|

Good Tidings of Great Joy for Taxpayers Who Were Trying to Complete Installment Sales in December of 2022 Because of Quickly Increasing Interest Rates

Written By: Alan Gassman, JD, LL.M, AEP (Distinguished)

The installment sale to a Grantor Trust is a popular and very effective strategy that allows for safeguarding family assets and avoiding or eliminating federal estate tax for wealthy family members.

The strategy entails establishing or using an irrevocable trust that will not be subject to federal estate tax in the donor’s estate, but may be disregarded for federal income tax purposes, so that the sale of assets to the trust, and the payment of interest on a promissory note to the Grantor will not be subject to income tax. Further, the Grantor’s payment of income taxes attributable to the income of the Trust will not be considered a gift for federal gift tax purposes, and the trust can grow income tax-free as the result of this.

The interest rate that applies with respect to the sale of assets or entity interests to a trust can be no lower than the Applicable Federal Rate, which is published monthly by the Internal Revenue Service. The long-term applicable federal rate, which applies to notes exceeding nine years in length is 4.29% for notes entered into in December of 2022, and will be 3.8% for notes entered into in January of 2023.

Alternatively, when a sale of assets occurs, the lowest of the rate for the month of the sale or the two previous months can be used. Therefore, for sales being finalized in December of 2022, the Applicable Federal Rate for October of 2022 of 3.4% can be used. The Applicable Federal Rate for November of 2022 was 3.88%.

The significant monthly increase in the Applicable Federal Rate that took place in November and December of 2022 led many advisors to urge families to complete installment sales as soon as possible, and in particular during the month of December, so that arrangements can be completed in 2022.

Sometimes this can be challenging, because part ownership of an LLC or other similar entity might occur so that valuation discounts can be used. For example, 49% ownership of an LLC holding $1 million worth of assets may be worth only $375,000.

Most advisors prefer to wait approximately 30 days between the funding of an entity and having the sale or transfer of discounted non-voting or minority interest ownership, because the IRS takes the position that there should be some period of time that passes between the funding of an entity and the transfer of part ownership of the entity in order to qualify for a discount.

It came as a pleasant surprise that the January long-term Applicable Federal Rate is 3.8%. This means that installment sales that are completed in January, February and March of 2023 can use 3.8%, or less if the February or March rates are less than this.

While it would be best to complete a sale transaction in December to receive use the 3.4% rate (the AFR for October 2022) instead of the 3.88% rate that will apply for January transactions, it is good to know that the January rate of 3.8% will be there for those who need it.

Back to Top

|

|

A New Book on Charitable Giving Is Coming To Towm

Written By: Alan Gassman, JD, LL.M, AEP (Distinguished)

You better watch out

You better not cry

Better not pout

I’m telling you why

A brand new book is coming to town!

We’re making a list,

And checking it twice;

Want to find out how to donate your used Christmas lights?

A brand new book is coming to town!

You can read it when you’re sleeping

You can read it when you’re awake

You can read it if you’ve been bad or good

Just read it for goodness sake!

O! You better watch out!

You better not cry.

Better not pout, I’m telling you why.

Our brand new book is coming to town!

Our gift to you this holiday season is this excerpt from the new book:

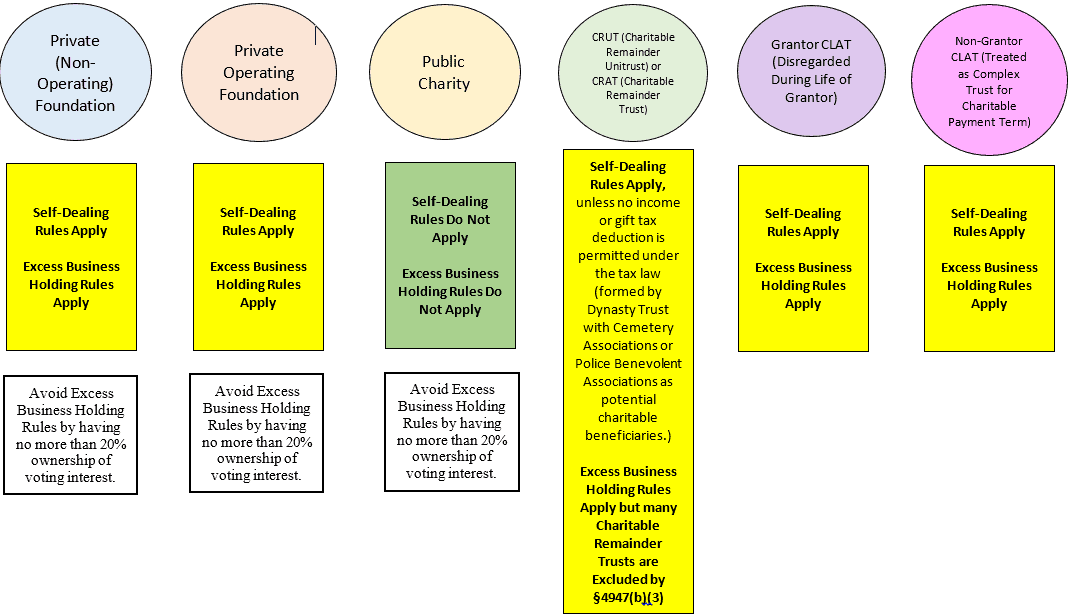

An Abbreviated Charitable Planning Checklist

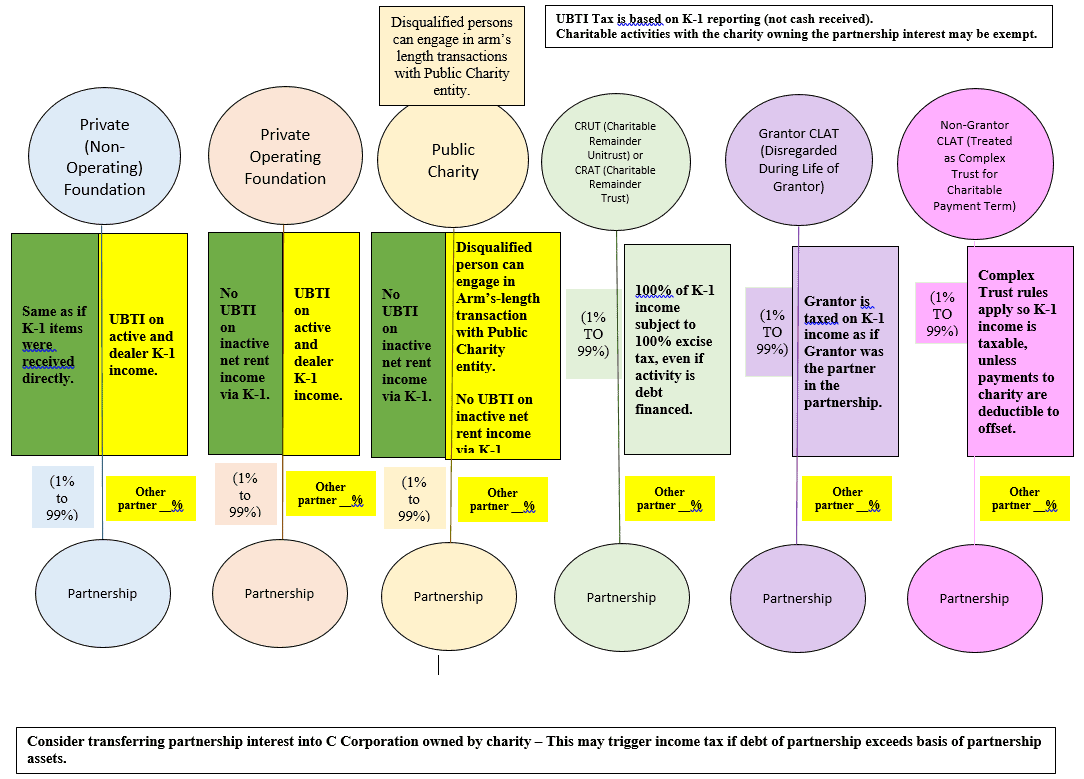

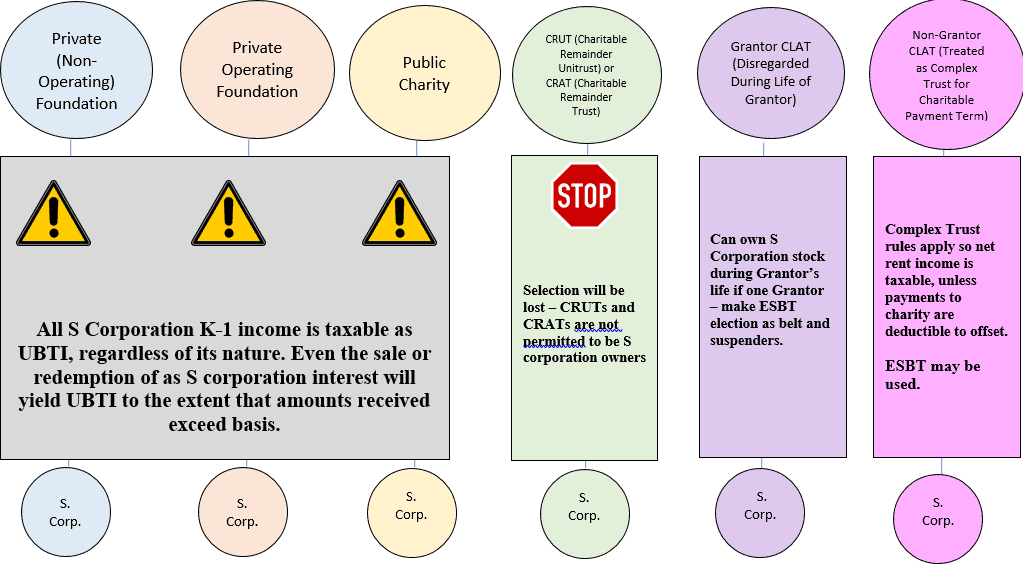

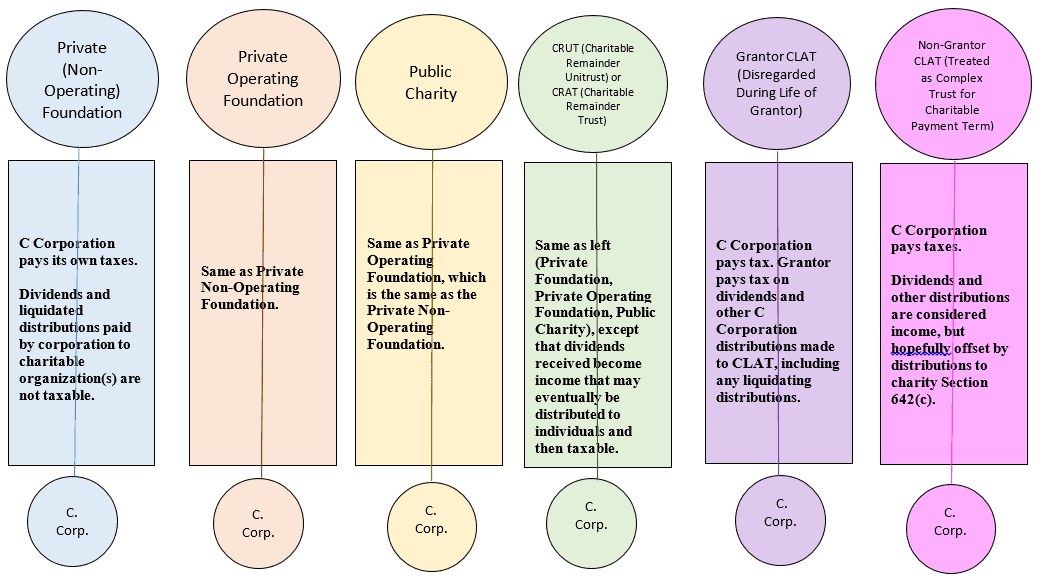

The following checklist provides some of the most important strategies and vehicles to consider when planning with respect to charitable giving:

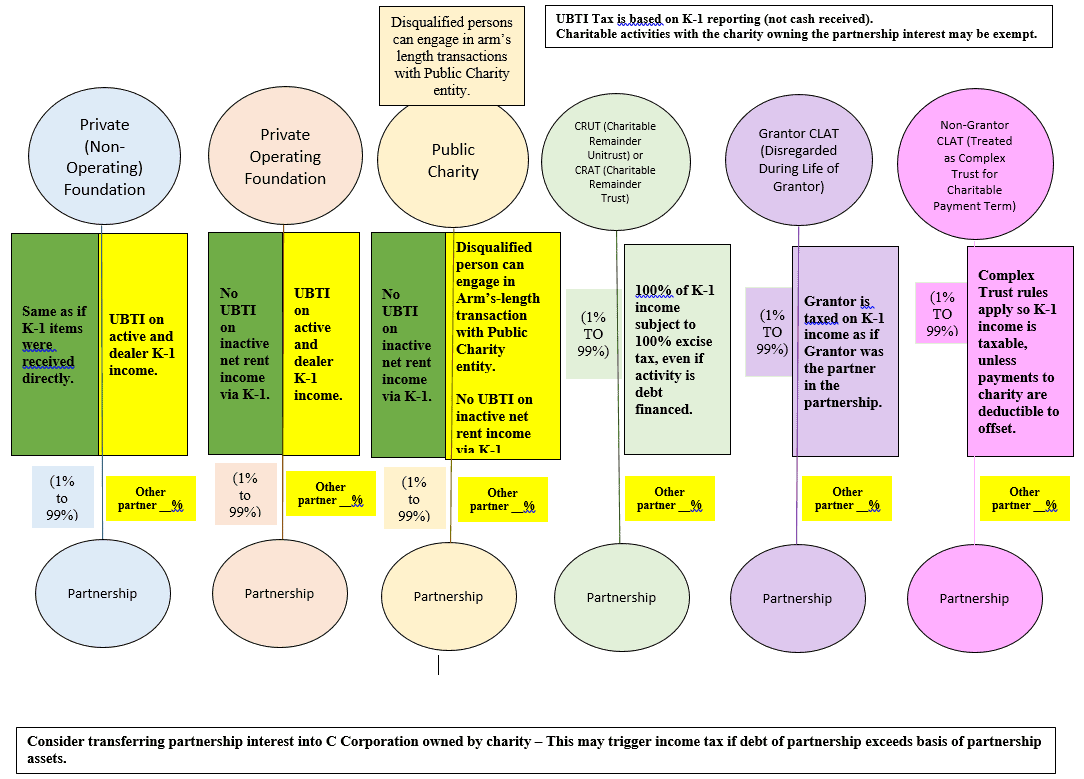

- Transfer up to $100,000 per year directly from an IRA to a Public Charity or a Family Operating Foundation if the IRA owner is over 70½ years old. This counts toward any minimum distribution requirements.

- An IRA or pension account owner can make a charity or Charitable Remainder Trust the “pay on death beneficiary” or contingent beneficiary to eliminate or defer income tax on distributions after death.

- Appreciated capital gains assets, like stock or real estate, can be gifted to a Public Charity or Private Operating Foundation to obtain an income tax deduction based upon the fair market value on what is transferred. This will also work for publicly traded stocks and mutual funds that are transferred to a Private Foundation. An amount equal to up to 30% of adjusted gross income can be deducted each year. This is 20% of adjusted gross income if the donation is to a Private Non-Operating Foundation, but the donation must be of marketable securities, unless the taxpayer elects to deduct the income tax basis instead of fair market value of the appreciated marketable securities. Additional amounts can be given in cash to reach up to 50% of adjusted gross income if appreciated capital gains assets are given. Alternatively, cash-only gifts to Public Charities and Private Operating Foundations can be deducted for up to 60% of adjusted gross income.

- In order for individual contributions to exceed the standard deduction, bunch deductions by making charitable donations every second, third, or fourth year. For 2023, each individual taxpayer filing a return has a standard deduction of $13,850 for a single person and $27,700 for a married couple filing jointly. The annual property tax deduction cannot exceed $10,000. Medical expenses only count to the extent exceeding 7.5% of adjusted gross income. Interest deductibility is subject to various limitation rules. A taxpayer who would like to donate $10,000 per year to charity could donate $50,000 to a Donor Advised Fund, Community Foundation, or a Private Operating or Non-Operating Foundation to receive a tax deduction for amounts exceeding the standard deduction and then use the gifted entity to make annual charitable gifts.

- For taxpayers who already use the full 50% or 60% of adjusted-gross-income deduction and/or taxpayers who wish to avoid the 3.8% Medicare Tax, consider placing income-producing assets into an irrevocable trust that can pay some or all of its income directly to charity so that the income will not be taxable.

- In addition, businesses may pay for advertising and become “sponsors” of a charitable organization’s activities and receive an income tax deduction under IRC § 162 for reasonable and necessary business expenses.

- A home or farm owner may transfer a remainder interest in a residence or farm and receive an income tax deduction for the present value of the remainder interest, while retraining the right to use the home or farm rent-free for the remainder for his or her lifetime. The life estate holder may thereafter decide to donate the life estate rights to charity in order to receive an additional income tax deduction.

- Give appreciated artwork, jewelry, or other collectables to a charity that can use or display them to obtain an income tax deduction based upon what a retail store would charge for such items (in used condition).

- Taxpayers who wish to support political causes and have appreciated assets that may be sold should consider contributing those assets to an IRC § 501(c)(4) Social Welfare Organization to avoid paying income tax on the sale of appreciated assets and income subsequently derived thereon. 501(c)(4) organizations are subject to tax on unrelated business taxable income.

- Other methods of obtaining recognition, a locked-in benefit for charity, and an income tax deduction for the donor who may retain the right to the “fruit from the tree” or more are available through the following:

- Pooled Income Fund: Transfer money or appreciated assets to charity in exchange for the right to participate in the income from a designated “pool” of assets based upon the charity’s adherence to IRS guidelines.

- Fund a Charitable Gift Annuity by giving cash or appreciated assets to the charity in exchange for receiving a stream of payments, which may begin immediately or after a given term. The donor receives an income tax deduction and the charity may spend some of the money received for charitable purposes and use the rest to purchase a commercial annuity contract to ensure that the charity will have the exact amounts needed to satisfy the annuity payment obligation.

- Consider a tax-neutral dedicated charitable trust if a family wants to commit a certain amount of assets for charitable purposes without the complexity of a 501(c)(3) organization. A tax-neutral dedicated charitable trust can be for both charitable and non-charitable purposes to provide a family identity and to “try a family foundation on for size” before committing to 501(c)(3) status.

- A donor administered or controlled Charitable Remainder Trust (CRT) can also give the donor deferral of income tax on the sale of appreciated assets transferred to the CRT before the appreciated assets are sold, in addition to annual payments that may be made for up to 20 years or for the lifetime or joint lifetime of one, two, or three individuals. The donor receives an income tax deduction. Alternatively, it is possible to structure a charitable remainder trust where there is no income tax deduction and the donor has the ability to enter into arm’s length transactions and even borrow money and pay tax deductible interest to the charitable remainder trust. Inventory and short-term capital gains assets can be transferred to a charitable remainder unitrust to facilitate deferral of income tax, but there will be no income tax deduction with respect to the remainder interest attributable to non-long-term capital gain property transferred.

- As an alternative to a CRT, a donor may consider making a transfer to a Pooled Income Fund that is operated by a charity in exchange for the right to receive income from the Pooled Income Fund for the lifetime of the donor. Another alternative is to purchase a Deferred Gift Annuity where the charity may invest some of the money that it receives in a commercial annuity contract to ensure that it can make the promised payments to the donor, while using excess funds for the charitable purposes of the organization. The general rule of the thumb is that one half of the amounts transferred are considered to be a donation and one half are in consideration for the annuity payment to be received back.

- A donor can fund a Charitable Lead Annuity Trust (CLAT) and receive an income tax deduction for putting a “tree” into the trust, while receiving back some fruit and possibly even a substantial portion of the “tree” after a term of years. Alternatively, the CLAT can be funded during the lifetime of a grantor to provide an income tax deduction and for significant value to be transferred to descendants of the grantor after one or more charities have received a stream of annual payments for a specified term of years.

- A zeroed-out testamentary CLAT can be used to completely avoid federal estate tax while being expected to provide a significant non-estate-taxable disposition for the descendants of the donor or others after a term of years and a number of annual payments to charity. A lifetime zeroed-out CLAT can provide the same result so that the donor can receive an income tax deduction upon funding and equivalent charitable and estate tax avoidance benefits.

- Family Private Foundation: an individual or family can form a 501(c)(3) company or trust and receive tax deduction for funding with appreciated marketable securities or cash. The foundation should transfer approximately 5% of its net worth each year to one or more public charities.

- Private Operating Foundation: Similar to a private foundation, the family or donor may transfer appreciated real estate or other assets besides marketable securities to deduct up to a 30% of adjusted gross income, plus cash up to 20% of adjusted gross income. Approximately 4.25% of the net value of the operating foundation assets should be spent on charitable activities and for charitable purposes at least 3 out of every 4 years.

- Some homeowners and some farmers will transfer the remainder interest in their home or farm to a charity to receive an immediate income tax deduction while retaining the absolute right to have continued use of the property for the lifetime of the donor.

“This is the best practical charitable tax planning resource out there. Advisors can do no better than to have this book handy to help their clients maximize both the tax and non-tax benefits of their charitable giving. The summaries, checklists and comparison charts give the essential quick-reference nutshells to go from starting the plan to the crucial follow through necessary for initial and ongoing qualifications. There is extensive discussion and helpful authority cited throughout. However, it’s not so heavy with regulations and jargon that you lose the forest in examining the lichen on the trees.”

-Edwin Morrow III, Wealth Strategist for Huntington Private Bank® Wealth Management

“The glossary itself is worth the price of the book.”

-Craig R. Hersch, Esq., Sheppard Law Firm

Our Christmas gift to you is the first 3 definitons from the glossory:

|

35/65 Trust

|

IRC § 4946(a)(1)(G) provides that certain trusts and estates that have 35% or less of their beneficial interest held by Disqualified Person(s) will not be classified as disqualified by reason of such beneficial interest[s]. Therefore, a family wishing to control an entity partly owned by a charity of which they are Disqualified Persons can place all of the voting interests in the investment or business entity under a trust under which up to 35% of its beneficial interest is held for Disqualified Persons, and 65% of which is held for individuals or entities that are not Disqualified Persons.

|

|

501(c)(3) Charitable Organization

|

“To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual. In addition, it may not be an action organization, i.e., it may not attempt to influence legislation as a substantial part of its activities and it may not participate in any campaign activity for or against political candidates.

Organizations described in section 501(c)(3) are commonly referred to as charitable organizations. Organizations described in section 501(c)(3), other than testing for public safety organizations, are eligible to receive tax-deductible contributions in accordance with Code section 170.

The organization must not be organized or operated for the benefit of private interests, and no part of a section 501(c)(3) organization’s net earnings may inure to the benefit of any private shareholder or individual. If the organization engages in an excess benefit transaction with a person having substantial influence over the organization, an excise tax may be imposed on the person and any organization managers agreeing to the transaction.

Section 501(c)(3) organizations are restricted in how much political and legislative (lobbying) activities they may conduct.”[1]

|

|

501(c)(4) Organizations

|

“Internal Revenue Code section 501(c)(4) provides for the exemption of two very different types of organizations with their own distinct qualification requirements. They are:

- Social welfare organizations: Civic leagues or organizations not organized for profit but operated exclusively for the promotion of social welfare, and

- Local associations of employees, the membership of which is limited to the employees of a designated person(s) in a particular municipality, and the net earnings of which are devoted exclusively to charitable, educational or recreational purposes.

Homeowners associations and volunteer fire companies may be recognized as exempt as social welfare organizations if they meet the requirements for exemption. Organizations that engage in substantial lobbying activities sometimes also are classified as social welfare organizations.”[2]

|

Back To Top

|

|

Did Gifts Come a Little Early This Year? New Florida Legislation Provides Much Needed Property Tax Relief during the Holiday Season

Written By: Juan Camilo Celis-Murcia, M.A.

Juan Camilo Celis-Murcia graduated from Florida International University with a Bachelor of Arts: Internation Relations/ Sociology. He also graduated from the University of Alabama with a Masters of Arts in Secondary Educations. He is a Pre-Law Student who speaks English, Spanish, Portugese and learning French. He participated in the 8th Annual Florida International Leadership Conference; representing F.I.U., and the study abroad club.

Hurricane Ian, a Category 4 storm that was considered to be one of the deadliest in recent times, made landfall in southwestern Florida on September 28th, 2022. The massive path of destruction throughout the state of Florida left a death toll of over 100 people, thousands of Floridians without a home, and damages estimated to exceed $50 billion.

Due to the extensive property loss and damage caused by the storm, Gov. DeSantis has signed three bills into law, which encompass three major reforms: Property Insurance (SB 2-A), Disaster Relief (SB 4-A), and Toll Relief (SB 6-A).

SB 2-A, Property Insurance, is geared towards the creation of the Florida Optional Reinsurance Assistance Program (FORA). This program reviews and authorizes the eligible insurers into the reinsurance coverage under FORA, and is to be administered only by the State of Board of Administration. The aim of SB 2-A is to strengthen Florida’s property insurance market by promoting market competition, eliminating one-way attorney fees, reducing the timelines for insurers to get payment.

SB 4-A, Disaster Relief, helps Floridians who have lost their houses due to the storm by providing property tax relief for individuals with “uninhabitable homes.” This bill also provides a package of around $750 million dollars primarily to aid communities affected by both Hurricane Nicole and Hurricane Ian, with the funds to be allocated in the following manner:

$150 million to The Hurricane Housing Program and to the Rental Recovery Loan Program.

$150 million to the Florida Department of Environmental Protection (DEP), in charge of beach renourishment projects, coastal fortification projects, and severe coastal erosion projects.

$100 million to DEP in order to aid, repair, and reconstruct the affected storm-water and waste-water infrastructure effected by these two storms.

$350 million to support FEMA Public Assistance, which aims to free local funds in order to extend the hurricane aid to Floridians in need.

SB 6-A, Toll Relief, was established through the Florida Department of Transportation (FDOT), and it creates a program of granting account credits to Florida commuters. Users who frequent toll roads across the state, will be given a fifty percent credit to their account if they accumulate 35 (or more) transactions per month.

At the end of the day, or the year, not everything is bad news here in Florida.

Back to Top

|

2021/2022 Legislative Updates and How They Impact Your Estate Plan

Written By: Barry Nelson, Jennifer Okular & Cassandra Nelson

Introduction

We hope this letter finds you doing well and that you had a pleasant summer. There have been a number of legislative developments relating to estate planning and asset protection. Although some of the legislative developments went into effect in 2021, we believe they warrant the consideration of our clients. This letter focuses on specific legislative developments that we believe are most relevant to our clients.

1. Projected Increases in Estate, Gift, and GST Exemptions and Exclusions for 2023

Thomson-Reuters Checkpoint issued a newsletter in which it estimated, based upon the Consumer Price Index published for August 2022, how inflation will impact the existing exemptions and exclusions for estate, gift, and GST tax as follows:

- The estate and gift exemption amount (currently $12.06 million) will increase to $12.92 million for 2023. The GST exemption will likewise increase by the same amount.

- The annual gift tax exclusion will increase from the current $16,000 up to $17,000 in 2023.

- The gift tax exclusion amount that can be given annually to a non-citizen spouse is increasing from $164,000 up to $175,000 next year.

It is important to note that in its newsletter, Thomson-Reuters Checkpoint provides that The IRS has not officially issued these figures, but generally speaking, these estimates are fairly accurate.

2. As of July 2, 2021, Florida Residents Can Transfer Homestead to their Revocable Trust and Benefit from Both Asset Protection and Probate Avoidance Upon their Death:

In the past, we advised our unmarried clients to retain title to their personal residence (homestead) in their individual names and not title their homestead in the name of their Revocable Trust due to asset protection concerns. Other than our married clients who may consider a Community Property Trust, as described in Section 3, below, we believe our married clients who own their Florida homestead jointly with their spouse, as tenants by the entirety, or in the name of both spouses should generally retain such title until the death of the first spouse. As a result of the statutory change described in the following paragraph, we now encourage unmarried clients or clients who prefer to hold title to their homestead in only their name (such as those in second marriages with prenuptial agreements where their spouse waived homestead) to convey their Florida homestead to their Revocable Trust to avoid any probate court pleadings upon death.

In 2021 Florida Statute Section 736.1109 was enacted (effective July 1, 2021), which allows for ones homestead to be transferred to the owners Revocable Trust and maintain homestead status as well as asset protection. Florida Statute Section 736.1109 is intended to clarify existing law and applies to the administration of trusts and estates of decedents who die before, on, or after July 1, 2021.

Clients who transfer their homestead to their Revocable Trust must reapply for homestead the year following the transfer (i.e., if a client transfers their homestead to their Revocable Trust in 2022, such client must reapply for homestead before March 1, 2023) or the client risks losing their homestead exemption and the Save Our Homes tax benefit that is likely to be very significant. Clients must carefully review these issues with their real estate attorney before taking any action to retitle their homestead and advise their insurance company of the transfer to maintain insurance coverage. Furthermore, with mortgage rates increasing significantly in 2022 it is important to confirm with your advisors that proposed transfers to your Revocable Trust will not accelerate existing mortgage debt on homesteads.

3. Married Clients Should Consider Community Property Trust for Homestead:

A new Florida law may provide an option for ownership of Florida homestead that could provide an income tax benefit upon the death of the first spouse. However, the law is not clear and the IRS could argue the income tax benefit is not available.

Chapter 736, Part XV, the Community Property Trust Act, (effective July 1, 2021), allows the creation of a trust, referred to as a Community Property Trust, which may result in the property held in such trust receiving a full step up in income tax basis upon the death of the first spouse rather than a 50% step up in income tax basis for most property owned jointly by Florida resident spouses. The benefit of receiving such full step up in income tax basis to fair market value at the date of the first spouses death is that the surviving spouse can then sell such asset without incurring capital gains tax on the entire appreciation that occurred prior to the deceased spouses death (as compared to only one-half (1/2) of such appreciation that occurred prior to the deceased spouses death under the tax law where a property is owned jointly between spouses).

It should be noted that some tax commentators have expressed concern as to whether a state statute that effectively allows property owners to elect community property status will be respected by the Internal Revenue Service (IRS). If the IRS takes the position that the full (double) step up in income tax basis upon the death of the first spouse is not permitted, the taxpayers should not be in any worse of a position, other than the transaction costs to create the Community Property Trust and potential audit costs, if the community property election and associated double step up in income tax basis upon the death of the first spouse is challenged, including possible interest as to the late payment of income tax when the property is sold and possible late payment penalties.

For clients with unencumbered homesteads, there are modest costs to create a Community Property Homestead Trust. If the homestead is subject to a mortgage, there is a possibility that documentary stamp taxes will be incurred when the homestead is conveyed to the Community Property Trust. As described in this Section 3, below, members of the Florida Bar committee that introduced the Florida Community Property Trusts have requested clarification on the documentary stamp tax from Florida state representatives. We believe that if the documentary tax issues are resolved favorably, the potential income tax savings of a Community Property Trust may be reason for many Florida homesteaders to make use of the new Florida Community Property Trusts. The advantages and disadvantages of creating a Community Property Trust are as follows:

Advantages:

● On the first spouses death, assuming the IRS does not challenge the application of Floridas new law, appreciated community property owned by the Community Property Trust will receive a full step up in basis for income tax purposes (whereas in Florida, upon the first spouses death appreciated jointly owned property will only receive a 50% step up in basis if the property is not owned in a Community Property Trust) to the fair market value of the property at the date of the first spouses death pursuant to Internal Revenue Code § 1014(b)(6).

● Added flexibility for the surviving spouse, who can sell such assets without incurring capital gains tax if the IRS does not challenge Floridas new law.

Disadvantages:

● Generally, assets transferred to a Community Property Trust are not protected from either spouses creditors. Under Florida law, assets owned as tenants by the entirety are generally protected from creditor claims while the couple is married and living provided such creditor is not a joint creditor of both spouses. Accordingly, there may be a loss of asset protection when conveying assets other than homestead to a Community Property Trust. Florida Statutes Section 736.151(1) provides that property transferred to or acquired subject to a community property trust may continue to qualify or may initially qualify as the settlor spouses homestead within the meaning of s. 4(a)(1), Art. X of the State Constitution and for all purposes of general law, provided that the property would qualify as the settlor spouses homestead if title was held in one or both of the settlor spouses individual names. To obtain homestead protection for asset protection purposes, among other requirements, the homestead must be located on no more than ½ acre if the homestead is in a municipality and 160 acres or less if the homestead is outside a municipality (referred to herein as qualifying homesteads). Accordingly, although non-homestead property and non-qualifying homesteads are more protected from creditors if held as tenants by the entirety and therefore should not be conveyed to a Community Property Trust by those concerned about asset protection, the Community Property Trust statute appears to protect qualifying homesteads from the qualifying homestead owners creditors and permits all homestead to maintain property tax benefits assuming the appropriate filings are timely made with the countys tax authorities.

● There could be a reassessment of the value of the homestead for property tax purposes, loss of the Save Our Homes Cap, and loss of the homestead exemption if a timely filing with the appropriate property tax assessors office is not made after a homestead is conveyed to a Community Property Trust. In addition, there may be documentary stamp tax due on the transfer of encumbered homestead property to the Community Property Trust, which could be significant as described more fully below. Based upon our correspondence with a number of Florida property tax assessors offices, the transfer of homestead should not result in a property tax reassessment if the Community Property Trust has certain required protective provisions relating to homestead and a timely filing is made for property tax purposes and the Save Our Homes Cap, to reapply for homestead status on or before March 1 of the year after the homestead was transferred to the Community Property Trust (for example, if the transfer to the Community Property Trust is executed and recorded on August 10, 2022, then the application for homestead status should be submitted on or before March 1, 2023). Note: If either spouse did not have homestead status on such property prior to the transfer to the Community Property Trust, then following the transfer of such property to the Community Property Trust, the spouse that did not have homestead status on such property should apply for homestead status on or before March 1 the year after such transfer. In the past, our office has walked trusts through the property assessors office prior to initiating the transfer of real property to confirm that such transfer of real property to the trust would not result in a property tax reassessment. We recommend that others do so prior to initiating a transfer of title and suggest that the clients real estate attorney handle this process.

Caution When Homestead is Encumbered:

- Florida Administrative Code R. 12B-4.013, entitled Conveyances Subject to Tax, addresses whether conveyances are subject to documentary stamp taxes. If a primary residence is subject to documentary stamps tax, the rate is .70 per $100. Thus, a $1 million primary residence subject to a $600,000 mortgage that is conveyed to a Community Property Trust, could be subject to documentary stamp taxes of as much as $4,200 unless exempt under Rule 12B-4.013(27) or (28).

- Several sections of Rule 12B-4.013 provide exceptions for transfers to trusts pursuant to Chapter 689, F.S. (Revocable Trusts and Irrevocable Trusts) and deeds between spouses (R. 12B-4.013(27) and (28). The exceptions do not specifically refer to a transfer to a Community Property Trust because the Community Property Trust Act was enacted effective July 1, 2021.

-

- Rule 12B-4.013(27)(c) provides no tax is due on a deed that transfers any interest in a homestead between spouses, when the only consideration for the transfer is the amount of mortgage on the homestead at the time of transfer. Our concern is whether a transfer of homestead to a Community Property Trust constitutes a transfer between spouses.

- Rule 12B-4.103(28)(i), entitled Revocable Trust, states that a deed to a trustee from a grantor who has the power to revoke the trust instrument, and upon such revocation of the trust instrument, the deed would return from the trustee to the grantor, is not subject to documentary stamp tax. Our concern is whether a transfer to a Community Property Trust qualifies under Rule 12B-4.013(28)(i) as such transfer may or may not satisfy the conditions based upon the terms of the Community Property Trust. We believe the following issues are unclear as to Rule 12B-4.103(28)(i):

- Who is the grantor of the Community Property Trust? If the transferor to the Community Property Trust is two spouses, as tenants by the entirety, is the transfer considered to be made by one grantor (i.e., the tenants by the entirety as a single grantor) or is each spouse considered a grantor?

- If the transfer is considered as being made by two separate grantors, can either grantor spouse revoke the Community Property Trust, acting unilaterally? If so, when one-half of the Community Property Trust property is deeded back to each spouse, is it certain there will be no stamp tax?

-

- During a July 2022 meeting of the Homestead Committee of the Florida Bar Real Property Probate and Trust Law Section, it was agreed that committee members will seek confirmation that a conveyance of encumbered property to a Community Property Trust and the return of such property to the original settlor will not be subject to Florida documentary taxes. Until such guidance is provided, there may be some risk of incurring documentary stamp taxes when conveying encumbered homestead property to a Community Property Trust.

- These issues are being addressed by members of the Florida Bar committee that proposed the Florida Community Property Trust and we are awaiting clarification.

4. SECURE Act Provisions: The SECURE Act of 2019 significantly changed the federal tax laws with respect to retirement plan assets. Some of the most important changes that tie into our clients estate planning are as follows:

- The Required Minimum Distribution date (when the original account owner must begin to receive distributions) was raised from 70.5 years of age to 72 years of age effective December 31, 2019. The SECURE Act 2.0 currently being considered in Congress will raise the age to age 75 by 2032, if passed.

- Limits the time during which beneficiaries, other than spouses, disabled beneficiaries, minors, and certain other exception beneficiaries, may withdraw the principal benefits inherited from qualified plans and IRAs from over the beneficiarys lifetime to no greater than ten (10) years from the original account owners death. Annual required minimum distributions from such plans must be taken by beneficiaries if the original account owner had already started to take his or her required minimum distributions. If the original account owner had not yet begun to receive the required minimum distributions, then the beneficiary may elect to take the entire proceeds within five (5) years or elect to receive required minimum distributions based upon the beneficiarys life expectancy; however, the entire principal must be taken by the tenth (10th) year (extending the required time to take the entire principal from five (5) years to ten (10) years. This change limits planning that can be implemented for a non-spouse beneficiary who is not disabled, a minor, and/or an exception beneficiary, as this rule also applies to trusts, which must be structured to qualify as a designated beneficiary to obtain the ten (10) year maximum payout period. Otherwise, qualified plans payments to trusts need to be distributed over five (5) years rather than ten (10) years. Because the additional five (5) years may not be significant and the income must be paid out to the beneficiary upon receipt by the trust, the benefits of using a trust for retirement plan benefits for beneficiaries, other than a spouse, a disabled person, a minor, or certain other permitted beneficiaries has been reduced.

- Because spouses and disabled beneficiaries continue to benefit from the ability to receive retirement distributions over their lives (as compared to the shorter ten (10) year duration under the SECURE Act), retirement plan distributions should be reviewed and possibly reallocated amongst spouses and disabled beneficiaries with a corresponding reallocation of other non-retirement assets to the family members to maximize deferral of income tax on retirement plan assets.

5. Revised Florida Statute § 736.0505(3)(b) Allows Spousal Limited Access Trust (SLAT) Assets to Return to the Original Donor Spouse and Benefit from Asset Protection but there is Uncertainty Regarding Estate Tax Inclusion to the Original Donor Spouse if SLAT Assets Return to the Donor Spouse, whether Outright or in Trust upon the Death of the Original Beneficiary:

In May 2022, Florida enacted revised Florida Statute § 736.0505(3) (effective July 1, 2022), which is similar, in part, to the Inter Vivos QTIP Trust legislation already enacted in eighteen (18) states, including Florida (originally enacted in 2010).[1] Florida inter vivos QTIP Trust legislation provides that when the original donee spouse dies and assets revert to the original donor spouse, in trust (e.g., in a credit shelter trust or bypass type trust), such trust assets will be treated as having been created by the original donee spouse if a QTIP election was made on the original gift to the inter vivos QTIP Trust. As a result, such assets held in trust for the original donor (upon the death of the original donee spouse) can be designated to be protected from the original donor spouses creditors [because the inter vivos QTIP Trust held for the original donor spouse upon the death of the original donee spouse is considered a third party created trust (i.e., created by the original donee spouse and not created by the original donor spouse)]. If, upon the death of the original donee spouse, the trust created for the original donor spouse was considered a first party created trust (i.e., created by the original donor spouse for the original donor spouses benefit), then such trust would be considered a self-settled trust and would have no asset protection or estate tax saving benefits. Inter vivos QTIP Trust assets that revert, in trust, to the original donor spouse benefit from a federal tax regulation providing that such assets that are protected from the original donor spouses creditors will not be includible in the original donor spouses estate under Code Sections 2036, 2038, and 2041 assuming the original trust qualifies for the marital QTIP election and the trust held for the original donor spouse upon the death of the original donee spouse is effectively drafted.

Revised Florida Statute § 736.0505(3) provides that assets gifted to a trust that includes the original donors spouse as beneficiary, whether or not a QTIP election is made, as to the original trust gift, which return to the original donor spouse, in trust, upon the death of the original donee spouse, whether under the terms of the trust or as a result of the exercise of a power of appointment, will be considered to have been settled by the original donee spouse (not the original donor spouse) so that such assets would be significantly protected from creditors of the original donor spouse if the original donee spouse predeceases the original donor spouse.

Revised Florida Statute § 736.0505(3) provides clarity with respect to asset protection for gifts using a Spousal Limited Access Trust (commonly referred to as a SLAT) returning to the original donor spouse in trust upon the death of the original donee spouse but it does not control whether the IRS will attempt to include SLAT assets returning to the original donor spouse, which pass, in trust, to the original donor spouse upon the death of the original donee spouse, in the estate of the original donor spouse upon the original donor spouses death under Code Section 2036 and Code Section 2038. Florida Statute § 736.0505(3) does not control Federal tax law. There is a possibility that SLAT assets returning to the original donor spouse in a Credit Shelter or bypass type trust would be included in the original donor spouses estate under Code Sections 2036 or 2038 if the IRS can establish there was an implied or express agreement that the assets gifted by the original donor spouse would be held for the benefit of the original donor spouse upon the death of the original donee spouse and that distributions would be made from such trust to benefit the original donor.

Two Internal Revenue Service Private Letter Rulings provide support for the position that assets passing from a SLAT upon the death of the original donee spouse to the original donor spouse in a credit shelter or bypass trust not being included in the estate of the original donor spouse. Private Letter Ruling 9837007 held that contributions by an Alaska resident to an Alaska domestic asset protection trust were completed gifts and PLR 200944002 held that the assets of an Alaska domestic asset protection trust would not be includible in the Alaska settlors gross estate. Private Letter Ruling 9837007 states that the ruling is dependent upon there being no agreement, express or implied, between the original donor and the trustee as to how the trustee will exercise its sole and absolute discretion to pay income and principal among the beneficiaries which included the original donor. Until the potential adverse estate tax consequences of SLATs are clarified by cases, rulings, or statutes, care should be exercised when creating SLATs, even after the July 2022 revision to Florida Statute § 736.0505(3) especially where there is an understanding that upon the death of the original donee spouse, assets will be held for and distributions paid to the original donor spouses during the original donors lifetime. We believe there will likely be a future Private Letter Ruling, Chief Counsel Memorandum, or court case that will provide guidance on whether and under what circumstance assets in a SLAT that return to the original donor spouse are includible in the original donors estate under Code Section 2036 or Code Section 2038. Until then, clients should be aware of the SLAT risks described above. We believe that many lawyers and advisors are unaware of this risk, in part because the White Paper provided during the legislative process to pass Florida Statute Section 736.0505(3)(b), appears to conclude that the new statute will provide estate tax benefits. We believe that Florida residents should be cautious and understand the estate tax risks of creating SLATs if the intent is that upon the death of the first spouse assets will be held in trust or paid outright to the initial donor spouse.

Until the Federal tax law is clarified as to the potential inclusion of SLAT assets reverting to the original donor spouse in the original donor spouses taxable estate, conservative clients will only create SLATs if they do not anticipate the SLAT assets will return to the original donor spouse upon the death of the donee spouse. If economic circumstances change and the original donor spouse needs assets in the SLAT created for his or her spouse, then the original donee spouse can exercise a power of appointment in favor of an asset protected trust for the original donor spouse (or outright to the original donor spouse) in which event inclusion of such assets in the estate of the original donor spouse may not result in creating a taxable estate for the original donor spouse (i.e., because the estate of the original donor spouse, including assets returning to the original donor spouse from the SLAT, are less than the original donors remaining basic exclusion amount at death), or if there may be a taxable estate, the tax may not be so significant as compared to the benefit of the original donor spouse having access to SLAT assets upon the death of the original donee spouse.

When SLATs are created by spouses who believe they will need to have access to the SLAT assets upon the death of the original donor spouse and, in fact, such assets revert to a trust for the original donor spouse upon the death of the original donee spouse and the trustee makes frequent distributions to the original donor spouse, then the SLAT assets returning in trust to the original donor spouse would likely be included in the original donor spouses estate under current federal tax law. This risk is even greater if shortly after creation of a SLAT, the original donee spouse exercises his or her power of appointment in his or her Last Will in favor of the original donor spouse.

Conclusion

We identified a number of recent issues, above, that we believe are most important for our clients. Unless changed by Congress, the current $12.06 million (for 2022, but estimated to increase to $12.92 in 2023 based upon the August 2022 Consumer Price Index) federal exemption from estate and generation skipping taxes is scheduled to be reduced to about $6 million on January 1, 2026. Accordingly, planning should be considered to fully utilize the existing $12.06 million (for 2022) exemption. For those clients who have not made full use of their annual exclusion gifting for the year 2022, such clients should consider utilizing the $16,000 annual exclusion for tax free gifts less prior gifts (for 2022). As stated in this letter, above, the annual exclusion for tax free gifts is estimated to increase to up to $17,000 in 2023 based upon the August 2022 Consumer Price Index.

We encourage our clients to schedule an “estate planning checkup every three to five years or sooner, if personal or financial circumstances materially change.

CITE AS:

LISI Estate Planning Newsletter #2984 (September 29, 2022) at http://www.leimbergservices.com. Copyright 2022 Leimberg Information Services, Inc. (LISI). Reproduction in Any Form or Forwarding to Any Person Prohibited – Without Express Permission. This newsletter is designed to provide accurate and authoritative information regarding the subject matter covered. It is provided with the understanding that LISI is not engaged in rendering legal, accounting, or other professional advice or services. If such advice is required, the services of a competent professional should be sought. Statements of fact or opinion are the responsibility of the authors and do not represent an opinion on the part of the officers or staff of LISI.

CITATIONS:

[1] Ariz. Rev. Stat. § 14-10505(E); Ark. Code. Ann. § 28-73-505(c)(1); 12 Del. C. § 3536(c)(4); Fla. Stat. § 736.0505(3); Ga. Code Ann. § 53-12-82(b); Ky. Rev. Stat. Ann. § 386B.5-020(8)(a); Md. Code Ann., Est. & Trusts § 14.5-1003(a)(2); Mich. Comp. Laws § 700.7506(4)(b); N.H. Rev. Stat. § 564-B:5-505A(e)(3)-(4); N.C. Gen. Stat. § 36C-5-505(c); Ohio Revised Code § 5805.06(B)(2)(b); Or. Rev. Stat. § 130.315(4); S.C. Code Ann. § 62-7-505(b)(2); Tenn. Code Ann. § 35-15-505(d); Tex. Prop. Code Ann. § 112.035(g); Va. Code Ann. § 64.2-747(B)(3); Wisc. Stat. Ann. § 701.0505(2)(e)1.a.; and Wyo. Stat. Ann. § 4-10-506(f).; See David G. Shaftel, Twelfth ACTEC Comparison of the Domestic Asset Protection Trust Statutes, updated through August 2022, available at https://www.actec.org/assets/1/6/Shaftel-Comparison-of-the-Domestic-Asset-Protection-Trust-Statutes.pdf?hssc=1.

Back to Top

|

Enhancing The Joy of Giving

Written By: Jill Ashley, CPA

Using charitable trusts – on their own or in conjunction with donor-advised funds – may offer greater flexibility and control over charitable intentions in meeting philanthropic goals, while bolstering estate planning and tax management, enabling a donor to realize the joy of giving (not possible with a bequest).

A charitable trust allows a donor to set aside assets for one or more charities. There are two general types of charitable “split interest” trusts: charitable remainder trusts (CRTs) and charitable lead trust (CLTs). These types of trusts “split” the assets between charitable and noncharitable beneficiaries. Which type you choose depends on your priorities with respect to estate planning and wealth preservation, how you want the charity to receive the gift, and even the types of assets you wish to donate.

CRTs and CLTs are similar in that some of the assets go to one or more charities and some go to one or more noncharitable recipients. The key difference is when the charitable and noncharitable beneficiaries receive their payments. With a CLT, the charity receives an income interest for a term of years or for a person’s lifetime, with the individual(s) receiving the remaining assets at the end of the trust term.

Conversely, with a CRT, individuals receive the income interest, while one or more charities receive the remainder.

Win – Win strategy for charities and donors

In short, charitable trusts can preserve wealth for those with charitable intentions because they provide a tax-efficient method for giving, while increasing the social capital of the donor.

Charitable Remainder Trust

With a CRT, you donate certain assets – often highly appreciated or non-income producing – to the trust, which makes at least an annual payout back to you or to another noncharitable beneficiary for the term of the trust. You choose the time period, which can be for your or someone else’s lifetime or up to a 20-year term. When that time has expired, the remaining assets, as well as any appreciation generated, go to the charity or charities selected.

An advantage of using a CRT is that you can fund it with highly appreciated property, such as stock or real estate and sell those assets within the trust without paying capital gains taxes. Thus, the trust receives the full market value of the assets (undiluted by taxes), which translates into more money for both the charity and the noncharitable beneficiaries.

Charitable Lead Trust

A CLT makes at least an annual payout to the charity first. Then after a pre-determined period of time, the trust terminates and the remainder transfers to noncharitable beneficiaries, such as family members or a family trust. Offering flexibility similar to that of a CRT, the CLT allows the donor to choose the annual payout amount and the term of the trust – either a period of years or a person’s lifetime.

Income tax deductions

CRTs potentially provide immediate partial income tax deduction based on the value of the eventual gift to charity.

Estate tax reductions

Generally, once a CRT is funded, those assets are irrevocably excluded from the donor’s gross estate for estate tax purposes.

Gift tax reductions

Contributions to a CLT during your lifetime may qualify for gift tax deductions based on the interest eventually passing to the charity. However, if the remainder beneficiary of the CLT is not the original donor, then the donor might be subject to gift tax reporting on the value of the remainder interest. The rules are tricky, but there are ways to structure these non-grantor CLTs to potentially eliminate transfer taxes on the value passing to the end beneficiary.

Creating income from non-income producing property

CRTs can provide an income stream back to a donor who is charitably inclined, needs income, but owns non-income-producing property.

Alternatively, CRTs can be structured to delay the income stream paid to the donor until a future date, such as when another income stream terminates, or when the donor is in a lower tax bracket during retirement.

Strategies to consider:

- Naming a donor-advised fund as the charitable beneficiary

Using donor-advised funds in conjunction with your charitable trust offers flexibility to change your ultimate charitable recipients, rather than locking yourself in with a specific charity. With this strategy you not only retain flexibility in choosing or changing your mind on the charity, you may encourage family involvement, establishing a family legacy of giving.

- Replacing assets for heirs

If you plan to give substantial assets to charity but still want to provide additional resources for your heirs, you might consider using a CRT to help fund the purchase of life insurance. Donors may contemporaneously set up a CRT for charitable giving, and purchase life insurance (covering his or her life), using the income stream form the CRT to pay the life insurance premiums, with the death benefits payable to your heirs. If the life insurance policy is owned by the donor’s Irrevocable Life Insurance Trust, the value is also sheltered from estate taxes.

CRUTs and CRATs – two flavors of CRTs

A charitable remainder unitrust, or CRUT, ties the annual annuity payment to a percentage of the annually re-determined fair market value of the assets. Thus, the annual payout goes up each year the trust value increases, and goes down if the trust value decreases.

A charitable remainder annuity trust, or CRAT, sets the annual payments at a fixed percentage of the value of the originally donated assets.

Pooled income trusts are a variation of CRTs

in which donated assets are pooled among many donors and each donor receives income based on their portion of the overall investment pool, after which the remainder does to charity.

Pooled income trusts are established and administered by non-profit organizations. Thus, they provide a low-cost split-interest solution attracting donors whose gifts are not large enough to justify establishing individual CRUTs or CRATs, although they lock in the named charity.

The Fine Art of Planning With Collectibles5

Collectibles are a very special asset class – one that requires expertise to analyze, value and incorporate as part of a larger advanced planning strategy.

Profitable sales of tangible personal property trigger a flat 28% long-term capital gains tax (in addition to potential Alternative Minimum Taxes and Net Investment Income Taxes – and possibly shifting the donor’s overall income into a higher tax bracket on all other income) – while profitable sales of securities trigger a lower long-term capital gain tax rate up to a maximum 20% (albeit potentially triggering the same AMT and NIIT taxes as with collectibles).

The amount of income tax deductions allowed for art donations depends on several factors:

- The donor’s holding period and adjusted gross income.

- Whether the gift represents a full and present interest.

- Whether the charitable beneficiary is a qualified tax-exempt organization or a private foundation.

- Whether the qualified charity uses art in furtherance of its tax-exempt purpose. (as opposed to simply selling the donated art to generate more useful cash for the organization’s general purposes)

Creative planning ideas:

If a donor wants to gift art to a charity that doesn’t use art in its tax-exempt purpose, the charity sells the art, thus limiting the donor’s income tax deduction to the lower of cost or fair market value. However, there are sources available to make loans against qualified art, permitting the donor to make a fully deductible cash donation instead. Thus, the donor keeps the art to enjoy, and if properly structured, loan interest can roll into the loan or interest paid may be deducted as investment interest expense.

If the loan is paid off, the art can be transferred to a CRT. The art would be sold inside the CRT allowing a stream of income to the donor and leaving the principle to charity.

Alternatively, art can be gifted to a family foundation, which then lends it to a museum. Such a foundation confers multi-generational access to philanthropic capital. Fifty years after the death of a donor, great grandchildren may run the foundation (optionally with salaries) and glean personal connections to insights of great grandparents they never knew.

Sources:

1Charitable Giving that Gives Back, FIDELITY VIEWPOINTS – 07/02/2015

2 The nuts and bolts of charitable trusts, Bankrate.com

3 Charitable Gift Annuities: A Primer, AICPA Wealth Management Insider

4 Lexisnexus.com

5 Lewis Schiff,The Fine Art of Planning with Collectibles, AICPA Wealth Management Insider

Back to Top

|