The Thursday Report – 10.15.15 – What the Heck is Scaling?

Avoiding the Carnage Caused by Pay-on-Death Accounts, Part I

An Esteemed Father and Son Team Share Their Love for the Law and Helping Others, Part I

Scaling a Medical Practice: 10 Lessons in the Art of Scaling by Dr. Pariksith Singh

Making Systems Part of Your Company Culture by David Finkel

Richard Connolly’s World – Keeping Up with Recent IRS Rulings

Thoughtful Corner – Responsibility to the Public and Public Service

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“We just concentrated on being silly, and the rest happened naturally.”

– John Cleese, when reflecting upon the success of Monty Python’s Flying Circus

For more on John Cleese, Eric Idle, and the fantastic show they’ve brought to Clearwater this week, check out our Humor section below!

Avoiding the Carnage Caused by Pay-on-Death Accounts, Part I

by Alan S. Gassman & Christopher J. Denicolo

Do not let pay-on-death accounts be the death of your estate plan.

This is Part One of a two-part series on pay-on-death accounts. Part One below will discuss distortion or obliteration of an estate plan by pay-on-death accounts and possible ways to manage this risk. Part Two will discuss the creditor protection advantages of using pay-on-death accounts.

Well-meaning banks and other financial institution personnel will often encourage customers to use a pay-on-death account so that an account will pass directly to a certain person or persons on the death of the account owner or upon the death of the survivor of joint account owners.

This can wreak havoc in an estate plan where will and trust documents provide for assets to pass into trusts for individuals or otherwise and the pay-on-death designation says something else completely. Pay-on-death designations for accounts can frustrate and render carefully thought out and drafted will and trust provisions ineffectual, and many individuals are not aware of the importance of coordinating account titling and beneficiary designations with will and trust documents.

No matter how many times we warn clients and even bankers and financial advisors about this, the problems are going to happen.

One idea is to have clients sign a document that will purport to neutralize or change any existing pay-on-death account beneficiary designation by saying something like the following:

I do hereby cancel and annul any pay-on-death account beneficiary designation now in place that will cause any financial account or accounts to pass other than as directed under my Last Will and Testament and/or the revocable trust agreement that I am signing or amending as of the date of execution hereof. I request that a court of competent jurisdiction issue an order, if and when requested by any personal representative or trustee appointed under my planning documents in order to cancel or annul any such pay-on-death account designation that would cause a payment on death or passage of assets contrary to my intent, as evidenced under my then applicable valid Last Will and Testament and/or revocable trust agreement in effect upon the date of my death.

[OPTIONAL CLAUSE] Any future pay-on-death account designation shall also be treated accordingly.

It is unclear whether a bank or other financial institute will recognize such document, but at the very least, it expresses the intent of the decedent and provides grounds for negating contrary pay-on-death account designations.

In addition, or in substitution of the above, the following language can be used to ensure that the client is made aware of the issue:

THE UNDERSIGNED, with reference to our estate planning, have been informed that the bank, brokerage and other accounts will often be payable by beneficiary designation or “pay-on-death” designation and not according to our estate planning documents. We understand that bank and financial accounts may pass on death based upon ownership, such as with right of survivorship, or based upon pay-on-death instructions, which can often distort an estate plan. We recognize that it is our responsibility to request that GASSMAN, CROTTY & DENICOLO, P.A. receive verification from any specific bank, brokerage and other financial institutions to determine whether our accounts would pass under any trust we might be establishing, under our estate, or by beneficiary designation.

GASSMAN, CROTTY & DENICOLO, P.A. has not and will not undertake to check any such accounts or to provide any communications or confirmations thereof, except as explicitly requested by us in writing or undertaken by them.

The same issues can arise under life insurance, annuities, pension plans, IRAs, safe deposit boxes, and otherwise.

Will and trust language can also be tailored to take this risk into account. The following language can be placed in wills and/or trusts.

Notwithstanding any specific devise of monies directly to any individuals set forth herein, if upon my death, or at the time a specific devise would apply under this instrument, if there are pay-on-death account designations or other similar arrangements that provide specific amounts of monies to be paid to individuals who receive specific devises herein, then the specific devises set forth under this instrument shall be reduced to the extent of monies so received as to each individual.

The same considerations can apply with respect to 529 Plans, which will pass by ownership/whoever is given the right to direct those accounts upon the death of the owner. The following language may apply for 529 Plans:

I recognize that I have or may have established one or more 529 Plans for my descendants. It is my intention that any such 529 Plans will be used for educational purposes for one or more of my descendants and that a plan set up for one of my descendants may be used for other descendants if and as when appropriate. I therefore request, but cannot require, that anyone designated as the successor owner of a 529 Plan for me will coordinate with the trustee of this trust, and the trustee of this trust shall have the right to reduce specific devises and to adjust the shares of trusts or dispositions as between my children to take into account 529 Plan balances and the use thereof.

In light of the above, pay-on-death accounts do have some merit in certain situations for clients. Where the beneficiary under the will or trust is the same as the beneficiary under a bank account, a pay-on-death account might be warranted to avoid probate and to keep things simple.

Part Two of this article will discuss creditor advantages and issues associated with pay-on-death accounts. Stay tuned!

An Esteemed Father and Son Team Share Their Love for the Law and Helping Others, Part I

The following interview of attorneys L. Howard and David Payne of the Payne Law Group took place on Wednesday, September 8, 2015 at the Community Foundation Building of Sarasota County. The interview was conducted shortly after a Distinguished Speakers Presentation on Asset Protection by Alan Gassman, which was hosted by the Foundation. The interview was conducted by Jennifer Hammond.

L. Howard Payne has been practicing law for over 50 years, first in New York and now in Southwest Florida. David has been practicing for over 20 years. The Payne Law Group is an Estate Planning boutique firm.

Jennifer Hammond: Thank you both very much for agreeing to speak with me. I really appreciate it. Alan was telling me what a great practice you have, and he really wanted to profile you in his Thursday Report. I looked on your website, and it looks like you do a lot of amazing work. Tell me a little bit about your practice. How would you describe it?

L. Howard Payne: Probably 85% of our practice deals with estate planning, estate administration, tax planning, and anything to do with transfers as a result of somebody dying or planning to die. Obviously, no one plans to die, but what I mean is that we’ve got to face up to the fact that someday, we’re not going to be around anymore. The rest of the practice, I would say, is devoted to transactional work. We do work for corporations and partnerships and LLCs and asset protection. We don’t do this to the degree that [Gassman, Crotty & Denicolo, P.A.] does it, but we do it.

In fact, we know a lot of what [Alan] taught us today [about asset protection] and we try to implement that. I think the biggest positive for why we have the success we do in our practice is that we try to treat the clients as though they are part of our family, and we get the work out rapidly, and we feel we charge a fair price.

We’re always appalled at the number of cases where we have totally dysfunctional families, and we just have to end up being umpires. We don’t enjoy that position at all.

J. Hammond: How do you think the practice has changed over the years that you’ve been practicing? Because, Howard, you’ve been doing this for a while.

L. H. Payne: Well, yes, I have. Back when I first started to practice, I don’t think anybody really thought about asset protection. That’s one thing that’s changed a lot. I think that we now have more of an emphasis on income tax planning at death rather than estate tax concerns. We have probably more use of LLCs versus S-corps.

Family limited partnerships are really complex, and, frankly, most of our clients kind of have some problem trying to understand what we’re doing. Then we have these references to Code Sections and words that are used in the Code that they don’t understand, and I, frankly, am not sure we understand all the length and breadth of some of these terms we use, but as Alan specified today, complex matters involve complex solutions. You can’t really do a job for a client in a simple manner anymore.

I know I constantly have to deal with clients asking, “Why can’t you write this document so I can understand it?” and I say, “Unfortunately, you are not hiring me to write a document that you can understand. You’re hiring me to write a document that other lawyers and judges understand, so we’ve got to use their code.” They all say, “Fine, yeah,” but they still don’t like it. Every once in a while, I think, ‘What kind of problem would I create for a client if I wrote it in plain, ordinary English?’

David Payne: Not that I’ve been practicing anywhere near as long as my dad here, but in my 20 plus years of experience, I think one of the other challenges we face is that the focus is much more on things that are often not tax-related for a lot of our clients. I mean, asset protection is definitely one of them. Undue influence protection is probably an even bigger area that interests a lot of them.

There’s also a lot more Medicaid planning out there. We don’t actually focus on that. Most of our clients are not in a position where they’ll ever qualify for Medicaid, and we’re not in a position to tell them how, nor do they want to, but in terms of focusing on non-tax aspects, I think what’s nice about the tax code changing is that now we can really help clients deal with issues that matter more to them.

People care about whether the family is actually going to stay together after they’re dead. Are their children going to get along? Are they going to continue to act as a family, or are they going to be in a feeding frenzy at the trough and walk away hating each other for the rest of their lives? I think for most of our clients, leaving their family intact is really their primary goal.

J. Hammond: Where are most of your clients geographically located?

L. H. Payne: I have clients that live in Manatee County, and I have some that live in the extreme southern edge of Sarasota County, in Englewood and Venice. Mostly, our clients are in Sarasota.

D. Payne: Obviously, we work with clients who live outside of Florida, primarily in the estate and trust settlement area, so we’re working with the kids who can live anywhere, but we’re licensed in Florida. Dad’s licensed in New York, but for what we really focus on, it’s more local activity, but we end up with clients who like dealing with us, and I still have a favorite client who lives out in California. We don’t do his estate planning, but he’s still administering his mom’s trust, which is a Florida trust, so 10 years later, he’s still calling me up and asking me about distributions and things like that, so they could be anywhere [while still having] Florida law issues.

J. Hammond: Do you think there’s anything that you deal with in this marketplace that’s unique that maybe other practices in Florida don’t necessarily have to deal with or haven’t seen or been exposed to?

L. H. Payne: I wouldn’t necessarily think so. Sarasota is a very Arts-centered community. We have the Circus Museum and the Ringling School of Arts and the College of Art. We have New College, and we have USF Sarasota/Bradenton. This is a very academic community.

That has attracted a lot of people who are very philanthropic and who really are supporting all the Arts here, and so I would say, if anything was different, we may have a greater number of people benefitting charities in this area. Just listening to the comments today about the Community Foundation of Sarasota, it is probably one of the larger ones in the state, and I think that’s just because of this particular community.

D. Payne: I think, too, if you went down the West Coast of Florida, Sarasota and Naples are the two high spots for estate planning in terms of where there is a high concentration of wealth. It also seems that compared to, say, the East Coast, we attract an awful lot of Midwesterners as opposed to Northeasterners, and I think that brings a Midwestern flavor to the family dynamic.

I’ll tell you, just dealing with the probate, the probate court here and the judiciary compared to our experiences when we do probate elsewhere in the state, it’s so much easier here. Frankly, it’s even easier here than Pinellas when we venture up there. We’ve run into some bumps up there.

Stay tuned for the conclusion of our interview with L. Howard and David Payne, where they will discuss where they see the estate planning profession going in the future.

Scaling a Medical Practice: 10 Lessons in the Art of Scaling

by Pariksith Singh, M.D.

Pariksith Singh, M.D. is a board-certified internal medicine physician who received his medical education at Sawai Man Singh Medical College in Rajasthan, India (where he was awarded honors in internal medicine and physiology). His residency training occurred at All India Institute of Medical Services (New Delhi, India) and Mount Sinai Elmhurst Services, (Elmhurst, New York). Upon completion of his residency, Dr. Singh relocated to Florida and worked for several years before establishing Access Health Care, LLC in 2001.

Over the last two decades in private practice and being part of the leadership of a practice that could scale from a couple of providers to a couple of hundred, I have often been asked by interesting providers and businessmen how we did it. This is often followed by the question of how they can do it, too.

I prefer to take the negative position, at least initially. How not to do it, or, as I sometimes call it, “Lessons Unlearnt in the Art of Scaling.” These are the suggestions I would make using the ancient Indian principle of “neti neti,” or “not this, not this”:

Do not scale after others. Just because others did it or are trying to do it, you do not have to do it, too. Scaling is a hard decision and is not meant for everyone. Many (most) physicians are not inclined or trained to be good managers or leaders. Often, scaling means leaving medicine and moving to administration or management. This may not be a good fit.

A lot of what is taught in management schools is only theory, imparted by arm-chair professors with no relevance to the real world of management, let alone medicine. It is often difficult for a physician to let go of a respected position as the leader in the office and suddenly become a student under someone else. It is also extremely difficult for a physician to be both a practitioner and a manager at the same time.

The key point here is the ancient Socratic injunction, “Know thyself.” Scaling may be for others and not for you. Do not ape blindly. Know your own heart and your own passion. Some physicians or specialties do very well as solo practitioners and are best left alone. You might be one.

Become dispensable, but not too soon! I have seen this all too often in my career. Smart physicians, far smarter than I, failed to scale even from one practice to two. Realizing early that they need to hire another physician or partner to free themselves up to be able to manage the growth, they start giving up their patients to the new provider in their practice. This makes them vulnerable to the vagaries of the new doctor in the practice who may not share their abilities or understanding or may have other ideas about his or her future rather than being part of the growth model. The key is to not compromise the core.

Measure scaling by the growth in the business. Success in scaling must be measured by the sanctity and strength of the core operations, infrastructure, and the integrity of the original entity in face of growth. Any other measure misses the point of scaling. Quantity is not relevant, quality is. It is quality and the core one should wish to scale.

Loss leaders are acceptable as long as there is growth. Warren Buffet’s first axiom comes to mind: “Lose no money.” Growth with profit is always preferable, and a clear plan for return on investment should be nailed.

Great managers would be great health care leaders. The laws of health care are complex and can be a minefield for the unwary. It is not that Health Care does not need great management. The difference is in the specifics which could be fatal to a medical corporation if missed. For example, the rules of compliance including Stark Law or Anti-Kickback Statutes are unlike other businesses. Even marketing or promotion could be misconstrued as inducement if not appropriately monitored and addressed. Often, the safe and constant review by a wise and experienced counsel is needed.

Great doctors would be great health care leaders. There is much in the training and practice of a medicine that may prepare a doctor to be an excellent manager. There is much that is not. The doctor has to develop a new skill set to succeed. How to begin to think strategically and how to see the business as separate from one are important in the beginning. Collaboration and team building are an essential part of good organizations for which much time is needed. In the beginning, considerable time and resources for this are needed, and the doctor has to manage the fine balance between doctoring and managing.

Risk goes down with bigger size. Sometimes, the opposite may happen. As the organization becomes larger, it may become an easier target for audits or reviews by federal agencies if quality control systems are not in place. There has to be a surveillance in place constantly for the constantly-moving parts and people.

A good compliance manual ensures protection. A good compliance manual that is not rigorously adhered to may, in fact, be of greater risk to the practice(s). Once one documents the policies and procedures and puts them in place, there is no excuse for flawed execution of the same.

Free is good, but the only free cheese is in a mousetrap. One needs to be very careful of the relationship of the organization with vendors, suppliers, pharmaceuticals, or nutraceuticals. If you are getting paid for a patient you did not see, please ensure that it does not look suspicious to an auditor. One needs to be extremely skeptical of any lab that wishes to rent your office space, or a drug company that promises to pay you for case reports masquerading as research, or anyone wanting to pay you. Consider them your enemies unless proven otherwise.

Physicians’ huge salaries are the biggest overhead and drawback. Physicians are the bottom-line. They are not the overhead. A doctor’s practice is a great platform to scale from as long as one is aware of the legal constraints, business, and financial regulations and is able to create a model where people become paramount but systems are not secondary.

Next week, Dr. Singh will discuss the three concepts of scaling, including height is scale, core is scale, and depth is scale. Dr. Singh can be reached at psingh@accesshealthcarellc.net.

Making Systems Part of Your Company Culture

by David Finkel

David Finkel is the Wall Street Journal bestselling author of SCALE: Seven Proven Principles to Grow Your Business and Get Your Life Back, which can be viewed by clicking here. As the CEO of Maui Mastermind, he has worked with 100,000+ business coaching clients and community members to buy, build, and sell over $5 billion worth of businesses.

You’ve heard all the talk about the need to systematize things in your business, but how do you get your team to buy in? Here’s how you make systems part of your company culture.

Today, I want to share with you what I think are the core concepts you need to make systems thinking (both creating and using them) an integral part of your company culture.

First, let’s be clear: Building systems can’t be a one-person, one-time effort. It’s got to be an ongoing company-wide culture of creating, using, organizing, refining, and if need be, deleting your business systems.

Likely, this will mean you’ll need to train your team to participate in the systematization of your business since many of your new team members will have little or no training in the importance, creation, and refinement of systems. In fact, some will instead see systems as a hassle or an impediment.

It’s your job to help them recognize how useful systems can be to get their jobs done and how critical they are to the long-term success of the business.

Click here to continue reading this article on inc.com. You can also follow David on Twitter: @DavidFinkel

See David Finkel Live in Clearwater on December 2, 2015!

Gassman, Crotty & Denicolo, P.A., in conjunction with the Sara F. Gassman Music Foundation, has arranged for best-selling book author and business advisor David Finkel to conduct an interactive problem-solving workshop on the topic of SCALING YOUR BUSINESS/PRACTICE – WHAT DOES THIS MEAN?

This presentation will take place on the evening of Wednesday, December 2, 2015 as a benefit for the Sara F. Gassman Music Foundation. The event will include a wine tasting and heavy hors d’oeuvres. Each attendee will receive a Scale Tool Kit. Requested donation is $100 per attendee or couple.

Details about this event will be forthcoming. Please email Alan Gassman at agassman@gassmanpa.com for more information.

Richard Connolly’s World

Keeping Up with Recent IRS Rulings

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “IRS Ruling Makes After-Tax Contributions More Attractive” by Ann Carrns. This article was featured in The New York Times on September 22, 2015.

Richard’s description is as follows:

Making pre-tax contributions to your 401(k) retirement plan is a no-brainer. But recent changes in federal tax rules may make it more attractive for serious savers to increase after-tax contributions as well.

A recent IRS ruling has made it easier to convert those after-tax contributions directly to a Roth IRA when you retire or leave your company. Under the new rules, you can roll over your pre-tax contributions and any earnings into a traditional IRA while putting the after-tax contributions into a separate Roth IRA where the money can then grow tax-free.

(Recall that a Roth, while funded with after-tax money, allows the funds to grow tax-free and remain tax-free upon withdrawal.)

This article discusses Notice 2014-54, which may be old news to you, but might be new to your clients.

Please click here to read this article in its entirety.

The second article of interest this week is “Questioning Timing of Shares Donation, IRS Nixes $12.7 Million Charity Deduction for Stein Mart CEO” by Ashlea Ebeling. This article was featured on Forbes.com on September 17, 2015.

Richard’s description is as follows:

Donate to charity. Take a charitable tax deduction off your federal income taxes. If it were only that simple. Jay Stein, chief executive of discount retailer Stein Mart, and his wife, Deanie, are fighting the Internal Revenue Service over a donation of 500,000 shares of publicly-traded Stein Mart they made back in 2005 to their private foundation.

On audit last year, the IRS questioned the timing of the donation and then bizarrely disallowed the entire $12.7 million charitable contribution deduction the Steins claimed. The IRS assessed an additional tax of $3.4 million, which the Steins paid. That’s according to a previously unreported lawsuit the Steins filed last week in federal district court in Jacksonville seeking to recover the tax they say was “erroneously or illegally assessed and collected by the IRS.”

Their lawyer, Robert Bernstein, a tax lawyer with Foley & Lardner, said, “We do not understand why the IRS disallowed the entire charitable contribution deduction claimed in the Stein’s tax returns other than to try to apply pressure on Mr. and Mrs. Stein to settle the case for less than they are entitled.”

Please click here to read this article in its entirety.

Thoughtful Corner

Responsibility to the Public and Public Service

As lawyers and members of our communities, we have a responsibility to help our communities. Rule 1.6 of the model rules of professional conduct states:

Every lawyer has a professional responsibility to provide legal services to those unable to pay. A lawyer should aspire to render at least fifty (50) hours of pro bono public legal services per year. In fulfilling this responsibility, the lawyer should:

- Provide a substantial majority of the fifty (50) hours of legal services without fee or expectation of fee to:

- Persons of limited means or

- Charitable, religious, civic, community, governmental, and educational organizations in matters that are designed primarily to address the needs of persons of limited means; and

- Provide any additional services through:

- Delivery of legal services at no fee or substantially reduced fee to individuals, groups, or organizations seeking to secure or protect civil rights, civil liberties or public rights, or charitable, religious, civic, community, governmental, and educational organizations in matters in furtherance of their organizational purposes, where the payment of standard legal fees would significantly deplete the organization’s economic resources or would be otherwise inappropriate;

- Delivery of legal services at a substantially reduced fee to persons of limited means; or

- Participation in activities for improving the law, the legal system, or the legal profession.

In addition, a lawyer should voluntarily contribute financial support to organizations that provide legal services to persons of limited means.

There are many opportunities to get involved in the community and donate your legal expertise for the greater good. Some of these opportunities will even give you some training like Bay Area Legal that offers free training on Guardianship Advocacy in exchange for accepting a non-paying client.

There are many non-profit legal foundations in the area that will allow you to come in and donate your time, even if you are not an expert in the field, which will give you the opportunity to gain some experience in that particular area of law. This gives you an opportunity to network and meet new people in the field, and, of course, the most important reason of all, you would be giving back to the community and helping the less fortunate.

Humor! (or Lack Thereof!)

Sign Saying of the Week

John Cleese and Eric Idle of Monty Python fame brought their show to Clearwater this week! John Cleese & Eric Idle: Together Again At Last…For the Very First Time was performed last night and will be performed again tonight at Ruth Eckerd Hall. REH’s description of the show is as follows:

In Together Again At Last…For the Very First Time, Cleese and Idle will blend scripted and improvised bits with storytelling, musical numbers, exclusive footage, aquatic juggling, and an extended audience Q&A to craft a unique comedic experience with every performance. No two shows will be quite the same, thus ensuring that every audience feels like they’re seeing the show for the very first time. And now you know why the show is called that, don’t you?

As founding members of Monty Python, Cleese and Idle are unarguably among the godfathers of modern comedy, helping to pioneer an irreverent, absurdist sensibility that is emulated by comics around the world. As individuals, they have written, performed, and produced some of the most beloved and critically-acclaimed shows of all time, including Spamalot, A Fish Called Wanda, Fawlty Towers, and The Rutles.

Tickets to Together Again At Last…For the Very First Time can still be purchased by clicking here. This is a production not to be missed!

**************************************************

Upcoming Seminars and Webinars

Calendar of Events

LIVE WEBINAR:

Jonathan Gopman, Jan Dash, and David Neufeld will join Alan Gassman for an informative webinar on THE NEW NEVIS TRUST LAW.

There will be two opportunities to attend this presentation.

Date: Wednesday, October 21, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 24th, 2015

Location: Hyatt Regency Sarasota | 1000 Boulevard of the Arts, Sarasota, FL, 34236

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

**********************************************************

LIVE WEBINAR:

Steve Gorin will join Alan Gassman for a free, informative webinar on the topic of INCOME TAX EXIT STRATEGIES.

There will be two opportunities to attend this presentation.

Date: Thursday, October 29, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE MANHATTAN PRESENTATION:

INTERACTIVE ESTATE AND ELDER PLANNING LEGAL SUMMIT

Alan Gassman will be speaking on SCIENTIFIC MARKETING FOR THE ESTATE PLANNER – HOW TO DO MORE OF WHAT YOU LOVE TO DO AND LESS OF THE OTHER WHILE BETTER SERVING CLIENTS, COLLEAGUES, AND YOUR COMMUNITY.

Other speakers include Jonathan Blattmachr, Austin Bramwell, Natalie Choate, Mitchell Gans, and Gideon Rothschild.

Date: November 4 – 6, 2015 | Alan Gassman will be speaking on November 5 | Time TBA

Location: New York Hilton Midtown Manhattan | 1335 Avenue of the Americas, New York, NY 10019

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information or visit http://ilsummit.com/ to register.

**********************************************************

LIVE PRESENTATION

Alan Gassman will present a talk at the November meeting of the Suncoast Estate Planning Council on the topic of PORTABILITY UNDER NEW REGULATIONS AND ALICE’S LOOKING GLASS.

Date: Thursday, November 12, 2015 | 8:00 AM – 9:00 AM

Location: All Children’s Hospital | 501 6th Avenue South, St. Petersburg, FL, 33701

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Byron Smith at bsmith@gsscpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

REPRESENTING THE PHYSICIAN: THE ONLY CONSTANT IS CHANGE

Alan Gassman will present two talks at the 2016 Representing the Physician seminar. His topics include:

- A Brief Introduction to the Current State of the Physician’s World (with Lester Perling)

- Creditor Protection for the Medical Practice

Other speakers at this event include Jerome Hesch, Michael O’Leary, Colleen Flynn, Jeff Howard, Darryl Richards, and others.

To download the brochure, or for a complete schedule, please click here.

Date: January 8, 2016 | Mr. Gassman will speak at 8:15 AM and 10:50 AM

Location: Rosen Plaza Hotel | 9700 International Drive, Orlando, FL, 32819

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30 and Sunday, January 31 | Time TBA

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday.

Alan’s Friday morning presentation will be entitled COFFEE WITH ALAN: AN INTRODUCTION TO SELECT ESTATE PLANNING AND ASSET PROTECTION STRATEGIES. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference. Attendees new to these specific estate planning areas will find the presentation useful and helpful.

Alan will also moderate the Luncheon Speaker Panel with Jonathan Blattmachr, Stacy Eastland, and Lee-ford Tritt. The panel will cover the topic of WHAT WE WISH WE KNEW WHEN WE STARTED PRACTICING LAW – NON-TAX AND PRACTICAL ADVICE FOR ESTATE PLANNERS YOUNG AND OLD.

Don’t miss it!

Date: May 6, 2016

Location: Ritz Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE ST. PETERSBURG PRESENTATION:

ST. PETERSBURG COLLEGE FOUNDATION PRESENTS THE WOZNIAK PROJECT

Apple co-founder Steve Wozniak will be the first featured speaker in the new St. Petersburg College Foundation Distinguished Speakers series.

Wozniak is a Silicon Valley icon and philanthropist who helped shape the computing industry with his design of Apple’s first line of products. In 1976, he and Steve Jobs founded Apple Computer, Inc. In 1985, for his achievements with Apple, Wozniak was awarded the National Medal of Technology, the highest honor bestowed on America’s leading technological innovators. He was inducted into the Inventors Hall of Fame in 2000.

Join Steve Wozniak and the Foundation for a lively, interactive discussion. Charitable proceeds will benefit the St. Petersburg College Foundation. Tickets range from $85 to $95.

Thanks to the Bank of Tampa, Merrill Lynch Wealth Management, Raymond James, and the CPA firm of Gregory Sharer and Stuart for being sponsors of this event.

Date: Monday, November 2, 2015 | 7:00 PM

Location: The Palladium Theater | 253 Fifth Avenue North, St. Petersburg, FL 33701

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

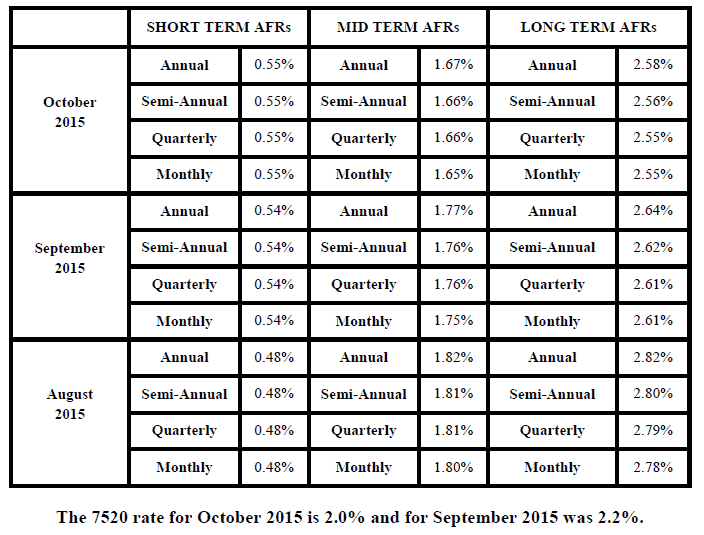

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.