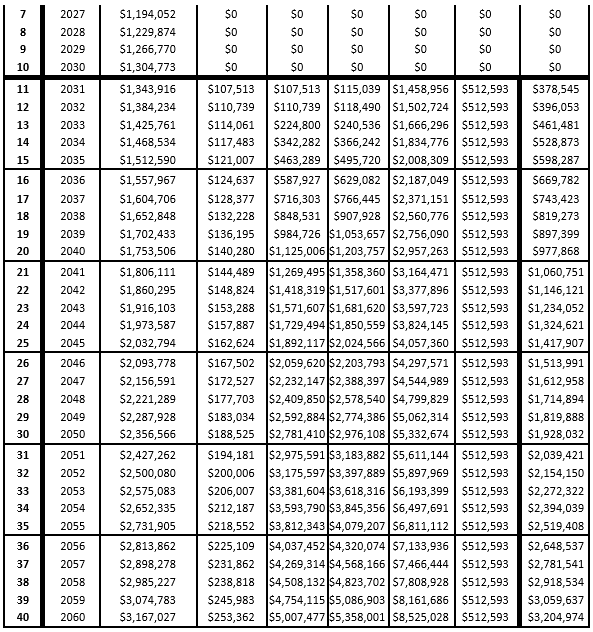

As an example, assume that Mork and Mindy are married and would now be 70 years old. They each expect to live past age 85 and to stay in the home for their entire lifetimes. Using $512,593 each of Mork and Mindy’s exemptions and assuming a 3% rate of return on the house. The home will be worth $1,512,590 in 15 years that will have escaped the estate tax system. Any major improvements made on the home are considered a gift to the trust. The amount of the taxable gift would be based on the fair market value of the improvement. Further, assuming that rent rates will be 8% of the value of the home, working Mindy’s estate will be reduced by 8% per year in rent, which could save $598,287 in estate tax if invested at 7% by year 15, assuming that Mork and Mindy do not pass away before the end of the QPRT term. An illustration of this scenario is depicted below:

For example, if one spouse dies in year 20 when the house is worth $1,753,506 the total rent that was paid, plus growth at 7% would be $1,203,757. So the two amounts combined would remove almost $3 million dollars from the surviving spouse’s estate, saving over $975,000 in estate tax assuming a 40% tax bracket. Further, the expectation of having the use of both estate tax exemptions for a married couple does not take into account the possibility that one exemption may not be used in whole or in part.

The exemption of the first dying spouse, for example, will only be used to the extent that assets pass to a Credit Shelter Trust or, at least, other than to the surviving spouse. Any excess |

|||

Article 3The Dark Side to Non-Reciprocal SLATs

By: Edwin P. Morrow IIIJ.D., LL.M., MBA, CFP, CM&AA edwin.morrow3@gmail.com Spousal Lifetime Access Trusts (SLATs) are the hottest thing in planning these days. In full disclosure, I often recommend them myself. One recent Ohio case, however, shows the potential dark side to SLATs. Ironically, it implicates those that are typically much safer for tax and asset protection purposes (i.e., non-reciprocal). In Dayal v. Lakshmipathy, 2020-Ohio-5441, a husband funded a SLAT for his wife and children in December of 2012 with nearly $4.6 million, filing a gift tax return to that effect (although the court referred to it erroneously as an “estate tax return”). Remember when the big fear was the exemption going from $5 million to $1 million in 2013 and everyone rushed to use the disappearing exclusion amount? Sound familiar to anyone? His wife was trustee and his attorney was special trustee (it was not stated, but presumably the wife’s interest was limited to ascertainable standards whereas the special trustee had wider discretion to make distributions, which is a common SLAT design). Great estate tax planning. But, after 24 years of marriage, the wife filed for divorce in 2016. The husband argued that the SLAT, now worth $6,790,251, should be considered marital property for purposes of dividing their assets in the divorce. The domestic relations trial court magistrate and judge agreed with the husband and final entry was issued in 2019. The appellate court, however, recently reversed, finding that the trust was clearly a gift from husband to wife and therefore her interest in the trust was her separate property. It is doubtful the Ohio Supreme Court would take a further appeal and even if it did, it is unlikely they would reverse the decision. After all, you have what was very clearly intended to be a gift to an irrevocable trust by the obvious plain language and intent of the donative instrument, not to mention the testimony of the estate planning attorney in the case. In Ohio as in most states, gifts and bequests that are shown to be given to only one spouse are considered separate (not marital) property of the donee. Ohio R.C. 3105.171. One odd provision (at least for Ohio trusts when there is no community property) even went so far as to state that the trust “shall be owned… as separate property and not as community property, it being the Grantor’s intent that such property is in the nature of a gift or inheritance from the Grantor.” End Result: the spouses split their marital assets (excluding the trust) equally, but with no compensation for the $6.7 million still accessible to the wife, since the trust was not considered a marital asset for this purpose. There was never a similar gift from wife to husband into trust. This was not a case that we often see where spouses try to make “non-reciprocal for tax purposes but really kind of reciprocal for all practical purposes” SLATs. Had Husband made a gift to Wife and she then funded a SLAT for him and their children, it may have been problematic for estate/gift tax purposes under the reciprocal trust doctrine enunciated in U.S. v. Grace (depending on the terms), but at least the property division would have been more equal in the end. Ultimately, you wonder which is more concerning to the Husband. Despite removing $1.8 million of growth in the SLAT from his estate, he may wish he had never made the gift, since his ex-wife may now be much wealthier than he is. What if the appellate court had upheld the trial court and found the trust to be marital property? Could this arguably endanger the SLAT with the prospect of estate inclusion under IRC 2036/2038? Perhaps – courts (e.g. Estate of Tully) have found that the potential for a divorce or having future children, etc. is an “act of independent significance” that generally precludes application of these “string sections”, but I’m not so sure these taxpayer-friendly cases would control if the divorce actually occurs before death, causing the trust to indirectly benefit the settlor by becoming subject to a property division and causing an argument that the beneficiary is now 50% grantor. I am not sure that IRC 2516 protects such a settlement regarding trusts for others from being a transfer for gift tax purposes the way it would protect distributions directly between spouses from being a transfer. At least the upside of the divorce decision is that the SLAT is clearly still outside of both the husband and the wife’s estate for estate tax purposes (if they have large enough net estates so that this result would be a positive rather than a negative). Lessons to Learn: does this case mean we should make trust gifts between spouses more “kind of reciprocal”, risking undermining the estate, gift and asset protection goals of the trust planning? No, obviously not. But, we should be more careful whenever one spouse makes unequal gifts to the other to inform the donor spouse of the potential negative consequences in the event of a divorce. https://www.linkedin.com/pulse/dark-side-non-reciprocal-slats-edwin-morrow-iii/

|

|||

Article 4Revocable Trust Execution Requirements: A Notary is Not Needed

By: Jeff Baskies and Mary KarrAs a result of the global Covid-19 pandemic and the related social distancing and “shelter-at home” orders/recommendations, there is a question making its way like a brush fire through the RPPTL Section practitioners throughout the state: If clients must execute estate planning documents on their own (e.g. at home), do Florida revocable trusts (or amendments or restatements to Florida revocable trusts) need to be acknowledged by a notary to be valid, particularly if the trust may/will hold an interest in real property? We know the requirements for the valid execution of a will: it must be executed at the end in the presence of two witnesses who execute in the presence of each other and the testator (i.e. there is no requirement for a notary to make a will valid – just to make it self-proving). Sec 732.502, F.S. Further, we know the requirements for the validity of the testamentary aspects of a revocable trust – the trust must be executed with “will formalities.” Sec. 736.0403(2)(b), F.S. But the generalized concern is: what if the revocable trust holds real property already or will hold real property in the future? My guess is some of you are dealing with this question in your practices as well. Perhaps the revocable trust notarization requirement is an “urban myth.” We reviewed the case law and statutes and do not see a requirement for notarization. Yes, a deed to a trustee requires acknowledgement by a notary to be recorded in the public records. And yes, a trust that holds real property must be in writing (not oral) to validly hold real property. But there does not appear to be a requirement that the trust’s execution be acknowledged or sworn to before a notary. Certainly, to record a trust (without further steps), having it acknowledged by a notary is required. However, you could record a trust certificate or a trust affidavit or really any affidavit that attaches the trust as an exhibit. So, the recordation of the trust should not be a deciding factor in its execution. Instead, if your client can sign the trust with witnesses and no notary (i.e. with “will formalities”) then we believe the trust will be validly executed. In looking, we could not find a statute supporting the idea that a trust needs to be notarized, if it holds or will hold real property. Instead, we found Sec. 736.0403(2)(a), F.S. which says in part: {00241159.DOCX / } “Notwithstanding …. No trust or confidence of or in any messages, lands, tenements, or hereditaments shall arise or result unless the trust complies with the provisions of s. 689.05.” Perhaps that is the “aha” moment. Will that statute lead to the notarization requirement? Alas, no it will not. When you look at Sec. 689.05, F.S. it only says the trust must be in writing. Ultimately, any deed in and to real property must be witnessed by two witnesses and acknowledged by a notary in order to be recorded, and if it passes title to real property to a trust, that trust must be in writing and must be valid (e.g. even if valid elsewhere if oral, it still can’t hold real property). But the trust itself only needs to be in writing, except that in the case of a revocable trust, for the testamentary aspects to be valid, the revocable trust needs to be executed with the formalities of a will (witnesses), whether real property is deeded to it or passes to it via a pour over will, etc. It is a good practice to check with your title insurance underwriter before conveying property to or from a revocable trust to determine the insurability of the conveyance. So for clients struggling to sign estate planning documents outside of your offices, consider having them sign their revocable trusts without a notary acknowledgement. Take care and be safe everyone.

|

|||

Featured Events |

|||

This Saturday 11 AM EDT

|

|||

Wednesday, June 16th 4:00 PM EDT |

|||

All Upcoming EventsRegister for all future free webinars from Gassman, Crotty & Denicolo, P.A. using this link |

|||

|

Saturday, May 22, 2021 |

Free webinar from our firm |

Alan Gassman and Brandon Ketron present: WHAT THE BIDEN TAX PLAN MEANS FOR ESTATE PLANNING AND MORE ESTATE TAX PLANNING STRATEGIES from 11 to 11:35 AM EDT (35 MINUTES) |

Register |

|

Wednesday, June 16, 2021 |

Association of Insolvency and Restructuring Advisors’ Pre-conference Bankruptcy Tax Toolbox |

Alan Gassman and Christopher Denicolo present: Tax Planning for Troubled Companies Involving CODI from 4:05 to 4:50 PM EDT |

Register |

|

Wednesday, June 16, 2021 |

Free webinar from our firm |

Alan Gassman, Professor Jerry Hesch, and Dr. Luz D. Randolph present: Life Insurance Planning, including Term Life Insurance for Charitable and Non-Charitable Purposes from 12:30 to 1:30 PM EDT |

Register |

|

Wednesday, July 21, 2021 |

Free webinar from our firm |

Alan Gassman, Dr. Luz D. Randolph and Michael Lehmann present: Charitable Planning for the Business Owner from 12:30 to 1:30 PM EDT |

Register |

|

Thursday, July 26-29, 2021 |

AICPA & CIMA ENGAGE 2021 in Las Vegas, NV |

Jerry August, Alan Gassman and Kevin McGraw present: Ready for a Sale Panel on Business in Distress from 9:30 to 10:45 AM PT |

Register |

|

October, 2021 |

Notre Dame Tax and Estate Planning Institute |

Topic TBD |

Coming Soon |

|

Thursday, November 4, 2021 |

Estate Planning Council of Birmingham |

Alan Gassman presents: Hot Topics In Estate Tax And Creditor Protection from 8:00 AM to 10:00 AM CT |

Coming soon |

|

Thursday, November 4, 2021 |

Alabama Banker’s Association |

Topic TBD |

Coming Soon |

Forbes Corner |

For Finkel’s FollowersWhat Your Auto-Reply Says About You As a Leader

By: David FinkelI recently sat down with Tara, a business owner, who was having trouble with the marketing pillar of her business. She had made it a goal to get new clients and her marketing department head had a ton of ideas on ways that they could market the product line and get the word out, but Tara struggled with many of her ideas due to cost constraints. So, she more often than not said “No” to marketing experiments and trials for fear of losing money on failed experiments. Now most small business owners struggle with cash flow issues from time to time, this is nothing new. But for Tara, her inability to pull the trigger on some key financial decisions was impeding the growth of her business. It Costs Too Much… Have you ever found yourself saying something along the lines of: “Sending my staff through a key training program costs too much.” What’s wrong with this frame of reference is that it sees only a price tag and makes a decision on that one piece of information. But in Tara’s case (and maybe yours) there is a lot more to a decision than just the price tag and you are doing yourself an injustice by just looking at the monetary side of things. The Big Picture The most successful entrepreneurs look at the big picture and consider what else they could gain from such an experiment or expense, even if it ends up being a failure on the surface. They ask, what’s the cost of the status quo? What rate of return should I expect from this investment? What is my risk in making this investment and how can I hedge that bet? What happens if I don’t make this investment? When you ask these other questions you can reach a more powerful answer. After talking to Tara a bit more, I learned that they had one main channel for customer acquisition and really hadn’t tried much else in terms of marketing. So, by saying “no” to anything new and risky, she was limiting her company’s ability to grow and learn from their experiences. Take the Leap (But Use a Harness) So, if you find yourself saying “It costs too much” too often consider stepping back and looking at the expense objectively. If it fails to yield the results you wanted, would your business learn a lesson from that failure? If the answer is yes, then you might want to consider giving it a go. Tip: Don’t forget to document your experiments to build upon in the future. This will allow you to make informed decisions and prevent others in the company from making the same mistakes twice. |

Humor

May 20th – Today in History

|

|

|

Younger Readers may not have heard of Samuel Clemens, who was a Broadway actor in the 1970s and became a popular comedian in the 1980s.

Here are some of our favorite Samuel Clemens sayings:

“Honesty: The best of all the lost arts.”“The source of all humor is not laughter, but sorrow.”“Never have a battle of wits with an unarmed person.”“The more things are forbidden, the more popular they become.”“I have never let my schooling interfere with my education.”“Age is an issue of mind over matter. If you don’t mind, it doesn’t matter.”

– Samuel Clemens

|

You Tube Channel |

5 Star Reviews from Readers like You!

David Howell “I should have long ago taken a moment to tell you how much I enjoy your Thursday Reports! Good stuff. Candid. No fluff. Funny.” – David Howell

“I soak up your posts, and appreciate your knowledge & enjoy your humor! If I ever win the lottery, you’ll be the 1st guy I call. My husband will be the second.” – Stacey Miller Stacy wins a free lifetime subscription to the Thursday Report and front row tickets to Samuel Clemen’s next comedy show at Capitol Theatre in Clearwater.

“Just an incredible amount of useful information in this week’s newsletter! It will take some time to digest it all.” – Anonymous

Did you like the Thursday Report? Send your thoughts and comments to info@gassmanpa.com for a chance to be our next featured 5 star review!

|

|

Gassman, Crotty & Denicolo, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200

|