The Thursday Report – Issue 303

|

ALWAYS FREE, SOMETIMES PUBLISHED ON THURSDAYS Making Thursday a Better Day for Most of Humanity

Thursday, April 29th, 2021 – Issue 303 Having trouble viewing this? Use this link

|

Table of ContentsArticle 1IRS PPP Loan GuidanceArticle 2A Florida Fraudulant Transfer Decision – Not Ready for Prime Time Draft (Part 1)Article 3President Biden’s Executive Order on Russia – A Dangerous Net?Article 4Get your SLAT – That’s Where It’s At (Part 1)Featured EventsUpcoming EventsForbes CornerFor Finkel’s FollowersBonus ArticleHumorReviews |

Article 1IRS PPP Loan Guidance

Brandon Ketron, Alan Gassman & Dummy McPuppet

REVENUE PROCEDURE 2021-20 HELPS FISCAL YEAR PPP BORROWERS On April 22, 2021, the IRS released Revenue Procedure 2021-20 in order to provide guidance to fiscal year taxpayers (generally C corporations, S corporations, partnerships, trusts, and estates which have taxable years that do not end on December 31st), if the tax return for the 2020 fiscal year was filed before December 27, 2020. An example of taxpayers that this may affect would include an S corporation that received permission to file its tax return with a July 31st year-end because its business is seasonal, or a C corporation with an October 31st year-end, that filed their 2020 returns before December 27, 2020. The Revenue Procedure basically provides that the vast majority of these fiscal year taxpayers who did not take PPP expenses as a deduction on their 2020 income tax return can elect to either (1) amend their return and take the deductions in 2020, or (2) take the deduction for expenses paid during the 2020 tax year on their 2021 income tax return, which may be a large benefit if they are in a higher tax bracket for the fiscal year ending in 2021. The only exception to the above is that the Revenue Procedure provides that the taxpayer may not move the deduction for any of the new categories of expenses that were added by the December 27, 2020 Economic Aid Act to their 2021 tax return if paid in 2020. These expenses consist of “covered operational expenditures”, “covered property damage”, “covered supplier costs”, and “covered worker protection expenses”, and are defined below . Since these categories were added after December 27, 2020 (the date the return must have been filed by in order to use the Revenue Procedure), it is likely that most taxpayers were already deducting these expenses since the taxpayer would not be including such expenses in their PPP Forgiveness calculations. If for some reason these expenses were not deducted in 2020, then it would be necessary to amend the 2020 tax return to deduct them. An important tea leaf from the Revenue Procedure is whether the entity has sufficient tax basis to allow for the deductibility of all expenses if the entity is treated as a partnership or S corporation for income tax purposes. While the general rule on this is that a PPP loan that is forgiven will be considered to increase a taxpayer’s basis, it appears that the loan must have either been forgiven, or the taxpayer must have had a “reasonable expectation” that the loan would be forgiven on the last day of the tax year in order for the basis increase to apply. The Revenue Procedure mentions that the IRS’s previous position was that a reasonable expectation of loan forgiveness would have caused the expenses to be non-deductible before Congress clarified the law on December 27th to make PPP forgiveness expenses deductible. This Revenue Procedure helps to show that the IRS can be expected to allow for PPP loan forgiveness amounts to be added to a taxpayer’s basis in 2020 unless there are unusual circumstances that would make it unlikely that the loan will be forgiven. As a practical matter it is best to file the forgiveness application without delay and get receipt of the forgiveness verification from the SBA before filing the 2020 tax return. The owners of S corporations and partnerships, and beneficiaries of trusts and estates having fiscal year ends that received PPP loans may have differing interests with respect to whether to take the deductions in 2020 or 2021. For example, the 51% owner of an S corporation may be better off if the deductions come through to her 2021 tax return, while the 49% taxpayer may be better off if the deductions come through on the 2020 tax return. On the other hand, there may be a breach of fiduciary duty if the 51% shareholder takes an action to her advantage. The deductions need to be “all or nothing” – for example, the Revenue Procedure does not permit the taxpayer to take one-half of the deductions in 2020 and one-half of them in 2021. More detail on the above and some of the technical requirements to use the Revenue Procedure to deduct expenses on the 2021 tax return as discussed below: In order for a fiscal year taxpayer to be eligible to deduct the PPP associated expenses incurred in 2020 on the 2021 tax return, the taxpayer must satisfy all of the following requirements: 1. The taxpayer received an original [“first draw”] PPP covered loan in 2020; 2. The taxpayer paid or incurred original eligible expenses during the taxpayer’s 2020 taxable year; 3. On or before December 27, 2020, the taxpayer timely filed, including extensions, a Federal income tax return or information return, as applicable, for the taxpayer’s 2020 taxable year (which generally would only occur if the taxpayer’s fiscal year ended on November 30th, 2020 or any preceding calendar month in 2020); and 4. On the taxpayer’s Federal income tax return or information return, as applicable, the taxpayer did not deduct the original eligible expenses because– B. The taxpayer reasonably expected at the end of the 2020 taxable year that the expenses would result in such forgiveness. If the taxpayer chooses to follow this procedure and make the election to deduct such expenses in 2021 rather than amending their 2020 tax return, the taxpayer must include a statement on their 2021 return creatively titled “Revenue Procedure 2021-20 Statement” and include the following information: 1. The taxpayer’s name, address, and social security number or taxpayer identification number; 2. A statement that the taxpayer is applying the safe harbor provided by section 3.01 of Revenue Procedure 2021-20; 3. The amount and date of disbursement of the taxpayer’s original PPP covered loan; and 4. A list, including descriptions and amounts, of the original eligible expenses paid or incurred by the taxpayer during the taxpayer’s 2020 taxable year that are reported on the Federal income tax return or information return, as applicable, for the taxpayer’s 2021 taxable year. It is noteworthy that the only taxpayers that are eligible to use this Revenue Procedure are taxpayers that filed their return for the 2020 tax year prior to December 27, 2020. Therefore this Revenue Procedure only applies for taxpayers that use a fiscal year for tax reporting, or possibly taxpayers that had a short tax year in 2020 whose tax returns were due prior to December 27, 2020. Section 304(b)(1)(A) of the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act (the “Economic Aid Act”) that was enacted on December 27, 2020 overruled the IRS’s position that expenses paid with forgivable PPP funds were non-deductible, and provided in relevant part that “no amount shall be included in the gross income of the eligible recipient by reason of forgiveness of indebtedness [on an original PPP covered loan],” and “no deduction shall be denied, no tax attribute shall be reduced, and no basis increase shall be denied, by reason of [that] exclusion from gross income.” Therefore, taxpayers that report on a calendar year basis (most taxpayers) will be able to deduct such expenses on their originally filed 2020 tax return, and will not need to use this Revenue Procedure as their return is not due until March or April of 2021 depending on how the entity is taxed. While this Revenue Procedure is of limited utility for most taxpayers, it does provide relief and a method to deduct expenses that were not deducted by reason of the IRS’s now overruled position that expenses paid with forgivable PPP funds were non-deductible without having to amend returns. These taxpayers can still amend their 2020 returns, so advisors will need to analyze whether the taxpayer, or its owners, are better off amending the 2020 return or deducting the expenses on the 2021 tax return. If the Biden Administration increases the tax rate applicable to the 2021 year, then it will probably be more beneficial to deduct these expenses in 2021, as a greater benefit will be realized if the expenses offset income at a higher tax rate. It is noteworthy that this Revenue Procedure only applies to the original PPP eligible expenses which includes, payroll costs, mortgage interest, rent, and utility expenses. The Procedure does not apply to the additional eligible expenses added by the Economic Aid Act which consist of covered operational expenditures, covered property damage costs, covered supplier costs and covered worker protection expenditures. If the additional eligible expenses were not deducted in 2020, then the taxpayer will have to amend the 2020 tax return to include the deduction for the additional categories of eligible expenses. These new categories of PPP forgivable expenses are defined as follows: “Covered operations expenditures” are “payment[s] for any business software or cloud computing service that facilitates business operations, product or service delivery, the processing, payment, or tracking of payroll expenses, human resources, sales and billing functions, or accounting or tracking of supplies, inventory, records and expenses.” “Covered property damage costs” are those costs “related to property damage and vandalism or looting due to public disturbances that occurred during 2020 that was not covered by insurance or other compensation[.]” “Covered supplier costs” are “expenditure[s] made by an entity to a supplier of goods for the supply of goods that:” (a) “are essential to the operations of the entity at the time at which the expenditure is made;” and (b) is made pursuant to an order, a purchase order, or a contract that is (1) “in effect at any time before the covered period with respect to the applicable covered loan[,]” or (2) “with respect to perishable goods, in effect before or at any time during the covered period.” “Covered worker protection expenditure” is the most complex of the new categories. This category refers to “an operating or a capital expenditure to facilitate the adaptation of the business activities of an entity to comply with requirements established or guidance issued by the Department of Health and Human Services, the Centers for Disease Control, or the Occupational Safety and Health Administration, or any equivalent requirements established or guidance issued by a State or local government, during the period beginning on March 1, 2020 and ending the date on which the national emergency declared by the President under the National Emergencies Act (50 U.S.C. 1601 et 8 seq.) with respect to the Coronavirus Disease 2019 (COVID–19).” The list of qualifying activities include expanding drive-through capabilities, creating physical barriers (such as a sneeze shield), and indoor or outdoor air filtration systems. This Revenue Procedure, or any other guidance for that matter, unfortunately did not directly address when basis is considered to be increased by reason of PPP loan forgiveness, but does mention the IRS’s previous position that a reasonable expectation of loan forgiveness would cause the expenses to be non-deductible. Therefore, taxpayers should be able to take the same position that a reasonable expectation that the loan will be forgiven should allow for the basis increase to apply at the time the taxpayer has such reasonable expectation of loan forgiveness. Stay tuned as we will continue to write and inform as further developments occur. |

|||

Article 2A Florida Fraudulant Transfer Decision – Not Ready for Prime Time Draft(Part 1)

Jonathan Gopman Jonathan Gopman has substantial experience in assisting high net worth families with international and domestic estate planning, implementing foreign trust structures, business planning and general tax planning. Jonathan has been interviewed for, and quoted in, a number of articles published in well known publications such as Bloomberg Magazine, Forbes Magazine, Wealth Manager Magazine and Elite Traveler. Jonathan is a commentator on asset protection planning matters for Leimberg Information Services, Inc. (“LISI”), a member of the legal advisory board of Commonwealth Trust Company in Wilmington, Delaware, and a member of the Society of Trust and Estate Practitioners (“STEP”). He is AV rated by Martindale Hubbell. |

|||

Article 3President Biden’s Executive Order on Russia – A Dangerous Net?

Howard S. Fisher Howard S. Fisher is one of the most well respected trust and estate planning lawyers in the United States, despite his affiliation with the Thursday Report. He and his son Alexander J. Fisher practice in Beverly Hills, California. Howard is a past chair of the California State Bar’s Taxation Section and of the Beverly Hills Bar Association’s Taxation Section, a former member of the Board of Trustees of the Los Angeles County Bar Association and a former secretary of the Western Division of the United States branch of the International Fiscal Association.

President Biden released Executive Order “Blocking Property with Respect to Specified Harmful Foreign Activities of the Government of the Russian Federation” on April 15, 2021 providing for the U.S. Goverenment to have the authority to seize assets of United States persons that have been used associated with Russia and Russian activities. This has caused more than one client to be concerned that almost anyone could accidently be caught in the net that might be cast be the government to investigate people who have had innocent and legitamate dealings. We asked our friend and well respected international tax lawyer Howard S. Fisher for his thoughts on Executive Order “Blocking Property with Respect to Specified Harmful Foreign Activities of the Government of the Russian Federation” and he had the following to say:

|

|||

Article 4Get your SLAT – That’s Where It’s At (Part 1)

Alan Gassman and Christopher Denicolo FLEXIBILITY IN UNCERTAIN TIMES-EXPLAINING THE SPOUSAL LIFETIME ACCESS TRUST TO CLIENTS A Spousal Lifetime Access Trust (“SLAT”) is a trust established by one person that is held for the benefit of his or her spouse in a manner that will not be subject to the creditor claims of the spouse and other beneficiaries of the trust and also will not be subject to federal estate tax in the estates of such beneficiaries. The SLAT has its roots under the common law of all 50 states of the United States, and has been fine-tuned and augmented by creative planners over the years to comply with and take advantage of guidance set forth under applicable state statutes. Given the present uncertainty and possible changes with respect to the federal estate and gift tax laws, the SLAT offers clients flexibility while making use of what might be a vanishing lifetime gifting exclusion. Under the federal estate and gift tax system, there is presently an $11,700,000 unified estate and gift tax exclusion amount. This allows a person to make large gifts which reduce the exclusion amount for both estate and gift tax purposes without paying gift tax unless or until the entire exclusion amount is exhausted. Current law provides for the unified estate and gift tax exclusion amount to be reduced to $5,000,000, plus increases for inflation as a result of the changes to the “Chained Consumer Price Index” since 2012 (which many estimate to be approximately $6,500,000) effective January 1, 2026. There has been much discussion and ink spilled regarding the possibility of decreases to the federal estate and gift tax exclusion amounts prior to 2026. Most notably is Bernie Sanders’ recently proposed “For The 99.5% Act,” which calls for a reduction in the estate tax exclusion amount to $3,500,000 and a reduction to the lifetime gifting exclusion amount to $1,000,000. Under this Bill, any gifts made by an individual exceeding $1,000,000 would result in a gift tax that would be based upon graduated rates beginning at 45% and increasing up to 65%, depending on the amount of the gift. Therefore, many wealthy clients are faced with the prospect of a vanishing exclusion amount, which has caused them to consider making gifts of assets to utilize an increased gifting exclusion amount that may not be available in the near future. Nevertheless, while many clients recognize that they want to use their vanishing lifetime gifting exclusion, they may not be inclined to part with the dominion, control, and access to assets that would otherwise be used for gifting purposes. For married couples, the SLAT is an excellent tool to help achieve the balance between gifting assets to make use of lifetime gifting exclusion and retaining the possibility of assets to such assets because it involves one spouse establishing a trust for the other spouse whereby the beneficiary spouse can receive distributions as needed for his or her health, education, maintenance, or support (“HEMS”). The other spouse also can be the sole trustee or a co-trustee of the SLAT, and the assets of the SLAT should not be subject to the beneficiary/spouse’s creditors or subject to estate tax in the beneficiary/spouse’s estate. This is based upon the federal estate tax law in this area, which was enacted to run parallel to a fundamental tenet of the common law with respect to “third-party irrevocable trusts.” If a “third-party irrevocable trust” is formed by one person for the benefit of another person who can only demand or effectuate withdrawals to the extent needed for HEMS, the assets of the trust will not be subject to federal estate tax in the estate of the beneficiary (which typically would not be subject to the creditors of the beneficiary), unless there are certain strings attached or arrangement in place. It is very important that a beneficiary of a trust (such as the beneficiary/spouse) not have the right or power to demand payment or distribution what is needed for his or her HEMS (such as distributions determined to be for the best interest of the beneficiary). A trustee other than the beneficiary may have the power to distribute the assets of the trust to the beneficiary beyond what is needed for HEMS, and this will not cause the assets of the trust to be subject to federal estate tax in the beneficiary’s estate or subject to the beneficiary’s creditors, so long as there is not an understanding between the beneficiary and the trustee that the trustee will make such distributions in excess of what is needed for HEMS. As with much of the tax law and estate planning techniques, it can be a challenge to explain complex topics such as the federal estate and gift tax law and the SLAT to the clients in an easily understandable format that allows them to make an informed decision in view of the salient benefits and limitations. It is the authors’ experience that even sophisticated and business-savvy clients can have difficulty with abstract concepts if they are not explained in layman’s terms in writing and in a format that can be referenced at a later time. Clients can be better educated and have many of their questions answered by a well-drafted letter explaining the mechanics of a SLAT, the planning opportunities associated therewith, and the implications and limitations of the technique. Such a letter can be invaluable in communicating the complex ideas associated with the federal estate and gift tax law and the SLAT in simple terms. *The informative client letter with footnotes will be featured in the next Thursday Report, which will probably be on a Thursday.

|

|||

Featured EventsHow to slice your SLAT in 35 minutes flat!

Saturday, May 1st 11:00 AM to 11:35 AM EDT |

|||

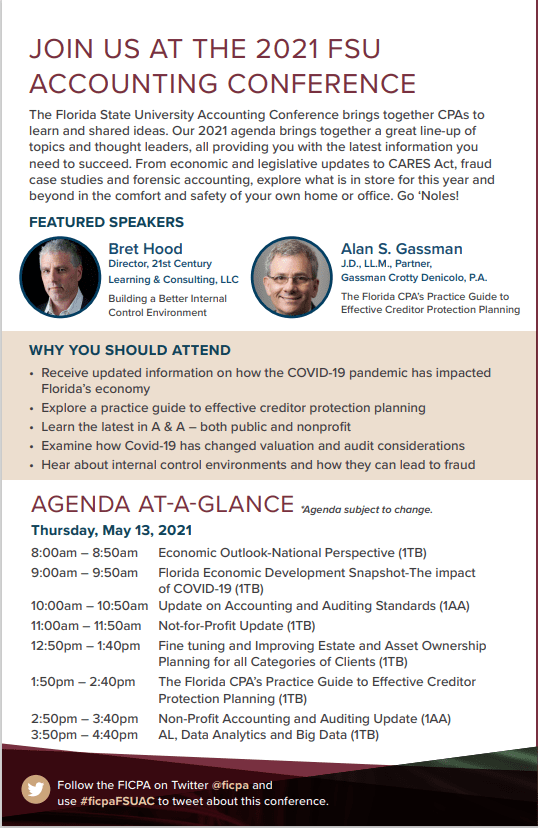

Go Seminoles!We are proud to participate in the 2021 FSU Accounting Conference without even having to drive to Tallahassee, FL. Please consider supporting this momentous event for all of history.

FICPA-FSU Spring Accounting Conference Thursday, May 13th from 12:50 to 2:40 PM EDT

|

|||

Upcoming Events!

Register for all future free webinars from Gassman, Crotty & Denicolo, P.A. using this link |

|||

|

Saturday, May 1, 2021 |

Free webinar from our firm |

Alan Gassman presents: SPOUSE LIMITED ASSET TRUSTS – HOW TO KEEP YOUR SLAT FROM GOING KERSPLAT! from 11:00 to 11:35 AM EDT |

|

| Monday, May 10, 2021 | Paralegal Association of Florida: Pinellas Chapter |

Alan Gassman presents: Making Your Job Better and Your Firm More Successful – the Legal Assistant’s Guide to Liberation and Effectiveness from 12:00 to 1:00 PM EDT |

|

| Thursday, May 13, 2021 | FICPA-FSU Spring Accounting Conference |

Alan Gassman presents: Fine Tuning and Improving Estate and Asset Ownership Planning For All Categories of Clients from 12:50 to 1:40 PM EDT & The Florida CPA’s Practice Guide to Effective Creditor Protection Planning from 1:50 to 2:40 PM EDT |

|

| Wednesday, May 19, 2021 | Free webinar from our firm |

Alan Gassman and Dr. Luz D. Randolph present: Private Foundations from A to Z. How Private Foundations help Donors help Public Charities and Causes from 12:30 to 1:30 PM EDT |

|

| Thursday, May 20, 2021 | Michigan ICLE Annual Probate & Estate Planning Institute |

Alan Gassman presents: Prebankruptcy and Bankruptcy Avoidance Strategies for Challenging Situations from 11:15 AM to 12 PM CT |

|

| Tuesday, June 15, 2021 | Association of Insolvency and Restructuring Advisors’ Pre-conference Bankruptcy Tax Toolbox |

Alan Gassman and Christopher Denicolo present: Tax Planning for Troubled Companies Involving CODI |

|

| Wednesday, June 16, 2021 | Free webinar from our firm |

Alan Gassman, Professor Jerry Hesch, and Dr. Luz D. Randolph present: Life Insurance Planning, including Term Life Insurance for Charitable and Non-Charitable Purposes from 12:30 to 1:30 PM EDT |

|

| Wednesday, July 21, 2021 | Free webinar from our firm |

Alan Gassman, Dr. Luz D. Randolph and Michael Lehmann present: Charitable Planning for the Business Owner from 12:30 to 1:30 PM EDT |

|

|

Thursday, July 26-29, 2021 |

AICPA & CIMA ENGAGE 2021 in Las Vegas, NV |

Jerry August, Alan Gassman and Kevin McGraw present: Ready for a Sale Panel on Business in Distress from 9:30 to 10:45 AM PT |

|

| October, 2021 | Notre Dame Tax and Estate Planning Institute | Topic TBD | Coming Soon |

| Thursday, November 4, 2021 | Estate Planning Council of Birmingham |

Alan Gassman presents: Hot Topics In Estate Tax And Creditor Protection from 8:00 AM to 10:00 AM CT |

|

| Thursday, November 4, 2021 | Alabama Banker’s Association | Topic TBD | Coming Soon |

Forbes CornerSenate Estate And Gift Tax Bill Will Reduce Exemption To $3,500,000 And Take Away Many OpportunitiesMar 27, 2021 Senator Bernie Sanders released his proposed estate and gift tax reform legislation on Thursday, March 25, to the displeasure of a great many American families and their advisors. Senators Kirsten Gillibrand, Jack Reed and Chris Van Hollen reportedly co-sponsored this plan… Continue reading on Forbes

All There Is To Know About The Restaurant Revitalization Stimulus RulesMar 18, 2021 The American Rescue Plan Act authorized and allocated $28.6 billion to the Restaurant Revitalization Fund program. Monies from this fund are to be paid as tax-free grants to restaurants, bars, and associated food and beverage related businesses in order to provide them with compensation for… Continue reading on Forbes

|

Bonus ArticleComing Soon to Bloomberg TaxAlan and Wesley Dickson have written an article entitled: The 501(c)(6) Noncompliance Problem – How Many Industry and Professional Organizations Are Out of Compliance and Should Not Have Qualified for PPP Loans *This article will be published in the Bloomberg Tax: Tax Management Memorandum on May 3rd, 2021. For a copy, you can email agassman@gassmanpa.com or subscribe to Bloomberg Tax at https://pro.bloombergtax.com/.

|

Want to Help your Direct Reports Grow?David Finkel

Ask any small business owner what they spend the majority of their time on, and you will likely hear something along the lines of: “I spend it putting out fires.” You are probably pretty accustomed to having direct reports come to you for help with problems and challenges. It takes up the bulk of your day and is often spent on fixing issues that don’t have a direct impact on the growth of your company. And I bet you often give them the answers — “Sure, Tina. Here’s what you should do…..” While it may seem easier (and quicker) to just help your team members get over any hurdles that they face along the way, you are better off letting them answer their own questions and fix their own problems. A Better Way Allowing your team members to fix their own problems, takes a little bit of faith and a whole lot of professional coaching. Everyone on your team has different strengths and weaknesses, and it is important to remember that when using this method. If a team member is mature and experienced in their role I might say, “I trust that you can handle this yourself.” I’ll ask her how she thinks she should handle it and then encourage her to try doing that. If a team member is less experienced, I might try a slightly different approach. “Well Jim, I’ve got some specific thoughts for you that I’ll share in a moment. But before I do, tell me what you think you should do here? If I wasn’t around, how would you handle this?” Of course, if he has a great answer, then you can say something like, “Wonderful, go ahead and make that happen. I can’t wait to hear how you do with that.” And if he comes up with a crazy, outlandish idea, ask him why he thinks that’s the best approach. Consider questions like, “If you weren’t able to do that, then what would you do? Why would you do that instead? Have you taken these other ideas into consideration?” Approaching the question this way not only helps you come to the best solution possible, but allows the team member to grow and develop within their role in the company. Over time they will begin to feel more confident in their decision making skills, and take on more within the business. And rely on you less to help them do their day-to-day tasks. Once you get into the habit of having your team members answer their own questions, you will find that they will begin to take ownership of the process and come to you for the things that they truly need your input on. Thus, allowing you to create a scalable business that is owner-independent.

|

Humor

Younger Readers may not have heard of Samuel Clemens, who was a Broadway actor in the 1970s and became a popular comedian in the 1980s.

Here’s some of our favorite Samuel Clemens sayings:

“Giving up smoking is the easiest thing in the world. I know because I’ve done it thousands of times.”

“I can teach anybody how to get what they want out of life. The problem is that I can’t find anybody who can tell me what they want.”

“Travel is fatal to prejudice, bigotry, and narrow-mindedness, and many of our people need it sorely on these accounts. Broad, wholesome, charitable views of men and things cannot be acquired by vegetating in one little corner of the earth all one’s lifetime.”

“The secret of getting ahead is getting started.”

“Never argue with stupid people, they will drag you down to their level and then beat you with experience.”

“Do the right thing. It will gratify some people and astonish the rest.”

“Get your facts first, and then you can distort them as much as you please. We do not deal much in facts when we are contemplating ourselves.”

– Samuel Clemens

|

|

|

5 Star Reviews from Readers like You!

David Howell “I should have long ago taken a moment to tell you how much I enjoy your Thursday Reports! Good stuff. Candid. No fluff. Funny.” – David Howell

“I soak up your posts, and appreciate your knowledge & enjoy your humor! If I ever win the lottery, you’ll be the 1st guy I call. My husband will be the second.” – Stacey Miller Stacy wins a free lifetime subscription to the Thursday Report and front row tickets to Samuel Clemen’s next comedy show at Capitol Theatre in Clearwater.

“Just an incredible amount of useful information in this week’s newsletter! It will take some time to digest it all.” – Anonymous

Did you like our Thursday Report? Send your thoughts and comments to info@gassmanpa.com for a chance to be our next featured 5 star review! |

|

Gassman, Crotty & Denicolo, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200

|