The Thursday Report – Issue 302

ALWAYS FREE, SOMETIMES PUBLISHED ON THURSDAYS

Making Thursday a Better Day for Most of Humanity

Thursday, April 15th, 2021 – Issue 302

Having trouble viewing this? Use this link

Thanks to Bernie Sanders – Estate Tax Planning Lawyers are Really BusyAlan Gassman |

What should we know about 501(c)(6) Industry Business Entities?Alan Gassman |

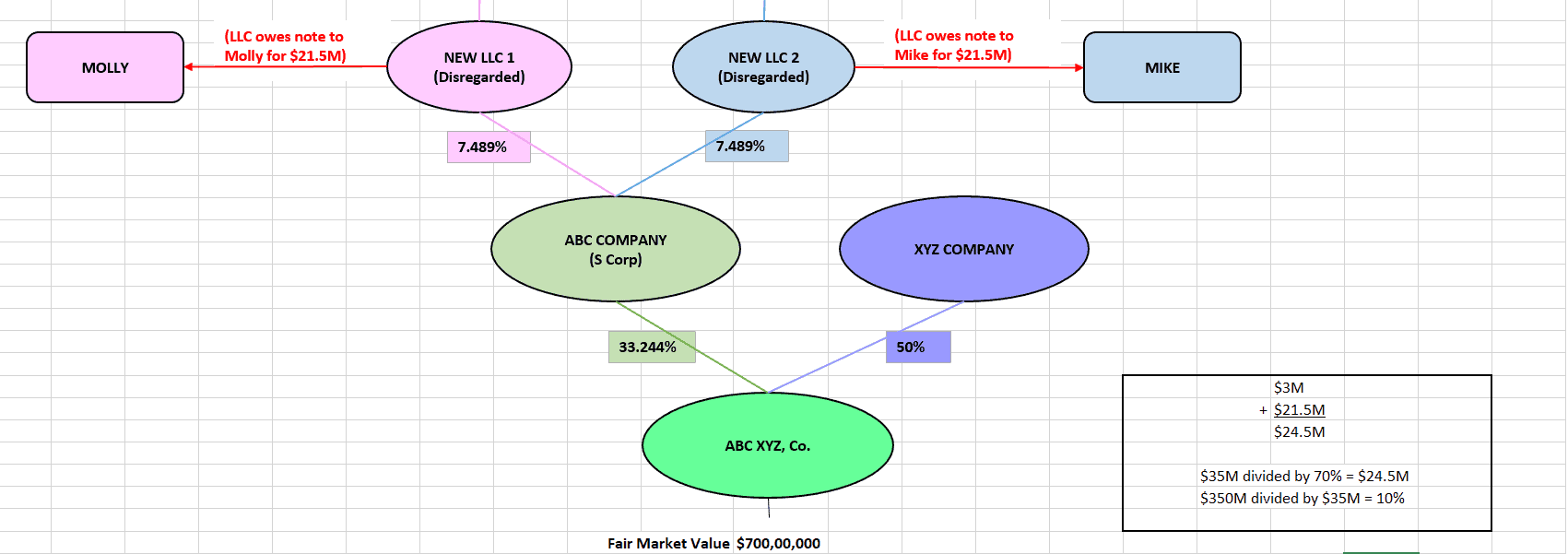

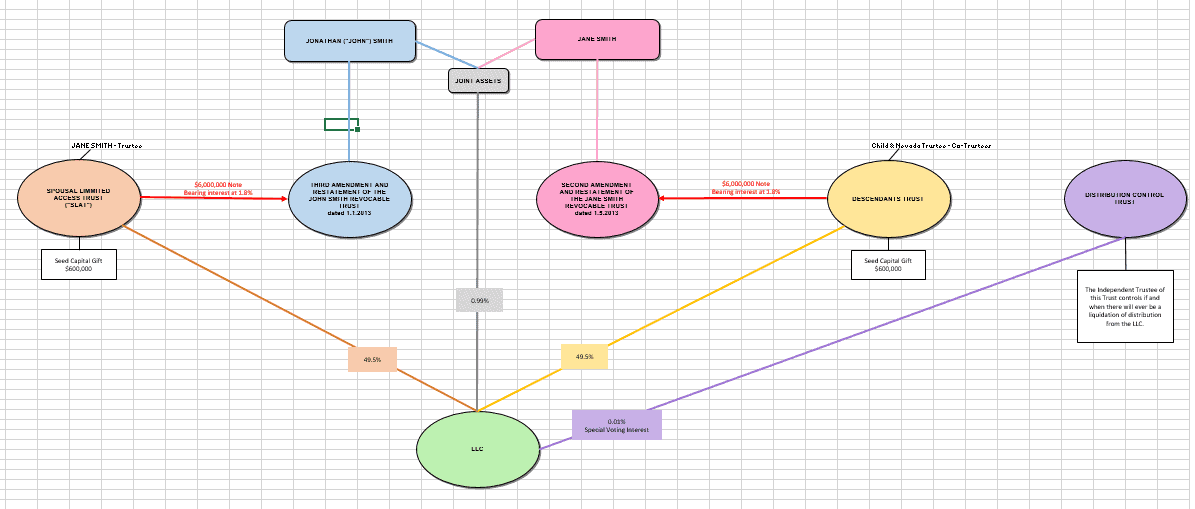

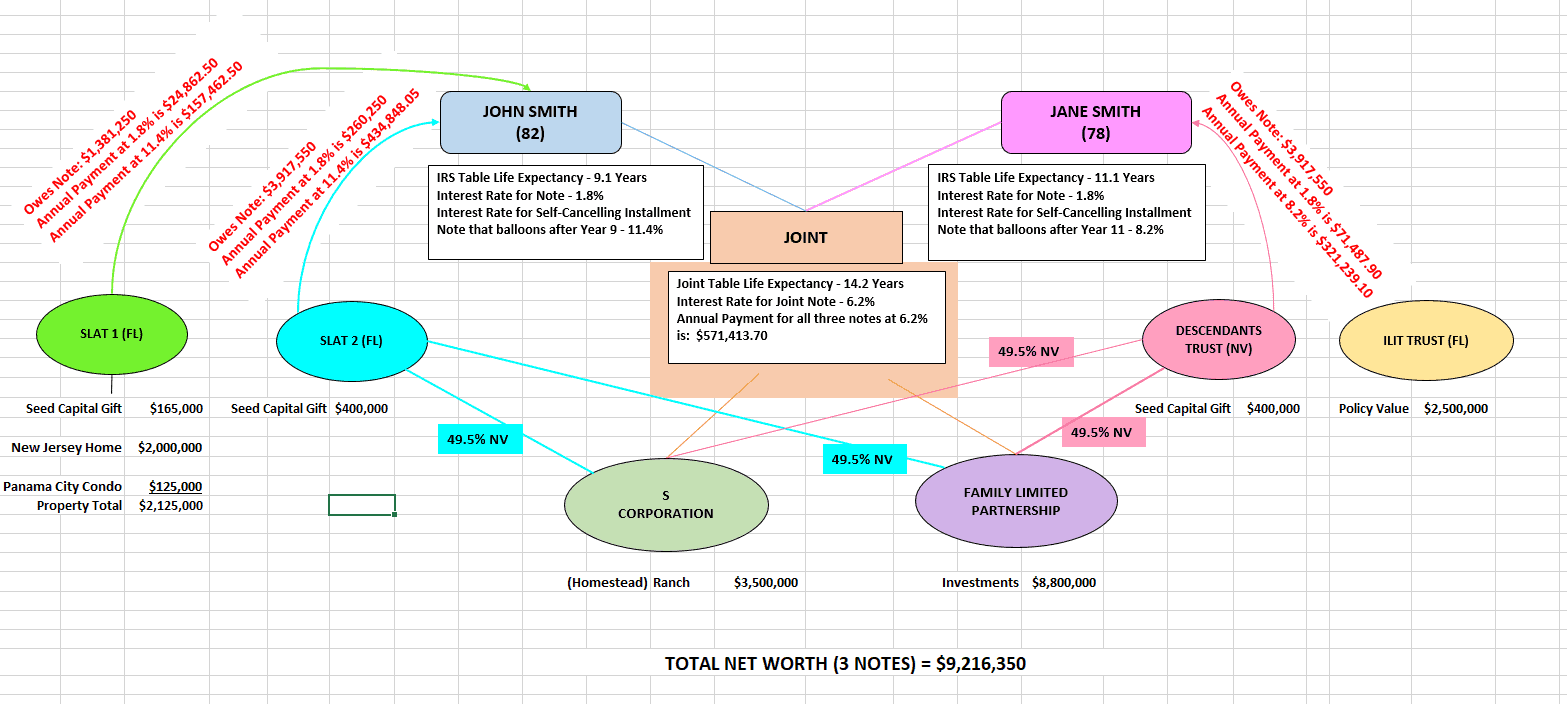

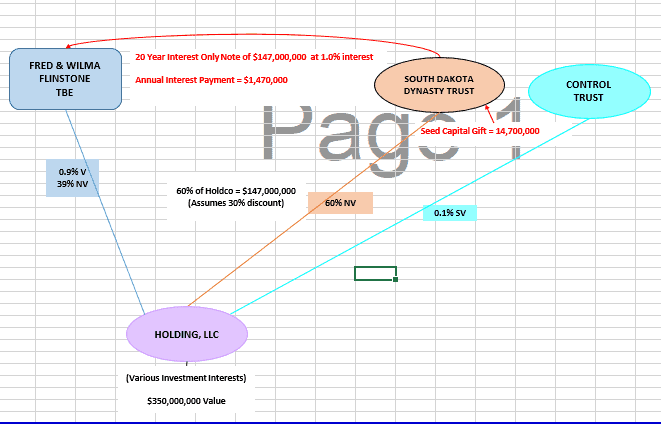

Questions and Answers with Alan Gassman: Estate Tax Planning“What is the likelihood of Congress passing legislation to reduce the gift exemption amount within the year 2021 and make it retroactive to the beginning of the year?” “I think the likelihood of that is less than 1%. I don’t think that all the multimillionaires who support Democrats would be very happy if they don’t have some warning. So I think there will be some warning on reducing the exemption if it does get reduced. Remember, it automatically comes down to half in 2026. There may not be warning as to the loss of discounts or the loss of defective grantor trusts. So we are asking clients, if you’re going to do a defective grantor trust like a SLAT or a Nevada trust, please get with us sooner rather than later or of course get with the lawyer of your choice.” “I have two trusts from my mother’s estate. One is generation skipping tax exempt which means it will never be taxed at my level. The other is a non- exempt trust. How will these fit into my estate plan?” “Well, fortunately, the GST exempt trust will never be subject to estate tax on your death no matter how big your estate is. But unfortunately, the non-exempt trust will be considered as owned by you for estate tax purposes. So if the total of your personal assets plus the non-exempt trust assets are subject to estate tax, or over the estate tax exemption, you will pay estate tax so you should be doing planning with a non-exempt trust and don’t take anything out of the exempt trust. The exempt trust should be investing in the better investments. If that is possible. Number two, I’m divorced with two children ages 23 and 24. What can I do to reduce estate tax as well? The first thing you can do is loan money to your children so that they can start businesses. That will definitely reduce your estate. Then you can marry somebody and give them a lot of money, and then divorce them and give them even more money.” “How should clients in the mid 60s, with 8 to 10 million net worth best prepare for potential future tax changes?” “I would like specific suggestions for actions to be taken in 2021. The first action is to see a good tax lawyer who can run the numbers for you. But most likely, I would form a Spousal Limited Access Trust for one of you and have the other of you put significant assets into that Spousal Limited Access Trust. The problem is, you know, at 8 or 10 million, you’re really middle class compared to what a millionaire was 30 years ago. So that’s why the Spousal Limited Access Trust allows you to live off of it and put in a divorce clause so that if there’s a divorce that divides into two SLATs and puts it in an asset protection jurisdiction. So, if you’re in poor health, but you have at least a reasonable period of time to live, you should consider a self-cancelling installment note. The IRS doesn’t like these, and they’ve challenged them. But there’s ways to handle that. If you are lucky enough to die within the term, and you don’t have to ever file an estate tax return, the IRS is unlikely to challenge it. The answer is give a lot of the money to lawyers, and then the rest of the money will go into promissory notes.” “For younger single clients in their 30s, what’s the general structure of estate planning, I would recommend?” “We have clients in their 20s and 30s, who are on their second trip to making over $10 million by starting a business and selling it in the tech industry. So, hats off to you guys that all the stories about the young people and the millennials are completely wrong when the 32 year old walks into your office with a $30 million net worth and he actually earned it. But what that 32 year old can do is go ahead and put $11 million in a trust or put 5 million in the trust and sell a discounted LLC interest in that trust. The trust is for your future descendants and your future spouse. In fact, it’s called a Floating Spouse Provision, it’s whoever you happen to be married to, at a time, can live off of that trust to pay half of your living expenses. And you can replace the trustee of the trust and the trustee of the trust also has the discretion to give to charity, and the trust is formed in an asset protection jurisdiction. And you can be added as a beneficiary of the trust if your networth ever goes below a certain amount. So that works well. And I have one client, a good friend of mine who is in his 60s who did one of these trusts before he was married, before he had children and now he’s married and has a beautiful child and he’s very happy he did it because he’s out of harm’s way from the estate tax, because of planning that we did in the 1990s.” “Assuming that the currently pending legislation looks as if it’s going to pass, Can you discuss the possible methods you use to protect a Roth IRA?” “That’s a really tough one. Because it’s stuck in the Roth IRA, you could have the Roth IRA paid to a trust that will qualify for the marital deduction, but then it will be taxed on the surviving spouses death, if she’s over the exemption, you could have a Roth IRA payable to a charity, that may not be what you want to do. Or you could withdraw the Roth IRA now, and forego the future tax free appreciation that you would have had, and put it into a gifting structure or a structure similar to what I showed you for the farm. When people have big, big IRAs, it’s difficult. Now, you could give a promissory note to your spouse. So you have $6,300,000 in a Roth IRA, but you owe your spouse 4 million, and then you die and your estate is not $6,300,000. It’s $2,300,000. You file an estate tax return reporting that but now your spouse has a larger estate, you don’t pay an estate tax. I wish I had a better answer for you. But the promissory note maybe — what are the odds of the exemption really going down to 7 million? I would say less than 3%. But the other stuff, taking away my blessed discounts and defective grantor trust, maybe 30 or 40%.” |

Back by popular demand! |

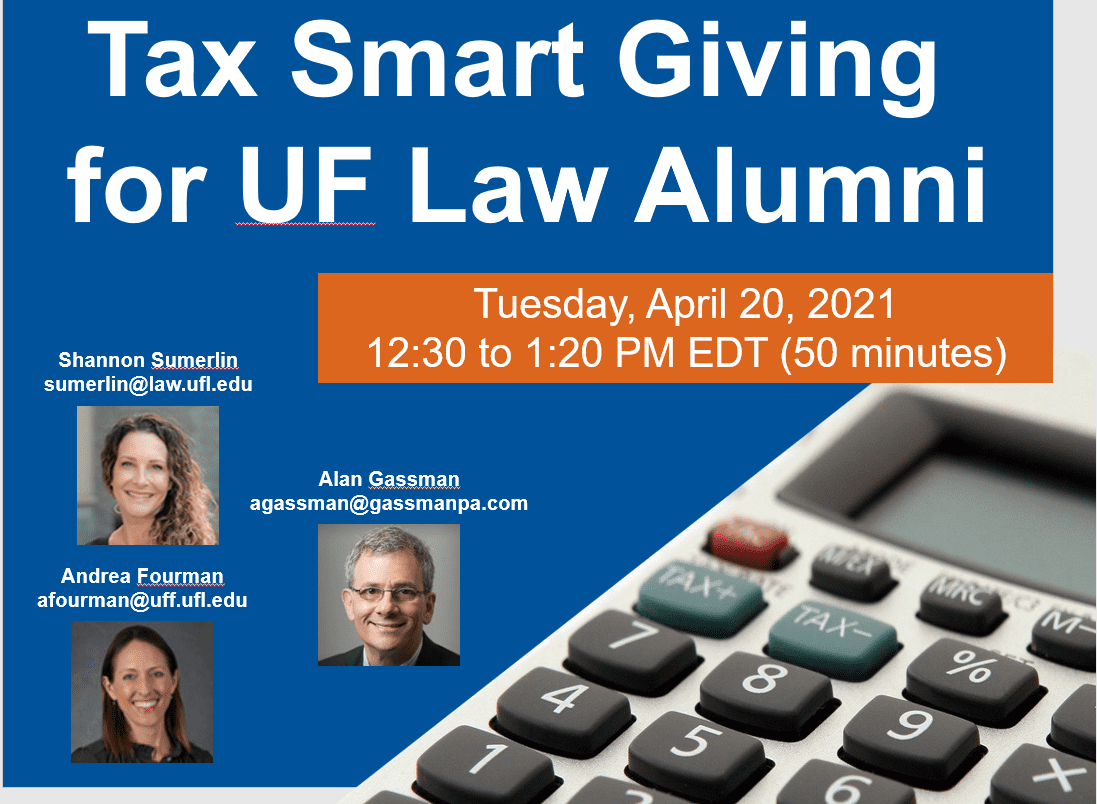

Tax Smart Giving for UF Law Alumni (and others)Presented by: Alan Gassman, Shannon Sumerlin and Andrea Fourman

Free LIVE Webinar April 20th 12:30 PM to 1:20 PM EDT

|

Upcoming EventsRegister for all future free webinars from Gassman, Denicolo & Ketron, P.A. using this link |

|||

| Saturday, April 17, 2021 | Free webinar from our firm |

Alan Gassman and Brandon Ketron present: Even More Questions and Answers on Estate Tax Planning for 2021 from 11:00 AM to 11:30 AM EDT |

|

| Tuesday, April 20, 2021 | Free webinar from our firm |

Alan Gassman, Shannon Summerlin and Andrea Fourman present: Tax-Smart Giving for UF Law Alumni from 12:30 to 1:20 PM EDT |

|

| Wednesday, April 21, 2021 | Free webinar from our firm |

Alan Gassman and Dr. Luz D. Randolph present: A Survey of Charitable Gifting Vehicles from 12:30 to 1:30 PM EDT |

|

| Monday, May 10, 2021 | Paralegal Association of Florida: Pinellas Chapter |

Alan Gassman presents: Making Your Job Better and Your Firm More Successful – the Legal Assistant’s Guide to Liberation and Effectiveness from 12:00 to 1:00 PM EDT |

|

| Thursday, May 13, 2021 | FICPA-FSU Spring Accounting Conference |

Alan Gassman presents: Fine Tuning and Improving Estate and Asset Ownership Planning For All Categories of Clients from 12:50 to 1:40 PM EDT & The Florida CPA’s Practice Guide to Effective Creditor Protection Planning from 1:50 to 2:40 PM EDT |

|

| Wednesday, May 19, 2021 | Free webinar from our firm |

Alan Gassman and Dr. Luz D. Randolph present: Private Foundations from A to Z. How Private Foundations help Donors help Public Charities and Causes from 12:30 to 1:30 PM EDT |

|

| Thursday, May 20, 2021 | Michigan ICLE Annual Probate & Estate Planning Institute |

Alan Gassman presents: Prebankruptcy and Bankruptcy Avoidance Strategies for Challenging Situations from 11:15 AM to 12 PM EDT |

|

| Tuesday, June 15, 2021 | Association of Insolvency and Restructuring Advisors’ Pre-conference Bankruptcy Tax Toolbox |

Alan Gassman and Christopher Denicolo present: Tax Planning for Troubled Companies Involving CODI |

|

| Wednesday, June 16, 2021 | Free webinar from our firm |

Alan Gassman and Dr. Luz D. Randolph present: Life Insurance Planning, including Term Life Insurance for Charitable and Non-Charitable Purposes from 12:30 to 1:30 PM EDT |

|

| Wednesday, July 21, 2021 | Free webinar from our firm |

Alan Gassman, Dr. Luz D. Randolph and Michael Lehmann present: Charitable Planning for the Business Owner from 12:30 to 1:30 PM EDT |

|

|

NEW DATES! Thursday, July 26-29, 2021 |

AICPA & CIMA ENGAGE 2021 in Las Vegas, NV |

Alan Gassman and Ken DeGraw present: Pre-Bankruptcy and Creditor Planning During the COVID-19 Pandemic |

|

| Thursday, November 4, 2021 | Estate Planning Council of Birmingham |

Alan Gassman presents: Hot Topics In Estate Tax And Creditor Protection from 8:00 AM to 10:00 AM CT |

|

Forbes CornerAll There Is To Know About The Restaurant Revitalization Stimulus RulesMar 18, 2021 The American Rescue Plan Act authorized and allocated $28.6 billion to the Restaurant Revitalization Fund program. Monies from this fund are to be paid as tax-free grants to restaurants, bars, and associated food and beverage-related businesses in order to provide them with compensation for…Continue reading on Forbes

Planning To Maximize Your Employee Retention CreditMar 17, 2021 The Economic Aid Act passed on December 27, 2020, made the Employee Retention Credit much more available by allowing PPP borrowers to apply for and receive the credit for 2020 if they satisfied the 50% of receipts reduction…Continue reading on Forbes

|

6 Things the World’s Best Bosses Have in Common(Besides Alan Gassman of course)David Finkel

Wish you could live up to the “World’s Best Boss” coffee mug sitting on your desk? These 6 tips will have you accepting the nomination in no time. Do you wish there was a way to supercharge your staff and help them achieve their full potential? Do you wonder if you are doing your best to support their efforts and put their best foot forward? Over the last 25 years, I have helped thousands of business owners just like you become great leaders. Here are my 6 tips to achieving “World’s Best Boss” status.

Here is the phrase to say to yourself, “Principles before personalities.” This means you let principles guide the tough conversations, and you deal with the tough stuff right away instead of letting it fester.

There is an old expression that has made an impact on me with respect to how I manage people–“With people, fast is slow and slow is fast.” Take your time with your team. Connect with them. Serve them. Listen to them. Over time the relationship and your results will blossom.

Leaders are not born, they are made. With every decision and interaction you are strengthening your leadership skills and building your company culture. Keep plugging away and you will be rewarded! 7. Have them subscribe to the Thursday Report and give them Thursday off to view it! |

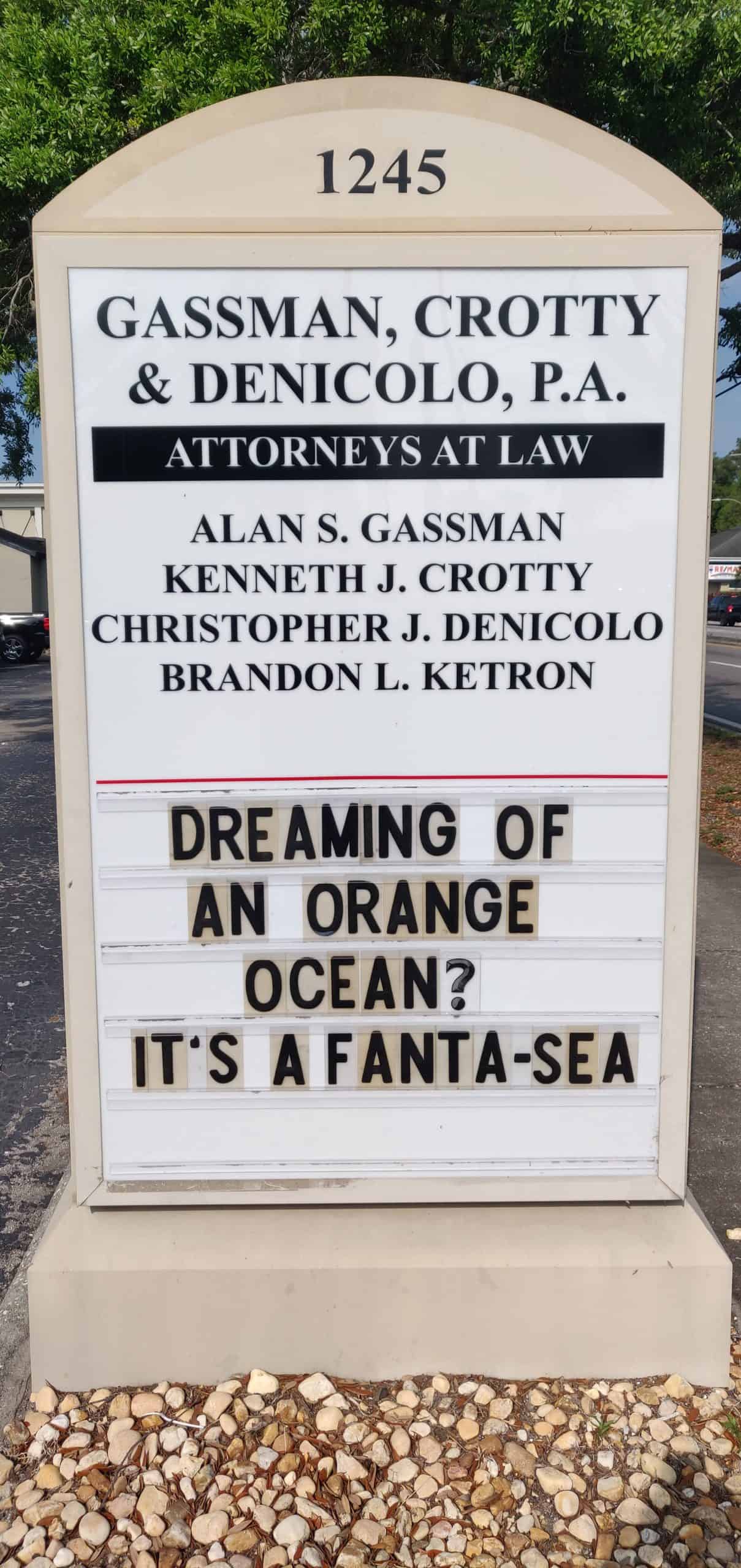

Humor |

|

|

Marc Nozell under Creative Commons 2.0 |

Gassman, Denicolo & Ketron, P.A.

1245 Court Street

Clearwater, FL 33756

(727) 442-1200