The Thursday Report – 10.8.15 – UTMA, ACO, and Away We Go

Questions and Answers About the Updates to the Uniform Transfers to Minors Act

An Account of Accountable Care Organizations (ACOs) by Pariksith Singh, M.D.

Pour-Over Will Savings Clause for Living Trusts

Seminar Spotlight: Representing the Physician 2016

Richard Connolly’s World – Estate Planning Habits of the Super Wealthy

Thoughtful Corner – Client Relationship Strategies

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“I believe that if you don’t derive a deep sense of purpose from what you do, if you don’t become radiantly alive several times a day, if you don’t feel deeply grateful at the tremendous good fortune that has been bestowed on you, then you are wasting your life.

And life is too short to waste.”

– Dr. Srikumar Rao

Questions and Answers About the Updates to the

Uniform Transfers to Minors Act

What is the Uniform Transfers to Minors Act (“UTMA”)?

The Uniform Transfers to Minors Act is an act that allows a minor to receive gifts such as money, patents, royalties, real estate, and fine art without the aid of a guardian or trustee. Under UTMA, the gift-giver or an appointed custodian manages the minor’s account until the minor becomes of age. The UTMA also shields the minor from tax consequences on the gifts, up to a specified value. The UTMA was originally drafted in 1986 by the National Conference of Commissioners on Uniform State Laws and is an extension of the Uniform Gifts to Minors Act (UMGA), which was limited to the transfer of securities.

Updates to the UTMA became effective on July 1, 2015.

Are the updates retroactive?

No. The amendment authorizes a transferor to create a new UTMA account after July 2015 that will not be required to terminate until the minor turns 25, as defined by the updated statutes, instead of 21, as defined by the old statutes.

What do you have to do?

To take advantage of the new termination age of 25, you must create a custodianship for a person who is a minor (also known as a person who has not yet attained age 21.)

Can creditors of the child reach account assets?

Creditors of the child can reach the account assets, but if these are invested in 529 Plans, creditors can probably not reach into them.

Who is the “owner” of the assets in a UTMA account?

The minor beneficiary is considered the owner of the assets as a transfer to the UTMA account is treated as an irrevocable gift.

Below is a compare of the 2014 statute and the updated 2015 statute. New additions to the 2015 statute are featured in green. Language that has been removed is featured in red.

710.123 Termination of custodianship.

(1) The custodian shall transfer in an appropriate manner the custodial property to the minor or to the minor’s estate upon the earlier of:

(a) The minor’s attainment of 21 years of age with respect to custodial property transferred under s. 710.105 or s. 710.106. However, a transferor can, with respect to such custodial property, create the custodianship so that it terminates when the minor attains 25 years of age;

(b) The minor’s attainment of 21 18 years of age with respect to custodial property transferred under s. 710.105 or s. 710.106; s.710.107 or s. 710.108; or

(c) The minor’s death.

(2) If the transferor of a custodianship under paragraph (1)(a) creates the custodianship to terminate when the minor attains 25 years of age, in the case of a custodianship created by irrevocable gift or by irrevocable inter vivos exercise of a general power of appointment, the minor nevertheless has the absolute right to compel immediate distribution of the entire custodial property when the minor attains 21 years of age.

(3) As to a custodianship described in subsection (2), a transferor may provide, by delivery of a written instrument to the custodian upon the creation of such custodianship, that the minor’s right to compel immediate distribution of the entire custodial property will terminate upon the expiration of a fixed period that begins with the custodian’s delivery of a written notice to the minor of the existence of such right. To be effective to terminate the minor’s right to compel an immediate distribution of the entire custodial property when the minor attains 21 years of age, the custodian’s written notice must be delivered at least 30 days before, and not later than 30 days after, the date upon which the minor attains 21 years of age, and the fixed period specified in the notice for the termination of such right cannot expire before the later of 30 days after the minor attains 21 years of age or 30 days after the custodian delivers such notice.

(4) Notwithstanding the definition of the term “minor” as provided in s. 710.102, if the transferor creates the custodianship to terminate when the minor attains 25 years of age, solely for purposes of the application of the termination provisions of this section, the term “minor” means an individual who has not attained 25 years of age.

(5) A financial institution has no liability to a custodian or minor for distribution of custodial property to, or for the benefit of, the minor in a custodianship created by irrevocable gift or by irrevocable exercise of a general power of appointment when the minor attains 21 years of age.

****************************************************

[1] https://www.franklintempleton.com/retail/page/generic_content/prog_serv/ugma_utma/ugma_utma_pub.jsf

An Account of Accountable Care Organizations (ACOs)

by Pariksith Singh, M.D.

Pariksith Singh, M.D. is a board-certified internal medicine physician who received his medical education at Sawai Man Singh Medical College in Rajasthan, India (where he was awarded honors in internal medicine and physiology). His residency training occurred at All India Institute of Medical Services (New Delhi, India) and Mount Sinai Elmhurst Services, (Elmhurst, New York). Upon completion of his residency, Dr. Singh relocated to Florida and worked for several years before establishing Access Health Care, LLC in 2001.

It has been more than three years since the Accountable Care Organization (ACO) initiative became operational in the United States. After all these years, what have we learned? It may be worthwhile to review these lessons, challenges, failures, and future possibilities that have or will occur.

It must be noted outright that accountable care, as practiced at present, is different from managed care. In some ways, this was intentional, offering a different model for physicians and health care professionals to focus on quality, incentivize physicians, and reduce the cost of medicine, but there have also been new business models thrown open with the success of ACOs over the last few years.

The latest numbers show that only 25% of ACOs in the country have turned a profit. The rest have floundered either because of the failure to reach the quality measures or because they are simply unable to reduce expenses. This was perhaps predictable since most ACOs have arisen de novo without any prior exposure to managed care. On the other hand, factors leading to the success of ACOs are physician leadership, hospital involvement, and the creation of a data and quality driven organization.

Reviewing the trends, it was counter-intuitive to see that the ACOs, which grew aggressively by signing up some of the worst utilizers, became highly successful. Upon a deeper look, it became clear that these organizations usually had an organizational leader who was experienced in managed care. Bringing poor utilizers into the ACO increased the benchmark, thereby increasing the chances of financial success as long as there was a modicum of focused and cost-effective management.

We have also seen specialists become highly involved in some of these ACOs, since the Center of Medicare and Medicaid Services (CMS) does not distinguish between primary care physicians and specialists, unlike managed care. This has given specialists a chance to participate in management and become stakeholders, not only as managers, but also as owners. In fact, more specialists own ACOs than primary care physicians.

The biggest expense items in the medical field have been, as expected, hospital inpatient claims followed by skilled nursing facilities (SNFs). In an attempt to improve earnings, we have observed SNFs attempting to increase the length of stay of Medicare patients, often even after they have shown the recovery needed for discharge from the facility. The next big expense items, in our experience, have been Inpatient Rehabilitation hospitals, Long Term Acute Care hospitals (LTACs) and home health care.

What are the present challenges for ACOs? It is difficult to control referrals or utilization as gate-keepers. However, engagement and proper education of patients, along with strong disease management and care management, can show great returns if properly implemented.

Data and analytics are still not as granular as with managed care. Medical professionals are hoping that CMS will address this deficiency as soon as possible. ACOs are not allowed to do a Memoranda of Agreement with vendors, facilities, or specialists to reduce costs or choose preferred providers. The initial expense and expertise involved in building an infrastructure, network, and information technology platforms and systems may still be prohibitively expensive for small physicians’ groups attempting to set up an ACO, even though CMA allows advance payout agreements with ACOs to set up the same.

It is entirely possible that more physicians will be encouraged with the marginal success of accountable care to join or create more ACOs. If managed properly, the program has the potential to reduce the national outlay for health care significantly. However, that remains to be seen. It is also possible that the movement to start new ACOs may come to a standstill due to the failure of nearly 75% of ACOs in becoming profitable.

The experience with Accountable Care may give organizations a flavor of managed care or even the desire to start Commercial ACOs. We have a much better understanding now of how the model works and hope that CMS will capitalize on this initial momentum to give ACOs an even greater incentive to expand and grow.

Pour-Over Will Savings Clause for Living Trusts

Every few years, we see a situation where another law firm’s client has signed a revocable trust but not a Will that would pour all assets into that trust.

Not only is this very embarrassing for the law firm, but it can be catastrophic for the estate plan.

The client’s personally-owned assets may pass under the Florida Intestacy Statute, and the main asset of the estate may be the cause of action against the law firm that somehow allowed a revocable trust to be signed without a pour-over Will.

We, therefore, use the following savings clause in our living trust agreements and hope that other lawyers reading this Thursday Report will consider doing the same.

We welcome any questions, comments, or suggestions on the following:

Article ____ – Pour-Over Will Savings Clause

To take into account the possibility that I may not have a Pour-Over Will at the time of execution of this Trust Agreement, this document shall be considered a Last Will and Testament or Codicil to my prior Last Will and Testament, whereby the rest, remainder, or residue of the property owned by me at the time of my death, real, personal and mixed, and wherever the same may be situated, including any interest that I might have in any estate, and all property which I may acquire or become entitled to after the execution of this document, shall pour into this Trust unless a Last Will and Testament is in place which explicitly refers to this Trust. For the purposes of this Article ___, the term “Pour-Over Will” shall mean a Last Will and Testament which, by its terms, gives, devises, or bequeaths all or a portion of the rest, remainder, or residue of the property owned by me at the time of my death to this Trust, or any trust that is revocable at the moment immediately preceding my death, of which I am a Grantor, if and to the extent executed on the same date of or after the date of execution of this Trust Agreement, from the date that this Trust began to exist.

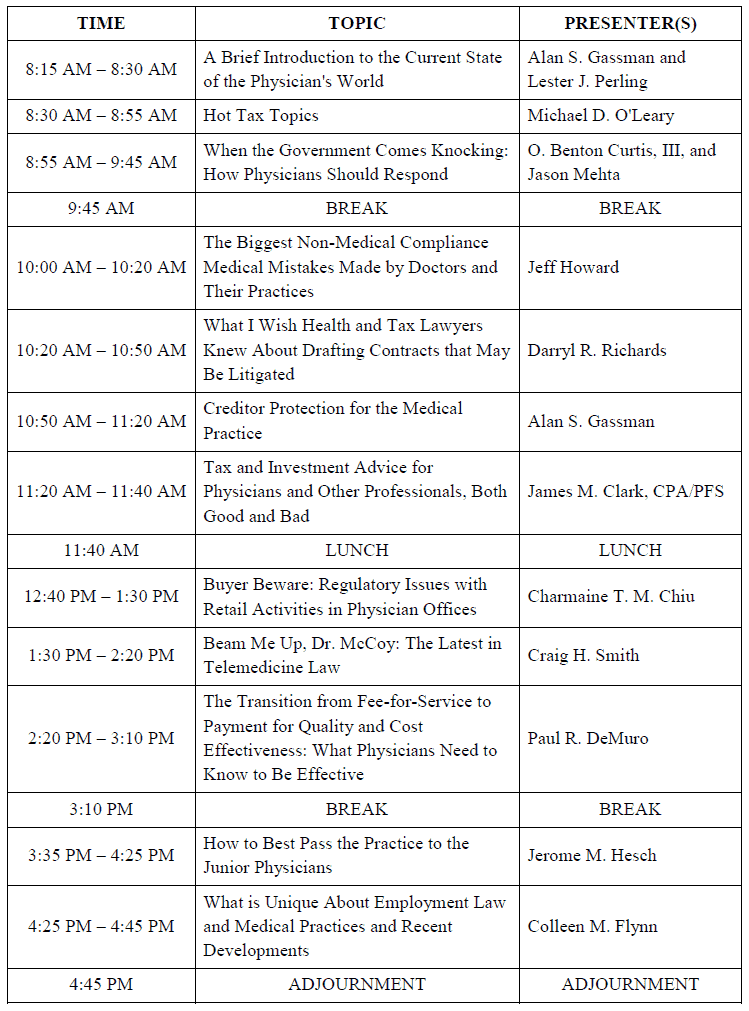

Seminar Spotlight

Representing the Physician 2016:

The Only Constant is Change

Pictured above are 5 featured speakers from the Florida Bar, Friday, January 8, 2016, Representing the Physician Conference at the Rosen Plaza Hotel in Orlando.

The 2016 Representing the Physician seminar will take place on Friday, January 8th in Orlando, Florida at the Rosen Plaza Hotel. The theme for the event will be The Only Constant is Change.

The schedule, developed by program co-chairs Lester J. Perling and Alan S. Gassman, is as follows:

For more information, please email Alan Gassman at agassman@gassmanpa.com.

Richard Connolly’s World

Estate Planning Habits of the Super Wealthy

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Private Trusts for the Very Rich” by Liz Moyer. This article was featured in The Wall Street Journal on December 14, 2014.

Richard’s description is as follows:

Mega-rich families increasingly are setting up their own trust companies to manage and invest their wealth.

Trust companies run by banks or other corporate entities have long helped rich families preserve their assets for the long term. But wealth managers and lawyers who specialize in trusts say they are seeing more families that typically have assets of $100 million or more – mainly in family-owned businesses or partnerships – setting up their own private trust companies.

Doing so, the advisers say, gives the families more control over the trust’s investment decisions and ensures more personal service than if the family uses a traditional trust company.

Please click here to read this article in its entirety.

The second article of interest this week is “Death and Taxes: What Better Legacy than Tax-Free Wealth?” by Genie Nguyen. This article was featured in Bloomberg BNA on September 1, 2015.

Richard’s description is as follows:

As reported by Bloomberg Business, General Electric paid $314,511 in premiums for $22 million of life insurance coverage for CEO Jeffrey Immelt. Why would the super wealthy need a multi-million dollar policy when they leave behind a massive fortune? For the super wealthy, life insurance is about providing liquidity to the beneficiaries to pay large estate taxes rather than for the replacement of lost income, according to Bloomberg Business.

Life insurance is a tax-efficient estate planning strategy. So long as the insured does not retain any incidents of ownership over the policy, life insurance proceeds are not taxable as income to the beneficiary or includible in a decedent’s estate.

Please click here to read this article in its entirety.

Thoughtful Corner

Client Relationship Strategies

Client Retention and Success

A prospective client will typically have a checklist for making sure they have the right attorney for their needs. The seven most common items on that checklist are as follows:

- Is the lawyer qualified?

- Is the lawyer knowledgeable and experienced?

- Is the lawyer recommended by someone [the client] trusts, a rating service or organization, or do they have a great website?

- Does the lawyer ask the right questions and seem to know what he or she is doing?

- Does the lawyer describe a process they will go through to provide the services needed?

- Does the lawyer care about his or her clients and want to achieve the best results?

- Are the lawyer’s fees reasonable for the services provided, and will the extent of the services be communicated to the client before, during, or after the work occurs?

Good habits for lawyers to pass this checklist include:

- Show up on time.

- Follow through on promises.

- Be friendly; say please and thank you.

- Show effort.

- Be thorough on the work provided, or make sure your team is thorough.

- Prepare in advance, but do not over-prepare. Let the client tell you their story.

- Let the client know what you are doing and when you are doing it.

Building Relationships During a Client Meeting

When the client comes in for a meeting, be sure to thank them for coming to see you. So often, we communicate with texts, phone calls, or even brief “bump into you” events without actually sitting down, one-on-one and uninterrupted with someone. There is a magic to meeting in person, as it gives you an opportunity to think through the client relationship and define common objectives and activities. Therefore, be sure to thank the client for taking time out of their day to come see you.

If you are meeting with a new client, ask that person how they found you. Be sure to speak positively of anyone who recommended them to you.

Ask open questions throughout the meeting. For instance, ask “what it is that I can do for you?” If they came in for estate planning, the answer might be obvious, but there has typically been an incident that made them seek you out at that particular point in time. An intended inheritance may need to be changed, one spouse might be about to have surgery, or something else that has made the clients fearful about the future may have happened.

Ask open-ended questions about their assets as well. For instance, “What do you like best about your home?” or “What are your current plans for your motorcycle collection?” or “I see that you have $2,000,000 at Wells Fargo. What is your investment philosophy or method?”

Open-ended questions such as the above allow the clients to communicate with their advisors about something that they know and care about, and they allow the advisors to gauge the client’s knowledge and thoughts along the way.

Getting the Client’s Attention

Everyone these days is overloaded with emails, letters, deliveries, faxes, and texts. So how do you get on your client’s list of things to do?

An important question to ask every client is “How do I best communicate with you when I need to get a response?” You can have a conversation about how some clients are hard to get a hold of and how it is often difficult to get responses from these clients. Ask them what method of communication works best for them.

Some clients will say it is best to email at any time of day. Some clients will say it is best to call them, and they will give you certain hours at which to make those calls. Some clients will respond to text messages; other clients won’t want you to text them at all. Some clients will only respond to regular mail or to faxes.

When they have indicated their preferred method of communication, note it on their file or in their directory. Use that note for future reference.

If they have indicated that emails to a business address are the best way to reach them, consider pre-setting your emails to go to those clients before 7 AM or after 7 PM so that you have less immediate competition from day-to-day business communication.

Have you tried their preferred method of communication and are still coming up short on responses? Try another method. If they’ve missed an email, they might notice a follow-up letter in the mail, or vice versa.

Humor! (or Lack Thereof!)

Sign Saying of the Week

**************************************************

In the News

by Ron Ross

Following the success of the first Crayola Activity and Children’s Fashion Store, the Mr. Bubble Company has opened their own themed store, selling toys and clothing in stores filled with soap bubbles that reach a height of four feet.

Customers can pick up their missing children next door at the Amber Alert store.

******************

In addition to jewelry, a salon, and banking services, Walmart is now offering their own legal services desk with a full-time attorney. So far, the most common legal question is, “Is this ‘Britney Forever’ tattoo legally binding?”

******************

Stephen Colbert gets the guests on his new show that no one else can book, including Jeb Bush, Joe Biden, Stephen Breyer, and that King Cobra that escaped from Orlando.

******************

Scott Walker dropped out of the Presidential race after falling in the polls to the spot just behind the New York Subway pizza rat.

******************

The Florida Department of Environmental Protection has issued a report on a non-native, invasive mouse species that has not only taken over the territory of native mice, but has usurped all of the natural resources in its habitation, forever changing the environment of Southwest Orange County. Wildlife officials are unable to remove it, as it seems to be impervious to any kind of government intervention.

The species in question wears yellow shoes, white gloves, and has sent the Florida Department of Environmental Protection this frightening note:

“M-I-C…See ya real soon!”

Upcoming Seminars and Webinars

Calendar of Events

LIVE WEBINAR:

Alan Gassman will present a free, 30 minute webinar on the topic of ESTATE AND ESTATE TAX PLANNING – CONVENTIONAL AND ADVANCED PLANNING TECHNIQUES TO MINIMIZE TAXES AND EFFECTIVELY PASS ON YOUR WEALTH.

There will be two opportunities to attend this presentation.

Date: Wednesday, October 14, 2015 | 12:30 PM and 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman, Steve Roll, and Lauren E. Colandreo will present a webinar on the topic of STATE TRUST NEXUS SURVEY for Bloomberg BNA.

Date: Thursday, October 15, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Jonathan Gopman, Jan Dash, and David Neufeld will join Alan Gassman for an informative webinar on THE NEW NEVIS TRUST LAW.

There will be two opportunities to attend this presentation.

Date: Wednesday, October 21, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 24th, 2015

Location: Hyatt Regency Sarasota | 1000 Boulevard of the Arts, Sarasota, FL, 34236

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

**********************************************************

LIVE MANHATTAN PRESENTATION:

INTERACTIVE ESTATE AND ELDER PLANNING LEGAL SUMMIT

Alan Gassman will be speaking on SCIENTIFIC MARKETING FOR THE ESTATE PLANNER – HOW TO DO MORE OF WHAT YOU LOVE TO DO AND LESS OF THE OTHER WHILE BETTER SERVING CLIENTS, COLLEAGUES, AND YOUR COMMUNITY.

Other speakers include Jonathan Blattmachr, Austin Bramwell, Natalie Choate, Mitchell Gans, and Gideon Rothschild.

Date: November 4 – 6, 2015 | Alan Gassman will be speaking on November 5 | Time TBA

Location: New York Hilton Midtown Manhattan | 1335 Avenue of the Americas, New York, NY 10019

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information or visit http://ilsummit.com/ to register.

**********************************************************

LIVE PRESENTATION

Alan Gassman will present a talk at the November meeting of the Suncoast Estate Planning Council on the topic of PORTABILITY UNDER NEW REGULATIONS AND ALICE’S LOOKING GLASS.

Date: Thursday, November 12, 2015 | 8:00 AM – 9:00 AM

Location: All Children’s Hospital | 501 6th Avenue South, St. Petersburg, FL, 33701

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Byron Smith at bsmith@gsscpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

REPRESENTING THE PHYSICIAN: THE ONLY CONSTANT IS CHANGE

Alan Gassman will present two talks at the 2016 Representing the Physician seminar. His topics include:

- A Brief Introduction to the Current State of the Physician’s World (with Lester Perling)

- Creditor Protection for the Medical Practice

Other speakers at this event include Jerome Hesch, Michael O’Leary, Colleen Flynn, Jeff Howard, Darryl Richards, and others.

For a complete schedule, please click here.

Date: January 8, 2016 | Mr. Gassman will speak at 8:15 AM and 10:50 AM

Location: Rosen Plaza Hotel | 9700 International Drive, Orlando, FL, 32819

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30 and Sunday, January 31 | Time TBA

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday.

Alan’s Friday morning presentation will be entitled COFFEE WITH ALAN: AN INTRODUCTION TO SELECT ESTATE PLANNING AND ASSET PROTECTION STRATEGIES. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference. Attendees new to these specific estate planning areas will find the presentation useful and helpful.

Alan will also moderate the Luncheon Speaker Panel with Jonathan Blattmachr, Stacy Eastland, and Lee-ford Tritt. The panel will cover the topic of WHAT WE WISH WE KNEW WHEN WE STARTED PRACTICING LAW – NON-TAX AND PRACTICAL ADVICE FOR ESTATE PLANNERS YOUNG AND OLD.

Don’t miss it!

Date: May 6, 2016

Location: Ritz Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE ST. PETERSBURG PRESENTATION:

ST. PETERSBURG COLLEGE FOUNDATION PRESENTS THE WOZNIAK PROJECT

Apple co-founder Steve Wozniak will be the first featured speaker in the new St. Petersburg College Foundation Distinguished Speakers series.

Wozniak is a Silicon Valley icon and philanthropist who helped shape the computing industry with his design of Apple’s first line of products. In 1976, he and Steve Jobs founded Apple Computer, Inc. In 1985, for his achievements with Apple, Wozniak was awarded the National Medal of Technology, the highest honor bestowed on America’s leading technological innovators. He was inducted into the Inventors Hall of Fame in 2000.

Join Steve Wozniak and the Foundation for a lively, interactive discussion. Charitable proceeds will benefit the St. Petersburg College Foundation. Tickets range from $85 to $95.

Thanks to the Bank of Tampa, Merrill Lynch Wealth Management, Raymond James, and the CPA firm of Gregory Sharer and Stuart for being sponsors of this event.

Date: Monday, November 2, 2015 | 7:00 PM

Location: The Palladium Theater | 253 Fifth Avenue North, St. Petersburg, FL 33701

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

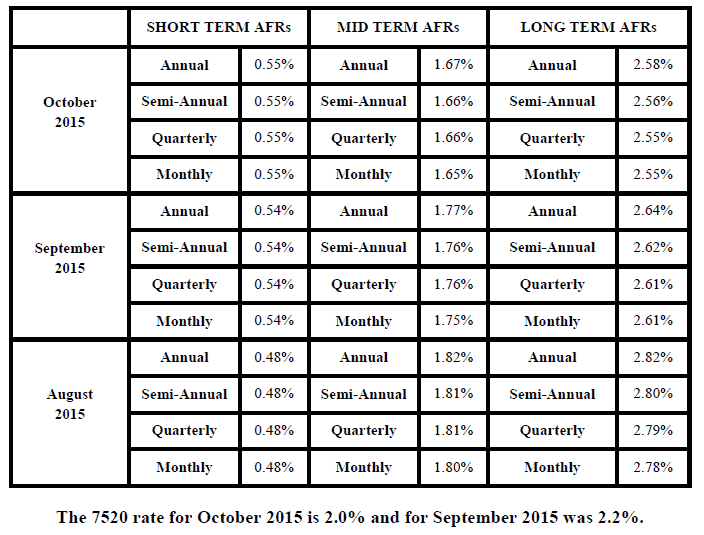

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.