The Thursday Report – Issue 294

ALWAYS FREE, SOMETIMES PUBLISHED ON THURSDAYS

Friday, December 4, 2020 – Issue 294

Having trouble viewing this? Use this link

Feeling InSECURE with Estate Planning for Your Large IRA? Consider the “TEA POT” Trust System, Unless Paying Taxes Is Your Cup of Tea

FICPA Federal Tax Conference

Upcoming Events

Summary of Jon Dickinson et ux. V. Commissioner

For Finkel’s Followers

Humor

Feeling InSECURE with Estate Planning for Your Large IRA? Consider the “TEA POT” Trust System, Unless Paying Taxes Is Your Cup of Tea

Alan Gassman, Christopher Denicolo & Brandon Ketron

EXECUTIVE SUMMARY:

New tax laws create new opportunities for estate and tax planners to optimize the economic results for their clients, using both time tested and newly adapted structures. The SECURE Act provides us with less complexity in the long run, but also has increased and accelerated the potential income taxes that are associated with required distributions from IRA and other qualified required plansii after the death of the IRA owner or retirement plan participant.iii Specifically, “stretch” payouts over the life expectancies of non-spouse adult beneficiaries who are not disabled, chronically ill, or less than 10 years younger than the deceased Plan Participant have been eliminated. Instead, all assets must be distributed from the IRA/Plan within a usually appreciably shorter timeframe (generally no longer than approximately 10 years after the death of the Plan Participant), and such distributions typically are treated as ordinary income subject to income tax. This can result in a significant departure from the income tax deferral afforded by the “stretch” that was available under prior law.

While qualified advisors can take an educated guess as to how to allocate IRAs/Plans among multiple trusts for multiple adult children and their descendants in a tax efficient manner, it is almost certain that such an estimate will miss the mark by a significant degree, given the changes in circumstances, tax law and family objectives, that can change considerably over the course of a decade.

In light of these potential cumbersome challenges, an alternative is for the Plan Participant to leave an IRA/Plan to a single pot trust and to give the trustee thereof the discretionary authority to sprinkle income among the Plan Participant’s children and other descendants, while allowing the trustee to conduct an annual strategic review of beneficiaries and their tax situations to determine if and when to make distributions that will carry taxable income out so that the net tax result is optimized. The trust will be drafted as an “Accumulation Trust,” meaning that all assets must be distributed from the IRA/Plan no later than December 31st of the 10th year following the year of the Plan Participant’s death, although the trustee is not required to distribute any assets from the trust to the trust beneficiaries.

The pot trust structure allows for tax efficient allocation of IRA/Plan assets between the trust beneficiaries; hence its name- the “Twin Tax Efficient Accumulation POT Trust℠,” or the “TEA POT Trust.”

FACTS:

“Take some more tea” the March Hare said to Alice, very earnestly.

The SECURE Act became law on December 20, 2019, and has drastically changed planning for qualified retirement plans. Effective January 1, 2020, the SECURE Act requires the vast majority of IRAs/Plans that are inherited by individuals or trusts, other than by a surviving spouse or certain other qualifying beneficiaries in limited circumstances (or in a special type of trust for the benefit of any such beneficiaries), to be paid out by no later than December 31st of the 10th year following the calendar year of the Plan Participant’s death. This rule is referred to as the “10-Year Rule.”

Under the previous law, IRAs/Plans that were inherited by individuals or properly drafted “See-Through Trusts” for individuals could be paid out over the life expectancy of the individual (in the case of an individual being the direct beneficiary of the IRA/Plan), or over the life expectancy of the oldest beneficiary of the trust who could receive benefits from IRA/Plan (in the case where the trust is a beneficiary). An IRA/Plan that can be paid out over the life expectancy of a beneficiary is known as a “Stretch IRA.” However, for most beneficiaries, the Stretch IRA has been eliminated. The effects of this change are drastic.

For example, as discussed in the authors’ Employee Benefits and Retirement Planning Newsletter #715 (January 6, 2020), if a 50-year-old non-spouse beneficiary who is the Designated Beneficiary of a $1,000,000 IRA with assets that grow at a 6% annual rate of return, and if the beneficiary is in the 37% income tax bracket, and will reinvest amounts distributed at a 5% after-tax rate of return, then the loss of life expectancy deferral will result in a $470,492 difference in the amount of total assets remaining after taxes 10 years after the death of the Plan Participant, assuming that the 10-Year Rule applies. The difference is $594,905 after 20 years and $470,810 after 30 years.

This is a very large difference.

The growth in value inside an IRA/Plan over a number of years will cause a significant advantage for a lifetime payout beneficiary that simply is not available under the SECURE Act.

There are exceptions under the SECURE Act for IRAs/Plans that are left directly to, or to a special type of trust for the Plan Participant’s surviving spouse, the Plan Participant’s minor children, beneficiaries who are chronically ill or disabled, and beneficiaries who are no more than ten years younger than the deceased Plan Participant (these beneficiaries are known as “Eligible Designated Beneficiaries”), but these exceptions will not help the vast majority of individuals who will inherit IRAs left by their parents, aunts, uncles or others.iv However, under the SECURE Act, the Stretch IRA treatment expires upon the death of an Eligible Designated Beneficiary, or upon a minor child reaching the age of majority, and all assets must be distributed out of the IRA/Plan by December 31st of the year that is 10 years after the event causing expiration of the Stretch IRA treatment. This can lead to undesired results, despite the initial attractiveness of the availability of the Stretch IRA treatment.

What’s more, the Stretch IRA treatment generally applies only where an IRA/Plan is left directly to an Eligible Designated Beneficiary or to a “Conduit Trust” for an Eligible Designated Beneficiary (which must require that all distributions from the IRA/Plan be paid directly to the Eligible Designated Beneficiary). Therefore, leaving an IRA/Plan to or for the benefit of an Eligible Designated Beneficiary in a manner that will qualify for Stretch IRA treatment comes at the cost of severely compromising the asset preservation and creditor protection benefits that result from leaving an IRA/Plan to a protective trust structure for the Plan Participant’s desired beneficiaries.

COMMENT:

For most married clients, a common approach is for the Plan Participant to leave IRA/Plans to his or her surviving spouse. This will enable the surviving spouse to roll over all or any portion of the inherited IRA/Plan into the spouse’s own IRA. The surviving spouse then will be treated as if he or she were the original Plan Participant of the rolled over IRA, which allows the surviving spouse to delay required distributions from the IRA until after he or she has reached the age of 72, and to take required minimum distributions over the more favorable “Uniform Life” distribution table. It also allows the surviving spouse to select the beneficiary who will inherit the IRA upon his or her later death.

In a second marriage situation or other circumstances where the Plan Participant wants the surviving spouse to have the lifetime benefit of an IRA/Plan, but not the ability to choose the beneficiary thereof after the spouse’s death, a Conduit Trust for the lifetime benefit of the surviving spouse might be the (relatively) optimal recipient of the Plan Participant’s IRA/Plan upon his or her death. The Conduit Trust can be drafted to provide for the IRA/Plan to be held in the Trust for the Plan Participant’s desired secondary beneficiaries after the spouse’s death, but the 10-Year Rule will apply after the surviving spouse’s death to require that all assets be distributed from the IRA/Plan.

When an unmarried Plan Participant dies and has multiple descendants, or the Plan Participant’s surviving spouse dies and the IRA/Plan had been held under a Conduit Trust for the spouse’s lifetime benefit, the typical distribution and division will be for equal shares set aside for each child, or for separate equal trusts to be funded for each child. Normally, these trusts are drafted so that the child can be the trustee or a co-trustee, and the child and his or her descendants can receive distributions as reasonably needed for their health, education, maintenance, or support, although no distributions are required to be made from the trusts. Such trusts should be drafted to qualify as Accumulation Trusts to avoid the having the otherwise default “5-Year Rule” (whereby all assets must be distributed from IRA/Plan by December 31st of the 5th calendar year following the Plan Participant’s death) from applying. While the Treasury Regulations will need to clarify this issue, it appears to the authors that the At Least As Rapidly Rule will continue to be available to beneficiaries of an IRA/Plan where the Plan Participant has died after reaching his or her required beginning date.v

Under the SECURE Act, IRAs/Plans that are left to such Accumulation Trusts will be subject to the 10-Year Rule whereby all assets must be distributed from IRA/Plan by December 31st of the 10th calendar year following the Plan Participant’s death (or from the surviving spouse’s death if the IRA/Plan was payable to a Conduit Trust for his or her benefit upon the original Plan Participant’s death). Nevertheless, income tax planning opportunities exist to mitigate the effect of the 10-Year Rule.

“The best way to explain it is to do it.”

Most affluent families who have large IRAs also have children who are well- educated and are in the upper income tax brackets, but this is not always the case. For example, an individual with a $900,000 traditional IRA and $3,000,000 of other assets may have one adult child who is in the 40% combined federal and state tax brackets (“Chrys Chamomile”), another adult child in the 25% combined federal and state tax brackets (“Earl Grey”), and a third adult child in the 10% combined federal and state tax brackets (“Chai Green”).

If trusts for the three adult children each receive $300,000 in IRA benefits that have to be paid out within 10 years of the death of the surviving parent, then the taxes that might have to be paid by each respective trust would be $120,000 by Chrys Chamomile ($300,000 x 40%), $75,000 by Earl Grey ($300,000 x 25%), and $30,000 by Chai Green ($300,000 x 10%).

It would make sense to leave the IRA to the trust for Chai Green, and other assets to the trusts for the other children in larger proportions to counterbalance the negative effect of income taxes on the IRA/Plan assets as the required distributions are made, in order to cause greater tax efficiency. However, it will be hard to estimate how much in extra assets to give to the other two children to take into account that Chai Green may have to pay significant income taxes on $900,000, plus growth, coming out of an IRA over 10 years. Additionally, circumstances might change. Chrys Chamomile may become disabled for one or two years and have deductible nursing expenses that would enable him or her to receive $100,000 a year from an IRA tax-free.

Twinkle twinkle little bat!

How I wonder where you’re at!

Up above the world you fly Like a tea tray in the sky.

(- the Mad Hatter)

For these reasons, and for this situation, the Twin TEA POT Trust System℠ makes good sense. In the above example, all $900,000 of the IRAs can be made payable to one Accumulation Trust, which can be the beneficiary of one or more IRAs/Plans until the tax year after date on which the 10-Year Rule mandates full distribution of all assets from the IRA/Plan. Such time period is referred to as the “Allocation Period” for the purposes of this Newsletter. During the approximately 10-Year Period, the trustee of that trust can sprinkle the distributions received among the children and their respective family members as the trustee deems appropriate, taking need and tax brackets into account.

This is why we believe that a “TEA POT Trust” serving solely as the “Stretch Trust” beneficiary of IRAs/Plans can provide advantageous income tax results, and that having a non-IRA, non-pension “Equalization Trust” set aside will enable the Trustees to make distributions to or for the benefit of one or more of the descendants or trusts for their benefit to “even things up” during or after the Allocation Period.

Obviously, the distributions received by this trust will be expended on some descendants to a greater extent than others. For example, annual payments can be made to Chai Green to make use of the lower brackets each year, as opposed to waiting to give him, or a trust for his benefit, all $900,000 worth, plus growth, in the 10th year.

Further, Chrys Chamomile might have a child of her own, Mushroom Brew, who is disabled and has significant deductible medical and personal care expenses. It can make good tax sense for the monies to be spent for low income grandchildren to the extent that they may not be subject to the Kiddie Tax.vi

In order to keep things fair and equitable, a separate “Equalization Trust” can be established as part of the TEA POT Trust System, which can be held until the expiration of the Allocation Period to provide benefits to the family members who do not receive a “fair share” of the benefit from the TEA POT Trust due to IRA/Plan assets having been allocated to other family members.

In our example, the TEA POT Trust would receive all rights to the $900,000 in IRA accounts, and the Equalization Trust would receive $1,500,000 worth of other assets. This would leave $1,500,000 worth of assets that would be divided into three under the surviving parent’s revocable trust shortly after such parent’s death, so that the trust for each separate child would receive $500,000 in assets. Over the course of the approximately 10-year Allocation Period following the surviving parent’s death (but no later than the expiration of the Allocation Period), each child’s trust will receive the child’s one-third share of the total $2,400,000, which can equate to at least $800,000 plus growth (net of taxes).

A competent CPA who understands income taxes for individuals and trusts can be retained by the trustee of the TEA POT Trust, and can advise each year on whether to take a distribution, and how to distribute the distribution to most effectively reduce income tax and enhance the inheritance of all beneficiaries.

The TEA POT Trust and the Equalization Trust can be managed by all of the children, along with a professional or corporate trustee, if desired, and someone from outside of the family, like a long-term lawyer, CPA, or other advisor or close friend can serve to act as the “tie-breaker” in order to help determine how the Equalization Trust is distributed. Alternatively, a CPA firm could be named and given the task to determine what the after-tax impact of the TEA POT Trust has been, and to calculate how much of the Equalization Trust should be distributed to the trusts for the separate children in order to facilitate after-tax sharing in the most equitable manner.

Most tax and estate planners are well aware that a separately taxed “complex trust” measures its taxable income in a manner very similar to what applies to individuals, but that distributions made during a tax year, as well as distributions made within 65 days of the end of the tax year that the trustee elects to have considered as having been distributed in the previous year.

As discussed in the authors’ LISI Employee Benefits and Retirement Planning Newsletter #715 (January 6, 2020), there is a question of whether the IRS will consider the TEA POT Trust and the Equalization Trust to be considered as one trust for federal income tax purposes.

Because of this, it will be safest to not make distributions from the Equalization Trust in the same calendar year that distributions are made from the TEA POT Trust, so that the IRS does not treat the income as coming pro rata from each trust to the recipient beneficiaries. Some families will distribute from the TEA POT only for the first ten years, and then from the Equalization Trust, while others may alternate years – year 1 from the TEA POT Trust, year 2 from the Equalization Trust, etc.

With reference to if and when two or more trusts will be considered to be a single trust, under IRC Section 643(f) and Treasury Regulation Section 1.643(f), two or more trusts will be treated as one trust if they have all three of the following:

- substantially the same grantor, with married couples being considered as one grantor, even if they each separately establish a separate trust;

- substantially the same primary beneficiaries, and

- a principal purpose of such trust is the avoidance of income tax.

Under the prior law, “shadow trusts” have been commonly used for the purpose of being the beneficiary of IRAs/Plans after the death of the Plan Participant, so that the rules and limitations required to qualify the trust as a “See Through Trust”, are complied with. This may provide sufficient justification to establish a multiple trust arrangement for reasons other than to avoid income tax. Further, it may be sufficient if each trust has different provisions regarding the distribution of income or principal, and one trust provides for the possibility of distributions being made to beneficiaries who are not beneficiaries of the other trust. For example, the Equalization Trust could permit the trustee thereof to make distributions of non-IRA Plan assets to charitable organizations.

A separate TEA CUP Trust could be established from the IRA accounts otherwise intended for the TEA POT Trust if there is a chronically ill or disabled beneficiary who is intended to receive IRA/Plan assets. The TEA CUP Trust can be structured as an Accumulation Trust for the benefit of such chronically ill or disabled beneficiary, and the TEA CUP Trust should be entitled to Stretch IRA treatment with respect to required minimum distributions payable over the lifetime of the chronically ill or disabled beneficiary. This is because a chronically ill or disabled beneficiary is an eligible designated beneficiary to which the Stretch IRA treatment applies, and a special exception unique to chronically ill or disabled beneficiaries allows for Stretch IRA treatment to apply even if the IRA/Plan is made payable to an Accumulation Trust for the benefit of the chronically ill or disabled beneficiary and such separate Accumulation Trust is divided from a larger trust after the death of the Plan Participant.

It is noteworthy that an Accumulation Trust established for a minor must be directly funded to qualify for the use of the minor’s life expectancy through the age of majority, so it does not appear that a TEA POT Trust can share its assets to fund a TEA CUP Trust under the new law.

In addition, the family may have charitable intentions, and the TEA POT Trust can allow the trustee to make distributions from the IRAs/Plans accounts directly to charity provided that no such distributions may be made to any charity or other non-individual after September 30 of the of the calendar year following the year of the death of the Plan Participant. The September 30 deadline serves to help assure that the Trust will qualify as an Accumulation Trust, as only individuals can be beneficiaries of an Accumulation Trust after such September 30. This means that the family may huddle shortly after the Plan Participant’s death to determine how much or what to give to charity, and which beneficiaries will have their inheritance trusts reduced to take this into consideration.

While we recommend that neither of the TEA POT Trusts have any disposition to charity after the September 30 of the year following death date, it seems that the tax law will permit the Equalization Trust to invest its assets in an entity taxed as a partnership, and to receive ownership in the partnership in exchange for such investment. The partnership can make charitable contributions, and can receive an income tax charitable deduction that is passed through to its partners (including the Equalization Trust) on Forms K-1. It might be possible for the TEA POT Trust to be a partner in the partnership as well, but the IRS may argue that the charitable recipients of the partnership’s charitable contributions are considered to be beneficiaries of the Trust, which would cause detrimental effects to the TEA POT Trust’s ability to qualify as an Accumulation Trust.

The TEA POT Trust has other advantages besides tax savings and flexibility, namely:

- The TEA POT Trust will relieve the children and their respective trustees from having to work with smaller ($300,000 each in our example) IRA stretch trusts that will need to be separate and apart from their other lifetime benefit trusts in order to have the 10-Year distribution deferral period apply, and to avoid the expenses and possible mistakes associated with the administration and maintenance thereof.

- The TEA POT Trust keeps the children together with respect to the management and distribution thereof, as opposed to each child going their own separate way from an investment decision-making, management and interpersonal standpoint. Further, the Trust can require that each child attend an annual meeting, and that competent advisors be hired and used.

The most adept and conscientious child or children will hopefully set a good example and “rub off” on the less adept and less attentive child or children, which may influence everyone to do a better job in being a trustee or co-trustee for their own trusts. Additionally, an advantage to not having separate trusts is that one child may have little or no appreciation for the need of staying in touch and requesting assistance from competent tax and legal advisors.

- As stated above, the TEA POT Trust can provide the creditor protection and asset preservation benefits afforded by a spendthrift trust that does not require compulsory distributions therefrom. This is perhaps the most significant advantage of the TEA POT Trust relative to the IRA/Plan being left directly to a child or to a Conduit Trust for the child.

- Having the children receive additional distributions after the Allocation Period can help assure that the trusts for the children and subsequent generations are not inadvertently exhausted.

- The TEA POT Trust will be more flexible, if there are law changes in the future, because of the special language that can be provided in the trust agreement to facilitate this.

Conclusion

Try a Little TEA POT, short and stout,

To pay less tax from distributions, so that the beneficiaries don’t pout.

Explain that it is a tax savings vehicle of choice.

And that interaction with tax advisors

To give tax advisors and good management a solid voice.

Let us know whether you agree

That for many clients this will be the right cup of tea.

The Twin TEA POT Trust System℠ will be discussed in greater detail on the authors’ upcoming LISI Webinar on Thursday, January 9, 2020, entitled “Practical Estate and Trust Planning After the Secure Act- Including Sample Provisions, Checklists and Client Explanation Letters.”

“But what happens when you come to the beginning again?” Alice ventured to ask.

“Suppose we change the subject”, the March Hare interrupted, yawning.

HOPE THIS HELPS YOU HELP OTHERS MAKE A POSITIVE DIFFERENCE!

CITE AS:

LISI Employee Benefits and Retirement Planning Newsletter #716 (January 7, 2020) at http://www.leimbergservices.com, Copyright 2020 Leimberg Information Services, Inc. (LISI). Reproduction in Any Form or Forwarding to Any Person Prohibited – Without Express Permission. This newsletter is designed to provide accurate and authoritative information in regard to the subject matter covered. It is provided with the understanding that LISI is not engaged in rendering legal, accounting, or other professional advice or services. If such advice is required, the services of a competent professional should be sought. Statements of fact or opinion are the responsibility of the authors and do not represent an opinion on the part of the officers or staff of LISI.

CITATIONS:

iii For the purposes of this Newsletter, the term “Plan Participant” means the person who is the IRA owner or qualified retirement plan participant, while alive, or after death.

iv For a great summary of the changes to qualified retirement plans brought about by the SECURE Act, see Employee Benefits and Retirement Planning Newsletter #713 written by Natalie Choate.

v Under prior law, if a Plan Participant died after reaching his or her required beginning date, then the beneficiaries would be entitled to choose whether the “At Least As Rapidly Rule” applied to cause required minimum distributions to be payable over the deceased Plan Participant’s life expectancy, based upon the single life table, without annual recalculation. There is some question as to whether this “At Least As Rapidly Rule” continues to apply where an IRA/Plan is left to an individual designated beneficiary or to a trust that qualifies as a See-Through Trust (i.e. a Conduit Trust or an Accumulation Trust).

Treasury Regulation §1.401(a)(9)-5, Q&A-5 references the longer of: (i) the life expectancy of the designated beneficiary (which no longer applies under the SECURE Act unless the beneficiary is an eligible designated beneficiary); or (ii) the deceased Plan Participant’s remaining life expectancy, regarding the determination of the distribution period if the Plan Participant dies on or after his or her required beginning date.

Nevertheless, it seems that a beneficiary of an IRA/Plan still has the ability to use the At Least As Rapidly Rule if the Plan Participant dies on or after his or her required beginning date because IRC Section 401(a)(9)(B)(i)(II) was not modified by the SECURE Act to modify or remove the “At Least As Rapidly Rule,” and nothing in the revised statute indicates that the 10-Year Rule was intended to eliminate the “At Least As Rapidly Rule” or change the default distribution period applicable where the Plan Participant dies on or after his or her required beginning date.

While IRC Section 401(a)(9)(H)(i)(II) indicates that the 10-Year Rule applies in lieu of the 5-Year Rule where there is a designated beneficiary, regardless of whether the Plan Participant died on or after his or her required beginning date, if Congress intended to remove the at least as rapidly rule, then Section 401(a)(9)(B)(i)(II) would have been modified accordingly. The objective of IRC Section 401(a)(9)(H)(i)(II) appears to be to replace the 5-Year Rule with the 10-Year Rule where a Plan Participant dies and leaves a (non-eligible) designated beneficiary, even if the Plan Participant dies on or after his or her required beginning date.

Further, if this Section is read in conjunction with the post-SECURE Act IRC Section 401(a)(9), it seems that the “longer of” the deceased Plan Participant’s remaining life expectancy, or the distribution period applicable to the designated beneficiary (whether it be the life expectancy rule if the designated beneficiary is an eligible designated beneficiary, or the 10-Year Rule otherwise) will apply if Plan Participant died on or after his or her required beginning date.

The solution is easier if a trust is the beneficiary of the Plan, as the choice can be made by intentionally failing to comply with the requirement that certain documentation be provided to the plan administrator by October 31st of the year after the Plan Participant’s death.

It also does not seem that Congress wanted to provide less flexibility for individual designated beneficiaries, rather than for situations where the designated beneficiary is determined under a See-Through Trust or if there is no designated beneficiary, as it is clear that the At Least As Rapidly Rule will apply if there is no designated beneficiary. Additionally, the At Least As Rapidly Rule would not change the distribution period that would apply if the Plan Participant were still living, so the distribution period would not be extended by reason of the Plan Participant’s death, which leads to conclusion that it was intended to remain in effect where there is a designated beneficiary of the IRA/Plan.

vi The Kiddie Tax was also changed by the SECURE Act to cause any investment or unearned income of a child under the age of 19 (or a full-time student between the ages of 19 and 23) to be subject to income tax at the tax brackets of the child’s parents, instead of at the tax brackets applicable to complex trusts which applied after the Tax Cuts and Jobs Act of 2017.

Alan Gassman, Brandon Ketron, Ken Crotty & Christopher Denicolo all have the honor of presenting to the FICPA next week.

Join them and your colleagues by registering to attend with this link.

Thursday, December 10, 2020

8 AM to 5 PM EST

Did Your IRA Planning Survive the 2019 Secure Act?

Presented by Thomas C. Shaw

Time: Thursday 8:00am – 8:50am Credits: 1 TB

Implementation of TCJA guidance

Presented by Alan Gassman & Brandon Ketron

Time: Thursday 9:00am – 9:50am Credits: 1 TB

This session will focus on the guidance issued by the Treasury to implement the provisions of the 2017 Tax Cuts and Jobs Act (TCJA) including:

- Section 199A Regulations and IRS Notices

- Recent Guidance issued on trust and estate miscellaneous itemized deductions

- Suspension of some TCJA provisions as a result of the CARES ACT

- And much more!

Taxpayer Rights Protections Under the “Taxpayer’s First Act” and Tax Resolution

Presented by Daniel Henn, CPA, MST

Time: Thursday 10:00am – 10:50am Credits: 1 TB

Current Developments in Partnership and Real Estate Taxation

Presented by Mark Eliot Brechbill, CPA

Time: Thursday 11:00am – 11:50am Credits: 1 TB

Practice Aids – Inflation adjusted amounts, mileage rates, retirement contributions and more

Presented by Daniel Henn, CPA, MST

Time: Thursday 12:50pm – 1:40pm Credits: 1 TB

AI & Data Analytics in Federal Tax Research

Presented by Nathan Leon Wadlinger, CPA, JD, LLM

Time: Thursday 1:50pm – 2:40pm Credits: 1 TB

Hot Topics and Planning Strategies for S and C Corporations

Presented by Ken Crotty & Christopher Denicolo

Time: Thursday 2:50pm – 3:40pm Credits: 1 TB

S corporations and C corporations are ubiquitous in business and estate planning settings. Recent changes to the tax law have affected S corporations and C corporations, and have created tax planning opportunities for such entities. This presentation will explore:

- Recent changes

- Practical estate/gift and income tax planning strategies

- Tricks and traps for the unwary

Estate and Gift Tax Update

Presented by Dana M. Apfelbaum, Esq.

Time: Thursday 3:50pm – 4:40pm Credits: 1 TB

UPCOMING EVENTS

FREE WEBINARS FROM OUR FIRM ARE HIGHLIGHTED IN BLUE

| When | Who | What | How |

|---|---|---|---|

| Friday, December 04, 2020 | Leimberg Webinar Services (LISI) |

Alan Gassman, Brandon Ketron and Michael Lehmann present: Time Sensitive Charitable Tax Opportunities: Technical Rules that Provide Solid Tax and Practical Opportunities for Taxpayers and their Charities and Family Members from 11 to 12:30 PM EST |

Register |

| Friday, December 04, 2020 | Free webinar from our firm |

Alan Gassman, Ken DeGraw and Michael Markham present: Subchapter V – And Recent Bankruptcy Law Developments from 12:30 to 1:15 PM EST |

Register |

| Friday, December 4, 2020 | Leimberg Webinar Services (LISI) |

Jerry Hesch, Alan Gassman and Brandon Ketron present: What The CRUT? Is It Time to Put One Up? from 1 to 2:30 PM EST |

Register |

| Monday, December 7, 2020 | CPA Academy |

Alan Gassman and Brandon Ketron present: TAX PLANNING WITH PPP LOANS AFTER REV. RUL. 2020-27 & REV. PROC. 2020-51 from 5:30 to 7 PM EST |

Register |

| Thursday, December 10, 2020 |

FICPA Federal Tax Conference |

Alan Gassman and Brandon Ketron present: Implementation of TCJA guidance from 9 to 9:50 AM EST |

Register |

| Thursday, December 10, 2020 | FICPA Federal Tax Conference |

Ken Crotty and Christopher Denicolo present: Hot Topics and Planning Strategies for S and C Corporations from 2:50 to 3:40 PM EST |

Register |

| Monday, December 14, 2020 | CPA Academy |

Alan Gassman and Leslie Share present: U.S. INTERNATIONAL TAX AND COMPLIANCE UPDATE from 5:30 to 6:30 PM EST |

Register |

| Tuesday, December 18, 2020 | Palm Beach County Bar Association |

Alan Gassman and Brandon Ketron present: 2020 Year End Planning from 12 to 1:30 PM EST |

Register |

| Tuesday, January 12, 2021 | CPA Academy |

Alan Gassman and Michael Lehmann present: Dynamic And Creative Charitable Planning – What You Wish You Had Known Before from 5:30 to 6:30 PM EST |

Coming Soon |

| Friday, January 29, 2021 | Florida Bar Health Law Section: Representing the Physician |

Alan Gassman presents: Medical Practices And PPP, EIDL, and Provider Relief Fund Planning and Implications |

Coming Soon |

| Thursday, February 11, 2021 | Johns Hopkins All Children’s Annual Estate Planning Seminar |

Alan Gassman: Introduces speakers and listens carefully |

Register |

| Tuesday, February 23, 2021 | New Jersey State Bar Association |

Alan Gassman presents: WHAT YOUR BEST CLIENTS NEED TO KNOW ABOUT FLORIDA LAW AND PLANNING from 4:30 to 5:30 PM EST |

Coming Soon |

| Friday, March 26, 2021 | Florida Bar: Tax Section |

Alan Gassman and Leslie Share present: Creditor Protection Nuts & Bolts |

Coming Soon |

| Thursday, May 13, 2021 | FICPA-FSU Spring Accounting Conference |

Alan Gassman presents: Topic to be determined |

Coming Soon |

| Friday, May 21, 2021 | Michigan ICLE Annual Probate & Estate Planning Institute |

Alan Gassman presents: Prebankruptcy and Bankruptcy Avoidance Strategies for Challenging Situations from 11:15 AM to 12 PM CT |

Coming Soon |

| Thursday, June 10, 2021 | AICPA & CIMA ENGAGE 2021 in Las Vegas, NV |

Alan Gassman and Ken DeGraw present: Pre-Bankruptcy and Creditor Planning During the COVID-19 Pandemic from 3 to 3:50 PM PT |

Register |

Call us now! Bookings accepted for haunted houses, bar mitzvahs, weddings, seminars, and symposiums (or symposia)!

Summary of Jon Dickinson et ux. V. Commissioner

Wesley Dickson

Jon Dickinson was the CFO of Geosyntec Consultants, Inc. (GCI). GCI allowed donations of shareholders’ shares to a Fidelity donor-advised fund program that qualified as a 501(c)(3) organization. Dickinson donated shares over a period of three years to the fund and signed a “letter of understanding” stating that the donated stock was owned and controlled by the fund exclusively. Shortly after each of Dickinson’s donations, Fidelity would redeem the shares and Dickinson would claim a charitable contribution deduction on his Form 1040. The IRS issued a notice of deficiency in March, 2019 citing that the petitioners “were liable for tax on the redemption of the donated GCI shares.” (Dickinson, 4)

Under IRC §61(a)(3) a taxpayer can donate an appreciated asset to a charity and avoid the tax that would arise from selling the asset to donate the proceeds. The petitioners donated the shares seeking this tax advantage, but the IRS felt that each donation of shares should be treated as a redemption of the shares for cash “followed by petitioners’ donation of the cash redemption proceeds to Fidelity.” (Id., 5)

The Court cited Humacid Co. v. Commissioner, which used a two-pronged analysis in determining whether a transaction should benefit from §63(a)(3) treatment:

- did the taxpayer give away the property absolutely and part with the title

- “before the property gives rise to income by way of sale.” (Id.)

The Court found that Dickinson made an absolute gift of his shares for each year he donated before the shares gave rise to income.

The 1 Mistake That Costs Me Years of Work (And How To Avoid The Same Fate)

David Finkel

We are all guilty of doing it. You have had a key team member for a while now, and they know the ins and outs of your business. They have helped you establish and nurture some of your most important clients and vendors, and you trust that they will be with you for the long haul.

But what happens if they leave? What happens if their spouse gets relocated? What happens if they decide to retire? Or they get ill and can no longer work? Having all of that customer or vendor knowledge locked inside a team member’s head (or on sticky notes on their desk) can pose a huge risk to your business should they decide to leave.

Knowing what is truly at stake

At Maui, we are pretty good about eating our own cooking when it comes to client and vendor relationships. Everything is stored within a CRM – a customer or client relationship management program. We personally use Zoho and Infusionsoft, but there are several other really great options out there. So on the client side of things we are really good about keeping track of our contacts.

But I recently realized that I was responsible for a lot of missing data. Over the years, I’ve published twelve books and done a large amount of promotional pieces surrounding those book launches. I’ve been on a lot of different media whether it be television, or radio talk shows and podcasts. And I had not done a great job at recording all that information and it is now almost impossible, after the fact to track it all down. And I realized that during my last book launch, those contacts and media pieces would have saved me a ton of work this time around.

I realized I needed to treat those relationships just like I would a client relationship and centralize all of that information.

So, today I wanted to share with you my tips for avoiding such a costly mistake in your own business.

- Go beyond name and phone number.

When entering in a vendor or client don’t just put in the standard contact fields (name, email, phone, business name). Instead, use your CRM to its fullest potential with tags or classifications. You can have them broken down into vendors, suppliers, joint venture partners, media contacts, channel partners, etc. You want to have it all in one place.

- Record your emails.

Most CRMs have the ability to do what’s called “record” an e-mail. So, if I send an e-mail to Joe Levy, who is a podcast host, I can send him an email but make sure that it also gets recorded to his client record inside my CRM.

So, a year from now when I’m talking with his assistant about doing another podcast I can go back to my email and notes right there in the CRM. It’s all centralized and ready for myself or my marketing team to take the appropriate action.

- Learn to love web forms.

This next tip is critical when putting your data into your CRM. Consider designing a few simple web forms or structured entry points to get data into your CRM properly. Most programs have their version of internal webforms. For example, we use a web form when one of our business coaches hold a consult. It’s a form 473 – otherwise known as a post-coaching session web form.

It has a series of questions regarding the client and their needs, it also contains tags that will give us extra bits of information like where they came from, what product they were interested in, etc. It’s all there in one form and ensures that the proper data is collected each and every time someone has a consultation. Then, on those occasions where it isn’t a fit to work with a client right there and then we have the information in our system for future conversations.

Keeping proper documentation seems easy enough, but for many of us it is easy to slip up and forget. It’s one of those things that one day you’re going to look back and say David I’m so glad I listened to you! Or you may be kicking yourself for not keeping those media contacts. The choice is yours.

Humor

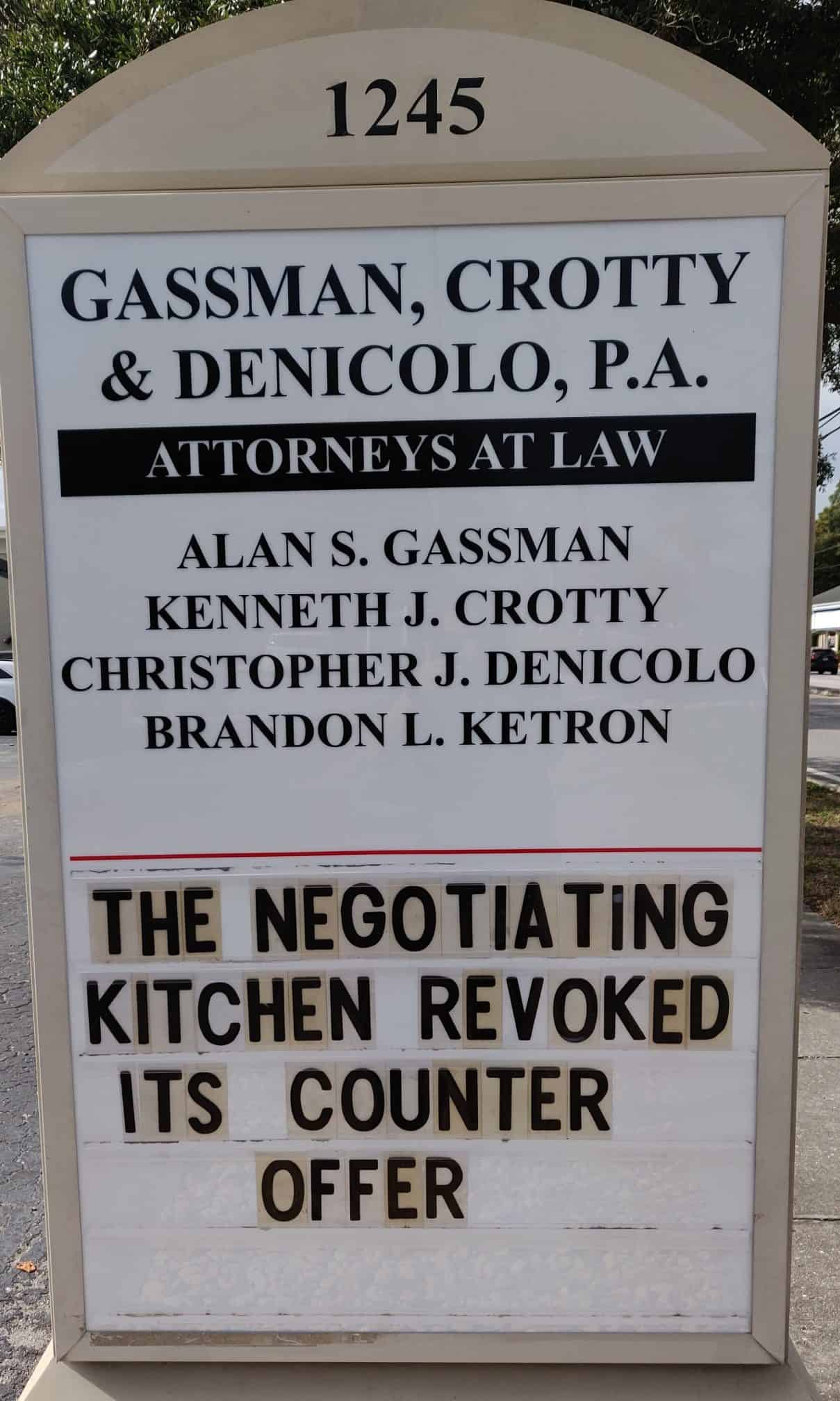

Gassman, Crotty & Denicolo, P.A.

1245 Court Street

Clearwater, FL 33756

(727) 442-1200