The Thursday Report – Issue 301

ALWAYS FREE, SOMETIMES PUBLISHED ON THURSDAYS

Friday, April 2, 2021 – Issue 301

Having trouble viewing this? Use this link

Potential Estate and Gift Tax Bill Could Reduce Exemption to a Fraction of Its Current Amount – What Is at Stake

The American Rescue Plan Act: Important New Updates for Small Business Owners

Upcoming Events

From the Law Clerks

Forbes Corner

For Finkel’s Followers

Humor

Potential Estate and Gift Tax Bill Could Reduce Exemption to a Fraction of Its Current Amount – What Is at Stake

Alan Gassman and Brandon Ketron

EXECUTIVE SUMMARY:

Senator Bernie Sanders released his proposed tax reform legislation on March 25th which outlined major changes to the estate and gift tax rules. This bill, which was co-sponsored by Senators Kirsten Gillibrand, Sheldon Whitehouse, Jack Reed and Chris Van Hollen, will have a similar version read into the House of Representatives by Representative Jimmy Gomez.

This bill is impactful and complex from a financial aspect but is straightforward in how it would achieve its goals – by reducing the current estate and gift tax exemption levels to $3,500,000 and $1,000,000 respectively beginning in 2022 and significantly eliminating or curtailing many of the important planning techniques used by estate planners effective upon enactment. The following commentary seeks to summarize and sort out some of the more important aspects of the pending legislation and, perhaps more importantly, outline what exactly we stand to lose.

COMMENT:

Besides a reduction of the estate tax exemption to $3,500,000 from the current amount of $11,700,000, and a reduction of the lifetime gift tax exemption to $1,000,000 in 2022, many very important planning strategies will become obsolete after the passage of the legislation.

If You Snooze, You Lose. If you have clients that may possibly be detrimentally impacted by this proposed legislation, it is important to encourage them to act quickly. Considering the nation-wide impact of this potential future legislation, and how quickly the change may occur, it is important to plan ahead, considering many estate and tax planning planners and experts will have lines of clients wanting to change their existing structure if and when Biden signs this legislation into law.

It is good, however, that most of the tax and estate planning structures that were put into place before the enactment of this legislation will be “grandfathered in” from an estate and gift tax standpoint. This only makes it more beneficial to act quickly and without delay.

The following is a client letter that the authors have prepared that can be used to reach out to clients to inform them of the proposed tax law changes:

LETTER TO CLIENTS:

RE: SANDERS 99.5% ACT ESTATE TAX PROPOSAL

Dear Clients:

Last Thursday, Senators Sanders and Whitehouse formally proposed a bill which would make changes to the current estate and gift tax system, that apparently has some support among Democratic Senators and Congressmen.

While it is our hope that this proposed law will not be enacted, it seems best to “plan for the worst and hope for the best,” given the unpredictable political climate, and the possible changes that may be made if a watered down version of this potent proposed law passes.

The good news is that the reduction of the estate tax exemption amount from $11,700,000 to $3,500,000 would not occur until January 1, 2022.

The same timing applies for the proposed reduction of the gift tax allowance to only $1,000,000, which means that people will not be able to gift more than $1,000,000 after 2021 without paying gift tax.

Also, the proposed increase in the estate tax rate to 45% once a deceased person’s taxable estate exceeds $3,500,000, and 50% and higher when the amount subject to tax exceeds $10,000,000 will not apply until 2022.

In addition to the above exemption and tax changes, gifting of up to $15,000 per year per person will be limited to $30,000 per donor per year for gifts to irrevocable trusts or of interests in certain “flow through entities” beginning in 2022.

The tougher news for many clients is that some of the primary tools and strategies that we have used in the past will not be available in the future, beginning upon the date that President Biden signs the bill into law, if this occurs.

Once that happens, we will not be able to fund or have assets sold to Irrevocable Trusts that can be disregarded for income tax purposes, and we will also not be able to use valuation discounts or Grantor Retained Annuity Trusts (GRAT’s) in most circumstances, although those arrangements put into place before the new law is passed will be grandfathered as long as they are not added to or altered after the law is passed, as presently written.

This is an important call to action for families having assets expected to exceed $3,500,000 per person to take a serious look at their present planning situation in order to determine whether to take immediate steps to avoid death taxes.

In particular, clients who have irrevocable trusts may want to act without delay to extend any notes that may be owned by them to the longest period practical, and to sell assets that may go up in value, and exchanges for assets that may be more suitable to be owned by these trusts, given that exchanges and changes made after a new law is passed may not be possible.

We have been very busy with estate tax planning since the middle of last year and are generally operating at capacity.

If you wish to complete an estate tax plan that you have started with us or to further develop or act upon an estate tax planning structure you already have in place, please let us know immediately, and confirm that you can provide us with updated asset and entity information so that we can avoid any delays in putting whatever you would like to do into action before new law may pass. We will give first priority to clients who contact us without delay and have plans in place or in progress.

If you do not have an estate tax planning structure or a plan in process, then we recommend that you start immediately with us or another qualified firm before the demand for these services causes us to be unavailable to finish before a new law may be enacted.

Best personal regards,

VIA EMAIL & U.S. MAIL

Alan S. Gassman

The following helps to explain the rules, and provides some helpful pointers along the way:

Unfortunately for Many, the Exemption Would be Only $3.5 Million (Minus any Past Reportable Gifts) – Use It or Lose It!

Effective the first day of 2022, the estate tax exemption amount would drop to $3.5 million per person from the present level of $11.7 million per person. This means the exemption for a married couple would only be $7,000,000, a 70% decrease! In addition, the rate will not be adjusted annually to account for inflation.

Many individuals (for good reason) will seek to gift a majority of what remains of their existing $11.7 million exemption prior to year end, but it is important to note that if an individual’s lifetime reportable gifting does not exceed $3.5 million, then the current additional exclusion amount will be wasted. In other words you have to “use” the current $11.7 million exemption or “lose it”.

EXAMPLE 1: Bob has made $2 million of taxable gifts and has a $9.7 million of his exemption remaining. If Bob uses another $1.5 million of his exemption, then he will have nothing left for 2022 if the legislation were to pass since total prior gifts would be equal to $3.5 million. Bob may be encouraged to use at least $6.2 million of his exemption before year’s end so that he does not lose that amount, and should consider using the full $9.7 million of exemption remaining. Bob would have to give more than $3.5 million in total in order to take advantage of the current increased exclusion amount.

The amount (in the above example) may be transferred to an irrevocable trust for the benefit of Bob’s spouse and descendants. That trust may also benefit Bob in the event Bob were to suffer any financial hardship, so long as the trust is properly formed and operated in a creditor-protection jurisdiction.

It is likely that many married couples, in response to this rule, will have one of the spouses establish the above-referenced trust for each other and the couple’s descendants, while the other spouse establishes a trust that solely benefits the couple’s descendants. This type of planning is in response to what is known as the “Reciprocal Trust Doctrine.”

The end of this year will be a contemplative time for wealthy individuals who are, or who have family who are, in intensive care, as there will be significant estate tax savings that could come with “pulling the plug.”

Surviving spouses who already have their portability allowance will not have this allowance reduced under this legislation.

EXAMPLE 2: Bob’s wife Gladys dies in 2021 and leaves all of her assets to Bob. Bob will then have an $11.7 million portability allowance, in addition to his own $3.5 million estate tax exemption if the law passes. Bob could therefore pass $15.2 million estate and gift tax-free, so long as he does not re-marry and the new spouse dies before him. In such situation, the new spouse’s portability allowance would be substituted for the amount of Gladys’ allowance “ported” to Bob.

New Year, New Limits: The gift tax exemption would be limited to $1,000,000 beginning January 1, 2022.

As previously mentioned, the current estate and gift tax exemptions are set at $11.7 million, minus whatever taxable gifts have been made previously. Such exemption is reduced whenever gifts are made that exceed $15,000 per person in any given year.

In Example 1 above, Bob has a $9.7 million exemption remaining after a prior gift of $2,000,000. If the legislation passes, Bob’s tax exemption will go down to $1 million in 2022, and after reducing this amount my prior gifts made, Bob will have no exemption remaining to make future gifts without paying gift tax.

In other words, Bob will only be able to gift the $15,000 of assets per year/per person without paying gift tax. Many families, in response to this change, will make significant gifts in 2021 in order to use the increased exclusion amount in case this legislation passes.

It is worth noting that many clients of the author and of other well-respected estate planning attorneys will choose to leave some of their exemption amount intact, to protect against the possibility of the IRS conducting a gift tax audit and finding that certain gifts were under-reported.

EXAMPLE 3: Frank owns 49% of ABC, Co., which is worth $30 million. The 49% ownership of the company is valued for Frank at significantly less than $15 million because of valuation discounts. These discounts account for the ownership share’s lack of marketability and lack of control. The courts do not align as to determining what percentage of valuation discount applies, but most claim that the determination involves the individual facts and circumstances. In many situations (such as this one), a compromise is struck and the valuation discount is placed somewhere between where Frank thinks it should be and where the IRS auditor thinks it should be.

A typical plan would involve Frank gifting the 49% ownership to a trust for the benefit of Frank’s wife and descendants. The transfer may be valued at $10,000,000 (assuming a 33.33% discount rate), which would leave $1,000,000 of exemption remaining as a buffer in case the IRS were to challenge the valuation of the company or the applicable discount taken so that no gift tax would be owed on any adjustment.

If the new law passes Frank would have no exemption remaining for future transfers, except for increases caused by inflation adjustments on the $1 million base exemption amount if an inflation adjustment is included in a final bill, as the exemption would drop to $1 million for gift tax and $3.5 million for estate tax, which is less than the amount Frank will have already gifted during his lifetime. Future transfers would need to be below $15,000/ per person or gift tax would be due and payable.

Many Are IrRATE at the Rate Increases.

The current flat estate tax rate of 40% will also go up in 2022 if the proposed bill is passed. This increase will make the rate a progressive rate beginning at 45% for taxable estates between $3.5 million and $10 million, 50% for estates between $10 million and $50 million, 55% for estates between $50 million and $1 billion, and 65% for estates over $1 billion.

EXAMPLE 4: Leonard dies with $2 billion in his estate in 2022. Leonard, before his death, never made a taxable gift. Leonard’s rates are as follows:

45% – After accounting for the $3.5 million exemption, the next $6.5 million (for a total of $10 million in assets).

50% – The next $40 million (a total of $50 million in assets).

55% – The next $950 million in assets (from $50 million to $1 billion).

65% – Anything that is above $1 billion in assets.

One of the biggest victors of this change would be charities. It is likely that many will benefit under this legislation as individuals seek to donate large amounts of money during their lifetime in order to maximize deductions and reduce estate tax exposure. Many families establish their own private foundations that can qualify for these deductions and allow for family members to control the foundations and even receive compensation for services rendered, as long as the charitable foundation rules are followed. This should increase if this Act is passed. IRA’s can also pass to such foundations to avoid both income tax on withdrawal and estate taxes, where the combined tax rate on death can exceed 75%, or more. While charities should be excited, they should be sure to remember that any changes that this legislation might bring would not go into effect until the beginning of 2022.

Taxpayers have approximately nine more months to plan accordingly for these changes. As mentioned above, moving fast is important as many of the key strategies in planning for this legislation (such as irrevocable trusts and certain discounts) will be rendered unavailable should this Act pass.

Do not get discouraged, however, as many great estate planning techniques will still be available after this legislation’s potential passing. These include:

- Low-interest rate promissory note installment sale planning between family members;

- Self-canceling installment notes; and

- Charitable Lead Annuity Trusts (CLATs).

While the above planning tools are excellent, the three tools that will either be disappearing completely or curtailed heavily under this act are even more helpful to most individuals. These (soon-to-be-gone) tools are:

- Grantor Retained Annuity Trusts (GRATs);

- Grantor Trusts; and

- Family entity discounts.

Should this act pass, the following outlines some of the other changes that are set to occur:

ELIMINATING DISCOUNTS FOR NON-BUSINESS ENTITIES AND ASSETS.

Married couples can presently place $15 million of assets into an LLC and then each spouse can then sell a 49% ownership in that LLC to an irrevocable trust in exchange for a $5 million note each (which assumes a 33.33% valuation discount)

This type of valuation would not be possible under this new Act. The new Act would amend the IRC and require that family entities base their valuation on the pro-rata percentage of ownership times the value of all the underlying assets. The exceptions to this valuation rule under the new legislation are very slim.

The legislation includes new look-through rules which seek to prevent against entitles abusing the valuation discount rules. Under this new legislation, even a 10% ownership of an entity being held by an entity will be valued at 10% of the value of the assets owned by such entity. Presumably, ownership of less than 10% can be discounted, but this takes away significant discounts that used to apply to minority ownership interests.

THEY WORKED OUT THE “DEFECTS” IN GRANTOR TRUSTS.

In what is a crushing blow to estate planning and tax professionals across the U.S., Section 2901, which would be added to the IRC under this legislation, would mandate that any trust which is created, funded, or transacted with after the date of enactment of the law, and is considered to be owned by the Grantor for income tax purposes or by a person that exchanges assets with such trust, will be subject to federal estate tax on the death of the Grantor as if the Grantor him or herself owned the trust’s assets.

Good-bye “Defective Grantor Trusts,” given that the passage of this law will make it essential that grantor trusts be fully funded and established before the enactment of such legislation.

To recap: Currently, a taxpayer can create a trust that will (a) not be subject to federal estate tax but (b) will be considered as owned by that taxpayer for income tax purposes. Doing so enables the taxpayer to pay the income tax on trust earnings without the payment of such taxes being considered a gift. Alternatively, a taxpayer can sell significant assets to the trust in exchange for long-term low interest rate promissory notes, special notes that may vanish on death, or special arrangements called “Private Annuity Sales” that may be used without triggering income tax on the exchange. The taxpayer may also exchange assets with the trust on an income tax-free basis.

This income tax-free nature will be eliminated under the new Act. Because of this, the time to act is now for individuals who have been intending to exchange low-interest promissory notes for other trust assets in order to freeze any future appreciation. If you wish to know more about these techniques, please see Alan S. Gassman, Jerome B. Hesch & Martin B. Shenkman on the Biden 2-Step for Wealthy Families: Why Affluent Families Should Immediately Sell Assets to Irrevocable Trusts for Promissory Notes Before Year-End and Forgive the Notes If Joe Biden Is Elected, A/K/A What You May Not Know About Valuing Promissory Notes and Using Lifetime Q-Tip Trusts LISI Estate Planning Newsletter 2813 (August 10, 2020).

To learn more about the use of installment sales and Grantor Trusts, please see the YouTube video at https://www.youtube.com/watch?v=4e7utgxtn7A&t=1534s. This video was recorded with Professor Jerry Hesch and estate tax planning lawyer Marty Shenkman in September, 2020. The relevant discussion begins at 6 minutes and 30 seconds into the presentation. WARNING: This is a pretty deep dive into the nitty-gritty of the law. This is primarily aimed at tax advisors, tax professionals, those who like mathematical discussions, and those who have trouble going to sleep.

STEP RIGHT UP FOR GOOD NEWS: THE GREAT BASIS STEP UP IN THE SKY STILL APPLIES ALBEIT WITH SOME SLIGHT MODIFICATIONS.

One piece of good news from the legislation is that capital gains taxes may still be avoided when the estate of a recently-deceased person is sold, as IRC 1014 still provides that any assets owned at death will receive a step up (or step down) in basis equal to their fair market value “date of death” amount.

EXAMPLE 5: Olivia owns stock worth $100,000 on death that cost her $10,000 initially. If Olivia’s family sells the stock for $110,000 after Olivia’s death, then only $10,000 is taxed as capital gains.

The question remains, however, what would happen if Olivia were to gift stock before she died to an irrevocable trust that was (a) located outside of her estate for estate tax purposes, but (b) considered to be owned by her for income tax purposes?

Under this new legislation, when the owner of a Defective Grantor trust dies, no fair market value (FMV) income tax basis will be assigned for the assets of the trust unless the trust is included in the Grantor’s estate. This is a definite defeat for those with existing grantor trusts who wished to continue those trusts’ existence until death.

There is still uncertainty in the law as to whether a new FMV income tax basis will be received when the Grantor of a trust disregarded for income tax purposes dies. Estate planning experts are split as to whether the step- up should be received. This pending law change is evidence that those who pre-decease the law’s enactment should get the step up in tax basis.

This provision would apply for all irrevocable trusts, including those formed prior to the passage of this Act, that are treated as owned by the Grantor of the trust.

TRUE GRIT ABOUT GRATs.

This legislation would severely impact the efficacy of an important planning structure known as the Grantor Retained Annuity Trust (GRAT).

Using a GRAT, a taxpayer can place assets in a trust and have all growth (exceeding a fairly low rate-of-return) pass to family members without such passage being considered a “gift” for tax purposes.

The Walton family, behind the Wal-Mart brand, brought the GRAT to the attention of many by winning an IRS Tax Court case that sought to challenge the ability to set up a short-term GRAT. Their involvement with GRATs even led to the popularization of the term “Walton GRAT.”

Using a “Walton GRAT,” a taxpayer could put up to $10 million worth of stock in a trust that pays back $5 million each year plus a small interest payment, for two years. Anything that remains after those two annual distributions can pass to children free of estate taxes. The Walton case found that the funding of such a GRAT as described in this case is not considered a gift.

In contrast to the above, the “anti-Walton” GRAT provision in the new legislation would require GRATs to have a minimum term of ten (10) years, and for there to be a minimum gift considered to have been made on the funding of the GRAT that would have to be at least equal to either:

- 25% of the fair market value of the property placed in the GRAT; or

- $500,000, depending upon the circumstances.

Similarly to defective grantor trusts, this legislation will cause GRATs to be much less attractive as an estate tax avoidance technique. Many savvy families will be forced to enter into GRAT transactions immediately so as to be grandfathered in if and when the Act is signed into law.

YOU CAN TRUST THAT MULTI-GENERATIONAL FAMILIES WILL NOT BE HAPPY.

One of the most controversial portions of the Sanders Plan is the requirement that long-term, multi-generational trusts be taxed occasionally as generations die.

As the law currently stands, long-term trusts can be established for beneficiaries and the trustee given the discretion to make distributions under an ascertainable standard, which will generally be for the “health, education, maintenance and support” of the applicable beneficiaries. This type of trust can benefit multiple generations without ever being subject to federal estate tax. This estate tax evasion even extends as new generations become beneficiaries.

The new legislation would cap a trust that would otherwise be exempt from the generation-skipping tax (GST) to a 50-year term and will cause pre-existing trusts to be deemed “terminated” 50 years after the passage date of the Act. If this new act passes, you will not catch a multi-generational trust saying “I’ll be back.”

What remains for pre-funded Dynasty Trusts is still unclear, but it seems that the intention of the law is clear and the IRS will have the authority to proscribe whatever regulations necessary to carry out the Act.

ANNUAL GIFTING TECHNIQUES CURTAILED.

Beginning January 1, 2022, the $15,000 per donee gift tax exemption will be limited to $30,000 per donor with respect to certain transfers.

Under the law, the $15,000 per year gift tax exclusion will be adjusted with inflation in increments of $1,000. The maximum “per donor” amount for qualifying transfers will increase accordingly.

EXAMPLE 6: Abraham’s $15,000 per year annual gift tax exclusion increases to $16,000, but he is still curious what his per donor amount is. Abraham’s per donor amount increased to $32,000 in this case with reference to the below mentioned “limitation transfers.”

As most sophisticated planners know, the annual exclusion can be leveraged by giving trust beneficiaries withdrawal rights to withdraw contributions made to a trust for a period of time (known as Crummey Powers). These contributions would qualify for the annual exclusion and thus reduce the amount of gift tax or exclusion used to fund a trust resulting in significant tax savings for trusts with multiple beneficiaries. For example, a $300,000 contribution to a trust with ten beneficiaries would result in no taxable gift if each beneficiary was given the right to withdraw a pro rata portion of the contribution.

These limitation transfers, to which the $30,000 per donor limitations apply, are as follows:

- A transfer into a trust;

- A transfer of an interest in certain family entities;

- A transfer of an interest in an asset that is subject to a prohibition on sale; and

- A transfer of an asset that cannot be immediately liquidated by the donee.

These limitations will also make it more difficult to transfer wealth from one generation to the next while still maintaining some degree of control over the use of such transferred assets.

EXAMPLE 7: Phil and Susan have four children. They can presently gift $120,000 of money or other assets into trusts. This amount is based upon the current $15,000 per parent, per child rule.

After this law passes, Phil and Susan will only be able to transfer a total of $60,000 into trusts for their children, while the other $60,000 that they would have transferred might have to be given to the children as gifts or transferred into 529 College Plans.

DID THEY GIVE AWAY THE FARM?

Farms and conservation easements are the target of the final changes of the legislation.

The Act provides for greater benefits for estates that use their property for farming or another family business that will keep the business in the family for 8+ years after the death of the Grantor.

Currently, families that use portions of their property for “qualified” purposes, as described above, may reduce the applicable value for estate tax purposes to take into account the decreased value the property would be worth if based on its historical trade/farming use. This limit, which is currently $1.19 million as indexed for 2021, stands to be increased to $3 million under this Act, with the number still set to index with inflation.

Additionally, the maximum estate tax exclusion amounts for conservation easements increased dramatically. The limit, which used to be $500,000, has quadrupled to $2 million and may be increased even further in the future.

Conclusion

This piece of legislation, whose fate is still undetermined, could have a profound impact on millions of American families hoping to plan for the future. Many, especially given the Coronavirus pandemic and the government’s slow response, have not expected sweeping changes to estate tax laws to occur. Such families will need to act fast if they want to preserve their wealth in what could be one of the most significant estate tax changes in decades.

HOPE THIS HELPS YOU HELP OTHERS MAKE A POSITIVE DIFFERENCE!

CITE AS:

LISI Estate Planning Newsletter #2873 (March 29, 2021) at http://www.leimbergservices.com, Copyright 2021 Leimberg Information Services, Inc. (LISI). Reproduction in Any Form or Forwarding to Any Person Prohibited – Without Express Permission. This newsletter is designed to provide accurate and authoritative information in regard to the subject matter covered. It is provided with the understanding that LISI is not engaged in rendering legal, accounting, or other professional advice or services. If such advice is required, the services of a competent professional should be sought. Statements of fact or opinion are the responsibility of the authors and do not represent an opinion on the part of the officers or staff of LISI.

The American Rescue Plan Act: Important New Updates for Small Business Owners

Barry Portugal, Alan Gassman, and Brandon Ketron

Free LIVE Stream April 7th

5:30 PM to 7:00 PM

Register Now

This free LIVE stream will cover important topics to small business owners regarding:

- The American Rescue Plan Act (ARPA) signed by the President in March. Learn how the latest stimulus bill includes more funds for PPP loans, EIDL, EIDL Advance and related employer/employee issues.

- The Employee Retention Tax Credit Act allows up to $10,000 in tax credit per employee for eligible businesses.

- The recently announced $28.6 billion in grants for the Restaurant Revitalization Fund and the soon to be available $2 billion Shuttered Venue Operator Grants.

Find out if your business qualifies for any of the above grants and loans and how to apply to receive them. You can also direct your questions to the most prominent experts in this field.

Upcoming Events

Register for all future free webinars from Gassman, Crotty & Denicolo, P.A. using this link

| When | Who | What | How |

|---|---|---|---|

| Wednesday, April 7, 2021 | SCORE Manasota |

Barry Portugal, Alan Gassman and Brandon Ketron present: The American Rescue Plan Act: Important New Updates for Small Business Owners from 5:30 to 7 PM EDT |

Register |

| Tuesday, April 20, 2021 | Free webinar from our firm |

Alan Gassman, Shannon Summerlin and Andrea Fourman present: Tax-Smart Giving for UF Law Alumni from 12:30 to 1:20 PM EDT |

Register |

| Wednesday, April 21, 2021 | Free webinar from our firm |

Alan Gassman and Dr. Luz D. Randolph present: A Survey of Charitable Gifting Vehicles from 12:30 to 1:30 PM EDT |

Register |

| Monday, May 10, 2021 | Paralegal Association of Florida: Pinellas Chapter |

Alan Gassman presents: Making Your Job Better and Your Firm More Successful – the Legal Assistant’s Guide to Liberation and Effectiveness from 12 to 1 PM ET |

Coming soon |

| Thursday, May 13, 2021 | FICPA-FSU Spring Accounting Conference |

Alan Gassman presents: Fine Tuning and Improving Estate and Asset Ownership Planning For All Categories of Clients from 12:50 to 1:40 PM EDT & The Florida CPA’s Practice Guide to Effective Creditor Protection Planning from 1:50 to 2:40 PM EDT |

Register |

| Wednesday, May 19, 2021 | Free webinar from our firm |

Alan Gassman and Dr. Luz D. Randolph present: Private Foundations from A to Z. How Private Foundations help Donors help Public Charities and Causes from 12:30 to 1:30 PM EDT |

Register |

| Friday, May 21, 2021 | Michigan ICLE Annual Probate & Estate Planning Institute |

Alan Gassman presents: Prebankruptcy and Bankruptcy Avoidance Strategies for Challenging Situations from 11:15 AM to 12 PM CT |

Register |

| Tuesday, June 15, 2021 | Association of Insolvency and Restructuring Advisors’ Pre-conference Bankruptcy Tax Toolbox |

Alan Gassman and Christopher Denicolo present: Tax Planning for Troubled Companies Involving CODI |

Register |

| Wednesday, June 16, 2021 | Free webinar from our firm |

Alan Gassman and Dr. Luz D. Randolph present: Life Insurance Planning, including Term Life Insurance for Charitable and Non-Charitable Purposes from 12:30 to 1:30 PM EDT |

Register |

| Wednesday, July 21, 2021 | Free webinar from our firm |

Alan Gassman, Dr. Luz D. Randolph and Michael Lehmann present: Charitable Planning for the Business Owner from 12:30 to 1:30 PM EDT |

Register |

|

NEW DATES! Thursday, July 26-29, 2021 |

AICPA & CIMA ENGAGE 2021 in Las Vegas, NV |

Alan Gassman and Ken DeGraw present: Pre-Bankruptcy and Creditor Planning During the COVID-19 Pandemic |

Register |

| Thursday, November 4, 2021 | Estate Planning Council of Birmingham |

Alan Gassman presents: Hot Topics In Estate Tax And Creditor Protection from 8 to 10 AM CT |

Coming soon |

Call us now! Bookings accepted for haunted houses, bar mitzvahs, weddings, seminars, and symposiums (or symposia)!

From the Law Clerks

Grace Paul is a Law Merit Scholarship Recipient who is studying for her J.D. at the Stetson University College of Law (Expected graduation May 2023)

ISSUE:

I was asked to further research a grantor’s duty and presumption to have read and understood the instrument before signing.

EXECUTIVE SUMMARY:

The widely accepted rule is that parties to a contract have a duty to read the instrument before signing and are presumed to have read and understood the agreement. The Florida case, Wexler v. Rich, stated that freedom to contract includes the freedom to make a bad bargain. Wexler v. Rich, 80 So. 3d 1097, 1100 (Fla. Dist. Ct. App. 2012). Florida adheres to the principle that a party has a duty to learn and know the contents of a proposed contract before he signs. Id. A district court case in Nevada held similarly, stating that a “party who signs a contract is bound by its terms regardless of whether he reads it or considers the legal consequences of signing it”. Trustees of Bricklayers & Allied Craftworkers Loc. 13 Defined Contribution Pension Tr. for S. Nevada v. Cont. Flooring & Interior Servs., Inc., No. 2:12-CV-00659-KJD, 2012 WL 4863060, at *3 (D. Nev. Oct. 10, 2012). Other jurisdictions have followed a similar rule as the Florida and Nevada courts. See. Operating Engineers Pension Tr. v. Gilliam, 737 F.2d 1501, 1504 (9th Cir. 1984), Taylor v. Godsey, 357 So. 2d 979, 981 (Ala. 1978), Ballard v. Com. Bank of DeKalb, 991 So. 2d 1201, 1207 (Miss. 2008).

Forbes Corner

Mar 27, 2021

Senate Estate And Gift Tax Bill Will Reduce Exemption To $3,500,000 And Take Away Many Opportunities

Senator Bernie Sanders released his proposed estate and gift tax reform legislation on Thursday, March 25, to the displeasure of a great many American families and their advisors. Senators Kirsten Gillibrand, Jack Reed and Chris Van Hollen reportedly co-sponsored this plan…Continue reading on Forbes

Want to Help Your Direct Reports Grow? Stop Answering Their Questions. Here’s Why

David Finkel

Ask any small business owner what they spend the majority of their time on, and you will likely hear something along the lines of:

“I spend it putting out fires.”

“I spend it answering employee questions and helping them do their jobs.”

“I spend it helping my team with problems and challenges.”

You are probably pretty accustomed to having direct reports come to you for help with problems and challenges. It takes up the bulk of your day and is often spent on fixing issues that don’t have a direct impact on the growth of your company. And I bet you often give them the answers — “Sure, Tina. Here’s what you should do…..”

While it may seem easier (and quicker) to just help your team members get over any hurdles that they face along the way, you are better off letting them answer their own questions and fix their own problems.

So the next time Tina comes to you and asks what she should do, flip the question on her. Ask, “What do you think we should do?”

A Better Way

Allowing your team members to fix their own problems, takes a little bit of faith and a whole lot of professional coaching. Everyone on your team has different strengths and weaknesses, and it is important to remember that when using this method. If a team member is mature and experienced in their role I might say, “I trust that you can handle this yourself.” I’ll ask her how she thinks she should handle it and then encourage her to try doing that.

If a team member is less experienced, I might try a slightly different approach. “Well Jim, I’ve got some specific thoughts for you that I’ll share in a moment. But before I do, tell me what you think you should do here? If I wasn’t around, how would you handle this?”

Of course, if he has a great answer, then you can say something like, “Wonderful, go ahead and make that happen. I can’t wait to hear how you do with that.” And if he comes up with a crazy, outlandish idea, ask him why he thinks that’s the best approach. Consider questions like, “If you weren’t able to do that, then what would you do? Why would you do that instead? Have you taken these other ideas into consideration?”

Approaching the question this way not only helps you come to the best solution possible but allows the team member to grow and develop within their role in the company. Over time they will begin to feel more confident in their decision-making skills, and take on more within the business. And rely on you less to help them do their day-to-day tasks.

Once you get into the habit of having your team members answer their own questions, you will find that they will begin to take ownership of the process and come to you for the things that they truly need your input on. Thus, allowing you to create a scalable business that is owner-independent.

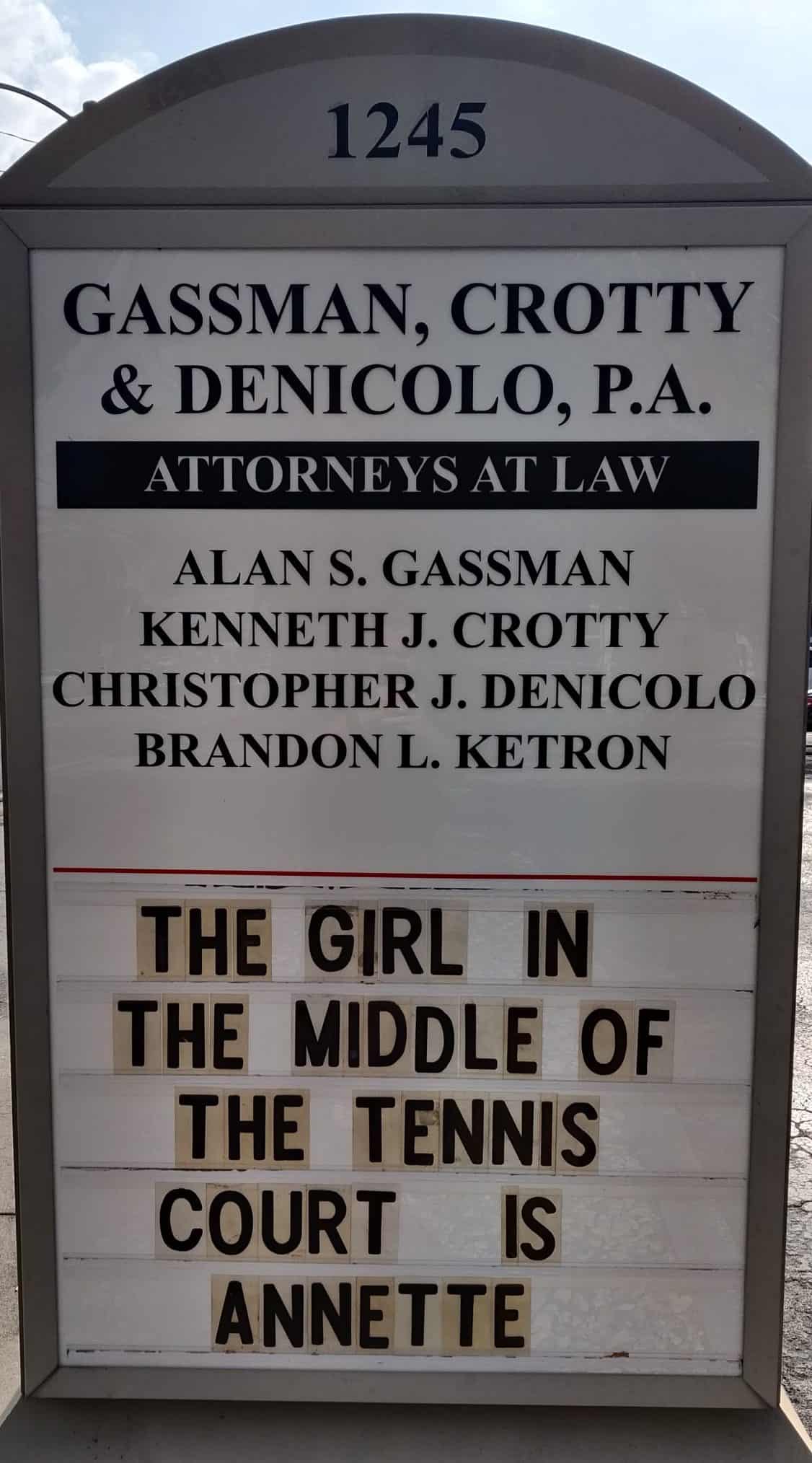

Humor

Gassman, Crotty & Denicolo, P.A.

1245 Court Street

Clearwater, FL 33756

(727) 442-1200