The Thursday Report – 7.30.15 – TeleThursday Report

The Future of Telemedicine

How has the 4% Rule Held Up Since the Tech Bubble and the 2008 Financial Crisis? By Michael Kitces

Resident – Does Anyone Really Know What it Means? By David Thompson, CPCU, AAI, API, CRIS

Richard Connolly’s World – Estate Planning for Single or Childless Individuals

Thoughtful Corner – Office Efficiency and Logistics, Part II

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

The Future of Telemedicine

Nowadays, everyone uses the internet for scheduling appointments – hair appointments, nail appointments, even doctor appointments – but what if you could also attend your appointment with your physician over the internet? This is the future of medicine, and it is called “telemedicine.”

Defined in the Florida Administrative Code as the practice of medicine where patient care, treatment, and services are provided through the use of one site to another via electronic communication, telemedicine is changing the way that doctors and patients interact. The Statute was set to be codified as Florida Statute Section 456.4501 on July 1, 2015, but the legislature is still working out some kinks. However, the following is what is expected to occur under the new regulations.

The proposed Florida legislation defines telehealth services to include: patient assessment, diagnosis, consultation, treatment, and monitoring.[1] It will not include optical-related issues, nor will it allow for the doctor to prescribe controlled substances, such as narcotic pain medication. Still, not only does this technology save the patient a trip to the doctor’s office, the appointment overall is significantly shorter, allowing the doctor to see more patients.

In order for a doctor to practice telemedicine as part of his office routine, a valid doctor-patient relationship must be established prior to providing telemedicine services.[2] The typical background history interview must be performed and documented as with any regular doctor appointment. Doctors must also ensure that the patient’s insurance will cover telemedicine visits and also ensure that their own liability insurance covers telemedicine as well.[3]

A representative from eVisit, a telemedicine company, stated that “[a] telemedicine visit is well suited for minor medical conditions and, in most cases, the patient is well aware of what’s wrong – i.e. ‘I’ve had a sinus infection, UTI, cold/flu, etc. in the past and this is what’s worked, etc.'” The representative also regarded the technology as beneficial for surgeons, especially, due to the idea that telemedicine saves them time and reduces unnecessary readmissions. Further, the representative stated that:

Physicians are trained to ask a series of questions to rule out other possible ailments…For example, if you thought you had a sinus infection, the physician would most likely ask you if you were experiencing soreness anywhere else, ruling out something more serious, like meningitis.

In fact, the reason why a patient-doctor relationship must be established is so that the doctor is able to make an accurate diagnosis via the telemedicine pathway as opposed to an in-office visit. Without a valid relationship, the doctor would be unable to make a definitive diagnosis.

While this concept could potentially prove to be more beneficial to doctors and patients, there have also been some points of contention regarding the proposed legislation. For instance, one problematic issue has been compensation. Sam Miller, a spokesperson for the Florida Insurance Counsel stated that insurers simply do not want the state to require them to compensate doctors the same rates for telemedicine visits as they do for in-office exams.[4] In fact, in February of 2015, the Senator proposing the bill removed language that would have required Medicaid to pay equal rates of reimbursement.[5] Another hurdle is cross-state licensure. Only 12 states have licensing procedures that allow physicians to give care via telemedicine techniques, and doctors are required to be licensed in the state where the patient receiving the services resides.[6]

Telemedicine is not only a more efficient way to provide healthcare, it is also less expensive and opens the door for a larger job market. The global movement towards telemedicine will provide high-quality, low-cost medical services to rural areas, at-need families, home-bound seniors, and patients who cannot travel to see their doctor.[7] With that movement will come an increase in the job market relating to telemedicine.

Paula Guy, the CEO of non-profit Georgia Partnership for Telehealth, stated that Florida will be the next state that offers new opportunities for the telemedicine industry. She further stated:

Jobs will open up for IT professionals to set up and maintain the secure teleconference, data-stream links and software. People will be needed to train and certify workers, to develop academic curricula and teach certification courses to tech-shy physicians and to coordinate the “nurse presenters” who serve as the remote physicians’ eyes, ears, and arms in dealing with on-site patients.[8]

Telemedicine, ranging from a simple telephone call to complex video conferencing, will help increase the job market in Florida for a multitude of industries and provide beneficial health care to people who need it most. A three to five minute meeting a doctor through a telemedicine interface will improve patient care by increasing the amount of patients that a doctor can see per day. Further, it will allow the patient to be in a more relaxed, comfortable environment and save them a trip to the doctor’s office. With what seems like everything being streamlined through the internet, it will be no surprise when doctor’s visits through telemedicine platforms become more and more commonplace.

**********************************************

[1] See Fla. Stat. §456.4501

[2] Troy Kishbaugh and Julie Tyk, Telemedicine Update: AMA Guidelines and Florida State Law, Florida MD, July 2014.

[3] Id.

[4] Brian Heaton, Florida Lawmakers Debate Bill to Allow Virtual Medical Visits, South Florida Sun-Sentinel, March 16, 2015.

[5] Id.

[6] Id.

[7] Ron Hurtibise, Coming telemedicine boom to drive job opportunities in Florida, South Florida Sun-Sentinel, Feb. 21, 2015.

[8] Id.

How has the 4% Rule Held Up Since the Tech Bubble

and the 2008 Financial Crisis?

by Michael Kitces

Michael E. Kitces, MSFS, MTAX, CFP®, CLU, ChFC, RHU, REBC, CASL, is a nationally recognized speaker and sought-after commentator on financial planning issues. He also writes extensively on a broad range of advanced financial planning topics. He is the co-author of books such as The Advisor’s Guide to Annuities and Tools & Techniques of Retirement Income Planning. He is currently a Director of Planning Research and a Partner at Pinnacle Advisory Group, Inc.

The following article was originally published on the blog Nerd’s Eye View: Commentary on Financial Planning News and Developments by Michael E. Kitces on July 29, 2015. Excerpts from the article are re-produced below.

To see the complete article, please click here.

The 4% rule has been much maligned lately, as recent market woes of the past 15 years, from the tech crash of 2000 to the global financial crisis of 2008, have pressured both market returns and the portfolios of retirees.

Yet, a deeper look reveals that if a 2008 or even a 2000 retiree had been following the 4% rule since retirement, their portfolios would be no worse off than any of the other “terrible” historical market scenarios that created the 4% rule from retirement years like 1929, 1937, and 1966. To some extent, the portfolio of the modern retiree is buoyed by the (only) modest inflation that has been occurring in recent years, yet even after adjusting for inflation, today’s retirees are not doing any materially worse than other historical bad-market scenarios where the 4% rule worked.

Ultimately, this doesn’t necessarily mean that the coming years won’t turn out to be even worse or that the 4% rule is “sacred”, but it does emphasize just how bad the historical market returns were that created it and just how conservative the 4% rule actually is, and that recent market events like the financial crisis are not an example of the failings of the 4% rule but how robustly it succeeds!

How the 4% Rule is Faring for 2000 and 2008 Retirees

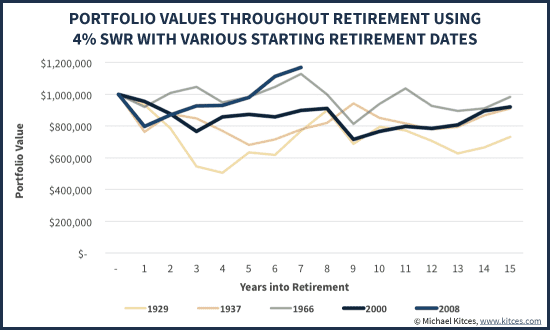

The fact that the 4% rule is based on a particular subset of especially bad historical scenarios gives us a unique opportunity to compare recent challenging times for retirees, like those who retired in 2000 or 2008, and see how they compare. In other words, if we looked at how the portfolio of a retiree was doing in the first half of a retirement starting in 1929, 1937, or 1966, would a retiree who started in 2000 or 2008 be doing similar, better, or worse?

As the results reveal in the chart above, despite how shocking the tech crash and the 2008 financial crisis appeared to be in real time, the reality is that such retirees still have portfolios that are performing similar to or better than most of the historical 4% rule scenarios. The 2000 retiree is already halfway through the 30-year time horizon with similar wealth to a 1929, 1937, or 1966 retiree at this point, and the 2008 retiree is even further ahead than any of those historical scenarios (and even ahead of the 2000 retiree, too!).

Of course, an important caveat to the chart above is that it’s based on “nominal” dollars, not adjusted for inflation, which is important, because it means that retirees who had similar portfolio balances after the first half of retirement were not necessarily going to have the same buying power with those dollars for the rest of retirement (because of what inflation had been in the first half of retirement). This is especially true for the 1966 retiree, who experienced significant double-digit inflation in the first half of retirement.

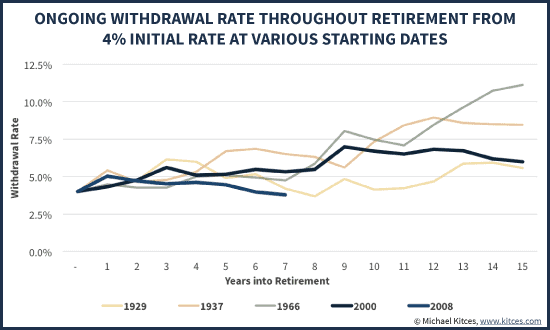

Accordingly, the chart below re-calculates the progress of these retirees, based not on the nominal value of their portfolio through the first half of retirement, but based on the amount of inflation-adjusted spending they were doing from the portfolio at that halfway point. In other words, what was the retiree’s then-current withdrawal rate, year by year, as both the portfolio bounced around and inflation-adjusted spending requirements continued to rise each year?

In this chart (where lower numbers are good because it means the withdrawal rate is low and spending is modest relative to wealth), it quickly becomes clear after adjusting for the level of inflation-adjusted spending how much more severely adverse the first half of retirement was for the 1966 retiree than the others (the 1966 line is much higher than the rest). Even though the value of the portfolio was similar to the other retirements when measured halfway through retirement, the current withdrawal rate at that point was far more problematic, having already spiked above 10% with 15 years still to go. In fact, the only reason the 1966 retiree was able to finish retirement at all with such a high withdrawal rate at the midpoint is that, by the half-way mark of retirement in 1981, both the stock and bond markets had gotten so cheap (yields had gotten so high) that the superior returns (and declining inflation) made it possible to finish successfully.

Relative to the 2000 or 2008 retiree, though, the results continue to look reasonably in line. Certainly the markets are not as favorably valued now for the 2000 retirees as they were in 1981 for the 1966 retiree, but then again, the 2000 retiree is still only at a 6.2% withdrawal rate today (with just 15 years to go,) while the 1966 retiree was over a 10% withdrawal rate at this point. And in the case of a 2008 retiree, the withdrawal rate is already right back at the 4% initial withdrawal rate the retiree began with (after already doing 6 years worth of retirement spending!).

Keeping Retiree Market Disasters in Historical Context

Ultimately, the key point here is simply to recognize that the 2000 retiree is merely “in line” with the 1929 retiree and doing better than the rest. And the 2008 retiree, even having started with the global financial crisis out of the gate, is already doing far better than any of these historical scenarios! In other words, while the tech crash and especially the global financial crisis were scary, they still haven’t been the kind of scenarios that spell outright doom for the 4% rule.

To read more about the 4% rule, including an analysis of how conservative a 4% safe withdrawal rate is, as well as a further discussion on how to keep retiree market disasters in historical context, please click here to read the article on Nerd’s Eye View.

Resident – Does Anyone Really Know What it Means?

By David Thompson, CPCU, AAI, API, CRIS

David Thompson, CPCU, AAI, API, CRIS, works in a training and education position with the Florida Association of Insurance Agents in Tallahassee, Florida, where he presents continuing education seminars throughout the country on a variety of insurance subjects. He received his degree from Mercer University in Macon, Georgia, and served as a commissioned officer in the US Army and US Coast Guard. He can be reached at dthompson@faia.com.

The following article is copyrighted by the Florida Association of Insurance Agents

and is used with permission.

Almost every personal lines policy uses the word “resident” somewhere in the form. The problem is few (if any) policies define what the term “resident” actually means. For example, the term “family member” is defined in the personal auto policy as “…a person related to you by blood, marriage, or adoption who is a resident of your household.” Having status as a resident often is the key to having coverage under the policy.

Lacking a policy definition of “resident,” court cases provide valuable insight in interpreting the term. I recently spent the better part of a day on the Internet reading court cases dealing with residency. Since few people would find that as interesting as I did, I’ll mention a few of the cases that were of interest.

College Kids

In the Oregon case of Waller v. Auto-Owners Insurance Company, the 17-year-old daughter of an insured moved from Florida to Oregon to attend college. She rented an apartment in her name and her father’s name, represented she lived in Oregon for the purposes of getting an in-state tuition rate, opened a bank account in her name, obtained utilities in her name, and obtained an Oregon driver’s license. The daughter also maintained a bedroom in her parent’s home in another state and some of her possessions remained there. She had never expressed intent not to return to her parent’s home after college, being unsure of her plans after graduation. After being injured in an auto accident, she claimed residency with her parents, seeking $1,475,000 in underinsured motorist coverage from her parent’s policy. While the trail court sided with the insurance company in denying the claim, the appeals court ruled the trail court had erred in its decision, and the case was sent back to the trial court.

Dual Residency

In the Ohio case of Prudential v. Koby, a 32-year-old captain in the US Army was ruled to have held dual residency, at his home as well as that of his parents. The court stated, “…there was no requirement that, in order for a person to be a resident of the named insured’s household, such residence must be the sole or exclusive residence of the person.”

Divorced Parents

In the Florida case of Progressive v. Wesley, a child, Taylor Wesley, was killed in an automobile accident. At the time of the accident, her parents were divorced, and the father was awarded primary custody of the child, however, both parents shared parental responsibility. The child kept a room at the home of both parents. Arguments were presented on both sides showing how the child lived with one parent. The court said, “Either determination of Taylor’s residency would be reasonable. We must accept the interpretation which would favor the insured.” Coverage was afforded under the policies of both parents.

Kids Renting from Mom and Dad

In the Florida case of Philbin v. American States, Richard and Rosemary Curtis owned a house and leased it to their son, William, who was the sole resident of the house. Richard and Rosemary owned another home and lived in that home full time. A pit bull dog owned by William attacked plaintiff Philbin, who sued Richard and Rosemary as owners of the house, and William as owner of the dog. Richard claimed residency under his parent’s policy, but lacking any evidence that William resided with his parents, coverage for the $2.3 million verdict against William was denied.

What Constitutes “Residency”?

During the eleven years after moving out of his parents’ home following high school graduation, the defendant had worked and lived on his own, married, and played professional hockey. Divorced and unemployed, he moved back in with his parents at age 29, although he “spent a lot of time” at his new girlfriend’s house. The Supreme Court supported an appeals court citation of three circumstances found by the Wisconsin Supreme Court to determine residency in a household: (1) living under the same roof, (2) a close, intimate, and informal relationship, and (3) when the duration of residency is likely to be substantial such that it is reasonable to conclude that the parties would consider the relationship in procuring insurance and in their reliance on it to protect them. Since the Minnesota Supreme Court found no conflict between these standards and Minnesota law and upheld the son’s status as an “insured” under the contract. (State Farm Insurance Company v. Short, et al., Minnesota Supreme Court, 1990.)

What is a “Resident” & what is “in the care of”?

An Indiana resident permitted her nephew’s three children to move in with her while he looked for work and a home. In a lawsuit that arose, the federal district court ruled that the children were “insureds” within a reasonable interpretation of the term “resident” because they manifested more than a mere physical presence in the household, were completely dependent on the named insured for food, clothing, shelter, and supervisory care. (Allstate Insurance Company v. Shockley, 793 F.Supp. 852, S.D. Ind., 1991.)

Residents of Multiple Households

A divorced woman’s son spent most weekdays at his father’s house, but most weekends, some weekdays, and most summers with his mother. The son was in the legal custody of his father, spent most of his time in his father’s house, kept most of his possessions there, and was living there when the occurrence happened that gave rise to a lawsuit under his mother’s policy. The court ruled that there was nothing in the mother’s policy that prohibited him from being a resident of more than one household. (Mutual Service Casualty Insurance Company, Minnesota Court of Appeals, 1987.)

Dual Households

An insured was divorced from his wife and she was awarded sole custody of their son, although the insured had extensive visitations rights and maintained a space in his home for his son’s frequent visits. The son was killed while riding in his mother’s car and the father sought recovery under the UM/UIM provisions of his auto policy on the basis that his son was a “family member” under his policy. The court found coverage on the basis that the policy did not preclude an insured from being a resident of more than one household. (American Family Mutual Insurance Company v. Thiem, Minnesota Supreme Court 1993). The same logic was applied in a homeowner’s case in the same state.

Children in College

Courts have generally held that children away at college are still considered to be “family members”, i.e., household residents (e.g. Crump v. State Farm Mutual Automobile Insurance Company, Missouri Court of Appeals, 1992). However, in one case, the jury determined that a child away at college was not a resident of the household – this determination enabled the child’s sister to recover over $600,000 under their father’s policy (he was driving the son’s auto) for a UM claim that would have been excluded if her brother had been considered a “family member” under the father’s policy, so this may have been a reason for this particular decision (Huskey v. Crisp, Tennessee Supreme Court, 1993). In addition, policy exclusions may apply even though the child may be considered an insured otherwise.

“Independent” Children

In one case, the named insured’s son who maintained his own apartment filed a UM claim under his father’s policy, contending that he was still a resident because he stored personal belongings and spent the night there occasionally – the court found that he did not meet the definition of a “family member” (Aetna C&S Company v. Gutstein, New York Court of Appeals, 1992). In a similar case, the court reached the same conclusion (State Farm Mutual Automobile Insurance Company v. Taussig, Illinois Court of Appeals, 1992).

Divorced Parents

As reported by IRMI, the Ohio Court of Appeals ruled that a child was a “resident relative” of a noncustodial parent’s household. Keith v. State Farm Ins. Co., 2007 Ohio 1878 (Ohio App. 4/20/2007).

As the above court cases demonstrate, determining residency is a complex task involving numerous issues. Each situation is unique and there is no “cut and dry” method to determine residency status. While courts tend to view coverage in favor of resident status (even when it appears there is sufficient doubt as to the status) the safe course of action is to gather all the facts and present the situation to the company for a coverage interpretation prior to the claim. As always, document answers given by the company for future reference.

Thank you to David and the Florida Association of Insurance Agents for allowing us to bring this article to Thursday Report readers! For more great articles, check out the FAIA’s Education Library at https://www.faia.com/Resources.aspx?pid=198.

Richard Connolly’s World

Estate Planning for Single or Childless Individuals

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Estate Planning Essentials for Single People: It Can Be More Complex than for Married Couples” by Carolyn T. Geer. This article was featured in The Wall Street Journal on December 7, 2014.

Richard’s description is as follows:

In 1970, slightly more than a third of Americans age 15 and older were single, according to the US Census. By 2013, their numbers approached 50% of Americans.

Among US citizens aged 65 and older, more than half (53%) of women and more than one quarter (26%) of men were unmarried last year. That amounts to 18 million divorced, never-married, or widowed seniors.

It’s important to create, at minimum, a will and/or revocable living trust stating specifically how you want your assets to be distributed after you die and naming an executor and/or trustee to carry out your wishes.

Please click here to read this article in its entirety.

The second article of interest this week is entitled “Estate Planning for Childless Couples” also by Carolyn T. Geer. This article was featured in The Wall Street Journal on November 8, 2014.

Richard’s description is as follows:

A basic estate plan for a couple with children is pretty simple, but readers might be wondering, “What about marrieds without kids?”

A reader in California asked, “My husband and I own our house, are retired, with a high six-figure nest egg, and no will or trust. What is the minimum we need to do?”

You have two main tasks. One is to decide what will happen to your property after you die. The other, arguably more important – and trickier – task is to specify who will handle your medical and financial affairs if you’re incapacitated.

If you don’t want to risk disinheriting your relatives, or if you’d like to leave something to friends or charity, you need a plan.

Please click here to read this article in its entirety.

Thoughtful Corner

Office Efficiency and Logistics, Part II

by Alan Gassman

Ideas and Time Savers

The following is a list of ideas that may help you save some time during your daily office tasks:

- Return all emails immediately. Then, they will not pile up, and you will not forget to reply to something important.

- Use multiple computer screens for multiple purposes.

- Print any email that needs a follow-up.

- Use different colored paper for different printers and/or different types of documents.

- Integrate reviewing draft bills into your weekly routine.

- Give the client a book that will answer many of the questions they may have.

- Use summary charts for key information and to facilitate client understanding. If you can chart it, do it. Once you own the chart, you own the client or the transaction.

Writing in the Margins

When in a client meeting or on a conference call, something said or discussed during the call or meeting may spark a remembrance of something you need to do with another client. Make note of this in the margin of your notepad in a way that, should the client you’re currently with read the notepad, they would not specifically know what other client or situation is involved.

If you have an assistant copy your notes after a meeting, they will notice that something is written in the margins. Request that they make extra copies of the pages that contain margin writing and follow-up with you as to what is needed or desired.

Those items can then be added to an action list or responded to appropriately.

“Ask Me Tomorrow”

Quite often, a team member will ask me a question, and my answer will be, “ask me again tomorrow.”

I will then write the question or matter down to activate my subconscious mind and allow it to begin thinking through what the final decision will be or should be.

The next day, or sometimes the day after, I will have an answer. It may come to me subconsciously or while thinking “offline.”

Given the choice between making sure that no one has sent you anything on Facebook in the last half hour or picturing yourself in the neatest place you’ve ever been or want to be with whomever you would prefer to have there with you, which do you choose?

Great ideas typically happen when you are “offline” from work but not normally while you are still plugged in to social media activities. Identify this time waster and set it aside so that you might have an answer for your team member the following day.

Your Smart Phone is Not All that Smart

It’s great to be able to get messages and reply to them on the go or anywhere in which you have a signal, but the great majority of professionals make a grave mistake by routinely answering questions and addressing opportunities with one finger, one letter at a time, without circling back to expound, connect, or follow-up. Here is why this is a grave mistake:

When you type, dictate a response for transcription, or call someone, you have a much easier flow of information, detail, creativity, and warmth to convey. When you reply by phone, you are much less likely to follow-up or really think through what the other person wants or needs.

The recipient is also not going to give much credence or thought to a hastily typed message that comes with the suffix “sent from my phone; please excuse typos and grammar errors.”

When I am away from the office and answering emails on my phone, I copy key people in my organization as a signal for them to follow up with me on the matter. I have my assistant print emails I sent on my phone whenever I am away for a long period of time. These print-outs help me ensure needed follow-ups are completed and any significant time spent reviewing messages or documents on my phone is billed for.

I am also mindful that responses and interactions composed via a phone will not be as rich, warm, or meaningful than they would be if I had a keyboard or a Dictaphone in front of me and act accordingly.

So many people just “fling” documents around and send scattered emails with no continuity as it is. Do not join that club. It will cheapen your image and weaken your response to important messages that deserve to be well answered. “I’ll get back to you” is an acceptable response and possibly the best response you can use in many cases.

Do not become a scattered mess like so many of our colleagues. The phone is to be our servant, not our master or our downfall.

The above has been excerpted from the Professional Acceleration Workshop Workbook, which can be purchased by clicking here.

Humor! (or Lack Thereof!)

Sign Saying of the Week

***************************************************

Upcoming Seminars and Webinars

Calendar of Events

LIVE BLOOMBERG BNA WEBINAR:

Jonathan Blattmachr, Lee-Ford Tritt, Sean Healy, and Alan Gassman will present a Bloomberg BNA webinar entitled HAVE GUN TRUST – WILL TRAVEL: HOW TO DESIGN, DRAFT, AND IMPLEMENT GUN TRUSTS.

This webinar will examine pertinent aspects of the National Firearms Act (NFA), explain how to stay compliant with the NFA, and elaborate on how to develop fully-compliant gun trusts. This program can qualify for up to 1.0 CPE credits.

Date: Wednesday, August 5, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman, Edwin P. Morrow, III, and Christopher Denicolo will present a Bloomberg BNA webinar entitled ESTATE AND TRUST PLANNING WITH IRA AND QUALIFIED PLAN BENEFITS.

This webinar will provide participants with clear guidelines for understanding and applying the rules with reference to minimum distributions, transfers and rollovers, trust beneficiaries, and how to otherwise handle and plan for pension and IRA accounts. Participants will receive a handbook with over 200 pages of concise yet thorough explanations, colored charts and guides, Excel spreadsheets that can be used to illustrate account growth and taxes inside and outside accounts using distribution rule scenarios and more.

Date: Thursday, August 6, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Christopher Denicolo will present a live, free, 30-minute webinar on the topic of CREDITOR PROTECTION PLANNING FOR PHYSICIANS AND MEDICAL PRACTICES. There will be two opportunities to attend this presentation.

Date: Wednesday, August 12, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email agassman@gassmanpa.com.

**********************************************************

LIVE BRADENTON PRESENTATION:

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

This 50 minute informative talk with extensive materials will cover essential aspects and trip-ups that doctors often encounter in the area of personal and practice entity asset protection. It will also discuss tax and investment planning, advisor selection, health law, compliance, and other areas of interest for physicians.

Each attendee will receive a complimentary copy of Mr. Gassman’s book, Creditor Protection for Florida Physicians and other valuable materials.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Thursday, August 13, 2015 | 6:00 PM

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on the topic of MEDICAL LAW UPDATE – FEDERAL AND FLORIDA DEVELOPMENTS THAT MEDICAL PRACTICES AND ADVISORS NEED TO BE AWARE OF. There will be two opportunities to attend this presentation.

Date: Tuesday, August 18, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Live webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE PORT RICHEY PRESENTATION:

Alan Gassman will be speaking with Barry Flagg at the North Suncoast Chapter FICPA meeting on a topic to be determined.

Date: Wednesday, August 19, 2015 | 4:30 PM – 6:15 PM

Location: Chili’s | 9600 US 19 North, Port Richey, FL, 34668

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Cost of attendance is $35.00. If you are a student or alumni of Ave Maria School of Law, the cost of attendance is $20.00.

Delicious lunch, snacks and amazing conversations included!

Date: Saturday, August 22, 2015 | 9:00 AM – 5:00 PM

I was fortunate to attend the Law Practice and Professional Development Workshop conducted by Alan Gassman, Esq. in Clearwater, Florida on August 3, 2014. The Workshop covered a wide range of topics from Goal Setting and Gratitude to as practical a topic as law office logistics. Alan’s approach was intimate, self-revelatory and highly instructive. I have been practicing law for 20 years and have never attended a program as broad ranging, practical and encouraging. The depth of Alan’s thought and experience is obvious in the materials and in the ease with which he led the discussions. This was not a dull lecture but a highly engaging workshop that was over before you expected it to be.

Daniel Medina, B.C.S

Board Certified in Wills, Trusts and Estates

Medina Law Group, P.A.

Course materials are available on Amazon.com for $1.99 and can be found by clicking here.

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

**********************************************************

LIVE SARASOTA PRESENTATION:

Alan Gassman will speak at the Southwest Florida Estate Planning Council meeting on September 8th on the topic of EVERYTHING YOU ALWAYS WANTED TO KNOW ABOUT CREDITOR PROTECTION AND DIDN’T EVEN THINK TO ASK.

Date: Tuesday, September 8, 2015 | 3:30 PM – 5:30 PM with dinner to follow

Location: Sarasota, Florida

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman and Al King, co-founder, co-chair, and co-CEO of South Dakota Trust Company, LLC, will present a Bloomberg BNA Webinar entitled WHAT IS SO SPECIAL ABOUT SOUTH DAKOTA? DOMESTIC ASSET PROTECTION TRUST LAW AND PRACTICES.

South Dakota’s legislature has attempted to take the best from each of the states that have the most favorable estate and trust laws to provide a fresh platform for examining and maximizing tax and non-asset protection objectives. This webinar will provide a practical and interesting discussion of both South Dakota and practical domestic asset protection law strategies. It will cover the legal aspects, present checklists and sample trust clauses, and provide creative and practical planning techniques that can be used by practitioners and their clients.

Date: Wednesday, September 9, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here. For additional information, please email Alan Gassman at agassman@gassmanpa.com

**********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of THE 10 BIGGEST MISTAKES THAT SUCCESSFUL PARENTS (AND GRANDPARENTS) MAKE WITH RESPECT TO COLLEGE AND RELATED DECISIONS FOR HIGH SCHOOL STUDENTS.

Date: Saturday, September 12, 2015 | 9:30 AM

Location: Online Webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SOUTH BEND PRESENTATION:

41ST ANNUAL NOTRE DAME TAX AND ESTATE PLANNING INSTITUTE

Rebecca Ryan, Bill Boersma, Daen Wombwell, Michael Halloran, and Alan Gassman will be presenting a talk at the Notre Dame Tax & Estate Planning Institute on the topic of UNDERSTANDING ILLUSTRATIONS, DESIGN OPPORTUNITIES, AND FINANCIAL EVALUATION OF WHOLE LIFE, UNIVERSAL, VARIABLE, AND EQUITY INDEXED LIFE INSURANCE.

Date: September 17 – 18, 2015 | Alan Gassman will speak on Thursday, September 17 | 11:30 AM – 12:30 AM

Location: Century Center | 120 South Saint Joseph Street, South Bend, IN 46601

Additional Information: Click here to download the 2015 program brochure. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: Friday, September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

**********************************************************

LIVE WEBINAR:

Alan Gassman, Christopher Denicolo, and Kenneth Crotty will present a 50-minute webinar entitled CREATIVE PLANNING FOR FLORIDA REAL ESTATE. This presentation will be free and worth every dollar!

There will be two opportunities to attend this presentation. This webinar will qualify for CLE and CPE credit.

Date: Wednesday, September 23, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman and Lee-Ford Tritt will present a webinar on the topic of WHETHER TO MARRY AND WHAT TO CONSIDER: A TAX AND ESTATE PLANNER’S GUIDE TO COUNSELING SAME-SEX COUPLES WHO MAY TIE THE KNOT for Bloomberg BNA.

Following the decision of the United States Supreme Court in Obergefell v. Hodges, same-sex couples now enjoy the same legal and tax benefits as opposite-sex couples. These benefits include marriage, divorce, adoption and child custody, separation agreements, Qualified Domestic Relations Orders (QDROs), marital property, survivorship spousal death benefits, inheritance through intestacy, priority rights in guardianship proceedings, and contract rights.

This program will discuss relationship and marital agreements, tax issues, reasons to marry or not marry, and a number of unique circumstances that can apply to same-sex couples as well as to opposite-sex couples.

Date: Wednesday, September 30, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Steven B. Gorin and Alan Gassman will present a free webinar on the topic of INCOME TAX EXIT STRATEGIES. There will be two opportunities to attend this presentation.

Date: Thursday, October 1, 2015 | 12:30 PM and 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE PINELLAS COUNTY PRESENTATION:

Christopher Denicolo will be speaking at the Pinellas County Estate Planning Council meeting on the topic of PLANNING WITH IRAs AND QUALIFIED PLANS.

Date: Monday, October 5, 2015

Location: To Be Determined

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Christopher Denicolo at christopher@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Christopher Denicolo will present a webinar on the topic of WHAT EVERY NEW JERSEY ATTORNEY SHOULD KNOW ABOUT FLORIDA ESTATE PLANNING. This webinar will qualify for 2 New Jersey CLE credits.

Most advisors with Florida clients are unaware of the unique rules and planning considerations that affect Florida estate, tax, and business planning. Unlike some other states, Florida’s laws regarding limited liability companies, powers of attorney, taxation, homestead, creditor exemptions, trusts and estates, and documentary stamp taxes are not simply versions of a Uniform Act. They have been crafted by the Florida legislature to apply to various specific issues in an often counterintuitive manner.

This presentation will the following objectives:

- Unique aspects of the Florida Trust and Probate Codes

- Creditor protection considerations and Florida’s statutory creditor exemptions

- The Florida Power of Attorney Act

- Traps and tricks associated with Florida’s Homestead Law and Elective Share

- Documentary stamp taxes, sales taxes, rent taxes, property taxes, and how to avoid them

- Business and tax law anomalies and planning opportunities

Date: Thursday, October 8, 2015 | 12:00 PM – 1:40 PM

Location: Online Webinar

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Eileen O’Connor at eoconnor@njsba.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

**********************************************************

LIVE MANHATTAN PRESENTATION:

INTERACTIVE ESTATE AND ELDER PLANNING LEGAL SUMMIT

Alan Gassman will be speaking on a topic to be determined at the InterActive Estate and Elder Planning Legal Summit.

Date: November 4 – 6, 2015 | Alan Gassman will be speaking on November 5 | Time TBA

Location: New York Hilton Midtown Manhattan | 1335 Avenue of the Americas, New York, NY 10019

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information or visit http://ilsummit.com/ to register.

Notable Events by Others

LIVE TAMPA EVENT:

TAMPA THEATRE 14TH ANNUAL WINEFEST

Bust out your sweet dance moves and come have a “killer time” with Napoleon, Pedro, Kip, and Lafawnduh at Tampa Theatre’s 14th annual WineFest, Napoleon Wineamite. This year’s event features snacks and samples from local independent restaurants, sips from the finest wineries, and evening of rare, top-rated wines and – for the first time this year – a “Movie Under the Stars” screening of this year’s theme, Napoleon Dynamite.

While the theme may be silly, the purpose is most serious. Now in its 14th year, the annual WineFest is Tampa Theatre’s biggest fundraising event of the year, benefitting the historic movie palace’s artistic and educational programs, as well as its ongoing preservation and restoration.

Date: September 10 – 17, 2015

Location: Tampa Theatre | 711 N. Franklin Street, Tampa, FL 33602

Additional Information: Tickets are on sale now at www.tampatheatre.org/winefest. Sponsorship opportunities are also available. Please contact Maggie Ciadella at maggie@tampatheatre.org for more information about sponsorship or the event.

**********************************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning will open on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, while Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfer in Context with Estate Planning.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

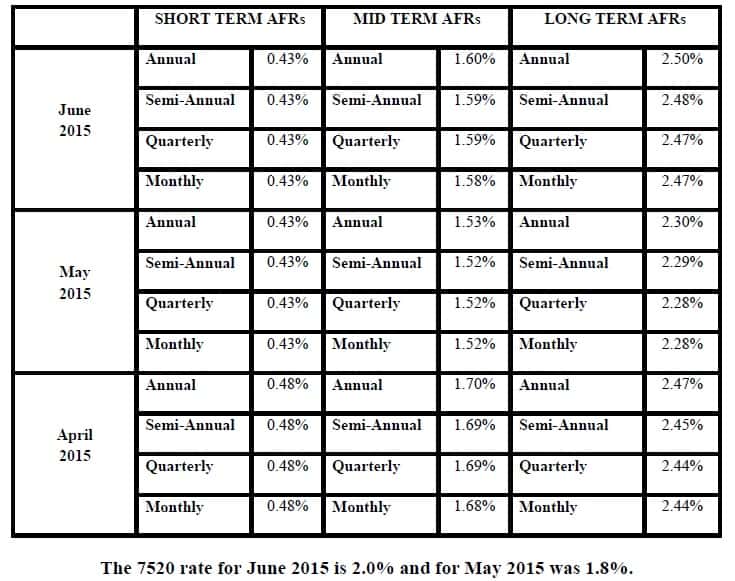

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.