The Thursday Report – 9.17.15 – News and Views from the Notre Dame Tax Institute

News and Views from the Notre Dame Tax Institute

Should Every Estate Planning Lawyer Offer to be Appointed as a Trust Protector?

NAIC Closing the Loop on Illustrations by Barry D. Flagg

Richard Connolly’s World – The Latest in Estate Planning & How to Avoid EP Fatigue

Thoughtful Corner – Don’t React Immediately

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

News and Views from the Notre Dame Tax Institute

The 41st Annual Notre Dame Tax and Estate Planning Institute opened this morning with participation from hundreds of lawyers, accountants, and other professionals. The brochure for this event can be viewed by clicking here.

Jonathan Blattmachr is stuck in weather in the Arctic Circle, so Alan Gassman will be delivering his talk on Reducing Estate and Trust Litigation Through Disclosure, In Terrorem Clauses, Mediation, Arbitration, and Pre-Mortem Probate.

The first part of this presentation is reproduced below in the article entitled “Should Every Estate Planning Lawyer Offer to Be Appointed as a Trust Protector?”

Alan Gassman and Barry Flagg, whom we also have more from below, also contributed materials for the panel presentation on Life Insurance.

Thursday Report readers can obtain a copy of these Chapter 6 materials next week by contacting agassman@gassmanpa.com.

Next year’s Notre Dame Tax and Estate Planning Institute will be held on Thursday, October 27th and Friday, October 28th, 2016. A large Florida contingency should be there. Please put this on your calendar, and hats off to Jerry Hesch and his fine team at Notre Dame for putting together another amazing program!

Should Every Estate Planning Lawyer Offer

to be Appointed as a Trust Protector?

by Alan Gassman, J.D., LL.M. and Seaver Brown, J.D.

Should every estate planning lawyer offer to be appointed as a trust protector to help ensure that testamentary intent will be followed a la Minassian v. Rachins, 152 So. 3d 719 (Fla. 4th Dist. App. 2014)?

The use of a trust protector has generally been confined to offshore trusts, but a recent opinion from Florida’s 4th District Court of Appeals may cause them to become more common in Florida.

Executive Summary

Florida Statute Section 736.0808 allows the settlor of a trust to give a third person the sole discretionary power to amend or terminate the trust for certain specified reasons. This discretionary power is typically given to either a trustee or another individual other than the settlor.[1]

The concept of a trust protector has a long and storied history. Under British Common Law, it was well-accepted procedure to appoint a trust protector who could change the terms of the trust for the benefit of some or all of the beneficiaries and, in some instances, terminate the trust altogether. One reason settlors would confer this power to amend or terminate trust provisions was to have a viable remedy to address any unforeseen events after their death, some of the most prominent of which included: ambiguous trust provisions, a change in circumstances, or a change in the applicable estate tax laws. However, despite the various reasons why a trust might need to be amended, the underlying purpose has always been to effectuate the settlor’s original intent.

Facts

In the case of Minassian v. Rachins, there was a dispute between the settlor’s surviving spouse, acting as trustee, and his children from a prior marriage.[2] The crux of the matter dealt with a trust protector who had the sole and absolute discretion to determine and then alter provisions that were ambiguous or erroneous enough to defeat the settlor’s original intent.

The language provided in the trust agreement, with respect to the trust protector’s appointment and authority, read as follows:

“To protect…the interests of the beneficiaries as the Trust Protector deems, in its sole and absolute discretion, to be in accordance with my intentions…The Trust Protector is empowered to modify or amend the trust provisions to inter alia: (1) to correct ambiguities that might otherwise require court construction; or (2) to correct a drafting error that defeats my intent, as determined by the Trust Protector in its sole and absolute discretion, following the guidelines provided in this Agreement.”

The disputed revocable trust was created by Mr. Minassian in 1999 and was followed by an executed restatement of trust in 2008 that would become irrevocable upon his death. The primary purpose for creating this trust was so that he and his wife, acting as sole trustees, could provide for themselves during their lives and then have the remaining trust assets pass to his children. Mr. Minassian and his wife were both very passionate about horse racing and legal gambling, and he wanted to provide for his wife so she could continue to live in the same manner she had grown accustomed to. However, Mr. Minassian was concerned that there would be problems between his children and wife, especially in regards to the manner in which she would spend the money contained in the Family Trust during her lifetime.

Eventually, his fears became true, and the beneficiaries sued the wife as trustee, alleging that she breached her fiduciary duties by taking too much out of the trust. The wife moved to dismiss the children’s claims for lack of standing because they were not beneficiaries of the trust. She argued that the Family Trust would terminate upon her death, at which point a new trust would then be created naming the children as beneficiaries. Contrary to the wife’s argument, the children insisted that the trust provisions would not create a new trust upon her death but instead would create separate shares in the existing Family Trust for each child. The trial court found that the wording of the trust was unclear and that it would be inappropriate to allow the Trust Protector to change the trust to clear up the ambiguity.

The wife nevertheless appointed a trust protector to clear up these ambiguities, as permitted by the above quoted language of the trust. Under such language, the protector was permitted to correct drafting errors that would have defeated the husband’s intent and, in certain circumstances, modify the trust without court authorization. The trust document further required the trust protector to determine the husband’s intent and consider the interests of current and future beneficiaries as a whole.[3] However, amending the trust could only be done if the agreement benefitted the beneficiaries as a group or furthered the husband’s probable wishes in an appropriate way.[4] Most importantly, though, the trust made any exercise of these powers binding and conclusive on all parties.

Pursuant to these guidelines, the trust protector modified the ambiguous trust provisions but did so unfavorably to the children’s position. In response, the beneficiaries filed a supplemental complaint against the wife and trust protector, arguing that those modifications were invalid. Both parties then moved for summary judgment as to whether the modifications were valid. Initially, the trial court held that the modifications made by the trust protector were improper and did not benefit all the beneficiaries. The court reasoned that, under the proposed modifications, the children had no right to challenge the actions of the wife as trustee and invalidated the provisions modified by the trust protector.

The wife then appealed the trial court’s ruling on the grounds that the provisions of the original trust were ambiguous and the trust protector could have modified it so as to properly effectuate her husband’s intent. Thus, the appellate court first had to address the validity of the trust protector provision under Florida law. If it was found to be invalid, then any subsequent amendments made by the trust protector would have been invalidated. On the other hand, if they were found to be valid, then the trust protector provision would control, and the protector could exercise any powers with sole and absolute discretion.

Florida Statute Section 736.0808(3) allows the terms of a trust to confer on a trustee or other person (i.e. trust protector) the power to direct the modification or termination of a trust. The children’s primary argument here was that Florida Statute Section 736.0808(3) conflicts with the common law rule that a trustee cannot delegate their discretionary powers to another person or entity. Here, the Court held that it is the settlor who delegates the power to modify the trust in a third person, not the trustee. Further, “the common law principles of trust and equity supplement [the Florida Trust Code], except to the extent modified by this code or another law of this state.”[5] Essentially, the Florida Trust Code controls when the common law of trusts contradicts it.

The children also argued that Florida Statute Sections 736.0410 – 736.04115 and Section 736.0412[6] provide the sole and exclusive means of modifying a trust.[7] Again, the court disagreed and held that those Sections are not the exclusive means for modifying a trust, otherwise Section 736.0808(3) would have no effect. Therefore, the Florida Trust Code permits the settlor to appoint a trust protector with the power to modify the terms of the trust.[8]

In sum, the trial court initially found that the trust was unambiguous and that the trust protector acted contrary to the settlor’s intent when he modified those unambiguous provisions. On appeal, however, the court found that the provision stating the Family Trust would terminate on the wife’s death was ambiguous. Since there was an ambiguity as to the husband’s original intent, the court was free to consider extrinsic evidence outside the four corners of the document. The appellate court noted that the trial record contained un-contradicted extrinsic evidence of the husband’s intent.[9] Specifically, “from the trust protector’s affidavit…it appears that the husband settled on the multiple-trust scheme for the very purpose of preventing the children from challenging the manner in which the wife spent the money.”[10]

While the trust protector’s actions may have disadvantaged the children, he was authorized to correct ambiguities as long as the actions benefitted the group of beneficiaries, or, as in this case furthered the husband’s desire to resolve any ambiguity with a trust protector.[11] His intent would have been violated if the authority he granted to the trust protector was stripped and given to a court. Thus, the modifications initially proposed by the trust protector were valid because they furthered the husband’s original intent.

Comment:

For many years, trust protectors have been a common theme for offshore trust agreements, but not until recently have they become more prevalent in the design of domestic trusts. Settlors are not limited in who they may select to serve as trust protector, unless by state statute. The protector may be one or several trustees of the trust, as well as one or more of the beneficiaries. They may also be a trusted friend of the settlor, a third party advisor, or some combination of the above.

Generally, the powers granted to a trust protector can take any form, limited only by the Settlor’s intent. Some of the most common and, oftentimes, controversial powers granted to protectors include the ability to:

- Remove or replace trustees;

- Remove, replace, or add beneficiaries;

- Terminate the trust;

- Vary trust provisions to reflect changes in tax laws;

- Modify distribution provisions;

- Consent to or veto discretionary powers of the trustee, such as investments or distributions to beneficiaries;

- Change trust situs to a state with favorable laws;

- Resolve disputes between beneficiaries and trustees; and

- Appoint a successor trustee.

As you can see, trust protectors are beneficial for many reasons, most notably because they provide flexibility within trust vehicles that are traditionally not so flexible. For example, an irrevocable trust cannot be changed by the grantor or trustees, but a trust protector can make such amendments as needed. This flexibility, however, can pose some significant problems in the future that the settlor and estate planner did not contemplate.

A settlor who has their mind set on using a trust protector should limit the protector’s powers to replacing a trustee and appointing a successor trust protector only. The reason for specifically limiting the protector’s powers is to prevent future conflicts between the protector, trustee, and beneficiaries. Without doing so, the protector could inadvertently expose the trust to unnecessary court costs and even completely destroy the original intent of the settlor. In order to maximize these potential complications, the provisions of the trust should clearly delineate the rights and responsibilities between protectors, trustees, and beneficiaries.

This then begs the question – do trust protectors hold personal powers that would allow them to act with impunity, or are they held to the higher standard of conduct related to fiduciaries? Unfortunately, the concept of a trust protector is still relatively new, so there is little statutory and case law guidance defining the fiduciary roles and responsibilities of trust protectors. In those cases where a trust protector’s power is deemed to be personal rather than fiduciary, the protector is limited only by exercising such power in good faith. Personal powers are those that a protector is under no duty to exercise and can be contrary to the settlor’s intent absent any fraud.[12]

The Uniform Trust Code, which Florida adopted and modeled their Trust Code after in 2006, states that an individual providing direction to a trustee is a fiduciary per se, but it does not address whether the trust protector is a fiduciary outright.[13] States such as Alaska and Arizona have statutes that expressly allow for the use of trust protectors and provide that the protector will not be treated as a fiduciary unless the trust instrument expressly provides for such treatment.[14] By contrast, other states such as Idaho and Wyoming provide that a protector will be treated as a fiduciary unless the trust provides otherwise.[15]

Many times, the duties a protector owes to the beneficiaries of a trust are dependent on what other roles they hold with respect to the trust. Alexander Bove provides a fairly simple example that illustrates this point.[16] Imagine that a settlor names his daughter as the trust protector with the sole power to add and delete beneficiaries with no restrictions.[17] With this power in mind, the daughter then proceeds to remove all her siblings from the trust and replace them with her children. In this scenario, it is likely that her actions would have been fully contemplated by the settlor, and therefore, a proper use of her personal powers. Using the same scenario, imagine that instead of naming the daughter as trust protector, the attorney who drafted the trust is now the protector. If the attorney began to remove beneficiaries and supplement them with beneficiaries of his own choosing, it is far more likely that the protector breached the applicable fiduciary duty.

Thus, to determine whether a trust protector will be held to a fiduciary standard, one should ask whether the protector is acting pursuant to the powers granted by the trust and in furtherance of the trust and its beneficiaries, as may have been contemplated by the settlor. However, even if a state statute or trust instrument requires the protector to be held as a fiduciary, the scope of those fiduciary duties continue to remain unclear.

As we briefly mentioned above, because of this uncertainty, it would be wise to include language expressly stating whether or not the protector is a fiduciary and how they should exercise those powers. Furthermore, the trust protector should be someone that the settlor “trusts,” because without the proper safeguards in place, the protector has the ability to cause significant and expensive problems.

In addition to the practical considerations described above, there are important tax considerations that should not be overlooked and often should be carefully thought through. This includes any power to limit the rights of a surviving spouse that could cause loss of the federal estate tax marital deduction, naming foreigners as trust protectors, which can implicate the foreign trust reporting requirements and cause penalties and interests that could exceed the value of the trust assets over time and the impact that trust protector provisions can have upon the income tax status of an irrevocable trust.

Trust settlors, and to some extent, estate planners, typically do not give much thought about how to minimize the cost and frustration of future complications. In our experience, most law firms do not appoint trust protectors or themselves as trust advisors. Consequently, there is no one that will have the ability to resolve ambiguities outside of a court or arbitration. We believe that a trust protector can save a family time, money, and relationship problems when it comes to resolving ambiguities and questions as to intent and what actions have been or should be taken by the trustee.

Should you and your law firm be doing the same?

***************************************************

[1] Fla. Stat. § 736.0808(3) (2008).

[2] 152 So. 3d 719 (Fla. 4th Dist. App. 2014).

[3] Id. at 722.

[4] Id.

[5] Fla. Stat. § 736.0106 (2008) (emphasis added); see also Abraham Mora, et. Al., 12 FLA. PRAC., ESTATE PLANNING § 6:1 (2013-14ed.) (“The common law of trusts supplements the Florida Trust Code unless it contradicts the Florida Trust Code or any other Florida law.”)

[6] This Section provides for non-judicial modification of an irrevocable trust, which requires the unanimous agreement of the trustee and all qualified beneficiaries.

[7] Minassian. 152 So. 3d at 724

[8] Id.

[9] Id.

[10] Id.

[11] Id. at 727.

[12] Trust Protectors: What Role Do They Play?, SS043 ALI-ABA 585, 588.

[13] See, Uniform Trust Code § 808(b) (amended 2005).

[14] See, Alaska Stat. Ann. § 13.36.370(d)(West); Ariz. Rev. Stat. Ann. § 14-10818.

[15] See, Idaho Code Ann. § 15-7-501 (2005); Wyo. Stat. Ann. §§ 4-10-710 – 4-10-718 (2005); Tenn. Code Ann. § 35-15-808 (2005).

[16] Bove, Alexander. The Trust Protector: Trust(y) Watchdog or Expensive Exotic Pet?, Estate Planning Vol. 30 No. 08: 390, 392, available at http://www.bovelanga.com/publications/articles/The_Protector.pdf.

[17] Id.

NAIC Closing the Loop on Illustrations

by Barry D. Flagg

Barry D. Flagg is the founder of Veralytic. He has more than 25 years of experience in the life insurance business. He is currently the youngest CFP in history and the inventor of all Veralytic patents. He is regularly engaged as an expert speaker on the topics of life insurance industry trends and regulations and has been a featured speaker at numerous national conferences. He has also been published or featured in ABA Trusts & Investments, AICPA Wealth Management Insider, National Underwriter, Financial Advisor, The Heckerling Institute on Estate Planning and more. Veralytic is a leading innovator in life insurance analytics. Their research has been trusted by dozens of brokerages and agencies across the United States representing billions in managing life insurance policies and assets.

On June 18, 2015, the Life Actuarial (A) Task Force of the National Association of Insurance Commissioner’s (NAIC) Life Insurance and Annuities (A) Committee adopted new Actuarial Guideline 49 governing indexed universal life (IUL) illustrations. The new guidelines are in response to overly aggressive marketing practices and are intended to make illustrations more reasonable. Despite insurance companies asking for a delay in implementation of this new Actuarial Guideline, it’s scheduled to become effective for all IUL policies sold on or after September 1, 2015 and all new business and inforce on March 1, 2016.

Uniform Guidance

NAIC Actuarial Guideline 49 was introduced to provide uniform guidance to IUL illustrations by:

- Addressing the obvious problem of using unrealistic index returns on illustrations;

- Limiting the policy loan leverage shown on illustrations; and

- Requiring additional consumer information to aid in consumer understanding

The NAIC acknowledges that this is just an interim guidance specifically for IUL illustrations, and on the April 16, 2015 conference call, they accepted that more needs to be done.

Mike Boerner, Chair of the Life Actuarial (A) Task Force said in a letter dated April 27, 2015, “the Life Actuarial (A) Task Force will consider requesting approval from the Life Insurance and Annuities (A) Committee to open Model 582 to incorporate the changes specified in the guideline and to address similar issues in other product illustrations. Revising Model 582 will provide the opportunity for the Task Force to ensure that a level playing field for all product illustrations is attained.”

Lack of Uniformity

NAIC adopted the Life Insurance Illustrations Model Regulation, which can be seen by clicking here.

Since then, there’s been continued evolution in products and their design, including the introduction of IUL with benefits that are tied to an external index or indices. “Although these [IUL] policies are subject to Model Regulation #582, not all of their features are explicitly referenced in the model, resulting in a lack of uniform practice in its implementation. In the absense of uniform guidance, two illustrations that use the same index and crediting method often illustrated different credited rates. The lack of uniformity can be confusing to potential buyers and can cause uncertaintity among illustration actuaries when certifying complicance with Model Regulation #582.”

Other Guidance

Other guidance suggests practitioners should avoid relying solely on hypothetical illustrations and embrace proven and long/well established Prudent Investor principles using research that independently measures policy charges and performance and provides documentation that the inforce policy and/or product being recommended is competitive and suitable relative to the universe of peer-group product alternatives.

In addition, comparing illustration of hypothetical policy performance can be “misleading,” are “strictly prohibited” by the chief regulatory body of the financial services industry are “fundamentally inapprorpriate,” according to a study by the chief actuarial body of the life insurance industry and “are subject to a high degree of fluctuation” and thus not reliable for determining the suitability of a given policy, according to the US Office of the Comptroller of the Currency.

A Good Start

This new guideline is a good start to a long and overdue process for reining in the life insurance illustration practices and educating the consumer on an essential financial product and should be considered together with emerging Best Practice Standards.

Richard Connolly’s World

The Latest in Estate Planning & How to Avoid EP Fatigue

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Breaking the Barriers of Estate Planning Fatigue” by Kimberly Bernatz. This article was featured on WealthManagement.com on September 8, 2015.

Richard’s description is as follows:

There’s been quite a buzz in the media since the recently published CNBC Millionaire Survey found that a third of those with at least $1 million in investable assets haven’t used a professional to establish an estate plan.

According to many industry experts, the constantly changing nature of federal estate tax laws has resulted in estate planning fatigue. We’ve had nearly a decade of uncertainty and changes in the tax law, and during that time, responsible advisors have been reaching out to their clients to explain those changes and encourage them to update their plans, if necessary. That consistent uncertainty is almost enough to make people wash their hands and say, “enough is enough.” Couple that feeling with the fact that today’s federal estate tax exemption amount of $5.43 million is making many people feel that planning is unnecessary if their estates fall below that threshold.

So while we, as professionals, understand the importance of an estate plan, the question is how do we most effectively communicate that message to our clients?

The answer might lie within psychological barriers that prevent our clients from taking important action.

Please click here to read this article in its entirety.

The second article of interest this week is “What’s Hot in Estate Planning Right Now May Surprise You” by the Wealth Counsel Staff at WealthManagement.com. This article was featured on their website on September 1, 2015.

Richard’s description is as follows:

Estate planning has truly evolved over the past 20 years. Gone is the uncertainty about federal estate taxes and the absolute requirement for married couples to use complex trusts to minimize these taxes.

But also gone is planning for the “traditional” family. In this article, you will learn why estate planning has become more complicated and what your clients need to do now to insure their estate plans are flexible enough to roll with the changes.

Please click here to read this article in its entirety.

Thoughtful Corner

Don’t React Immediately

There is no way to avoid having an emotional response to challenging situations. One of the things that our brain does is prompt an immediate reaction to such situations, and this reaction is often not rational.

One of the things our reptile brain does is provoke the “flee or fight” response. This response was helpful to prehistoric men and women, as they would not have been able to survive if they did not have an immediate response to dangers, challenges, or otherwise.

Fortunately, we no longer live in caves, and immediate response by email, in meetings, or on the telephone are simply not necessary or in the best interests of ourselves, our clients, or our business relationships if we are having an emotional response.

Many lawyers and other professionals are quite adept at setting up opponents or even clients to provide an emotional response that they can then take further advantage of. Don’t fall victim to this trap!

Also, emails may sometimes appear to be terse and rude, but they are instead simply shortened and filled with less eloquent statements made by someone who might not be thinking about how their message could be interpreted.

The adage to “count to ten and take deep breaths” certainly has a great deal of utility to modern man (and probably cavemen as well!) Ask for a minute to think things through. If you’d like, you can use an excuse, such as you need to make a phone call, go to the bathroom, check on something, or something else that could provide a moment alone.

You can get used to saying things like the following when these circumstances apply:

- I think I understand where you are coming from, but I need to think this through. I may also talk it over with _______________ and review before getting back to you.

- Thanks very much for…

- I’m very surprised that you said that and will simply not respond at this time.

If you “lose it” or say the wrong thing or let your emotions get the better of you or otherwise realize, perhaps an hour later, that you made a big mistake, apologize immediately and tell the person that they will receive a less emotional response from you the following day. Then, talk the situation over with someone you trust to get it off of your list of things to worry about.

The same principles apply with interacting with office staff, friends, or family members.

Why come to blows or risk doing something that can cause the loss of a good relationship, someone else to be upset, or undermining the ability to have productive team work?

Immediate reprimands work well with children but not necessarily with colleagues, clients, or employees. Let yourself cool down before deciding exactly how to communicate, unless you have already thought through the response in advance and know that it is appropriate based upon what the person has done.

Humor! (or Lack Thereof!)

Sign Saying of the Week

**********************************************

Alan Gassman has been out of town this week, starting with a day in Boston and then heading on to the Notre Dame Tax and Estate Planning Institute in South Bend, Indiana. While he was gone, you might have gotten one of the following messages when attempting to send him an email:

Boston:

We hopped on Jet Blue for one day in Boston,

The streets are a maze, so we are now lost in

The cradle of the American Revolution,

Where tea-throwing seems a clever solution.

Marcia and I are dining on chowda,

Drinking Sam Adams, and saying to locals “How do-

you do? Do you pahk you cah?

I heah that Hahvahd is not very fah.”

Thanks for enduring this quick little blip,

So that we can focus on our very short trip.

The Freedom Trail is a great historical walk,

But mostly we just hear fans yelling “Go Sox!”

If you need to get in touch, our office is not yet on Yelp;

But you’ve got our number, so please call us for help.

Notre Dame:

On the first day of Notre Dame,

Marcia wouldn’t go with me,

“I’ll see you at the end of the week.”

I flew to South Bend, with anything but sorrow,

To learn from Jerry Hesch and Edwin Morrow

On the second day of Notre Dame,

I saw Natalie Choate speak,

She’s truly the bees’ knees.

And the exhibit booths were one big party,

I cut loose with Barry Flagg and many tax geeks.

On the last day of Notre Dame,

I just so totally freaked!

I learned all about jurisdictions that are weak,

I attended the lunch meeting (all the food was free),

And I brainstormed ideas for Steve Leimberg’s LISI.

………

On the Monday after Notre Dame, my assistant shrieked at me:

You have twelve clients in the lobby,

Eleven new estate plans,

Ten dozen unanswered voice mails,

Nine probate cases waiting,

Eight dozen follow up letters pending

Seven revised petitions,

Six angry attorneys,

FIVE IRS CLEARANCE LETTERS!

Four notebooks lost,

Three incomplete articles,

Two notebooks of un-reviewed bills……….

Oh, how long until the next Notre Dame???????

Thanks to Kristen Sweeney for the above poems!

Upcoming Seminars and Webinars

Calendar of Events

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: Friday, September 18, 2015 | 3:30 PM – 4:30 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free, 30-minute webinar on the topic of THE 10 BIGGEST LEGAL MISTAKES MOST BUSINESS OWNERS AND INVESTORS MAKE (AND HOW YOU CAN AVOID MAKING THEM.)

There will be two opportunities to attend this presentation.

Date: Thursday, September 24, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman and Lee-Ford Tritt will present a webinar on the topic of WHETHER TO MARRY AND WHAT TO CONSIDER: A TAX AND ESTATE PLANNER’S GUIDE TO COUNSELING SAME-SEX COUPLES WHO MAY TIE THE KNOT for Bloomberg BNA.

Following the decision of the United States Supreme Court in Obergefell v. Hodges, same-sex couples now enjoy the same legal and tax benefits as opposite-sex couples. These benefits include marriage, divorce, adoption and child custody, separation agreements, Qualified Domestic Relations Orders (QDROs), marital property, survivorship spousal death benefits, inheritance through intestacy, priority rights in guardianship proceedings, and contract rights.

This program will discuss relationship and marital agreements, tax issues, reasons to marry or not marry, and a number of unique circumstances that can apply to same-sex couples as well as to opposite-sex couples.

Date: Wednesday, September 30, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Steven B. Gorin and Alan Gassman will present a free webinar on the topic of INCOME TAX EXIT STRATEGIES.

This seminar will focus on how owners can transition their businesses to employees or others who buy over time. Topics include avoiding unnecessary capital gain tax on exit, deferred compensation, profits interests, redemptions, life insurance, and getting assets out of corporate solution to obtain a basis step-up (without self-employment tax.)

There will be two opportunities to attend this presentation. Attendees will be given the opportunity to receive over 850 pages of technical business planning materials at no charge.

Date: Thursday, October 1, 2015 | 12:30 PM and 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE CLEARWATER PRESENTATION:

Christopher Denicolo will be speaking at the Pinellas County Estate Planning Council meeting on the topic of PLANNING WITH IRAs AND QUALIFIED PLANS.

Date: Monday, October 5, 2015

Location: To Be Determined

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Christopher Denicolo at christopher@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Christopher Denicolo will present a webinar on the topic of WHAT EVERY NEW JERSEY ATTORNEY SHOULD KNOW ABOUT FLORIDA ESTATE PLANNING. This webinar will qualify for 2 New Jersey CLE credits.

Most advisors with Florida clients are unaware of the unique rules and planning considerations that affect Florida estate, tax, and business planning. Unlike some other states, Florida’s laws regarding limited liability companies, powers of attorney, taxation, homestead, creditor exemptions, trusts and estates, and documentary stamp taxes are not simply versions of a Uniform Act. They have been crafted by the Florida legislature to apply to various specific issues in an often counterintuitive manner.

This presentation will have the following objectives:

- Unique aspects of the Florida Trust and Probate Codes

- Creditor protection considerations and Florida’s statutory creditor exemptions

- The Florida Power of Attorney Act

- Traps and tricks associated with Florida’s Homestead Law and Elective Share

- Documentary stamp taxes, sales taxes, rent taxes, property taxes, and how to avoid them

- Business and tax law anomalies and planning opportunities

Date: Thursday, October 8, 2015 | 12:00 PM – 1:40 PM

Location: Online webinar

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Eileen O’Connor at eoconnor@njsba.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free, 30 minute webinar on the topic of ESTATE AND ESTATE TAX PLANNING – CONVENTIONAL AND ADVANCED PLANNING TECHNIQUES TO MINIMIZE TAXES AND EFFECTIVELY PASS ON YOUR WEALTH.

There will be two opportunities to attend this presentation.

Date: Wednesday, October 14, 2015 | 12:30 PM and 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman, Steve Roll, and Lauren E. Colandreo will present a webinar on the topic of STATE TRUST NEXUS SURVEY for Bloomberg BNA.

Date: Thursday, October 15, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Jonathan Gopman, Jan Dash, and David Neufeld will join Alan Gassman for an informative webinar on THE NEW NEVIS TRUST LAW.

There will be two opportunities to attend this presentation.

Date: Wednesday, October 21, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

**********************************************************

LIVE MANHATTAN PRESENTATION:

INTERACTIVE ESTATE AND ELDER PLANNING LEGAL SUMMIT

Alan Gassman will be speaking on Scientific Marketing For The Estate Planner – How to do more of what you love to do, and less of the other, while better serving clients, colleagues, and your community.

Other speakers include Jonathan Blattmachr, Austin Bramwell, Natalie Choate, Mitchell Gans, and Gideon Rothschild.

Date: November 4 – 6, 2015 | Alan Gassman will be speaking on November 5 | Time TBA

Location: New York Hilton Midtown Manhattan | 1335 Avenue of the Americas, New York, NY 10019

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information or visit http://ilsummit.com/ to register.

**********************************************************

LIVE PRESENTATION

Alan Gassman will present a talk at the November meeting of the Suncoast Estate Planning Council on the topic of PORTABILITY AND RECENT DEVELOPMENTS.

Date: Thursday, November 12, 2015 | 8:00 AM – 9:00 AM

Location: TBD

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Byron Smith at bsmith@gsscpa.com.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30 and Sunday, January 31 | Time TBA

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman will be presenting on a topic to be determined at the 3rd Annual Ave Maria School of Law Estate Planning Conference.

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday.

Alan’s Friday morning presentation will be entitled COFFEE WITH ALAN: AN INTRODUCTION TO SELECT ESTATE PLANNING AND ASSET PROTECTION STRATEGIES. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference. Attendees new to these specific estate planning areas will find the presentation useful and helpful.

Date: May 6, 2016

Location: To Be Determined – Naples, Florida

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

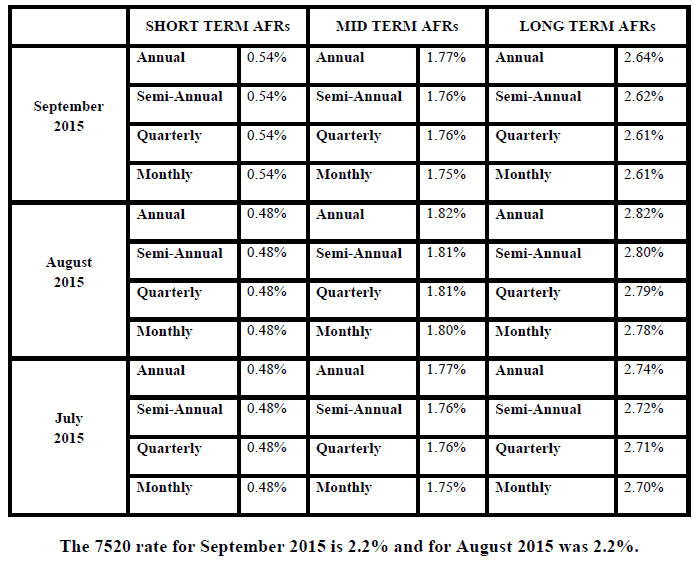

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.