Is It Still Thursday? – The Thursday Report – Issue 343

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Friday, April 19, 2024Issue #343Happy After April 15th!

As we are aware, April 15th marks the filing deadline for many tax returns and usually signifies the end of “tax season” for CPAs and other tax advisors. We salute CPAs and other tax advisors who have burned the midnight oil and worked over weekends to ensure their clients filing deadlines are met. The fun does not stop simply because tax season has ended. We hope that this Thursday Report can provide a nice respite from meeting tax filing deadlines and that the insights provided here can be helpful for tax advisors and taxpayers alike. In fact, in recegonition of the hardwork devoted on meeting tax filing deadlines we have reserved this Thursday Report for an extra day to hopefully provide for relaxing (weekend) reading. Coming from the Law Offices of Gassman, Crotty & Denicolo, P.A. in Clearwater, FL. Edited By: Christopher Denicolo |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Please Note: Gassman, Crotty, & Denicolo, P.A. will be sending the Thursday Report out during the first week of every month. Article 1Hot off the Press – IRS Releases Notice 2024-35 to Extend Required Minimum Distribution Relief Regarding Retirement PlansWritten By: Christopher Denicolo & Brandon Ketron Article 2Following FIRPTA: Understanding the Basics of the Foreign Investment in Real Property Tax Act of 1980 and Traps for the UnwaryWritten By: Christopher Denicolo Article 3Important Aspects of the Corporate Transparency ActWritten By: Chriseanna Mitchell Article 4Check Out Our EstateView Illustrated TourWritten By: Joey Kleiner Forbes CornerYour CPA’s Guide to the New ERC CrisisWritten By: Alan Gassman For Finkel’s Followers5 Processes You Should Go Over With Every New AssistantWritten By: David Finkel Upcoming WebinarSophisticated Charitable Planning and Recent Events Associated TherewithPresented By: Alan Gassman & Paul Caspersen More Upcoming EventsYouTube LibraryHumor |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1Hot off the Press – IRS Releases Notice 2024-35 to Extend Required Minimum Distribution Relief Regarding Retirement Plans

Written By: Christopher Denicolo & Brandon Ketron

Taxpayers and their advisers have been anxiously awaiting the IRS’s release of final regulations regarding the sweeping changes to the required minimum distributions from IRAs and other qualified retirement plans (“Retirement Plans”) under the SECURE Act that was released in 2020. On April 16, 2024, the IRS released IRS Notice 2024-35 to extend transition relief that applies to certain required minimum distributions from Retirement Plans following the death of a Retirement Plan participant/IRA owner (“Participant”), in a manner similar to what applied under the previously issued IRS Notice 2022-53. The SECURE Act generally eliminated the ability to stretch required minimum distributions from Retirement Plans over a beneficiary’s life expectancy following the death of a Participant, except under certain circumstances where the beneficiary was deemed to be an “eligible designated beneficiary.” Instead of this life expectancy stretch that had previously been available, many taxpayers would be subject to the 10 Year Rule. The 10 Year Rule provides that the beneficiary must take a distribution of all assets held under the Retirement Plan on or before December 31 of the 10th year following the Participant’s death. In February of 2022, proposed regulations were released that provided significant guidance to the new landscape of required minimum distributions from Retirement Plans. The proposed regulations contained much welcomed guidance with respect to the interpretation of the SECURE Act, but also provided for a major surprise in that certain taxpayers would be required to take required minimum distributions on an annual basis following the death of a Participant where the Participant died after reaching his or her required beginning date and the required minimum distributions would be subject to something known as the “10 Year Rule.” Specifically, if a Participant dies after reaching his or her beginning date (which now generally is April 1 following the date on which the Participant attains the age of 73), then a designated beneficiary who inherits a Retirement Plan from such Participant that is subject to the 10 Year Rule would have to take annual required minimum distributions in Years 1 through 9 in the same manner as they would have had to before the SECURE Act was enacted, with a final distribution of all remaining assets under the Retirement Plan no later than December 31 of the 10th year following the Participant’s death (such interpretation of the 10 Year Rule is referenced in this article as the “Modified 10 Year Rule”). Many taxpayers and practitioners were of the understanding that the 10 Year Rule simply meant that all assets must be distributed from the Retirement Plan by December 31 of the 10th year following the Participant’s death, and that no distributions would be required in Years 1 through 9 following such death. The “Modified 10 Year Rule” interpretation was unexpected and was the target of much scrutiny by commentators and taxpayers, including through formal comments made in the 90-day period following issuance of the proposed regulations in 2022. Interestingly enough, if a Participant died before reaching his or her required beginning date (generally April 1 following the date on which the Participant attains the age of 73), then the 10 Year Rule applies in the same manner as the 5 Year Rule (which has traditionally applied in situations where a Participant died before his or her beginning date and left no designated beneficiary) in that the assets of the Retirement Plan can be held with no required minimum distributions during Years 1 through 9 with a full distribution of all assets from the Retirement Plan by December 31 of the 10th year following the Participant’s death. This Notice does not impact the rules that apply with respect to distributions when a Participant dies before his or her beginning date. Subsequent to the proposed regulations being issued, the IRS issued Notice 2022-53 which provided that the final regulations that are to be released with respect to the required minimum distributions from Retirement Plans would not apply any earlier than the 2024 tax year. Nevertheless, here in April of 2024, the final regulations have yet to be released, and there is no indication as to when this may occur. As such, IRS Notice 2024-35 extends this transitional relief further by stating that the final regulations will not apply any earlier than January 1, 2025. IRS Notice 2022-53 further stated that, if a beneficiary fails to take any required minimum distributions that were required under the Modified 10 Year Rule in any of 2020, 2021, 2022 or 2023 as set forth under the proposed regulations, then the beneficiary would not be subject to excise tax on such failure if certain requirements are met. IRS Notice 2024-35 extends the relief provided by IRS Notice 2022-53 by applying the relief from excise tax to any such required minimum distributions mandated under the Modified 10 Year Rule for 2024 (in the same manner that applied to such required minimum distributions for 2020, 2021, 2022 and 2023). In other words, no excise tax would be assessed by the IRS for the failure to take a required minimum distribution in Years 1 through 9 under the Modified 10 Year Rule, meaning that the IRS has excused required minimum distributions for beneficiaries in years 2020 through 2024 only in those situations where the proposed regulations would have mandated required minimum distributions in Years 1 through 9 following the death of a Retirement Plan Participant who died after reaching his or her required beginning date. Nevertheless, proper practice is for the annual required minimum distributions to be taken under the Modified 10 Year Rule, as it is not clear whether the final regulations will mandate such required minimum distributions. IRS Notice 2024-35 is a welcome development that is favorable to taxpayers, and it signifies that the final regulations may soon be released. However, there is no guarantee as to when the final regulations will be released, or whether they will deviate from the proposed regulations’ interpretation of the “Modified 10 Year Rule.” Back to Top |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Following FIRPTA: Understanding the Basics of the Foreign Investment in Real Property Tax Act of 1980 and Traps for the Unwary Written By: Christopher Denicolo

Many practitioners and taxpayers alike have any only a passing familiarity with a law commonly known as “FIRPTA.” The Foreign Investment in Real Property Tax Act of 1980 (or FIRPTA for short) was enacted in 1980 as a mechanism to help assure that non-residents/non-citizens would have funds withheld to cover any United States tax associated with the disposition of an interest in United States real property. In theory, this is to address the risk that the non-resident/non-citizen would not file a United States tax return or pay taxes associated with the disposition of such property. Most run-ins with FIRPTA by United States citizens involve real estate transactions where the seller provides something known as a “FIRPTA Non-Foreign Affidavit” wherein the seller is the representing and warranting to the buyer that he, she or it is not a foreign person for United States tax law. Nevertheless, FIRPTA can become very complicated and tricky because of the obligations of the parties under the law, and the draconian penalties that can apply if the appropriate forms are not filed or the appropriate amounts are not withheld from the transaction. Generally, FIRPTA provides that 15% of the amount realized by the seller who is a “foreign person” for United States federal tax purposes on the disposition of an interest in United States real property must be withheld and sent to the IRS within twenty (20) days following the sale of the United States real property interest. Additionally, an IRS Form 8288 must be filed when the withheld funds are sent to the IRS. As a starting point and commonly misunderstood trap, the obligation to make the FIRPTA withholding and file the Form 8288 is that of the buyer of the United States real property interest, even if the buyer is a United States person. Therefore, if the FIRPTA withholding amount is not paid to the IRS or a Form 8288 is not timely filed with the IRS, then the buyer can be on the hook for substantial penalties and interest with respect to such non-compliance. Most taxpayers are not aware of this wrinkle in the law, and often assume that the seller under the transaction (or the title agent) will be addressing these obligations (which commonly are undertaken by the seller or the title agent in practice). Nevertheless, it is important for the buyer to assure that all appropriate forms are filed and all appropriate monies are paid to the IRS on a timely manner in order to assure that the buyer will not be responsible for penalties and interest (or potentially the withholding tax if it is not paid). For FIRPTA purposes, the term “amount realized” means all consideration received by the seller under the transaction, including debt relief, non-cash assets transferred to the seller, and payment to third parties at the seller’s behalf. A potential trap can apply where the seller’s net sales proceeds from the transaction are less than 15% of the amount realized, which would mean that the buyer would have to come out of pocket FIRPTA withholding amounts to the IRS in order to satisfy its obligations. This of course can be addressed contractually. One example is the standard form Florida Bar/Florida Association of Realtors As-Is Residential Real Estate Contract which places upon the seller the contractual obligations to pay any FIRPTA withholding amount out of pocket if the net sales proceeds to the seller from the transaction are not sufficient to meet this obligation. There are several exceptions to the FIRPTA withholding requirement. First, the commonly known FIRPTA Non-Foreign Affidavit exception applies where the seller under the transaction provides to the buyer an affidavit confirming that the seller is not a foreign person. This is a very common document in closings of real estate transaction and the delivery of such document from the seller to the buyer at closing can absolve the buyer for filing and withholding obligations associated with the transfer. Nevertheless, if such affidavit is not given to the buyer at closing, whether because the seller is a foreign person or for another reason, then the buyer technically remains on the hook for paying the FIRPTA withholding amounts and filing the Form 8288 therewith. Another exception applies where the amount realized by the seller is $300,000 or less, and the subject property is residential real estate that will be used by the buyer as a residence. Under this exception, no withholding needs to be made nor are any Form 8288 or other tax forms required to be filed with the IRS to claim this exception. However, it is good practice to assure either that the seller is not a foreign person (by the seller giving a FIRPTA Non-Foreign Affidavit), or the parties signing a document confirming this exception applies. Further, an exception to the requirement that the Form 8288 be filed and the FIRPTA withholding amount be paid to the IRS within twenty (20) days following the closing is if either the seller or the buyer files a Form 8288-B with the IRS on or before the closing date whereby the applicable party makes a bona fide request that the IRS issue a “withholding certificate.” The request for a withholding certificate generally requests that the FIRPTA withholding obligation be eliminated or reduced based upon one of the following reasons: (1) the seller is claiming that he, she or it is entitled to non-recognition treatment or is exempt from tax; (2) the maximum tax liability to the seller from the transaction will be less than the 15% withholding amount; or (3) the seller is claiming that the special installment sale rules described in Section 7 of Revenue Procedure 2000-35 allows for reduced withholding. One trap for the unwary is that the Form 8288-B must be filed on or before the closing date. This means that if the Form 8288-B is not filed until after the closing date, the exception does not apply and the buyer must be obligated to file the Form 8288 and pay the appropriate withholding amount within the 20th day following the closing. Once the IRS issues its decision regarding the request for a withholding certificate, the buyer then has twenty (20) days to file the Form 8288 and pay the withholding amount to the IRS, unless the IRS has found that no withholding should apply. The trap in this regard is that, in practice, the seller commonly files the Form 8288-B and, in such instance, notice of the IRS’s decision with respect to the withholding certificate would be sent to the seller, rather than the buyer or the buyer’s agent receiving such decision. This means that the buyer would have to implement mechanisms whereby it will receive communications on the status of the withholding certificate so that the buyer can be aware of how to proceed with respect to the filing of the Form 8288 and payment of the FIRPTA proceeds. Another limited exception could apply to reduce the withholding rate from 15% of the amount realized to 10%. This exception can apply if the buyer elects on a timely filed Form 8288 if: (a) the amount realized by the seller under the transaction is more than $300,000 but less than $1,000,000, and (b) the buyer intends to use the property as a residence. The penalties for non-compliance are severe. Specifically, the penalty for failure to timely file a Form 8288 is 5% of the unpaid tax amount per month, up to five (5) months, and the failure to timely pay the applicable FIRPTA withholding amount is subject to a penalty of one-half (½) of 1% per month not to exceed five (5) months. FIRPTA withholding and filing obligations also apply to dispositions of interests by partnerships, corporations and trusts, if they would be characterized as a “foreign person” under the tax law, or, in the case of partnerships, where the partnership has a foreign partners who have income that is effectively connected to the United States. The rules associated with entities can be very complicated and it is important to assure that taxpayers have reputable and qualified tax advisers assisting them in a foreign person is involved in the real estate transactions. This is especially so if the taxpayer is the buyer or transferee in a real estate transaction involving a foreign person. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Article 3Important Aspects of the Corporate Transparency Act

Written By: Chriseanna Mitchell

Chriseanna Mitchell is a student at Stetson University College of Law. She graduated from the University of Florida and is from Ocala, Florida, where she was raised with her three siblings. She is dedicated to serving her community and, with the help of the Suncoast Estate Planning Council, has followed her passion for promoting and educating others on effective estate planning practices in collaboration with industry professionals. She is also a contributor for Leimberg Information Services Inc. and is presently interning at Johns Hopkins All Childrens Hospital Foundation. Introduction Estate planning poses unique challenges for compliance with the CTA. There is ambiguity regarding the filing for minors or the responsible party who files on their behalf. Inheritors might also find it difficult to comply with tight deadlines. If you die and your will transfers ownership in a Reporting Company to your heirs or trusts for them, that will have CTA implications.

Minors Minors are exempt from CTA filings, but a responsible party will have to file on their behalf.[1] Once the former minor reaches the age of majority, the CTA filings will have to be amended to reflect the minor as the Beneficial Owner instead of the adult who had previously filed. The Treasury Department also elected to provide no leniency or safe harbor for the requirement that an individual who reaches the “age of majority” must register with FinCEN within 30 days. It would have been nice if FinCEN could have used “age 21” instead of “age of majority.” Presently, all states other than Alabama, Nebraska and Mississippi use age 18 as the age of majority. In Alabama and Nebraska, the age of majority is 19 years, and Mississippi sets it at 21. The lack of consistency between the states can cause confusion with regard to what age reporting is expected. When the minor child reaches the age of majority, as defined by the law of the State or Indian tribe in which the Reporting Company was created or first registered, the exception no longer applies. At that time, if the individual is a beneficial owner, the Reporting Company must file an updated BOI report providing the individual’s own information. Example: Mary Minor owns 25% of the interests in a Reporting Company formed in New York. In New York, the age of majority (when she legally becomes an adult) is 18. Mary lives in Mississippi, where the age of majority is 21. Mary’s mother files for her under the CTA within thirty days of Mary initially getting the interests. Mary’s mother realizes that when Mary becomes an adult, Mary will have to file. So, she reasonably calendars the date of Mary’s 21st birthday as a reminder to have Mary file. When Mary becomes an adult under her state law, she files with the FinCEN reporting that she, not her mother, is now the Beneficial Owner of the Reporting Company. But because FinCEN defines the age of majority based on the law of the state where the Reporting Company was formed, not where the minor lives, Mary filed three years late and owes huge penalty charges if caught. As discussed earlier, there is no exception for a good faith effort to comply with the CTA. This is yet another example of how unfair the CTA can be and why it is so important for people to exercise caution. Example: Continue the preceding example. Mary’s mom used a filing service to try to comply with the CTA. Will whoever programmed the filing service have addressed this odd nuance of the CTA that it is the state where the Reporting Company was formed, not where the minor lives, that is the determinative factor? Will any service or professional adviser be able to pick up on all these unexpected and non-initiative nuances? Likely not. The CTA does not stipulate who is specifically responsible for reporting. Is it one parent or both? If the parents are divorced, and one is the legal guardian, but the other has the reporting entity, will the reporting parent have to use the ex-spouse’s information? Planners may want to begin placing specific duties upon both parents to comply with the CTA when they have a common minor child. Fortunately, family law judges have significant authority to order parents to do the “right thing” in most states. Example: Suzie, a Shareholder, is planning on gifting 30% of the stock in her home-based specialty soap business to her daughter Dana. If that gift is made, Dana will own 30% of the ownership interests in the Reporting Company, so she will be a Beneficial Owner and will have to report under the CTA.

Those Who Inherit There is a problem for those set to inherit shares of a Reporting Company. When an individual dies, the successor owners of that individual’s entity interests will be required to register within 30 days of receiving the title. This will permit significant time to comply when assets are held under a probate estate or a trust that is being administered, but it can also cause significant confusion and hardship for individuals who inherit immediately upon the death of a loved one (or even a decedent whom they do not like) by right of survivorship, or when the law otherwise immediately vests ownership of an inheritance. An example of this is under the Florida homestead rules whereby a spouse and children of the deceased homestead owner instantly own a life estate in the spouse and a remainder interest in the children or 50% ownership by the spouse and 50% ownership by the children if the spouse elects. Because of this, it will be safest to simply report within 30 days of a death, particularly in situations where a revocable trust becomes another trust or provides for the funding of a separate trust, such as a credit shelter trust and/or QTIP trust, in situations where the trustee of the revocable trust might be considered to be holding the assets under the trusts that sprout from the revocable trust document. Another example is a 19-year-old who loses an older family member and suddenly inherits numerous shares of a relative’s company. This teen will now have been deemed a Beneficial Owner as defined by the CTA and will be subject to the exact reporting requirements without necessarily having the proper business acumen and experience to comply. The 19-year-old must tell the government about themselves and provide a copy of their driver’s license 30 days after the estate is finished. This is not a realistic timeline for this scenario and is another hallmark of the many gaps the CTA leaves. Oftentimes parents or grandparents will not tell a young adult that they have inherited or will be inheriting from family members, or that they own assets that were put into their names years back and might be mishandled by such young adult.

Executors Executors, as representatives of estates, may need to comply with the CTA’s reporting requirements if the estate includes entities subject to the CTA. It’s important to consult with a qualified estate-planning attorney to understand how the CTA may specifically affect your situation. For example, an executor handling an estate that includes a family-owned corporation would need to gather and disclose information about the corporation’s Beneficial Owners to FinCEN. It is an additional step in the estate administration process to ensure compliance with the CTA’s reporting requirements. The personal representatives or executors of a deceased individual’s estate or revocable trust will need to be vigilant with respect to finding out whether the deceased individual has properly reported entity ownership control or involvement and determining when and how to file with respect to ownership changes and successor owners, managers, and entities or arrangements that constitute control. While the regulations appear to be quite lenient with respect to being able not to report the ownership of an estate or beneficiaries until the administration has been completed, making sure that previous registration obligations are carried forward and registering sooner rather than later to reduce the exposure of personal representatives, executors, and trustees, will be important elements of probate courts and Trust companies will be vigilant in varying degrees. Still lawyers and accountants who administer and provide accountings for estates, as well as Trust companies, will need to understand the CTA and be able to rely upon one or more professionals to assure that proper registration occurs. This will include providing advice as to whether individuals who are involved with the estate by reason of positions of control and ownership should obtain their own FinCEN numbers or file entity reports with consequent obligations to determine whether involved individuals have changed primary address, driver’s license or passports, as applicable.

Community Property If the interest is CP (community property) but only titled in one spouse’s name, must both spouses be involved in the reporting? It may be that both spouses would not need to be considered the owner of property held by only one spouse or the other, which is consistent with how S corporation stock, partnership interests, and separate spouses who file separate personal income tax returns are reported under the federal tax law, but the safer approach would be to report that both spouses are the owners of entity interests held by either spouse. Advisors can review that couples living in community property states can transmute out-of-community property treatment, which has the advantage in some states of safeguarding community property held by one spouse when another spouse owes monies to creditors. Sometimes, it is best for most assets to be owned by one spouse when the other spouse has a high-risk situation, such as if he or she is a physician or architect with a high risk of malpractice liability. On the other hand, an advantage of community property is that all community property receives a new fair market value income tax basis for capital gains measurement purposes on the death of one spouse, so determining whether to transmute out of community property status should be carefully considered.

Creditor Protection A review of corporate entities and the appropriate ownership and use thereof would not be complete without consideration of creditor protection implications. The litigious society that we live in and the legal implications of doing business or holding investments give advisors and business and investment entity owners reason to be vigilant with respect to structuring companies and other entities and engaging in activities with a mind towards reducing liability exposure, limiting liability to the extent feasible, and owning wealth in ways that make it difficult or impossible for creditors to take it away, and which allow for the best combination of ownership and insurance coverages to apply. While compliance with the Corporate Transparency Act may not have a direct impact on creditors’ rights and an individual or family’s exposure to creditors, planning to determine what individual, individuals, or entities will be the direct or indirect owners of investment and business entities, and what entities could be used will certainly have an impact upon Corporate Transparency Act planning. Example: The ownership of a company owned jointly by a married couple might be appropriately transferred to a spouse who has less risk of being sued to protect the ownership of the company from the creditors of the other spouse who may be engaged in highly risky conduct. At the same time, a spouse who has less in assets may be better suited or at least a more logical choice to be the manager of a real estate rental operation than the spouse who has significant assets, assuming that the spouse with fewer assets will actually be the one to conduct the management of the company. In both examples above, only one spouse, instead of two, will be required to register under the Corporate Transparency Act, assuming that only one spouse is the owner and manager of a particular company. Simplifying registration requirements under the Act may be a good business reason to support the proposition that transferring ownership of corporate interests from a spouse at risk in a lawsuit is not a transfer intended to avoid creditors, but competent counsel should be consulted if this may be at issue. Irrevocable trusts are often used for creditor protection purposes. For example, one spouse might transfer significant assets to an irrevocable trust for the other spouse and their common descendants, which is commonly known as a Spousal Limited Access Trust. The beneficiary spouse may be able to act as the Trustee of the Trust and it would still not be accessible to spouse two’s creditors. The beneficiary spouse and any other person or persons who have control over the Trust may have to register as “Beneficial Owners” under the Act by reason of being beneficiaries and having control over voting of ownership interests held under the Trust, but this does not cause the assets under the trust to be subject to creditor claims if they would otherwise be immune from such claims. A review of what operations and activities take place under a company or companies that individuals may own is also almost always merited. Example: An active business with a real estate location will commonly be divided by ownership under two separate companies, one of which can own the business and the other which can own the real estate where the business is located. A third company might own the equipment that the business uses, and a fourth company might provide management services to the operating company for practical, liability limitation, and tax planning purposes. Creditor protection planning should generally be conducted with the advice of a knowledgeable attorney who understands debtor-creditor law. Transferring assets “at the last minute” when a creditor is or may be approaching can have serious implications for everyone involved and may even constitute a criminal act in some situations.

Conclusion Estate planning, bequests, or gifts of assets all raise CTA reporting consequences, and many of them are not clear or intuitive. Minors, inheritors, and executors need to be extra cautious to comply with the regulations because of the seemingly strict compliance. A source of frustration for those affected by these rules will be reporting in time. [1] FinCEN, Small Entity Compliance Guide, 2.4 (Dec. 2023) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

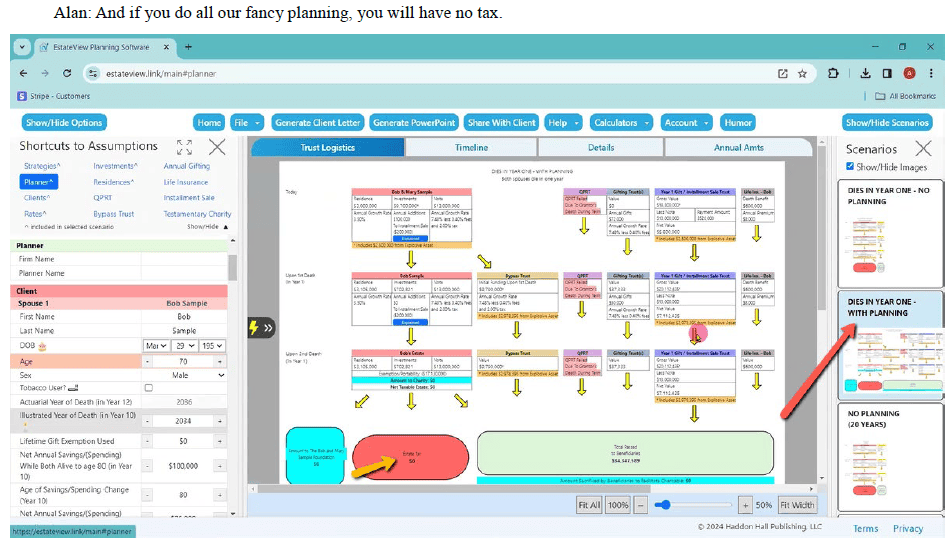

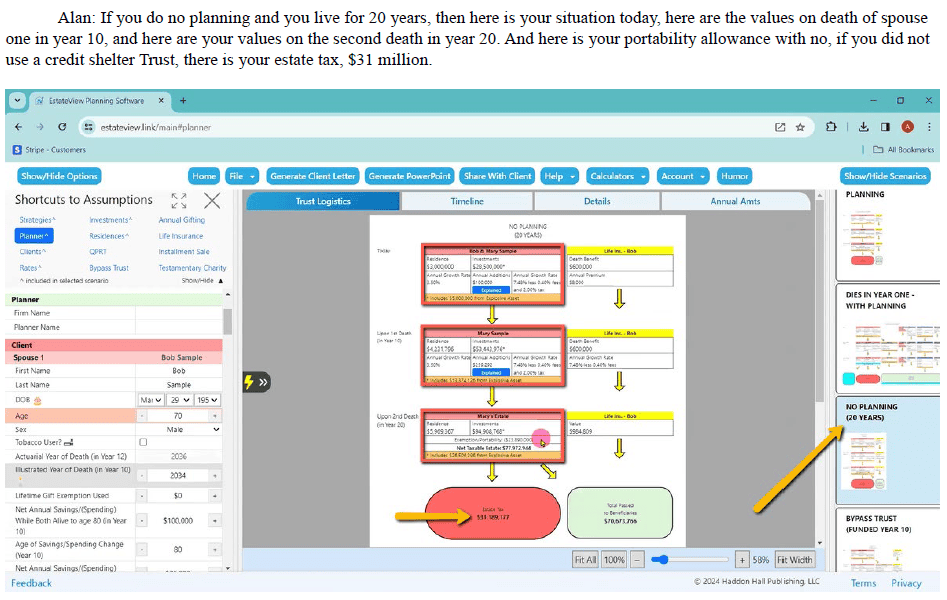

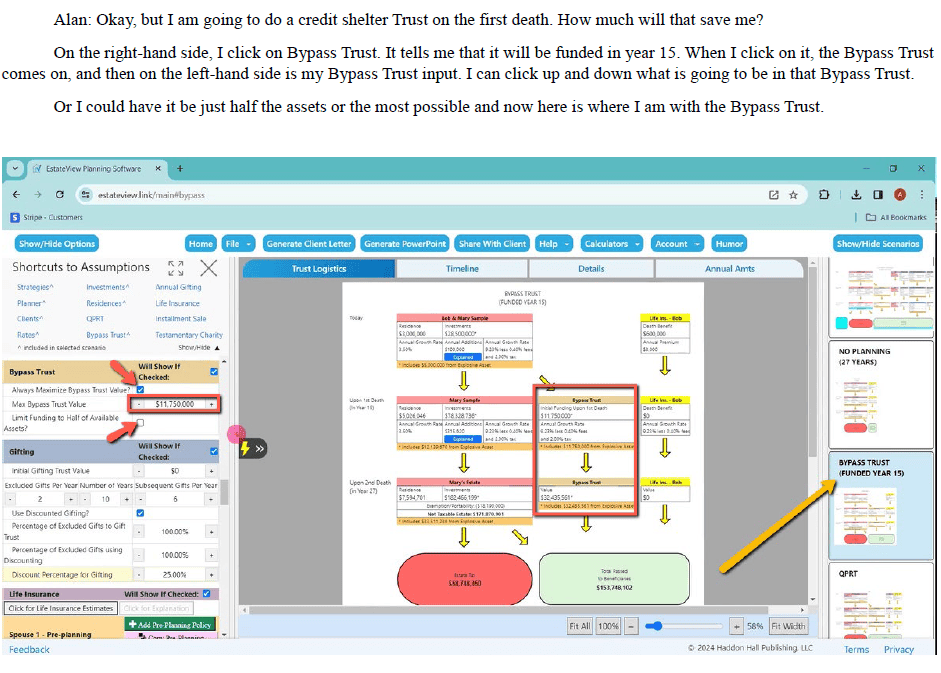

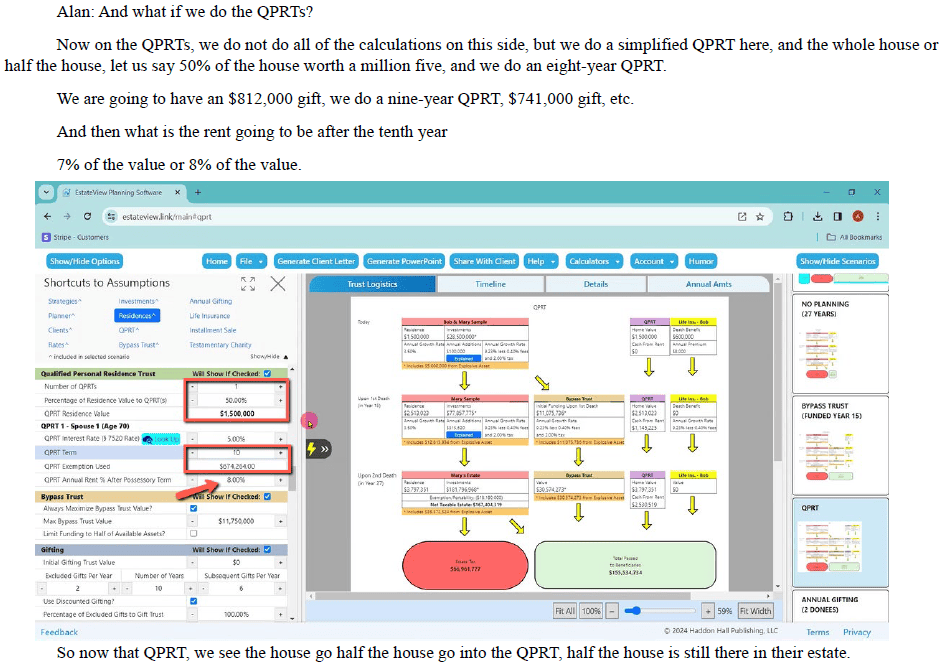

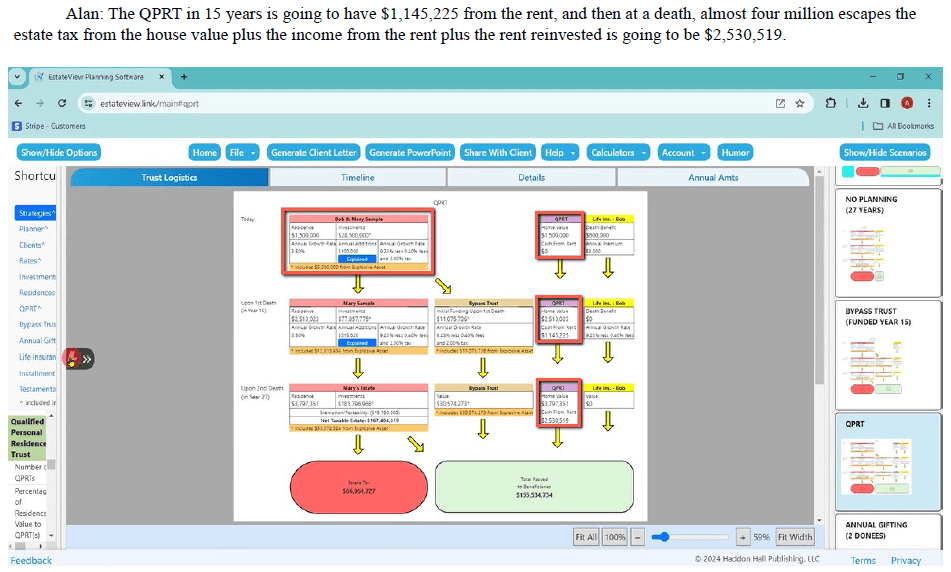

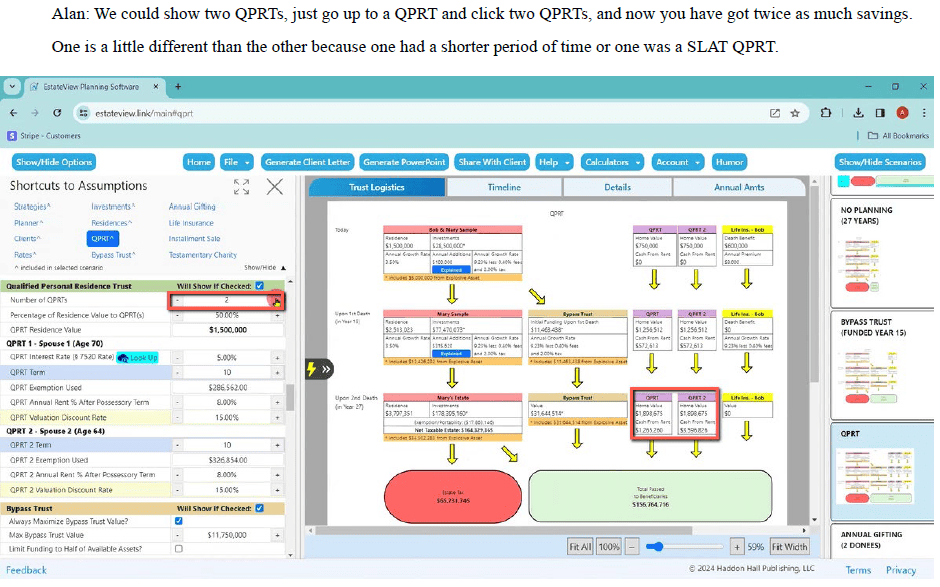

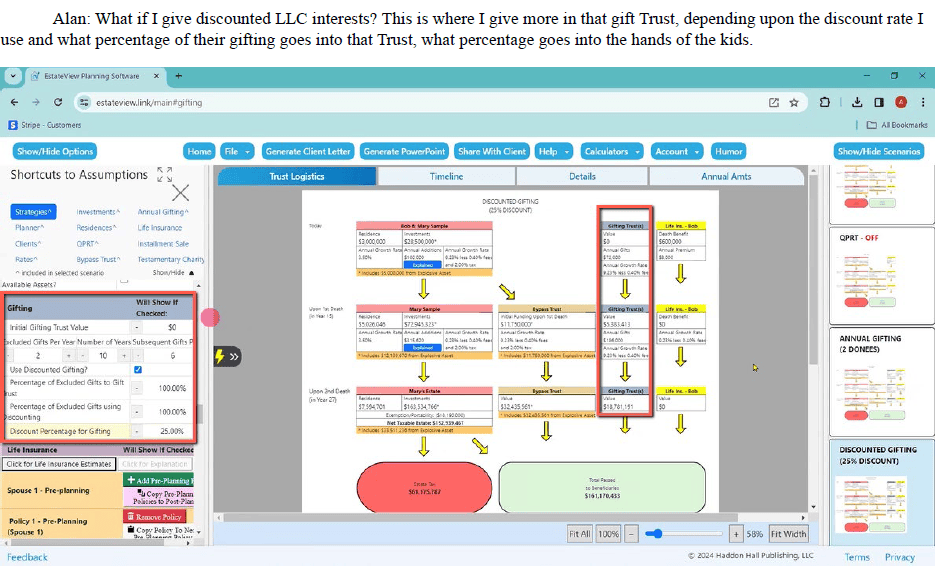

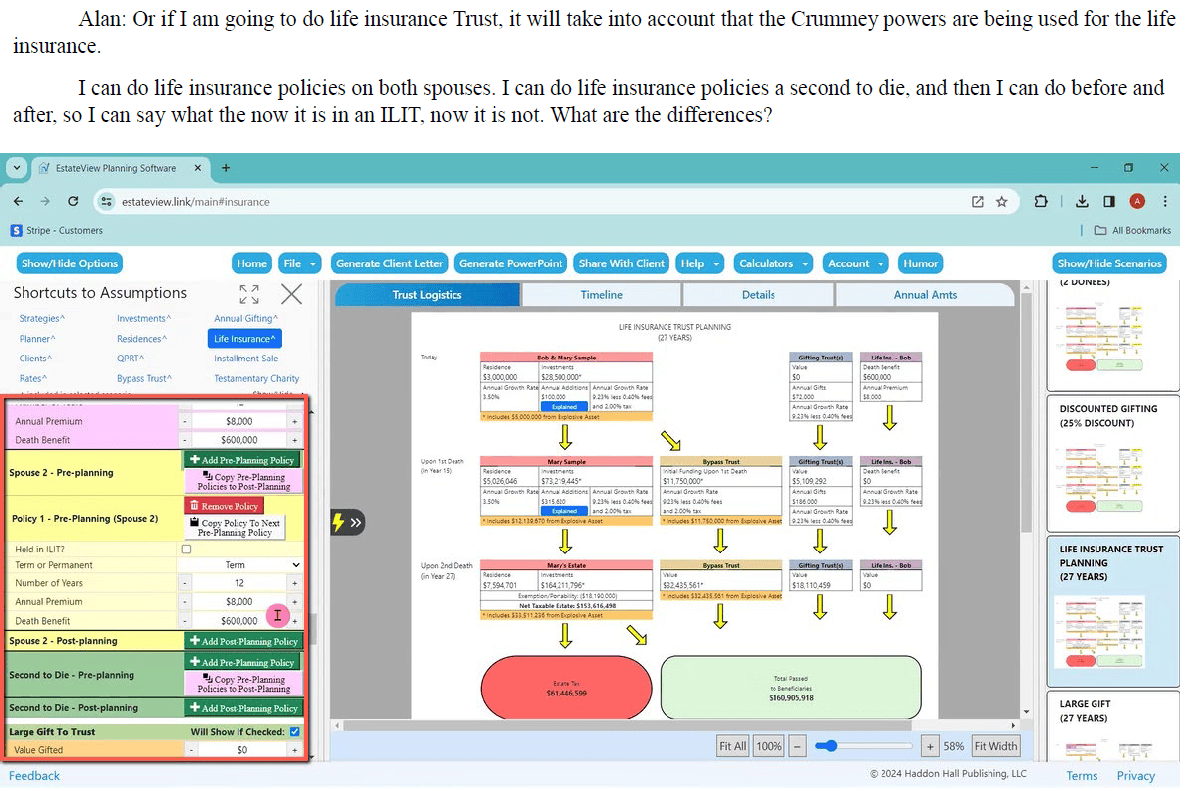

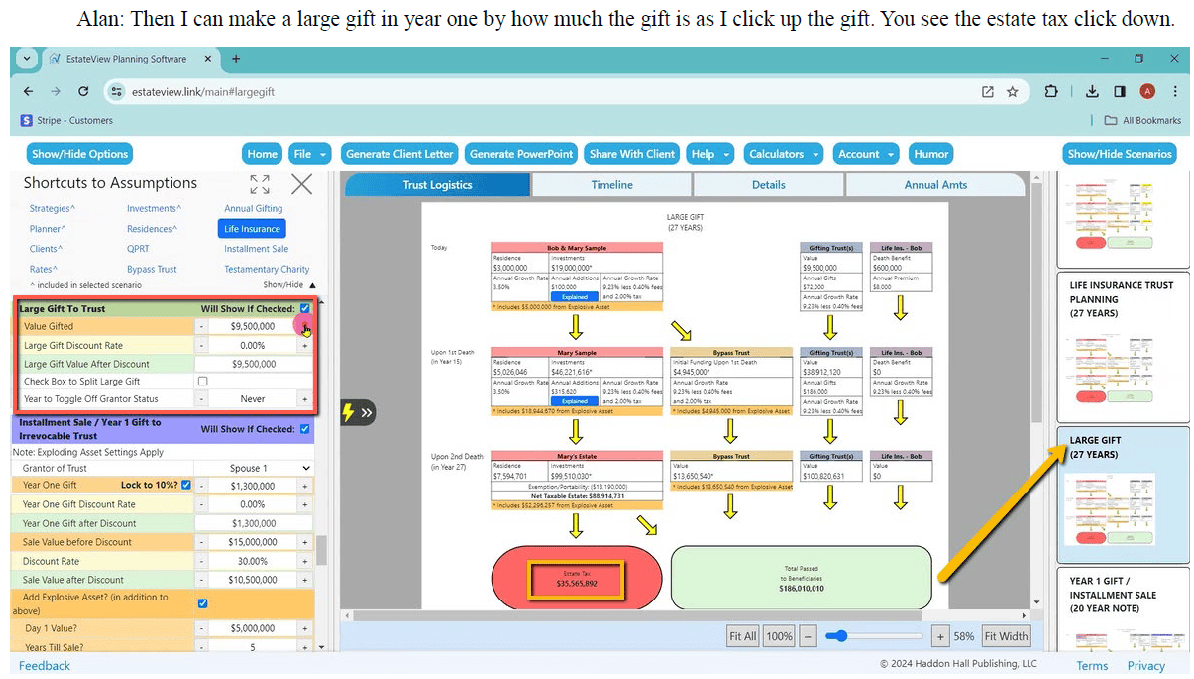

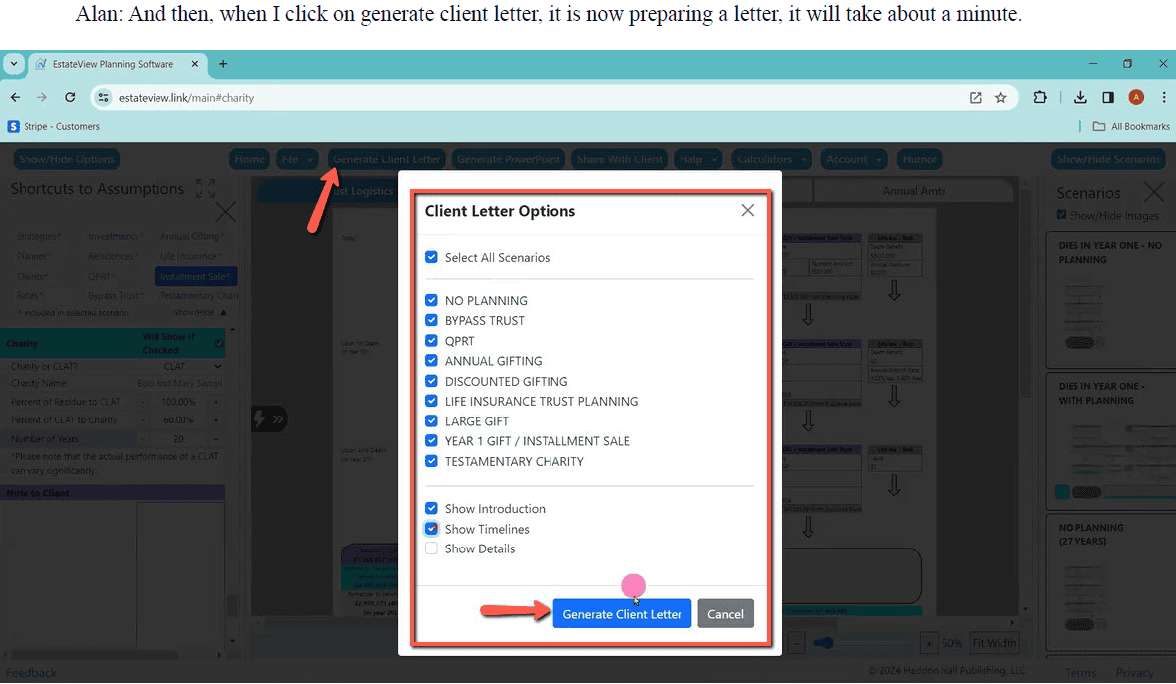

Article 4Check Out Our EstateView Illustrated Tour Written By: Joey Kleiner

Recently, Alan met a finanical services firm to demonstrate our new software product, EstateView. EstateView is a software tool that lets tax lawyers, CPAs, financial planners, and sophisticated clients run the numbers on their estate plan and illustrate its impact on their tax burden upon death. The software includes around 20 different calculation modules, including comprehensive estate tax planning for married or single clients, NEST retirement planning, and individual calculators for specific trust techniques. A video of the meeting was converted into a PowerPoint described below by our Thursday Report creative team. We hope you agree they did a great job in a very innovative way. In the transcript, I have replaced the real participant’s names with my own to preserve their anonymity. However, the rest of the content is their reaction to the wonderful tour Alan conducted and how he answered their questions. To view a copy of the illustrated transcript click here or you can view some sample slides at the bottom of this Thursday Report. EstateView is currently free to all users until May 1, 2024. If you would like to schedule a tour of your own to see the software in action, we host workshops every afternoon which you can schedule through my Calendly. The link for Monday, Wednesday, and Friday 25-minute workshops can be found here: https://calendly.com/joey_kleiner/estateview-workshop. The link for Tuesday and Thursday 50-minute workshops can be found here: https://calendly.com/joey_kleiner/estateview-extended?month=2024-04 . We also are currently running a founding member offer! If you pay $1 before May 1, 2024, or send an email to agassman@gassmanpa.com agreeing to donate $5 to the John Hopkins All Children’s Hospital Foundation you will become a founding member of EstateView without any commitment to purchase the software later. Founding members receive 14 months instead of 12 months for your first year, the first two renewals will not cost more per year than the first-year subscription price, and you will also receive a special gift from our team to show our appreciation for your support! To become a founding member, choose the $1 option when creating your EstateView account through https://estateview.link or, if you already have a free account, click “Manage Billing” on the homepage to be directed to Stripe where you can click “update plan” and complete the founding member purchase. We welcome your comments, questions, and suggestions: Estateview@gassmanpa.com I look forward to helping you Measure, Design, Illustrate & Educate your clients on their projected estate tax liability and estate planning techniques!

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Forbes Corner

Your CPA’s Guide to the New ERC CrisisWritten By: Alan Gassman, JD, LL.M, AEP (Distinguished) The expansion and strong marketing tactics of good-for-nothing “accounting advisors” who encouraged taxpayers to qualify for the Employee Retention Credit (“ERC”) when… Continue Reading on Forbes. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

For Finkel’s Followers5 Processes You Should Go Over With Every New Assistant |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Upcoming WebinarSOPHISTICATED CHARITABLE PLANNING, AND RECENT EVENTS ASSOCIATED THEREWITH

Date: Saturday, April 20, 2024 Time: 11:00 AM to 1:00 PM EST (120 minutes) Presented by: Alan Gassman, JD, LL.M, AEP (Distinguished) REGISTER HERE FOR NON CLE OR CPE CREDIT |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

ALL UPCOMING EVENTS

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

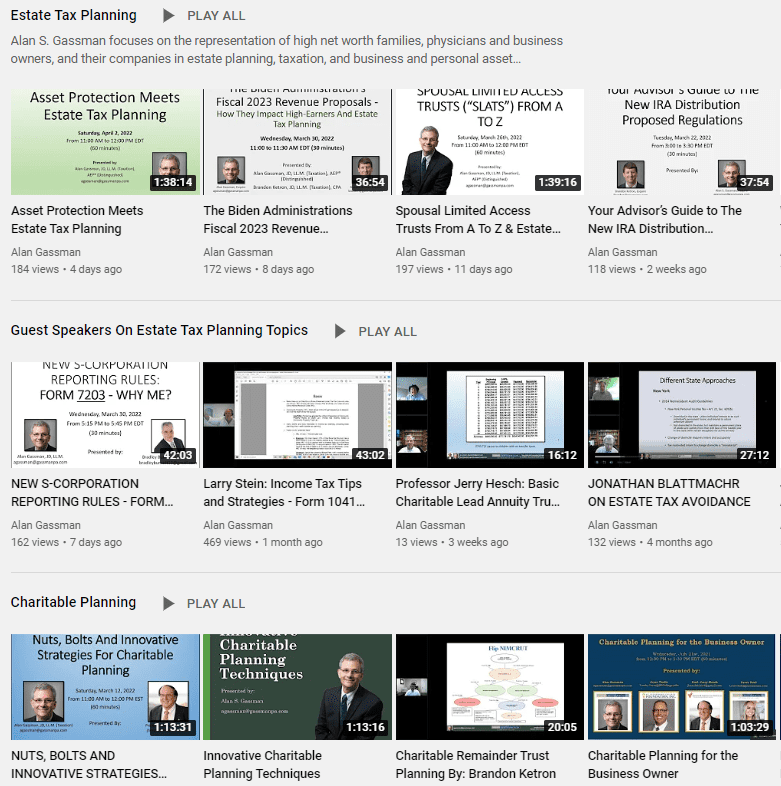

YouTube Library

Visit Alan Gassman’s YouTube Channel for complimentary webinars and more! The PowerPoint materials can be found in the description box located at the bottom of the YouTube recording. Click here or on the image of the playlists below to go to Alan Gassman’s YouTube Library. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

HUMORTax Season Jokes1. Why did the accountant break up with their calculator right after tax season ended? Because they said, “You’re great for numbers, but our relationship is subtracting too much joy!” 2. Tax season is like a rollercoaster ride. It’s full of twists, turns, and loops, but thankfully, it eventually comes to an end, and you can finally get off without feeling queasy. 3. You know tax season is over when you start seeing accountants doing the “tax season victory dance” – it looks a lot like the Macarena, but with more sighs of relief. 4. Tax season ending is like reaching the finish line of a marathon, except instead of a medal, you get a stack of receipts and a pat on the back from your accountant. 5. Why was the tax preparer so excited when tax season ended? Because they finally got to trade in their calculator for a beach towel and their spreadsheets for sunscreen! 6. Tax season is like a storm – it’s intense, it makes you want to pull your hair out, but eventually, the clouds clear, the sun shines, and you’re left wondering what all the fuss was about. 7. Tax season is officially over when you can walk into an accountant’s office without hearing the faint sound of stressed-out sighs and the smell of coffee that’s been reheated one too many times. 8. How do accountants celebrate the end of tax season? By shredding documents with the same enthusiasm as a parade confetti cannon. 9. Tax season ending is like finding a pot of gold at the end of a rainbow – except the pot of gold is your sanity, and the rainbow is made of overdue tax forms. 10. Why do tax accountants make the best comedians after tax season ends? Because they’ve had months of practice at finding humor in numbers!

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Gassman, Crotty & Denicolo, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2023 Gassman, Crotty & Denicolo, P.A |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||