The Thursday Report – Issue 295

ALWAYS FREE, SOMETIMES PUBLISHED ON THURSDAYS

Thursday, December 17, 2020 – Issue 295

Having trouble viewing this? Use this link

PPP Loan Expense Deductibility – A Close Call For Tax Advisors, A.K.A. Machinations of Manocchio

Upcoming Events

Nevis Business Tax Update – What’s the Latest?

For Finkel’s Followers

Humor

PPP Loan Expense Deductibility – A Close Call For Tax Advisors, A.K.A. Machinations of Manocchio

Alan Gassman & Brandon Ketron

EXECUTIVE SUMMARY:

While the tax world waits to see whether Congress and the President will provide a new law to make clear that PPP loan expenses are deductible, others are analyzing the tax law to determine whether legislative action is needed.

We believe that the key to this question revolves around the 1982 Tax Court decision of Manocchio v. Commissioner (“Mannocchio”), which has been quoted in many subsequent cases, Revenue Ruling 2020-27, and IRS Notice 2020-32 for the proposition that expenses paid for with the proceeds of tax-exempt income should not be deductible, was correct, or would apply given congressional intent and other factors. A close review of this case calls to question whether the holding was correct.

In the meantime tax advisors need to understand the meaning and impact of the terms “substantial authority” and “reasonable basis” in determining how to advise clients who may wish to deduct expenses that were paid with PPP loans that are expected to be forgiven, and preparer penalty rules as well.

FACTS:

The primary issue with the IRS’s position is that the non-deductibility of expenses paid with PPP loan funds essentially turns the PPP loan into taxable income, a result that most, if not all, borrower’s did not realize when the loan moneys were spent. In addition, those with large PPP loans will likely end up in a higher tax bracket as a result of this additional income. The impact to borrowers is significant and the following two real life examples brought to our attention by Kevin Cameron, CPA illustrate just how significant of an issue this is:

Example 1 – Construction Company ABC borrowed $1,300,000 and told their employees that no one would be laid off. The company kept paying employees their full pay, even if the employees didn’t work. Not a single employee was laid off, none collected unemployment, and all of the PPP loan funds were used by July. ABC’s business picked up enough to allow it to continue to operate with no lay-offs, and was at breakeven as of 9/30/20. ABC’s owner feels he is in good shape, but then realizes he has $1,300,000 of additional taxable income for 2020 and only has about $100,000 in the bank. He owes approximately $300,000 in taxes on this additional “phantom income” and has to borrow on his line of credit to pay the taxes. He would have been better off laying-off workers and potentially generating a small profit for 2020.

Example 2 – XYZ Company has held its own during the pandemic, actually generating a decent profit. Their PPP Loan was $560,000 and the company did not terminate any employees using 100% of the PPP Loan funds on payroll. The partners in XYZ have historically paid about 26% in income taxes. So, in anticipation of having to pay taxes on the PPP amount, they set aside about $145,000 for taxes, thinking all will be good. Now, they start their tax planning and find out that the non-deductibility of the expenses paid with PPP funds puts them in the 37% tax bracket increasing their effective rate to 31%! They owe far more than the $145,000 because of the progressive nature of the tax rates.

Is this what Congress intended? The IRS seems to think so, but their position may be incorrect as explained below.

Manocchio

Mr. Manocchio was an Air Force veteran who was able to take courses to enhance his career as a pilot in 1977 and was reimbursed for 90% of the expenses under a Federal program for veterans. The question before the Tax Court was whether (a) the expenses were deductible when they were reimbursed, and therefore not really expenses in substance or (b) whether the expenses were not deductible under Internal Revenue Code § 265 by reason of being “allocable to” the non-taxable Veterans Administration reimbursement.

The Tax Court found that I.R.C. § 265 barred the deduction of the reimbursed expenses, but noted that the committee reports released by Congress after establishing the 90% Reimbursement Program did not “address the possibility of a double tax benefit arising under the circumstances which present themselves here. . . [I]t is unrealistic to assume that Congress even considered, let alone approved, the deduction of specifically reimbursed educational expenses while the reimbursement itself remains sheltered by the umbrella exemption provided in 38 U.S.C. § 3101(a).”

38 U.S.C. § 3101(a) was enacted in 1970 to provide educational expense reimbursement rights for veterans and contained the following language, which included what we have underlined with respect to the tax-free nature of reimbursement when received by veterans:

(a) Payments of benefits due or to become due under any law administered by the Veterans’ Administration shall not be assignable except to the extent specifically authorized by law, and such payments made to, or on account of, a beneficiary shall be exempt from taxation, shall be exempt from the claim of creditors, and shall not be liable to attachment, levy, or seizure by or under any legal or equitable process whatever, either before or after receipt by the beneficiary. The preceding sentence shall not apply to claims of the United States arising under such laws nor shall the exemption therein contained as to taxation extend to any property purchased in part or wholly out of such payments. The provisions of this section shall not be construed to prohibit the assignment of insurance otherwise authorized under chapter 19 of this title, or of servicemen’s indemnity.

Distinction between U.S.C. § 3101(a) & CARES Act § 1106

Similar to the above underlined language quoted under U.S.C. § 3101(a), Congress clearly addressed tax treatment in the CARES Act by stating the following under § 1106(i):

(i) TAXABILITY.—For purposes of the Internal Revenue Code of 1986, any amount which (but for this subsection) would be includible in gross income of the eligible recipient by reason of forgiveness described in subsection (b) shall be excluded from gross income.

While this newsletter does not include a significant discussion of the Tax Benefit Rule, many experts believe that the above indented language from the CARES Act was specifically intended to neutralize the taxation that will otherwise apply when an expense is deducted, and then reimbursed or compensated for in a subsequent year. How much louder will Congress need to speak than the above indented language? If I.R.C. § 265 does not apply so that the expenses are deductible then it would seem to the authors that the Tax Benefit Rule would be neutralized by the above language.

The following quote from the Manocchio case shows that the Tax Court may have held for the taxpayer if it had been clear that Congress had intended otherwise. It may be arguable that Congress felt stronger about making sure that PPP borrowers did not have tax obligations resulting from forgivable expenses because the above subsection was given a title and a complete sentence as compared to § 3101(a) which was given 13 words attached within a long string of features.

In Manocchio, the Tax Court specifically considered and discussed this question and indicated as follows:

In short, there is nothing in the legislative history of the relevant veterans’ provisions to suggest that Congress intended for a veteran to have both an exemption and a tax deduction where his reimbursed flight-training expenses otherwise qualify as deductible business-related education. On the other hand, the legislative purpose behind section 265 is abundantly clear: Congress sought to prevent taxpayers from reaping a double tax benefit by using expenses attributable to tax-exempt income to offset other sources of taxable income. This is precisely what petitioner is attempting to do here, and in our judgment, the application of section 265(1) to disallow the reimbursed portion of the flight-training expense deduction is both reasonable and equitable.

Mr. Manocchio argued that I.R.C. § 265 and its predecessor, Section 24(a)(5) of the Revenue Act of 1934, indicated “that the purpose of the statute is to disallow deductions allocable “to the production” of exempt income.” It appears that Mr. Manocchio’s lawyer did a good job representing him, but the amount at stake was only a $2,700 tax deduction. If this had been a $2,270,000 tax deduction, one might speculate that his legal counsel would have had more time to do more research and provide more ardent representation, with a different outcome.[i] “In America you get as much justice as you can afford” – O.J. Simpson.

The Congressional intent in passing the CARES Act, however, appeared to have been that PPP loan borrowers would not have to pay income taxes on the loan amount(s), whether directly or indirectly. On May 5th, 2020, Senators Grassley, Neal, and Wyden wrote a letter to Treasury Secretary Steve Mnuchin which included the following:

Providing assistance to small businesses, only to disallow their business deductions as provided in Notice 2020-32, reverses the benefit that Congress specifically granted by exempting PPP loan forgiveness from income… Section 1106(i) was specifically included in the CARES Act to exclude from income loan forgiveness, which would otherwise be taxable, to provide a tax benefit to small businesses that received the PPP loan. Had we intended to provide neutral tax treatment for loan forgiveness, Section 1106(i) would not have been necessary.

From the above, it is clear that Congress intended for businesses that received PPP loans to also be able to benefit from the general business deductions. This is different than what the Tax Court in Manocchio concluded, which was that Congress did not consider or discuss the double deductibility of expenses paid for with funds from the government. The Manocchio Court found that § 3101(a) was intended to prevent the deduction of monies received from the tax-exempt source. The above position is well-described in a 2007 New York Law School Faculty Scholarship article entitled Deductibility of Treble Damages Paid for Breach of National Health Service Corps Scholarship Contracts: The Misuse of I.R.C. 265(a)(1) in Stroud v. United States and of the Origin of the Claim Test in Keane v. Commissioner by Richard C.E. Beck.

COMMENT:

Support for Position Above

This well-written 36-page law review-quality article comes to the conclusion that I.R.C. § 265 does not apply to prevent the deduction of expenses that are paid from tax-free or tax-exempt funds. Simply put, §265 was enacted to prevent the deductibility of expenses incurred for the purpose of producing exempt income.

In point of fact when Section 24(a)(5) of the Revenue Act of 1934 (the predecessor to I.R.C. § 265(a)(1)) was enacted Congress explicitly decided to deny the deduction for expenses incurred for the purpose of producing exempt interest, while not eliminating the deductibility of certain expenses that were paid with tax-exempt income.

House Version

The House version of the law would have disallowed the deduction of amounts spent by state employees from tax-exempt salaries and amounts spent by landlords from rent received from state school tenants. The Senate version of the bill was intended to limit this impact.

Professor Beck explains the history of 265(a)(1) and quotes the House and Senate committee reports as follows:

B. History of l.R.C. § 265(a)(l)

The original predecessor of current l.R.C. § 265(a)(l) was enacted as section 24(a)(5) in the Revenue Act of 193446 in order to disallow deductions for the production of tax-exempt income. Such deductions would, in effect, shelter unrelated taxable income and provide an unwarranted double tax benefit. The specific situations Congress had before it when it enacted (former) section 24(a)(5) were: (1) expenses incurred for the purpose of producing exempt interest on state securities; (2) exempt salaries received by state employees; and (3) exempt income from leases of state school lands. The House version would have disallowed all such expenses.

It is clear from the italicized words in the legislative history below that the statutory language “allocable to,” later to cause great confusion, should be read as interchangeable with “paid or incurred for the production of’ tax-exempt income. The House Report states:

Section 24(a)(5). Disallowance of deductions attributable to tax-exempt income: This paragraph has been added to the bill to eliminate as deductions from gross income expenses allocable to the production of income wholly exempt from the income tax. Under the present law interest on State securities, salaries received by State employees, and income from leases of State school lands are exempt from Federal income tax, but expenses incurred in the production of such income are allowable as deductions from gross income.

Senate Version

The Senate version adds the express provision that such deductions are disallowed even if the tax exempt income fails to materialize, and also limits the provision to tax-exempt income other than interest, which was then dealt with in a separate provision. The Senate Report states:

The House bill disallows amounts otherwise allowable as deductions which are allocable to one or more classes of tax-exempt income even though the income fails to materialize or is received in an amount less than the expenditures made or incurred. For instance, under the present law, salaries received by State employees, income from leases of State school lands, and the interest on State and some classes of Federal securities are exempt from the income tax. It is contended that under the existing law all expenses incurred in the production of such income are allowable as deductions. The House bill specifically disallows expenses of this character. While your committee is in general accord with the House provision, it is not believed that this disallowance should be made to apply to expenditures incurred in earning tax-exempt interest. To do so might seriously interfere with the sale of Federal and State securities ….

I.RC. § 265(a)(l) prohibits otherwise allowable deductions for expenses which are allocable to classes of income (other than interest) which are wholly exempt from tax. Until Stroud, the provision had been applied-albeit in a haphazard manner-in essentially two different types of situations. The first is that which was originally contemplated by Congress when the provision was enacted: disallowance of direct costs of earning tax-exempt income. Here would belong, for example, disallowance of deductions for legal fees in suits to acquire tax-exempt inheritances, damages for personal injuries, or for state and foreign income taxes imposed on items exempt from federal income tax. If the expenses are incurred to earn a mixture of taxable and tax-exempt income, they will be denied a deduction in the same proportion that the tax-exempt income bears to total income.

The second situation, and one of more recent provenance, is the result of the IRS’s efforts to extend the prohibition to disallow expenses for deductible items for which the taxpayer has arguably been paid reimbursement with tax-free grants in one form or another. GCM 34,50651 ably recounts the history and purpose of I.RC. § 265(a)(l), and concludes that Congress’s intent requires that the provision be applied in only two situations: first, in the original situation in which the expense is incurred for the purpose of earning tax-exempt income; and second, where the taxpayer receives tax-exempt income which is earmarked for a particular purpose, and the taxpayer incurs expenses in carrying out that purpose. The GCM was only half right: the second application is erroneous, and is the root of the problem in Stroud.

The Ninth Circuit Did Not Confirm the §265 Holding.

The decision of the Tax Court in Manocchio was appealed to the Ninth Circuit Court of Appeals, which decided in 1983 that a “taxpayer cannot deduct the expenses in question because they were reimbursed” by concluding that I.R.C. § 162(a) does not allow the deduction of expenses that will clearly be reimbursed, and cited a string of cases going back to 1932 to support this conclusion.

Footnote 2 of the Ninth Circuit’s opinion specifically indicates that “[b]ecause we rest our decision on the definition of an expense under I.R.C. § 162(a), we need not reach the Tax Court’s construction of I.R.C. §265(1).”

The above footnote could be taken as an indication that the Tax Court’s decision on § 265(1) was not accurate, and even if it had been accurate, the intent of Congress under the CARES Act was clearly to put the loan proceeds into the economy so that they could be used to pay for wages, employee benefits, and expenses for interest, rental, and utilities. The CARES Act committee reports indicated that up to $659 billion was going to be put into businesses and did not indicate that businesses were going to pay back one-third or more of those amounts in taxes!

Professor Beck’s article concluded that by the above referenced footnote “the Ninth Circuit rejected the Tax Court’s reliance on I.R.C. § 265(a)(1) in Manocchio, and if the Ninth Circuit was correct, all authority for basing the conclusion in Stroud, GCM 39,336, and GCM 34,50651 on I.R.C. § 265(a)(1) vanishes.”[ii] This perhaps exaggerates the impact of the 9th Circuit indicating that they did not need to “reach” the Tax Court’s construction of I.R.C. § 265(1).

Professor Beck appropriately concluded as follows:

[t]he erroneous ‘reimbursement’ application of I.R.C. § 265(a)(l) did no harm in Manocchio and Induni – largely because I.RC. § 265(a)(l) was not really applied at all . . . The most significant danger is that the IRS seems increasingly aggressive and unreasonable in its interpretations of law, and the courts seem uncritically deferential to the government. If the IRS is outgunned by big business, as is often asserted, it seems equally true that the IRS in turn outguns relatively defenseless taxpayers with whom the mainstream business tax bar is largely unconcerned.

Professor Beck was obviously suggesting that the law in this area should have been cleaned up, and it was unfortunate that it did not happen.

If Congress acts to save PPP borrowers from this unfortunate and inaccurate result a later action may be to clarify I.R.C. § 265 to prevent further but smaller carnage of taxpayers to prevent further injustice.

Another question is why the IRS would now attempt to disallow deductions spent from monies borrowed where the loan is forgiven on a tax-free basis. It is noteworthy that I.R.C. § 108 provides that forgiveness of indebtedness will be tax-free under many circumstances, but to our knowledge the IRS has never attempted to limit the deductibility of amounts paid from loans that were forgiven on a tax-free basis.

Milkovich

A Reply Brief of the Appellant filed in the 2019 Ninth Circuit Court of Appeals case of Milkovich v. U.S. indicates that neither the taxpayer nor the IRS was able to find any case or authority linking the exemption allowed under IRC § 265(a)(1) to the deferral of income under § 108.

In the Milkovich case, Lisa Milkovich and Dang Nguyen (the Appellants) purchased a property and gave a lender a recourse mortgage, and then filed a joint Chapter 7 bankruptcy petition a number of years later. The property was abandoned during the course of the bankruptcy proceedings, with the proceeds from a foreclosure sale first going to pay the lender for accrued unpaid interest, and then being applied towards principal. The Appellants attempted to deduct the interest payment of $114,688. The complaint was dismissed for failure to state a claim by the District Court, and arguments were heard on November 3rd, 2020 by the 9th Circuit Court of Appeals.[iii] No decision has been issued.

According to the Reply Brief dated December 30, 2019, the IRS argued that Section 265(a)(1) causes the loss of the interest deduction in this case, by taking the position that Section § 108 excluded the reduction in debt from the income of the debtors, and that the debt discharged was what paid the interest that the debtors deducted on their income tax return. Section 108 excludes the forgiveness of debt in income when a taxpayer is insolvent or meets other qualifications, but in many cases simply defers gain, because the basis of assets or other tax characteristics are adjusted if the taxpayer has assets and tax attributes that can be adjusted. For many it is simply an exclusion statute.

It may be of interest that Section 4 of the Appellant’s brief discusses whether money spent from the tax-free sale of a primary residence would be deductible because the sales proceeds were excluded from income under I.R.C. § 121, and reads as follows:

Section 121 of the Tax Code illustrates why there is a need for the classes-of-income-wholly-exempt wording in § 265(a)(1). Section 121 excludes from income the gain on the sale of a personal residence. The exclusion amount is $250,000 or $500,000 for qualifying spouses who file a joint return. I.R.C. § 121(b)(1), (2). If the classes-of-income-wholly-exempt wording were not present in § 265(a)(1), any sale of an individual’s personal residence for a gain of less than $250,000 would generate tax-exempt income and the interest deductions taken on the house would not be deductible. And, if the gain were over $250,000, the deduction would be allowable to some extent. All of this would be an accounting nightmare. Because of the classes-of-income-wholly-exempt wording, there is no accounting nightmare (and the wrath of the real estate industry is avoided). Because the gain on the sale of a house may be taxable, the gain on sale is not wholly exempt, and I.R.C. § 265 does not disallow qualified-residence-interest deductions.

Section 265(a)(1) purposefully refers to classes of income that are wholly exempt. The test is not whether a particular taxpayer deferred income or reported gain. Cf., Responsive Brief p.33 (“taxpayers have not alleged that they had any such tax attributes”). Even if the test were applied on a taxpayer-by-taxpayer basis, here, the discharge of indebtedness income that the United States says was excluded from income was not “wholly exempt.” That “discharged debt” was ultimately included in amount realized on the sale of the personal residence. Tufts; Simonsen v. Comm’r, 150 T.C. No. 8 (2018) ( “Simonsen”); and Treas. Reg. § 1.1001-2(a)(1) (collectively “Tufts et. al.”); and see ER 12 (Milkovich/Nguyen included the nonrecourse debt in amount realized on sale).

It is true that the Opening Brief cited no cases dealing with the application of I.R.C. § 265 to I.R.C. § 108. Responsive Brief p.33. This is because Milkovich/Nguyen could not find any such cases. Apparently, neither could the United States as it did not cite any such cases either.

Potential Civil and/or Criminal Liability

Despite the support for the above-stated positions from well-respected tax and estate planning experts, it is important for tax preparers and their clients to be aware of potential penalties they may face when filing returns that take positions contrary to IRS pronouncements, and offering advice with respect thereto.

For example, IRC § 6701 is a civil statute which provides for “[p]enalties for aiding and abetting understatement of a tax liability,” and states in part:

(a) Imposition of penalty

Any person—

(1) who aids or assists in, procures, or advises with respect to, the preparation or presentation of any portion of a return, affidavit, claim, or other document,

(2) who knows (or has reason to believe) that such portion will be used in connection with any material matter arising under the internal revenue laws, and

(3) who knows that such portion (if so used) would result in an understatement of the liability for tax of another person,

shall pay a penalty with respect to each such document in the amount determined under subsection (b).

If there is “substantial authority” for a position taken on a tax return then the above penalties will not apply, and there is no obligation to disclose that there might be up to a 66 and two-thirds percent chance of the position not being upheld in court.

In determining whether an authority is “substantial,” courts use an objective standard that “involv[es] an analysis of the law and application of the law to [the] relevant facts.” Lawinger v. Commissioner, 103 T.C. 428 (1994).

If there is not “substantial authority” but there is a “reasonable basis” to take a position on a tax return then the taxpayer will not be subject to the above penalties, but must disclose the position taken on a Form 8275 Disclosure Statement in order to explain the position to the IRS. This reasonable basis standard is the standard by which taxpayers would likely have to report a position contrary to a Revenue Ruling.

The Treasury Regulations provide that an individual has a reasonable basis for supporting his or her position if “a reasonable and well-informed analysis by a person knowledgeable in tax law would lead such a person to conclude that the position has approximately a one in three, or greater, likelihood of being sustained on the merits.” Treas. Reg. § 1.6694-2(b)(1).

In the 2009 9th Circuit Court of Appeals case of United States v. Kapp, that Court found that the appellant lacked substantial authority for claiming that seamen (mariners) were “entitled to claim the full [meals and incidental expense] rate” while working aboard ships, despite the fact that no meal expenses were actually incurred by them.

The Court ruled that,

a well-formed analysis by a person knowledgeable in tax law would have led to the conclusion that Kapp’s position had less than a one in three chance of being sustained on the merits . . . his position was unreasonable and not supported by substantial authority. United States v. Kapp, 564 F. 3d 1103, 1112 (2009).

Unless Congress acts to clear up this issue, a taxpayer that wants to deduct expenses paid with PPP loan funds will be well advised to file the Form 8275 Disclosure Statement with the taxpayer’s tax return to disclose that they are taking a position contrary to a published Revenue Ruling. The Disclosure Statement will need to thoroughly explain the taxpayer’s position and why the taxpayer has a “reasonable basis” for deducting the expenses in order to avoid potential penalties.

What Does This All Mean?

Based upon the above it certainly appears possible, and in the opinion of some experts probable, that PPP loan forgiveness should not be subject to Federal income tax, and that the deductibility for the expenses paid to facilitate such forgiveness should not be limited.

It is unfortunate that Congress has not yet acted to clear the path for tax-free forgiveness and deductibility of expenses, but hopefully this will occur before tens of thousands of taxpayers are put into peril in having to decide whether to file a return that is contrary to IRS pronouncements, or comply with the IRS position and apply for a refund.

When thousands of tax return preparers and tens of thousands of taxpayers have to worry about whether taking a position that seems reasonable to them could expose them to significant civil and possibly even criminal liabilities, it seems clear the tax system is being stress tested, perhaps like never before.

It seems that, based on the fact that there is a current legislative proposal designed to address the double tax benefit issue, Congress is well aware of the issue at hand.

It would be very helpful if the political parties could make a decision quickly to provide relief, or possibly even implement a sliding scale system so that borrowers who are on their dying legs could survive through next April 15th.[iv]

CITE AS:

LISI Business Entities Newsletter #214 (December 14, 2020) at http://www.leimbergservices.com Copyright 2020 Leimberg Information Services, Inc. (LISI). Reproduction in Any Form or Forwarding to Any Person Prohibited, Without Express Permission. This newsletter is designed to provide accurate and authoritative information in regard to the subject matter covered. It is provided with the understanding that LISI is not engaged in rendering legal, accounting, or other professional advice or services. If such advice is required, the services of a competent professional should be sought. Statements of fact or opinion are the responsibility of the authors and do not represent an opinion on the part of the officers or staff of LISI.

CITATIONS:

[i] Ryan Messmore, Justice, Inequality, and the Poor. https://www.nationalaffairs.com/publications/detail/justice-inequality-and-the-poor

[ii] Foonote 32. See, https://digitalcommons.nyls.edu/cgi/viewcontent.cgi?article=1366&context=fac_articles_chapters

[iii] Kenneth C. Weil, Legal Counsel for Lisa Milkovich and Dang Nguyen

[iv] The authors would like to thank attorneys Wesley Dickson and Caleb Suszko, and Stetson University College of Law students Alexander Sorley and Ian MacLean

UPCOMING EVENTS

| When | Who | What | How |

|---|---|---|---|

| Friday, December 18, 2020 | Palm Beach County Bar Association | Alan Gassman and Brandon Ketron present:

2020 Year End Planning from 12 to 1:30 PM EST |

Register |

| Friday, December 18, 2020 | Leimberg Webinar Services (LISI) | Alan Gassman and Brandon Ketron present:

PPP Loan Expense Deductibility, What Is An Advisor To Do? from 3:30 to 4:45 PM EST |

Register |

| Monday, December 21, 2020 | CPA Academy | Alan Gassman, Jerry Hesch and Brandon Ketron present:

Dynamic And Creative Charitable Planning – What You Wish You Had Known Before from 5:30 to 6:30 PM EST |

Register |

| Monday, December 28, 2020 | CPA Academy | Alan Gassman, Jerry Hesch and Brandon Ketron present:

Dynamic And Creative Charitable Planning (Part 2) – What You Wish You Had Known Before from 5:30 to 6:30 PM EST |

Register |

| Tuesday, January 5, 2021 | CPA Academy | Alan Gassman, Jerry Hesch and Brandon Ketron present:

CRUT Planning from 5:30 to 6:30 PM EST |

Coming soon |

| Tuesday, January 12, 2021 | CPA Academy | Alan Gassman, Jerry Hesch and Brandon Ketron present:

CLAT Planning from 5:30 to 6:30 PM EST |

Coming soon |

| Tuesday, January 19, 2021 | CPA Academy | Alan Gassman, Jerry Hesch and Brandon Ketron present:

Charitable Planning Series Finale – Putting It All Together With Real Life Examples from 5:30 to 6:30 PM EST |

Coming soon |

| Friday, January 22, 2021 | Collier County Bar Association | Alan Gassman presents:

An Estate Tax Planning Tune Up from 11 AM to 12 PM EST |

Register |

| Friday, January 29, 2021 | Florida Bar Health Law Section: Representing the Physician | Alan Gassman presents:

Medical Practices And PPP, EIDL, and Provider Relief Fund Planning and Implications |

Coming soon |

| Thursday, February 11, 2021 | Johns Hopkins All Children’s Annual Estate Planning Seminar | Alan Gassman:

Introduces speakers and listens carefully |

Register |

| Tuesday, February 23, 2021 | Estate Planning Council of Northern New Jersey | Alan Gassman presents:

WHAT YOUR BEST CLIENTS NEED TO KNOW ABOUT FLORIDA LAW AND PLANNING from 4:30 to 5:30 PM EST |

Coming soon |

| Friday, March 26, 2021 | Florida Bar: Tax Section | Alan Gassman and Leslie Share present:

Creditor Protection Nuts & Bolts |

Coming soon |

| Thursday, May 13, 2021 | FICPA-FSU Spring Accounting Conference | Alan Gassman presents:

Topic to be determined |

Coming soon |

| Friday, May 21, 2021 | Michigan ICLE Annual Probate & Estate Planning Institute | Alan Gassman presents:

Prebankruptcy and Bankruptcy Avoidance Strategies for Challenging Situations from 11:15 AM to 12 PM CT |

Coming soon |

| Thursday, June 10, 2021 | AICPA & CIMA ENGAGE 2021 in Las Vegas, NV | Alan Gassman and Ken DeGraw present:

Pre-Bankruptcy and Creditor Planning During the COVID-19 Pandemic from 3 to 3:50 PM PT |

Register |

| Thursday, November 4, 2021 | Estate Planning Council of Birmingham | Alan Gassman presents:

Hot Topics In Estate Tax And Creditor Protection from 8 to 10 AM CT |

Coming soon |

Call us now! Bookings accepted for haunted houses, bar mitzvahs, weddings, seminars, and symposiums (or symposia)!

Nevis Business Tax Update – What’s the Latest?

Christopher Denicolo

In August of 2020, the Saint Kitts & Nevis (“Nevis”) government announced that all entities registered under the Nevis Business Corporations Ordinance (i.e., Nevis Corporations) or the Nevis Limited Liability Companies Ordinance (i.e., Nevis LLCs) will be required to file a simplified tax return whereby the directors or managers of each entity will be required to sign a declaration and provide information regarding the activities and income of the applicable entity.

Further, the Nevis government also announced a proposed income tax on Nevis corporations and LLCs that would implement a 32% tax on Nevis sourced income earned by entities. However, the proposal was not clear as to whether the tax would apply to Nevis entities that have managers and activities not located in Nevis, or what would constitute “activities located within Nevis.”

The above came as a surprise to many planners who have used Nevis in part due to its privacy laws and favorable legal and tax environment for offshore entities.

The process for filing the simplified tax returns was to begin in August of 2020, but the late notice and efforts required to comply therewith have caused the government to extend this requirement several times, most recently until December 31, 2020. Nevertheless, Trident Trust Company, a well known trust company who has offices in Nevis and who has offices that assist with the creation of Nevis entities have indicated that future extension likely will be implemented.

Trident also has indicated that a bill has been proposed to limit the tax on Nevis entities only to those entities have a permanent establishment in Nevis and locally sourced income, or that have a substantial centralized management in control located in Nevis. This bill would cause any Nevis entities that have no directors or managers located in Nevis, or that do not have a physical presence in Nevis, to not be subject to a Nevis income tax. A copy of the proposed bill can be found at the following link: Click here.

In speaking with a source familiar with the situation, there is a widely-held view that there is no legislative framework in Nevis which authorizes the government to require the filing of tax returns or to impose such a tax, and that the government’s issuance of the tax return requirements is in response to concerns from the European Union. The source believes that Nevis is heading in the direction of requiring some form of reporting, although not as comprehensive as has been proposed by the government.

Further, there is a belief that any legislation that tax returns be filed or that a Nevis income tax be assessed cannot apply until legislation is approved whereby the government is permitted to require tax returns to assess such a tax. In other words, there is a feeling that the government has “put the cart before the horse” in issuing requirements that tax returns be filed and imposing a Nevis business income tax without first having legislative authority to do so.

In any event, clients and their advisors will want to keep a close eye on further developments with respect to the potential Nevis income tax and any possible exceptions thereto.

Training New Team Members in Half the Time

David Finkel

Most business owners spend 45 hours finding and hiring a new staff member. And it often takes another 40+ hours to onboard and train that individual depending on their position and responsibilities. Which means that each new team member could take up to two weeks to get fully trained. And unfortunately for many business owners, we just don’t have that kind of time. There are a thousand other things that demand our attention, and many of them require our focus.

So, as a business owner, the best thing that you can do is learn how to streamline your training process to get a new team member up and running with little to no time investment from you.

Straightforward and Simple: Create a Simple Training Outline

The first step is to get clear on what you want the new hire to learn and putting that down into a simple training outline. You want to include things like. What is the information you want them to know? What do they need to be responsible for? Where will they go to learn all the different items in the outline? What behaviors or company culture do they need to be aware of?

Once you’ve got that simple outline, that outline by itself, is actual version 1.0 of your training system.

I can’t tell the number of times I will talk to a client about how they’ve onboarded a new person or they’ve trained somebody in a new area of the business that’s new to them, and they just kind of winged it. Then, the next time that person has to train somebody else in that same thing, they’ve got to kind of recreate the wheel, which isn’t effective and leads to inconsistencies in your training program.

Keep It Short

Once you have your outline put together the next thing you want to do is break it down into small modules. Don’t do a three-hour training. Think about that outline as a series of small modules that they can do over the course of a few days or even weeks.

Think about how we learn on YouTube. We don’t want the 30 to 60-minute how-to version. We want it broken down into small pieces. There are some real inherent advantages to that even though it seems a little bit harder to do. So, if you take your outline, look for logical ways to break that into small chunks that build one after the other.

Get The Right Tools

The next thing you want to ask yourself is what tools would I want to augment your training outline and modules with? Is there a checklist that should go with this? Is there a written description that should go with it? Would this be better done as a video? Would this be better done as an audio recording of a sales conversation if it’s done over the phone? Would this be better done with a template that’s a Word doc with merge fields in it? The idea behind it is you’re just thinking through what tools do I have at my disposal that could make this training piece go better?

Make it Replicable

The fourth and final piece to making your training go faster and smoother is to think through how you are going to make this training replicable? Is it something that really has to be done person-to-person? If so, is there some feedback loop you can set up so that you know the person is getting the information and training they need to be successful? For a lot of this training, especially for the companies we’re dealing with, a lot of it can be video-based training once they get it going.

They can create a series of modules – five, ten, fifteen modules to cross-train on how to do X or Y inside their company. And now training is as easy as giving a person access to the shared drive or Vimeo channel where all the videos are held.

Training a new team member doesn’t have to take two weeks of your time. With these four tips you can do it in the half the time and with a lot less effort.

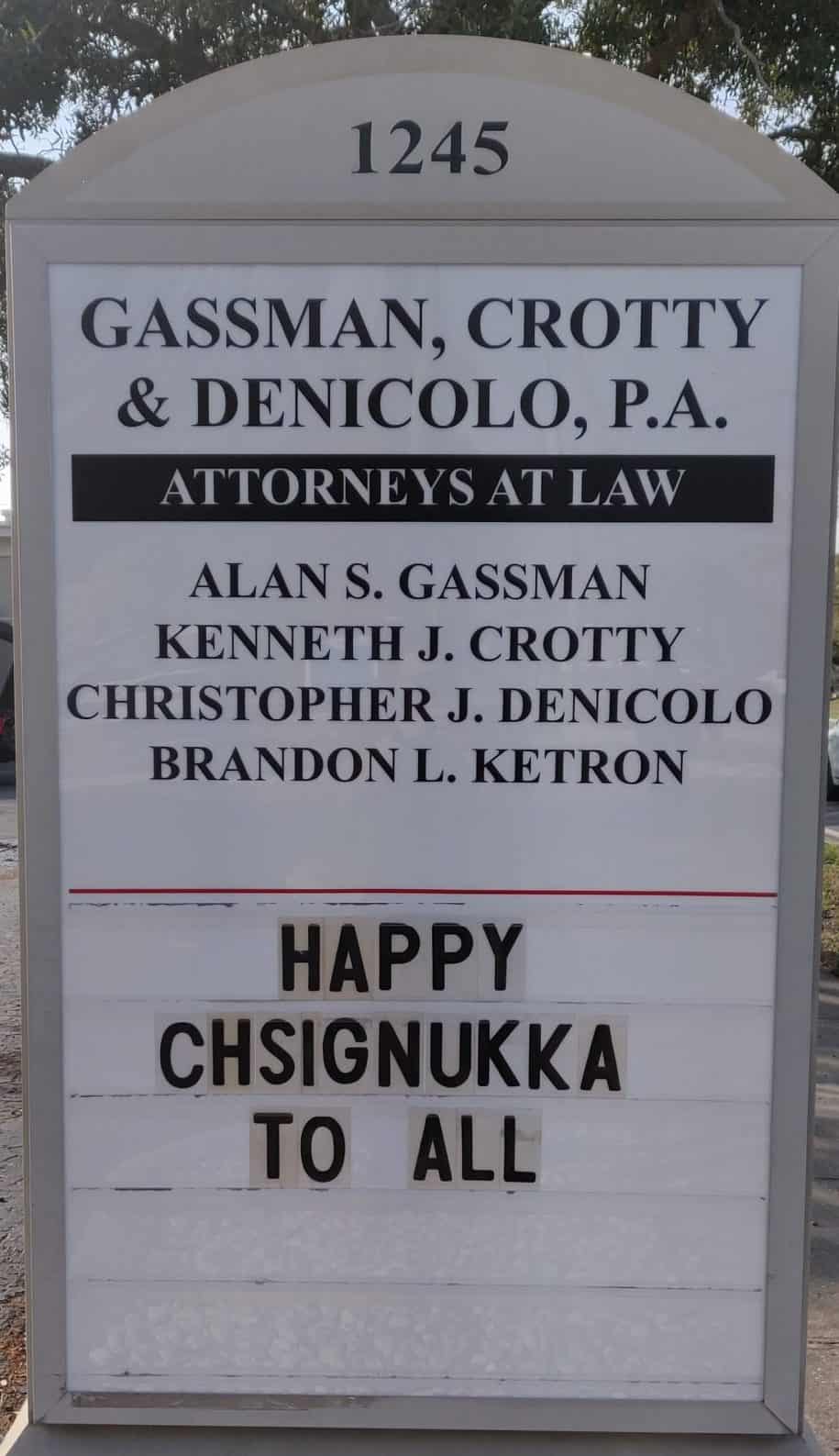

Humor

Gassman, Crotty & Denicolo, P.A.

1245 Court Street

Clearwater, FL 33756

(727) 442-1200

Unsubscribe here