The Thursday Report – 7.9.15 – Tampa WineFest and More!

The Supreme Court’s Decision on Same-Sex Marriage with Alan Gassman and Mike Reedy on WUSF Radio

Claiming Social Security Benefits and Other New Opportunities for Same-Sex Married Couples by Michael Kitces

Life Insurance Definitions, Part I

Tampa Theatre 14th Annual WineFest – September 10-17

Richard Connolly’s World – Estate Planning Pitfalls to Avoid

Thoughtful Corner – The Resilience Response

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

The Supreme Court’s Decision on Same-Sex Marriage with Alan Gassman and Mike Reedy on WUSF Radio

Alan Gassman appeared on WUSF radio on July 7th and was interviewed on the impact of the recent US Supreme Court’s decision regarding same-sex marriage, which requires all states to recognize same-sex marriage and to grant spouses all of the same rights and privileges accorded to opposite sex spouses.

Alan recently had the following to say about planning for same-sex couples:

The day has arrived for same-sex couples to do the math and make the hard decisions regarding whether or not to take advantage of this new opportunity in the face of well over a dozen important legal, tax, social, and other planning factors. There will doubtlessly be many errors made and many estate plans distorted by well-meaning new married couples who thought with their hearts but not with their accountants, lawyers, and wallets.

Equality Florida Statewide Organizer Mike Reedy joined Alan on the show hosted by Carson Cooper, the description for which reads as follows:

Same-sex couples have been able to marry in Florida since January 6, 2015. On June 26, the US Supreme Court ruled that same-sex marriage is legal nationwide. What are the impacts of this ruling on Florida’s same-sex couples? What questions are they asking as they consider tying the knot? We check in again with Clearwater attorney Alan Gassman, author of The Florida Legal Guide for Same-Sex Couples, and Mike Reedy with Equality Florida.

We received the following message via email after the initial broadcast of the show:

Alan,

I listened to your talk on NPR this evening. You were very professional and informed. I appreciate your dedication to this important area.

You can hear a replay of the entire broadcast on WUSF Radio’s website by clicking here.

You can also listen to Alan and Mike’s first WUSF appearance, regarding the January 2015 change in Florida law regarding same-sex marriage by clicking here.

Click here to purchase The Florida Legal Guide for Same-Sex Couples or here for The Florida Advisor’s Guide to Counseling Same-Sex Couples by Alan Gassman, Danielle Creech, and Kristen Sweeney.

Thanks to Lottie Watts, Carson Cooper, and everyone at WUSF Radio!

Claiming Social Security Benefits and Other New Opportunities for Same-Sex Married Couples

by Michael Kitces

Michael E. Kitces, MSFS, MTAX, CFP®, CLU, ChFC, RHU, REBC, CASL, is a nationally recognized speaker and sought-after commentator on financial planning issues. He also writes extensively on a broad range of advanced financial planning topics. He is the co-author of books such as The Advisor’s Guide to Annuities and Tools & Techniques of Retirement Income Planning. He is currently a Director of Planning Research and a Partner at Pinnacle Advisory Group, Inc.

The following article was originally published on the blog Nerd’s Eye View: Commentary on Financial Planning News and Developments by Michael E. Kitces on July 1, 2015. Excerpts from the article are re-produced below.

To see the complete article, please click here.

While the case of United States v. Windsor in 2013 required the Federal government to recognize the marriage of a same-sex couple if the marriage was legal where performed, states were not required to permit same-sex marriage, nor were they required to recognize legal marriages of same-sex couples performed elsewhere. However, with last week’s Supreme Court decision in the case of Obergefell v. Hodges, states are now required to permit same-sex couples to be married and furthermore, must recognize same-sex marriages performed in other states and jurisdictions.

The Supreme Court’s decision creates several immediate new planning opportunities for same-sex married couples, particularly those who were previously married in another states but have been recently living in a state that did not recognize (or one of the 13 that outright banned) their marriage. Those couples will now be able to do everything from filing joint income tax returns, to benefit from the marital deduction for state estate and inheritance tax purposes, to get divorced if the couple decides to separate. In fact, for many such couples, a major planning issue will simply be unwinding the strategies previously in place to handle the fact that their marriage wasn’t recognized but are no longer necessary!

Perhaps most financially significant, though, is that same-sex married couples will now be able to claim spousal and survivor benefits as a married couple, regardless of their current state of residence. This creates both immediate Social Security claiming opportunities for some same-sex couples and the need to plan more proactively for a same-sex married couples’ Social Security benefits in the future, as all the claiming strategies for married couples – including file-and-suspend and restricted application – are now available.

On the other hand, the Supreme Court decision actually makes financial planning for same-sex couples far simpler in the future – or, at least, no more complicated than the conversations that arise when any couple is considering whether to marry and how it might impact them from income tax planning to financial aid to estate planning and everything in between. In fact, as the legal differences for marriage between same-sex and heterosexual couples shrink to almost nothing, it remains to be seen whether LGBT planning will even remain as a distinct ‘niche’ amongst financial advisors – as while potential discrimination against gays and lesbians remains an issue, equal marital rights appears to be eliminating most of the need or relevance of ‘specialized’ LGBT financial planning in the first place.

Same-Sex Marriage, Obergefell v. Hodges, and the Fourteenth Amendment

In 2013, the Supreme Court’s decision in the case of United States v. Windsor declared that Section 3 of the Defense of Marriage Act (DOMA) – which required that under Federal law, a marriage union must be between a man and a woman (and not a same-sex couple) – was unconstitutional under the Fifth Amendment. The outcome of the case was that the Federal government had to recognize an otherwise-legal same-sex marriage and allow the couple to be treated as married for Federal tax purposes, including filing joint tax returns as a married couple and eligibility for the marital deduction for estate tax purposes (which was the actual issue at hand in the Windsor case.)

However, the Windsor decision did not require states to allow same-sex marriages, nor did it require states to recognize a same-sex marriage from another state (even if it had to be recognized by the Federal government.) This, in turn, lead to confusing planning scenarios where same-sex couples were recognized as married for Federal purposes as long as the marriage ceremony was legal where it was performed (the “place of celebration”) but might not be recognized for state purposes if the couple’s current state of residence did not permit same-sex marriage.

On June 26, 2015, though, this distinction between “place of celebration” and “[current] state of residence” came to an end as the Supreme Court ruled in the case of Obergefell v. Hodges that marriage is a fundamental right under the Fourteenth Amendment between any two people, regardless of whether they are of the opposite or same sex. Accordingly, the right to marry is protected under the Due Process and Equal Protection Clauses of the Fourteenth Amendment, and states cannot limit that right to marry, which means that states may no longer ban same-sex marriage and must not only issue marriage licenses to same-sex couples, but must also recognize such same-sex marriages that occurred in another state.

Social Security Benefits Planning for Same-Sex Married Couples

In the immediate aftermath of the Windsor decision in 2013, President Obama directed then-Attorney General Eric Holder to begin a process of reviewing all Federal rules and regulations to support the recognition of same-sex marriage under Federal law where feasible. As noted earlier, this directive led the Treasury and IRS to declare in Revenue Ruling 2013-17 that same-sex marriages would be recognized in the case of Federal tax law (for both income and estate tax purposes), as long as the same-sex marriage was legal at the “place of celebration” where the marriage ceremony legally occurred. However, in the case of Social Security benefits, the law technically stated that the determination of whether a couple is married is based on the couple’s current state of residence, and as a result, same-sex couples that were legally married in one location but moved to another where the marriage would not be recognized were not eligible for spousal and survivor benefits as a couple.

With the new Supreme Court ruling, though, a same-sex couple that was legally married must be recognized as married in every state, as states are no longer permitted to limit same-sex marriage or fail to recognize such marriages from another state. As a result, same-sex married couples living in a state that did not recognize their marriage have now suddenly become eligible for benefits as a married couple.

Suddenly becoming eligible for benefits as a couple can be a significant income bump for many same-sex (or any) married couples. This means a same-sex partner can receive spousal benefits (as long as the couple has been married for at least one year) as well as survivor benefits (as long as the couple was married at least nine months.) The dollar amounts of these Social Security benefits can be significant, potentially the equivalent of a retirement asset worth several hundred thousand dollars that has just become available now that the marriage is recognized!

In addition, the fact that the marriage is recognized also means that the various Social Security claiming strategies for married couples also becomes relevant. For instance, upon reaching full retirement age, one member of a same-sex married couple can now file-and-suspend to activate spousal benefits for his/her partner or file a restricted application to receive spousal benefits based on the other spouse’s record while delaying his/her own. Delaying Social Security benefits for at least one member of a same-sex married couple will often be more appealing now, as the availability of spousal and especially survivor benefits increases the potential for the couple to survive to requisite “breakeven” periods.

Notably, same-sex couples who are married and then get divorced have the potential to receive ex-spouse spousal or survivor benefits as well. Though, in order to be eligible, the marriage must have lasted for at least 10 years, and the couple then must be divorced for at least two years, which means few couples will likely be eligible now as same-sex marriage is still a ‘relatively recent’ phenomenon in most states. However, ex-spouse benefits may be increasingly relevant in the future, as more and more same-sex couples are married long enough to be eligible.

Though given that same-sex marriage has been permitted for many years in a number of states, for some couples, the sudden availability of Social Security benefits means the couple may actually wish to not only claim benefits now but try to claim benefits retroactively to when they were eligible. In point of fact, back in 2013 when the Windsor ruling occurred, same-sex couples were encouraged then to file for any benefits they might become eligible for if their otherwise-legal marriage became recognized in their current state, in order to protect against their potential loss of benefits. Accordingly, at a minimum, those who already filed for benefits but found them to be “pending” for the past two years may soon find those benefits paid. Whether a broader level of retroactive claiming will be permitted or not remains to be seen, but expect to hear further guidance from the Social Security Administration about whether or under what circumstances it will be possible to claim benefits retroactively for a same-sex couple that was already married but couldn’t claim Social Security spousal or survivor benefits because their state didn’t recognize the marriage until now.

Future of Financial Planning for the LGBT Community

Ultimately, the reality is that the full recognition of same-sex marriage across the entire United States should actually make financial planning for such couples far easier in the long run – at least relative to what it’s been in the past. Going forward, for better or worse, same-sex couples will generally face the exact same issues that any other couples – same-sex or heterosexual – must consider when deciding whether to marry.

Ironically, that means the Obergefell v. Hodges Supreme Court decision may even represent the beginning of the end of the “LGBT planning” as a specialty niche for financial advisors – at least as it pertains to the couples’ financial issues (though, notably, anti-discrimination protections against gays and lesbians outside of marriage are still a challenge in many states.) Accordingly, it remains to be seen whether or how designation programs like the Accredited Domestic Partnership Advisor (ADPA) may change to remain relevant in the future.

In the near term, though, the introduction of the right to marry for same-sex couples who lived in states that prohibited, as well as the sudden recognition of an existing marriage for same-sex couples who married legally but now reside in states that weren’t acknowledging the marriage, creates a wide array of immediate planning opportunities, from income and estate tax planning to health insurance and other employee benefits to unwinding ‘old’ strategies that are no longer relevant, and, perhaps most significantly, the availability of potentially significant Social Security spousal and survivor benefits.

To read more about new opportunities presented to same-sex couples after the June 26th Supreme Court decision, including planning for ‘married’ same-sex couples in states that previously prohibited same-sex marriage and financial and other issues for same-sex couples deciding whether or not to marry, please click here to read the article on Nerd’s Eye View.

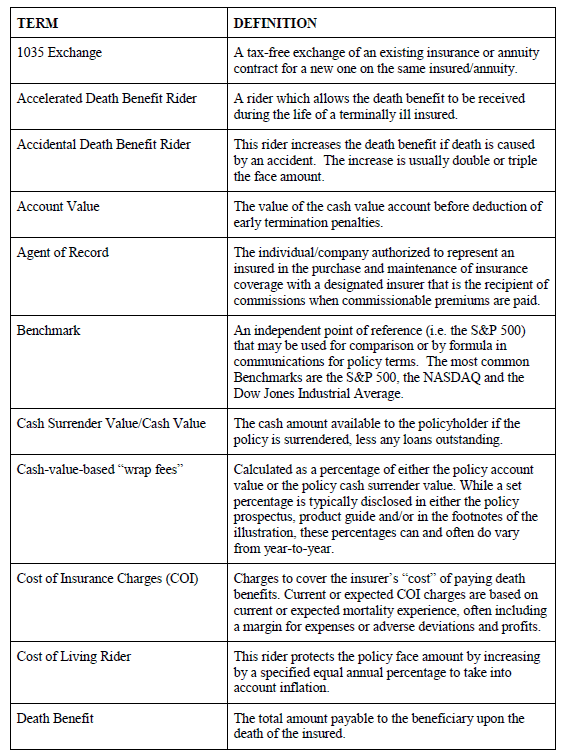

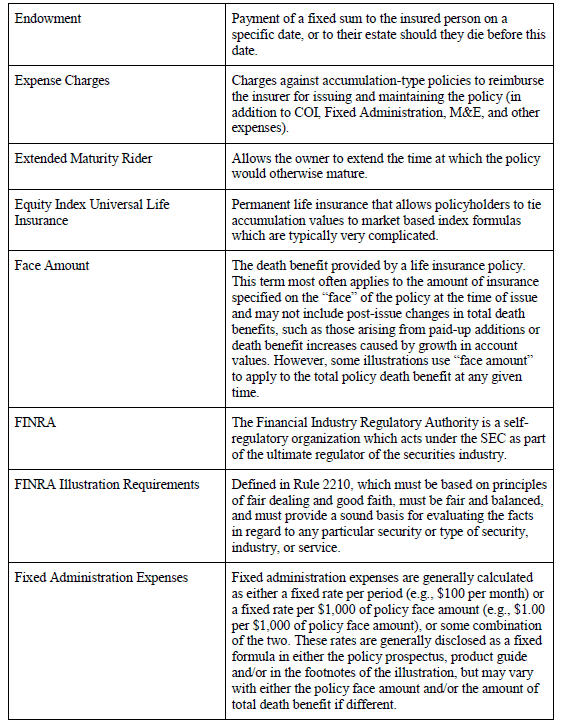

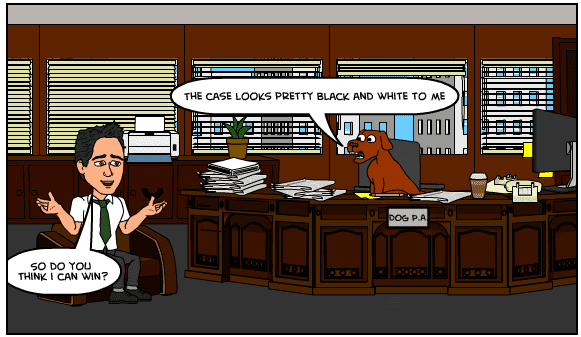

Life Insurance Definitions, Part I

This is a continuation of our series on life insurance fluency. How many of the following definitions do you know?

Tampa Theatre 14th Annual WineFest

Bust out your sweet dance moves and come have a “killer time” with Napoleon, Pedro, Kip, and Lafawnduh at Tampa Theatre’s 14th annual WineFest, Napoleon Wineamite. This year’s event features snacks and samples from local independent restaurants, sips from the finest wineries, and evening of rare, top-rated wines and – for the first time this year – a “Movie Under the Stars” screening of this year’s theme, Napoleon Dynamite.

While the theme may be silly, the purpose is most serious. Now in its 14th year, the annual WineFest is Tampa Theatre’s biggest fundraising event of the year, benefitting the historic movie palace’s artistic and educational programs, as well as its ongoing preservation and restoration.

This great event will take place September 10-17, 2015. Tickets are on sale now at www.tampatheatre.org/winefest.

Sponsorship opportunities are also available. Please contact Maggie Ciadella at maggie@tampatheatre.org for more information about sponsorship or the event.

Richard Connolly’s World

Estate Planning Pitfalls to Avoid

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Estate Planning: It’s Never Too Early to Start” by Elizabeth O’Brien. This article was featured on MarketWatch.com on January 17, 2015.

Richard’s description is as follows:

A picture persists in the popular imagination of a grieving family huddled in the attorney’s office, anxiously awaiting a reading of the deceased’s will. That scene perpetuates some myths and mistakes of the estate-planning process, so it’s time to forget about it.

A copy of the will is typically mailed to all people named in it, so relatives rarely gather at the attorney’s office, elder law attorneys say. But more importantly, it’s generally a lousy idea to make your heirs wait until you die to learn the details of your estate plan.

In fact, some experts advocate beginning the estate-planning discussion when adult children are still in their 20s.

Consider: does your client need you to facilitate a family meeting to discuss the estate plan?

Please click here to read this article in its entirety.

The second article of interest this week is entitled “9 Estate Planning Pitfalls to Avoid” by Rachel F. Elson. This article was featured on FinancialPlanning.com on April 21, 2015.

Richard’s description is as follows:

In the attached article, attorney Jeff Scroggins says changes in both demographics and tax laws require a massive rethinking of estate planning strategies.

He also identifies and describes nine mistakes estate planners should avoid, including:

- No contingency planning for retirement assets

- Failing to account for unique personal property

- Not planning for Dad’s new romance

- Cutting corners in the estate plan

- Coming up short on incapacity planning

- Failing to plan for aging parents

- Not getting appraisals of assets that are not readily marketable assets

- Failing to ask clients, “Who do you trust?”

- Not considering income tax consequences of trusts

Please click here to read this article in its entirety.

Thoughtful Corner

The Resilience Response

Nelson Mandela once said, “The greatest glory in living lies not in never failing but in rising every time we fall.”

It is difficult to go through a week, let alone life, without challenges and obstacles, but one common trait I see in many of the impressive and successful people I represent is resilience.

It is easy to see a challenge or obstacle and to simply fold up the tent, give up, take a different direction, or follow the advice of someone who tells you an easy way out that will not get you where you thought you were going, but somewhere between stubbornness, never taking no for an answer, creativity, confidence, and the simple willingness to fight and not flee from a challenge situation is that magic of resilience.

We all face adversity, disappointment, and challenges that we may or may not be able to overcome, and while resiliency may seem to come naturally to some people, many of these behaviors can be learned. Here are three things you can do to become more resilient:

- Stay Positive

For many, when a negative experience hits, negative emotions are also common. People who are resilient tend to have the ability to experience not only negative but also positive emotions. People who are resilient absolutely acknowledge the bad experience, but they don’t let the negative emotions take over. They usually find the silver lining in the situation. After all, as Abraham Lincoln said, “We can complain because rose bushes have thorns, or we can rejoice because thorn bushes have roses.”

- Live and Learn

Although this may seem like a cliché, it’s definitely worth repeating. One of the best things you can do is learn from your experiences. Instead of sitting around, moping, and asking, “Why me?” reflect on the situation. See what happened to lead to the bad experience this time, and think about what you can do differently next time to lead to a more positive outcome.

- Show Kindness

Studies have found that acts of kindness boost serotonin, the neurotransmitter that is associated with happiness and well-being. These acts of kindness, such as volunteering in the community, tend to have a cumulative effect. Essentially, you can build a reservoir of happiness and resilience that you can draw from in the future.

If you have your doubts about the endless mishaps, bureaucracy, and disorganization that we all have to surmount, check out the YouTube video of a Sean Stephenson TED talk entitled “The Prison of Your Mind.” You can view this video by clicking here.

Humor! (or Lack Thereof!)

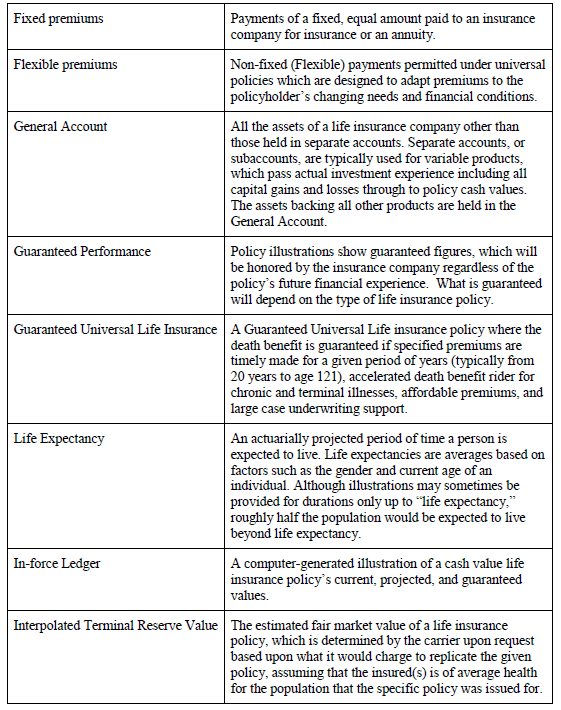

Sign Saying of the Week

*****************************

********************************

Upcoming Seminars and Webinars

Calendar of Events

LIVE CLE TELECONFERENCE PRESENTATION:

Alan Gassman will serve as a speaker and panelist for an ABA Probate, Estate Planning and Trust section CLE teleconference on the topic of COMPARING AND CONTRASTING VARIOUS METHODS TO ACHIEVE A STEP-UP BASIS ON A MARRIED COUPLE’S APPRECIATED ASSETS AT FIRST DEATH IN NON-COMMUNITY PROPERTY STATES.

Attorney David Slenn with Quarles Brady will moderate the conference. Other panelists include Edwin Morrow, III.

Date: Tuesday, July 21, 2015 | 1:00 PM – 2:30 PM

Location: Teleconference

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Edwin Morrow at edwin_p_morrow@keybank.com.

******************************************************

LIVE ORLANDO PRESENTATION:

ORLANDO BUSINESS AND PROFESSIONAL PRACTICE OWNER SYMPOSIUM

Alan S. Gassman, business coach and author David Finkel, and others will present a two-day conference for high-net-worth business and professional practice owners sponsored by Maui Mastermind®.

Alan’s topics will include BASIC AND ADVANCED PLANNING TECHNIQUES FOR THE PROTECTION OF WEALTH, THE 10 BIGGEST MISTAKES THAT BUSINESS OWNERS AND PROFESSIONALS MAKE, and ESTATE TAX AVOIDANCE TECHNIQUES FOR BUSINESS OWNERS AND PROFESSIONALS.

Other topics include A Proven Map to Grow Your Business and Get Your Life Back, Building Wealth Outside of Your Company, Tax Reduction Strategies, and Understanding How Investments Work and What They Cost.

Date: July 30th and 31st, 2015

Location: Hyatt Regency Orlando | 9801 International Drive, Orlando, FL 32819

Additional Information: Interested individuals can contact agassman@gassmanpa.com or David Finkel at david@mauimastermind.com.

********************************************

LIVE WEBINAR:

Alan Gassman and Christopher Denicolo will present a live, free, 30-minute webinar on the topic of CREDITOR PROTECTION PLANNING FOR PHYSICIANS AND MEDICAL PRACTICES. There will be two opportunities to attend this presentation.

Date: Wednesday, August 12, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email agassman@gassmanpa.com.

**********************************************************

LIVE BRADENTON PRESENTATION:

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

This 50 minute informative talk with extensive materials will cover essential aspects and trip-ups that doctors often encounter in the area of personal and practice entity asset protection. It will also discuss tax and investment planning, advisor selection, health law, compliance, and other areas of interest for physicians.

Each attendee will receive a complimentary copy of Mr. Gassman’s book, Creditor Protection for Florida Physicians and other valuable materials.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Thursday, August 13, 2015 | 6:00 PM

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on the topic of MEDICAL LAW UPDATE – FEDERAL AND FLORIDA DEVELOPMENTS THAT MEDICAL PRACTICES AND ADVISORS NEED TO BE AWARE OF. There will be two opportunities to attend this presentation.

Date: Tuesday, August 18, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Live webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Cost of attendance is $35.00. If you are a student or alumni of Ave Maria School of Law, the cost of attendance is $20.00.

Delicious lunch, snacks and amazing conversations included!

Date: Saturday, August 22, 2015 | 9:00 AM – 5:00 PM

I was fortunate to attend the Law Practice and Professional Development Workshop conducted by Alan Gassman, Esq. in Clearwater, Florida on August 3, 2014. The Workshop covered a wide range of topics from Goal Setting and Gratitude to as practical a topic as law office logistics. Alan’s approach was intimate, self-revelatory and highly instructive. I have been practicing law for 20 years and have never attended a program as broad ranging, practical and encouraging. The depth of Alan’s thought and experience is obvious in the materials and in the ease with which he led the discussions. This was not a dull lecture but a highly engaging workshop that was over before you expected it to be.

Daniel Medina, B.C.S

Board Certified in Wills, Trusts and Estates

Medina Law Group, P.A.

Course materials are available on Amazon.com for $1.99 and can be found by clicking here.

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

****************************************************

LIVE SARASOTA PRESENTATION:

Alan Gassman will speak at the Southwest Florida Estate Planning Council meeting on September 8th on the topic of EVERYTHING YOU ALWAYS WANTED TO KNOW ABOUT CREDITOR PROTECTION AND DIDN’T EVEN THINK TO ASK.

Date: Tuesday, September 8, 2015 | 3:30 PM – 5:30 PM with dinner to follow

Location: Sarasota, Florida

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com.

********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman and a guest to be determined will present WHAT TAX PLANNERS NEED TO KNOW ABOUT NORTH DAKOTA TRUST LAW for Bloomberg BNA.

Date: Wednesday, September 9, 2015 | Time TBA

Location: Online webinar

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanp.com

*******************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of THE 10 BIGGEST MISTAKES THAT SUCCESSFUL PARENTS (AND GRANDPARENTS) MAKE WITH RESPECT TO COLLEGE AND RELATED DECISIONS FOR HIGH SCHOOL STUDENTS.

Date: Saturday, September 12, 2015 | 9:30 AM

Location: Online Webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

*****************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: Friday, September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

*************************************************

LIVE WEBINAR:

Alan Gassman, Christopher Denicolo, and Kenneth Crotty will present a 50-minute webinar entitled CREATIVE PLANNING FOR FLORIDA REAL ESTATE with a guest (victim) to be determined. This presentation will be free and worth every dollar!

There will be two opportunities to attend this presentation. This webinar will qualify for CLE and CPE credit.

Date: Wednesday, September 23, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email agassman@gassmanpa.com.

**************************************************

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman and Lee-Ford Tritt will present a webinar on the topic of WHETHER TO MARRY AND WHAT TO CONSIDER: A TAX AND ESTATE PLANNER’S GUIDE TO COUNSELING SAME-SEX COUPLES WHO MAY TIE THE KNOT for Bloomberg BNA.

Date: Wednesday, September 30, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

*************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

****************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Christopher Denicolo will present a webinar on the topic of WHAT EVERY NEW JERSEY ATTORNEY SHOULD KNOW ABOUT FLORIDA ESTATE PLANNING. This webinar will qualify for 2 New Jersey CLE credits.

Most advisors with Florida clients are unaware of the unique rules and planning considerations that affect Florida estate, tax, and business planning. Unlike some other states, Florida’s laws regarding limited liability companies, powers of attorney, taxation, homestead, creditor exemptions, trusts and estates, and documentary stamp taxes are not simply versions of a Uniform Act. They have been crafted by the Florida legislature to apply to various specific issues in an often counterintuitive manner.

This presentation will the following objectives:

- Unique aspects of the Florida Trust and Probate Codes

- Creditor protection considerations and Florida’s statutory creditor exemptions

- The Florida Power of Attorney Act

- Traps and tricks associated with Florida’s Homestead Law and Elective Share

- Documentary stamp taxes, sales taxes, rent taxes, property taxes, and how to avoid them

- Business and tax law anomalies and planning opportunities

Date: Thursday, October 8, 2015 | 12:00 PM – 1:40 PM

Location: Online Webinar

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Eileen O’Connor at eoconnor@njsba.com.

********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: To be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please visit http://www.law.miami.edu/heckerling/.

*******************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, while Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfer in Context with Estate Planning.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins, which is not affiliated with Anthony Hopkins.

Please provide us with your input for other topics for this year and next! Watch this space for more speaker and topic announcements.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

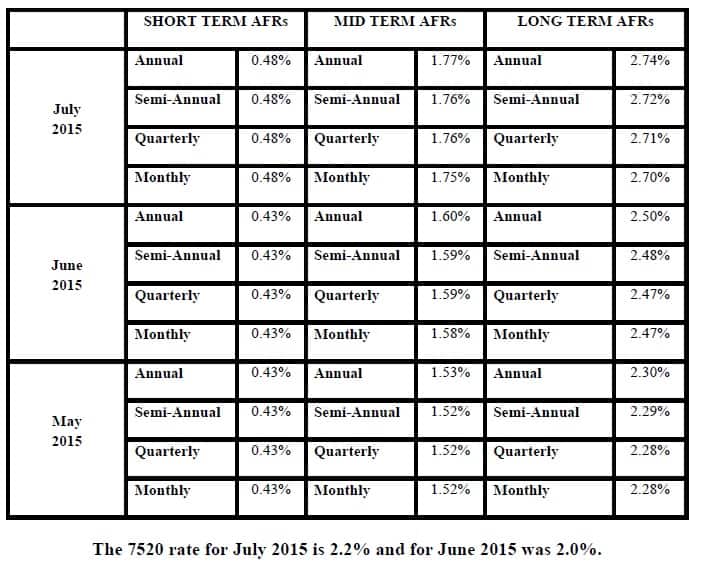

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.