The Thursday Report – 11.12.15 – Don’t Miss David Finkel in Clearwater on December 2nd!

A Life Insurance Interview with Barry Flagg and Alan Gassman, Part III

Scaling a Medical Practice: Three Concepts of Scaling by Dr. Pariksith Singh

The 5 Most Costly Hiring Mistakes by David Finkel

Seminar Spotlight – Dynamic Problem Solving for the Successful Business

Don’t Miss This Webinar! – Asset Protection Checklist Items You Have Not Thought About

Richard Connolly’s World – The Wallets of the Super-Rich & the Best Law Schools for 2016

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“If two wrongs don’t make a right, try three.”

– Laurence J. Peter

Laurence J. Peter was a Canadian educator best known for The Peter Principle. The Peter Principle is a concept in management theory in which the selection of a candidate for a position is based on the candidate’s performance in their current role, rather than on abilities relevant to the intended role. This concept is often illustrated by the popular saying, “Managers rise to the level of their incompetence.”

A Life Insurance Interview with Barry Flagg

and Alan Gassman, Part III

Barry Flagg and Alan Gassman recently appeared on a podcast interview on the subject of their article, “Ten Questions to Ask About a Client’s Life Insurance and Planning: What Every Estate Planning or Tax Planning Advisor Should Know.” The interview was conducted by experienced life insurance executive Randy Zipse. Part I of the transcript can be viewed by clicking here, Part II can be viewed by clicking here, and the conclusion is as follows:

Randy Zipse: The next thing that you guys write about in your article is historical performances of whole life or use of universal life and the importance of historical values when looking at the performance of a contract over time. Alan, when trying to determine what rate of return is a reasonable expectation from an insurance contract, could you talk a little bit about the proper ways to determine what might be a proper rate of return or a reasonable rate of return?

Alan Gassman: Well, again, this goes back to educating yourself and educating the client as to what the underlying rate of return is expected to be on how the policy credits and trying to gauge what the real, probable expenses are that are going to reduce that rate of return. So there are two different aspects of that education. The first is what’s the rate of return before expenses?

It is useful to show not only an illustration of what the product you buy today is expected to be in the future but also, illustrations of what’s happened in the past for the carrier. It’s pretty interesting to clients when I say to them, “Well, you know, this same carrier issued a very similar policy to another client of mine six years ago, and we did spreadsheet it. Let me show you how it actually performed.”

When you look at that, you get an idea of how this works and what is involved. That’s a client who’s going to be much less disappointed later if things take a turn for the worse since they at least went in understanding that the risk was there.

Randy Zipse: And, Alan, one of the other things that I find when I speak with agents and I see agents talk to their clients and I spend a lot of time out in the field is a lot of times, the spreadsheeting of life insurance contracts is simply showing IRR (internal rates of return) at death, and when they look at the IRR at death, they oftentimes ignore the cash value of that contract during life.

Certainly, having cash value is an important consideration. If you’re a fiduciary, how important is that consideration if you’re going to hold the policy until death? How much consideration should you give to the liquidity that the policy has prior to death?

Alan Gassman: Well, given the high rate of families who buy a policy and then, a few years later, wish they hadn’t, it’s very important in the communications process to make sure the family understands that in exchange for a fairly high death benefit rate of return, they are giving up liquidity in the policy, and, oftentimes, the death rate of return expectation will be exaggerated.

In fact, Barry and I had a pretty intricate situation. The agent was certainly well-meaning and told the family, “If your mom dies at her life expectancy, this is going to be a 6% rate of return. I can’t get you bonds at that rate of return, so this is a great deal,” but I think he inadvertently used the wrong life expectancy table.

When we went to the table used by the American Society of Actuaries, we found that for a normal person her age and health, it would’ve been a 5.08% rate of return, and then we found the Society of Actuaries has another rate table you use for people who buy policies over $1,000,000 because those people tend to live longer – probably because they have more fun.

So we found the probable rate of return was 4.31%, so it’s not only showing the family that if you give up the liquidity, you’re getting a higher rate of return, but it’s also making sure they understand what that rate of return means because the longer the mom lives, the lower the rate of return. I don’t know how great it is to hope that your grandma dies early so you get a higher rate of return, but sometimes, that’s what happens.

Randy Zipse: Any last comments you’d like to make? Anything else that you’d like to add? If not, we can adjourn for now, and there’s so much in this article, we could come back to some of these points at a later date.

Alan Gassman: Randy, thanks so much for letting us talk on your show. It’s a fantastic platform to allow advisors who are involved with insurance and estate planning to be educated on what needs to be looked at and what needs to happen when life insurance is placed and evaluated. I really appreciate the opportunity to talk to you about this today.

Randy Zipse: Thanks, Alan. It’s always a pleasure to work with you, and again, “10 Questions to Ask About a Clients’ Life Insurance and Planning” is coming out in November. It’s a very, very good article; as you could tell from the show, there was a lot of content in there. There are a lot of issues to look at. It’s very, I think, appropriate. It’s a good read, an important read for agents and fiduciaries. So, again, thank you for your time.

Scaling a Medical Practice: Three Concepts of Scaling

by Pariksith Singh, M.D.

Pariksith Singh, M.D. is a board-certified internal medicine physician who received his medical education at Sawai Man Singh Medical College in Rajasthan, India (where he was awarded honors in internal medicine and physiology). His residency training occurred at All India Institute of Medical Services (New Delhi, India) and Mount Sinai Elmhurst Services, (Elmhurst, New York). Upon completion of his residency, Dr. Singh relocated to Florida and worked for several years before establishing Access Health Care, LLC in 2001.

Previously, Dr. Singh discussed 10 Lessons in the Art of Scaling. That article can be viewed by clicking here. Today, Dr. Singh discusses three essential concepts to scaling your business.

There are three essential concepts to growth that seem to describe what it means to scale. After many years of errors and learning, this is what true growth seems to mean. Blind and erratic growth is deleterious, even calamitous, for an organization, but this growth, if made to happen with the soul and integrity of the seed organization intact, can be wholesome and beneficial to all including the entrepreneur, the employees, the customer, and all business affiliates.

The three concepts are as follows:

Height is scale. I recently read of the concept of ‘phase conversion’ in physics. When a liquid is heated, the molecules get more energized and move more freely and intensely. This energy, as it keeps increasing with greater heat, brings the molecules to a boil (literally) until the molecules can no longer bear the kinetic intensity. At this point, a sudden transformation in the very state or nature of the liquid happens, and the substance turns to gas. This is the point of breakthrough, the radical shift. I find this physical description very apt to the state of an organization.

The other way to look at this is the concept of evolution: a brilliant concept, if one truly understands it. If one would discard the spurious controversy between creationists and evolutionists, what one comes across in the increase in specialization and organizational complexity of the entity or physical organism until it is transformed into a new species, an organism that moves in an entirely new set of conditions, rules, and principles. This is when the true shift happens into an entirely different mode of being. Whether one agrees with Darwin or not, this principle is real and must be understood clearly.

The only and best way for an organization to scale, in my mind, is to take an ascent into a transformative level, a quantum leap where one transcends the usual competition and struggles and is able to see new horizons. That is when one has ‘scaled.’

Core is scale. The whole idea of scaling is moot if the core is lost or sacrificed (unless one transforms it to a new core.) In the ancient Indian concept of svadharma, this is elaborately described. One’s svadharma is one’s way of being, one’s central being, one’s nature and potentiality, or, as modern management might call, the core competence. Svadharma is more than core competence. It is the very essence of one’s existence.

This is a principle we often forget. In human development and upskilling, we find that an individual is most successful when he or she does what is most dear or central to his heart or core passion. Jim Collins describes it beautifully in his book Great by Choice as one of the three circles of an organization. Just like the three circles of an organization, there are three circles of an individual: what the individual has the greatest passion or love for, what he or she does best, and what he or she does for a living. If these three circles coincide and become one, not only is the individual happy and fulfilled, the results of the work speak for themselves. This is when utmost potential becomes utmost manifestation and utmost realization. When each individual in the leadership finds these three circles overlapping, they are in a mode of constant reward, creativity, fun, and learning.

An organization needs to stay true to its core constantly, through all the upheavals, transformations, shifts, and mutations. The core cannot be sacrificed. As one grows, it is the central function, value, or practice that must be protected, nurtured, and preserved. That will ensure the survival of the entity. If the core is lost, with its financial strength or value basis, the organization is lost. This core must be reviewed constantly with the leadership, and they must be reminded of it, whether in the framing of the organization’s vision and mission statements, credo, or policy and procedures manual. This core is the soul of who one is. It cannot be reiterated or revisited too often.

Depth is scale. I recently came upon the concept of a T organization, one that grows deep into the mastery of some function or specialty or expertise and also grows wide in reach. In this day and age, when knowledge travels faster than though, and competition is fiercer than ever, the time between disruption of business models and the explosive success of organizations is shorter than ever. The business cycle between boom and bust has shrunk dramatically. In these challenging times, where no one can rest on their laurels and the very manner of doing business is changed rapidly with the advent of digital technology, mastery is the sole protection.

As one looks further, this is the only way to distinguish an organization, adapt quickly, and disrupt the business one is in. Without mastery of facts, data, systems, processes, technology, or know-how, survival is extremely difficult and well-nigh impossible, but if one pursues excellence as one’s way of being, then depth is scaling.

If these three concepts are understood and implemented, the organization stays lean, alive, vital, and intense. It is able to weather all storms and able to shift strategies and implementation on a dime. If these three concepts are integrated as one in an organization, that entity becomes unassailable.

Dr. Singh can be reached at psingh@accesshealthcarellc.net.

The 5 Most Costly Hiring Mistakes

by David Finkel

David Finkel is the Wall Street Journal bestselling author of SCALE: Seven Proven Principles to Grow Your Business and Get Your Life Back, which can be viewed by clicking here. As the CEO of Maui Mastermind, he has worked with 100,000+ business coaching clients and community members to buy, build, and sell over $5 billion worth of businesses.

One of the most important functions you and your leadership team are responsible for is the selection, hiring, onboarding, and integrating of your top level talent. Yet most business owners repeatedly make poor hiring decisions that come as a direct result from falling afoul of one or more of these top five hiring gaffs.

Considering that the true costs of a bad hire can be in the hundreds of thousands of dollars, and the value of a strong hire can be the same or more, each year, your company needs you to avoid making these all too common hiring mistakes.

As you read through the list, ask yourself, “Which of these hiring mistakes are we guilty of making, and what are we prepared to do about it?”

Click here to continue reading this article on inc.com. You can also follow David on Twitter: @DavidFinkel.

Seminar Spotlight

Dynamic Problem Solving for the Successful Business

Don’t Miss This Webinar!

Asset Protection Checklist Items You Have Not Thought About

Based upon a recent live presentation and corresponding worksheet, this webinar will provide practitioners with a number of fairly simple, but not so obvious, creditor protection strategies, arrangements, and checklist items that often can and should be implemented, or at least offered, to clients in the process of estate and financial planning.

Those who attended the recent presentation were extremely complimentary of the ideas and checklist worksheet that all participants will receive.

This webinar will take place on Tuesday, November 17, 2015.

Register for the 30-minute, 12:30 PM webinar presentation

Register for the 30-minute, 5:00 PM webinar presentation

Richard Connolly’s World

The Wallets of the Super-Rich & the Best Law Schools for 2016

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “When the Super-rich Die, Here’s What’s in Their Wallets” by Richard Rubin and Josh Zumbrun. This article was featured in The Wall Street Journal on October 30, 2015.

Richard’s description is as follows:

Estate tax data recently released by the Internal Revenue Service shows what the wealthiest Americans possess when they die – and where the money goes.

First, a few basics. The returns in the data sample were all filed in 2014, which means they came largely from the estates of people who died in 2013. That year, the tax applied to estates of individuals exceeding $5.25 million, with a top rate of 40 percent, up from 35 percent the year before.

The most important thing to remember about the estate tax is that almost no one pays it anymore.

That leaves the very wealthiest sliver of the country. Fewer than 12,000 estate tax returns were filed in 2014, and more than half of those returns didn’t yield any tax for the federal government.

The data breaks down what assets people hold at death, offering a glimpse into the holdings of the ultra-wealthy.

Please click here to read this article in its entirety.

The second article of interest this week is “2016 US News Law School Ranking: the Highlights” by Jacob Gershman. This article was featured on The Wall Street Journal Law Blog on March 10, 2015.

Richard’s description is as follows:

US News & World Report released the latest edition of its ranking of America’s best law schools. For the most part, institutions that have dominated the list for years still rule, but other schools lost or gained substantial ground. One reason is a new scoring methodology that punishes schools for employing their own graduates.

This article explains the new ranking criteria and provides an updated list of the Top 25 Law Schools, as ranked by US News.

Please click here to read this article in its entirety.

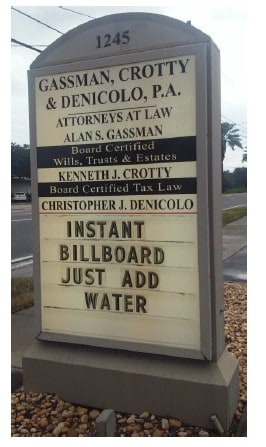

Humor! (or Lack Thereof!)

Sign Saying of the Week

**************************************************

This week’s Thursday Report is brought to you by Kentucky Fried Chicken and their new fragrance, “The Colonel’s Cologne.” Now you can smell like the famous 11 herbs and spices all the time!

**************************************************

Exciting News About the New Star Wars Movie!

Sources have learned of another character returning to the beloved series. Jar Jar Binks will be appearing in Episode Seven: The Force Awakens, and this time, he’s a lawyer! Sources also report that frantic editing is taking place after sneak previews with a test audience indicate that Jar Jar Binks is now somehow less likeable than in the earlier Star Wars films.

Upcoming Seminars and Webinars

Calendar of Events

LIVE WEBINAR:

Alan Gassman will present a free webinar on the topic of ASSET PROTECTION CHECKLIST ITEMS YOU HAVE NOT THOUGHT ABOUT.

There will be two opportunities to attend this presentation.

Date: Tuesday, November 17, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Bill Kahn will join Alan Gassman for a free webinar on the topic of CREATIVE BUSINESS SECURITY.

Company espionage is big business, and it’s not just limited to biggies. When a new business is in its early stages or before it has its operational system laid out in concrete, establishing the right security concepts can carry through as it grows. It minimizes unwanted exposure and unneeded expense of later changing how it operates. Preventing vulnerability to hackers, for example, would be one consideration. Making sure cell and office phones can’t be bugged and keeping competitors and governments from spying on the operation should also be an upfront consideration.

A business doesn’t have to be the NSA to make all of these things a reality. Conventional methods of information security, no matter how effective they profess to be, just end up with an organization being the eventual loser. Every day, you hear of a new intrusion. This webinar will look at the problem from a non-conventional perspective to obtain a more secure system.

Questions to be answered during this presentation include:

- Why don’t conventional security measures work for small to medium sized businesses?

- Who makes a company less secure?

- What steps can be taken to make companies more secure?

- How vulnerable are you and your company to spying from competitors and others?

There will be two opportunities to attend this presentation.

Date: Wednesday, November 18, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Bill Kahn will join Alan Gassman for a free webinar on the topic of THE SUGAR DADDY HUSTLE.

The classic “Sugar Daddy” situation is usually a win-win for both the male and the female involved. Both understand the situation and are willing participants. But for an older man who has undergone a traumatic life experience, is lonely, and may have somewhat diminished mental capacity, there are certain types of women who will use this to their advantage and make him their unknowing “Sugar Daddy.”

These women have researched the legal aspects of their operation and identified loop holes in the law which they can exploit. They take over the man’s life, make decisions, allow his health to deteriorate, and place him in financial tenuous situations for their own benefit. Within the USA, it amounts to a con of over $3 billion annually.

This webinar will discuss what proactive preventive steps to take when an emotional episode has occurred in an elderly person’s life. If a con has already begun, we’ll look at the signs delineating financial and non-financial abuse. Once in progress, there are steps which should be taken to minimize the impact.

Questions to be answered during this presentation include:

- For elderly men, what is the difference between the conventional Sugar Daddy and the Sugar Daddy Hustle?

- Why are older men more susceptible to being scammed?

- Are there preventive steps which should be taken when a man has recently undergone a traumatic life experience?

- How can you recognize a con?

- What should be done after a scam has begun?

There will be two opportunities to attend this presentation.

Date: Wednesday, December 9, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Bill Kahn will join Alan Gassman for a free webinar on the topic of WHY OUR GOVERNMENT REJECTS PUBLIC IDEAS AND KEEPS PEOPLE IN THE DARK ABOUT SERIOUS ISSUES.

In the area of rejecting ideas, consider this country has won more Nobel prizes than any other country, yet getting new ideas into the government from the general public is almost impossible. Yes, pulling the gems from the pile and evaluating them can be a problem. Unfortunately, it really doesn’t matter whether the potential ideas save lives, money, or time. The government generally ignores them.

Questions to be answered during this presentation include:

- Why are ideas often ignored by politicians and government agencies?

- What drives the motivations of politicians and government agencies?

- Why does the government try to keep the public in the dark about certain subjects?

- Does the government classify things that shouldn’t be marked as classified? Is that against the law?

There will be two opportunities to attend this presentation.

Date: Wednesday, January 6, 2016

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

REPRESENTING THE PHYSICIAN: THE ONLY CONSTANT IS CHANGE

Alan Gassman will present two talks at the 2016 Representing the Physician seminar. His topics include:

- A Brief Introduction to the Current State of the Physician’s World (with Lester Perling)

- Creditor Protection for the Medical Practice

Other speakers at this event include Jerome Hesch, Michael O’Leary, Colleen Flynn, Jeff Howard, Darryl Richards, and others.

To download the brochure, or for a complete schedule, please click here.

Date: January 8, 2016 | Mr. Gassman will speak at 8:15 AM and 10:50 AM

Location: Rosen Plaza Hotel | 9700 International Drive, Orlando, FL, 32819

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning (January 30th: 10:10 AM – 11:10 AM)

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You (January 30th: 11:10 AM – 12:10 PM)

- 50 Ways to Leave Your Overhead (January 31st: 8:00 AM – 9:00 AM)

- Essential Creditor Protection and Retirement Planning Considerations (January 31st: 9:00 AM – 10:00 AM)

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30, from 10:10 AM to 12:10 PM and Sunday, January 31 from 8:00 AM to 10:00 AM

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday.

Alan’s Friday morning presentation will be entitled COFFEE WITH ALAN: AN INTRODUCTION TO SELECT ESTATE PLANNING AND ASSET PROTECTION STRATEGIES. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference. Attendees new to these specific estate planning areas will find the presentation useful and helpful.

Alan will also moderate the Luncheon Speaker Panel with Jonathan Blattmachr, Stacy Eastland, and Lee-ford Tritt. The panel will cover the topic of WHAT WE WISH WE KNEW WHEN WE STARTED PRACTICING LAW – NON-TAX AND PRACTICAL ADVICE FOR ESTATE PLANNERS YOUNG AND OLD.

Don’t miss it!

Date: May 6, 2016

Location: Ritz Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

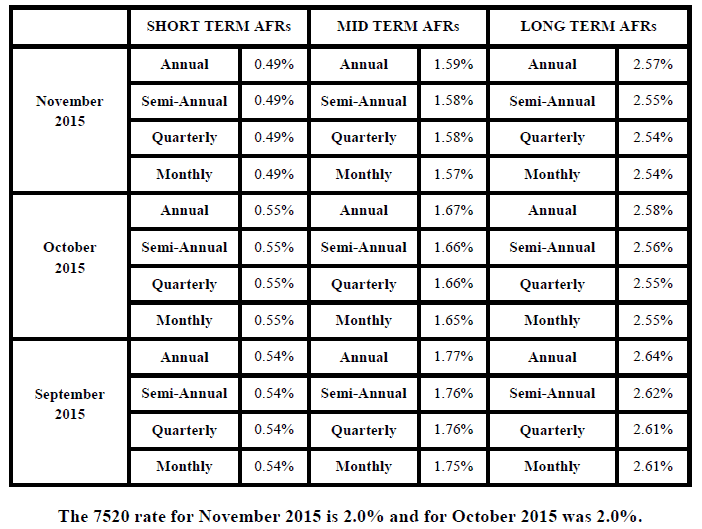

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.