The Thursday Report – 11.26.15 – Gobble, Gobble, and Avoid Legal Trobble!

Correction to Last Week’s “Can I Get a Witness?: A Grantee as Witness to a Deed”

Will 529 Plans Distort Your Client’s Estate Plan?

Being Thankful for Mistakes Avoided: The Most Common Errors in Physician Planning

12 Productivity Hacks to Get Control of Your Business Day by David Finkel

Richard Connolly’s World – A Brighter Future for the Legal Profession

Thoughtful Corner – Being Thankful for People in Particular, Not Everything in General

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“Gratitude can transform common days into thanksgivings, turn routine jobs into joy, and change ordinary opportunities into blessings.”

– William Arthur Ward

William Arthur Ward is one of the most-quoted American writers of inspirational maxims. He was a Captain in the United States Army and served as assistant to the president of Texas Wesleyan College. Over 100 of his articles, poems, and meditations were published in magazines and periodicals. He is also one of the most frequently quoted writers in the pages of The Quote, an international weekly digest for public speakers.

Correction to Last Week’s “Can I Get a

Witness?: A Grantee as Witness to a Deed”

Last week, in an article by Dena Daniels and Alan Gassman, we reported that Florida Statute §689.01 requires a deed be signed by the grantor (the individual conveying the property), grantee (the individual receiving the conveyance), and two witnesses.

The above information is incorrect. The grantee does not sign the deed. A deed must only be signed by the grantor, two subscribing witnesses, and a notary public.

We have corrected this error on our website, and we thank James M. Flick and James J. Flick for bringing this mistake to our attention. To see the corrected article, please click here.

Will 529 Plans Distort Your Client’s Estate Plan?

by Alan Gassman

Commonly, clients want all assets divided equally among children, but what about 529 Plans that may be set aside for younger children or children who have not yet been educated?

Do you specifically ask the client whether they want everything equally divided, or should the 529 Plans be above and beyond the equal division? Another question to consider is who the owner of a 529 Plan will be if the client dies.

The following language can be useful to explain and provide for the mechanics associated above:

FOR A CLIENT EXPLANATION LETTER, ADD:

We have put in a special provision that provides for having the 529 Plan designated for each child kept separate and apart for that child and not included in the total value of assets that will be divided by three to otherwise determine what is placed in trust for each child.

IN THE DOCUMENT, ADD:

Notwithstanding the above, I recognize that my spouse and I have funded 529 Plans that presently exist for one or more of our children, and that we wish to have the 529 Plan or Plans designated for each child held for the sole benefit of the designated child, without having the share of such child otherwise reduced or impacted as a result thereof. Therefore, the Trustee shall make adjustments as appropriate to facilitate fulfilling this intention. For example, if on the death of the survivor of myself and my spouse, there is a $100,000 529 Plan designated for one child, a $150,000 529 Plan designated for a second child, and $3,000,000 of other assets, then each child’s Trust described below will be funded with $1,000,000, with such child additionally having the sole and exclusive benefit of the 529 Plan designated for him or her, in a manner as determined appropriate by the Trustee to fulfill the above intentions.

Being Thankful for Mistakes Avoided: The

Most Common Errors in Physician Planning

(originally published in the 11.27.14 Thursday Report)

by Alan Gassman

The following list of common physician planning errors can be read as an entire article by clicking here, or you may prefer to read only 1 or 2 of the sections by clicking each title and its brief introduction.

This commentary reviews eleven avoidable mistakes that can be the cause of fatal errors for medical practices and physician well-being.

While different physicians and groups of physicians tend to make more mistakes in one area than another, each common mistake area should be reviewed and understood with appropriate advisors. These common errors, which can be viewed in more detail by clicking on each mistake, are as follows:

1.) Failure to Maintain and Appropriately Use Independent Professional Advisors

Many of the calamities described in this section will be avoided if a medical practice has experienced advisors on board. The practice should consult with its advisors when making major practice decisions and periodically confirm that appropriate procedures and safeguards are in place.

2.) Failure to Maintain Medical Law Compliance

A great many physicians are annihilated financially when Medicare and/or private insurance carriers request hundreds of thousands of dollars in refunds because the physician has used inappropriate billing practices or financial arrangements with third parties. In many cases, these problems are reported to the government by employees who can earn a 15% “whistle-blower fee.”

Many physician clients simply do not realize that they use improper coding, do not maintain sufficient patient file back-up, or bill for items that are inappropriately unbundled or altogether un-billable.

3.) Failure to Maintain Proper Malpractice Insurance

While malpractice insurance is not inexpensive, it is necessary in order to protect physicians from the significant legal fees, expert witness costs, and liability exposure associated with defending lawsuits. The proliferation of the personal injury lawyer industry shows no sign of slowing down, and a sympathetic jury system, coupled with experts willing to testify that a doctor committed malpractice under complicated circumstances that a jury can never understand provides good cause for maintaining appropriate malpractice insurance coverage.

Many successful medical practices are run on a handshake or a long-forgotten and now archaic agreement, but when problems or changes in circumstances arise, the results can be catastrophic and quite lucrative for the legal profession.

5.) Failure to Procure and Maintain Proper Insurances

There are a myriad of insurances required to appropriately safeguard a medical practice from the normal risks of doing business, particularly in view of the American trial system. Fortunately, most of these risks can be reasonably handled on an affordable basis, assuming that proper coverage is in place.

6.) Failure to Make the Medical Malpractice and Doctor Judgment-Proof

There are many ways that a medical practice and a doctor can work to make themselves a less-attractive target for a plaintiff’s lawyer.

7.) Failure to Theft-Proof the Practice’s Monies and Accounts Receivable

We regularly receive at least one phone call per year from a very upset physician who has had tens of thousands of practice dollars stolen by an employee. This employee has often been with the practice many years and, most of the time, is the most-trusted person in the practice other than the physicians themselves. As such, the employee is able to obtain physical possession of checks made payable to the practice by one or more payer sources and/or has written checks on the practice accounts for bogus expenses.

8.) Using Greedy Investment Advisors

There are a number of different investments and life insurance and annuity arrangements that can be sold to doctors and their practices in the financial world. The quality of each particular investment vehicle can vary dramatically in terms of actual financial safety, conservative versus aggressive orientation, likelihood of being acceptable to the IRS in the event of an audit, and the amount of commissions paid to advisors who may suggest such arrangements.

9.) Unbalanced Investment Portfolios

Statistical studies show that a diversified portfolio of investments will generally out-perform a non-diversified portfolio with significantly less risk. Many successful clients own investment real estate, mutual funds allocated among the various classes of stock investments, and bond funds or CDs. It almost never makes sense for anyone to put all of their eggs in one basket.

10.) Doing Business with the Wrong People

Unfortunately, crime and deceitful or misleading behavior can be lucrative for the “bad or careless actor,” and these individuals are often found courting doctors to do business and investment transactions or to provide consulting services.

Since the overwhelming majority of doctors are very honest and do not have formal business training, it is not difficult to market “unique propositions” to doctors and to eventually find a handful of doctors who may succumb to participate in a recommended arrangement.

11.) Failure to Have Anyone in the Practice Pay Attention to Contracts with Third Parties

Quite often, medical practices get into disputes or find themselves stuck in agreements as a result of a trusting nature or lack of attention to details associated with contracts they enter into with third parties.

We hope that this list helps you to help yourself and others, whether you are a lawyer, a physician, or the owner and operator of a Kentucky Fried Chicken franchise!

12 Productivity Hacks to Get Control of Your Business Day

by David Finkel

David Finkel is the Wall Street Journal bestselling author of SCALE: Seven Proven Principles to Grow Your Business and Get Your Life Back, which can be viewed by clicking here. As the CEO of Maui Mastermind, he has worked with 100,000+ business coaching clients and community members to buy, build, and sell over $5 billion worth of businesses.

If you’re pulled in too many directions, you’ll enjoy these 12 productivity hacks to help take back control of your day. Thank you to our business coaching clients for both contributing ideas and being the test cases to try these out.

1.) Start your day by asking what ONE thing could you do today that, in 30 minutes or less, would have the biggest impact on your business? Then, do that one thing before you do anything else.

I caution you to be ruthlessly realistic about what you can get done in 30 minutes. Chunk down a larger project into the one piece you could bite off and get done in just 30 minutes of focused time.

2.) Set aside one 4-hour (half-day) chunk of time each week for high value focus time. To create value, we need blocks of time. Yet, as business owners, our time is increasingly fractured into smaller and smaller units.

Pick one day each week that you’ll carve out a 4-hour block to work on your highest value work. During this time, turn off your email, close your door, and perhaps even leave your office altogether and work from a remote, distraction-free location.

Click here to continue reading this article on inc.com. You can also follow David on Twitter: @DavidFinkel.

Richard Connolly’s World

A Brighter Future for the Legal Profession

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Law Schools and Industry Show Signs of Life, Despite Forecasts of Doom” by Steven Davidoff Solomon. This article was featured in The New York Times on March 31, 2015.

Richard’s description is as follows:

Law school enrollment has plummeted to the lowest level in decades. If a bottom has been reached, is now a good time to go to law school?

Some say no – not now and possibly not ever. The legal market, they argue, has fundamentally changed, meaning that many of the legal jobs of years past are gone forever.

Several new studies, however, point to signs of vigorous life in the legal job market, at least toward the higher end.

Please click here to read this article in its entirety.

The second article of interest this week is “Better Times for Law Firms, With More on the Horizon, Says Report” by Ashby Jones. This article was featured in The Wall Street Journal on February 12, 2015.

Richard’s description is as follows:

Citi Private Bank Law Firm Group has some very welcome news to report to the nation’s largest law firms and the people who run them: things are looking up.

The bank, which has access to the financials for a number of large law firms, issued its Full Year 2014 Legal Industry Results. The results were mostly positive. According to the report, net income was up 6.0% over that of 2013, and profits-per-partner were up 5.7%.

“Firms across the board are doing better,” said John Wilmouth, a senior client advisor with the bank.

Please click here to read this article in its entirety.

Thoughtful Corner

Being Thankful for People in Particular, Not Everything in General

by Alan Gassman and Stephanie Herndon

Each November, it is easy to get caught up in the spirit of Thanksgiving and express gratitude towards all of the good fortunes you’ve experienced in your life. Here at the Thursday Report, this year, it is our wish that this year to slow down and remember to be thankful for specific gestures and contributions from important people in your life. We hope that everyone who cares deeply about the Thursday Report will take some time this week to call (or at least email) and leave a personal and real message thanking someone for something they have done for you, whether that was in childhood, recently, or in combination thereof.

In addition, for your parents and other significant people who helped to bring you up, consider the Gratitude Awareness Enhancement System (GAES) which you can view by clicking here and actually write down what important things someone did for you, what you have learned since then, and what you could do next to best remember and best honor the kindness they have shown you and the wisdom they have shared.

Also, this Thanksgiving, please enjoy all of your relatives and close friends, whether you really like them or not. You could always just be thankful that you don’t have to be with them all year long!

Please also be thankful for mashed potatoes, gravy, cole slaw, and onion rings. The pilgrims didn’t have any of these things!

May there be minimum fear and loathing in your Thursday and your Thanksgiving, a tiger in your tank, and two mints in one before all your kisses. May your spring be Irish, and may your re-entry into the working world on Monday go as smoothly as John Glenn’s re-entry in 1962 when he became the fifth person in space and the first American to orbit the Earth and return safely on the Friendship 7 mission.

This Thursday Report is dedicated to the memory of John Glenn and all of the others that came before and after him to help us and those that we try to help by enriching our lives and increasing our knowledge of the world around us.

This Thanksgiving, don’t forget to thank someone who has enriched your life as well.

Happy Thanksgiving from the Thursday Report and all of us at Gassman, Crotty, & Denicolo, P.A. We hope you have a wonderful holiday.

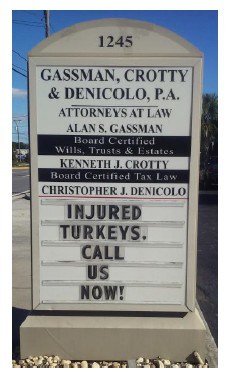

Humor! (or Lack Thereof!)

Sign Saying of the Week

***************************************************

Happy Thanksgiving from Gassman, Crotty & Denicolo, P.A.

by Alan Gassman

(without the assistance of Tina Arvin, Carl Jenne, and Colonel Sanders)

Every Thanksgiving

We focus on gratitude,

Gathering with family,

Enjoying a holiday interlude.

We must first thank our readers,

Then our writers and our staff,

And for those who are still working,

Collecting time and a half.

Looking forward to the future,

Of Thursday Reports to print,

The next improved edition,

After our readers comment (and relent).

And thanks to the turkeys,

Who put their necks on the line,

To allow us to promote the Thursday Report,

By this holiday poem and line.

Let us not forget to thank Col. Sanders

As we carve the turkey with cheer,

For the chicken we enjoy

The rest of the year.

Let’s welcome the holiday season

With joy and with mirth,

Whatever that is,

And for all that its worth.

May you have a great meal,

With those you hold close,

May your holiday season

Include many a warm toast.

And remember that no gift

Is complete without love,

Unless it has value

Of $50 or above.

We thank all our staff,

With great warmth and affection,

Better that they are off on Friday,

Than having a staff infection.

***************************************************

Upcoming Seminars and Webinars

Calendar of Events

LIVE WEBINAR:

Keith Hodgdon and Alan Gassman will present a free webinar on the topic of THE 10 BIGGEST MISTAKES BUSINESS OWNERS MAKE THAT REDUCE OR DAMAGE THE ABILITY TO SELL THEIR BUSINESS OR PRACTICE.

There will be two opportunities to attend this presentation.

Date: Wednesday, December 2, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5 PM webinar, please click here. For additional information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Bill Kahn will join Alan Gassman for a free webinar on the topic of CREATIVE BUSINESS SECURITY.

Company espionage is big business, and it’s not just limited to biggies. When a new business is in its early stages or before it has its operational system laid out in concrete, establishing the right security concepts can carry through as it grows. It minimizes unwanted exposure and unneeded expense of later changing how it operates. Preventing vulnerability to hackers, for example, would be one consideration. Making sure cell and office phones can’t be bugged and keeping competitors and governments from spying on the operation should also be an upfront consideration.

A business doesn’t have to be the NSA to make all of these things a reality. Conventional methods of information security, no matter how effective they profess to be, just end up with an organization being the eventual loser. Every day, you hear of a new intrusion. This webinar will look at the problem from a non-conventional perspective to obtain a more secure system.

Questions to be answered during this presentation include:

- Why don’t conventional security measures work for small to medium sized businesses?

- Who makes a company less secure?

- What steps can be taken to make companies more secure?

- How vulnerable are you and your company to spying from competitors and others?

There will be two opportunities to attend this presentation.

Date: Wednesday, December 9, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free, 30-minute webinar on the topic of PLANNING TO PROTECT MEDICAL PRACTICE ENTITIES AND INCOME.

There will be two opportunities to attend this presentation.

Date: Tuesday, December 15, 2015

Location: Online webinar:

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Bill Kahn will join Alan Gassman for a free webinar on the topic of THE SUGAR DADDY HUSTLE.

The classic “Sugar Daddy” situation is usually a win-win for both the male and the female involved. Both understand the situation and are willing participants. But for an older man who has undergone a traumatic life experience, is lonely, and may have somewhat diminished mental capacity, there are certain types of women who will use this to their advantage and make him their unknowing “Sugar Daddy.”

These women have researched the legal aspects of their operation and identified loop holes in the law which they can exploit. They take over the man’s life, make decisions, allow his health to deteriorate, and place him in financial tenuous situations for their own benefit. Within the USA, it amounts to a con of over $3 billion annually.

This webinar will discuss what proactive preventive steps to take when an emotional episode has occurred in an elderly person’s life. If a con has already begun, we’ll look at the signs delineating financial and non-financial abuse. Once in progress, there are steps which should be taken to minimize the impact.

Questions to be answered during this presentation include:

- For elderly men, what is the difference between the conventional Sugar Daddy and the Sugar Daddy Hustle?

- Why are older men more susceptible to being scammed?

- Are there preventive steps which should be taken when a man has recently undergone a traumatic life experience?

- How can you recognize a con?

- What should be done after a scam has begun?

There will be two opportunities to attend this presentation.

Date: Wednesday, December 16, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

REPRESENTING THE PHYSICIAN: THE ONLY CONSTANT IS CHANGE

Alan Gassman will present two talks at the 2016 Representing the Physician seminar. His topics include:

- A Brief Introduction to the Current State of the Physician’s World (with Lester Perling)

- Creditor Protection for the Medical Practice

Other speakers at this event include Jerome Hesch, Michael O’Leary, Colleen Flynn, Jeff Howard, Darryl Richards, and others.

To download the brochure, or for a complete schedule, please click here.

Date: January 8, 2016 | Mr. Gassman will speak at 8:15 AM and 10:50 AM

Location: Rosen Plaza Hotel | 9700 International Drive, Orlando, FL, 32819

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning (January 30th: 10:10 AM – 11:10 AM)

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You (January 30th: 11:10 AM – 12:10 PM)

- 50 Ways to Leave Your Overhead (January 31st: 8:00 AM – 9:00 AM)

- Essential Creditor Protection and Retirement Planning Considerations (January 31st: 9:00 AM – 10:00 AM)

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30, from 10:10 AM to 12:10 PM and Sunday, January 31 from 8:00 AM to 10:00 AM

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BOSTON PRESENTATION:

INTERACTIVE LEGAL ESTATE & ELDER PLANNING SUMMIT: SUBSTANCE, PROFITS, AND PRACTICE

Alan Gassman will be presenting at the InterActive Estate & Elder Planning Summit on a topic to be determined.

Other speakers include Jonathan Blattmachr, Michael Graham, Pope Francis, Mother Theresa, Thomas Jefferson, and others.

Date: April 20-22, 2016 | Mr. Gassman’s presentation time is TBD.

Location: Courtyard Marriott Boston Downtown | 275 Tremont Street, Boston, MA 02116

Additional Information: For more information, please visit http://ilsummit.com/ or contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday.

Alan’s Friday morning presentation will be entitled COFFEE WITH ALAN: AN INTRODUCTION TO SELECT ESTATE PLANNING AND ASSET PROTECTION STRATEGIES. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference. Attendees new to these specific estate planning areas will find the presentation useful and helpful.

Alan will also moderate the Luncheon Speaker Panel with Jonathan Blattmachr, Stacy Eastland, and Lee-ford Tritt. The panel will cover the topic of WHAT WE WISH WE KNEW WHEN WE STARTED PRACTICING LAW – NON-TAX AND PRACTICAL ADVICE FOR ESTATE PLANNERS YOUNG AND OLD.

Don’t miss it!

Date: May 6, 2016

Location: Ritz Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

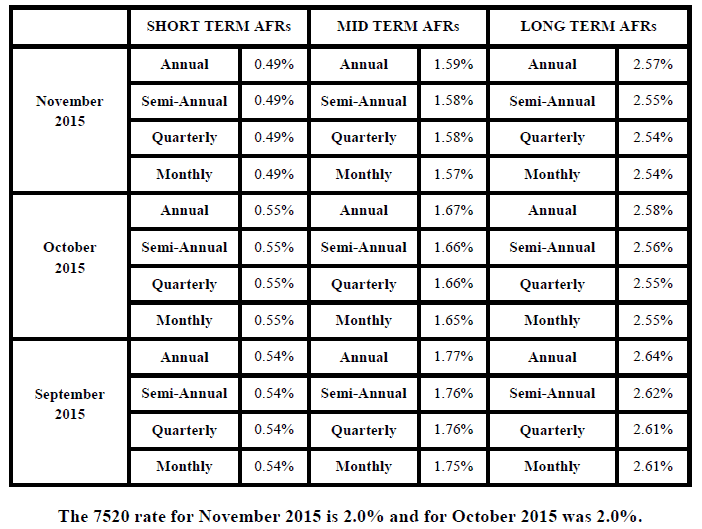

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.