The Thursday Report – 1.14.16 – Thank Goodness It’s Thursday!

What You Probably Do Not Know About Portability, Part II

The Teaching Organization by Pariksith Singh, M.D.

JEST (Joint Exempt Step-Up Trust) Recommended by John O. McManus, NextAvenue.org, and MarketWatch

Richard Connolly’s World – Financial Abuse of the Elderly

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“Smiling begets a warmer (work, home) environment. Thanking begets

an environment of mutual appreciation.”

– Tom Peters

Tom Peters is the author of several books on business management practices. He is best known for the books Thriving on Chaos and In Search of Excellence, which he co-authored with Robert H. Waterman, Jr. In Search of Excellence was released in 1982 and quickly became a national best-seller. It can be viewed by clicking here. Today, Tom Peters continues to write and speak about personal and business empowerment and problem-solving methodologies.

What You Probably Do Not Know About Portability, Part II

by Alan S. Gassman; Edwin P. Morrow, III;

Seaver Brown; and Brandon Ketron

The introduction to our new, extensive article on Portability Mistakes, printed in the Christmas Eve 2015 edition of the Thursday Report covered the common mistake of assuming estate tax planning is not needed, given the potential rapid growth of assets that a married couple may have and the slow growth of the consumer price index that adjusts the estate tax exemption.

Part Two of this examination will look at Clayton QTIPs and the mistakes one can make involving those arrangements.

Mistake:

Not Using the Clayton QTIP Arrangement to Safeguard Assets

and Make Use of the First Dying Spouse’s GST Exemption

Many planners are mistakenly not using Clayton QTIP language and providing for assets to pass into a Credit Shelter Trust that can become a Clayton QTIP. The authors strongly prefer having the disposition of assets of the first dying spouse to a Credit Shelter Trust that the surviving spouse, or one or more fiduciaries may retroactively elect to convert to a QTIP Trust within nine months of the decedent’s date of death (and, unlike qualified disclaimers, an extension can be granted to allow another six months, for a total of fifteen from date of death). An election that permits different terms for the Trust, depending on whether or not the election is made, is known as a Clayton QTIP election.

A Clayton QTIP Trust can qualify for the Federal Estate Tax Marital Deduction, while protecting the Trust assets (but not the income) from potential future creditors, spouses, and potential improvidence. Further, the surviving spouse will have the right to receive all income, will be required to be the sole lifetime beneficiary, and may direct how the Trust assets pass on such spouse’s subsequent death by retaining powers of appointment that can be provided in the Trust documents.

An independent fiduciary can be appointed to have the power to direct that some or all of the Trust assets be paid outright to the surviving spouse, and it is not necessary that this occur within nine months of the decedent spouse’s date of death.

The Clayton QTIP Trust also has another very important advantage – it allows for use of the deceased spouse’s GST exemption, so that for deaths occurring in 2016 up to $5,450,000 can pass to the Trust, without being considered as owned by the children and grandchildren for federal estate tax purposes when they die.

It can be a huge mistake for an affluent or potentially affluent family to lose the GST exemption of the first dying spouse by having an outright disposition to a surviving spouse. Especially, if instead, the mechanisms and desire to fund a QTIP Trust are not available to the surviving spouse.

Example:

Upon the death of husband (first dying spouse), assume that assets are left to his wife in a Clayton QTIP Trust. The executor can use the Clayton QTIP election to determine how much of the Trust should qualify for the marital deduction, and how much should pass into a Bypass/Credit Shelter Trust. The assets will pass to a Credit Shelter Trust to the extent that the QTIP election is NOT made, which may pass to another Trust or to other beneficiaries without jeopardizing the marital deduction, while the remaining assets will pass to a QTIP Trust for the wife, giving the executor the flexibility to determine the appropriate amount.

As discussed above, the advantage here is that the husband has a $5,450,000 generation skipping tax exemption that enables that amount in assets to be placed into the Clayton Q-TIP Trust on the husband’s death (after any needed disclaimer and the Clayton Q-TIP Trust election have been made) and if that $5,450,000 grows to $12,000,000 before the wife dies it can pass to a Trust that can benefit the children without being subject to federal estate tax at the children’s level.

Mistake:

Assuming the IRS Will Not Deny Clayton QTIP Treatment when it is

Not Necessary to Avoid Estate Tax on the First Spouse’s Death

The next mistake is assuming that the IRS will allow the Clayton QTIP Trust to work as intended, when in fact there is perhaps a 3% or greater chance that the IRS will try to use Revenue Procedure 2001-38 to prevent assets that pass to a Marital Deduction Trust from qualifying for the marital deduction when not needed to avoid estate tax. This will reduce the portability allowance by the amount passing to the Marital Deduction Trust. While the vast majority of commentators and estate tax professionals expect that the IRS will not take this position, the law is not so certain, and for reasons described below it will be much safer to use only partial Clayton or other QTIP marital deduction elections, as opposed to full marital deduction elections.

Revenue Procedure 2001-38 was issued to save estates that had inadvertently elected the marital deduction for QTIP Trusts that were intended to work as Credit Shelter Trusts to avoid Federal Estate Tax on the death of the surviving spouse. Oftentimes, the Will or Trust of the first dying spouse would provide that a Trust which would pay all income to the surviving spouse would be formed, with the intent being that all or a portion of such Trust could avoid estate tax on the surviving spouse’s death by acting as a Credit Shelter Trust. Unfortunately, many estate tax return preparers erroneously elected marital deduction treatment for the entire Trust, which caused the intended Credit Shelter Income Trust to be estate taxable on the surviving spouse’s death. Fortunately, for those wishing to have QTIP Trusts qualify for the marital deduction in portability planning, the Revenue Procedure provides that it will not apply unless a full marital deduction election is made, and will not apply where there is a partial election. Until this issue is cleared up, it will be safest to make partial QTIP marital deduction elections, even though that may leave an otherwise intended Clayton QTIP Trust with some small, but material, part thereof that will be treated as a Credit Shelter Trust.

To explain further for those who may wish to have more background and history we can start with an example where the first spouse died when the exemption amount was only $1,000,000 in 2003, and left $1,800,000 into a QTIP Trust. The best planning would have been to elect for only $800,000 to qualify for the marital deduction, and to have the $1,000,000 amount applied to enable that portion of the QTIP Trust to not qualify for the marital deduction, and to instead not be subject to federal estate tax on the surviving spouse’s death. But commonly estate tax return preparers were accidentally, or from ignorance, electing for a full $1,800,000 marital deduction, which caused loss of the first dying spouse’s $1,000,000 exemption, and was therefore expected to cost the family significant estate tax, since all QTIP assets would be subject to estate tax on the surviving spouse’s death. Back then there was no portability allowance, and the capital gains tax rate was only 15%, so the basis step-up that occurs on the part of the QTIP that qualified for the marital deduction was not as important.

As indicated above, the faulty excess election meant that any qualified property used in conjunction with this election would then be included in the surviving spouse’s gross estate. Further, had the spouse disposed of any income interest from the part of the QTIP that qualified for the marital deduction, then all assets in the marital deduction QTIP would be subject to a gift tax.

Now, on the same facts, the family may wish to make a QTIP marital deduction election for the full $1,800,000, but the Revenue Procedure may be applied by the IRS to prevent this. In such circumstances, it would be safer to make a partial QTIP election so that there would be a $100,000 Credit Shelter Trust portion and a $1,700,000 marital deduction portion.

LISI authors Austin Bramwell, Brad Dillon, and Lisi Mullen explained in their excellent 2013 LISI Newsletter #2100 on this topic that “the IRS does not have and has not actually claimed the power to disregard a valid prior QTIP election. So long as the taxpayer does not seek the relief described in the Procedure, a prior QTIP election must be respected.” Any planner will be well served by carefully reading their well-reasoned analysis, but IRS positions are not always as well reasoned as LISI Letters!

Howard Zaritsky has urged caution, and shared the following thoughts with us on this Revenue Procedure, and its impact on QTIP elections going forward:

“I expect that they will allow [a full QTIP marital deduction, if not needed to avoid estate tax], but I remain concerned until formal notice is given.

The language of Revenue Procedure 2001-38 suggests that the relief must be sought affirmatively by the surviving spouse’s executor, and that it does not operate automatically. I recall, however, the fight over the regulations under Section 2040, dealing with the estate taxation of certain jointly owned property. Treasury Regulation Section 20.2040-1(a)(2) states that “[t]he entire value of jointly held property is included in a decedent’s gross estate, unless the executor submits facts sufficient to show that property was not acquired entirely with consideration furnished by the decedent, or was acquired by the decedent and the other joint owner or owners by gift, bequest, devise, or inheritance.”

It was argued that the Regulations, under Section 2040, allowed the executor of the first co-owner’s estate to decide whether or not to include the entire property in the estate (and obtain the Section 1014 basis increase), merely by declining to show contribution by the surviving co-owner.

They had a slight problem, however, because Section 2040(a) itself states that inclusion occurs except to the extent that the property may be shown to have originally belonged to the surviving co-owner. Some courts held that the entire property was includible unless the executor showed contribution by the survivor.

The IRS’ arguments in those cases, and the Tax Court’s view suggests that, despite the language of Revenue Procedure 2001-38 that appears to place the burden of negating the effect of the QTIP election on the executor of the surviving spouse’s estate, the IRS may be able to raise this issue affirmatively.

So stay tuned and let’s hope for the best on this.

The Teaching Organization

by Pariksith Singh, M.D.

Pariksith Singh, M.D. is a board-certified internal medicine physician who received his medical education at Sawai Man Singh Medical College in Rajasthan, India (where he was awarded honors in internal medicine and physiology). His residency training occurred at All India Institute of Medical Services (New Delhi, India) and Mount Sinai Elmhurst Services, (Elmhurst, New York). Upon completion of his residency, Dr. Singh relocated to Florida and worked for several years before establishing Access Health Care, LLC in 2001.

We have heard of a lot of Learning Organizations (entities that learn constantly, individually, and organizationally by challenging themselves, setting new goals, and sharing knowledge in a quest for excellence.) It seems to me that the next step to a Learning Organization would be a Teaching Organization. Such an organization could also be called a Mentoring Organization, a Sharing Organization, or perhaps even a Facilitating Organization.

Such organizations can tap the human potential and energy that stays locked within each of us, the energy that we know we hold within, afraid that by sharing, we shall somehow lose it and let others grow stronger at our expense. We create walls within and silos without, and we close the boundaries around our own growth and that of others around us, but the true human learning happens when we teach and share. By sharing, we ourselves learn more. In fact, sharing makes the education real and establishes it within us.

In each great human culture and tradition of the past and present, we have revered our teachers and Gurus, those who led us from darkness to light, taught us an important skill or trade, or facilitated our growth in this sweltering world. When it comes to sharing, however, we hold back. We do not learn to give unconditionally as our teachers did with us. What kind of legacy do we leave? Perhaps this holding back is a vestige of the pre-information age when control was power, vesting was authority, and intellectual property was at a premium.

Now, all of that is changed.

In this new world, free is money, sharing unconditionally is value generation, and giving is taking. Value generation is not from copyrighting but from posting it for all to see. For knowledge (or at least information,) it is growing at a logarithmic pace, and there is no sense in holding back to that which will be obsolete tomorrow or even the next moment.

Not only that, the information is already out there. If we hold back, we hold back at our own peril. If we hold back, we do not shed our baggage, and we learn nothing new. The best attitude is to constantly clean the slate of past information and be constantly ready to learn afresh. The future belongs to those businesses which transcend clinging and build engagement and relationships.

This does not mean that the basics have changed. The fundamental human values have remained unchanged, but they might just have been accelerated a little in the new world. If we really want to mentor and help others, the tools are all there, the mechanics are now easy, and the systems are easily available at the click of a mouse. What should we do in this cataclysm of information to help our organizations?

I create an organization where institutionally and individually, learning is always at a premium, team work supersedes individual brilliance and credit, and each is valued in the whole. The tools are technology-enabled (intranet, email, webinars, podcasts, Skype, social media, mobile, YouTube, etc.) and among these tools is a Content Management System, a way to organize these tools made possible today.

In the old days, we used to keep files with tabs in various shelves. These had the proper information to help us with office procedures. For example, each insurance plan had its own folder with tabs on who the specialists were in their network, how to fill out a referral form, who to call in case of difficulty, etc. Now, all of that has been replaced by computer files.

We have seen that not only can these files be shared, but they can be updated by other members of the team in a manner that enhances the organization’s collective knowledge. Best practices can, thus, be shared and disseminated. Standard policies and procedures can be better ingrained in the staff’s work habits, and organizational memory can be improved.

If this were accomplished, it would be the beginning of a Learning Organization. The next step is to connect all team members as and in one ecosphere, sharing not only mental information and the memes, but also developing relationships, bonding, and creating true engagement. This engagement happens not only by working together for long periods of time, but challenging the whole team together in a manner that is conducive to learning. When each individual exerts himself or herself in a common aspiration, something remarkable happens: a transformation that creates a true team.

We move then from processes and bits of information to anticipating the moves of team members to a point where synergy is instinctive and spontaneous and where the whole starts becoming greater than its parts. From a deeper view of things, this mutation is inspirational and fulfilling. The journey towards the common endeavor becomes rewarding and full of joy.

What happens when such a Learning Organization not only records the expertise of each individual and shares it within the organization, but also starts sharing it without? Suddenly, a new paradigm emerges. A new way of doing businesses and new synergies inside the company and even with those outside of the company become possible.

If this sounds fanciful and idealistic, look to Google, Wikipedia, LinkedIn, the Khan Academy, and so on.

The learning organization was but a first step in our journey to a new way of looking at business and the wonderful art of give and take. The future of organizations stands re-organized, and new horizons are open to those who can see them.

JEST (Joint Exempt Step-Up Trust) Recommended by John O. McManus, NextAvenue.org, and MarketWatch

John O. McManus is the Founding Principal of McManus & Associates. He received his Juris Doctor from Fordham University School of Law and practiced for five years with the Wall Street firm of Dewey Ballantine and with the national firm of Jones, Day, Reavis & Pogue with a concentration on estate planning and real estate transactions. In 1991, he formed his own firm, representing individuals and families around the globe. After 10 years of receiving Martindale Hubbell’s highest AV rating as a practicing attorney, he was named to the National Bar of Preeminent Lawyers.

The following article has been reprinted with permission from NextAvenue.org. Thanks to Richard Connolly for bringing this to our attention!

5 Ways to Protect Your Estate from Capital Gains Taxes

by John O. McManus

The time-honored approach to estate planning is being turned on its head by significant tax law changes that have taken effect in recent years.

Long-term capital gains tax rates now range from 25% to 33% (when you add together the top federal, state and local rates, and Obamacare’s Medicare surtax). So now that the federal estate tax exemption is $5.43 million ($10.86 million for a couple’s combined exemptions), many Americans may no longer be exposed to federal estate taxes, making taxes on income and capital gains more prominent.

In fact, some legal practitioners who spent the first half of their careers zealously transferring assets out of their clients’ estates to avoid estate taxes now expect to spend the second half pushing assets back into their clients’ estates because the estate planning paradigm has changed.

What are the best ways to strategize around capital gains taxes to keep them as low as possible?

Rundown of the Tax Rules for Gifts

To answer that, it helps to first understand the rules about gifts and taxes.

If you give assets to family members to put them into a trust to minimize estate taxes, and the assets have appreciated significantly, when they’re sold, the gain (the amount that is taxed) is the difference between your original purchase price and the sale price at the current market value.

That purchase price is known as your “cost basis” (adjusted for any stock splits and dividends). With residential real estate, basis can increase depending on capital improvements to the property; for commercial real estate, basis can be adjusted due to depreciation. Examples of assets with a low basis: Exxon stock your grandfather gave you years ago when he was alive or the Brooklyn brownstone you bought in the 1970s that has appreciated in value by several million dollars.

Without strategic planning, $33,000 in capital gains taxes may be due when an asset is sold with a $100,000 gain, leaving the net proceeds at just $67,000.

When the owner of an asset passes away, the asset’s basis can shift upward, which shrinks the amount of gain that will eventually be taxed upon its sale. The basis then gets reset to the fair market value at the date of death. This is called a “step-up” in basis, and it is essential to many income and gains tax planning strategies. When assets are included in an estate, the Internal Revenue Service (IRS) gives you a capital-gains tax break because of the step-up in basis upon death.

5 Capital-Gains Cutting Strategies

Here are five ways you might be able to reduce your capital gains taxes through timely estate planning strategies:

First, consider undoing a trust. Assets that were gifted into trust are not part of an estate, but putting them back into the estate could avoid capital gains taxes.

For example, once a home has been given by a parent to a child and put into trust, the parent can’t live in the home without a lease and scheduled rent payments. But if you decide to live in the home without paying rent, terminate the lease, and create an agreement saying your intention is to undermine the previous trust transfer, the home gets clawed back into the estate.

Second, consider ”upstream gifting.” This is a strategy that involves transferring an asset up the generational chain to an older family member (like your parent) or a trust for the benefit of the older family member. This allows the asset to achieve a step-up in basis at the time of the parent’s death (inherited assets receive a step-up upon death but gifts have no step-up). Upon the parent’s passing, he or she would leave the asset back to the child who made the gift or to his or her descendants. The asset could then be sold, with the new high basis at current market value, free of capital gains tax, on the one condition that the parent survived the transfer from the child by at least one year.

Third, if you and your spouse have highly-appreciated assets, you could consider using a special type of trust. It’s a Joint-Exempt Step-Up Trust (JEST) or an Estate Trust or, if you live in Alaska or Tennessee, a Community Property Trust. Each lets the surviving spouse sell an appreciated asset without the imposition of any capital gains tax after the first spouse’s death. In effect, they provide the benefit of a step-up in basis to current market value upon the passing of the first spouse, so the surviving spouse can sell the appreciated asset without owing any capital gains tax.

These are valuable strategies because it is quite common for assets to be jointly owned between spouses, and the typical step-up in basis upon the death of the first spouse would apply to only 50% of the asset, rather than its full market value at the time.

Just make certain there is a separate side agreement saying this property is treated as community property.

Fourth, take advantage of the home sale tax exclusion. It lets homeowners exclude up to $250,000 of capital gain ($500,000 for a married couple) when they sell if they’ve owned and lived in the home for at least two out of the past five years before the sale.

Fifth, if you have a real-estate investment or artwork you bought as an investment, use a 1031 Exchange. This is a strategy that lets you delay capital gains taxation by rolling over the sale proceeds from the original asset into a new, similar property or piece of art — known as a “like-kind” investment. The new investment takes the original basis, which is carried over based on the original basis of the asset.

When it comes to your estate plan, it may be time to say “out with the old and in with the new.”

To see this article on MarketWatch.com, please click here.

Richard Connolly’s World

Financial Abuse of the Elderly

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Financial Abuse of the Elderly: Sometimes Unnoticed, Always Predatory” by Elizabeth Olson. This article was featured in The New York Times on November 27, 2015.

Richard’s description is as follows:

It was only after Mariana Cooper, a widow in Seattle, found herself with strained finances that she confessed to her granddaughter that she was afraid she had been bilked out of much of her savings.

Over three years, Ms. Cooper, 86, had written at least a dozen checks totaling more than $217,000 to someone she considered a friend and confidant, but the money was never paid back or used on her behalf, according to court documents, and in early November, the woman who took advantage of Ms. Cooper, Janet Bauml, was convicted on nine counts of felony theft.

Ms. Cooper lost her home, now lives in a retirement community, and is one of an estimated five million older American residents annually who are victimized to some extent by a caregiver, friend, family members, lawyer, or financial advisor.

Please click here to read this article in its entirety.

The second article of interest is “Protect Your Future Self from Financial Abuse” by Anna Prior. This article was featured in The Wall Street Journal on December 29, 2015.

Richard’s description is as follows:

People approaching retirement age should act to cut down on the chances of becoming victims of financial abuse later in life. This abuse can occur by criminals, employees, or even family members.

“Planning in advance is important, and it only gets tougher as you age,” says Ron Long, Head of Regulatory Affairs and Elder Client Initiatives for Wells Fargo Advisors. “Even without dementia, as we age, our cognitive thinking isn’t what it used to be.”

To start, financial advisors and other experts suggest creating an inventory of assets – including retirement, brokerage and bank accounts, along with other investments.

Identifying a trusted individual who could help with your affairs is the next step.

Please click here to read this article in its entirety.

Humor! (or Lack Thereof!)

Sign Saying of the Week

***************************************************

***************************************************

THE SIMPLER DAYS OF THE LAW

by Ron Ross

In the nineteenth century,

You didn’t need a law degree.

Abe Lincoln didn’t go to law school,

But he toured the circuit on his mule.

Oh, for the simpler times when

Lawyers slept with other men!

On the circuit there would just be one bed,

And the judge was either drunk or dead

The only reason they hated a lynch mob

Was because it put them out of a job.

This was before you needed paper to file pleas,

Before “your shingle” was a disease.

Best of all, the law was a kind of fight,

And everyone believed they were right.

Even if you lost a case for someone you defended,

He wouldn’t accept it, and no lawsuit ever ended.

Upcoming Seminars and Webinars

Calendar of Events

LIVE WEBINAR:

Alan Gassman will moderate a Bloomberg BNA Essential Elements webinar with special guest Jonathan Blattmachr on the topic of FUNDAMENTALS AND PLANNING FOR THE INCOME TAXATION OF ESTATES AND TRUSTS.

This is a free webinar series being presented by Bloomberg BNA. Save up so you can afford it!

Date: January 21, 2016 | 12:30 PM to 1:30 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare to attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning (January 30th: 10:10 AM – 11:10 AM)

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You (January 30th: 11:10 AM – 12:10 PM)

- 50 Ways to Leave Your Overhead (January 31st: 8:00 AM – 9:00 AM)

- Essential Creditor Protection and Retirement Planning Considerations (January 31st: 9:00 AM – 10:00 AM)

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30, from 10:10 AM to 12:10 PM and Sunday, January 31 from 8:00 AM to 10:00 AM

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of ESTATE PLANNING BASICS FOR BUSINESS OWNERS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. There will be two opportunities to attend this presentation.

Date: Wednesday, February 17, 2016 | 12:30 PM or 5 PM

Location: Online webinar:

Additional Information: To register for this presentation or for more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will moderate a Bloomberg BNA Practical & Creative Planning webinar with special guest Jonathan Blattmachr on the topic of FUNDAMENTALS, FINE POINTS, AND INNOVATIVE STRATEGIES FOR LIFE INSURANCE AND USE THEREOF.

Bloomberg BNA will charge for this webinar and this series of webinars, but we believe it is well worth it! We will have the full schedule available in a future Thursday Report.

Date: February 25, 2016 | Replay on March 1, 2016

Location: Online webinar

Additional Information: For more information or to register, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of ASSET PROTECTION BASICS FOR BUSINESS OWNERS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. There will be two opportunities to attend this presentation.

Date: Wednesday, March 16, 2016 | 12:30 PM or 5 PM

Location: Online webinar:

Additional Information: To register for this presentation or for more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BOSTON PRESENTATION:

INTERACTIVE LEGAL ESTATE & ELDER PLANNING SUMMIT: SUBSTANCE, PROFITS, AND PRACTICE

Alan Gassman will be presenting at the InterActive Estate & Elder Planning Summit on a topic to be determined.

Other speakers include Jonathan Blattmachr, Michael Graham, Pope Francis, Mother Theresa, Thomas Jefferson, and others.

Date: April 20-22, 2016 | Mr. Gassman’s presentation time is TBD.

Location: Courtyard Marriott Boston Downtown | 275 Tremont Street, Boston, MA 02116

Additional Information: For more information, please visit http://ilsummit.com/ or contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday. Be sure to bring an extra pair of socks because the first pair will get knocked off by Jonathan’s talk!

Alan’s Friday morning presentation will be entitled COFFEE WITH ALAN: AN INTRODUCTION TO SELECT ESTATE PLANNING AND ASSET PROTECTION STRATEGIES. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference. Attendees new to these specific estate planning areas will find the presentation useful and helpful.

Alan will also moderate the Luncheon Speaker Panel with Jonathan Blattmachr, Stacy Eastland, and Lee-ford Tritt. The panel will cover the topic of WHAT WE WISH WE KNEW WHEN WE STARTED PRACTICING LAW – NON-TAX AND PRACTICAL ADVICE FOR ESTATE PLANNERS YOUNG AND OLD.

Don’t miss it!

Date: May 6, 2016

Location: Ritz Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of EQUITY STRIPPING AND OTHER ADVANCED ASSET PROTECTION IDEAS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. There will be two opportunities to attend this presentation.

Date: Wednesday, May 11, 2016 | 12:30 PM or 5 PM

Location: Online webinar:

Additional Information: To register for this presentation or for more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

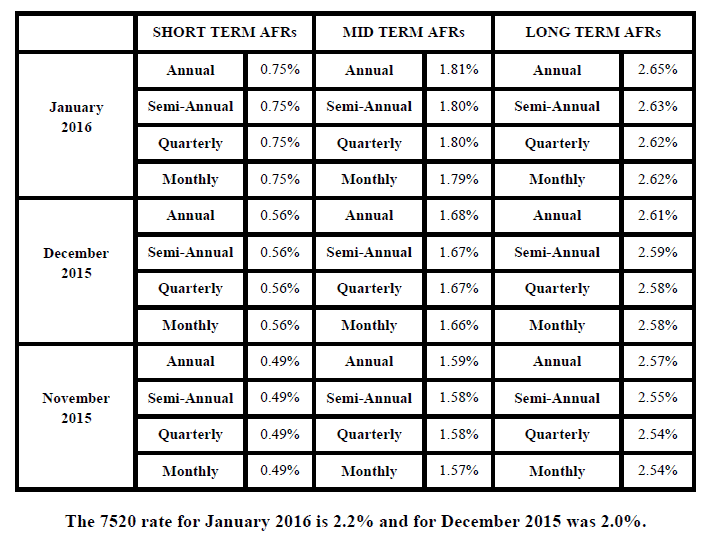

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.