The Thursday Report – Issue 299

ALWAYS FREE, SOMETIMES PUBLISHED ON THURSDAYS

Thursday, March 4, 2021 – Issue 299

Having trouble viewing this? Use this link

Now is your chance to become a “PPP Enthusiast” by signing up here, contact info@gassmanpa.com if you encounter issues.

Forbes Corner

HHS Provider Relief Rules and Deadlines Modified by the January 28 and January 15 Announcements, with a Useful Summary of Other Available Programs for All Businesses

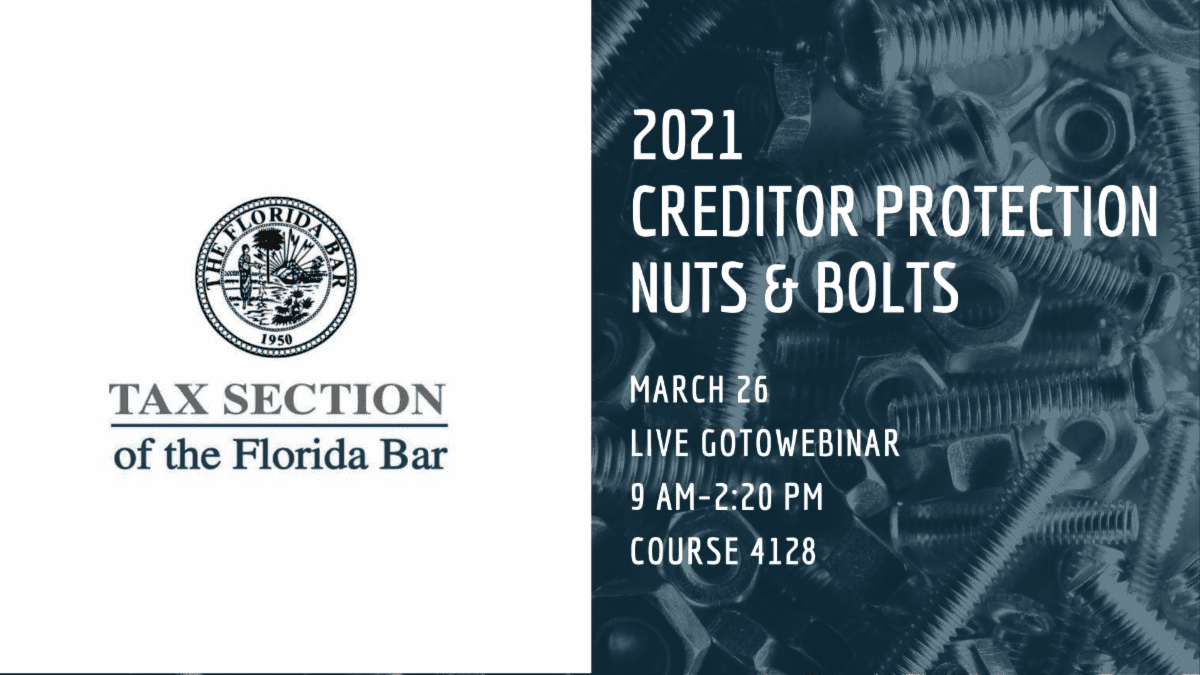

2021 Creditor Protection Nuts & Bolts

Upcoming Events

Changes From the 2020 Regular Legislative Session

Renting Out Your Home Sweet Homestead

For Finkel’s Followers

Humor

Forbes Corner

This week both the IRS and SBA have provided clarification on stimulus programs for business. Below you will find my contributions to Forbes on the subject.

The New $10,000 EIDL Program Under The $1.9 Trillion Stimulus Package

The new House Resolution 1319, titled the American Rescue Plan Act of 2021, creates a $10,000 EIDL targeted advance that will be available to businesses and nonprofit organizations that previously applied for the original EIDL Advance program…Continue reading on Forbes

March 1st IRS Notice Provides Essential Guidance And Safe Harbors For The Employee Retention Credit

On Monday, March 1st, the IRS released 102 pages of well-written and reasoned guidance on the Employee Retention Credit (ERC) in the form of Notice 2021-20. While further guidance will be forthcoming as to the application of these rules for 2021, the provisions of the Notice provide considerable…Continue reading on Forbes

SBA PPP Pronouncement Provides Higher Loans And Other Changes For Proprietors And Independent Contractors

In an Interim Final Rule announcement on Wednesday, March 3, 2021, the SBA issued new rules which provided a number of important changes for independent contractors and sole proprietors, which are discussed below…Continue reading on Forbes

PPP Law Changes Under $1.9 Trillion Stimulus Package

Under the proposed $1.9 trillion stimulus package, the Paycheck Protection Program would be expanded to provide loans to more categories of not-for-profit entities…Continue reading on Forbes

Delinquent Student And Non-Fraud Past Felons Can Now Receive PPP Loans

The new Interim Final Rule issued by the SBA on March 3, 2021 reverses the prior rules by indicating that independent contractors and employers who were otherwise eligible to receive PPP loans may do so regardless of whether the borrower or a 20% or more owner is in default under Federal Student…Continue reading on Forbes

HHS Provider Relief Rules and Deadlines Modified by the January 28 and January 15 Announcements, with a Useful Summary of Other Available Programs for All Businesses

Alan Gassman & Brandon Ketron

EXECUTIVE SUMMARY:

The HHS Provider Relief Program was established under the CARES Act on March 27, 2020 and resulted in over $178 billion being distributed to medical practices, medical businesses and hospitals. It was based upon a somewhat random but consistent criterion. The end result for most health care providers and businesses has been the receipt of distributions which are equivalent to approximately 2% of the 2019 gross receipts for each business or practice based upon tax return reporting.

The first provider relief payments distributed in April and May of 2020 were based upon approximately 1.99% of each Medicare provider’s 2019 total Medicare payments. The second round of provider relief payments consisted of large payments which arrived in June and July of 2020, and were intended to provide each practice and business with enough extra money to amount to a total of 2% of the 2019 reported receipts from patient care. This allocation of money was fair and reasonable for many providers but not nearly enough for others, and there were some windfalls.

For example, a rheumatologist might have a practice that is very similar to that of an internist financially, except that a rheumatologist may sell medications for $1 million a year that cost him/her $920,000. Instead of receiving extra money based upon an $80,000 differential, he/she would have received extra money based upon a $1 million dollar differential, resulting in a windfall. It is important to note that the HHS payment received is considered to be taxable income, however, the payment of the tax on that income is considered to be an expense for purposes of determining how much, if any, of the HHS payment has to be returned to the government.

As further described below, the HHS payment is subject to reporting and must be refunded in whole or in part by any practice that did not suffer from lost revenues or increased expenses. These medical practices and businesses may be able to keep what they received, but not all of them. For example, infectious disease doctors who primarily provide inpatient hospital services, and medical businesses that support inpatient hospital services, may have had more revenues and fewer additional expenses due to the COVID-19 virus crisis.

COMMENT:

Before reviewing how revenues and expenses are measured for the purposes of determining whether there should be a repayment, we should mention how the HHS Provider Program is impacted by the other CARES Act financial benefit programs and how it is reflected on medical practices and businesses. Most importantly, there is no direct ban under the CARES Act on accepting payment from the Provider Relief Fund and the other programs, so long as the payment from the Provider Relief Fund is used only for permissible purposes and the recipient complies with the Terms and Conditions. By attesting to the Terms and Conditions, the recipient certifies that it will not use the payment to reimburse expenses or losses that have been reimbursed from other sources or that other sources are obligated to reimburse. For example, a medical practice that received both the Provider Relief Fund and a Paycheck Protection Program loan cannot count increased expenses attributable to the virus for both the Provider Relief Fund and PPP Loan Forgiveness.

THE PAYCHECK PROTECTION PROGRAM (PPP)

The PPP provided most small to mid-sized American businesses and medical practices with a loan payment based upon approximately 20.833% (2.5 ÷ 12) of a business’s or practice’s previous twelve-month payroll. The loan was, or will be, forgiven to the extent that payroll and other enumerated expenses are paid by the business during the testing period of up to twenty-four weeks.

The PPP Loan, as well as the fact that it was forgiven, should not be counted as revenues for purposes of determining whether there must be any repayment of the HHS provider relief amount, although the expenses that count towards PPP forgiveness cannot also be included in determining increased expenses for purposes of the HHS provider relief payments. This “double counting” is not permitted under any of the CARES Act relief programs, including the HHS Provider Relief Fund, PPP, Employee Retention Credit, and use of EIDL Loan funds.

The PPP second draw program will work the same way as the first PPP program, but businesses must also show a 25% reduction in revenues for a calendar quarter to be eligible. The loan must still be “necessary” and will generally be the same amount as the first loan for most medical practices.

EMPLOYEE RETENTION CREDIT (ERC)

Many employers who were not able to take advantage of the Employee Retention Credit now can. Until December 27, 2020, PPP borrowers were not permitted to receive both the PPP loan and the Employee Retention Credit. The PPP loan was a better arrangement for the vast majority of businesses and practices, but now the Economic Aid Act has dropped this restriction and the credit can apply retroactively to applicable quarters of 2020.

A great many medical providers and businesses were pleased to learn, or are just now realizing, that significant payments can now be received by businesses and practices that suffered a 50% reduction in receipts during the second, third, or fourth quarter of 2020 in comparison to the same quarter in 2019, or had a partial suspension of their business operations as a result of the virus. The 2020 ERC is based upon 50% of wages paid up to $10,000 per employee, and therefore cannot exceed a $5,000 credit per employee for all quarters for which the employer is eligible. This means that a medical practice that had ten employees earning $6,000 a quarter could receive a $3,000 credit for each such employee for the first quarter that it qualifies, and another $2,000 credit per employee for the second quarter that it qualifies.

The rules for the credit are complicated, and the above explanation and example are significantly oversimplified.

The ERC opportunity for a medical business or provider is significantly improved for 2021, because an employer will qualify for the first quarter of 2021 if receipts for the first quarter are less than 80% of the receipts for the first quarter of 2019, or alternatively can qualify if the receipts for the fourth quarter of 2020 are less than 80% of receipts for the fourth quarter of 2019. The business could also qualify for the credit if it was partially suspended as a result of shut down orders, which likely will not impact many medical practices. The credit is now up to 70% of wages paid to each employee, but not exceeding $7,000 per employee per quarter. This means that up to $14,000 per employee can be received by an employer who qualifies for both the first and second quarters in 2021.

To qualify for the second quarter, the receipts in the second quarter of 2021, including any HHS provider relief payments, must be 80% or less than the receipts for the second quarter of 2019, or alternatively receipts in the first quarter of 2021 are less than 80% of receipts for the first quarter of 2019.

IMPACT ON THE NECESSITY REQUIREMENT

Employers may only receive PPP loans if they meet the “necessity requirement.” PPP borrowers must certify that the loan was “necessary to support the ongoing operations of the business.” If an employer is expecting or has received a large ERC payment or HHS Provider Relief Funds, then they may not be able to meet the necessity requirement for PPP loans. The ability to receive an Employee Retention Credit for 2020 is a significant windfall for practices and businesses that have fully or almost fully recovered from the virus crisis, and is perhaps a reward for being successful and financially stable.

THE ECONOMIC INJURY DISASTER LOAN PROGRAM (EIDL)

The Economic Injury Disaster Loan Program consists of two parts. The first part provides each applicable business or practice a grant that turned out to be the lesser of (1) $10,000 or (2) $1,000 per employee. This grant (not a loan) aimed to reduce the amount of PPP forgiveness that a business or practice would otherwise receive. The December Economic Aid Act provided that the EIDL grant is tax-free and will not reduce PPP forgiveness – it is essentially “free money.”

The second part of EIDL essentially consists of loans from the small business association (SBA) that bear interest at 3.75% and may be amortized over thirty years. Small businesses, including independent contractors and sole proprietors, with less than five hundred employees that have suffered substantial economic injury as a result of a declared disaster can apply for an EIDL loan. What is considered a “substantial economic injury”? The 2011 SBA Regulations provide as follows:

-

A business that sustains a substantial economic injury is unable to meet its obligations as it matures or to pay its ordinary and necessary operating expenses.

-

Loss of anticipated profits or a drop in sales is not considered substantial economic injury for this purpose.

Essentially, the EIDL loans are reserved for businesses that would be forced to shut down or lay off employees if they did not receive the EIDL loan. If a business received an EIDL loan and did not meet the standard for “substantial economic injury,” there may be some serious consequences later. For example, if a business ends up in bankruptcy and cannot repay the EIDL loan that it should not have received, it is possible that the Department of Justice may claim that it was a crime to receive the loan and a bankruptcy may be denied, with criminal charges filed.

In addition to the strict qualification requirements, there are also numerous guidelines for what you can spend the EIDL loan on. The EIDL loan documents provide that the proceeds of the loan must be used “solely as working capital to alleviate economic injury”. The loan cannot be used as a gift, bonus, or loan to any owner, partner, or employees without approval from the SBA. EIDL loan recipients must also provide proof that they complied with the spending restriction. The borrower must obtain itemized receipts for all EIDL funds spent and retain those receipts for three years after the date of the final disbursement.

In general, we discouraged our clients from applying for an EIDL loan unless it was desperately needed to keep the business open, but if you have already done so, it is probably best to pay it off as quickly as possible. If, however, you are unable to pay back your EIDL loan, there may be another option. The SBA’s January 6, 2021 Interim Final Rule provides a complicated provision that may allow EIDL loans made between January 31, 2020 and April 3, 2020 to be refinanced into PPP loans. We are still analyzing how this will work and what impact it will have on borrowers. That being said, we do know that borrowers will not be allowed to refinance an EIDL loan into a second draw PPP loan.

HHS PROVIDER RELIEF FUNDS

Now that we have reviewed the other CARES Act financial benefit programs, we can turn our attention to the HHS Provider Program. It is important to note that the HHS funds are paid to the business or practice entity that billed to Medicare, or was otherwise the owner of the business or practice, without regard to whether doctors or other health care providers who worked for the practice or business are still owners or still work there. This has resulted in many situations where doctors who left the practice and formed their own practice have received nothing, while those who were left with a smaller practice have received the entire payment and an economic windfall.

In addition, it is noteworthy that the new law provides that creditors cannot reach Provider Relief Funds. Medical practices and businesses that have received monies and have cash amounts and creditor concerns should earmark Provider Relief Funds. Perhaps spend them on permitted expenses only when necessary to enhance creditor planning.

Let us now review what the definitions of lost revenues and COVID-19 related expenses are for purposes of determining whether the combined loss of revenues and COVID-19 related expenses will exceed the Provider Relief Funds received.

The first question is what period of time the loss of revenues and COVID-19 expenses are to be tracked. The answer is that these can be tracked until the total disparity equals or exceeds the total Provider Relief Funds up until June 30, 2021. The vast majority of medical practices and businesses had lost receipts and increased expenses that more than exceeded the amount of Provider Relief Funds received during 2020, but those practices who have not had sufficient loss of revenues and COVID-19 expenses to justify full forgiveness can add in the loss of revenues and COVID-19 expenses incurred through June 30, 2021, and possibly longer if this is extended, to arrive at full “forgiveness”.

“Lost Revenues Attributable to Coronavirus”

The technical language of the statute defines revenue loss as:

To remain available until expended, to prevent, prepare for, and respond to coronavirus, domestically or internationally, which shall be for necessary expenses to reimburse, through grants or other mechanisms, eligible health care providers for health care related expenses or lost revenues that are attributable to coronavirus.

There was virtually no guidance on what the words “lost revenues” actually meant, but we did finally receive the below quoted guidance in the form of a Post-Payment Reporting Notice on January 15, 2021 and FAQs issued by HHS on the Provider Relief Fund, which indicate that revenues will mean any revenue that a health care practice lost due to coronavirus, which may include fewer outpatient visits, canceled elective procedures or services, or increased uncompensated care.

Information used to calculate lost revenues attributable to coronavirus, as provided in the HHS’s Post-Payment Notice of Reporting Requirements (issued on January 15, 2020), is as follows:

Total Revenue/Net Charges from Patient Care Related Sources in 2020: Revenue/net charges from patient care (prior to netting with expenses) for the calendar year 2020. Calendar year actual revenues will be entered by quarter (e.g., January–March 2020) and by payer mix:

Medicare Part A or B: Actual revenues/net charges received from Medicare Part A or B for patient care for the calendar year.

Medicare Part C: Actual revenues/net charges received from Medicare Part C for patient care for the calendar year.

Medicaid/Children’s Health Insurance Program (CHIP: Actual revenues/net charges received from Medicaid/CHIP for patient care for the calendar year.

Commercial Insurance: Actual revenues/net charges from commercial payers for patient care for the calendar year.

Self-Pay (No Insurance): Actual revenues/net charges received from self-pay patients, including the uninsured or individuals without insurance who bear the burden of paying for health care themselves, for the calendar year.

Other: Actual gross revenues/net charges from other sources received for patient care services and not included in the list above for the calendar year.

The term “patient care” means health care, services and supports, as provided in a medical setting, at home, or in the community. It should not include:

1) insurance, retail, or real estate values (except for SNFs, where that is allowable as a patient care cost), or 2) grants or tuition unrelated to patient care.

The same Post-Payment Notice of Reporting Requirements indicates that an organization can calculate lost revenues in three ways:

The difference between 2019 and 2020 actual patient care revenue.

Reporting Entities electing to calculate lost revenues attributable to coronavirus using the difference between their 2019 and 2020 actual patient care revenue must also submit Revenue from Patient Care Payer Mix as outlined above for the 2019 calendar year (by quarter).

The difference between 2020 budgeted and 2020 actual patient care revenue.

Reporting Entities electing to calculate lost revenues attributable to coronavirus using the difference between their 2020 budgeted and 2020 actual patient care revenue must submit their 2020 budgeted amount of patient care revenue. Recipients must also submit: 1) a copy of their 2020 budget, which must have been approved before

March 27, 2020, and 2) an attestation from the Reporting Entity’s Chief Executive Officer, Chief Financial Officer, or similar responsible individual, attesting under 18 USC § 1001 that the exact budget being submitted was established and approved prior to March 27, 2020.

For example, a medical practice that received approximately $20,000 a month over the two years ending in February 2020 may have budgeted to receive $25,000 a month because they were adding a new doctor, new equipment, or engaging in a new marketing program.

Even though none of the things that they expected to occur to enhance revenues were implemented, the practice can compare their actual revenues to the budgeted $25,000 per month amount in the calculation of lost revenues.

An Alternative Methodology

Reporting Entities electing to calculate lost revenue attributable to coronavirus using an alternate methodology must submit a description of the methodology, a calculation of lost revenues attributable to coronavirus using that methodology, an explanation of why the methodology is reasonable, and a description establishing how lost revenue was in fact a loss attributable to coronavirus, as opposed to a loss caused by any other source.

We also now know that lost revenues can be determined using a method other than the measurement of receipts for a comparison to budgeted receipts or 2019 receipts by asking the HHS to accept another reasonable method of determining your medical business’s lost revenues and why those losses were because of coronavirus.

“Health Care Related Expenses Attributable to Coronavirus”

The technical language of the statute defines health care related expenses as:

To remain available until expended, to prevent, prepare for, and respond to coronavirus, domestically or internationally, which shall be for necessary expenses to reimburse, through grants or other mechanisms, eligible health care providers for health care related expenses or lost revenues that are attributable to coronavirus.

Fortunately, the January 15th Post-Payment Notice of Reporting Requirements also provides guidance on what expenses are considered to be “health care related expenses attributable to coronavirus” and can therefore be used for the HHS provider program. These expenses fall into two broad categories: 1) General and administrative; and 2) Other health care related expenses.

Guidance from HHS additionally provides the following:

Reporting Entities that received between $10,001 and $499,999 in aggregated PRF payments are required to report health care related expenses attributable to coronavirus, net of other reimbursed sources (e.g., payments received from insurance and/or patients, and amounts received from federal, state, or local governments, etc.) in the two categories.

Reporting Entities that received $500,000 or more in PRF payments are required to report health care related expenses attributable to coronavirus, net of other reimbursed sources, in greater detail than the two categories of G&A expenses and other health care related expenses.

General and Administrative Expenses Attributable to Coronavirus include:

Mortgage/Rent: Payments related to mortgage or rent for a facility.

Insurance: Premiums paid for property, malpractice, business insurance, or other insurance relevant to operations.

Personnel: Workforce-related actual expenses paid to prevent, prepare for, or respond to coronavirus during the reporting period, such as workforce training, staffing, temporary employee or contractor payroll, overhead employees, or security personnel.

Fringe Benefits: Extra benefits supplementing an employee’s salary, which may include hazard pay, travel reimbursement, and employee health insurance.

Lease Payments: New equipment or software leases.

Utilities/Operations: Lighting, cooling/ventilation, cleaning, or additional third party vendor services not included in “Personnel.”

Other General and Administrative Expenses: Costs not captured above that are generally considered part of overhead structure.

Health Care Related Expenses Attributable to Coronavirus include:

Supplies: Expenses paid for purchase of supplies used to prevent, prepare for, and/or respond to coronavirus during the reporting period. Such items may include personal protective equipment (PPE), hand sanitizer, or supplies for patient screening.

Equipment: Expenses paid for purchase of equipment used to prevent, prepare for, and/or respond to coronavirus during the reporting period, such as ventilators, updates to HVAC systems, etc.

Information Technology (IT): Expenses paid for IT or interoperability systems to expand or preserve care delivery during the reporting period, such as electronic health record licensing fees, telehealth infrastructure, increased bandwidth, and teleworking to support remote workforce.

Facilities: Expenses paid for facility-related costs used to prevent, prepare for, and/or respond to coronavirus during the reporting period, such as lease or purchase of permanent or temporary structures, or to modify facilities to accommodate patient treatment practices revised due to coronavirus.

Other Health care Related Expenses: Any other expenses, not previously captured above, that were paid to prevent, prepare for, and/or respond to coronavirus.

It is important for practices to note that increases in the previously listed expenses do not need to be directly traced to the coronavirus. If there was a general increase in one of the listed examples, then this could be assumed to be a result of the virus. One example would be offering employee retention perks or bonuses, covering transportation costs, or offering temporary employee housing. Other acceptable uses of funds include outsourced expenses such as facilities management, disinfection services, and even food/patient nutrition services. While this definition does seem generous, it is important to remember that any expenses that were reimbursed by other sources, whether it be a donation, operational revenues, or other direct assistance, must be subtracted from total expenses attributable to the coronavirus.

For practices who made a capital expenditure to purchase equipment, this too may potentially be added as an increased expense. Full value expenses include capital expenditures directly linked to the preparation, prevention, and response to the coronavirus. For costs directly relating to the coronavirus, the standard is slightly stricter but nonetheless likely to be an expense shared by all healthcare providers. Examples of this equipment include ventilators, masks, face shields, disinfectants, and biohazard suits. Any other purchasing of equipment not directly pertaining to coronavirus (such as X-Ray machines or surgical tables) can only include the depreciable value of that piece of equipment for the time period as an expense.

If your business’s accrued lost revenues and increased expenses attributable to coronavirus exceed your payment, then you get to keep it. If not, Uncle Sam is going to want it back. The twist is that the income tax on the funds that your business received will be considered an expense. For example, if you were given $100,000 and your lost revenues were $70,000 and health care expenses were $20,000, you would not have to give back the $10,000 because you could also count the approximately $30,000 of income taxes due on the receipt of Provider Relief Funds as an additional expense.

PHASE 3 HHS PAYMENTS

There are still funds available for distribution through Phase 3 of the HHS Provider Relief Fund. Phase 3 is available for eligible practices that have lost revenue or increased expenses attributable to COVID-19 that have not already received HHS funds that equal or exceed 88% of reported losses, as well as to those that have not yet received a payment that is approximately 2% of annual revenue from patient care from Phase 1 or 2.

Guidance on the HHS website provides that HHS will review and validate applications received and will disperse payments in batches as applications are processed. Phase 3 also excludes targeted distributions to high impact areas and low income communities.

Deadline Questions And “Some” Answers

When do I need to report lost revenues and expenses attributable to COVID-19?

This is a great question that does not currently have an answer. HHS’s Provider Relief Fund Portal was scheduled to open on January 15th and it did…but only for registration. The reporting functionality is not yet available. An HHS FAQ released on January 15, 2021 states that providers will be notified when they can complete the second step and report on the use of funds. The original deadline for reporting funds was February 15th but because of the delay, the deadline has been postponed indefinitely.

Is there a deadline for using my HHS Provider Funds?

Yes. Recipients with funds unexpended after December 31, 2020 have until June 30, 2021 to use the remaining funds. After this date, a second report must be submitted by July 31, 2021. All funds that are not used by June 30th must be returned to HHS.

HOPE THIS HELPS YOU HELP OTHERS MAKE A POSITIVE DIFFERENCE!

CITE AS:

LISI Business Entities Newsletter #220 (February 10, 2021)

at http://www.leimbergservices.com Copyright 2021 Leimberg Information Services, Inc. (LISI). Reproduction in Any Form or Forwarding to Any Person Prohibited, Without Express Permission. This newsletter is designed to provide accurate and authoritative information in regard to the subject matter covered. It is provided with the understanding that LISI is not engaged in rendering legal, accounting, or other professional advice or services. If such advice is required, the services of a competent professional should be sought. Statements of fact or opinion are the responsibility of the authors and do not represent an opinion on the part of the officers or staff of LISI.

2021 Creditor Protection Nuts & Bolts

2021 Creditor Protection Nuts & Bolts provides a comprehensive and practical treatment of Florida and Federal creditor protection rules for tax and estate planning lawyers and other professionals.

The program is perfect for both newcomers and experienced practitioners, and the speakers are all experienced in this area and will offer practical approaches and wisdom that no planner should be without.

This year’s content will also address the intersections between COVID-19 relief legislation, creditor protection planning, and planning for the discharge of indebtedness.

All registrants will receive printed copies of the 2021 edition of the Bloomberg Tax book “Gassman & Markham on Florida & Federal Asset Protection Law” by Alan Gassman and Michael Markham and the Leimberg Information Services book “Planning for Ownership and Inheritance of Pension and IRA Accounts and Benefits in Trust or Otherwise” by Alan Gassman, Christopher Denicolo, Brandon Ketron, and John Beck. These books have a value of over $300.

Live GoToWebinar. Section members register for only $240. Course 4128. Approved for 6 General CLE; 6 Tax and 6 Wills, Trusts & Estates certification credits.

9:00 AM – 9:50 AM: Florida Exemption Planning.

Alan Gassman, Gassman, Crotty & Denicolo P.A.

9:50 AM – 10:40 AM: Florida Limited Liability Companies.

Andrew Comiter, Comiter, Singer, Baseman & Braun LLP

10:50 AM – 11:40 AM: Florida Irrevocable Trust Planning.

Leslie A. Share, Packman Neuwahl Rosenberg P.A.

11:40 AM – 12:30 PM: Protecting Florida Corporations from Inside and Outside Attacks.

Tom Wells, Wells & Wells, P.A.

12:40 PM – 1:30 PM: Domestic Asset Protection Trusts—Planning and Pitfalls.

David A. Warren, Bridgeford Trust, Alfredo R. Tamayo, Packman Neuwahl Rosenberg P.A.

1:30 PM – 2:20 PM: COVID 19 Relief/New Laws and Related Planning.

Brandon Ketron, Gassman, Crotty & Denicolo P.A.

Regsiter for the Friday, March 26, 2021 webinar here

Upcoming Events

Register for all future free webinars from Gassman, Crotty & Denicolo, P.A. using this link

| When | Who | What | How |

|---|---|---|---|

| Saturday, March 6, 2021 | Free webinar from our firm |

Alan Gassman, Brandon Ketron and Kevin Cameron present: March 1st IRS Notice Provides Essential Guidance And Safe Harbors For The Employee Retention Credit from 9 to 9:30 AM EST |

Register |

| Saturday, March 6, 2021 | Free webinar from our firm |

Kevin Cameron presents: PPPL Excel Workbook Tune-up from 10 to 10:30 AM EST |

Register |

| Wednesday, March 10, 2021 | Leimberg Webinar Services (LISI) |

Alan Gassman and Brandon Ketron present: PPP and Employee Retention Credit (ERC) Update – What is New and What is Still to Come from 1 to 2:30 PM EST |

Register |

| Thursday, March 11, 2021 |

New York State Society of CPAs Foundation for Accounting Education |

Alan Gassman and Brandon Ketron present: New Changes to Employee Retention Credit and PPP from 11 AM to 12:40 PM EST |

Register |

| Thursday, March 11, 2021 | MyTaxCoursesOnline |

Alan Gassman and Christopher Denicolo present: Tax Planning for Insolvency and the Discharge of Indebtedness from 2 to 3 PM EST |

Register |

| Saturday, March 13, 2021 |

Free webinar from our firm |

Kevin Cameron presents: PPPL Excel Workbook Tune-up from 10 to 10:30 AM EST |

Register |

| Wednesday, March 17, 2021 | Free webinar from our firm |

Alan Gassman and Dr. Luz D. Randolph present: New Charitable Contribution Tax Laws and Recent Developments, Including The Over $100,000/Year IRA opportunity for IRA account owners over 59 1/2 and the New IRA Distribution Rules for Charitable and Non-Charitable Beneficiaries from 12:30 to 1:30 PM EDT |

Register |

| Saturday, March 20, 2021 | Free webinar from our firm |

Kevin Cameron presents: PPPL Excel Workbook Tune-up from 10 to 10:30 AM EDT |

Register |

| Friday, March 26, 2021 | Florida Bar: Tax Section |

Alan Gassman, Leslie Share, Brandon Ketron & Friends present: Creditor Protection Nuts & Bolts from 9 AM to 2 PM EDT |

Register |

| Saturday, March 27, 2021 | Free webinar from our firm |

Kevin Cameron presents: PPPL Excel Workbook Tune-up from 10 to 10:30 AM EDT |

Register |

| Tuesday, April 20, 2021 | Free webinar from our firm |

Alan Gassman, Shannon Summerlin and Andrea Fourman present: Tax-Smart Giving for UF Law Alumni from 12:30 to 1:20 PM EDT |

Coming soon |

| Wednesday, April 21, 2021 | Free webinar from our firm |

Alan Gassman and Dr. Luz D. Randolph present: A Survey of Charitable Gifting Vehicles from 12:30 to 1:30 PM EDT |

Register |

| Monday, May 10, 2021 | Paralegal Association of Florida: Pinellas Chapter |

Alan Gassman presents: Making Your Job Better and Your Firm More Successful – the Legal Assistant’s Guide to Liberation and Effectiveness from 12 to 1 PM ET |

Coming soon |

| Thursday, May 13, 2021 | FICPA-FSU Spring Accounting Conference |

Alan Gassman presents: Fine Tuning and Improving Estate and Asset Ownership Planning For All Categories of Clients & The Florida CPA’s Practice Guide to Effective Creditor Protection Planning |

Register |

| Wednesday, May 19, 2021 | Free webinar from our firm |

Alan Gassman and Dr. Luz D. Randolph present: Private Foundations from A to Z. How Private Foundations help Donors help Public Charities and Causes from 12:30 to 1:30 PM EDT |

Register |

| Friday, May 21, 2021 | Michigan ICLE Annual Probate & Estate Planning Institute |

Alan Gassman presents: Prebankruptcy and Bankruptcy Avoidance Strategies for Challenging Situations from 11:15 AM to 12 PM CT |

Register |

| Tuesday, June 15, 2021 | Association of Insolvency and Restructuring Advisors’ Pre-conference Bankruptcy Tax Toolbox |

Alan Gassman and Christopher Denicolo present: Corporate Tax |

Coming soon |

| Wednesday, June 16, 2021 | Free webinar from our firm |

Alan Gassman and Dr. Luz D. Randolph present: Life Insurance Planning, including Term Life Insurance for Charitable and Non-Charitable Purposes from 12:30 to 1:30 PM EDT |

Register |

| Wednesday, July 21, 2021 | Free webinar from our firm |

Alan Gassman, Dr. Luz D. Randolph and Michael Lehmann present: Charitable Planning for the Business Owner from 12:30 to 1:30 PM EDT |

Register |

|

NEW DATES! Thursday, July 26-29, 2021 |

AICPA & CIMA ENGAGE 2021 in Las Vegas, NV |

Alan Gassman and Ken DeGraw present: Pre-Bankruptcy and Creditor Planning During the COVID-19 Pandemic |

Register |

| Thursday, November 4, 2021 | Estate Planning Council of Birmingham |

Alan Gassman presents: Hot Topics In Estate Tax And Creditor Protection from 8 to 10 AM CT |

Coming soon |

Call us now! Bookings accepted for haunted houses, bar mitzvahs, weddings, seminars, and symposiums (or symposia)!

Changes From the 2020 Regular Legislative Session

The 2020 Florida Regular Session of the Legislature made several changes that will affect the area of estate planning.

Elimination of Subscribing Witnesses

New Fla. Stat.§ 689.01, effective for leases executed on or after July 1, 2020, eliminates the requirement for witnesses to validate a landlord’s execution of a lease with a term exceeding one year. The amendment simplifies the administration of Florida real property leases by eliminating the witness requirements. With this amendment, Florida joins the majority of jurisdictions not requiring witnesses to the execution of real property leases. (Chapter 2020-109, Laws of Florida.)

Expanding Guardianship

New Fla. Stat. § 744, effective July 1, 2020, expands the list of factors for courts to consider when appointing a guardian; prohibits a guardian from signing a “do-not-resuscitate order” without a court order; and prohibits professional guardians from petitioning for their appointment. The amendment also provides other related revisions such as exceptional circumstances where professional guardians may petition for their appointment or certain guardians may sign a “do-not-resuscitate” order. (Chapter 2020-35, Laws of Florida.)

Trusts

New Fla. Stat. § 736.08145, effective July 1, 2020, authorizes trustees of certain trusts to reimburse individuals being treated as the owner of the trust for taxes attributed to income from the trust. The new statute prohibits certain funds from being used for the reimbursement, such as a life insurance policy held in the trust. The statute also places restrictions on the trustee’s authority to reimburse persons being treated as the owner, for example, if the trustee is treated as the owner of the trust. CS/HB 1089 further provides that the provisions of this legislation apply to trusts created both before and after the effective date. 2020. (Chapter 2020-70, Laws of Florida.)

Deceased Account Holders

New Fla. Stat. § 753.303, amended from Fla. Stat. § 655.059 and effective July 1, 2020, authorizes a financial institution to make payment to a surviving successor from a qualified depository account or certificate of deposit without any court proceeding, as long as the total amount paid does not exceed $1,000 and the payment is made no earlier than six months after the decedent’s death. (Chapter 2020-110, Laws of Florida.)

Transfer of Homestead Benefit

A new amendment to the Florida Constitution (amending Article VII and adding Article XII) and its implementing legislation amending Fla. Stat. § 193.155, both effective January 1, 2021, increase the time frame for the transfer of homestead property tax benefits from a prior homestead to a new homestead. This amendment extends the period to transfer the Save-our-Home (SOH) benefit from a prior homestead to a new homestead by an additional year. The time frame for the SOH benefit to be transferred will be increased from 2 years to 3 years. HB 371 was approved by the governor and will become law upon approval of the amendment by the voters. (Chapter 2020-175, Laws of Florida.)

Expanding Protection of Vulnerable Investors

New Fla. Stat. § 415.1034, effective July 1, 2020, widens the definition of “financial exploitation of vulnerable adults” and expands the reporting requirements to include investment advisers and security dealers. Under the amended statute, security dealers and investment advisers are now required to immediately report knowledge of abuse, neglect, or exploitation of vulnerable adults. The act also allows security dealers or investment advisors to delay the disbursement of funds or securities when they reasonably believe that exploitation is present. The act became effective on July 1, 2020. (Chapter 2020-157, Laws of Florida.)

Ad Valorem Tax Discounts

New Fla. Stat. § 196.011, effective July 1, 2020, provides that a disabled veteran or the surviving spouse of a disabled veteran may apply for and collect a prorated refund of property taxes for new homestead property acquired between January 1 and November 1 of any calendar year. (Chapter 2020-140, Laws of Florida.)

Renting Out Your Home Sweet Homestead

Recent cases in Florida’s 2nd District Court of Appeals have ruled that owners of single family residences can rent out spare rooms and maintain their homestead exemption status.

Article X, section 4, of the Florida Constitution provides:

(a) There shall be exempt from forced sale under process of any court, and no judgment, decree or execution shall be a lien thereon, except for the payment of taxes and assessments thereon, obligations contracted for the purchase, improvement or repair thereof, or obligations contracted for house, field or other labor performed on the realty, the following property owned by a natural person:

(1) a homestead, … if located within a municipality, to the extent of one-half acre of contiguous land, upon which the exemption shall be limited to the residence of the owner or the owner’s family;

….

(b) These exemptions shall inure to the surviving spouse or heirs of the owner.

In Florida, the homestead exemption can result in exempting up to $50,000 of your home’s assessed value in tax liability. In addition, after the first year a home receives the homestead exemption, the assessed value cannot increase more than 3%.

In these pandemic filled times, many people are looking for ways to make ends meet and make a little bit of extra money and renting out that spare bedroom may begin to seem more and more appealing.

Luckily for those considering this option, the Florida Supreme Court has held that the homestead statute is to be construed liberally in favoring of preserving homestead. So if those bills are getting to be a little too much or you’re just trying to give a friend a place to stay, you don’t have to worry about losing your homestead status.

Analysis

Based on the rulings below, a homeowner can rent out rooms in their permanent resident and still qualify for 100% homestead exemption as long as the property is a single-family residence that is not severable. Property appraisers are not authorized to “carve up” your permanent residence to determine what percentage is eligible for protection.

Furst v. Rebholz as Tr. of Rod Rebholz Revocable Tr., 302 So. 3d (Fla. Dist. Ct. App. 2020)

A homeowner rented out two bedrooms in his homesteaded property. Upon discovering that the homeowner was renting out these rooms, the property appraiser sent a letter to the homeowner informing him that he may have improperly received the 100% homestead exemption for the years that he was renting out the bedrooms. The appraiser determined that 15% of the residence was being used for commercial purposes, and so the homeowner was only entitled to a homestead exemption for 85% of the property.

The property appraiser recorded a tax lien against the homeowner seeking the taxes that the homeowner should have paid on the 15% of his residence that the appraiser deemed was non-exempt. The homeowner filed suit.

The issue for the court was whether the homeowner’s rental of the rooms disqualified him from full homestead property tax exemption. The court found that it did not.

The court held that the homeowner had satisfied the statutory requirements for homestead exemption and that the rental of bedrooms and common spaces did not create a place of business. The court also pointed out that there is no legislative language granting the property appraiser the right to divide a homeowner’s permanent residence.

Finally, the court expressed concern that if property appraisers were allowed to divide up single family residences into commercial and homestead sections, then those who rent bedrooms or work from home could have their tax benefits chipped away.

Anderson v. Letosky, 304 So. 3d (Fla. Dist. Ct. App. 2020)

Following the death of his father, the plaintiff filed a petition seeking a determination from the probate court that the residence that his father had owned and resided qualified for homestead exemption. Prior to the father’s passing, he had rented out three out of the four bedrooms. The probate court held that the leased portion of the residence was not eligible for homestead exemption, but the Second District Court of Appeals reversed.

The appellate court held that the entire residence was subject to homestead protection because it was a single family residence that was not severable. The father’s single family residence was contrasted with a case involving a triplex where the units that the owner did not live in could be separated from the unit that was her permanent residence. In this case, the father and the tenants shared common spaces and the individual rooms could not be severed from the residence without losing their utility. Because the rooms could not be severed, the court held that the whole property qualified for full homestead exemption.

The 3 Things You Should Be Teaching Your Kids About Business

David Finkel

Fatherhood has been one of the greatest things I have ever done, hands down. Watching my three sons grow up and learn about the world has taught me more things than I ever expected, and has really given me a new perspective on life and business.

As a business coach for over twenty-five years, I have worked with thousands of business owners, teaching them how to navigate the business world and grow and scale their businesses to run without them. And now that I am a father, I can’t help but keep a mental checklist of all the skills and traits that I want to teach my own children before they venture out into the business world on their own.

Here are my top three things that I want to teach my kids about business before they graduate.

1. The Importance of Focus Time and Unplugging Daily.

As a parent, the topic of “screen time” comes up often in our household, but this goes much deeper than limiting the number of hours my kids spend on Netflix. Instead, this has to do with understanding priorities and tasks and setting aside real focus time to get things done. I want my kids to understand that setting aside a block of time each day to put their iPads down and focus on their schoolwork or interests is going to make everything easier and more fruitful. I want them to recognize that turning off the electronics, and giving themselves a moment to think and focus will serve them well in adulthood.

This is something that I teach my business coaching clients as well. The idea of setting aside blocks of time to do their high-value tasks, without interruptions.

2. Time Management Skills.

As my kids get older, their schedules have gotten more hectic. There are school projects, after school activities, and playdates with friends. And the more things that pile up on their plate, the harder it is to get everything done. This is why I want to make sure that they understand the value of time management and are able to prioritize what’s most important and what can be postponed or moved.

Now, a word of caution on this one. The “Dad” in me wants to say that schoolwork comes before everything else. But as a business coach that sees far too many stressed out, burnt out business owners who work too much and neglect their social lives and families, I want to make sure that my kids understand the importance of a healthy work-life balance. Because sometimes going camping with your family is the best thing for you to do with your time.

3. Make Time for Creativity

And the last thing that I want to teach my kids about the business world, is to make time for creative endeavors. And this can mean a myriad of things, but I want them to know that making time for things that they are passionate about is always time well spent. For me, that comes through my writing. I am able to not only share my passion with all of you on this column, but I have been able to express myself creatively by writing business books, including my newest release, The Freedom Formula.

And I encourage my clients to do the same. Some enjoy public speaking and sharing their passion with others, some express themselves through product design while others find their creative outlet through their company’s branding and marketing. Whatever sparks joy in your life, make it a habit to do it often.

Humor

We thought the Buccaneers win was our treasure,

But maybe the real treasure was the Estate Plans we made along the way.

Gassman, Crotty & Denicolo, P.A.

1245 Court Street

Clearwater, FL 33756

(727) 442-1200