The Thursday Report -1.19.17

Will New Tax Laws Trump Charities – A Serious Alarm has Been Rung – Budget for Lower Donations

The Brady Bunch – Yours, Mine and Billable hOurs

My Three Sons – Planning for Children of All Ages

Silencers is Golden?

The 10 Stupidest Things Business People Do that Get Them Sued by David Finkel

Seminar Spotlight: Ave Marie School of Law’s 4th Annual Estate Planning Conference

Richard Connolly’s World – Life Insurers Draw on Date, Not Blood

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Alan at agassman@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“I would define, in brief, the poetry of words as the rhythmical creation of beauty.”

– Edgar Allan Poe

Edgar Allan Poe was born on this day in 1809 in Boston, Massachusetts and is regarded as one of the greatest American short-story writers, often focusing on mystery and the macabre. In 1810, his father abandoned his mother and siblings, and in the following year his mother died of consumption. In 1827 Poe enlisted in the Army, but a mere two years later he left after declaring that he wanted to become a poet and writer. In 1836 he married his 13 year old cousin, Virginia Clemm, who died 11 years later at the age of 24. In 1849 Edgar Allan Poe died at the age of 40. The cause of death remains unknown, but has been widely attributed to alcohol, brain congestion, cholera, drugs, heart disease, rabies, suicide, tuberculosis, and/or other agents.

The authors of the Thursday Report suggest the following works by Edgar Allan Poe, based on the following interests:

- For the rare-old wine connoisseur, The Cask of Amontillado

- For the bird watching aficionado, The Raven

- For the medieval torture history buff, The Pit and the Pendulum

- For the rich and successful party animal, The Masque of the Red Death

- For the structural engineer student, The Fall of the House of Usher

Will New Tax Laws Trump Charities – A Serious Alarm has Been Rung – Budget for Lower Donations

by Conrad Teitell

We thank Steve Leimberg for permission to reprint the following very important message from Conrad Teitell Income Tax Planning Email Newsletter – Archive Message #106.

“Charities and the people they serve face an imminent crisis. And it is by far the greatest threat to tax-encouraged charitable gifts that I’ve seen in over half a century. I say this not lightly. This newsletter includes suggested talking points for use with House Ways and Means Committee members and your Congressional representatives.”

Please click here to read this article in its entirety.

The Brady Bunch – Yours, Mine and Billable hOurs

by Alan Gassman

A good many second marriages flourish, with both spouses fully engaged and dedicated to children by prior marriages. Oftentimes, there will also be a common child or children.

Couples having only common children will often leave all assets to the surviving spouse, or into a trust system, while expecting or requiring that assets will be passed to the descendants after the second death.

The question of potential remarriage by the surviving spouse, and possible situations where the common children of a marriage might not receive an expected inheritance on the second death makes planning and drafting interesting.

The above issues are, commonly, much more challenging where one or both spouses have children by prior relationships that may not fare well if they are not the child of the surviving spouse.

In such situations, it is common to provide for one or more separate trusts to be established on the first death to safeguard the inheritance of the child or children of the first dying spouse, while also making it possible or probable that the trust income and principal may be used to support the surviving spouse.

Oftentimes, assets consist of items that are not ideal for trust funding, which can include pension and IRA accounts, assets belonging to the surviving spouse as the result of right of survivorship or community property laws, homestead, and other vehicles of ownership.

Commonly, the spouses will enter into a Marital Asset Agreement that will require the surviving spouse to set aside and safeguard some portion of the marital assets for the benefit of the various descendants, based upon pre-agreed formulas.

Family heirlooms and other physical items of emotional significance should also be addressed.

Some agreements or trusts provide for changes in asset management and logistics that would occur if and when a surviving spouse would cohabitate or remarry.

It will often be a good idea to have the children execute an Inheritance Agreement, whereby they will be bound to share the inheritance based upon percentages or a formula, in order to discourage possible undue influence and similar actions, and to give each child, and the descendants thereof, a cause of action against any other child or children who become “favored” by the surviving spouse.

As the result of a careful review of assets, life insurances, and possible logistical trust planning, advisors and clients can come to agreement on what appears to be the best combination of efforts to facilitate the desired result, but everyone involved must realize that there will always be a risk of unfair or unintended consequences, given the changes in circumstances, uncertainty of the law, changes of intentions and assumptions as to what would be done and expected after one death, and Murphy’s Law in general can make for a challenging situation.

My Three Sons – Planning for Children of All Ages

by Alan Gassman

In the 1960’s sitcom, My Three Sons, Fred MacMurray played the thoughtful and patient parent of three adolescent and teenage boys, who learned many interesting lessons living a wholesome life in suburban American.

Parents with children of all ages need guidance in a number of areas that are typically not mentioned during an estate or financial planning meeting.

The planner who brings up the discussion points set forth below will certainly be providing his or her clients with better tailored planning solutions:

- Liability for Driving Cars

A parent’s wealth is threatened by any child who drives the parent’s car.

By law, the parent may be strictly liable for any negligence that the child incurs on the roadway when the child has not reached age 18. In Florida, a parent must sign for a minor to receive a license, and is absolutely liable for the child’s negligence as the result of signing.

Typically, children have to be on the parents’ liability and umbrella insurance policies while living at home. But once they go to school or live independently, it is often best to give them their own car, and sometimes best to allow them to be on a separate, less expensive, insurance policy.

Children may also operate boats, wave runners, four-wheelers, and motorcycles. Similar concerns apply.

- Saving for Education

Prepaid tuition and dorm programs, as well as 529 College Savings Plan programs, should be considered by all parents and grandparents who can afford them. In many situations, clients who do not have children will purchase 529 Plans to defer tax on earnings and have creditor protection if they reside in a state that protects 529 Plan assets. 529 Plans normally belong to the parent or grandparent, and can be changed each year to a different intended beneficiary.

- Health Care and Financial Proxies

Young adults can give their parents and/or significant other the power to make health care decisions and also to sign documents for if and when they are unavailable, or for the sake of convenience. Every 18-year-old should sign these documents. Effective planners can set their calendar for the 18th birthday to help make sure that this happens.

- Child Health Care Authorizations

In most states, parents can sign documents to enable others to make medical decisions and authorize treatment for a minor child. It is risky to leave town and not be available if a babysitter or non-parent family member needs to take a child for non-emergency treatment. Emergency rooms will only do what is absolutely necessary without consent of a parent for elective and non-emergency treatments in most states. Florida’s 2015 Health Care Surrogate Act changes specifically requires two witnesses for a parent to enable a non-parent to make health care or medical decisions.

- How Much Responsibility to Give to a Young Adult

Sometimes parents have well-placed confidence in their young adult children before the child has the type of experience and has molded with a good significant other.

Oftentimes, a child in college or just out of college is not equipped for the emotional and practical challenges that may be faced if a parent dies or becomes incapacitated.

Young adults will often be distracted or will not be assertive with medical, legal, and other advisors in the same way that a responsible and more experienced person may act. We normally recommend that older family members or close friends be named as additional Agents on Health Care and Financial Powers of Attorney.

Having to face the death of your own parent is difficult enough, but being a young adult who may suffer guilt or indecision later will not be optimum for many families.

In addition, young adults may change dramatically or be “controlled” by the bad influence of a significant other.

All of the above is worthy of discussion when a client is inclined to appoint a young adult to a position of responsibility, notwithstanding that we have seen many college students and young adults do a great job under trying circumstances.

- A Last Will and Testament

Having a young adult consider and sign a Last Will and Testament helps educate him or her about the importance of addressing the contingency of death, and being responsible with assets. Almost every year we have to counsel clients who have lost a young adult child. Having a Will in place, or even a Revocable Trust where there may be significant assets, avoids the need to have a plan administered based upon state law, which may give priority as to the selection of a Personal Representative to someone who the family finds to be undesirable or irresponsible. This will especially be the case where the child’s parents are divorced because one of them might not be stable or may be malicious.

- Knowing Your Lawyer and Other Advisors

Many clients make it a point to have their children meet their lawyer, accountant, and other advisors. It helps the advisors develop a grasp and dedication to the family. In addition, advisors can serve as good role models, sounding boards for both positive and stressful situations, and networking friends when it comes time to get into college or graduate school, find a job, or have someone to talk to about important decisions.

An outstanding example of this would be a meeting that a young adult would have with a financial planner to decide how to invest the first $5,000 that their parents have given them to open an IRA. The financial planner can help the child become motivated to save and to watch the savings grow, while also providing knowledge and suggested further study that the young adult might not accept or receive from a parent or their own otherwise applicable life experience. Too often, young adults (and everyone else for that matter) get the wrong advice based upon faulty perceptions, unqualified advisors, or confusing “something on the Internet” with what would otherwise be in their best interests.

- Showing a General Interest in a Family Well Being

While some clients may “brush off” the suggestion that a planner should be involved with some or all of the above considerations, more often we find that clients are extremely pleased that we are able to provide advice and conversation that enhances their family life and helps their children.

Sometimes the conversation moves to the possibility of seeing a mental health counselor to discuss a child’s situation, whether to refer the child to the planner or another professional for a legal or other problem, challenge or opportunity the child might have, or just to allow the parents to “let off steam” about a particular situation.

Our office particularly has experience in representing addiction treatment centers, and many parents do not have a good understanding of how addiction should be approached.

A planner with particular background, experience and sincere interest in some aspect of children and young adult lives can make this known to clients who would not otherwise think to make mention of a particular circumstance that can be addressed.

Life is much more complicated now than it was in 1962, which was the third season of “My Three Sons.”

Silencers is Golden?

by Seaver Brown and Alan Gassman

In the classic James Bond film, Goldfinger, Bond uses a suppressor (“silencer”) on a pistol to assassinate the “bad guys.” The ability to shoot people while making minimal sound has been a concern to regulators, which is the reason a suppressor is now regulated in the same way as a machinegun.

Recently, two Congressmen from South Carolina and Texas introduced H.R. 367, the Hearing Protection Act (HPA), which aims to remove suppressors from the National Firearms Act, thereby making them cheaper and easier to purchase from a licensed gun dealer.

Currently, individuals and other legal entities (gun trusts and LLCs) must file an ATF Form 4, pay a $200 transfer tax, supply photographs and fingerprints, submit to a background investigation, and notify their local chief law enforcement officer of their intention to purchase a suppressor. The same rules apply to NFA firearms such as automatic machineguns, short barreled rifles and shotguns, destructive devices, and firearms defined as “any other weapon.”

The HPA will effectively remove suppressors from the class of firearms and firearm accessories that are under Title II of the Federal gun control laws.1 This will enable owners to share use and possession of suppressors, and to no longer be accountable to federal agencies with respect thereto.

Supporters of the HPA argue that suppressors should be regarded as safety devices because they provide additional protection for hearing and from the muzzle blast. In fact, many liken the use of a suppressor to wearing ear protection on the gun. Hunters and double agents prefer the use of a suppressor because it allows them to hunt without wearing or carrying ear protection.

“Man has climbed Mount Everest, gone to the bottom of the ocean. He’s fired rockets at the Moon, split the atom, achieved miracles in every field of human endeavor . . . except crime.”

*********************

1 See the National Firearms Act of 1934 and the Gun Control Act of 1968.

The 10 Stupidest Things Business People Do that Get Them Sued

by David Finkel

David Finkel is the Wall Street Journal bestselling author of SCALE: Seven Proven Principles to Grow Your Business and Get Your Life Back, which can be viewed by clicking here. As the CEO of Maui Mastermind, he has worked with 100,000+ businesses coaching clients and community members to buy, build, and sell over $5 billion worth of businesses.

Click here for the 10 all-to-common things you or your staff unintentionally do that is putting your company at risk of getting sued.

Follow David on Twitter: @DavidFinkel.

Seminar Spotlight:

For more information please email Alan at agassman@gassmanpa.com.

Do not miss this April 28 Naples Event

8:30 – 9:45 am | Keynote Speaker

- Stacy Eastland

- Topic: Comparing Freeze Techniques

- Grand Lawn Pavilion

10:00 – 10:50 am | Concurrent Session 1A

- Jonathan Gopman

- Topic: Asset Protection Trusts: An Update and Discussion of Planning

- Grand Lawn Pavilion

10:00 – 10:50 am | Concurrent Session 1B

- Joan Crain

- Topic: Challenges for Trustees in Dealing with Millennial Beneficiaries

11:00 – 11:50 am | Concurrent Session 2A

- Jerry Hesch

- Topic: Passing a closely-held business on to junior family members or key employees or co-owners: An analysis of the income tax, estate tax and financial impact of business succession planning techniques.

- Grand Lawn Pavilion

11:00 – 11:50 am | Concurrent Session 2B: (tbc)

11:50 am – 12:10 pm | Networking Break

12:10 – 1:20 pm | Lunch

- Jerry Hesch and Alan Gassman

- Life Insurance Planning Panel – Techniques, Tax Planning and The Good, the Bad, and the Ugly

- Grand Lawn Pavilion

1:30– 2:20 pm | Concurrent Session 3A

- Tae Kelley Bronner

- Topic: Homestead Planning and Update

1:30 – 2:20 pm | Concurrent Session 3B

- Lester Law

- Topic: Basis Consistency for Estate and Income Tax Planning Purposes, and Multiple Implications Thereof.

2:30 – 3:20 pm | Concurrent Session 4A

- Marve Ann Alaimo and Dixon Miller

- Topic: International Estate Planning Rules and Planning Opportunities

2:30 – 3:20 pm | Concurrent Session 4B

- Susan Cassidy MD

- Topic: What You Need to Know for Your Client’s Medical Issues: Competency, Great Care Versus the Mainstream, What Medicare Recipients Should Seek Outside of the Medicare System, End of Life Communications and Planning and How Will the Above be Trumped.

3:30 – 4:20 pm | Concurrent Session 5A

- Alan Gassman

- Topic: Ethical Considerations to Avoid Estate and Trust Litigation and Family Disputes, and the 10 or so Avoidance Techniques You Should Be Actively Using

3:30 – 4:20 pm | Concurrent Session 5B

- Suzy Walsh

- Topic: Special Needs Trusts Essentials and Well Beyond

4:30 – 5:30 pm | Panel

- The Smart Planners Checklist for 2017 Planning and Q&A

5:30 pm | Closing Reception (tbc)

Richard Connolly’s World

Life Insurers Draw on Date, Not Blood

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the article of interest is “Life Insurers Draw on Data, Not Blood” by Leslie Scism. This article was featured in the Wall Street Journal on January 12, 2017.

Richard’s description is as follows:

In October, Dan Finkelstein, a 37-year-old father of three, set out to explore buying life insurance. He went online, and to his surprise in about 20 minutes he was the owner of a $750,000 policy.

Just a year ago, Mr. Finkelstein’s purchase would have taken a month and required blood and urine samples and other medical analysis. “I was definitely surprised how easy it was,” says Mr. Finkelstein, a computer-systems architect in Ellicott City, Md.

More life-insurance companies are trusting algorithms—using answers provided by applicants and data pulled from prescription-drug databases, motor-vehicle records and other sources—to reveal nearly as much about many people as analysis of blood and urine.

So confident are these companies, they are making some of the industry’s best prices available for the algorithm-driven policies. Mr. Finkelstein is paying $394 a year, one of the lowest rates currently available on a $750,000 policy for a mid-30s male, according to price-comparison websites.

This “simplified issue” term insurance is available only to people in preferred health looking for maximum insurance amounts of $500,000 to $1,000,000, depending on the insurance company.

Please click here to read this article in its entirety.

Humor! (Or Lack Thereof!)

Sign Sayings of the Week

**********************************************************

Peter the Piper

Ideal Spouse or Viper

Peter Piper met a mate.

Peter Piper had a prenuptial debate.

Before he knew her very well,

Dispute resolution chart clauses he did compel.

With full disclosure of assets and income,

They negotiated living arrangements, alimony and then some.

She had a good lawyer, he paid the fees,

And disclosed every asset including a car lease.

And there was no wedding date set, or invitations,

Until following full signing by all, and resulting libations.

The wedding went off without a hitch,

And then Peter started a business and got really rich.

His wife turned out to be a pest,

And we are sure that you have heard the rest.

Peter Piper paid the price,

And can preserve his wealth, even marrying twice or thrice.

This message is brought to you by the American Bar,

Heed this advice and you can go far.

And we thank Peter Piper for the promotional permission,

And apologize that we forced upon him a rough marital position.

**********************************************************

In the News

by Ron Ross

In the confusion of transition, the U.S. Constitution has been lost among mountains of other paper. But it probably won’t be needed for the next four years anyways.

**********************************************************

Upcoming Seminars and Webinars

Calendar of Events

**********************************************************

Just Announced

FREE LIVE WEBINAR:

Alan and Brandon Ketron will present a live webinar on the Estate Planner’s Update – Tax and Florida Law.

Date: February 6, 2017 | 12:30 PM (Eastern)

Additional Information: For more information or to register for this webinar, please contact Alan at agassman@gassmanpa.com or click here.

**********************************************************

REACH YOUR 2017 GOALS!

Saturday, February 11, 2017

Professional Achievement Workshop with Dr. Srikumar Rao and Alan Gassman

Join Dr. Rao and Alan for a seven-hour, interactive workshop designed towards law students, recent graduates, and other business professionals to reach new levels of enjoyment and achievement in their business or professional careers. The workshop is approved for two ethical hours, and five general legal hours of continuing legal education.

This workshop is based on Alan’s workshop materials that have been presented at the University of Florida, Ave Maria School of Law, and state & city Bar conferences. Net proceeds will benefit Stetson Law School.

Please click here for a schedule of the sessions Dr. Rao and Alan will cover in this workshop.

Date: Saturday, February 11, 2017 | 9:00 a.m. – 4:30 p.m.

Location: Stetson Law School, Gulfport Campus | 1401 61st Street South, St. Petersburg, FL, 33707

Cost: Free for all current law students and Alumni out less than one year. $75 for Alumni out one to three years, St. Pete and Clearwater Bar Solo Practice members, and charitable organization employees. $125 for all others. Includes free lunch, but not fried chicken.

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

Sunday, February 12, 2017

The Enjoyment Solution: How to Replace Worry and Stress with Clear Direction and Confidence, for your “In the Groove Experience” at Work and at Home with Dr. Srikumar Rao

This 6-hour workshop will be an intimate private workshop held by the Rao Institute at the request of Alan and friends. This will be provided for a limited number of attendees at a cost of $475 per person. Please RSVP now while spaces are available!

See Dr. Rao’s YouTube TED Talk, and you will see why he is so well-regarded and sought out worldwide as a presenter, coach, and author. Meet this gentle and brilliant man who has changed so many lives up close and personal!

You can see his best-selling books, Are You Ready to Succeed? and Happiness at Work on Amazon by clicking here. You can also see his TED Talk that has been viewed by well over 1 million people by clicking here.

Sarah Palin said that she would not leave Nome without them!

Date: Sunday, February 12, 2017

Location: Stetson Law School, Gulfport Campus | 1401 61st Street South, St. Petersburg, FL, 33707

Cost: $475 per person, or three for $1425

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan will present a live webinar on how FDIC Insurance works with Taylor Binder.

Date: February 14, 2016 | 12:30 PM (Eastern)

Additional Information: For more information, please contact Alan at agassman@gassmanpa.com.

**********************************************************

LIVE TRINITY PRESENTATION

Ken Crotty and Chris Denicolo will present RECENT DEVELOPMENTS AND STRATEGIES FOR ESTATE PLANNERS for the North Suncoast Estate Planning Council.

Date: Tuesday, February 21, 2017 | 5:00 p.m. EASTERN

Location: Fox Hollow Golf Club | 10050 Robert Trent Jones Pkwy, Trinity, FL 34655

Additional Information: For more information, please contact Alan at agassman@gassmanpa.com.

**********************************************************

LIVE SAN DIEGO PRESENTATION:

Alan will present ASSET PROTECTION AND ESTATE PLANNING FOR SAVVY BUSINESS OWNERS AND PROFESSIONALS at the 2017 Maui Mastermind Freedom Formula Workshop. You’ll get a “charge” out of this, whether you are a San Diego fan or not. For Maui Mastermind members only.

Date: Friday, January 27, 2017 – Sunday, January 29th, 2017 | Time TBD

Location: Hilton San Diego Mission Valley | 901 Camino del Rio South, San Diego, CA, 92108

Additional Information: For more information, please contact Alan at agassman@gassmanpa.com.

**********************************************************

LIVE TAMPA PRESENTATION:

ANNUAL ALEXANDER L. PASKAY MEMORIAL BANKRUPTCY SEMINAR

Alan, Mike Markham and John Anthony, Esq. will speak on a panel at the American Bankruptcy Institute’s annual Alexander L. Paskay Memorial Bankruptcy Seminar on the topic of THE ETHICS OF ASSET PROTECTION.

Bring your copy of Gassman and Markham on Florida and Federal Asset Protection Law for free autographs.

Date: Thursday, February 2, 2017 | 4:00 p.m. EASTERN

Location: The Embassy Suites Tampa Downtown Convention Center | 513 S. Florida Avenue, Tampa, FL, 33602

Additional Information: If you are interested in registering for this presentation, please contact Alan at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO FLORIDA BAR PRESENTATION:

REPRESENTING THE PHYSICIAN: IT IS HARDER THAN IT LOOKS

Alan and Lester Perling will give a panel discussion talk on Structuring Medical Practices and Related Entities for Tax, Creditor Insulation, and Regulatory Compliance Purposes

Other speakers at this event include William Eck, Susan Thomas, Melissa Mora, Sachi Mankodi, Kimberly Brandt, Al Gomez, Kathleen Premo, and Radha Bachman.

Topics include:

- The Brave New World of Medicare Physician Compensation Under MACRA and Beyond

- Office of Civil Rights HIPAA Audits – Preparing Your Clients and Yourself

- The Physician’s Role Under EMTALA and the Florida Access to Emergency Services Act

- Medical Marijuana in Florida – The Highs and Lows of its Regulation

- The Post-Election View from the Hill

- What the Doctor’s Lawyer and the Doctor Need to Know About Bankruptcy and How Creditors Approach Health Industry Related Situations

- Medicare and Other Risk Contracts

- Medical Entities and Rules You Must Know About

Date: Friday, February 3, 2017 | Alan speaks at 8:30 AM and 4:10 PM.

Location: Rosen Centre Hotel | 9840 International Drive, Orlando, FL, 32819

Additional Information: If you are interested in registering for this presentation, please contact Alan at agassman@gassmanpa.com.

**********************************************************

LIVE DISNEY WORLD PRESENTATION (HOW MICKEY MOUSE CAN YOU GET?):

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan will be speaking at the Medical Education Resources (MER) Internal Medicine and Country Bear Jamboree for primary care physicians and other characters. We thank MER for this wonderful opportunity and Walt Disney for having paved all of Osceola County. His topics will include:

- The 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning

- Lawsuits 101

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: Wednesday, March 15, 2017 and Thursday, March 16, 2017

Location: Walt Disney World BoardWalk Inn | 2101 Epcot Resorts Blvd, Kissimmee, FL 34747

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE ESTATE PLANNING DISCUSSION AT FLORIDA STATE UNIVERSITY SCHOOL OF LAW

Alan will appear via Skype with professors Steven Hogan and Bob Pierce to give his views, by interview style, for their estate planning course at Florida State University School of Law on Thursday, March 23, 2017.

Date: Thursday, March 23, 2017 | 1:15 – 3:00 p.m. (EASTERN)

Location: Florida State University School of Law

Additional Information: To receive a live call in code or videotape of this presentation, which we will qualify for continuing legal education credit, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE ESTATE PLANNING COUNCIL OF NORTHEAST FLORIDA PRESENTATION:

Alan will be speaking for the Estate Planning Council of Northeast Florida on March 20, 2018 on the topic of DYNAMIC PLANNING STRATEGIES FOR THE SUCCESSFUL CLIENT. This will be Alan’s third visit to Pensacola, and a welcome treat. Watch this space, as more details will be forthcoming!

Date: Tuesday, March 20, 2018

Location: To Be Determined

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

4th ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Please put Friday, April 28th, 2017 on your calendar to enjoy the 4th Annual Ave Maria School of Law Estate Planning Conference and the weekend that follows in Naples.

Alan will be speaking at this conference on the topic of THE ETHICS OF AVOIDING TRUSTS AND ESTATE LITIGATION.

Alan will also appear on a panel of speakers with Jerry Hesch and Lester Law on the topic of TAX PLANNING WITH LIFE INSURANCE PRODUCTS, RECENT LITIGATIONS, AND OTHER HOT TOPICS.

Other speakers and topics include the following:

- Stacy Eastland – So Much to Choose From and So Little Time: A Comparison of the Best Freeze Planning Techniques

- Jonathan Gopman – Tax Issues and Tax Compliance for Asset Protection Trusts

- Jerry Hesch – Innovative Business Succession Techniques, and is appearing on the panel Tax Planning with Life Insurance Products, Recent Litigations, and Other Hot Topics

Date: Friday, April 28, 2017

Location: The Ritz-Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE PRESENTATION:

ESTATE PLANNING COUNCIL OF NORTHEAST FLORIDA

Please put Tuesday, September 19, 2017 on your calendar to enjoy a dinner conference for the Estate Planning Council of Northeast Florida.

Date: Tuesday, September 19, 2017

Location: TBA

**********************************************************

Save the Dates!

LIVE ST. PETERSBURG PRESENTATION:

2017 ALL CHILDREN’S HOSPITAL FOUNDATION SEMINAR

Please put Thursday, February 9th, 2017 and on your calendar to enjoy the 19th Annual All Children’s Hospital Estate, Tax, Legal, and Financial Planning Seminar.

Speakers will include Turney Berry, Paul Lee, Sanford Schlesinger, and Jerry Hesch.

Date: Thursday, February 9th, 2017

Location: Johns Hopkins All Children’s Hospital Education and Conference Center, St. Petersburg, FL

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE LAS VEGAS PRESENTATION:

AICPA ADVANCED PERSONAL FINANCIAL PLANNING CONFERENCE

Alan will be speaking at the Advanced Personal Financial Planning Conference, sponsored by The American Institute of CPAs. His tentative topic for this event is LIFE INSURANCE TIPS FOR THE FINANCIAL PLANNING PROFESSIONAL.

This conference is part of the AICPA ENGAGE event, which brings together five well-known AICPA conferences with the Association for Accounting Marketing Summit for one, four-day event. The conferences included in ENGAGE are Advanced Personal Financial Planning, Advanced Estate Planning, Tax Strategies for the High-Income Individual, the Practitioners Symposium/TECH+ Conference, the National Advanced Accounting and Auditing Technical Symposium, and the Association for Accounting Marketing Summit.

Date: June 12th – June 15th, 2017 | Alan’s date and time are to be determined.

Location: MGM Grand | 3799 S. Las Vegas Blvd., Las Vegas, NV, 89109

Additional Information: For more information, please email Alan at agassman@gassmanpa.com or click here.

**********************************************************

LIVE PRESENTATIONS:

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan will be speaking at the following Medical Education Resources (MER) events:

- October 20th – October 22nd, 2017 in New York, New York

- November 30th – December 3rd, 2017 in Nassau, Bahamas

His tentative topics for these events include the 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning, Lawsuits 101, 50 Ways to Leave Your Overhead, and Essential Creditor Protection and Retirement Planning Considerations.

Date: New York: October 20th – 22nd, 2017; Nassau: November 30th – December 3rd, 2017

Location: New York: To be determined.

Nassau: Atlantis Hotel | Paradise Beach Drive, Paradise Island, Bahamas

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

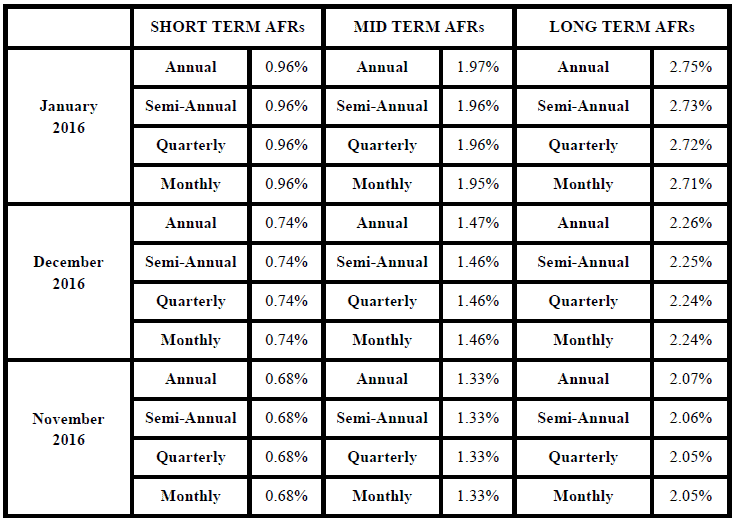

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.