The ERC Report – Issue 341

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Friday, October 27, 2023ERC ALERT

Issue #341Coming from the Law Offices of Gassman, Denicolo & Ketron, P.A. in Clearwater, FL. Edited By: Alan Gassman |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Please Note: Gassman, Crotty, & Denicolo, P.A. will be sending the Thursday Report out during the first week of every month. Article 1Corporate Transparency Act: Implications to Estate PlanningWritten By: Abigail O’Connor, Martin Shenkman & Jonathan Blattmachr Article 2How the 3% Cap on Homestead Tax Assessments Continues after Death – You can’t take it with you but can you leave it to your spouse or significant other?Written By: Brock Exline Article 3When There is No Will, There is Still a Way (To Retitle Automobiles of the Decedent)Written By: Brock Exline & Joey Kleiner For Finkel’s FollowersYou Are Probably Looking for the Wrong Type of Personal AssistantWritten By: David Finkel Free Upcoming WebinarDesigning and Building a Family’s Complex Wealth StructurePresented by: Alan Gassman, JD, LL.M. (Taxation), AEP (Distinguished) & Chris Roe More Upcoming EventsYouTube LibraryHumor |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Your CPAs Guide to the New ERC Crisis

Written By: Alan Gassman, JD, LL.M. (Taxation), AEP® (Distinguished)

Alan Gassman’s Forbes article posted today starts as follows: The expansion and strong marketing tactics of good-for-nothing “accounting advisors” who encouraged taxpayers to qualify for the Employee Retention Credit (“ERC”) when they did not technically qualify has caused tens of thousands of ineligible and false applications. This will result in hundreds – if not thousands – of criminal investigations and many more civil penalty situations. Taxpayers who may have filed an ERC claim with these issues should consult independent legal counsel immediately under the attorney/client privilege to determine how to move forward best. On September 14, 2023, the Internal Revenue Service (“IRS”) issued IR-2023-169, which announced the immediate suspension of new claims through the end of the year. The Announcement came following “growing concerns inside the tax agency, from tax professionals as well as media reports that a substantial share of new claims from the aging program are ineligible and increasingly putting businesses at financial risk by being pressured and scammed by aggressive promoters and marketing.” Following the Announcement, the IRS also issued FS-2023-24 on October 19th, which outlines a process for taxpayers to withdraw their ERC claims. Taxpayers who have filed claims should review the qualification requirements with a qualified attorney to determine whether the claim was appropriate. If the claim was deemed not appropriate, they should immediately withdraw the claim through the withdrawal process outlined by the IRS…Continue reading on Forbes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Join us for this Spook-tacular Presentation!

REGISTER HEREPlease Note: After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 3-5 hours after the program concludes, the recording and materials will be sent to the email address you registered with. Important: If you are already on the “Register For All Upcoming Free Webinars” list, you will be auto-registered. Please email registration questions to info@gassmanpa.com.

REGISTER HERE |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1This article is being shared courtsey of our Friends at Leimberg You can get a free trial at Leimberg by clicking here. it is am amazing library and update system. DON’T go home without it. Corporate Transparency Act: Implications to Estate Planning

Written By: Abigal O’Connor, Martin Shenkman, CPA, MBA, PFS, AEP, JD & Jonathan Blattmachr, JD, LL.M.

1. Introduction. a. The Corporate Transparency Act (“CTA”)1 is a new federal law that will impact the owners, principles and other control persons involved in almost all limited liability companies (LLCs), corporations (both C and S corporations), limited partnerships (LPs), and other closely held entities, as well as those who form those companies. Congress enacted the CTA in 2021 as part of the National Defense Authorization Act for Fiscal Year 2021. The principal purpose of the CTA is to strip U.S. shell companies of anonymity that can hide illicit financial activity and for use in financing terrorist activities. But the reach will be very broad and will impact millions of legitimate small businesses. This is accomplished by requiring “reporting companies” to file information with the Federal government about those who control or own interests in them. There are exceptions to these filing requirements that are discussed below; generally, those exceptions apply to very large or already-regulated industries. Most of the entities created by individuals as part of an investment plan (e.g., a holding company for securities or owning rental real estate or almost any type of a small business,), an estate plan (e.g., an LLC designed to hold various investments to facilitate trust funding or administration), or asset protection planning (any entity created to insulate the assets it holds, or to insulate those who own the entity for claims arising from the assets the entity holds) likely will be subjected to the new reporting rules. Unlike most laws which are aimed at larger entities, the CTA is aimed at smaller ones: those with fewer than 20 fulltime employees or whose gross receipts for the prior year do not exceed $5 million. b. The US Treasury’s Financial Crimes Enforcement Net (known as FinCEN and which is charged with enforcing the law), estimates that 32 million existing entities may face filing obligations. That will be increased by all new entities formed in the future. Thus, the CTA will impact a wide swath of Americans and their advisers as all try to grapple with this broad new requirement. FinCEN will be in charge of creating and maintaining the database, which as of now will not be public record but it will be available to a variety of governmental agencies, and possibly others in the future. c. Existing entities (those in existence prior to January 1, 2024) will have until January 1, 2025 to comply. But as discussed in more detail below, entities and owners/control persons should begin planning for the filings now. New entities formed after January 1, 2024 will have 30 days to file their initial reports. FinCEN has proposed to extend the initial filing deadline for beneficial ownership reports from 30 to 90 days for entities created or registered on or after Jan. 1, 2024, and before Jan. 1, 2025, from formation to file.2 As of the writing of this article, that extension has not been granted and companies should for now plan on the 30-day requirement. While lawsuits have been filed challenging these new requirements, considering that similar requirements apply in many other countries, it may be unlikely for the challenges to succeed. But in any event, given the proximity of the filing requirements, the challenges of 32 million entities complying with a new and complex law, everyone who might be impacted should begin planning now for how they will comply. d. Considering the severe penalties for non-compliance, anyone who may even possibly be effected should proactively address the requirements. These are discussed below. e. Most, if not all, small businesses will be subject to the new rules (other than proprietorships and general partnerships), including “business” entities that are formed as part of what most practitioners consider regular, everyday estate planning. The couple who purchases a weekend home but uses an LLC to insulate themselves from liability for anything occurring on the property, will be subject to these rules. The group of siblings, who inherit a family cabin together and create an LLC to govern coownership more easily, will be subject to the new rules. Although there are exemptions to the rules, there are no exemptions for small entities such as these. It matters not if the entity has no (or virtually no) receipts, if the entity holds assets. Indeed, while there is an exemption for very large entities, there is no exemption for very small entities, even if there is no gross income, as long as there are assets held by the entity. f. There are significant civil and criminal penalties for failing to comply, so all entities, entity owners, managers and those controlling these entities, need to be aware of these developments. Importantly, the reporting requirement is not a one-time event. There is an initial reporting requirement and then ongoing reporting requirements if there is a change, e.g., a control person moves to a new home address, or perhaps a new manager is named for an LLC and that might have to be reported as a change in control persons. These rules will impact many who have implemented estate planning or asset protection planning. The clients of most estate planning practitioners are likely to be affected. g. A critical issue will be who will handle the filing. Corporate filing services that assist in the formation of entities and serve as registered agents may try to expand to meet the new CTA filings as yet another service they offer. CPAs may try to assist in the CTA reporting but may not have the information or expertise for all aspects of this. Wealth advisory firms might even endeavor to expand the scope of services they offer. However, attorneys will have the most relevant expertise and in addition to handling the filings may also be able to identify other legal matters that need to be tended to (e.g., an update of the entity governing documents, identifying “beneficial owners” of trusts that hold interests in LLCs). h. As an example the complexity and challenges that will face potential filers involved with estate planning the guidance issued to date is not clear or particularly instructive as to complex trust planning. The guidance provided: “Note for trusts: The following individuals may hold ownership interests in a reporting company through a trust or similar arrangements: A trustee or other individual with the authority to dispose of trust assets; A beneficiary who is the sole permissible recipient of trust income and principal or who has the right to demand a distribution of or withdraw substantially all of the trust assets; A grantor or settlor who has the right to revoke or otherwise withdraw trust assets.” Given the tremendous variation it fiduciary and non-fiduciary positions, variations in state laws that govern trusts, trustees, powerholders, etc. there will be significant uncertainty over filing requirements and who will have responsibility. Beginning the analysis of each trust and its position and rights will be a daunting task that should begin now. Note that while trusts themselves are not among the entities directly covered by the new CTA, a trust which owns or controls an entity that is covered will have reporting requirements. 2. Corporate Transparency Act. a. The purpose of the CTA is to create a national database of companies in the U.S. that identifies the human beings behind the companies (both owners and those in control of the entities). The law is part of an increasing effort to combat money-laundering, terrorism, tax evasion and other financial crimes. Congress intended to try to help law enforcement by creating this national database that would allow law enforcement to sift through so-called “shell companies” that are used for nefarious purposes. These rules are very different from any reporting that people have faced previously (e.g., annual reports to states where formed and income tax returns). Because the reporting requirements are quite different from income tax returns, clients’ CPAs may not be able to, or perhaps may not be willing to, handle these filings. b. These rules and reports will be uncomfortable as well as burdensome. Those required to report may have to disclose their names and home addresses to comply with the rules, even if they do not actually own an interest in a company. This could apply, for example, to someone who has control over certain financial aspects of a reporting entity, but owns no interests, and will have to make detailed personal disclosures. Many will find these disclosures invasive and a further erosion of whatever limited privacy they believed they still have…..Continue Reading on LISI

LISI Business Entities Newsletter #280 (October 23, 2023) at http://www.leimbergservices.com ©2023 by Martin M. Shenkman, Abigail OConnor, and Jonathan G. Blattmachr. All Rights Reserved. Reproduction in Any Form or Forwarding to Any Person Prohibited Without Express Permission. This newsletter is designed to provide accurate and authoritative information regarding the subject matter covered. It is provided with the understanding that LISI is not engaged in rendering legal, accounting, or other professional advice or services. If such advice is required, the services of a competent professional should be sought. Statements of fact or opinion are the responsibility of the authors and do not represent an opinion on the part of the officers or staff of LISI. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Article 3When There is No Will, There is Still a Way (To Retitle Automobiles of the Decedent)

Written By: Brock Exline, Esq. & Joey Kleiner, Stetson Student

When transferring an automobile in Florida, the Department of Motor Vehicles (DMV) requires the name on the vehicle’s title to match the name of the person selling the vehicle. Of course, matching the seller to the owner makes sense; you can’t sell what you don’t own! So how should you handle the sale or transfer of a vehicle following the unfortunate event of a loved one’s passing? Many estate assets can bypass the probate process. For example, assume a deceased individual’s estate is comprised of real estate, bank accounts, brokerage accounts, retirement accounts, and a couple of automobiles. If the deceased individual’s real estate transfers to their intended heirs through tenancy by the entireties, and the bank, brokerage, and retirement accounts all have valid pay-on-death beneficiary designations, the only remaining assets without an effective transfer on death would be the automobiles. In such a situation, it would appear both costly and cumbersome to initiate a probate proceeding solely for the purpose of transferring the vehicle’s title after the owner’s demise. Particularly of note for this article, Subsection 319.28(1)(c) provides that when the application for a Certificate of Title is made by an heir of a previous owner who died intestate (without a valid will), it is not necessary to obtain an order of a probate court as long as the applicant files an affidavit with the DMV stating that the estate is not indebted and that the surviving spouse (if any) and other heirs have reached a mutual agreement upon a division of the estate. The DMV publishes a helpful form for this exact scenario, called the HSMV 82040 MV. This two-page form allows the applicant wishing to gain ownership of the automobile to provide necessary information to transfer title, as well as gain signatures from any heirs to release the heirs potential claim to the vehicle. Section 13 of the HSMV form 82040, entitled “Release of Spouse or Heirs Interest,” is signed under penalties of perjury by the surviving spouse and/or heirs and serves as the affidavit to satisfy the requirements of Section 319.28(1)(c). Alternatively, a more formal affidavit may be completed which contains recitals that the estate is not indebted and that the surviving spouse and other heirs have amicably agreed on the division of the estate. Be sure to make an appointment at the DMV once you have all the paperwork in order to prevent sitting around a government office longer than necessary! Other important items to bring with you when applying for a transfer of Certificate of Title include: the current Certificate of Title, a photocopy of the decedent’s death certificate, proof of the applicant’s ID, notarized affidavits of no estate indebtedness and agreement among the surviving spouse and heirs regarding the amicable division of estate assets. The affidavit does not need to list specifics regarding how the estate’s assets will be divided, just that all parties have agreed upon a plan of distribution. In conclusion, vehicles registered with the Florida DMV require a few extra steps to transfer ownership when there is no will directing an estate administrator. By following the guidelines in this article, you can navigate this process more smoothly and efficiently, arriving prepared for your appointment with the documents you need to get the vehicle retitled. For more information, check out section E (“Ownership is Recorded only in the Name of the deceased and the Estate is Not Administered”) on page 10 of the DMV’s procedure manual available at https://www.flhsmv.gov/pdf/proc/tl/tl-18.pdf. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

For Finkel’s FollowersYou Are Probably Looking for the Wrong Type of Personal Assistant |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Free Saturday WebinarPart 1: Designing and Building A Family’s Complex Wealth StructureDate: Saturday, October 28, 2023 Time: 11:00 AM to 12:00 PM EST (60 minutes) Presented by: Alan Gassman, JD, LL.M. (Taxation), AEP (Distinguished) & Chris Roe

STICK AROUND FOR A 30 MINUTE DEMONSTRATION OF ESTATEVIEW FROM 12:00 PM TO 12:30 PM EST REGISTER HERE FOR NON-CPE CREDIT REGISTER HERE FOR 1.0 CPE CREDIT Please Note: After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 3-5 hours after the program concludes, the recording and materials will be sent to the email address you registered with. Important: If you are already on the “Register For All Upcoming Free Webinars” list, you will be auto-registered on Friday for non-CPE credit. If you would like 1.0 free CPE Credit for this webinar, please register above through CPA Academy. If you would like Florida CLE Credit, please register through the provided link above. Please email registration questions to info@gassmanpa.com. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

ALL UPCOMING EVENTS

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

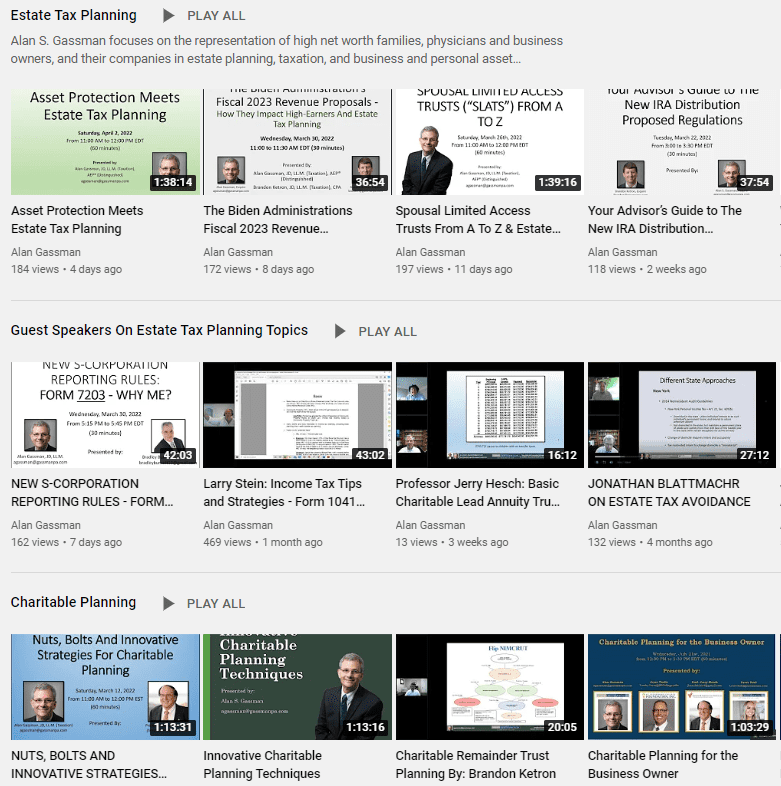

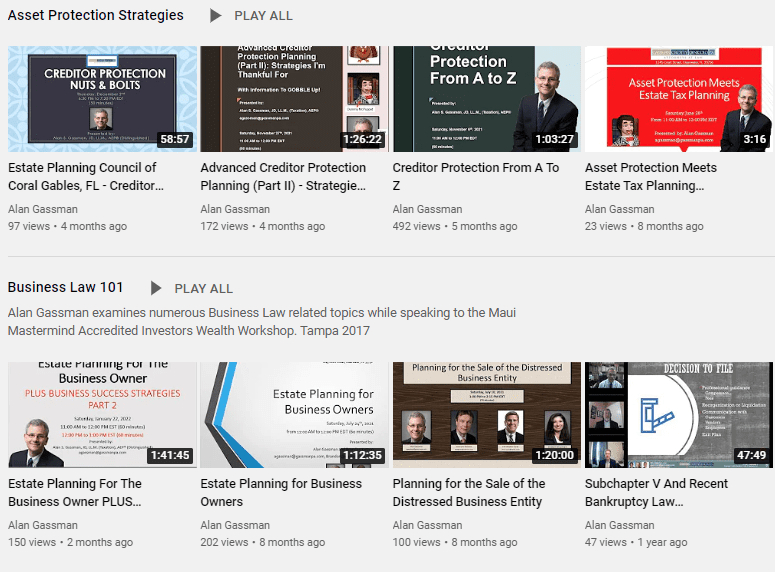

YouTube Library

Visit Alan Gassman’s YouTube Channel for complimentary webinars and more! The PowerPoint materials can be found in the description box located at the bottom of the YouTube recording. Click here or on the image of the playlists below to go to Alan Gassman’s YouTube Library. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

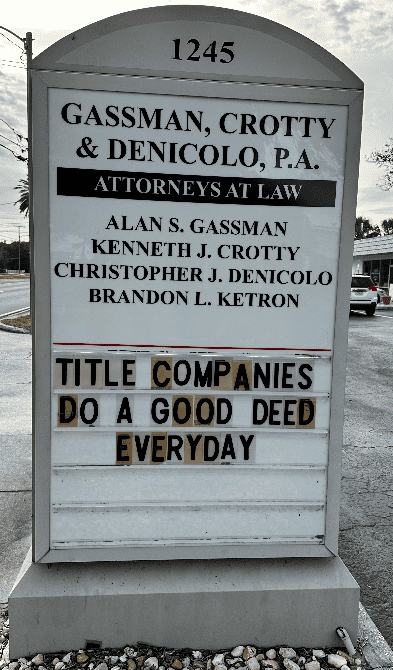

HUMOR – Or Lack Thereof

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Gassman, Denicolo & Ketron, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2023 Gassman, Crotty & Denicolo, P.A |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||