The Thursday Report – 5.14.15 – Have Gun, Will Thursday

Drafting a Gun Trust – Don’t Take a Shotgun Approach, Part I

Charitable Board Members Liability Alert on BP Claims

Gregory Gay’s Corner – Grandparent Visitation

Get 25% Off Your Next Bloomberg BNA Webinar!

Gassman Firm Featured in Tampa Bay Rants and Raves!

Seminar Spotlight – Ave Maria Professional Acceleration Workshop

Richard Connolly’s World – The Trouble with Trustees and Using Gun Trusts to Smooth Firearms Transfer

Colonel Sanders and the Shootout

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlawassociates.com.

Have Gun, Will Thursday

Have Gun – Will Travel was an American Western television series that aired on CBS from 1957 through 1963. The show was consistently rated in the top 5 in the Nielsen ratings every year of its first four seasons, and it even spawned a successful radio series in 1958.

The story follows the exploits of a man who called himself “Paladin,” a gentleman gunfighter portrayed by Richard Boone on the television series and voiced by John Dehner on radio. Paladin’s primary weapon was a custom-made, first-generation, .45 caliber Colt Single Action Army Cavalry Model revolver with a 7½ inch barrel. This weapon was carried in a black leather holster with a platinum chess knight symbol.

The television show was nominated for three Primetime Emmy Awards and can be seen today on the Encore-Western television channel.

For a favorite song about guns by Kay Kyser, entitled “Praise the Lord and Pass the Ammunition,” please click here. This song was written by Frank Loesser and published in 1942 in response to the attack on Pearl Harbor that marked the official entrance of the United States into World War II.

Drafting a Gun Trust – Don’t Take a Shotgun Approach, Part I

by Alan Gassman, Seaver Brown, and Travis Arango

Executive Summary:

Gun Trusts are quickly becoming the new rage in estate planning, and for very good reason. Machine guns and suppressors are becoming more and more popular among collectors and enthusiasts, not to mention sawed-off shotguns and other collectibles. There have been no machine guns manufactured that can legally be sold since 1986, so resale prices are going to levels that many knowledgeable people believe may become a new bubble to take advantage of.[1]

The normal approach is to register the gun to a single individual owner, and then, by federal law and in most states, the owner must be the only one who can have access to the firearm/item, and the owner can be the only one who uses it. However, not everyone wants various agencies to have their name identified as the “owner” of these dangerous weapons. This is one advantage of the gun trust. The federal regulations permit multiple Trustees to have joint responsibility but separate possession and use rights over automatic weapons, suppressors, and certain permitted explosives.

Gun enthusiasts considering how to take title and facilitate use and readiness of such weapons have three basic choices, and each choice will be impacted by different laws that will provide different results. The choices are individual ownership, corporate ownership, and trust ownership. This article will explain the advantages and disadvantages of the use of a Gun Trust and provide the basic information and legal framework that advisors need to be aware of when attempting to navigate these complicated and potentially perilous rules.

Facts:

When it comes to buying and selling firearms, individuals must sift through complex federal regulations and state laws, which operate concurrently with one another. For example, when someone wishes to transfer a firearm from one state to a gun trust established in another state, they must pay particular attention to each state’s rules on transferring firearms. All of this must be done while maintaining compliance with the various federal regulations. In addition to any of the federal or state gun laws an individual may be subject to, some local jurisdictions impose additional restrictions on the right to possess firearms. In any event, the failure to comply with the applicable federal, state, or local gun laws will result in either felony charges or some other sort of penalty. Most notably, these can include prison sentences in excess of a year, substantial monetary fines, parole or probation, forfeiture and seizure of restricted firearms, and usually the complete loss of all gun ownership rights.

The National Firearms Act and the Gun Control Act were enacted to achieve different results, but their purpose still remains the same – restrict who may possess, buy, and sell certain restricted firearms and firearm accessories. The National Firearms Act was intended to operate as a taxing statute and, in fact, still does. It imposes a $200 statutory excise tax per item and requires the person to register all restricted firearms with the Bureau of Alcohol, Tobacco, Firearms and Explosives (“Bureau of Alcohol”). Once the Bureau of Alcohol approves an application, they issue a tax stamp, which allows someone to then purchase or manufacture the National Firearms Act items specifically applied for.

The Gun Control Act, on the other hand, was enacted to restrict the transfer of certain types of firearms between individuals. As a practical matter, it is important to distinguish the types of weapons that the federal government restricts with the National Firearms Act and the Gun Control Act. The Gun Control Act places all weapons into two separate titles: Title I firearms and Title II firearms. Title I firearms primarily include long rifles, shotguns, and handguns, which make up the vast majority of firearms owned in the United States. Title II firearms, however, are composed of a slightly less popular, albeit sometimes more lethal, category of weapons including automatic machine guns, short-barreled rifles, sawed-off shotguns, suppressors, and destructive devices such as grenades, bombs, explosive missiles, poison gas weapons, and more.

Every state is charged with regulating the firearms that residents may possess and whether or not they will even allow possession and use of Title II firearms. For example, Florida Statute Section 790.221 (1) makes it unlawful for a person to own, have custody of, or have control over a short-barreled rifle, a short-barreled shotgun, or a machine gun that may be readily operable. However, Florida Statute Section 790.221 (3) has an exception for antique firearms, and, also, it is not unlawful to own the above firearms when in compliance with the provisions of federal law.

Comment:

Together, the National Firearms Act and the Gun Control Act of 1968 impose various restrictions on the rights of gun owners to possess and transfer their weapons. In fact, they allow for three different ways in which someone may purchase and/or transfer these weapons to others. The first is as an individual, which is perhaps the most difficult and the most susceptible to high levels of risk. The other two options come in the form of corporations and trusts, which are slightly easier to satisfy but are much more complex.

In most of the states that permit Title II firearms, applying as an individual will usually produce unfavorable results. With this route, the individual must fill out and submit the appropriate Bureau of Alcohol Form, pay the $200 excise tax, provide photographs and fingerprints, consent to a background check, and obtain a signature from a chief law enforcement officer (CLEO), which is generally the sheriff. Depending on the individual, the first three requirements are fairly easy to satisfy. However, many chief law enforcement officers are reluctant, and often refuse, to sign for a civilian to own and use restricted Title II firearms.

In the event someone is able to obtain a signature from a chief law enforcement officer, they must take extraordinary care not to allow other individuals to have either actual or constructive control over the Title II firearms. Actual control means allowing them to hold the item and/or fire the item. Constructive possession is when the non-permitted person has the ability to gain access to the item. Constructive possession includes having the item in the same house as someone not authorized to own the restricted item, the non-authorized person knowing the code to the safe that the item is kept in, etc. Based on these restrictions, one could easily imagine a scenario where a Title II firearm, such as a short-barreled rifle or automatic machine gun, is legally obtained and then stored in a home gun safe. If everyone in the house has the combination to the gun safe so that in the event of an emergency they can access a handgun or any other Title I firearm, they will be deemed to have constructive possession over the Title II firearm. Under these circumstances, they would almost certainly be subject to criminal liability, even if they did not know about the Title II item being inside of the safe.

The next option available to an individual who wants to possess a Title II item is to do so through a corporation such as an LLC. This process eliminates the need to submit fingerprints and obtain a chief law enforcement officer’s signature of approval. However, the person submitting the paperwork must still pay the $200 excise tax and submit to a background check. The obvious downside to this process is that all of the formalities of forming a corporation must be met, including the annual corporate filing fee. Over time, this can become more expensive than a gun trust. More importantly, however, if the corporation or LLC fails to pay this annual fee within the required time, the Secretary of State will dissolve the corporation, and all National Firearms Act firearms that were once lawfully owned by the corporation will be in your possession illegally.

Furthermore, trusts are private and do not require a public filing. Whereas, LLCs and corporations are not private and information concerning the individuals associated with them is of public record. In addition to the privacy issues, you will have to update the Secretary of State with changes in the management of the company whenever you want to change who can possess/use the Title II item, which can cost money and take time to do.

The final and perhaps most popular option today is the use of a gun trust. When compared to the aforementioned application processes, gun trusts are usually seen as the preferred method of acquiring Title II firearms. Applicants must still complete the standard Bureau of Alcohol forms, submit to a background check, and pay the $200 tax stamp per item, but there is no need for chief law enforcement officer approval or fingerprints. The individual must be a resident of the same State as the dealer when receiving the firearm/item.

However, just because a gun trust makes it simpler to own Title II firearms, that does not mean they are free of complications. Gun trusts may need to last for multiple generations, there may be more than one trustee with the ability to control the firearms, and, most importantly, they must address and comply with both state and federal weapon laws.

For more on this subject, see the Richard Connolly’s World section below, where we have, this week, featured an article about gun trusts. The conclusion to our article will run in next week’s Thursday Report.

********************************************

[1] For a comprehensive discussion on bubbles, see A Failure of Capitalism (2011) by Richard A. Posner.

Charitable Board Members Liability Alert on BP Claims

Charity donation and grant reductions from the BP Oil Spill are compensable according to the 5th Circuit Court of Appeals. This decision shows that charitable organizations can consider donations and grants as “revenue” to determine eligibility and amounts for BP Class Settlement Action, meaning advisors now have a fiduciary duty to make claims for charitable organizations.

A great many charitable organizations suffered a reduction in donations and grants following the April 2010 oil spill tragedy. The class action suit that enables charitable organizations to make claims on or before June 8th of this year was thought by most of us to include revenues resulting from donations and grants, but it was no surprise to find that BP thought otherwise and did not assert this position until well after the vast majority of its “bad publicity” days were over.

The Fifth Circuit found that “BP has failed to show that non-profits that operate on donation and grant funding are not engaged in commercial activity…” and that BP failed “to show that the non-profit revenue interpretation violates the language of the agreement.”

The vast majority of large charities have hopefully filed their BP claims, and a great many of them are on track to receiving significant awards, leaving open the question as to whether smaller charitable organizations, or those that have been on the fence, will be filing claims. It is noteworthy that the officers and directors of not-for-profit organizations have a fiduciary duty to maximize revenues, and therefore, by our view, an affirmative obligation to make BP claims or to call their errors and omissions carriers to give them notification of any decision to not make a BP claim.

Those officers and directors on boards and executive committees that have decided not to make BP claims by matter of principle or otherwise will be well advised to send formal objecting correspondence and/or to consider resigning because of the high level of potential liability this may bring.

To see the complete decision by the Fifth Circuit Court of Appeals, please click here.

Gregory Gay’s Corner

Grandparent Visitation

Gregory G. Gay, Esquire is an attorney from Tarpon Springs who specializes in meeting the special needs of senior citizens and the disabled. He is Board Certified in Wills, Trusts & Estates and in Elder Law by the Florida Bar. He has also been named a Certified Advanced Practitioner by the National Elder Law Foundation.

Mr. Gay is the author of the Florida Senior Legal Guide, the 8th edition of which can be purchased by clicking here. In the coming weeks, we will be profiling some of the best chapters from this excellent publication. Our deepest thanks to Mr. Gay for making this content available to Thursday Report readers!

This week Gregory Gay’s series continues with a brief look at Grandparent Visitation.

In 1984, the Florida Legislature passed a statute authorizing our courts to grant visitation rights to grandparents under certain limited circumstances. This court-ordered grandparent visitation was authorized for when the marriage of the parents of the child has been dissolved, a parent of the child has deserted the child, or the child was born out of wedlock and not later determined to be a child born within wedlock.

This statute required the court to first determine that such visitation would be in the best interest of the grandchild. In determining if this visitation was in the best interest of the grandchild, the Florida statute stated that the court was to consider the grandparent’s willingness to encourage a close parent-child relationship, the child’s preference, the child’s mental and physical health, and the grandparent’s mental and physical health.

While never finding this statute to be completely unconstitutional, the Florida Supreme Court has systematically ruled that various provisions of this grandparent visitation statute are unenforceable. This court has repeatedly held that the state should not permit grandparents to interfere with parental rights to custody and control of children except in cases where the health and welfare of a child is threatened. Even assuming that grandparent visitation promotes the health and welfare of the child, our courts have consistently held that the state may only impose a grandparent visitation over the parent’s objections on a showing that failing to do so would be harmful to the child. This right of a parent to be free from this form of governmental interference is based on protections afforded in the Fourteenth Amendment of the United States Constitution and the right of privacy provisions found in Article 1, Section 23 of our Florida Constitution.

All fifty states have statutes that provide for grandparent visitation in some form. In the year 2000, the United States Supreme Court confirmed in the case of Troxel v. Granville that the Fourteenth Amendment to the United States Constitution permits a state to interfere with a parent’s fundamental right to rear their children only when there is a showing of demonstrable harm to the child’s health or welfare. Thus, only where there is a showing of substantial harm to the child by denying a grandparent visitation is the state’s interest sufficiently compelling to warrant such governmental intrusion.

The harm to the grandchild often arises when a child loses a parent to illness or an accident and the surviving parent cuts off access to the deceased spouse’s family. Often, the deceased spouse’s parents have been a primary caretaker for the grandchild after school while the parents are still at work. In some cases, grandparent visitation is cut off when the spouse remarries. In these cases where the parents have allowed their child to closely bond with grandparents, a psychologist may find that the loss of that relationship can be equal to a child experiencing another death. This is especially true when a grandparent has been a regular caretaker and a psychological parent relationship has been formed between the child and grandparent.

If you would like to read the Florida Senior Legal Guide in its entirety, please visit http://www.seniorlawseries.com. Mr. Gay can be reached at gregg@willtrust.com.

Get 25% Off Your Next Bloomberg BNA Webinar!

Scott Harper, the Coordinator of Professional Learning with Bloomberg BNA, has provided us with a 25 percent discount promotional code to share with Thursday Report readers and their natural and adopted (but not in vitro!) descendants. This code will allow you to receive 25% off on any Bloomberg BNA Webinar.

To take advantage of this fantastic and generous offer, follow the steps below:

- Go to the Bloomberg BNA website and find the title of the webinar you wish to apply the discount code to.

- Select the title of your chosen webinar.

- Choose “webinar” from the drop-down menu and click on “Add to Cart.” At this point, you may be asked to sign in to bna.com.

- Navigate to the checkout screen.

- On the right hand side of the checkout screen, there is a box that says “Promotional Code.” In that box, please type (do NOT copy & paste!) the promo code FIRMDISC25 and hit Enter/Apply.

- The dollar amount will decrease by 25%. Click “Proceed to check out” to complete the purchase.

Once the purchase has been made, an automatically-generated email will arrive containing the connectivity information to be used the day of your chosen program.

Thanks, Scott Harper, for sharing this great offer with us! Scott can be contacted at sharper@bna.com.

Gassman Firm Featured in Tampa Bay Rants and Raves!

We received the following message from Bob Clark:

This appeared on the blog Tampa Bay Rants and Raves this week. Couldn’t agree more. Your signs always brighten the day!

The people behind Tampa Bay Rants & Raves had this to say about our sign:

Thanks to the Gassman Law Firm on Court Street in Clearwater for always bringing a smile to our face with their catchy marquee. It is truly a Sign of the Times.

Thanks to Tampa Bay Rants & Raves for their endorsement, and thanks to Bob Clark for bringing it to our attention! To see the full article, please click here.

Seminar Spotlight

Ave Maria Professional Acceleration Workshop

On August 22, 2015, Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

This interactive workshop is CLE approved and will completely engage all participants in personal goal setting, one-on-one conversations about how to handle practical challenges and obstacles, important strategies for business and personal relationships, and one-on-one client interaction guidelines and techniques used by the most successful professionals in law and other important industries.

The workshop will run from 9:00 AM to 5:00 PM in the Thomas Moore Commons at the Ave Maria School of Law. Lunch will be included. The address for the workshop venue is as follows:

Ave Maria School of Law

1025 Commons Circle

Naples, FL 34119

To download the official invitation to this event, which includes a more detailed look at what each hour of the workshop will include, please click here.

To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

See you there!

Richard Connolly’s World

The Trouble with Trustees and

Using Gun Trusts to Smooth Firearms Transfer

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with a link to the articles.

This week, the first article of interest is “The Trouble with Trustees” by Liz Moyer. This article was featured in The Wall Street Journal on November 21, 2014.

Richard’s description is as follows:

It’s a matter of trust.

Beneficiaries of family trusts stand to inherit stock portfolios, childhood homes, and treasured heirlooms. Yet those assets come with what can be a delicate relationship with the trustees who control the purse strings.

A trustee can be a valued partner and mentor. But if disagreements develop, the result can be costly problems and years of frustration.

This article talks about how to manage a delicate relationship with a trustee.

Please click here to read this article in its entirety.

The second article of interest this week is entitled “Planners Use Gun Trusts to Smooth Firearms Transfer” by Anna Prior. This article was featured in The Wall Street Journal on November 10, 2014.

Richard’s description is as follows:

Estate planning can get complicated when it involves transferring a collection of art, cars, or other such possessions. It gets trickier still for guns.

Some lawyers and advisors say these often can be solved through the use of a so-called gun trust.

Typically set up as a revocable living trust, a gun trust is crafted specifically to hold firearms, with the gun owner generally acting as the trustee.

They are most commonly used to hold certain federally-restricted items, such as silencers, because they can help cut down on some of the paperwork needed to possess, transfer, and own such possessions, but estate planners say they are increasingly being used to create a road map for families left to handle a deceased loved one’s collection.

Please click here to read this article in its entirety.

Colonel Sanders and the Shootout

One of the most commonly heard “fun facts” about Colonel Sanders is that he once killed a man in a shootout. This so-called fact, like many other so-called facts that can be found on the Internet, is not true. Colonel Sanders never killed a man, but he did shoot one.

Colonel Sanders was once involved in a shootout with a business rival. He shot the rival in self-defense, but that man did not die. The man who died in the shootout was Colonel Sanders’s business associate. Colonel Sanders was arrested after the shootout occurred.

To find out what happened upon Colonel Sanders’s arrest, or for the full story about how and when the shootout occurred, please click here for a fun and informative article by Matt Novak.

Humor! (or Lack Thereof!)

Sign Sayings of the Week

*******************************************

******************************************************

In honor of our new article about Gun Trusts, we are featuring one of our favorite jokes from comedy writer Ron Ross, who provided us with this poem for our Christmas 2014 Edition of The Thursday Report.

‘Twas the Night Before Christmas aka The Story of Standra Claus

by Ron Ross

‘Twas the night before Christmas

And all through the house

Sirens were blaring

Because Dad is a louse

Santa lies on the floor

Inside a chalk outline

And Dad will get off

Without even a fine

He got Santa with a bullet

Right square in the jaw

But Dad is not worried

Because “Stand Your Ground” is the law!

Upcoming Seminars and Webinars

LIVE STUART, FLORIDA PRESENTATION:

Alan Gassman will be the featured headline speaker at the Martin County Estate Planning Council Annual Tax and Estate Planning Seminar. He will be doing a three-hour talk on the following:

- JOINT EXEMPT STEP-UP TRUSTS (JESTs)

- MATHEMATICS FOR ESTATE PLANNERS

- THE ESTATE PLANNER’S GUIDE TO PLANNING FOR IRA AND PENSION BENEFITS – YES, YOU CAN FINALLY UNDERSTAND THESE RULES!

Date: Friday, May 15, 2015 | 8:15 AM – 4:30 PM; Alan Gassman speaks from 9:00 AM to 12:00 PM

Location: Stuart Corinthian Yacht Club | 4725 SE Capstan Avenue, Stuart, FL 34997

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Lisa Clasen at lclasen@kslattorneys.com.

************************************************

LIVE MIAMI LAKES WORKSHOP:

Alan Gassman will be speaking at the Miami Lakes Bar Association Luncheon on the topic of ACCELERATING YOUR LAW PRACTICE. This luncheon will qualify for 2 CLE credits.

Date: Thursday, May 21, 2015 | 11:45 am – 1:45 pm

Location: Italy Today | 6743 Main Street, Miami Lakes, FL 33014

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

******************************************************

LIVE UNIVERSITY OF FLORIDA PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a five hour workshop on legal practice and making the most of your legal practice to Professor Dennis Calfee’s summer workshop class. Experienced professionals are also welcome to attend by making a small donation to the Lind Chair.

Date: Saturday, May 30, 2015 | 10:00 AM – 3:00 PM

Location: University of Florida | 2500 SW 2nd AE, Gainesville, FL 32611

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

*********************************************************

LIVE WEBINAR:

Alice Rokahr, President, Trident Trust Company (South Dakota) Inc., and Alan S. Gassman will present a free, 30-minute webinar entitled WHAT IS SO SPECIAL ABOUT SOUTH DAKOTA – DOMESTIC ASSET PROTECTION TRUST LAW AND PRACTICES.

Date: Tuesday, June 9, 2015 | 12:30 pm

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or click here to register for this webinar.

**********************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, Ed Morrow, Christopher Denicolo, and Brandon Ketron will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on ESTATE AND TRUST PLANNING WITH IRA AND QUALIFIED PLAN BENEFITS: AN UNDERSTANDABLE SYSTEM WITH CHARTS AND EASY-TO-UNDERSTAND MATERIALS.

This presentation will include a 300 page E-book for each attendee.

Date: Wednesday, June 10, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

*******************************************************

LIVE WEBINAR:

Alan Gassman will present a live, free, 30-minute webinar on the topic of THE NEW DOCTOR’S GUIDE TO WEALTH BUILDING, CREDITOR PROTECTION, TRUST PLANNING, AND WHAT THEY DIDN’T TELL YOU IN MEDICAL SCHOOL. There will be two opportunities to attend this presentation.

Date: Wednesday, June 17, 2015 | 7:30 PM

Saturday, June 20, 2015 | 9:30 AM

Location: Online webinar

Additional Information: To register for the Wednesday/7:30 PM webinar, please click here. To register for the Saturday/9:30 AM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE WEBINAR:

Alan Gassman and noted trust and estate litigator, LL.M in estate planning, and blog master Juan Antunez, J.D., LL.M. will be presenting a free 30-minute webinar on ARBITRATING TRUST AND ESTATES DISPUTES.

Don’t miss Juan’s wonderful blog site entitled Florida Probate & Trust Litigation Blog, which can be accessed by clicking here, and the many very useful articles thereon.

Date: Thursday, June 25, 2015 | 12:30 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on FINANCIAL RELATIONSHIPS WITH PATIENTS, CO-PAYMENTS, GIFTS, AND GRAFT – HOW TO STAY OUT OF TROUBLE UNDER FLORIDA AND FEDERAL LAW.

This is an essential guide for medical practices and those who advise them. There will be two opportunities to attend this presentation.

Date: Tuesday, July 7, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR:

Alan Gassman will present a webinar on the topic of WHAT FLORIDA CPAS NEED TO KNOW ABOUT ASSET PROTECTION for the Florida Institute of CPAs.

More information about this webinar will be forthcoming. Please stay tuned!

Date: Thursday, July 9, 2015 | 9:30 AM – 10:30 AM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com. To register, please contact Thelma Givens at givenst@ficpa.org.

**************************************************

LIVE WEBINAR:

Alan Gassman will present a live, free, 30-minute webinar on the topic of CREDITOR PROTECTION PLANNING FOR PHYSICIANS AND MEDICAL PRACTICES. There will be two opportunities to attend this presentation.

Date: Wednesday, August 12, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email agassman@gassmanpa.com.

**********************************************************

LIVE BRADENTON, FLORIDA PRESENTATION:

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Thursday, August 13, 2015 | 6:00 PM

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on the topic of MEDICAL LAW UPDATE – FEDERAL AND FLORIDA DEVELOPMENTS THAT MEDICAL PRACTICES AND ADVISORS NEED TO BE AWARE OF. There will be two opportunities to attend this presentation.

Date: Tuesday, August 18, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Live webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: Saturday, August 22, 2015 | 9:00 AM – 5:00 PM

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

****************************************************

LIVE SARASOTA PRESENTATION:

Alan Gassman will speak at the Southwest Florida Estate Planning Council meeting on September 8th on a topic to be determined. We are open to suggestions!

Date: Tuesday, September 8, 2015 | 3:30 PM – 5:30 PM with dinner to follow

Location: Sarasota, Florida

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com.

********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of THE 10 BIGGEST MISTAKES THAT SUCCESSFUL PARENTS (AND GRANDPARENTS) MAKE WITH RESPECT TO COLLEGE AND RELATED DECISIONS FOR HIGH SCHOOL STUDENTS.

Date: Saturday, September 12, 2015 | 9:30 AM

Location: Online Webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

*****************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: Friday, September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

*************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

****************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: Hotel information to be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please visit http://www.law.miami.edu/heckerling/.

*******************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Recent Homestead Cases, while Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfer in Context with Estate Planning.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins, which is not affiliated with Anthony Hopkins.

Please provide us with your input for other topics for this year and next! Watch this space for more speaker and topic announcements.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

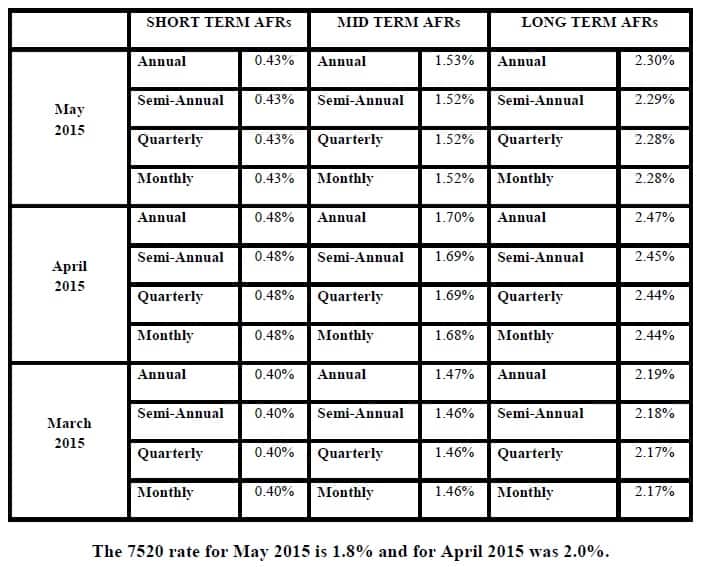

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.