The Thursday Report – 12.24.15 – Santa Got Run Over By a Thursday Report!

If Your Client’s Assets Grow at a Normal Pace, They May Outdistance the Estate Tax Exemption, Especially in 2016

Excessive Executive Compensation Can Be a Breach of Fiduciary Duty

The Future of Health Care by Dr. Pariksith Singh

Announcing the Alan Gassman Channel with InterActive Legal

Gassman, Crotty & Denicolo to Match All Ruth Eckerd Hall School Time Donations Through December 31, 2015!

Richard Connolly‘s World – Year–End Extenders & IRS Budget Cuts

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“For me, holidays are about the experiences and the people and the memories,

rather than sitting on a nice beach getting tanned. I try to plant myself where I am

and embrace what is there in front of me.”

– Evelyn Glennie

Evelyn Glennie is a Scottish virtuoso percussionist and one of the two recipients of the 2015 Polar Music Prize, a Swedish international award that is often referred to as the “Nobel Prize of Music.” Glennie began losing her hearing at 8 years old and has been profoundly deaf since age 12. She has been awarded with 15 honorary degrees from universities in the United Kingdom and is an Ambassador of the Royal National Children’s Foundation, which helps support disadvantaged young people in the UK.

To see Evelyn’s TED talk on How to Truly Listen, in which she illustrates how listening to music involves much more than letting sound waves hit your eardrums, please click here.

If Your Client’s Assets Grow at a Normal Pace, They May Outdistance the Estate Tax Exemption, Especially in 2016

The Estate Tax Exemption Will Only Rise by $20,000 in 2016; The Gifting Allowance Remains at Only $14,000

by Alan Gassman and Seaver Brown

Many planners do not have great concern when a single client in the $2 million to $3 million net worth range or a married couple in the $4 million to $7 million range present themselves for estate and estate tax planning, but this can be a grave error.

The estate tax exemption increases with the Consumer Price Index, but clients who are in the saving and investment mode may be expected to have their investments more than double every ten years.

The Rule of 72 allows an investor to quickly calculate the number of years it would take an investment to double in value at a fixed interest rate. This calculation is done by simply dividing the number 72 by the expected annual rate of return. For example, it provides that $10 invested at 10% would take roughly 7.2 years to double in value.

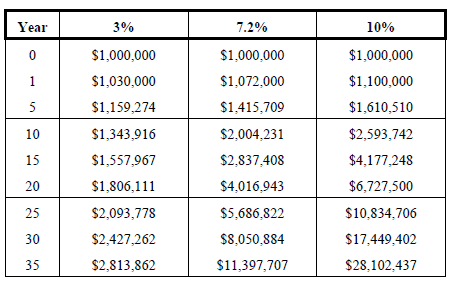

Those who may want to see some sample numbers and/or rules of thumb with respect to potential growth, without adding to savings, may want to use the following charts. These charts illustrate the potential growth of $1 million, $3 million, and $5 million at growth rates of 3% (which may reflect future increases in the estate tax exemption growing at the Consumer Price Index), 7.2% (which is not far from the average rate of return that a typical stock and bond based portfolio has earned over the past fifty years), and 10% (which is below what many of our clients have historically earned on their investments in a number of privately held businesses and entities.) The results of these charts can be startling.

The only way to responsibly plan for an estate that may significantly exceed the estate tax exemption is to start early through the use of gifting, discounting, installment sales for long-term low interest notes, and other devices.

We are currently working on an article that will be published in January of 2016 entitled “The Eight Portability Mistakes.” The article will highlight a number of errors that many planners are making with respect to assumptions and strategies when electing portability. One of these errors is to assume that the portability allowance that a surviving spouse will receive (to the extent that the first dying spouse does not use his or her entire basic exclusion amount) will be sufficient coverage to help assure that the surviving spouse will not have an estate tax issue.

In the process of writing this article, we have come across a number of poorly publicized planning considerations that may pose significant problems in the future. Moreover, we typically find that these issues and considerations are almost never mentioned in literature, during client conferences, or otherwise.

Many misconceptions result from an assumption that there will be greater income tax savings on the death of the surviving spouse if a credit shelter trust is not funded on the death of the first spouse. Nearly every responsible planner representing a married couple, where there is a substantial possibility of estate tax exposure, should be posturing his or her client’s plans to enable the surviving spouse to have the credit shelter trust funded to some extent after the first death and to have a Clayton QTIP arrangement in place. This will be described in greater detail in a later edition of the Thursday Report.

For now, let us simply say that we hope our readers will review and find value in this upcoming article, which will be profiled in eight Thursday Reports in the New Year as we review “The Eight Portability Errors” and other considerations.

We welcome any and all questions, comments, and suggestions on this series going forward.

Excessive Executive Compensation Can Be a Breach of Fiduciary Duty

Can a claim for breach of fiduciary duty be based on excessive executive compensation?

Yes. Such a claim may succeed if the petitioner can show that excessive executive compensation equated to corporate waste. To be considered corporate waste, the compensation must lack a reasonable relationship to the services rendered. A three-tiered inquiry determines if a reasonable relationship exists:

(1) Did the corporation benefit?

(2) If so, was the compensation commensurate to the services?

(3) If so, did the compensation spring directly from the services?

A positive response to all three questions is needed to dispense of a corporate waste claim. The paragraphs below briefly discuss the line of reasoning from Florida’s corporation statutes and the business judgment rule to corporate waste and reasonable relationship doctrines.

The court in International Ins. Co. v. Johns, 874 F.2d 1447 (11th Cir. 1989) examines Florida law on executive compensation plans and golden parachutes. Per the Johns court, the fact-finder must first recognize the push-and-pull between Florida corporations’ directors’ ability to fix their own pay (Fla. Stat. § 607.0801) and Florida courts’ acknowledgment of the business judgment rule.[1]

The presumptions of good faith and fair dealing inherent in the business judgment rule will be overcome only if the circumstances show evidence “of abuse of discretion, fraud, bad faith, or illegality.”[2] Without one of those factors, the court will defer to the boards’ or director’s decision-making.[3]

In order to apply the business judgment rule to director and/or officer compensation systems, the Johns court held that the compensation must equate to corporate waste.[4] This comparison leads to a long line of analytical steps that the court must take: corporate waste requires payment without adequate consideration; what constitutes consideration is up to a corporation’s directors. Courts cannot overrule such a decision by the directors unless the compensation does not bear a “reasonable relationship” to the services rendered. Such a reasonable relationship exists if the payment “insures that the benefit provided by the services rendered will inure to the corporation.”[5]

But the inquiry does not end there. Now the court must apply the 3-step “reasonable relationship” test discussed above. A negative answer to any of the three questions is indicative, if not probative, of corporate waste.

The court in AmeriFirst Bank v. Bomar, 757 F. Supp. 1365, 1378 (S.D. Fla. 1991) found that a director or officer’s statutory fiduciary duty towards the corporation and its shareholders was “independent of his contractual obligations arising out of the employment contract.” So holding, it allowed the plaintiff to proceed with the claim of tortious conduct by the director defendants by way of accepting “grossly excessive compensation in violation of federal regulations.”[6]

Similar activity by directors can be argued to violate Fla. Stat. § 607.0830 – General Standards for Directors – and impose personal liability upon directors per § 607.0831 – Liability of Directors.

*****************************************

[1] Id.

[2] Id at 1461 (referencing Lake Region Packing Assoc. Inc. v. Furze, 327 So.2d 212, 214 (Fla. 1976)).

[3] Id.

[4] Id (citing Rogers v. Hill, 289 U.S. 582, 591-592 (1933)).

[5] Id (citing Kaufman v. Shoenberg, 91 A.2d 786 (Del. Ch. 1952)).

[6] Id.

The Future of Health Care

by Pariksith Singh, M.D.

Pariksith Singh, M.D. is a board-certified internal medicine physician who received his medical education at Sawai Man Singh Medical College in Rajasthan, India (where he was awarded honors in internal medicine and physiology). His residency training occurred at All India Institute of Medical Services (New Delhi, India) and Mount Sinai Elmhurst Services, (Elmhurst, New York). Upon completion of his residency, Dr. Singh relocated to Florida and worked for several years before establishing Access Health Care, LLC in 2001.

As one reviews the landscape of health care that is shifting significantly over the last few years, one sees some changes that are seismic and some that are only a variation on the status quo. Fundamentally, the model of health care does not change, i.e., that of a personalized service that focuses on healing. Any variation on this basic value of health care would be disastrous. Machines cannot replace the doctor’s touch, presence, smile, kind words, and compassion, nor can protocols or algorithms transplant intuition and sensitivity.

But there are aspects of health care that can be turned from service into product, following the lines of development of the information-age companies. Also, the provider can be enhanced by supplying him data, analytics, machine learning, and cognitive computing. These are aspects of health care where we are seeing the biggest changes, where the digital is fast replacing the analog.

Michael Porter has noted that there are essentially two kinds of value that a business provides: the product or the service. In that sense, health care is a service. However, with this service are aligned an array of products and other services such as billing, coding, contracting, financial and legal services, and health information technology. All, or at least several, of these services can be turned into products and automated. The goal of these products is to enhance the essential service, and that is the engagement of humans with humans to facilitate healing.

The future of health care, in my view, will see a greater need for the human to human engagement and the dynamic of healing. Holistic medicine and integral healing reflect this growing need and trend. A research into nutraceuticals and herbaceuticals and not pharmaceuticals alone will happen, driven not by big pharmacy, but the empowerment of disruptive business and individuals. Research itself will get transformed and will not be function only of big labs or academic institutions whose sole drive is to get published for acclaim or financial returns. The research into the various paradigms of diverse health care approaches, such as Ayurveda, yoga, naturopathy, homeopathy, unani, siddha, and Bach therapy on their terms and accepting their own paradigms is also a future that I foresee.

The true healing, that which evokes the essential inner health of each individual, was called ‘svaasthya’ in Sanskirt, meaning being established or seated within oneself. This healing will happen only when the psychological and spiritual development of the person is no longer divorced from the physical, nor the mental from the emotional or vital. This would be the true integral healing the world needs, and one might envisage a future where this will be natural and organic.

At the same time, the products that support the back office or side office or front office need to be made extremely efficient and effective. At present, the electronic medical records (EMRs) are slow and inefficient. The analytics are weak because a true Health Information Exchange has not been created. This, too, is a development for the future.

In the same vein, creating a support system for providers that helps them become better healers via education, coaching, feedback systems, rating systems, and partnerships with patients as crowd or communities is another step that needs to happen. A true Physician Information System is in order.

We talk of big data, but big data is meaningless unless it is also fast data, right data, and effective and efficient data that is meaningful, real-time, actionable, and pooled from all the sources available in an easy-to-use format. In short, the ability of the systems to speed where one needs to speed up and slow down where one needs to slow down. This is the need of future medicine.

As a physician, I want to spend more time with the person and less time entering data into the EMR or digging through mountains of information to find the things I need. This is the end-use that all health care products and services have to aim for. As a physician, I want to be enhanced as a healer, and I want my patients to be protected, empowered, and healed. This is where the future of health care needs to head.

Announcing the Alan Gassman Channel with InterActive Legal

InterActive Legal and Gassman, Crotty & Denicolo are pleased to announce the January inauguration of the Alan Gassman Florida Law Channel on InterActive Legal.

Subscribers to this channel will have unlimited electronic computer access to a wide range of useful and informative materials, including the following:

- Gassman & Markham on Florida & Federal Asset Protection Law

- Florida Law for Tax, Business, and Financial Planning Advisors

- Eight Steps to a Proper Florida Trust and Estate Plan

- The Florida Power of Attorney & Incapacity Planning Guide

- A Practical Guide to Anti-Kickback and Self-Referral Laws for Physicians

- Relevant and related Florida statutes

- The JEST (Joint Exempt Step-Up Trust) Guide, Charts, and Trust Provisions

- Coleslaw & Fried Chicken Straight from Your Computer (if you turn your monitor to the East at a 45 degree angle)

- And more!

The books on this platform are fully digitized, with an interactive table of contents, links to related cases, and the ability to search for key terms and ideas throughout the text.

Please visit the InterActive Legal booth at the 50th Annual Heckerling Institute on Estate Planning from January 11-15, 2016, check out the channel, and be one of the first to subscribe!

Heckerling Show Special: Be one of the first to sign up for your one-year, $129.40 subscription and receive a printed copy of any one of the above books at no additional charge!

Please consider enhancing your practice and your Florida legal and planning library with the Alan Gassman Florida Law Channel with InterActive Legal.

Special thanks goes out to Michael Graham, Jonathan Blattmachr and George Brittingham of InterActive Legal for risking their entire operation on the success of this channel. Special thanks also to Howard Stern for his support and advice.

And while you’re there, be sure to stick around for Alan’s 15 minute speech on Have Gun Trust, Will Travel. His bullet points will be very useful and give you ammunition to help make your gun trusts more explosive than ever! We expect this talk to be right on target, so take off your silencers and come to see this important, thorough, and detailed 15 minute talk. This talk will be presented at the InterActive Legal booth on Wednesday, January 13, 2016 at 10:40 AM.

See you there!

Gassman, Crotty & Denicolo to Match All Ruth Eckerd Hall

School Time Donations Through December 31, 2015!

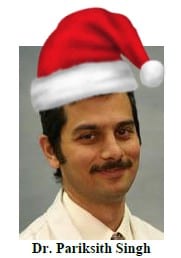

The Marcia P. Hoffman Institute recently announced its 2015-2016 School Time Field Trip Series. This program brings live theater to young students through educational performing arts experiences, which include classroom reinforcement in math, reading, and science, and touches the lives of more than 15,000 students each year, 75% of whom qualify for free or reduced lunches. To see a brochure for this program, please click here.

Providing 15,000 kids with free performances and free transportation requires $50,000 in donations. Last week, through a generous anonymous challenge pledge and the contributions of many other donors, Ruth Eckerd Hall made it halfway to that donation goal in only 24 hours.

This week, Ruth Eckerd Hall board member Alan Gassman has pledged to match all donations to the School Time series up to $10,000. Alan found out that children who were unable to bring in 5 dollars to cover the cost of the field trip were not permitted to go, which he found unacceptable.

All donations made through December 31, 2015 of up to $10,000 will be matched by Gassman, Crotty & Denicolo, P.A.

Click Here to Donate Today

or email Alan Gassman at agassman@gassmanpa.com to donate!

To be sure your donation is matched, please provide a donation amount and select “Year End Giving” from the initiative drop-down menu.

Richard Connolly’s World

Year-End Extenders & IRS Budget Cuts

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “2015 Extender Bill May Throw Out 831(b) Captive Baby with the Bathwater” by Jay Adkisson. This article was featured on Forbes.com on December 9, 2015.

Richard’s description is as follows:

There is no dispute that in recent years, the 831(b) election has been abused by tax shelter promoters, and either Congress or Treasury (or both) need to take action to stop these abuses.

However, Congress now appears ready to address the problem by using a hammer instead of a scalpel, and in the process, may hurt America’s small businesses.

In the numerous 2015 year-end extenders, as found in H.R. 34 (offered by Hon. Rep. Kevin Brady of Texas), we find Section 262, which relates to “Modifications to Alternative Tax for Certain Small Insurance Companies,” which, of course, means the 831(b) election.

The proposed legislation does basically four things, all limited to insurance companies that have made the 831(b) election:

- It practically eliminates the ability of small insurance companies to meet the tax tests for risk distribution through risk pooling arrangements;

- It eliminates the so-called “estate planning benefit” of small captives that are owned, directly or indirectly, by the heirs of the business owner so as to accomplish a “free” transfer for federal estate and gift tax purposes;

- It eliminates the ability to many small captives to meet the tax tests for risk distribution by changing the attribution rules; and

- It increases the premium limit of 831(b) from $1.2 million to $2.2 million and adjusts that latter number upwards to correspond to inflation.

Please click here to read this article in its entirety.

The second article of interest this week is “The IRS is Losing Hundreds of Criminal Investigators” by David Voreacos. This article was featured in Bloomberg Business on December 3, 2015.

Richard’s description is as follows:

Tax cheats can breathe a little easier. The gun-toting Internal Revenue Service investigators who send felons to prison are retiring in droves, and there’s no one to replace them.

Since 2010, when Republicans won control of the House, the IRS budget has been cut $1.2 billion to this year’s $10.9 billion. One consequence of those cuts is that many of CI’s best investigators are retiring at the first chance they get.

By the end of next year, the number of criminal agents is projected to fall by 21 percent since 2011.

Please click here to read this article in its entirety.

Humor! (or Lack Thereof!)

Sign Sayings of the Week

***************************************************

In the News

by Ron Ross

Republicans respond to “The Big Short,” the new Brad Pitt – Steve Carrell movie about the 2008 financial crisis. They said, “This movie is an attempt to push more legislation based on the false, unproven belief that drops in the market are caused by human behavior.”

**********

Global warming deniers block agreement in Paris until they all watch the tragic ending to the Frosty the Snowman special. Says one official, “If we hadn’t raised global temperature through human industrial growth, that lovable snowman would still be alive, not just coming back someday!”

**********

Anthropologists have determined that the cave paintings of Europe are actually menus for a trendy, prehistoric high-protein restaurant. The images next to the animals on the walls indicate prices. You could get bison for 20 spear points, horse for 30 arrow heads, antelopes for the secret of fire, and if you have to ask for the price of bear, you can’t afford it.

***************************************************

Kentucky for Christmas

Americans don’t typically think of fried chicken as a food to be had on Christmas Day, but did you know that not only fried chicken, but Kentucky Fried Chicken, is the Christmas meal of choice in Japan?

Christmas isn’t a national holiday in Japan, as only a small percentage of the population is estimated to follow the Christian religion, and turkey is not a common meat in Japan, so Kentucky Fried Chicken saw a marketing opportunity, and a tradition was born in the winter of 1974.

The first KFC Japan opened in 1970 and quickly gained popularity. The franchise introduced their first Christmas meal in 1974, chicken and wine for $10. Today, that meal has expanded to fried chicken, cake, and champagne, and sells for about $40. Many of these meals are ordered months in advance because the lines in KFC restaurants on the holiday itself can reach up to two hours long.

The Financial Times reports, “Japan is well-known for taking foreign products and ideas and adapting them to suit domestic taste, and Christmas is no exception. A highly commercialized and non-religious affair, lots of money is spent annually on decorations, dinners, and gifts. KFC is arguably the biggest contributor, thanks in part to its advertising campaign.”

The advertising campaign, “Kurisumasu ni wa kentakkii!” (“Kentucky for Christmas!”) was launched in 1974 with the restaurant’s original Christmas meal. The catchphrase “Christmas = Kentucky” caught on and is now paired with television commercials.

To learn more about this fun tradition, please click here.

Upcoming Seminars and Webinars

Calendar of Events

LIVE ORLANDO PRESENTATION:

REPRESENTING THE PHYSICIAN: THE ONLY CONSTANT IS CHANGE

Alan Gassman will present two talks at the 2016 Annual Florida Bar Health Law and Tax Section Representing the Physician seminar. His topics include:

- A Brief Introduction to the Current State of the Physician’s World

(with Lester Perling) - Creditor Protection for the Medical Practice

Other speakers at this event include Jerome Hesch, Michael O’Leary, Colleen Flynn, Jeff Howard, Darryl Richards, and others.

To download the brochure, or for a complete schedule, please click here.

Date: January 8, 2016 | Mr. Gassman will speak at 8:15 AM and 10:50 AM

Location: Rosen Plaza Hotel | 9700 International Drive, Orlando, FL, 32819

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

HECKERLING INSTITUTE – INTERACTIVE LEGAL TALK

Alan Gassman will present a 15 minute speech at the InterActive Legal booth at the Heckerling Institute for Estate Planning on HAVE GUN TRUST, WILL TRAVEL. His bullet points will be very useful and give you ammunition to help make your gun trusts more explosive than ever! We expect this talk to be right on target, so take off your silencers and come to see this important, thorough, and detailed 15 minute talk.

While at the InterActive Legal booth, see the new Alan Gassman Channel and get a free book of your choice by being one of the first to sign up for this new, monthly, interactive, computer-based library featuring several of Alan’s books, many forms, charts, and even exclusive video webinar presentations. $129.40 per year gets you this and a bucket of Kentucky Fried Chicken if you sign up before January! (Mashed potatoes are extra.)

Special thanks to Michael Graham and George Brittingham of InterActive Legal for risking their entire operation on the success of this channel.

Date: Wednesday, January 13, 2016 | 10:40 AM

Location: InterActive Legal Booth | Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will moderate a Bloomberg BNA Essential Elements webinar with special guest Jonathan Blattmachr on the topic of FUNDAMENTALS AND PLANNING FOR THE INCOME TAXATION OF ESTATES AND TRUSTS.

This is a free webinar series being presented by Bloomberg BNA. We will have the full schedule available in a future Thursday Report. Save up so you can afford it!

Date: January 21, 2016 | Replay on January 26, 2016

Location: Online webinar

Additional Information: For more information or to register, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare to attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning (January 30th: 10:10 AM – 11:10 AM)

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You (January 30th: 11:10 AM – 12:10 PM)

- 50 Ways to Leave Your Overhead (January 31st: 8:00 AM – 9:00 AM)

- Essential Creditor Protection and Retirement Planning Considerations (January 31st: 9:00 AM – 10:00 AM)

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30, from 10:10 AM to 12:10 PM and Sunday, January 31 from 8:00 AM to 10:00 AM

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of ESTATE PLANNING BASICS FOR BUSINESS OWNERS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. There will be two opportunities to attend this presentation.

Date: Wednesday, February 17, 2016 | 12:30 PM or 5 PM

Location: Online webinar:

Additional Information: To register for this presentation or for more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will moderate a Bloomberg BNA Practical & Creative Planning webinar with special guest Jonathan Blattmachr on the topic of FUNDAMENTALS, FINE POINTS, AND INNOVATIVE STRATEGIES FOR LIFE INSURANCE AND USE THEREOF.

Bloomberg BNA will charge for this webinar and this series of webinars, but we believe it is well worth it! We will have the full schedule available in a future Thursday Report.

Date: February 25, 2016 | Replay on March 1, 2016

Location: Online webinar

Additional Information: For more information or to register, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of ASSET PROTECTION BASICS FOR BUSINESS OWNERS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. There will be two opportunities to attend this presentation.

Date: Wednesday, March 16, 2016 | 12:30 PM or 5 PM

Location: Online webinar:

Additional Information: To register for this presentation or for more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BOSTON PRESENTATION:

INTERACTIVE LEGAL ESTATE & ELDER PLANNING SUMMIT: SUBSTANCE, PROFITS, AND PRACTICE

Alan Gassman will be presenting at the InterActive Estate & Elder Planning Summit on a topic to be determined.

Other speakers include Jonathan Blattmachr, Michael Graham, Pope Francis, Mother Theresa, Thomas Jefferson, and others.

Date: April 20-22, 2016 | Mr. Gassman’s presentation time is TBD.

Location: Courtyard Marriott Boston Downtown | 275 Tremont Street, Boston, MA 02116

Additional Information: For more information, please visit http://ilsummit.com/ or contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday. Be sure to bring an extra pair of socks because the first pair will get knocked off by Jonathan’s talk!

Alan’s Friday morning presentation will be entitled COFFEE WITH ALAN: AN INTRODUCTION TO SELECT ESTATE PLANNING AND ASSET PROTECTION STRATEGIES. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference. Attendees new to these specific estate planning areas will find the presentation useful and helpful.

Alan will also moderate the Luncheon Speaker Panel with Jonathan Blattmachr, Stacy Eastland, and Lee-ford Tritt. The panel will cover the topic of WHAT WE WISH WE KNEW WHEN WE STARTED PRACTICING LAW – NON-TAX AND PRACTICAL ADVICE FOR ESTATE PLANNERS YOUNG AND OLD.

Don’t miss it!

Date: May 6, 2016

Location: Ritz Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of EQUITY STRIPPING AND OTHER ADVANCED ASSET PROTECTION IDEAS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. There will be two opportunities to attend this presentation.

Date: Wednesday, May 11, 2016 | 12:30 PM or 5 PM

Location: Online webinar:

Additional Information: To register for this presentation or for more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

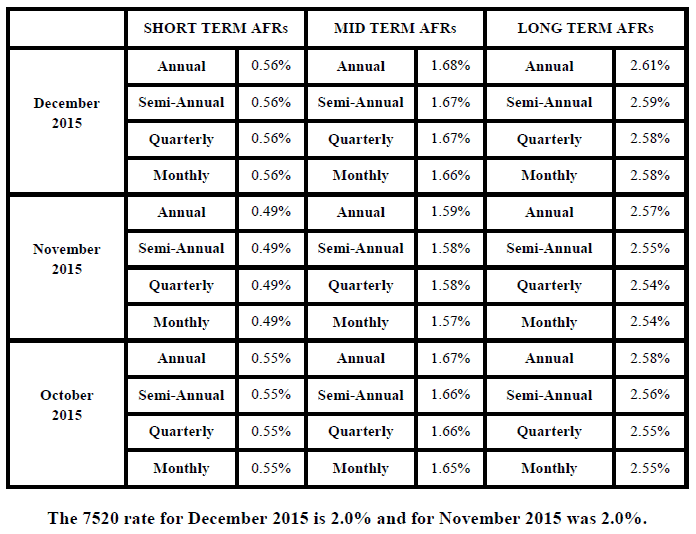

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.