Happy Thursday from the New Year’s Report – 1.1.15

Happy Thursday from Kristen Sweeney and The New Year Report

Biel Reo is Not in Rio de Janeiro – The 4-Year Fraudulent Transfer Statue Will Apply in Bankruptcy, Even if Trumped by the Florida Supplementary Proceedings Law

Judge Williamson’s Comment on Ill-Gotten Gains and the Bifani Case

Find Us in Bloomberg BNA’s Estate and Gift Tax Quarterly!

Best of The Thursday Report 2014, Part II

Richard Connolly’s World – Focusing on the Human Element of Estate Planning

Thoughtful Corner – Resolutions are Not Legally Binding

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Happy Thursday from Kristen Sweeney and The New Year Report

You might never guess from the bright Florida sun,

But 2014’s over, finished, and done.

Its sendoff had whistles and confetti rain

And beautiful flutes of bubbly champagne.

We watched the ball drop, way up in Times Square,

And we thought, “It’s so crowded; I’m glad I’m not there!”

Then we all yelled and shouted at 11:59

When they said, “Let’s open one more bottle of wine.”

If you woke up this morning with red bloodshot eyes,

Just have a mimosa, your headache disguise.

You might watch football all day on TV

Or maybe it’s time to take down the tree.

It might be this Thursday you find some solutions

To help follow through on this year’s resolutions.

Take time to be grateful for all that you’ve got.

The sunshine is warm or the fireplace hot.

You might write a goal, a thing or two,

That in this year you would like to do.

You might join the gym or go on a diet.

But today’s a family day – wait for tomorrow to try it.

You might pass the Bar or buy a new car,

Whatever you choose, you’re sure to go far.

Before the new habit you were going to abort,

Don’t forget to share your Thursday Report.

Every day is special and the only day you are in,

But Thursdays are the best when you are Thursday Report’n.

So onward and upward, toward the future we lean,

Here’s the first Thursday Report of 2015!

Biel Reo is Not in Rio de Janeiro – The 4-Year Fraudulent Transfer Statue Will Apply in Bankruptcy, Even if Trumped by the Florida Supplementary Proceedings Law

A previous Thursday Report reported on the Biel Rio case, in which the First District Court of Appeals found that the four-year fraudulent transfer statute does not block a judgment creditor from proceeding against a transferee more than four years after a transfer made to avoid creditors. Click here to see our previous commentary on the case.

Here is what one very bright bankruptcy lawyer has had to say about avoiding this result by filing bankruptcy:

The decision in Biel Reo, LLC v. Barefoot Cottages Development Co., LLC — So.3d — (2014) is interesting and raises a number of questions about Florida law (including exactly how far back can a judgment creditor look to recover transfers made before a judgment is entered). That said, the decision begs one strategic federal question as to why the judgment debtors’ families did not pursue a different path. Specifically, perhaps Gwin and Shoults should have considered seeking relief in a Chapter 7 bankruptcy case.

In that event, once the bankruptcy case was filed, the right to recover the transfer would be property of the bankruptcy estate, not the judgment creditor. In re Moore, 608 F.3d 253, 261 (5th Cir. 2010) (fraudulent transfer claims “become estate property once bankruptcy is under way by virtue of the trustee’s successor rights under § 544(b)”); In re C.D. Jones & Co., Inc., 482 B.R. 449 (Bankr. N.D.Fla. 2012); In re Zwirn, 362 B.R. 536 (Bankr. D.S. Fla. 2007).

The automatic stay would then immediately stop the proceedings supplementary. 11 U.S.C. §362(a)(1), (2), and (3). At that point, only the bankruptcy trustee has standing to pursue the transfers. In re Pearlman, 472 B.R. 115, 121-122 (Bankr. M.D.Fla. 2012) (“Indeed, only the trustee can bring federal and state law fraudulent transfer actions to recover property for the bankrupt estate.”) The trustee would have different and greater limitations problems than the judgment creditor. 11 U.S.C. §546(a); In re Hill, 332 B.R. 835, 843 (Bankr. M.D.Fla. 2005) (“the Trustee cannot use Florida Statute §56.29 as an alternative basis to set aside the transfers”).

A bankruptcy discharge would take care of the judgment. 11 U.S.C. §524(a)(1) & (2) (“[a] discharge in a case under this title voids any judgment at any time obtained [and] operates as an injunction against the commencement or continuation of an action, the employment of process, or an act, to collect, recover or offset any such debt.”). To be sure, there are lots of other issues to consider, but taking the bankruptcy route before the ruling on the proceedings supplementary could have meant millions of dollars of difference for the judgment debtors’ families.

Judge Williamson’s Comment on Ill-Gotten Gains and the Bifani Case

Last week, we published a follow-up article about the Bifani bankruptcy/homestead case. You can see our article by clicking here.

Since our last Thursday Report went out, Judge Michael Williamson had this to say:

While Havoco attracts the most attention in allowing a fraudulent conversion of non-exempt property into a homestead, what is often overlooked is that Havoco itself recognizes the Fishbein exception, 619 So. 2d 267 (Fla. 1993), which allows the imposition of an equitable lien where there are two frauds: (1) the permitted fraudulent conversion into the homestead, and (2) the initial wrongful conduct that taints the proceeds as being ill-gotten, e.g. the funds were stolen or obtained through fraud. The 11th Circuit in Bifani simply confirms what has long been the law in this area.

In Havoco, the Florida Supreme Court found that an intentionally fraudulent transfer into homestead would not be set aside because the protection of homestead under the Florida Constitution trumps the Florida Fraudulent Transfer Statute. In Fishbein, however, the Florida Supreme Court found that when ill-gotten monies are transferred into homestead, the transfer can be set aside. In Bifani, the 11th Circuit agreed with Judge Williamson that a fraudulent transfer made by someone contemplating bankruptcy will be considered as ill-gotten gains for purposes of recapturing the transfer from the homestead of the transferee that was funded thereby.

Stay tuned for more details on this case next year!

Find Us In Bloomberg BNA’s Estate and Gift Tax Quarterly!

Check out Bloomberg BNA’s January 2015 Estate and Gift Tax Quarterly with our articles on The Most Common Mistakes Florida Planners Make (besides not reading The Thursday Report every week!) and Way Down Upon the Bifani River. We thank Aen Webster, Esquire for all of her assistance and patience in editing and designing our articles.

“I love deadlines. I love the whooshing sound they make as they fly by.”

Douglas Adams

Best of The Thursday Report 2014, Part II

Remembering Michael Keane

originally published in the February 20, 2014 Thursday Report

We were very sad last February to note the passing of St. Petersburg litigator, Michael J. Keane. Michael was a great friend of almost every client he represented and had magical powers both in the conference room and the court room.

Michael was always very sympathetic to clients having business, family, and emotional challenges. Michael settled his matters whenever he could but also would not hesitate to go to court to fight for his clients’ rights.

Perhaps one in one hundred or three hundred lawyers has the passion, total dedication, and amazing raw talent that Mike Keane had and so freely shared.

Mike had so many close friends in the community, garnered from the time he spent as a great father, a baseball coach, and a friend and confidant for many. Almost everyone who practices in St. Petersburg and many of us who practice in the Tampa Bay area have a couple of great stories about Mike.

Mike’s amazing partners Shirin Vesley, Brandon Vesley, and Charles Gerdes and associates, R. Garrison Mason and Nicole M. Ziegler, along with their wonderful staff will carry the torch to help a great many people in the upcoming years. Let’s wish them and Michael’s family the very best, and remember how privileged we are to carry our own torches to help others in need while serving as platforms to uphold and improve the integrity of our legal, tax and judicial systems.

We welcome any comments and suggestions for further observance of Michael Keane and express our most sincere condolences to his family and friends.

George Allen – A University of Florida and National Hero Who Overcame Racial Obstacles to Succeed in Practicing Law and Helping Others

By Alan S. Gassman, Esq. and Dena Daniels

originally published in the February 20, 2014 Thursday Report

Dena Daniels is from the small town of Jasper, FL and is the first individual from both sides of her family to receive a bachelor’s degree. Dena Daniels is a second-year law student at Stetson University College of Law. She was amongst the first group of students from Hamilton County High School to complete the dual-enrollment program at North Florida Community College; she graduated high school with 62 college credit hours. Dena graduated with her B.S. in Business Administration from the University of South Florida and her Masters of Business Administration from Valdosta State University. Dena is seeking a concentration in Social Justice Advocacy and is a law clerk at Gassman Law Associates.

Born on March 3, 1936 in a totally segregated Sanford, Florida, Attorney W. George Allen was the first African-American to receive his J.D. from the University of Florida Law School. Allen grew up working in the celery fields of Sanford, Florida where the county closed down the black schools in the winter and forced every able-bodied black person to work in the fields. Blacks were arrested for not working. Mr. Allen never saw a toilet flush until he was four years old. He grew up in a small house on a dirt road and attended elementary school, middle school, and high school in all black programs.

After graduating with the highest grade point average from his high school, Crooms Academy, in 1954, Allen attended college at Florida A&M University in Tallahassee, FL. While he was a student there, Allen was a high level seeker. He mentions in his book, “Where the Bus Stops,” “I sought out the hardest, most demanding teachers because I learned more from teachers who were demanding and who challenged students to achieve at their highest level.” Allen was extremely active on campus. He became a member of the Alpha Phi Alpha fraternity in 1955. Allen became vice president and was elected president during his senior year of Beta Nu Chapter of Alpha Phi Alpha. He was also a member of the ROTC. While in college, Allen suffered financial hardship, “Also, in my freshman year I did not have funds to buy the required texts, so I borrowed my books, principally from athletes who were mostly uninterested in studying and reading the books. I would read the entire book and go to class to take notes.” Because Allen did not have enough money to afford his books, he had two jobs during his junior year. Without being affected by his hardship, Allen gained popularity at FAMU, “I was popular, smoked a pipe, wore bowties, and engaged in my share of extracurricular activities. I made many trips to Hoffman Restaurant and Bar, which was near the campus and where most of the popular students met to drink Spearman Beer.” Upon graduation in 1958, he was commissioned as a 2nd Lt. in Army Intelligence. In 1960 Allen applied to four law schools: the University of Florida, Florida A&M University, Harvard, and the University of California at Berkeley. Being accepted to the three of the four schools (he never heard from Florida A&M Law School), he decided to attend the University of Florida after George Starke (a Sanford native and the first black to be admitted to the University of Florida Law School) and Regina Langston (one of the first blacks to attend the University of Florida Medical School) withdrew from these University of Florida graduate schools due to unbearable racial discrimination.

Mr. Allen faced significant racial mistreatment from fellow students, but he had some support from the administration. In his book, “Where the Bus Stops”, Mr. Allen shares one of the many tensed racial moments that he experienced at the University of Florida School of Law. During his second semester of law school, Mr. Allen was standing in line for over 30 minutes to register for courses; the courses were assigned on a first-come, first-served basis. Mr. Allen details in his book:

“When it was my turn to choose courses, Ralph Paul Douglas, whom I did not know, stepped in front of me and said, ‘boy I’m next’. I became incensed about being called boy and his attempt to move in front of me, so I hit him with a right cross on the chin and knocked him out. I stepped over Ralph, spread my list of courses in front of Professor Weyrauch, and said, ‘Sir, I would like to register for these courses.’ The professor signed me up, I turned, stepped over Ralph and left the library with many students whispering about my violent behavior.”

Much to his surprise, years later, Mr. Allen appeared in West Palm Beach, FL for a hearing and the presiding judge was none other than the receiver of his deadly cross, Ralph Paul Douglas. Automatically realizing who each other was, the judge asked Mr. Allen, “Should I duck?” and his response was, “Only if I am insulted.” The two laughed as they both reflected on the once tensed situation, but regardless of their past, Judge Douglas was fair and justice was served.

Throughout his law school career Mr. Allen experienced an insurmountable amount of threats and discrimination. Allen and his wife attended a wedding in Tampa in 1958, and to celebrate they went to the famous Columbia Restaurant. They were not permitted to eat there because of their color. He mentions: “That treatment buttressed my desire to attend law school and fight to end discrimination in public accommodations in all institutions in Florida.” He even got into a few physical altercations. In an interview he stated, “I made it known that I don’t believe in non-violence like Martin Luther King. You bother me, I’m violent.” His no nonsense attitude shaped him to be the perfect individual to successfully handle the rigor of being black in a southern institution of higher learning. Allen graduated from the University of Florida Law School in 1963. He has run a successful practice in Ft. Lauderdale, FL for forty-two years, and he has helped to liberate many minority organizations and individuals from being mistreated. Mr. Allen indicates that there is still a significant amount of discrimination and societal resistance to equal treatment, but he is proud of what he and other black lawyers have accomplished in the past five decades.

Please be sure to read W. George Allen’s autobiography, entitled “Where the Bus Stops.” You will not want to stop until you are completely done with this book.

New 4th DCA Decision May Dramatically Change the Landscape for Many Creditor Protection Plans

originally published in the May 15, 2014 Thursday Report

Florida’s fourth district court of appeals chewed an opinion on March 5, 2014, which indicated that Florida courts do not have in rem or quasi in rem jurisdiction over foreign states and does not have the authority to order the debtors to turnover foreign stock certificates. In this case a gentleman named Mohammad Anwar Farid Al-Saleh, who is a citizen of the Country of Jordan, sued two individuals for having proceeded with a corporate business arrangement without sharing profits with him. He received a judgment for over $20,000,000 and then asked the Palm Beach County court, in a motion for proceedings supplementary, to order the two defendants in the case to turn over “all stock certificates and similar documents memorializing their ownership interest in any corporation.”

The court noted that “allowing trial courts to compel judgment debtors to bring out-of-state assets into Florida would effectively eviscerate the domestication of foreign judgment statutes”. The court also noted that “there may be competing claims to the foreign assets and we believe that claims against a single asset should be decided in a single forum – and . . .that the forum should be, as it traditionally has been, a court of the jurisdiction in which the asset is located.” The court cited the 2009 New York Court of Appeals case of Koehler v. Bank of Bermuda Ltd., 911 N.E.2d 825 (N.Y. 2009) for the above quotation, and distinguished the situation in this case from the circumstances of the Koehler decision, where an international bank with a presence in New York was ordered to turn over stock certificates that it was holding outside of New York. In this case the party with the physical possession of the stock certificates apparently has no physical ties to Florida.

This case has made the national news and will be quoted by many for the proposition that the best place to keep stock certificates and other evidence of ownership may by in foreign countries.

In this case the subject stock certificates concerned assets located in the Bahamas, the Netherlands, Jordan, The Isle of Man, and the Dominican Republic.

Courts may find that the assets owned and/or the state of incorporation is Florida, then a debtor may be required to turn over stock certificates, no matter where they are.

As the result of this case many planners will doubtlessly encourage clients and potential clients to keep more assets in offshore companies, and to issue stock certificates and have them held in jurisdictions that do not recognize U.S. judgments.

Tea for Two Liked by Bloomberg BNA, Too!

originally published in the July 3, 2014 Thursday Report

Our recent article entitled “Tea for Two and Two for TBE” has been featured in the July edition of the Bloomberg BNA Tax Management Estates, Gifts and Trusts Journal, with the following introductory poem:

Tea for Two,

And two for TBE,

Many clients want to own assets jointly,

If not sure, why not try and see………..

The article explains that same gender couples residing in Florida and other states that do not recognize their marriages may still nevertheless attempt to use tenancy by the entireties in anticipation of court decisions that will quite likely provide that state law must recognize these marriages.

For a copy of the article, please click here.

What about situations where the individuals are married and one dies owning a homestead and Florida does not recognize the marriage? Will there be a cause of action later to the effect that the surviving spouse had homestead inheritance rights? Time will tell, but on some days it is better to be a lawyer than a title insurance company.

Some Kind of Wonderful – Can I Get a Witness?

Fifth Circuit Court of Appeals Leaves the IRS in a Grand Funk

originally published in the September 25, 2014 Thursday Report

Tax Court overturned on decision to grant IRS-requested 10% discount on partial ownership of artwork where only the estate had experts to testify; 14 million dollar refund results

Just 10 days ago, the Fifth Circuit Court of Appeals delivered an early Rosh Hashanah gift to the Elkins family, who stuck by their guns with reference to the valuation of a very special art collection.

The Fifth Circuit Court of Appeals rejected the Tax Court’s 10% discount, and applied the estate expert’s discount at 47.5%. In Estate of Elkins v. C.I.R., 2014 wl 4548527 (2014), the decedent had an aggregate 73.055% interest in the art, and his three children had the remaining interest divided equally among them. In the Tax Court proceedings, the estate had two experts testify that any hypothetical willing buyer would demand discounts because they would become co-owners with the Elkins decedents. The Commissioner, however, did not use any evidence to establish another fractional-ownership discount but instead stayed with his no-discount position.

The Court of Appeals stated that the Commissioner had the burden to refute the estate’s discounts under U.S.C. section 7491. The court held, however, that the Tax Court’s failure to give the burden of proof made no difference in the end. “This is because, having put all of his eggs in the one, no-discount basket at trial, the Commissioner cannot be heard on appeal to question the quantity, quality, or sufficiency of the evidence adduced by the estate to prove the quantum of the fractional-ownership discounts to be applied.”1 Thus, the Tax Court was required to accept the discounts that the estate proved through their expert’s testimony.

The Court of Appeals held the estate’s expert’s testimony was satisfactory to determine how much a hypothetical willing buyer would pay for the art: “a potential willing buyer would undoubtedly insist that his potential willing seller further discount the sales price to account for the virtual impossibility of making an immediate ‘flip’ of the art.”2 The Court of Appeals held that the Estate was entitled to a refund of $14,359,508.21.

The estate in this case was lucky that the Commissioner stuck to his no-discount guns and did not present an expert, and should be praised for their savvy use of expert witnesses.

**************************************************

1Estate of Elkins v. C.I.R., 2014 wl 4548527 (2014).

2Estate of Elkins v. C.I.R., 2014 wl 4548527 (2014).

MSA Homestead Rights Nixed by Florida Constitution: Friscia’s Make for Uncola Decision: MSA Provision MIA According to DCA Opinion That Is Supported by a Prior DCA Opinion

originally published in the October 2, 2014 Thursday Report

Note–Fresca® is a carbonated beverage that was introduced in 1966. Advertised as the UNCOLA, this grapefruit-based, sugar-free soft drink enjoyed great popularity in the 1970s. It was so popular that the author’s grandmother drank 8 or more Frescas a day. It was so popular, in fact, that Lyndon B. Johnson had a soda fountain that dispensed Fresca installed in the Oval Office. Fresca eventually succumbed to the likes of Diet 7-Up, but still remains on the market, unlike Mrs. Friscia Two.

In Friscia v Friscia, Mr. Friscia tasted the real UNCOLA by divorcing Mrs. Friscia One and signing a Marital Settlement Agreement under which he owned one-half of the house, without right of survivorship, and Mrs. Friscia One (presumably unsweetened) had the right to live in the other half with their minor son (“Little Friscia”) until he graduated from high school. After the child’s graduation, the residence was to be listed for sale and the proceeds divided equally between the former spouses.

Mr. Friscia then married a slightly sweeter Mrs. Friscia Two and they lived happily, but not ever after, close to a grocery store that stocked plenty of Diet 7 Up, in the event that Mrs. Friscia Two got tired of Mr. Friscia.

Mr. Friscia apparently tired of Mrs. Friscia Two first; he kicked the can and died intestate. Mrs. Friscia Two wanted to have the value of the residence included in determining her elective share, and wanted to stake a claim for control of the former marital residence as an asset of the estate.

Mr. Friscia’s estate had creditors who weren’t so sweet, and filed claims exceeding the value of the other estate assets.

The probate court and the 2nd DCA (“Desweetening Commission and Authority”) determined that the Florida Constitution trumped the MSA (Marital Sweetness Agreement). The court concluded that because the decedent died intestate the protected homestead interest descended to the second wife as a life estate with a vested remainder in the two sons. The first wife can continue to live there until the son graduates, then the home must be sold or the first wife has the option to buy out the interest owned by the second wife. This is because of Article X, Section 4 of the Florida Constitution (some wonder if they were drinking Coca-Cola with cocaine in it while drafting it, however Coca-Cola did not come out until 1892), which states that:

(a) There shall be exempt from forced sale under process of any court, and no judgment, decree or execution shall be a lien thereon,…the following property owned by a natural person:

(1) a homestead, if located outside a municipality, to the extent of one hundred sixty acres of contiguous land and improvements thereon…; or if located within a municipality, to the extent of one-half of contiguous land, upon which the exemption shall be limited to the residence of the owner or the owner’s family;

(b) These exemptions shall inure to the surviving spouse or heirs of the owner.

Mrs. Friscia Two thus owns her half plus her choice of (1) a life estate in Mr. Friscia’s half, and his children have a remainder interest, or (2) a half interest in his half and his children own the other half. A guardian will have to be appointed by the probate court to hold the minor child’s interest if it is to be sold or mortgaged or traded for a few kegs of root beer.

So when drafting MSAs for sweet Mrs. Friscia One, or representing Mrs. Friscia Two, or Mr. Friscia, or artificially sweetened children, make sure to take into account the FL Constitution, and hold the aspartame.

Even a six-pack of Mrs. Friscias would not have overcome the Florida Constitution, and thus there was no Southern Comfort to be added to this mix for the creditors or Mrs. Friscia Two.

Solutions (without Aspartame):

Next time: (1) have Mr. Friscia’s homestead interest placed in an LLC or other homestead device if you represent Mrs. One; and/or (2) give her a recorded lease on the home to enforce her rights; or (3) have the child adopted by its stepfather (Dr. Pepper) after Mr. Friscia gives up parental rights.

Also, during his life, Mr. Friscia could have mortgaged his half, with Mrs. Friscia One’s permission, to a friendly creditor (like Aunt V-8 or Uncle Sanka) who was not sweet but may have helped liquefy his financial position.

Specific case language that helped to carbonate and ice this case and its result are as follows:

The final judgment of dissolution did not operate to transfer the Decedent’s interest and the former marital home had not been deeded when the Decedent died. Thus, the Decedent and the Former Wife still owned the former marital home as tenants in common at the time of his death.1

The Decedent’s interest retained its homestead protection because the Decedent’s sons, whom he still supported financially, continued to live on the property.2

Because the Decedent died intestate and was survived by a spouse and lineal descendants, the probate court properly determined that the Decedent’s protected homestead interest descended to the Second Wife as a life estate with a vested remainder in Nicholas and Thomas.3

The Personal Representative argues that, by agreeing to these [MSA] provisions, the Decedent waived his homestead rights in his interest in the former marital home. The rights at issue in this case are the Decedent’s homestead rights in his own property, not in the property of the Former Wife. Thus, these waiver provisions are inapplicable.4

Hope that this helps you to help other bubbly families prevent calamities.

********************************************

1Friscia v. Friscia, 2D13-412, 2014 WL 4212689 (Fla. 2d Dist. App. 2014).

2 Id.

3Friscia v. Friscia, 2D13-412, 2014 WL 4212689 (Fla. 2d Dist. App. 2014).

4 Id.

Richard Connolly’s World

Focusing on the Human Element of Estate Planning

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature one of Richard’s recommendations with a link to the article.

This week, the article of interest is “Focusing on the Human Element of Estate Planning” by Paul Sullivan. It was featured in The New York Times on November 7, 2014.

Richard’s description is as follows:

John A. Warnick remembers exactly when he realized trust and estate lawyers like him were doing a disservice to their clients.

It was early on a Tuesday, after a holiday weekend, when a 21-year-old client called cursing and saying that she wanted to fire her trustee. She hadn’t received her monthly distribution check from a trust fund set up for her and her siblings.

Mr. Warnick tried to explain that, given the holiday weekend, the check had probably been delayed in the mail and would arrive in the next day or two. But she was convinced the trustee was holding back the money.

“The trust was created for them to get an education, and here she was at 21, dropped out, living on a monthly distribution,” he said. “What I found out is she had spent the weekend gambling at a casino in the mountains and had written checks that were going to bounce if she didn’t get a distribution.

I said, ‘There has to be a better way to do planning so all this tax-efficient, elegant trust planning doesn’t hurt people,’” he said. “I saw well-intentioned, technically precise plans reap negative unintended consequences.”

His solution: purposeful planning.

Please click here to read the article in its entirety.

Thoughtful Corner – Resolutions are Not Legally Binding

Congratulations on having successfully survived another holiday season!

A majority of Americans make New Year’s Resolutions, but statistics show that most of them are broken, causing a good deal of disappointment and bounce back.

The following are some simple strategies to make the most of New Year’s Resolutions and the opportunity for change that the new year brings:

Be Realistic

It takes fourteen or more days to make a new habit, and it is very difficult to change more than two habits at a time. Most resolutions require software changes in our minds, which don’t come from merely wishing that these changes will be so.

Unless changing the habit becomes a number one goal with respect to that aspect of your life, it is simply not going to happen. Most goals cannot be attained without accountability, support, and realistic approaches.

Based upon the above, you might think through the following today and also maybe next week, when you are not as hung over from staying up so late last night (yes, this means you!)

- Write down each of your resolutions – This triggers true communication with your conscious and subconscious mind.

- Prioritize each resolution – Mark each resolution on an alphabetical scale. A is the best and most important and E means disregard it completely.

- Write down two advantages to be derived from following through with the resolution. Also consider the two biggest cons involved.

- Write down what you have to change to accomplish the resolution and who can help you make the change(s).

For example, if you are trying to lose weight, seriously consider a program like Weight Watchers or following what Weight Watchers and all other accountable change organizations recommend for this. Some of their recommendations are listed below:

- Write down everything you eat. If you do this, you will lose weight. That is absolutely guaranteed.

- Count calories and carbohydrates, whether this is direct or indirect

- Plan ahead with reasonable daily parameters

- Count exercise as increasing your allowance

- Weight yourself periodically and be accountable

- Reward yourself emotionally and with appropriate attention for success

- Get your spouse or significant other involved – Have them make sure unhealthy food or unwise choices are excluded from being in your sight or being readily available

- Consider reduction of alcohol both for calories and willpower purposes

- Stay the heck away from KFC!

Weight Watchers is successful simply because their program models work. There is something quite magical that happens when ten or fifteen people sit in a room and talk about planning their food intake and what they will achieve, knowing they will face each other again the following week and receive recognition for goals accomplished and support for goals still to be reached.

Also pledge to take the next step if the above steps do not work for you. Try something more extreme, such as seeing a doctor or a psychologist if you have not lost five pounds in the first six weeks.

If you make a resolution to lose more weight your number one priority and are high-fiving yourself every time you do something right, the rest of your life will be better. Nothing will suffer but the sellers of unhealthy foods.

Help a Friend or Two Reach Their New Year’s Resolutions

While Keeping Track of Your Own

Choose one or two of your resolutions and have a serious talk with somebody you trust about what you are trying to change. Arrange to speak with them at least once a week about this for no more than three minutes. Then, do the same for them. Listen to their goals and what they would like to change about themselves. What can you do to help them get there?

Make 2015 the best it can be!

But understand your limitations.

This is well surmised by the renowned psychologist and author Robert Kegan in Chapter 3 of his book entitled The Evolving Self: Problem and Process in Human Development, which we will review in more detail next year. You can purchase or preview this book by clicking here.

Have a great Thursday and a great new year!

Humor! (or Lack Thereof!)

Esate Planning in the Mongol Empire:

Mongol leader Genghis Khan established the largest empire in history, stretching from Western China to Eastern Europe. He was unable to pass the land down to his descendants because he had killed all the lawyers. Have you been to Eastern Europe? Did you meet anyone named Genghis?

I rest my case.

****************************************

Little Known Historical Fact:

During the War of 1812, American Francis Scott Key was being held prisoner abroad the British warship HMS Tonnant while the enemy bombarded Fort McHenry near Baltimore. Key passed the time by fishing off the side of the ship.

He later wrote the well-known patriotic anthem describing his experience, “The Star Spangled Angler.”

*****************************************

Upcoming Seminars and Webinars

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR:

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on TRUST PLANNING FROM A TO Z for the Florida Institute of CPAs.

Learn how to plan, structure, and protect wealth using revocable and irrevocable trusts and trust systems to effectuate wealth preservation and inheritance planning in a tax-efficient manner.

This course is designed for both new and experienced accountants and includes valuable materials, free use of estate tax projection software, client explanation letters, and a number of useful Excel spreadsheets that can be used on client matters.

Many past attendees have expressed significant praise for this presentation, indicating that it is both dynamic and interesting, while providing a fresh new look at both time tested and new strategies and planning considerations with an emphasis on the numbers, practical application and an accountant’s role in planning and implementation.

Part Two of this presentation will be offered on May 21, 2015 at 10 AM and is entitled “A Practical Trust Planning Checklist and Practitioner Compliance Guide for Florida CPAs.” Please view the seminar announcement below for more details.

Date: January 6, 2015 | 11:00 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

*******************************************************

FREE LIVE WEBINAR SERIES ON LIFE INSURANCE FOR TAX ADVISORS:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 30-minute webinar on HOW TO READ LIFE INSURANCE ILLUSTRATIONS in the first of a series of webinars intended to help tax lawyers and CPAs understand how life insurance and life insurance structuring works from a technical and mechanical standpoint.

Bring your wrench and screwdriver as we look under the hood to see how we can do our clients some good!

Please note the below announcements for subsequent installments of this series:

February 18, 2015 – Criticism of Hybrid Index Life Insurance Products – What the Heck are These, and Why are They Becoming So Popular?

March 4, 2015 – Premium Financing in 15 Minutes

March 17, 2015 – Split-Dollar in 15 Minutes

March 31, 2015 – Comparing the Financial Strength and Risks Associated with Different Life Insurance Carriers

Gassman, Crotty & Denicolo, P.A., and The Thursday Report receive no direct or indirect compensation from any investment advisors and have no financial relationship with Barry Flagg or Veralytic. We thank Barry for putting together what we are sure will be an informative and objective program!

Date: January 7, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE FLORIDA BAR FORT LAUDERDALE REPRESENTING THE PHYSICIAN LAW CONFERENCE:

Alan Gassman will speak at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Please consider attending the Florida Bar 2015 Representing the Physician Seminar at the beautiful Renaissance Fort Lauderdale Cruise Port Hotel in Fort Lauderdale on Friday, January 16, 2015.

Start a great weekend there and then work yourself down to South Beach or stay at The Breakers in West Palm.

The topics (and speakers) are unbeatable. We thank chair Lester Perling for doing most of the work on this annual conference.

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or click here to download the registration package.

********************************************************

LIVE TAMPA PRESENTATION:

Alan Gassman will speak at the Tampa Bay Estate Planning Council Dinner Program on the topic of PLANNING WITH RETIREMENT ACCOUNTS. We have put a great many hours of time into a comprehensive, easy-to-understand outline that we plan to have become a book on this topic. Satisfaction guaranteed!

Date: January 21, 2015 | 5:30 p.m. – 7:30 p.m.; Alan Gassman will be speaking from 6:45 to 7:15.

Location: The Tampa Club, 101 E Kennedy Boulevard, 41st Floor, Tampa, FL

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

***********************************************************

LIVE NEWPORT BEACH PRESENTATION:

Jerry Hesch will present THE MATHEMATICS OF ESTATE PLANNING at the Society of Trust and Estate Practitioners 4th Annual Institute on Tax, Estate Planning, and the Economy. This conference is a collaboration between STEP Orange County and the University of California, Los Angeles, School of Law.

Professor Hesch’s presentation will make use of the materials that Alan Gassman, Ken Crotty, and Chris Denicolo presented to the 40th Annual Notre Dame Tax & Estate Planning Institute on November 14, 2014.

Date: January 22 – 24, 2015

Location: California Marriott Hotel and Spa at Fashion Island, Newport Beach, CA

Additional Information: For more information, please email agassman@gassmanpa.com or visit http://www.step.org/4th-annual-institute-tax-estate-planning-and-economy.

**************************************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 15-minute webinar on CRITICISM OF HYBRID INDEX LIFE INSURANCE PRODUCTS – WHAT THE HECK ARE THESE AND WHY ARE THEY BECOMING SO POPULAR?

Date: February 18, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE FREE ETHICS CREDIT WEBINAR:

Alan Gassman and Dr. Srikumar Rao will present a free 50-minute webinar on HOW TO HANDLE STRESSFUL MATTERS IN AN ETHICAL WAY.

This webinar will qualify for 1 hour of CLE Ethics Credit and is classified as Advanced. See Professor Rao’s Ted Talk YouTube video, and you will understand how important this webinar might be to accelerating your law practice and enhancing your enjoyment of the practice as well. You can sign up for this free webinar by clicking here.

Dr. Srikumar Rao is the creator of the original Creativity and Personal Mastery (CPM) course that has helped thousands of executives and entrepreneurs achieve quantum leaps in effectiveness. He earned a Ph.D. in Marketing from Columbia University and has taught the course at Columbia University, Northwestern University, University of California at Berkeley, and the London School of Business. He is the author of Happiness at Work and Are You Ready to Succeed? which can be reviewed by clicking here. Are You Ready to Succeed? has been published in over 60 languages!

Date: February 19, 2015 | 12:30 p.m.

Location: Online webinar

Additional Information: Please email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: February 21, 2015 | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To see the official program for this workshop, please click here.

To register for this program please email agassman@gassmanpa.com.

***********************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 15-minute webinar on PREMIUM FINANCING IN 15 MINUTES.

Date: March 4, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE ORLANDO PRESENTATION:

THE ADVANCED HEALTH LAW TOPICS AND CERTIFICATION REVIEW 2015

Alan Gassman will speak at The Advanced Health Law Topics and Certification Review 2015 on HEALTHCARE TAX ISSUES.

To see the complete schedule for this program, please click here.

Date: March 6 – 7, 2015 ǀ Alan Gassman will speak on March 6 at 11:00 AM

Location: Hyatt Regency Orlando International Airport, 9300 Jeff Fuqua Blvd., Orlando, FL 32827

Additional Information: For more information, please email agassman@gassmanpa.com.

***********************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 15-minute webinar on SPLIT-DOLLAR IN 15 MINUTES.

Date: March 17, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 30-minute webinar on COMPARING THE FINANCIAL STRENGTH AND RISKS ASSOCIATED WITH DIFFERENT LIFE INSURANCE CARRIERS.

Date: March 31, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Alan Gassman, Jerry Hesch, and Richard Oshins will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins on 11 Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION, AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami, 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on A PRACTICAL TRUST PLANNING CHECKLIST AND PRACTITIONER COMPLIANCE GUIDE FOR FLORIDA CPAs for the Florida Institute of CPAs.

Review a practical planning checklist and practitioner tax compliance guide to facilitate implementing a comprehensive overview of practical planning matters and tax compliance issues in your practice. This presentation will cover over 20 common errors and missed planning opportunities that accountants need to understand and counsel their clients on.

This course is designed for practitioners who wish to assure that trust planning structures and compliance are both aligned with client objectives and that common catastrophic errors and misconceptions can be corrected.

Past attendees have indicated that this is an interesting and practical presentation that offers a great deal of practical information for both compliance and planning functions, based upon an easy to follow checklist approach. Includes valuable materials.

Date: May 21, 2015 | 10:00 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

******************************************

LIVE PRESENTATION:

2015 MOTE VASCULAR SEMINAR

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

NOTABLE SEMINARS BY OTHERS

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott, 8701 World Center Drive, Orlando, Florida

Additional Information:

Don’t miss Howard M. Zaritsky and Lester B. Law’s January 12th morning discussion of Basis – Banal? Basic? Benign? Bewildering?, which will include mention and some commentary and advice on the use of our JEST trust system. Don’t leave home without it!

When browsing the tables, be sure to stop by Management Planning, Inc. or Veralytic for a chance to purchase one of our books or check out our EstateView software! Phil’s Ultimate Estate Planner will also be featuring our JEST forms and instructional webinar.

For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE CLEARWATER PRESENTATION:

RUTH ECKERD HALL PLANNED GIVING ADVISORY COUNCIL MEETING

Ruth Eckerd Hall’s next Planned Giving Council Meeting will be a spectacular two-part event, featuring an educational presentation at 4:30 p.m. and a networking session at 5:30 p.m.

“Improve with Improv: Using Humor and Immediate Responses to Enhance Client, Professional, and Social Interaction” will be led by Jack Halloway, a well-known improvisational coach and actor. This workshop will cover the basic and effective methods of improvisation in order to increase participants’ ability to think quickly, listen closely, and feel more comfortable responding to situations.

The presentation will be followed by a social networking and information session led by Ruth Eckerd Hall’s President and CEO Zev Buffman.

Call Ruth Eckerd Hall, learn improvisation, get an hour of credit, a glass of wine, and a great time!

Date: Tuesday, January 20, 2015 ǀ 4:30 p.m.

Location: Ruth Eckerd Hall’s Margarete Heye Great Room

Additional Information: For more information, or to RSVP, please contact Alan Gassman at agassman@gassmanpa.com or Suzanne Ruley at sruley@rutheckerdhall.net.

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a full list of speakers and presentation descriptions, please click here. For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

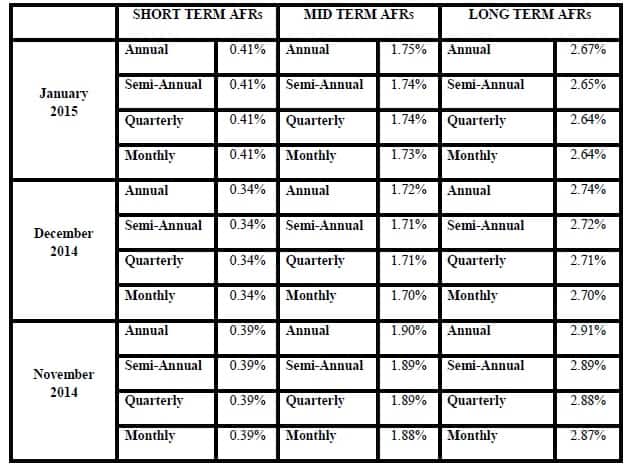

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.

The 7520 rate for January is 2.2% and for December was 2.0%.