The Thursday Report – Issue 292

ALWAYS FREE, SOMETIMES PUBLISHED ON THURSDAYS

Thursday, November 5, 2020 – Issue 292

Having trouble viewing this? Use this link

2020 Year-End Tax Planning – With or Without a Regime Change

Upcoming Events

PPP Borrowers May Now Apply For $100,000+ Main Street Loans

For Finkel’s Followers

Humor

2020 Year-End Tax Planning – With or Without a Regime Change

Alan Gassman, Brandon Ketron & Wesley Dickson

EXECUTIVE SUMMARY:

2020 has been a difficult year, to say the least. Fortunately, however, real estate and stock market values have remained stable, and most affluent families have sufficient cash on hand and resources to weather the COVID- 19 induced recession that we are facing.

Nevertheless, many affluent Americans currently find themselves in a tough situation. With less than 2 weeks remaining before the national elections and less than 3 months remaining before the end of 2020, there is a large amount of uncertainty surrounding the question of whether taxes will go up, and what to do about it.

With a large possibility that taxes will be raised in the upcoming years, regardless of the outcome of the November elections, this newsletter serves to highlight a number of ways that individuals, who are in lower tax brackets in 2020 because of the COVID-19 situation, can take income before the end of the year so it can be taxed at the lower brackets.

FACTS:

Although President Trump has pledged not to increase taxes in the foreseeable future and Joe Biden has promised not to increase taxes on those who earn less than $400,000 per year, we are looking at a record-breaking historical annual deficit that for the month of June, 2020 exceeded what the entire national debt was in 2018, and a total present national deficit that exceeds the total value of all goods and services sold in the United States for an entire year (also known as the Gross Domestic

Product “GDP”).i

It therefore seems quite likely that we will see substantial tax increases as early as January 1st, 2021, or more probably in the latter half or quarter of 2021.

Joe Biden’s expressed intentions are to increase the highest individual back to the 39.6% bracket that was in place from 2013 through 2017, while not necessarily restoring certain deductions that were taken away as a part of the 2017 Tax Act, such as the 100% deduction for state and local taxes (SALT) and business interest deductions, which are now subject to certain limitations.

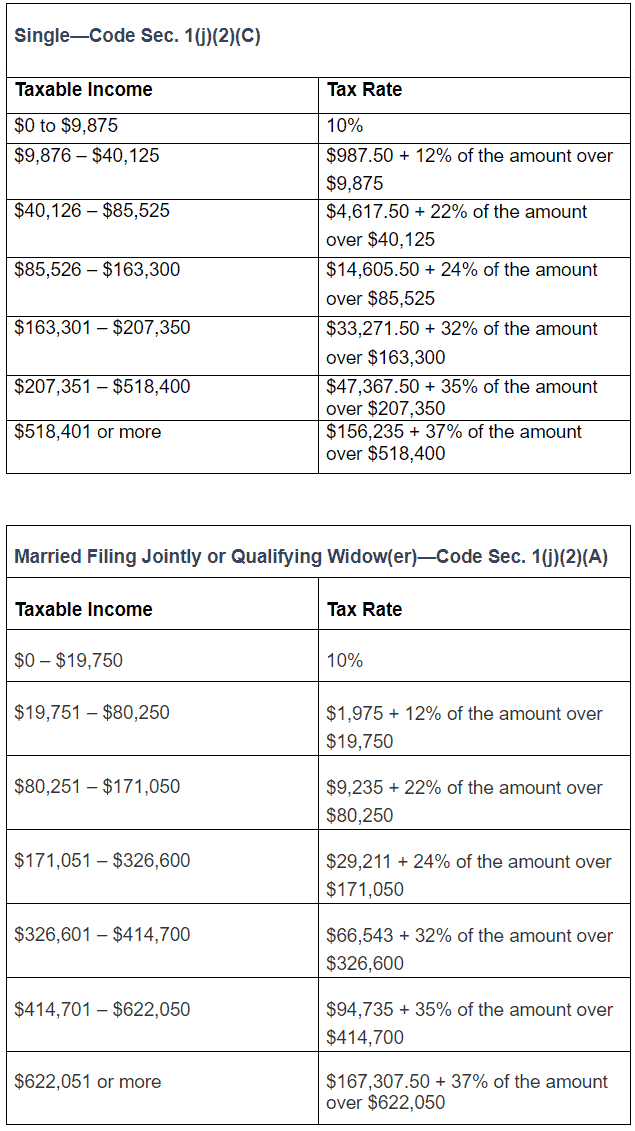

Individuals who are in a lower bracket in 2020 because of the Coronavirus situation may consider taking income before the end of the year so that it can be taxed at the lower brackets, which are as follows for single individuals and married couples filing jointly:

COMMENT:

There are several ways that individuals can accelerate income, which are as follows:

1. Withdrawals from Pension and Non-IRA Accounts

Individuals can make withdrawals from pension and non-Roth IRA accounts. However, a 10% excise tax will normally apply if the withdrawal occurs before the account holder has reached age 59

½.

There are exceptions to the imposition of the 10% excise tax for certain individuals who have been detrimentally impacted by the Coronavirus this year.

Specifically, the Coronavirus Aid, Relief, and Economic Security (CARES) Act allows for the waiver of the 10% penalty on pre-59½ payouts from retirement accounts for up to $100,000 of coronavirus-related payouts. Any funds repaid within three years are treated as rollover distributions. Otherwise, taxes due on the distribution can be spread over three years.

A “coronavirus-related distribution” is defined as a distribution from an eligible retirement plan made on or after March 27, 2020, and before December 31, 2020, made to an individual who satisfies one of the following requirements:

- The individual is diagnosed with the virus SARS-CoV-2 or with coronavirus disease 2019 (Covid-19) by a test approved by the Centers for Disease Control and Prevention (CDC);

- The individual’s spouse or dependent is diagnosed with such virus or disease by such a test;

- The individual experiences adverse financial consequences as a result of being quarantined, furloughed, laid off, or having reduced hours due to virus or disease;

- The individual experiences adverse financial consequences as a result of being unable to work due to a lack of child care caused by such virus or disease; or

- The individual experiences adverse financial consequences as a result of closing or reducing hours of a business that the individual owns or operates due to such virus or disease.

In addition, such eligible individuals are allowed to borrow more from retirement plans, such as 401(k)s, up to the lesser of

$100,000 or 100% of the account balance, until September 23, 2020. Any repayments on retirement plan loans due in 2020 are also delayed for one year.

2. Trigger Accounts Receivable

Professionals who are on the cash method of accounting may trigger accounts receivable to pay taxes on them in 2020 by transferring them from the professional corporation or entity to the owners, or by purchasing them from the professional entity at fair market value.

Normally, amounts owed for services rendered are not subject to income tax for a cash basis taxpayer until actually received.

An individual taxpayer who owns accounts receivable could trigger them early by conveying them to an S Corporation and having the S Corporation dissolve or re-convey them back to the individual before year-end.

This could be some, or all, of the accounts receivable that are owed to the individual.

3. Skip or Defer Pension Plan Contributions

Pension plan contributions may be skipped or deferred so that more income is recognized this year and larger deductions are available in 2021, depending on the kind of pension plan in place and the rules associated therewith.

On the other hand, pension plan contributions and taking whatever deductions are available may be a better strategy for taxpayers who can generate Net Operating Losses to receive cash from the IRS in early 2021.

4. Elect to Use 5- or 7-Year Depreciation on Depreciable Items

Taxpayers who have purchased depreciable items that can typically be fully deducted in the year of acquisition may elect to use 5- or 7-year depreciation, depending upon the item purchased.

5. Offer Discounts to Customers Based on Their Method of Payment

Customers can be offered discounts for early payment, or payment in cash, instead of in a deferred manner.

Sell Depreciable Assets and Purchase Their Replacements

Depreciable assets can be sold before year-end to generate income from depreciation recapture, with replacement assets purchased in 2021, to generate a new depreciation deduction.

7. Defer Charitable Donations

Charitable donations can be deferred until 2021. One exception would be for individuals who do not itemize their charitable deductions. The total deductible amount for such individuals is $300, and the IRS has announced its position that a $300 per year limitation applies instead of $600 for a married couple.

Another 2020 temporary rule permits deduction of up to 100% of an individual taxpayer’s adjusted gross income, if given in cash to a public charity or community foundation. A donor-advised fund will not qualify. Some experts have indicated that it would be possible to give appreciated assets of up to 50% of adjusted gross income, and another 50% of adjusted gross income in cash, but we do not read the statute this way. We believe that in order to go above 50% of adjusted gross income everything below that amount must be in cash.

A bigger trap exists for taxpayers who donate cash in the amount of their adjusted gross income, but also have other itemized deductions so that the amount of the charitable deduction exceeds the taxpayer’s taxable income. In that situation we believe that the excess donation of adjusted gross income over taxable income is wasted. For example, a married couple having $600,000 of adjusted gross income and $540,000 of taxable income by reason of having $60,000 of itemized deductions other than charitable contributions would receive the same deduction for charitable contributions by donating $540,000 in cash. This is because the excess $60,000 that is not used did not constitute amounts exceeding the $600,000 adjusted gross income limitation, and would therefore not be carried forward under the 5-year charitable deduction carryforward rule.

Further, individuals who would like to transfer IRA assets or monies to charity who have reached age 59 ½ may choose to do so regardless of whether they have reached age 70 ½, and in amounts exceeding $100,000.

While the $100,000 Qualified Charitable Distribution will still allow taxpayers over 70 ½ to transfer monies tax-free from an IRA directly to charity and not include the distribution in income, the same result applies if cash is withdrawn from the IRA and transferred to charity prior to December 31, 2020. This assumes that the taxpayer is over age 59 ½ so that the 10% excise tax does not apply, and that the individual has used his, her, or their other itemized deductions to offset other taxable income, or does not mind losing a portion of their charitable deduction to the extent that the allowable deduction exceeds taxable income.

For example, a 60-year-old could request a $1,000,000 distribution from his or her IRA in cash, give that cash to charity in 2020, and receive a corresponding income tax deduction of $1,000,000 to completely offset the income attributable to the IRA withdrawal using the temporary special rule for 2020 that allows taxpayers to deduct charitable contributions up to 100% of adjusted gross income.

Don’t try this at home! – Make sure that clients receive advice from an independent Certified Public Accountant or tax lawyer before relying on our observations above, because other authors have come to different conclusions in the charitable realm.

The Incomplete Charitable Gift Foundation is another gifting technique that is discussed below.

8. Potential Strategies for S Corporations

S Corporations that have had significant losses and may become profitable in the later part of the year might consider shifting activities or income to a C Corporation, or terminating the S election to become a C Corporation in order to maximize losses, particularly if they are sufficient to generate a Net Operating Loss that will enable the S Corporation shareholders to file a 2020 tax return and receive a refund in 2021 by carrying the NOL back pursuant to the liberalized CARES Act rules that now permit this.

Transferring operations out of an S Corporation could trigger income tax based upon the value of any goodwill owned by the company, and converting an S Corporation to a C Corporation should be considered carefully before proceeding because the company will not be able to make a new S election for 5 years, and converting from C Corporation status to S Corporation status can have challenging tax results.

Another idea would be for the shareholder who has owned the S Corporation for most of the year to transfer ownership to a lower bracket taxpayer as it becomes profitable in the final part of 2020 in order to spread income among the brackets.

Many affluent taxpayers have not been diverting unearned income via ownership of S Corporation and partnership entity situations or co-ownership of rental or other income producing property because of the “Kiddie” tax, as it was applied from 2017 until 2019, that required the unearned income of a “child” to be taxed at the highest bracket to the extent it exceeded approximately $12,750 per year.

9. Allocate Income to Children – The Kiddie Tax.

The pre-2017 Kiddie tax rules, which have now again become the current rules, provide that income subject to the Kiddie Tax be taxed at the highest bracket of a parent of the child. This result would be more advantageous when the child has parents who are in lower tax brackets, which is common in 2020.

In addition, the Kiddie tax only applies to individuals who are:

- Under age 18;

- Age 18 and who do not have earned income that exceeds half of their support; or

- A full-time student at least age 19 and under age 24 who does not have earned income that exceeds half of their support.

TURN ON, TUNE IN, DROP OUT?ii

Being in school full time is defined as being enrolled on the first day of at least 5 different calendar months during the tax year.

HAVE THEM SUPPORT THEMSELVES!

As mentioned above, a full-time student over the age of 18 will still not be subject to the Kiddie tax if he or she has earned income that exceeds one-half of his or her support. Many believe that monies withdrawn from a 529 College Savings Plan will be considered to be monies spent by the child since the child would pay the tax on any non-qualified withdrawal from the plan. Others say that if the parent can change the beneficiary of the account then it would be considered as support from the parent. The IRS has not addressed this issue in any formal or informal guidance.

When the Kiddie tax does not apply, there can be significant income tax savings.

The tax brackets for single and married individuals for 2020 are shown above.

An individual can have up to $518,400 of ordinary income before reaching the 37% bracket and a married couple can have up to

$622,050 of ordinary income before reaching the 37% bracket, so considerable income tax savings can be realized.

This becomes more attractive where a grandparent or other high income family member owns an interest in a business or professional practice that can qualify for the 20% deduction under Internal Revenue Code Section 199(A), but for being in a high income tax bracket.

Those individuals can gift part ownership to a trust that is considered as owned by a low-income individual, even though that low income individual is only one of the beneficiaries under the trust. Section 678 of the Internal Revenue Code permits this treatment when certain requirements are met, and such a trust can be taxed to one person, while other are beneficiaries thereof.

10. Convert Vacation Homes to Rentals.

Affluent taxpayers who have one or more vacation homes may consider converting such properties into rental properties and renting them out for a majority of the year.

If the market takes a sudden downturn having these rental properties can provide for some needed additional income and can create capital losses to the extent that the value of the properties decreases after the date of conversion.

11. Not All Rentals are Created Equal – Consider Short-term Solution.

Converting a vacation home into a rental property is not a feasible solution for the majority of taxpayers, in large part due to the passive loss rules. By engaging in short-term rentals, such as Airbnb and VRBO, it is possible to avoid the real estate passive loss pitfall.

While rental activities are considered per se passive, an activity is not considered to be a rental activity if the average stay-time is seven days or less, and therefore short term rental activities are not subject to the more restrictive rules that apply to passive losses from real estate activities such as the requirement that the taxpayer be a Real Estate Professional in order to deduct losses. Short-term rentals will still need to satisfy one of the seven material participation tests in order to be deducted as “active” losses, such as if the owner is spending 500 or more hours on the activity, or spending 100 hours with no other individual spending more than 100 hours.

12. It’s a Boat! It’s a Plane! It’s a Potential Write-off!

Taxpayers who wish to buy a boat or a plane may consider chartering it at least once during the first year of ownership with no personal use whatsoever in order to qualify for 100% bonus depreciation. Taxpayers can deduct the full purchase price of the aircraft or boat acquired and put into service after September 27, 2017 so long as the aircraft or boat is used exclusively in a trade or business in 2020, is rented out or otherwise chartered at arm’s- length to an unrelated party at fair market value at least once, and the individual taxpayer or taxpayers owning the boat or plane spend 500 hours in 2020 on the business, or spend 100 hours and no other individual spends 100 hours in order to avoid passive loss limitations.

In 2021 the boat or plane entity may be converted into a C corporation and personal use would be paid for by the taxpayers at fair market value so that the C corporation will have income and operating revenues in the future.

Don’t try this at home, or in a houseboat or plane. This is a complicated area of income tax law that calls for specific and careful guidance on the nooks and crannies associated therewith. And it would be silly to buy a plane or boat just for a tax deduction, but some people do!

13. Real Estate Planning for Insolvency, Do What You Can But Leave the CREST to the Professionals.

In LISI Business Entities Newsletter #181 we discussed the CREST which is an LLC that is taxed as a partnership or is disregarded for income tax purposes that has an operating agreement and documentation that will permit an S election to occur 75 days in arrears from when the election is made. The purpose of this is so that income from the discharge of indebtedness can be blocked at the S corporation level; however, the S election should be made before debt that is counted under Internal Revenue Code Section 357 exceeds the basis of the assets being contributed to the LLC.

This is one of many considerations that will apply when a possible upcoming recession beyond what we are seeing now brings down real estate values and possible rent income insolvency ratios.

This can result in banks and other lending institutions ensuing foreclosure or deed in lieu of foreclosure strategies which would cause income tax to individual owners who are not insolvent. If the property is owned by an S Corporation, the insolvency exclusion is evaluated at the S corporation level under the Section 108 insolvency rules, and therefore the income attributable to the cancellation of debt can be excluded.

14. Section 139 – Turn Lemons into Lemonade.

Many small businesses are not aware of Internal Revenue Code Section 139, which allows an employee or independent contractor to receive a “qualified disaster relief payment” that is tax deductible by the employer, and not includable as income, or considered to be wages for wage tax or pension contribution rule purposes.

Qualified disaster relief payments are any amount paid to an individual:

- To reimburse or pay reasonable and necessary personal, family, funeral, or living expenses incurred as the result of a qualified disaster;

- To reimburse or pay reasonable and necessary expenses incurred for the repair or rehabilitation of a personal residence or repair or replacement of its contents to the extent that the need for such repair, rehabilitation, or replacement is attributable to a qualified disaster;

- By a person engaged in the furnishing or sale of transportation as a common carrier by reason of the death or personal physical injuries incurred as a result of a qualified disaster; or

- If such amount is paid by a Federal, State, or local government, or agency or instrumentality thereof, in connection with a qualified disaster in order to promote the general welfare, but only to the extent any expense compensated by such payment is not otherwise compensated for by insurance or otherwise.

Covid-19 constitutes a “qualified disaster” meaning that many Covid- related expenses may be covered, including:

- Protective items (masks, hand sanitizer, gloves, etc.)

- Creating or improving a home office.

- Meal delivery services.

- Telecommunication costs (upgrading phones, Wi-Fi, etc.)

- Child care due to closed schools.

- Home security upgrades.

Certain items are not covered under Section 139, such as any luxury items or monies that have already been reimbursed by insurance. But sound proof masks that must be worn by certain family members should qualify, along with ear plugs, daily counseling sessions, and extra strong alcohol products.

15. What Newsletter Would be Complete without the Incomplete Charitable Gift Foundation?

The last and perhaps least known planning tool is to create an irrevocable Grantor Trust for the benefit of one or more charities. These trusts must be set up in a manner that will not cause the trust to be subject to the limitations placed on Private Foundations. These trusts are usually set up as follows:

- The trust lists both 501(c)(3) entities and other charitable entities that are not 501(c)(3) entities. Making non-501(c)(3) entities discretionary beneficiaries prevents the Private Foundation rules from applying.

- The Grantor retains control over which charities receive distributions.

- An individual of the Grantor’s choosing should have the ability to permanently set-aside all trust assets for the 501(c)(3) entities.

- The trust should be established as a Grantor Trust so that the Grantor will receive an income tax charitable deduction for the monies and assets contributed to charitable organizations.

- The Grantor may flip a switch to cause the entity to begin to qualify as a Section 501(c)(3) organization with its assets considered to be transferred to it when the transition occurs.

The benefits of this type of structure include no excise taxes, no minimum distribution requirements, creditor protection for the trust funds, ease of set-up and use, and a high amount of donor control over the trust.

Conclusion

Tax advisors have received a significant challenge from circumstances involving individuals and businesses who face an assortment of challenges, which can include existential threats to their existence, insolvency, PPP and EIDL loan rules, income tax liability, employment taxes, and both individual and entity level considerations.

Hopefully we have done significantly more than scratch the surface with respect to primary and not-so-well known income tax avoidance or deferral techniques that can be considered. Responsible professionals will review other sources of information and help assure that clients are using or referred to competent and caring tax planning professionals who may apply some or all of the ideas described above.

HOPE THIS HELPS YOU HELP OTHERS MAKE A POSITIVE DIFFERENCE!

CITE AS:

LISI Income Tax Planning Newsletter #206 (October 27, 2020)

at http://www.leimbergservices.com All rights reserved. Reproduction in Any Form or Forwarding to Any Person Prohibited Without Express Permission. This newsletter is designed to provide accurate and authoritative information in regard to the subject matter covered. It is provided with the understanding that LISI is not engaged in rendering legal, accounting, or other professional advice or services. If such advice is required, the services of a competent professional should be sought.

Statements of fact or opinion are the responsibility of the authors and do not represent an opinion on the part of the officers or staff of LISI.

CITATIONS:

i – As of the end of June, 2020, the figure was 106% of GDP; “We Have Crossed the Line Debt Hawks Warned Us About for Decades,” NEW YORK TIMES, 8/21/2020, Section B, Page 1.

ii – This phrase was popularized by American psychologist Timothy Leary, who is best known for his strong advocacy of psychedelic drugs, before the legalization of medical marijuana. One author spent 45 minutes in a car with Timothy Leary in 1979 and he was very friendly and interesting. Please note that it is still a federal crime to ingest prescribed medical marijuana, and having possession of an automatic rifle, silencer, and certain other weaponry at the same time as possessing state-legal prescribed marijuana is a federal crime with a long jail penalty.

UPCOMING EVENTS

FREE WEBINARS FROM OUR FIRM ARE HIGHLIGHTED IN BLUE

| When | Who | What | How |

|---|---|---|---|

| Wednesday, November 11, 2020 | CPA Academy |

Alan Gassman and Brandon Ketron present: Hot Topics For Post-Election Planning from 5:30 to 6:30 PM EST |

Coming Soon |

| Thursday, November 12, 2020 | Leimberg Webinar Services (LISI) |

Alan Gassman, Michael Lehmann and Brandon Ketron present: Innovative Charitable Year End Planning from 3 to 4:30 PM EST |

Coming Soon |

| Saturday, November 14, 2020 | Big Brothers Big Sisters of Tampa Bay |

Gassman, Crotty & Denicolo, P.A. sponsors: Frenchy’s BIG Clays For Kids from 2:30 to 6:30 PM EST |

Register |

| Monday, November 16, 2020 | AICPA Sophisticated Tax Conference in Washington, D.C. |

Alan Gassman presents: Dynamic Planning for Professionals and Their Entities from 5:20 to 6:10 PM EST |

Register |

| Tuesday, November 17, 2020 | AICPA Sophisticated Tax Conference in Washington, D.C. |

Alan Gassman and Brandon Lagarde present: COVID 19: What Did We Learn About Financial Viability During a Pandemic – Part 1 from 12:40 PM to 1:30 PM EST |

Register |

| Tuesday, November 17, 2020 | AICPA Sophisticated Tax Conference in Washington, D.C. |

Alan Gassman and Brandon Lagarde present: COVID 19: What Did We Learn About Financial Viability During a Pandemic – Part 2 from 1:40 PM to 2:30 PM EST |

Register |

| Tuesday, November 17, 2020 | CPA Academy |

Ken Crotty presents: EFFECTIVE ESTATE PLANNING WITH LLCs AND LLLPs AFTER POWELL from 5:30 to 6:30 PM EST |

Register |

| Wednesday, November 18, 2020 | Free webinar from our firm |

Alan Gassman, Ken DeGraw and Andrew Barg present: Advanced Tax Planning And Strategies For Insolvent Taxpayers – Including State Law Impact And State Taxes from 12:30 to 1:15 PM EST |

Register |

| Thursday, November 19, 2020 | Clearwater Jazz Holiday Foundation |

Alan Gassman sponsors: Wanderlust – A Reimagined Live Music Experience for 2020 from 6 to 9 PM EST |

Register |

| Thursday, November 19, 2020 | FICPA Scholarship Foundation |

Gassman, Crotty & Denicolo, P.A. sponsors: The 16th Annual Suncoast Scramble Golf and Wine Tasting event |

More Information |

| Tuesday, November 24, 2020 | CPA Academy |

Alan Gassman and Leslie Share present: U.S. INTERNATIONAL TAX AND COMPLIANCE UPDATE from 5:30 to 6:30 PM EST |

Coming Soon |

| Tuesday, December 01, 2020 | Ohio State Bar Association’s Great Lakes Asset Protection Institute |

Alan Gassman presents: Ten Examples of Asset Protection Plans that have Worked from 9 to 10:30 AM EST |

Register |

| Tuesday, December 01, 2020 | Ohio State Bar Association’s Great Lakes Asset Protection Institute |

Alan Gassman participates: In a panel discussion from 4:30 to 5 PM EST |

Register |

| Friday, December 04, 2020 | Free webinar from our firm |

Alan Gassman, Ken DeGraw and Michael Markham present: Subchapter V – And Recent Bankruptcy Law Developments from 12:30 to 1:15 PM EST |

Register |

| Tuesday, December 15, 2020 | Palm Beach County Bar Association |

Alan Gassman and Brandon Ketron present: 2020 Year End Planning |

More Information |

| Tuesday, January 12, 2021 | CPA Academy |

Alan Gassman and Michael Lehmann present: Summary of Restrictions Applicable to Different Types of Entities from 5:30 to 6:30 PM EST |

Coming Soon |

| Friday, January 29, 2021 | Florida Bar Health Law Section: Representing the Physician |

Alan Gassman presents: Medical Practices And PPP, EIDL, and Provider Relief Fund Planning and Implications |

Coming Soon |

| Thursday, February 11, 2021 | Johns Hopkins All Children’s Annual Estate Planning Seminar |

Alan Gassman: Introduces speakers and listens carefully |

Register |

| Tuesday, February 23, 2021 | New Jersey State Bar Association |

Alan Gassman presents: WHAT YOUR BEST CLIENTS NEED TO KNOW ABOUT FLORIDA LAW AND PLANNING from 4:30 to 5:30 PM EST |

Coming Soon |

| Friday, March 26, 2021 | Florida Bar: Tax Section |

Alan Gassman and Leslie Share present: Creditor Protection Nuts & Bolts |

Coming Soon |

| Thursday, May 13, 2021 | FICPA-FSU Spring Accounting Conference |

Alan Gassman presents: Topic to be determined |

Coming Soon |

Call us now! Bookings accepted for haunted houses, bar mitzvahs, weddings, seminars, and symposiums (or symposia)!

PPP Borrowers May Now Apply For $100,000+ Main Street Loans

Alan Gassman

The Main Street New Loan Facility Program was established as a part of the CARES Act earlier this year to provide banks with a 95% guaranteed re-payment when they extend credit under this program to a business borrower.

In an apparent reaction to the delay in extending new PPP loans the SBA announced on Friday, October 30 that it is expanding the Main Street New Loan Facility Program to now permit loans as small as $100,000, in lieu of the former $250,000 minimum size, and confirmed that the Department of Treasury has committed to make $75 billion available for the Program.

Under the Program, a U.S. federally insured depository institution (a bank whose deposits qualify for FDIC protection) is able to make a loan to a borrower and immediately transfer 95% of the risk and reward of the loan to the Federal Reserve Bank of Boston (the “Reserve Bank”). Continue Reading On Forbes

3 Things You Can Do Today To Encourage A Growth Culture

David Finkel

Motivating key employees can be an uphill battle for many small business owners. The key to helping your staff reach their true potential lies in the way you frame your feedback and praise.

As a business coach of over 25 years, I have helped thousands of company owners guide their key employees to greatness. We coach them on good hiring practices, how to overcome worry and procrastination, and the best way to get feedback from their team. But one of the most important skills we teach our clients has to do with creating a growth mindset culture.

What Is a Growth Mindset Culture?

A growth mindset culture stems from the company-wide belief that progress can be made over time by incremental growth and development as a team. By encouraging recognition of such growth and development, key team members are primed emotionally and mentally for further forward momentum.

Achieving A Growth Mindset Culture

One of the most powerful tools you have as a leader is to help your team recognize their growth and development from a 3rd party vantage point. Overachieving employees have a natural tendency to gloss over their victories in pursuit of perfection. This can be counter productive in the long run, so I would suggest keeping an employee notebook where you keep track of each of your direct reports victories and concrete progress so that you can help them feel their progress over time. When they feel their progress this reinforces their growth mindset, which in turn boosts their performance over time.

Give them feedback across three key time frames: long term, short term, and in the moment. Here’s what it might sound like as you give feedback across each of these time frames.

1. Long Term:

“Tina, I wanted to commend you on a fantastic year! From my viewpoint, you have made amazing strides in the sales department and I wanted to take a few minutes to go over some of the highlights together. I know that when you are in the day to day grind of things, it can be difficult to see your progress, but I can see the growth. A year ago, you were consumed with putting out fires and making sales calls yourself. Now, you have an amazing sales staff in place and have been able to focus on improving the process and growing the business. Pause for a moment and let that sink in… do you see how far you’ve come because if you don’t let it in Tina, you’re not giving your team permission to let it in either…”

2. Short Term:

“Wait a second Eric, backup a moment. You almost got away with just shooting right past this! You just hit 23 sales this past week, and your last 3 weeks have all been sales over 18 each week. That’s incredible Eric. A few months ago before you implemented the conversion changes we went through together you were at 12-15 each month, and now you’re 40-60% higher. That’s amazing… have you shared this with the rest of the team? How can we celebrate this victory together?”

3. In The Moment:

“Carol, hearing you say that really makes it clear to me what a smart woman you are. You’re approach to handling that was spot on… way to go!”

Acknowledge The Process

Another way to encourage a growth mindset culture is to acknowledge the process and the struggle that comes with growth and development. This might sound like:

“Great work on drafting that new marketing piece Sam, I know that was hard to make the time to do that.”

“Way to go Risa. That’s a really big deal that you had that adult conversation with Rick about his recent slip in performance. I know that it took real courage to step up and talk with him directly about this.”

A growth mindset is one that starts with you as a leader, and trickles down to every department. Stop to really feel your progress and growth and your team members will start to do the same.

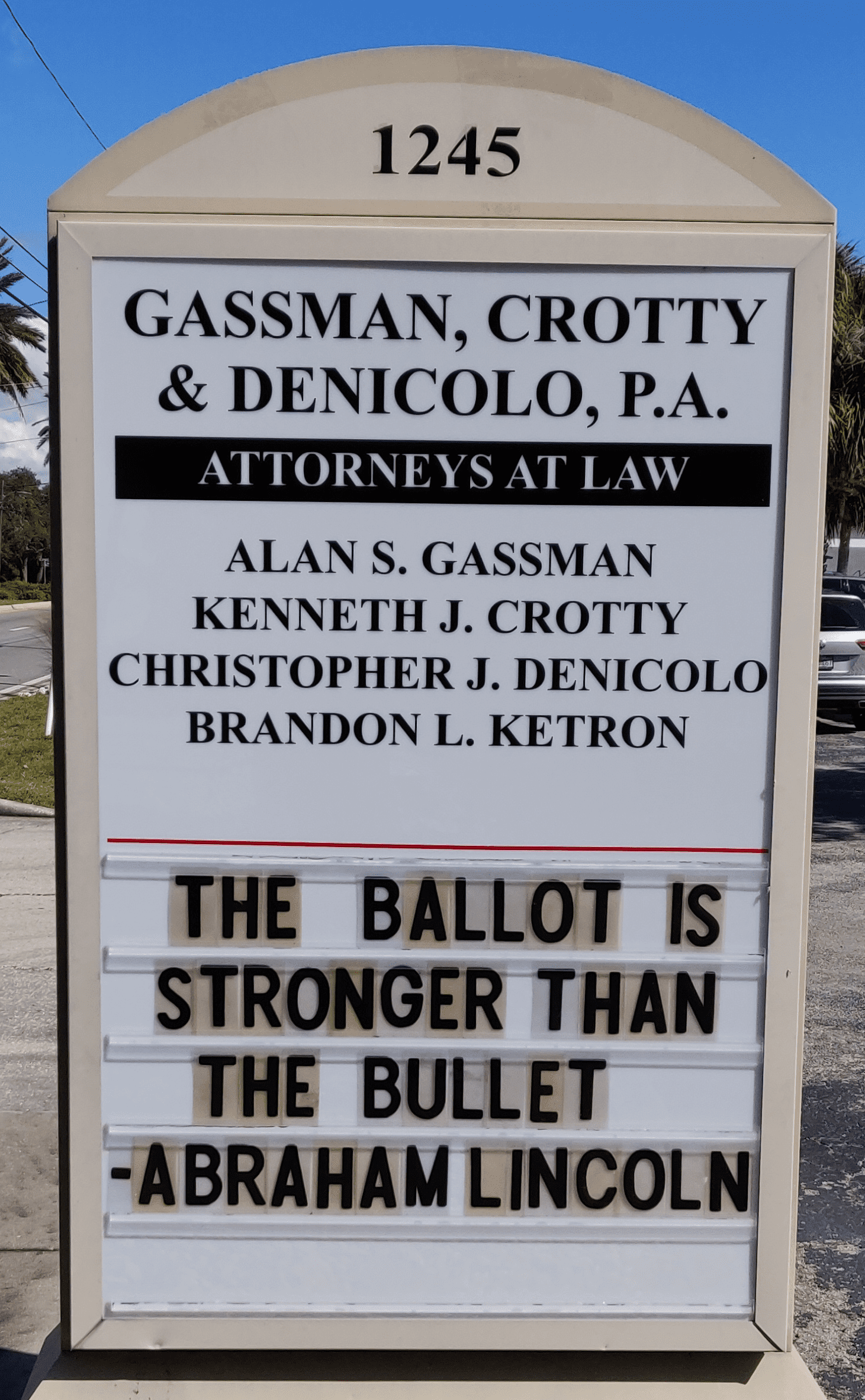

Humor

Gassman, Crotty & Denicolo, P.A.

1245 Court Street

Clearwater, FL 33756

(727) 442-1200