Dualinars, In-State Tuition and Some Humor

Wednesday was a blur; to Thursday I demur.

Demur is defined later in this report.

PROFESSIONAL QUOTE OF THE WEEK

“I am always glad to try to help another practitioner if I can”

– William “Bill” P. Weatherford, Jr.

Anyone who knows Bill Weatherford in Winter Park is aware that he is a gentleman and a scholar. The above was sent to us after thanking him for going through an ex-client’s file and letting us know where to find important documents. He did this without delay. Thanks again Bill!

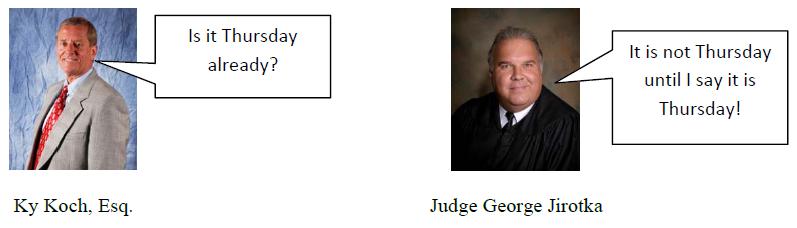

Pre-Nuptial and Post-Nuptial Agreements: An Interview with noted divorce attorney, Ky Koch and Judge George Jirotka – Part 2 of a 7 Part Series

In-State Means In-State: A Quick Overview of the Residency Requirements for In-State Tuition at Florida’s Public Universities – It’s Not What You Think It Is by Alan S. Gassman and Eric Brooks

Phil Rarick’s Fantastic and Informative Client Blog Entries: Homestead: Three Tricky Issues to Watch

Profiled “Dualinars” of the Week: Financial Planning Association of Tampa Bay and the Third Annual Federal Tax Institute of New England

11 Steps to Happiness at Work

Our Best Testimonial Ever!

Thursday Report Jokes

Definition of the Week and a Quick Contest

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer or to win $1,000,000 in KFC gift certificates, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Our Best Testimonial Letter Ever!

We have never met Susan King, but she became our favorite person in the galaxy when she sent the e-mail quoted below on Thursday, August 1:

Hello Alan,

I have been receiving your Thursday Report for several months now and I find it very helpful so I wanted to thank you for all of the work and information that goes into each report. As a solo practitioner your office webinars and reports have become a great resource.

I also wanted to thank you for the great information on Florida Land Trusts in the August 1, 2013 edition. This type of trust is something that I feel could be helpful to certain clients of mine but until I read your article I was a bit unsure how to present it to them. I now feel better prepared and will bring this up for discussion.

I would like to recommend to some of my colleagues that they ask to be put on your e-mail list. May I just forward them your e-mail address or is there a different one that should be used for this purpose? I added to the list after attending my first webinar and I do not recall if there is a separate link to sign up.

Warmest regards,

Susan M. King Attorney at Law 2499 Glades Road Suite 111 Boca Raton, FL 33431 Tel: 561.989.0622 Fax: 561.989.9982 sking@smkinglaw.com www.smkinglaw.comWe thank Susan so much for this wonderful compliment.

This is a wonderful reminder of how easy it is to make someone else’s day by telling them something nice about themselves, whether it is true or not!

Pre-Nuptial and Post-Nuptial Agreements: An Interview with noted divorce attorney, Ky Koch and Judge George Jirotka – Part 2 of a 7 Part Series

This week we cover the important topics of how much disclosure is enough disclosure, whether both parties need to have lawyers, and questions to ask the lawyer or spouse you are not representing to document appropriate disclosure and circumstances by video taped interview or written correspondence.

- Last Thursday, August 8, 2013, the reader was introduced to the present overall status of prenuptial agreement statutory law and caselaw, and talks about prominent malpractice traps and how to get clients prepared for what they can encounter in the prenuptial agreement universe. Click here to be directed to the Thursday Report for August 8, 2013.

- Part 2, today, August 15, 2013, discusses the important topics of how much disclosure is enough disclosure and whether or not both parties need to have lawyers.

- Part 3 on Thursday, August 22, 2013, Questions to ask the lawyer or spouse you are not representing to document appropriate disclosure circumstances by video-taped interview or written correspondence.

- Part 4, on Thursday, August 29, 2013, the article discusses Castro v. Castro and Belcher v. Belcher, and what they mean for clients and lawyers who are involved in the pre and post nuptial agreement planning.

- Part 5, on Thursday, September 5, 2013, a discussion of alimony and lawyer fee obligations that may not be waivable in pre-nuptial or post nuptial agreements, and offset clauses and other ways to handle these.

- Part 6, on Thursday, September 12, 2013, Bifurcation – whether you can require the validity of the pre-nuptial or post-nuptial agreement be litigated or also before having to also litigate what the result could be if it is or is not enforceable.

- Part 7, on Thursday, September 19, 2013, How to keep marital and asset information confidential in a divorce scenario, arbitration, and the Roddy v. Roddy case.

Below is the next part of the interview:

Alan Gassman: Now on the amount of disclosure, does it have to be a 30 page disclosure document that shows the spouse a copy of every type of document, including brokerage statements and prior tax returns, or can it be schedule of the 12 biggest assets, which add up to $9,000,000. What kind of financial disclosure would you be providing for your clients if you were practicing Judge?

Judge Jirotka: Well, my understanding from the cases I have reviewed is that it cannot be just a simple statement: ranch in Idaho, stock. It has to be a little bit more detailed – a little bit is my word, not necessarily the appellate court’s word. What kind of stock, how many shares, how big a ranch, where is it? There is some case law on this, and Ky correctly points out that we don’t have a whole lot of case law on the statute per se. We do have some pre-statute case law that requires much more disclosure than simple statements.

Ky Koch: My advice to clients when I’ve got the monied spouse is to tell them to put it all on the disc and pack it with your tax returns. If you’ve got business valuations put them in there.

Alan Gassman: Financial statements.

Ky Koch: Brokerage statements, all your financials you’ve given to the banks. Give them more rather than less because you don’t want it to be challenged for insufficient disclosure. By the way, I tell them if you’re going to estimate values, estimate on the way high side. For instance, if you were in business and you estimate its value at $100,000 in your prenup, if you get divorced, and your wife relied upon that representation, it is not good if she comes back in and says well that business is really worth $10,000,000, not $10,000.

Alan Gassman: Wow.

Ky Koch: Those are the kind of things that you need to be cautious of in drafting these agreements and attaching financial disclosures.

Alan Gassman: In the basic elements there’s no mention that there has to be a lawyer representing either party.

Judge Jirotka: That is correct.

Alan Gassman: So people are going to bookstores, I guess, and buying these agreements. Those are going to be interesting, but Ky what’s your attitude when you draft one of these agreements and the other party just signs it and sends it back? Do you require them to have a lawyer?

Ky Koch: Well, those are difficult situations, but you’ve got the agreement packed with language saying the undersigned has been advised to seek counsel and have this agreement in their possession for X number of days, weeks or months. They have either sought counsel or have chosen not to do it and they’re doing so at their peril. Judge Jirotka’s going to talk in a minute about a case he was just alluding to and that’s about representation of lawyers.

Judge Jirotka: Ky, if I could just ask in your preparing of these type of agreements and the disclosure aspect that Alan was talking about, would you attach the monied spouse’s financials to the agreement as an exhibit or would you do a separate document, or refer to it or how would you do that?

Ky Koch: In every instance we have it attached to the agreement.

Judge Jirotka: So it would be a copy – for example of the then current brokerage statement?

Ky Koch: Exactly, and I would make it as complete as possible. I’ll have a summary sheet, which would be a financial statement, and then backup.

Profiled “Dualinars” of the Week:

A dualinar is two seminars profiled at once in a weekly report – Webster’s World Dictionary

Financial Planning Association of Tampa Bay 2013 Florida Symposium

This two day intensive financial planning seminar will take place next Monday and Tuesday, August 19 and Tuesday, August 20 and is called FPA of Tampa Bay 2013 Florida Symposium at the Marriott Westshore Tampa, 1001 N Westshore Blvd.

Alan Gassman will be joining Ken Zahn, CFP at the Financial Planning Association (FPA) Tampa Bay 2013 Florida Symposium. Ken Zahn and Alan Gassman will speak Monday, August 19 from 3pm until 5pm on the mechanics of the federal estate tax and use of the new software program developed by Gassman Law Associates, which will be distributed at no charge to attendees.

Ken Zahn, is a very well known and respected CFP course author and lecturer. He has a great sense of humor, amazing common sense, and most importantly he reads the Thursday Report. Ken has also provided us with very good advice for the next improved version of our software.

Other notable speakers at the Symposium include Elizabeth Jetton, CFP, Linda Chamberlain, JD, CMC and Dale Van Scoyk, GFS. On Tuesday afternoon there will be a 2 hour program that will fulfill the CFP ethics portion of the recertification process. For more information and to register for this webinar please click here.

Please plan to attend this excellent event.

Third Annual Federal Tax Institute of New England

The Federal Tax Institute of New England is hosting its Third Annual Comprehensive All-Day Program for 2013 and Beyond on Friday, September 27, 2013 in Farmington, Connecticut. Speakers for the event include Professor Jerry Hesch, Bruce Stone, Ronald Aucutt and Lawrence Brody to name just a few. This will be a fantastic event that you will not want to miss. Click here for more information.

Weekend in New England (our lyrics by Barry Taxesmelow are based off of the lyrics and song by Barry Manilow)

Time in New England.

Took me away.

To a tax deductible seminar.

Hip hip hooray.

I got to see Bruce Stone and Jerry by the Bay.

Not to mention Larry Brody, a bell man with a goatee.

With nice cool weather I Wish I could stay.

When will our forms meet?

When can I PowerPoint?

Why will this strong seminar have to end?

Even Barry Manilow may attend this fantastic one-day seminar in Farmington.

Fly into Hartford on Thursday afternoon and enjoy a day by Batterson Pond Park.

Attend the seminar on Friday, and then drive along I84 to see the leaves change.

Listen to continuing education tapes on the way and discuss them with your extremely tolerant significant other.

Rooms are available at the Hartford Marriot Farmington Hotel.

If you have never seen Connecticut or if you have seen it and want to go back, here is your opportunity.

And who signed the Declaration of Independence for Connecticut?

It was none other than Samuel Huntington, Roger Sherman, William Williams, and Oliver Wolcott.

11 Steps to Happiness at Work, a Profile of Dr. Srikumar Rao’s book Happiness at Work

Dr. Srikumar Rao is the creator of the groundbreaking program Creativity and Personal Mastery in which he has helped thousands of professionals find happiness in their professional and personal lives. He is also the author of two acclaimed books, Happiness at Work and Are You Ready to Succeed.

Dr. Rao will be visiting us in Clearwater the week of October 7, 2013. He will be speaking at a Meet & Greet cocktail party and a half-day workshop.

The topic for the Wednesday, October 9, 2013 Meet & Greet is “Good Thing – Bad Thing – Who Knows? Changing Your Immediate and Long-Term Responses to Events and Challenges.” This event will take place at the Holiday Inn Express on U.S. 19 and Gulf-to-Bay Blvd. in Clearwater and begins at 6pm with wine and hors d’oeuvres. All Thursday Report readers are invited to attend the cocktail party and can register for the event by clicking here.

On Saturday, October 12, 2013, Gassman Law Associates, Dean & Associates CPAs, LLLP and Spine & Orthopedic Center, P.A. will sponsor a half-day workshop with Dr. Rao on Enhanced Effectiveness and Enjoyment of Your Professional and Personal Life. The cost of the workshop is $575, however if you register before September 1, 2013 you will pay the discounted rate of $495. Full time students and medical interns and fellows can attend for $285. This workshop will also take place at the Holiday Inn Express on U.S. 19 and Gulf-to-Bay Blvd. The program begins promptly at 1pm and will end around 6pm. There will be an optional question and answer session with Dr. Rao after a brief dinner break. If you would like to attend the half-day workshop please click here to register.

Dr. Rao’s program began in top business schools including Columbia Business School and the London School of Business. Through the years he has honed his expertise into a series of tools and exercises designed to help you rid yourself of the stresses of daily life, learn to appreciate the things you have and look toward the future with a clear vision of the path ahead. The half-day workshop will touch on a few of the tools that Dr. Rao teaches in his program.

Forbes writer, Jacquelyn Smith, has written a profile on Dr. Rao’s book Happiness at Work that is quite instructive.

To achieve greater happiness at work, you don’t need your boss to stop calling you at night. You don’t need to make more money. You don’t need to follow your dream of being a sommelier, or running a B&B in Vermont. So says Srikumar Rao, the author of Happiness at Work. The biggest obstacle to happiness is simply your belief that you’re the prisoner of circumstance, powerless before the things that happen to you, he says. “We create our own experience,” he adds. Here are 11 steps to happiness at work, drawn from his recommendations.

1. Avoid “good” and “bad” labels. When something bad happens, don’t beat yourself up, says Rao. Instead, when you make an error, be aware of it without passing judgment. “Do what you have to do, but don’t surrender your calmness and sense of peace.” For example, if you make a mistake at work the best thing to do is to realize your mistake, figure out what you can learn from the mistake and then move past it. Dwelling on the mistake only leads to further mistakes and can lead to a bad day all around.

2. Practice “extreme resilience.” Rao defines “extreme resilience” as the ability to recover fast from adversity. “You spend much time in needless, fruitless self-recrimination and blaming others,” he writes. “You go on pointless guilt trips and make excuses that you know are fatuous. If you’re resilient, you recover and go on to do great things.” (He also says that if you fully take his advice to avoid “bad thing” labels, you don’t have to practice resilience at all.)

3. Let go of grudges. Rao says that a key to being happy at work is to let go of grudges. “Consciously drop the past,” he writes. “It’s hard, but with practice you will get the hang of it.”

4. Don’t waste time being jealous. “When you’re jealous you’re saying that the universe is limited and there is not enough success in it for me,” says Rao. “Instead, be happy, because whatever happened to him will happen to you in your current job or at another company.”

5. Find passion in you, not in your job. Sure, you can fantasize about a dream job that pays you better and allows you to do some kind of social good, work with brilliant and likable colleagues and still be home in time for dinner, but Rao warns against searching for that perfect position, or even believing that it exists. Instead, he advocates changing how you think about your current situation. For example, instead of thinking of yourself as a human resources manager at a bank, identify yourself as someone who helps other bank employees provide for their families, take advantage of their benefits and save for the future.

6. Don’t view people as mechanisms. “Much of the time we evaluate other persons in terms of what they can do for us,” Rao says. “[For instance], we are super nice to senior executives because of the help they can give us.” Don’t relate to people in terms of the role they play; rather relate to them as one human being to another–“and serve them because that is what you are on Earth to do.”

7. Picture yourself 10 years ago and 10 years from now. “Most problems that kept you awake ten years ago have disappeared,” says Rao. “Much of what troubles you today will also vanish. Realizing this truth will help you gain perspective.”

Even in corporate America, where so much of work is every man for him or herself, Rao advocates inhabiting an “other-centered universe.” If the nice guy gets passed over for a promotion, he still may succeed in less tangible ways or land an even better job down the road. “They may rise later in the shootout,” says Rao. “I’m challenging the assumption that you need to be a dog-eat-dog person to survive in a corporate environment.”

8. Banish the “if/then” model of happiness. Rao says that many of us rely on a flawed “if/then” model for happiness. If we become CEO, then we’ll be happy. If we make a six-figure salary, then we’ll be happy. “There is nothing that you have to get, do or be in order to be happy,” he writes. To see Dr. Rao’s TED video please click here.

9. Invest in the process, not the outcome. “Outcomes are totally beyond your control,” Rao writes. You’ll set yourself up for disappointment if you focus too much on what you hope to achieve rather than how you plan to get there.

10. Think about other people. Even in corporate America, where so much of work is every man for him or herself, Rao advocates inhabiting an “other-centered universe.”

11. Swap multitasking for mindfulness. Rao thinks that multitasking gets in the way of happiness. “Multitasking simply means that you do many things badly and take much more time at it,” he writes. He recommends instead working on tasks for 20-minute intervals that you gradually increase to two-hour spans. Turn off any electronic gadgets that can be a distraction. He claims that with practice, you’ll be able to accomplish much more and with less effort.

Dr. Rao was also featured in a new article on Fast Company. To view the article please click here.

For more information or to attend either program please email agassman@gassmanpa.com.

Thursday Report Humor

Our copyrighted joke:

What do you call a wallaby with gangrene?

Click here for the answer to our copyrighted joke.

Permission to use this joke is given only to those who receive the Thursday Report and like it!

Colonel Sanders and the Pope

Colonel Sanders is on his death bed and has one final wish. So he calls up the Pope and says “Pope, I’ll donate a million dollars to the Church if you do a favor for me.” The Pope asks what it is.

The Colonel says “You know the Lord’s Prayer? The line that says ‘Give us this day our daily bread?’ I want you to change that to ‘Give us this day our daily chicken.'”

The pope thinks for a minute, because after all, a million dollars! But then says no.

The next day, Colonel Sanders calls back. “I’ll up my offer. I’ll donate one hundred million dollars if you change the line to ‘Give us this day our daily chicken’.”

The next day, an announcement goes out to all the cardinals and bishops all over the world. It reads “I have good news and bad news. The good news is that we just got a one hundred million dollar donation. The bad news is that we just lost the Wonder Bread account.”

Phil Rarick’s Fantastic and Informative Client Blog Entries: Florida Homestead: Three Tricky Issues to Watch

Our friend Phil Rarick of Rarick, Beskin & Garcia Vega, P.A. in Miami has been kind enough to allow us to provide one of his excellent client communications articles each week until you have read all of them.

Phil Rarick has 30 years of experience in both private and public legal work. Mr. Rarick concentrates in the fields of estate planning (wills and trusts), asset protection, probate, and corporate law. Integrated asset protection with an estate plan designed to protect wealth and secure tax advantages are a primary focus of his practice. He is an active member of the Elder Law Section of the Florida Bar, and the Real Property, Probate and Trust Law section of the Florida Bar Association.

Mr. Rarick is the author of a number of popular guides for fellow attorneys and the public, including Florida Probate Quick Reference Guide and Understanding Living Trusts for Florida Residents.

Mr. Rarick is the President of the Miami Lakes Bar Association, and served as a Director of the Association since its founding in 2005.

This week’s entry is entitled Florida Homestead: Three Tricky Issues to Watch and can be found by clicking here.

Have you considered writing articles like this for your clients and for those in your community?

Phil sets a great example for this.

Visit his website at www.rbgvlaw.com

In-State Means In-State: A Quick Overview of the Residency Requirements for In-State Tuition at Florida’s Public Universities – It’s Not What You Think It Is

By: Alan S. Gassman and Eric Brooks

We are fortunate to have a very good university system in Florida. Many of us had not expected that this would ever occur.

The difference between being a Florida resident and not being a Florida resident for tuition purposes is significant.

The following are the full-time annual tuition amounts that someone would expect to pay to go to Florida’s 4 largest state universities and selected private schools for the 2013 – 2014 academic year (based on 30 credit hours).

| Name of University | Number of Students | Floridian Tuition | Non-Floridian Tuition |

| University of Florida | 32,776 | $6,263.10 | $28,540.20 |

| Florida State University | 32,171 | $6,506.50 | $21,673.00 |

| University of South Florida (Tampa) | 30,289 | $6,409.70 | $19,664.90 |

| University of Central Florida | 50,968 | $6,317.10 | $22,415.40 |

| Flagler College (private) | 2,588 | $16,180.00 | $16,180.00 |

| University of Miami (private) | 10,590 | $41,580.00 | $41,580.00 |

| Rollins College (private) | 1,884 | $41,460.00 | $41,460.00 |

*The above assumes that the student takes off the summer to catch up on Thursday Report readings and work at Kentucky Fried Chicken!

There is obviously a staggering difference between what a Floridian and a non-Floridian will pay at the state schools.

What does it take to be a Floridian for tuition purposes?

That answer can be as complicated as many tax questions, and advance planning may be essential.

In 2005 the Florida Board of Governors standardized the residency requirements for in-state tuition at all public universities.

Gone are the days of paying out-of-state tuition for the first year, staying around during the summer to qualify for in-state tuition thereafter. That is still possible, but no longer simple.

Here is the methodology to follow to determine whether in-state tuition is possible:

A. Is the student dependent or independent? If the student is independent then you can skip to Step C below.

Your family must determine if the student will be classified as “dependent” or “independent.” The State of Florida defines a dependent child for tuition purposes as a person who is eligible to be claimed by his or her parent as a dependent (aka, “a qualifying child”) under the federal income tax code.

To qualify as a dependent, all four of the following four tests must be met:

1. Relationship Test – the student meets the relationship test if he or she is a child or stepchild (whether by blood or adoption), foster child, sibling or stepsibling, or a descendant of one of these. 25 U.S.C.A. § 152(d)(2) (West 2013).

2. Residence Test – the student must have “the same principal place of abode as the [parent/guardian] for more than one-half of such taxable year. 25 U.S.C.A. § 152(c)(1)(B).

3. Age Test – the student must be younger than the parent/guardian claiming the student as a dependent and is under the age of 24. 25 U.S.C.A. § 152(c)(3).

4. Support Test – the student seeking dependency must not have provided more than one-half of his or her own support for the year. 25 U.S.C.A. § 152(c)(1)(D).

B. Which family member will be used to qualify the student as a resident for in-state tuition?

Once you have determined whether the student is dependent or independent you can then decide which family member will be the basis for your student’s residency claim. If you decided that the student was independent, the student will be used as the basis for residency. The more common determination is that the student is still a dependent. In this case, either parent can be used as the basis for determining residency. This leads us to our final and most important question;

C. Does the family member claiming residency qualify as a Florida resident for tuition purposes?

The student or parent claiming residency must have established a legal residence in Florida and maintained that residence for at least 12 consecutive months immediately prior to the student’s initial enrollment in an institution of higher education. There must also be proof that the claimed residency is the product of a “bona fide” domicile, which is one’s intention to reside in Florida in comparison to a temporary arrangement made in order to qualify for a lower tuition rate.

What follows is the (nonexhaustive) statutory list of potential forms of residency evidence a college or university’s admissions department would evaluate when considering a claim for Florida residency.

Verification of residency includes two or more of the following documents:

1. The documents must include at least one of the following:

- A Florida voter’s registration card.

- A Florida driver’s license.

- A State of Florida identification card.

- A Florida vehicle registration.

- Proof of a permanent home in Florida which is occupied as a primary residence by the individual or by the individual’s parent if the individual is a dependent child.

- Proof of a homestead exemption in Florida.

- Transcripts from a Florida high school for multiple years if the Florida high school diploma or GED was earned within the last 12 months.

- Proof of permanent full-time employment in Florida for at least 30 hours per week for a 12-month period.

And may include one or more of the following documents:

- A declaration of domicile in Florida.

- A Florida professional or occupational license.

- Florida incorporation.

- A document evidencing family ties in Florida.

- Proof of membership in a Florida-based charitable or professional organization.

- Any other documentation that supports the student’s request for resident status, including, but not limited to, utility bills and proof of 12 consecutive months of payments; a lease agreement and proof of 12 consecutive months of payments; or an official state, federal, or court document evidencing legal ties to Florida.

Definition of the Week and a Quick Contest

Demur as a verb is defined as: Raise doubts or objections or show reluctance.

Next week’s Thursday Report will cover the noun demur.

Contest: The first five readers who click here will be before everyone else.

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.

|

SHORT TERM AFRs |

MID TERM AFRs |

LONG TERM AFRs |

||||

| August 2013 | Annual | 0.28% | Annual | 1.63% | Annual | 3.16% |

| Semi-Annual | 0.28% | Semi-Annual | 1.62% | Semi-Annual | 3.14% | |

| Quarterly | 0.28% | Quarterly | 1.62% | Quarterly | 3.13% | |

| Monthly | 0.28% | Monthly | 1.61% | Monthly | 3.12% | |

| July 2013 | Annual | 0.23% | Annual | 1.22% | Annual | 2.80% |

| Semi-Annual | 0.23% | Semi-Annual | 1.22% | Semi-Annual | 2.78% | |

| Quarterly | 0.23% | Quarterly | 1.22% | Quarterly | 2.77% | |

| Monthly | 0.23% | Monthly | 1.22% | Monthly | 2.76% | |

| June 2013 | Annual | 0.18% | Annual | 0.95% | Annual | 2.47% |

| Semi-Annual | 0.18% | Semi-Annual | 0.95% | Semi-Annual | 2.45% | |

| Quarterly | 0.18% | Quarterly | 0.95% | Quarterly | 2.44% | |

| Monthly | 0.18% | Monthly | 0.95% | Monthly | 2.44% | |

The 7520 Rate for August is 2.0% and for July was 1.4%.

Seminars and Webinars

- FINANCIAL PLANNING ASSOCIATION (FPA) TAMPA BAY 2013 FLORIDA SYMPOSIUM

Alan Gassman will be joining Ken Zahn, CFP for a joint seminar on A Brief Introduction on the Art of Wealth Protection Planning. This seminar will also include a demonstration of our new EstateView Estate Planning Software. Attendees will also receive a link to download the software to use on their own clients’ matters for a number of weeks. For more information and to register for this webinar please click here.

Ken Zahn is probably the best known CFP course teacher in the country. Thousands of certified financial planners have taken Ken’s course, and it is highly recommended for anyone in the financial, legal, or tax services business. You can access Ken’s excellent website by clicking here.

Date: Monday, August 19, 2013 | 3:00 – 5:00 p.m.

Speakers: Elizabeth Jetton, CFP, Linda Chamberlain, JD, CMC, Ken Zahn, CFP and Alan Gassman, JD, LL.M.

Location: Marriott Westshore Tampa, 1001 N. Westshore Blvd, Tampa, Florida

Additional Information: For more information and to register for this webinar please click here.

- THE JOINT EXEMPT STEP-UP TRUST (JEST) TELESEMINAR WITH ALAN GASSMAN AND CHRISTOPHER DENICOLO

Many lawyers are using our Joint Exempt Step Up Trust to enable clients in non-community property states to receive a stepped-up basis on all “joint trust assets” on the death of the first dying spouse. Our Leimberg article on the Joint Exempt Step-Up Trust can be viewed by clicking here and the accompanying chart can be viewed by clicking here.

The Ultimate Estate Planner, Inc. is also featuring our Joint Exempt Step Up Trust forms, client explanation letter and other materials on their website. To order the forms you can click here.

Date: Wednesday, August 21, 2013 | 12pm Eastern/9am Pacific

Sponsor: The Ultimate Estate Planner, Inc.

Additional Information: The cost of the teleseminar is $139 for the teleseminar only or $189 if you would like to receive both the teleseminar and the accompanying PowerPoint and downloadable PDF materials. For more information and to register please click here. The JEST Trust will also be discussed at the Notre Dame Tax Institute in September by Paul Lee and attorney Barry.

LEGISLATIVE UPDATE – AUGUST 444 SHOW

Join us on Thursday, August 24, 2013 for The 444 Show. This month we will be speaking on the new legislative update with Sandra Diamond, Aimee Diazlyon and Jim Daughton. The webinar qualifies for 1 hour of continuing education credit.

Date: Thursday, August 24, 2013 | 4:00 p.m (50 Minutes)

Speakers: Sandra Diamond, Aimee Diazlyon and Jim Daughton

Sponsor: The Clearwater Bar Association.

Additional Information: To register for this webinar please click here or email Janine Gunyan at Janine@gassmanpa.com

- WHAT CLIENTS ARE AND ARE NOT SUITABLE FOR LONG TERM CARE INSURANCE

Date: Thursday, August 29, 2013 | 5:00 p.m.

Presenter: Rob Cochran

Location: Online webinar

Additional Information: To register for the webinar please click here.

- AVOIDING THE TRAPS IN EMR/TECH CONTRACTS….NOW YOU TELL ME I’M STUCK WITH THIS FOR 5 YEARS!

Date: Tuesday, September 10, 2013 | 5:00 p.m. and Thursday, September 12, 2013 | 12:30 p.m. (Each webinar will last 30 minutes)

Presenter: Sandra Greenblatt, Board Certified Health Lawyer

Location: Online webinar.

Additional Information: To register for the Tuesday, September 10, 2013, 5pm webinar please click here. To register for the Thursday, September 12, 2013, 12:30 p.m. webinar please click here.

- NIP & TUCK: MAKING THE CALL ON OFFICE-BASED SURGERY

Date: Wednesday, September 18, 2013

Presenter: Cheryl White, RN, BS, MSHL, LHRM, LNCC, MSCC, DFHRMPS and Lester Perling, J.D., MHA, PhD, SOB

Location: Online webinar

Additional Information: To register for the webinar please click here.

- NORTH SUNCOAST FICPA MONTHLY MEETING

Date: Wednesday, September 18, 2013, 4:30 – 6:30 p.m.

Speakers: Christopher Denicolo and Tom Davis will speak on the Affordable Care Act; Alan Gassman will be speaking on a topic to be determined.

Location: Chili’s in Port Richey

Additional Information: To attend this seminar please email agassman@gassmanpa.com

- WEDU ESTATE PLANNING SEMINAR

Gassman Law Associates meets Big Bird – Sesame Street vs. Wall Street?

Alan Gassman will be speaking on the topic of ASSET PROTECTION – ESSENTIAL KNOWLEDGE AND HOT TOPICS

Date: Thursday, September 19, 2013 | 7:30 am – 11:30 am

Location: WEDU PBS Berman Family Broadcast Center

Additional Information: If you would like to sign up for this seminar please click here.

- NOTRE DAME TAX INSTITUTE

Jerry Hesch and Alan Gassman will be speaking on the topic of INTERESTING INTEREST QUESTIONS, PLANNING WITH LOW INTEREST LOANS, PRIVATE ANNUITIES, DEFECTIVE GRANTOR TRUSTS, AND PRIVATE AND COMMERCIAL ANNUITIES

Date: Wednesday, October 16 through Friday, October 18, 2013

Location: Notre Dame College, South Bend, Indiana

Additional Information: Professor Jerry Hesch’s Notre Dame Tax Institute will once again emphasize the importance of income tax planning and implications in addition to estate, estate tax, and related concepts. Also Paul and attorney Barry will be discussing stepped-up basis tools and techniques, including our JEST Trust.

We welcome questions, comments and suggestions for the presentation that we are assisting Jerry in preparing and presenting.

- PINELLAS COUNTY ESTATE PLANNING COUNCIL HALF-DAY SEMINAR

Alan Gassman will be speaking on the topic of HOT TOPICS FOR ESTATE PLANNERS

Date: Wednesday, October 23, 2013 | 8:00 am – 12:00 p.m. (60 MINUTE PRESENTATION)

Location: TBD

Other Speakers: Other speakers include Barry Flagg on Insurance and Estate Planning; Sean Casey, SR. VP Fifth Third Bank on an Economic Update, and Sandra Diamond on a topic to be determined.

Additional Information: To attend the meeting or to receive information on joining the Council please click here or email agassman@gassmanpa.com

- 2013 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: October 25 – 27, 2013 | Times TBD

Location: TBD

Additional Information: Please contact agassman@gassmanpa.com for additional information.

- NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE) HEALTH LAW SYMPOSIUM – AN ALL DAY SEMINAR

Alan Gassman will be speaking on the topic of WHAT HEALTH LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Date: Friday, November 1, 2013 | 9am – 5pm (Mr. Gassman speaks from 1:10 pm until 2:10 p.m.)

Location: Seton Hall Law School, Newark, New Jersey

Additional Information: Seton Hall University in South Orange, New Jersey was founded in 1856, and they have remodeled since. Today, Seton Hall has over 10,000 students in its undergraduate, graduate and law school programs and is in close proximity to several Kentucky Fried Chicken locations.

DECODING HEALTHCARE SEMINAR

Alan Gassman will be moderating the Decoding Healthcare Seminar hosted by Fifth Third Bank.

Date: Tuesday, October 29, 2013

Location: Grand Hyatt, 2900 Bayport Drive, Tampa, Florida

Additional Information: For more information on this event please email agassman@gassmanpa.com

- NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE)_SPECIAL 3 HOUR SESSION

Alan Gassman will be speaking on the topic of WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW – A 3 HOUR OVERVIEW BY ALAN S. GASSMAN

Date: Saturday, November 2, 2013

Location: Wilshire Grand Hotel, West Orange, New Jersey | 9am – 12pm

Additional Information: Please tell all of your friends, neighbors and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information please email agassman@gassmanpa.com

- SALT LAKE CITY ESTATE PLANNING COUNCIL’S FALL ONE DAY “TAX AND DEDUCTIBILITY OF YOUR SKI TRIP” INSTITUTE

Alan Gassman will be speaking on the topic of PRACTICAL ESTATE PLANNING, WITH A $5.25 MILLION EXEMPTION AMOUNT

Date: Thursday, November 7, 2013

Location: Hilton Downtown Salt Lake City, Utah

Additional Information: Please support this one day annual seminar conveniently located near skiing and tourism opportunities. If you would like to attend this event or receive the materials please email agassman@gassmanpa.com

- 1st ANNUAL ESTATE PLANNER’S DAY AT AVE MARIA SCHOOL OF LAW

Speakers: Speakers will include Professor Jerry Hesch, Jonathan Gopman, Alan Gassman and others.

Date: April 25, 2014

Location: Ave Maria School of Law, Naples, Florida

Sponsors: Ave Maria School of Law, Collier County Estate Planning Council and more to be announced.

Additional Information: For more information on this event please contact agassman@gassmanpa.com.

NOTABLE SEMINARS PRESENTED BY OTHERS:

- MEDITATION, Science, Spirituality, Sustainability – An Experimental Workshop by the Bridge and Maulik K. Trivedi, M.D.

On Saturday, September 28, 2013 from 10 am to 1pm the Bridge, a not-for-profit organization that promotes ecocentric living, social justice and personal development is providing a 3 hour workshop on Meditation. The session will be administered by integral psychiatrist and Yogi, Dr. Maulik K. Trivedi and will be accompanied by accomplished sitar player, Douglas Werner. For more information on this event, please click here.

Date: Saturday, September 28, 2013 | 10am – 1pm

Location: Carrollwood Cultural Center, 4537 Lowell Road, Tampa

Additional Details: The cost for attending this workshop is $45 and you can register by clicking here or call 813-416-3069 for more information.

- THIRD ANNUAL FEDERAL TAX INSTITUTE OF NEW ENGLAND

Date: September 27, 2013

Location: Hartford Marriot Farmington Hotel, Farmington, Connecticut

Sponsor: Connecticut Bar Institute

Additional Information: Chairman Frank Berall will be using part of an earlier Thursday Report article on same-sex planning in his presentation. You can also catch an early dose of Jerry Hesch’s talk on Income Tax Ideas for Estate Planning here before the Notre Dame Tax Institute in October, and Bruce Stone will be speaking on Assisted Reproductive Technology Children. For more information or to register please visit the Institute’s site here.

- 48th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING SEMINAR

Date: January 13 – 17, 2014

Location: Orlando World Center Marriott, Orlando, Florida

Sponsor: University of Miami School of Law

Additional Information: For more information please visit: http://www.law.miami.edu/heckerling/

- 16th ANNUAL ALL CHILDREN’S HOSPITAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

Date: Wednesday, February 12, 2014

Location: All Children’s Hospital Education and Conference Center, St. Petersburg, Florida with remote location live interactive viewings in Tampa, Sarasota, New Port Richey, Lakeland, and Bangkok, Thailand

Sponsor: All Children’s Hospital

- THE UNIVERSITY OF FLORIDA TAX INSTITUTE

Date: February 19 – 21, 2014

Location: Grand Hyatt, Tampa, Florida

Sponsor: UF Law alumni and UF Graduate Tax Program

Additional Information: Here is what UF is saying about the program on its website: “The UF Tax Institute will provide tax practitioners and other leading tax, business and estate planning professionals with a program that covers the most current issues and planning ideas with a practical, informative, state-of-the-art approach. The Institute’s schedule will devote separate days or half days to individual income tax issues, entity tax issues and estate planning issues. Speakers and presentations will be announced as the program date nears to ensure coverage of the most timely and significant topics. UF Law alumni have formed the Florida Tax Education Foundation, Inc., a nonprofit corporation, to organize the conference.”

For details about each event, please visit us online at gassmanlaw.com/newsandevents.html

Thank you to our law clerks that assisted us in preparing this report.