The Employee Retention Credit Report – Issue 298

ALWAYS FREE, SOMETIMES PUBLISHED ON THURSDAYS

Thursday, January 28, 2021 – Issue 298

Having trouble viewing this? Use this link

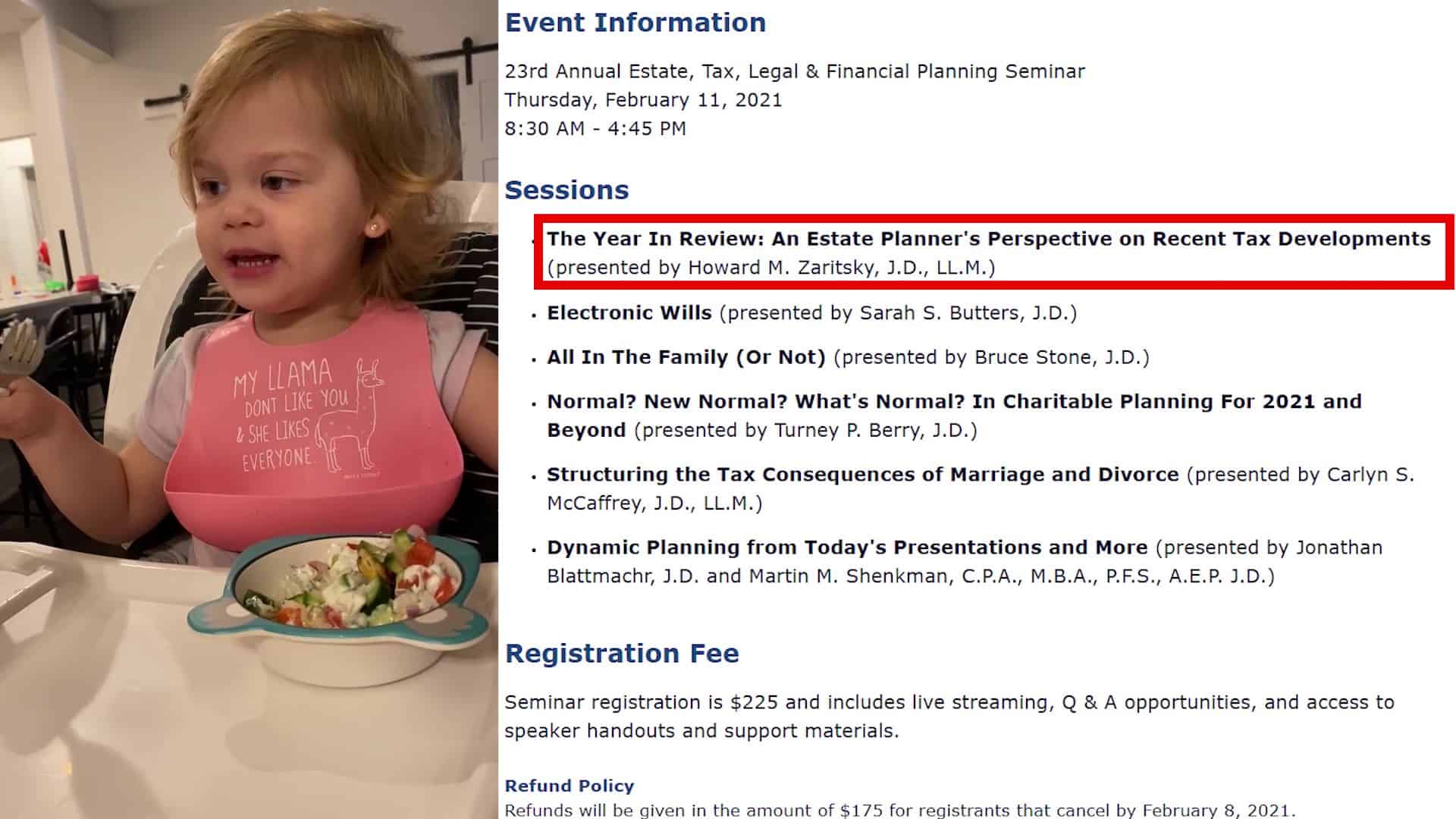

Johns Hopkins All Children’s Hospital 23rd Annual Estate Planning Seminar

Excerpts from The Employee Retention Credit Guide

Charities Can Enjoy Enhanced Donations from Donors Who Wish to Contribute Appreciated Assets Plus Cash to a Combined Limit of Their Adjusted Gross Income

Upcoming Events

Lawyer 2 Lawyer Podcast: Legal Liability Stemming from the Capitol Riot

New PPP Resource

For Finkel’s Followers

Humor

Ava Archer (Future Presenter), Jonathan Blattmachr, Martin Shenkman & Alan Gassman introduce the Johns Hopkins All Children’s 23rd Annual Estate Planning Seminar’s Speakers & Topics

Is your day fully billable? Watch the 4-minute version using this link

Still not convinced? Watch the 19-minute version which includes Unique Planning Opportunities from Jonathan Blattmachr and Martin Shenkman

Excerpts from The Employee Retention Credit Guide

On January 25th, we published an eBook: The Employee Retention Credit Guide – Everything You Need to Know to Claim and Receive the Employee Retention Credit

It is available for purchase through Leimberg Information Services using this link.

INTRODUCTION

Please note that we both explain the law and provide the relevant sections of the law throughout this book, for those who want verification and more information and detail. We have also provided all Frequently Asked Questions (FAQs) issued by the Internal Revenue Service (IRS) on the ERC to date in the Appendix; however please note that the FAQs have not been updated since the passage of the Economic Aid Act so some may be out of date. This book will be updated as guidance is released.

We begin by describing how businesses determine if they are eligible to receive the ERC, what quarters, or time period, that they are eligible to receive the ERC for, and then how to calculate and claim the ERC.

Perhaps the most consequential change from 2020 to 2021 is that employers who received PPP loans in 2020, and were therefore not eligible to receive ERCs, are now permitted to retroactively claim the ERCs they would have qualified for. Prior to the passage of the Economic Aid Act, there was a strict prohibition against employers receiving both PPP loans and ERC credits. Now businesses have the opportunity to apply for the ERC so long as they do not use the same wages for the ERC and also for PPP forgiveness, as further described herein.

Another consequential change is that employers can now retroactively claim the ERCs for wages paid in previous quarters if the business filed their payroll tax return before December 27th, 2020. This is described in greater detail in subsection 7 of this book.

Interestingly, the law does not require that any decline in Gross Receipts or damage to the business had to be attributable to COVID-19. Any employer that satisfies the Gross Receipts reduction test is eligible for the credit, even if the employer made more profits in 2020 or 2021 than in 2019! This could be a huge windfall for many business owners.

The first step for businesses is to determine whether they are eligible to receive the ERC.

WHAT BUSINESSES ARE ELIGIBLE TO RECEIVE THE ERC?

There are very few restrictions regarding what type of businesses can claim ERCs. There are no size limitations, and the only real stipulation is that an employer must be “carrying on a trade or business in the year 2020” and must be an “Eligible Employer.”

An Eligible Employer is defined in the CARES Act as follows:

(2) ELIGIBLE EMPLOYER.—

IN GENERAL.—The term ‘‘eligible employer’’ means any employer—

(i) which was carrying on a trade or business during calendar year 2020, and…

Even 501(c) organizations that are exempted from federal taxation, and can include organizations considered to be charities will be permitted to receive the ERC. The CARES Act states as follows:

(C) TAX-EXEMPT ORGANIZATIONS.—In the case of an organization which is described in section 501(c) of the Internal Revenue Code of 1986 and exempt from tax under section 501(a) of such Code, clauses (i) and (ii)(I) of subparagraph (A) shall apply to all operations of such organization.

The IRS defines a “trade or business” as “any activity carried on for the production of income from selling goods or performing services,” and IRS FAQ #17 additionally provides the following guidance:

17. What is a “trade or business” for purposes of the Employee Retention Credit?

For purposes of the Employee Retention Credit, “trade or business” has the same meaning as when used in section 162 of the Internal Revenue Code (the “Code”) other than the trade or business of performing services as an employee. Under section 162 of the Code, an activity does not qualify as a trade or business unless its primary purpose is to make a profit and it is carried on with regularity and continuity. The facts and circumstances of each case determine whether an activity is a trade or business. A taxpayer does not necessarily need to make a profit in any particular year in order to be in a trade or business as long as a good faith profit motive is present.

For purposes of the Employee Retention Credit, a tax-exempt organization described in section 501(c) of the Code that is exempt from tax under section 501(a) of the Code is deemed to be engaged in a “trade or business” with respect to all operations of the organization.

Despite the great number of businesses that will qualify for the ERC, the following entities will not qualify:

1. Sole proprietors and independent contractors who file a Form 1040 Schedule C income tax return, and business entities taxed as S corporations, C corporations and partnerships will not qualify for the credit unless they paid W-2 wages in 2020 or 2021 to one or more individuals who are not related to the employer. (See IRS FAQ # 23)

2. Employers having more than 100 employees for 2020, or more than 500 employees for 2021, will only qualify to the extent of wages that were paid to employees for time where the employee was not working whatsoever (i.e. furloughs), as further discussed below.

3. Federal, state, or local government entities.

4. Household Employers. (See IRS FAQ #24)

DID THE ELIGIBLE BUSINESS HAVE (1) A SUFFICIENT REDUCTION IN REVENUES OR (2) FULL OR PARTIAL SUSPENSION OF THE BUSINESS TO QUALIFY FOR THE CREDIT?

Once it is determined whether or not a business will qualify to receive the ERC on its face, advisors can determine if a business has any quarters in which they are eligible to actually receive credits.

HOW TO DETERMINE WHAT PERIOD A BORROWER IS ELIGIBLE TO RECEIVE THE ERC FOR

Eligibility to receive ERCs is determined on a quarter-by-quarter basis if the revenue reduction test is met and on a per day basis if the business is fully or partially suspended.

To qualify for the ERC, an employer must demonstrate that their business was a victim of either one of the following:

1. Full or Partial Suspension – For the Days Applicable. The operation of the business was fully or partially suspended due to orders from a government authority limiting commerce, travel, or group meetings due to COVID-19; or

2. Reduction in Gross Receipts for a Calendar Quarter. Gross Receipts are less than 50% of the Gross Receipts for the same quarter in the previous year until Gross Receipts are 80% of the Gross Receipts in the same quarter for the previous year, as further described below (this changed for 2021 but more on that later).

The CARES Act provision that provides these rules in far less simple terms is as follows:

(A) IN GENERAL.—The term ‘‘eligible employer’’ means any employer—

(i) which was carrying on a trade or business during calendar year 2020, and

(ii) with respect to any calendar quarter, for which—

(I) the operation of the trade or business described in clause (i) is fully or partially suspended during the calendar quarter due to orders from an appropriate governmental authority limiting commerce, travel, or group meetings (for commercial, social, religious, or other purposes) due to the coronavirus disease 2019 (COVID–19), or

(II) such calendar quarter is within the period described in subparagraph (B).

(A) SIGNIFICANT DECLINE IN GROSS RECEIPTS.—The period described in this subparagraph is the period—

(i) beginning with the first calendar quarter beginning after December 31, 2019, for which gross receipts (within the meaning of section 448(c) of the Internal Revenue Code of 1986) for the calendar quarter are less than 50 percent of gross receipts for the same calendar quarter in the prior year, and

(ii) ending with the calendar quarter following the first calendar quarter beginning after a calendar quarter described in clause (i) for which gross receipts of such employer are greater than 80 percent of gross receipts for the same calendar quarter in the prior year.

Obviously, there are a lot of moving parts to consider here…

Charities Can Enjoy Enhanced Donations from Donors Who Wish to Contribute Appreciated Assets Plus Cash to a Combined Limit of Their Adjusted Gross Income

Alan Gassman & Ian MacLean

EXECUTIVE SUMMARY:

In 2017, the Tax Cut and Jobs Act (TCJA) raised the standard deduction from $6,350 to $12,000 for individuals and $12,700 to $24,000 for married couples filing jointly (for 2020, the standard deduction is $12,400 for individuals and $24,400 for married couples filing jointly). With this increase, there was speculation that charitable contributions would inevitably decrease due to more taxpayers choosing to use the standard deduction, thus resulting in less taxpayers choosing to itemize deductions on their tax returns, with such deductions consisting of charitable contributions.

On the other hand, there was also the hope that charitable contributions could increase because the TCJA increased the limit for charitable deductions made in cash from 50 percent to 60 percent of a taxpayer’s contribution base (the taxpayer’s Adjusted Gross Income (AGI)) for tax years beginning after December 31, 2017 and before January 1, 2026).

With respect to this increased limitation, the major drawback is that this TCJA 60 percent change does not allow for “stacking.” By stacking, we mean, that the TCJA only allows a taxpayer to receive a full deduction equal to 60 percent of their AGI if their charitable contributions are made only in cash, and not, for example, a full deduction equal to 60 percent of their AGI if the taxpayer’s aggregate donations consisted of a contribution of appreciated long-term capital gain property equal to 30 percent of their AGI and the remaining contributions made in cash or equal to 30 percent of their AGI.

When the Coronavirus Aid, Relief, and Economic Security (CARES) Act was passed in March 2020 as a response to the COVID-19 pandemic, Sec. 2205(a) of such Act increased the limitation for cash contributions made to public charities from the TCJA’s limitation of 60 percent of a taxpayers AGI to 100 percent of the taxpayers AGI. Sec. 2205(a) of the CARES Act also removed the TCJA’s major drawback described above by allowing taxpayers to, for the 2020 tax year only, “stack” their charitable contributions made in cash on top of their non-cash charitable contributions (which are still subject to the 50 percent AGI limitation described in Internal Revenue Code § 170(b)(1)(A)), and receive a full deduction equal to 100 percent of their AGI.

As we note later in this newsletter, a difference between the TCJA’s 60 percent limitation and the CARES Act’s 100 percent limitation for cash contributions is that the 60 percent limitation applies to cash contributions made to all of the organizations described in IRC § 170(b)(1)(A), while the 100 percent limitation applies to cash contributions made to all of the organizations described in IRC § 170(b)(1)(A), with the exception of supporting organizations and donor advised funds.

Because the 2017 TCJA provision does not allow stacking, some practitioners, including us, believed that it was the intent of Congress to expand the 60 percent rule to a 100 percent rule, with the assumption that stacking would again not be allowed. Contrary to our belief, the IRS’s draft instructions for Form 1040 that were issued on November 25, 2020 help to confirm that Sec. 2205(a) of the CARES Act and Internal Revenue Code Section 170 allow for “stacking.”

Thus, for example, in 2020 an individual can contribute appreciated long- term capital gain property to charity for an income tax deduction worth up to the normal percentage of gross income limitation on deductibility (normally the fair market value (FMV) of the appreciated asset, not exceeding 50 percent of the individual’s adjusted gross income (AGI)) and then they may additionally make tax deductible cash gifts to public charities where the combined value of cumulative donations do not exceed 100 percent of AGI.

Tax advisor David Kirk, who was with the IRS Office of Chief Counsel and now works for the CPA firm Ernst & Young believes that this is the case, and we cannot think of a better source of confirmation for this. David’s comment on this is as follows:

The opportunity to stack cash on top of the other percentage limitations is a 2020 only windfall for taxpayers, especially those with contribution carryovers. Because these special cash contributions are the last contribution to be applied to the “contribution base (a/k/a AGI)” the normal rules of section 170 will apply. Therefore, regular contributions made in 2020 come first, carryovers from prior years come second, and then the special cash contributions come last. This allows extremely generous taxpayers to clear out their carryovers while still maintaining their normal level of giving. This also allows many taxpayers to zero-out taxable income.

However, it is important to keep in mind that giving away 100% of AGI is not the target threshold for those looking to eliminate taxable income. The target contribution amount is actually the excess of (a) AGI, minus (b) the total of all other itemized deductions other than charity. For example, a taxpayer has

$1,000,000 of AGI, $10,000 of real estate taxes paid, and

$80,000 of interest expense, her target for charitable donations is only $910,000. This could be accomplished, for example, by giving $300,000 of appreciated securities to a DAF / public charity, and then putting $200,000 of cash into a DAF / public charity, and then ‘topping up’ with $410,000 of these special cash contributions. The same would occur if this taxpayer had

$300,000 of 30% carryovers and $200,000 of 50% carryovers. Thus, the taxpayer with carryovers could give away $410,000 in cash in 2020 and have zero taxable income.Finally, keep in mind that individual taxpayers can zero-out their taxable income, but charitable contributions do not offset SE Tax or the NIIT, so there still may be some liability with the filing of their 2020 returns.

The following provides further background with respect to the “stacking” issue, and delineates how this change for the 2020 tax year works to allow individuals to make larger charitable contributions than they may have made in previous years.

COMMENT:

As described above, the limit for noncash contributions is generally 50 percent of the taxpayer’s AGI,i and gifts of appreciated property are generally subject to lower deduction limits. Section 170(b)(1) of the Internal Revenue Code provides that donations of long-term capital gain property to public charities, private operating foundations, or federal, state, or local government are limited to 30 percent of the taxpayer’s AGI, while contributions to private nonoperating foundations or certain other qualifying organizations are generally limited to 20 percent of the taxpayer’s AGI.

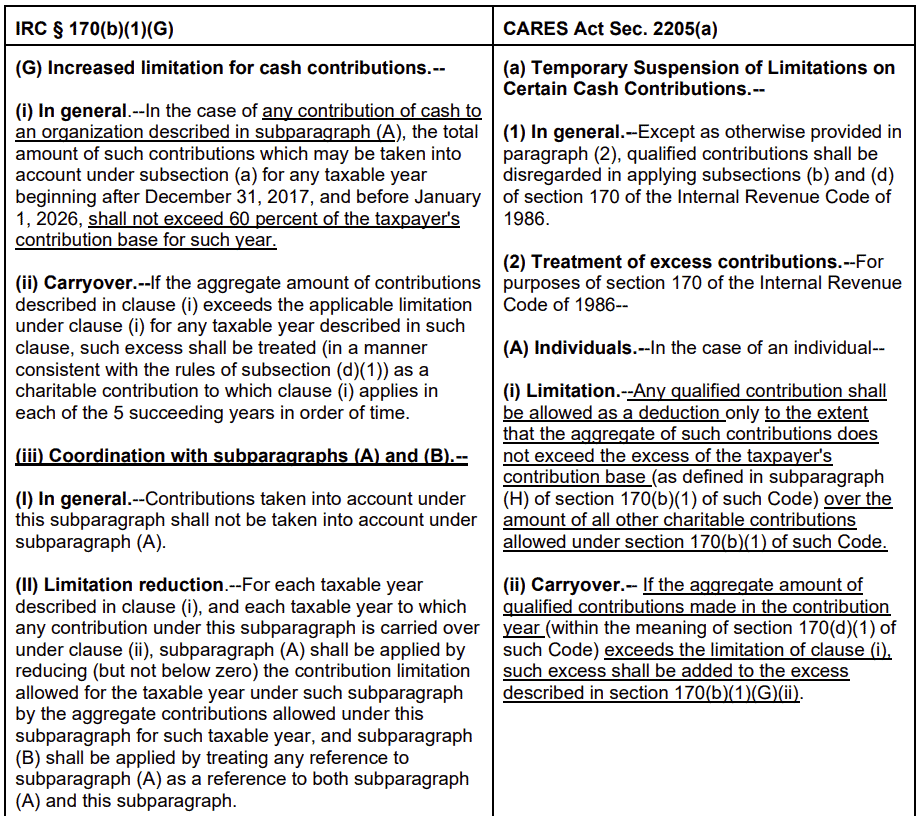

The TCJA’s temporary increase in the AGI limit for cash donations made to public charities, from 50 percent to 60 percent, for any taxable year beginning after December 31, 2017 and ending before January 1, 2026 is codified in IRC §170(b)(1)(G) and it only applies if charitable donations, in an amount equal to 60 percent of AGI, are made in cash.

Thus, if a taxpayer were to make noncash charitable donations equal to 50 percent of their AGI in the aggregate and then make an additional charitable donation of cash equal to 10 percent of the taxpayer’s AGI, the deduction that the taxpayer receives would remain at 50 percent of their AGI.

For individuals, Sec. 2205(a) of the CARES Act increases the 60 percent cap for cash contributions made to public charities during calendar year 2020 by providing for a “temporary suspension of limitations on certain cash contributions.”

Sec. 2205(a)(3)(A) defines the term “qualified contribution” as any charitable contribution (as defined in Section 170(c) of the Internal Revenue Code of 1986) if:

(i) such contribution is paid in cash during calendar year 2020 to an organization described in Section 170(b)(1)(A) of such Code, and

(ii) the taxpayer has elected the application of this section with respect to such contribution.

However, Sec. 2205(a)(3)(B) provides that the term “qualified contribution” does not include a contribution by a donor if the contribution is:

(i) to an organization described in Section 509(a)(3) of the Internal Revenue Code of 1986,ii or

(ii) for the establishment of a new, or maintenance of an existing, donor advised fund (as defined in Section 4966(d)(2) of such Code).iii

Sec. 2205(a)(2)(A)(i) of the CARES Act provides that “[a]ny qualified contribution shall be allowed as a deduction only to the extent that the aggregate of such contributions does not exceed the excess of the taxpayer’s contribution base (as defined in subparagraph (H) of Section 170(b)(1) of such Code) over the amount of all other charitable contributions allowed under Section 170(b)(1) of such Code.”

Because “any qualified contribution” that does not exceed the taxpayer’s contribution base is allowed as a deduction, and because this deduction is allowed “over the amount of all other charitable contributions allowed under Section 170(b)(1),” this provision does not have the same “all cash” requirement that the 60 percent limitation does, so cash and noncash contributions can be stacked and can exceed the general 50 percent limitation that would otherwise apply.

Thus, this provision allows for an individual to receive a deduction of up to 100 percent of their AGI in 2020 by only making “qualified contributions,” or by making qualified contributions in addition to other charitable contributions that are subject to limitations, in order to reach a full deduction of 100 percent of their AGI.

Additionally, if the qualified contribution does exceed the excess of the taxpayer’s contribution base over the amount of all other charitable contributions, Sec. 2205(a)(2)(A)(ii) allows for the excess amount contributed in 2020 to be treated as a charitable contribution that may be carried over into each of the 5 years that succeed the year in which the excess contribution was made.

Specifically, Sec. 2205(a)(2)(A)(ii) states that “[i]f the aggregate amount of qualified contributions made in the contribution year (within the meaning of Section 170(d)(1) of such Code) exceeds the limitation of clause (i), such excess shall be added to the excess described in Section 170(b)(1)(G)(ii).” The following chart provides a comparison for the language of IRC § 170(b)(1)(G) and CARES Act Sec. 2205(a):

Conclusion

Many individuals make charitable contributions purely out of their generosity, the euphoria they feel from doing a good deed, and the joy of knowing such good deed will benefit others and have a positive impact on their community, our country, or even the world as a whole. For many individuals, a tax deduction isn’t seen as an incentive to give; it is more akin to being an added bonus that comes along with the charitable contributions they would have made regardless of whether this tax incentive existed.

With all of this is mind, and before 2020 comes to a close, it is important that practitioners and tax advisors inform their charitable clients that now is the perfect time for individuals to make larger charitable contributions than they may have made in prior years.

As clients continue to see the harmful effects that the COVID-19 pandemic continues to have on the economy and the toll it is taking on charities that are now desperate for any donations they can get, clients may be eager to learn that they stack gifts of cash on top of noncash charitable contributions like appreciated long-term capital gain property, and have the combined value of these cumulative donations provide them with a full deduction of up to 100 percent of their AGI.

You can give 100 percent of AGI to cause the charity elation

But not for any charity that is a donor advised fund or supporting organization

WE HOPE THIS HELPS YOU HELP OTHERS MAKE A POSITIVE

DIFFERENCE!

CITE AS:

LISI Charitable Planning Newsletter #304 (December 17, 2020)

at http://www.leimbergservices.com Copyright 2020 Leimberg Information Services, Inc. (LISI). Reproduction in Any Form or Forwarding to Any Person Prohibited Without Express Permission. This newsletter is designed to provide accurate and authoritative information in regard to the subject matter covered. It is provided with the understanding that LISI is not engaged in rendering legal, accounting, or other professional advice or services. If such advice is required, the services of a competent professional should be sought. Statements of fact or opinion are the responsibility of the authors and do not represent an opinion on the part of the officers or staff of LISI.

CITATIONS:

i – For individuals, IRC § 170(b)(1)(A) provides that charitable contributions made to public charities are deductible “to the extent that the aggregate of such contributions does not exceed 50 percent of the taxpayer’s contribution base for the taxable year.” The term “contribution base” is defined in IRC Section 170(b)(1)(H) as a taxpayer’s “adjusted gross income (computed without regard to any net operating loss carryback to the taxable year under Section 172).”

ii – A 509(a)(3) organization is a “Supporting Organization,” which is a charity that carries out its exempt purposes by supporting other exempt organizations.

iii – IRC § 4966(d)(2)(A) defines the term “donor advised fund” as a fund or account; (i) which is separately identified by reference to contributions of a donor or donors, (ii) which is owned and controlled by a sponsoring organization, and (iii) with respect to which a donor (or any person appointed or designated by such donor) has, or reasonably expects to have, advisory privileges with respect to the distribution or investment of amounts held in such fund or account by reason of the donor’s status as a donor. 4966(d)(2)(B) provides exceptions for accounts or funds that the term “donor advised fund” does not include, and 4966(d)(2)(C) provides the Secretary of the Treasury with the authority to exempt certain funds or accounts, which are not excluded in 4966(d)(2)(B), from treatment as a donor advised fund.

UPCOMING EVENTS

Free registration for this Saturday, January 30th from 9:30 to 10 AM EST using this link

Barry Portugal of Manasota SCORE talks with Alan about the SCORE organization and how it’s helping PPP borrowers.

Free registration for this Saturday, January 30th from 10:30 to 11 AM EST using this link

Kevin Cameron separates Fact from Fiction for frequently misunderstood PPP issues.

| When | Who | What | How |

|---|---|---|---|

| Friday, January 29, 2021 | BankersWeb |

Brandon Ketron presents: PPP: Loan Forgiveness Update Live Q&A from 2:30 to 3:15 PM EST |

Register |

| Friday, January 29, 2021 | Florida Bar Health Law Section: Representing the Physician |

Alan Gassman presents: Medical Practices And PPP, EIDL, and Provider Relief Fund Planning and Implications from 3 to 3:50 PM EST |

Register |

| Saturday, January 30, 2021 | Free webinar from our firm |

Alan Gassman and Barry Portugal discuss: The SCORE Mentor program from 9:30 to 10 AM EST |

Register |

| Saturday, January 30, 2021 | Free webinar from our firm |

Kevin Cameron presents: PPP Loans – Update on Round 2 Loans and Separating Fact from Fiction from 10:30 to 11 AM EST |

Register |

| Wednesday, February 3, 2021 | CPA Academy |

Alan Gassman and Michael Lehmann present: Establishing 501(c)(3) Organizations and the Form 1023 from 5:30 to 6:30 PM |

Register |

| Thursday, February 4, 2021 | CPA Academy |

Alan Gassman and Brandon Ketron present: THE CPAS GUIDE TO THE EMPLOYEE RETENTION CREDIT from 3 to 4 PM EST |

Coming soon |

| Friday, February 5, 2021 | CPA Academy |

Alan Gassman and Brandon Ketron present: THE CPAS GUIDE TO THE HHS PROVIDER RELIEF FUND from 4 to 5 PM EST |

Coming soon |

| Tuesday, February 9, 2021 | BankersWeb |

Alan Gassman and Brandon Ketron present: PPP Loans from 2 to 3 PM EST |

Coming soon |

| Wednesday, February 10, 2021 | CPA Academy |

Alan Gassman presents: The Creditor Protection Conversation – What CPAs Can Explain to Their Clients (and Themselves) to Safeguard Wealth and Insulate from Potential Creditor Catastrophe from 5:30 to 6:30 PM |

Register |

| Thursday, February 11, 2021 | Johns Hopkins All Children’s Annual Estate Planning Seminar |

Alan Gassman & Friends: Introduce speakers and listen carefully from 8:30 AM to 4:45 PM EST |

Register |

| Thursday, February 11, 2021 | BankersWeb |

Brandon Ketron presents: PPP: Loan Forgiveness Update Live Q&A from 2 to 2:45 PM EST |

Coming soon |

| Wednesday, February 17, 2021 | CPA Academy |

Alan Gassman presents: How Asset Protection Trusts Work, and When They Won’t Work – Pros, Cons and Related Going Ons from 5:30 to 6:30 PM |

Coming soon |

| Monday, February 22, 2021 | Pace University Small Business Development Center |

Alan Gassman and Ramona Cedeno present: TAXES AND THE PANDEMIC CARES ACT – REGULATORY COMPLIANCE ISSUES AND OPPORTUNITIES FOR SMALL BUSINESS from 2 to 3 PM EST |

Coming soon |

| Tuesday, February 23, 2021 | Estate Planning Council of Northern New Jersey |

Alan Gassman presents: WHAT YOUR BEST CLIENTS NEED TO KNOW ABOUT FLORIDA LAW AND PLANNING from 4:30 to 5:30 PM EST |

Register |

| Saturday, February 27, 2021 | MOTE Vascular Surgeon Conference |

Alan Gassman presents: Managing Your Money: How to Save It, Manage It and Protect It from 1:15 to 2:15 PM EST |

More information |

| Friday, March 26, 2021 | Florida Bar: Tax Section |

Alan Gassman, Leslie Share, Brandon Ketron & Friends present: Creditor Protection Nuts & Bolts from 9 AM to 2 PM EDT |

Coming soon |

| Monday, May 10, 2021 | Paralegal Association of Florida: Pinellas Chapter |

Alan Gassman presents: Making Your Job Better and Your Firm More Successful – the Legal Assistant’s Guide to Liberation and Effectiveness from 12 to 1 PM ET |

Coming soon |

| Thursday, May 13, 2021 | FICPA-FSU Spring Accounting Conference |

Alan Gassman presents: Fine Tuning and Improving Estate and Asset Ownership Planning For All Categories of Clients & The Florida CPA’s Practice Guide to Effective Creditor Protection Planning |

Register |

| Friday, May 21, 2021 | Michigan ICLE Annual Probate & Estate Planning Institute |

Alan Gassman presents: Prebankruptcy and Bankruptcy Avoidance Strategies for Challenging Situations from 11:15 AM to 12 PM CT |

Register |

| Thursday, June 10, 2021 | AICPA & CIMA ENGAGE 2021 in Las Vegas, NV |

Alan Gassman and Ken DeGraw present: Pre-Bankruptcy and Creditor Planning During the COVID-19 Pandemic from 3 to 3:50 PM PT |

Register |

| Thursday, November 4, 2021 | Estate Planning Council of Birmingham |

Alan Gassman presents: Hot Topics In Estate Tax And Creditor Protection from 8 to 10 AM CT |

Coming soon |

Call us now! Bookings accepted for haunted houses, bar mitzvahs, weddings, seminars, and symposiums (or symposia)!

Lawyer 2 Lawyer Podcast: Legal Liability Stemming from the Capitol Riot

Inspired by Alan’s Forbes blogpost The Legal Fallout Expected After The Capitol RiotsOn January 22nd, Lawyer 2 Lawyer Podcast Host Craig Williams extended an invitation to discuss it on air.

Listen to their January 22nd podcast using this link.

Lawyer 2 Lawyer is an award-winning podcast covering relevant, contemporary news from a legal perspective. Host J. Craig Williams invites industry professionals to examine current events and recent rulings in discussions that raise contemplative questions for those involved in the legal industry. Launched in 2005, Lawyer 2 Lawyer is one of the longest-running podcasts on the Internet.

New PPP Resource

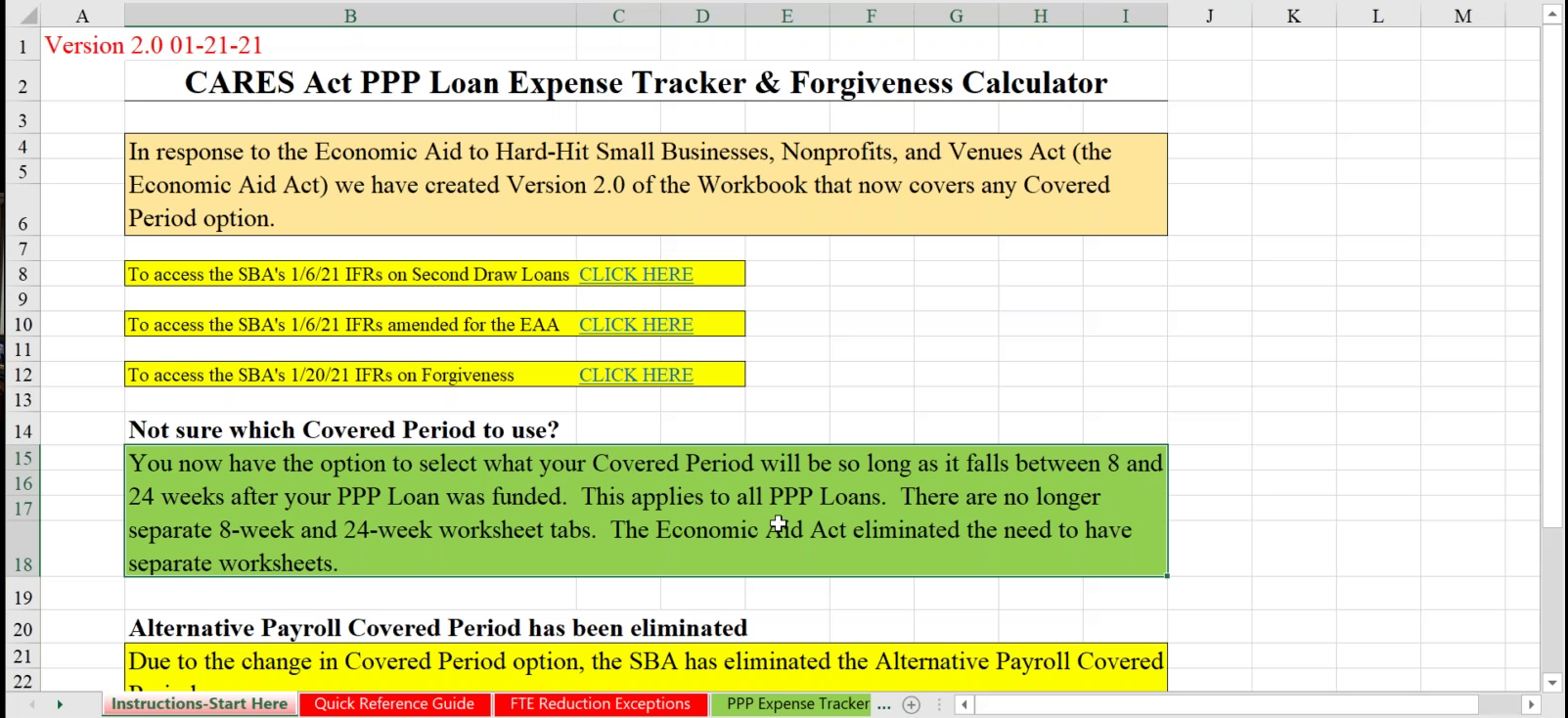

On January 21st, Kevin Cameron completed his PPP Spreadsheet Version 2.0 which now includes the Employee Retention Credit and PPP Round 2 rules.

A walkthrough of the new spreadsheet is available using this link.

It is available for purchase through Leimberg Information Services using this link.

Past purchasers can now refer to their original delivery email and refresh the link to receive the update for free!

The Real Reason Your Turnover is High

David Finkel

A while back we talked about the real reasons why you weren’t hiring new employees, and shared the hard truths behind why you might be hesitant to find and hire new talent despite a need for help. Today, I wanted to share a little more hard truth – this time surrounding the reasons why your employees quit. As a business owner, you may have an idea of why you have turnover, but it generally boils down to four main categories.

1. Lack of Recognition

One of the main reasons that employees look for another position has to do with a lack of recognition from management. They think “I have been busting my hump for these people for the last ten years and I haven’t had a raise in three and all they ever do is give praise to Julie and I have done twice as much as Julie….etc.” Really taking the time to celebrate victories with your employees and recognize their hard work goes a long way to keeping them happy in their current position. And it’s important to think outside of the “employee of the month” box and really get to the heart of recognizing hard work and talent on your team.

Hiring Tip: If your job opening has growth opportunities make sure to list that in the listing. A lot of job seekers are looking for this specifically and will help you stand out amongst the crowd.

2. Lack of Growth

Does the position have the opportunity for promotion? Employees that have no promotion opportunities, are already at the top of their pay grade and have no coaching or mentorship opportunities available to them are the most likely to leave to look for something else. Depending on your company, you may not be able to offer up a promotion in the traditional sense but mentoring or coaching your key team members to grow in their field can go a long way to keeping them interested and engaged.

Hiring Tip: Instead of hiring for a project manager right out of the gate consider hiring for a project manager level 1 or level 2, allowing the candidate room to be promoted over time.

3. Lack of Management

We have all heard the phrase, “people don’t quit jobs, they quit managers.” And this is very true. If they aren’t getting recognition, training, or advancement opportunities it’s usually because of a manager. You want to make sure that your managers know what they’re doing, value their team, and are doing all those things that are important to be able to keep those people.

4. Money

Everyone has economic needs and it’s important to pay your employees fairly. This should be a given. But when we talk about money and compensation it really comes down to two things.

- Are you being fair? Are you paying the person what they are worth to the company?

- Are you being respectful? Are you paying them what the market values their skill set at?

We can’t all compete to pay the highest wage, but you can make sure that you are being fair and respectful of your employees and their economic needs.

Hiring Tip: It’s also important to note here that often times when an employee comes to you asking for more money, what they really mean is that they want more independence, autonomy, or growth opportunities. Those things can often be achieved with a larger salary, but there are other ways to make an employee feel appreciated without offering up more money. So if you are paying a fair wage, it might be a good idea to look at other factors that are at play here.

Humor

Gassman, Crotty & Denicolo, P.A.

1245 Court Street

Clearwater, FL 33756

(727) 442-1200