Don’t Delay, Register Today For The CTA – The Thursday Report – Issue 344

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Thursday, May 9, 2024Don’t Delay, Register Today For The CTAIssue #344Did Get Smart predict The Corporate Transparency Act? It seems Agent 86 contemplated the passage of The Corporate Transparency Act, the movie The Nude Bomb, which clearly alludes transparency.

Coming from the Law Offices of Gassman, Crotty & Denicolo, P.A. in Clearwater, FL. Edited By: Alan Gassman |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Please Note: Gassman, Crotty, & Denicolo, P.A. will be sending the Thursday Report out during the first week of every month. Article 1CTA – April 18th, 2024 FAQ’s Give Guidance On Some Fronts, But With Trusts Not So MuchWritten By: Alan Gassman, Zackaria Khaled, Netzy Preciado, Anthony De Rosario & Nickolas Tibbetts Article 2Sea Trials of the CTAWritten By: Elizabeth Holloway, David Barrow Article 3State Sales Tax Rate Imposed On Rentals, Leases, or Licenses To Use Real Property Reduced to 2.0%Forbes CornerYour CPA’s Guide to the New ERC CrisisWritten By: Alan Gassman For Finkel’s Followers7 Things You Should Consider When Reviewing Your Marketing StrategyWritten By: David Finkel Upcoming WebinarRunning the Numbers on Estate Tax Planning – Don’t Sale Without A CompassPresented By: Alan Gassman More Upcoming EventsYouTube LibraryHumor |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1CTA April 18th, 2024 FAQ’s Give Guidance On Some Fronts, But With Trusts Not So Much

Written By: Alan Gassman, Zackaria Khaled, Netzy Preciado, Anthony De Rosario & Nickolas Tibbetts

By: Alan Gassman, Zackaria Khaled, Netzy Preciado, Anthony Del Rosario, & Nickolas Tibbetts Alan Gassman: Alan S. Gassman, J.D., LL.M. is a partner at the Clearwater, Florida law firm of Gassman, Crotty & Denicolo, P.A. He is a frequent contributor to LISI and has published numerous articles in publications such as BNA Tax & Accounting, Estate Planning, Trust and Estates, and recently co-authored an article entitled Community Property Planning in Non-Community Property States & Understanding the Florida Community Property Trust Act Opportunities, Developments and Traps for the Unwary in the Stetson Business Law Review. Mr. Gassman is a board certified Trust and Estate lawyer. Alan Gassman, Jerry Hesch, Jonathan Blattmachr, Bob Keebler and Eido Walny are working together to improve and formally issue EstateView Estate and Estate Tax Planning Software in 2024, which will be marketed by LISI. EstateView is an estate and estate tax planning software program that provides calculations and illustrations for many facets of estate planning and more. His e-mail address is alan@gassmanpa.com. Zackaria Khaled: Zackaria Khaled is a 3rd-year law student at Stetson University College of Law. In addition to his legal studies, Zackaria is concurrently pursuing an MBA at the Stetson University College of Business Administration. Before clerking with Gassman, Crotty & Denicolo, P.A., Zackaria interned with in-house counsel at Ideal Image Corporation, and worked as a summer associate at Wicker Smith. Zackaria is committed to pursuing a career in business law and plans to pursue an LL.M in Taxation to further his studies. Netzy Preciado: Netzy Preciadois a 3rd-year student at Stetson University College of Law currently pursuing a joint law degree and MBA. She graduated from USF with a bachelors degree in Accounting. Netzy also interned at the IRS Office of Chief Counsel over the summer. Netzy was an extern for the Honorable Judge Honeywell at the United States District Court for the Middle District of Florida. She plans on working for the IRS Office of Chief Counsel after graduation. Anthony Del Rosario: Anthony Del Rosario is a 3rd-year law student at Stetson University College of Law. Anthony graduated from USF with a Bachelor of Arts in Philosophy and works as the head law clerk at Gassman, Crotty & Denicolo, P.A., in Clearwater, Florida. In spring 2023, Anthony had the privilege of interning in the Middle District of Florida s Bankruptcy Court for Judge Robert A. Colton. Anthony has a passion for bankruptcy, tax law, and estate planning. Nickolas Tibbetts: Nickolas Tibbetts is a 2nd-year law student at Stetson University College of Law. Nickolas graduated from Yale University with a Bachelor of Arts in Political Science with a concentration in Leadership. Nickolas is a Notes and Comments Editor for the Stetson Law Review and the head law clerk at Gassman, Crotty & Denicolo, P.A. While at Stetson, Nickolas has developed a passion for tax and business law.

EXECUTIVE SUMMARY The Corporate Transparency Act (“CTA”), which has been in effect since January 2024, is a law that requires disclosure from domestic and foreign reporting companies and their beneficial owners (persons who own 25% of or exercise substantial control over these reporting companies) in order to combat financial crimes. To address the misconceptions and doubts surrounding the Corporate Transparency Act and its required disclosures, the Treasury Department’s Financial Crimes Enforcement Network (“FinCEN”) has stepped in. They have released a comprehensive set of Frequently Asked Questions (“FAQs”) on the law, providing authoritative guidance on the matter. On April 18, the Treasury Department made significant updates to the beneficial ownership Information Frequently Asked Questions (“FAQs”) on the Corporate Transparency Act. These updates bring clarity to several aspects of the Act, ensuring a better understanding of the law and its implications. The new FAQs provide that previously exempt companies that subsequently lost their exemption status still have to file their initial BOI report until the end of the year or later under certain circumstances. Reporting companies created or registered to do business before January 1, 2024, have until January 1, 2025, to file their initial BOI report, while those formed after have 30 days after formation or loss of exemption status. FinCEN will give companies the longer of the two possible reporting windows. In particular, the new FAQs offer guidance on if and when trust companies should register as “Beneficial Owners” and to what extent beneficiaries, individual Trustees, and settlors of trusts will be required to register. The general stance being taken by the Treasury Department appears to be very reasonable, given the vagueness of the law and regulations that it is charged with administering. In addition, the FAQs provide guidance for homeowner associations and further provide state, local, and foreign law enforcement agencies with information with respect to how to receive access to CTA filing information and what rules and procedures will need to be followed to safeguard the data share. FinCEN added an entire section of FAQs which explain how FinCEN plans to give federal agencies access to the beneficial ownership information collected from all reporting companies.

FACTS As part of the April 18th FAQ updates, FinCEN addressed the following:

The above-mentioned updates to the FAQs are detailed below:

COMMENTARY Examining these new FAQs, we note the following: 1) S-Corporations. New FAQ C.8. provides that S-Corporations are subject to these rules. By definition, an S-Corporation is an LLC or regular corporation that has made a valid election on a form with an F-2553 to be treated as an S-Corporation for federal income tax purposes. It seems evident that an S-Corporation will be subject to these rules, but perhaps not to many laymen who apparently asked about this. Some S-Corporations will nevertheless be exempt, such as if they meet the large employer exception. New FAQ L.7. explains that to meet that exemption, the entity must have at least 20 full-time employees in the United States, an operating presence at a physical office in the United States, and filed either a Federal income tax return or an information return in the United States that demonstrates more than$5,000,000 in gross receipts or sales in the previous year. The specific language of the FAQs is as follows: C.8. Do the BOI reporting requirements apply to S-Corporations? Yes. A corporation treated as a pass-through entity under Subchapter S of the Internal Revenue Code (an “S Corporation” or “S-Corp”) that qualifies as a reporting company—i.e., that is created or registered to do business by the filing of a document with a secretary of state or similar office, and does not qualify for any of the exemptions to the reporting requirements—must comply with the reporting requirements. The S-Corp’s pass-through structure for tax purposes does not affect its BOI reporting obligations. In particular, pass-through treatment under Subchapter S does not qualify an S-Corp as a “tax-exempt entity” under FinCEN BOI reporting regulations.

2) Entities Not Created by Filing. Reporting companies are entities that are formed by filing documents with the secretary of state or similar office. This FAQ explains that if an entity is created without meeting that filing requirement, then it is not a reporting company and has no reporting requirements under the CTA. The specific language of the FAQ is as follows: C. 9. If a domestic corporation or limited liability company is not created by the filing of a document with a secretary of state or similar office, is it a reporting company? No. While FinCEN’s BOI reporting regulations define a domestic reporting company as including a corporation or limited liability company, the inclusion of those entities is based on an understanding that domestic corporations and LLCs are generally created by the filing of a document with a secretary of state or similar office. In an unusual circumstance where a domestic corporation or limited liability company is created, but not by the filing of a document with a secretary of state or similar office, such an entity is not a reporting company.

3) Beneficial Owners are Individuals. BOI FAQ section D.1. was updated to clarify that only natural persons can be beneficial owners. Trusts, corporations, and other entities cannot be beneficial owners under the CTA, but there are situations where the information of the entity may be reported instead of the beneficial owner’s information. The specific language of the FAQ is as follows: D. 1. Who is a beneficial owner of a reporting company? A beneficial owner is an individual who either directly or indirectly: (1) exercises substantial control over a reporting company (see Question D.2), or (2) owns or controls at least 25 percent of a reporting company’s ownership interests (see Question D.4). Because beneficial owners must be individuals (i.e., natural persons), trusts, corporations, or other legal entities are not considered to be beneficial owners. However, in specific circumstances, information about an entity may be reported in lieu of information about a beneficial owner (see Question D.12). FinCEN’s Small Entity Compliance Guide provides checklists and examples that may assist in identifying beneficial owners (see Chapter 2.3 “What steps can I take to identify my company’s beneficial owners?”).

4) HOAs and Homeowners. The FAQs also covered homeowner associations, which are organizations that neighborhoods or condominium buildings/complexes establish to enable property owners to contribute to an entity that handles common expenses and governs certain aspects of neighborhood or condominium conduct. Typically, a homeowner’s association is not “owned” by anyone in particular, and these organizations will commonly be tax-exempt under Internal Revenue Code Section 501(c)(4). To qualify as a 501(c)(4), the entity must file a Form 8976, which is a notice of intent to operate under Section 501(c)(4). Form 8976 only needs to be completed and submitted once, but once an organization has submitted it, the entity must file annual information returns or notices. Those forms are Form 990, Form 990EZ, or Form 990-N. The type of form depends on the total assets and gross receipts of the organization. Any individuals who have substantial control of a homeowner’s association are beneficial owners of said HOA. The FAQs clarify that there must be at least one person with substantial control, but there can be multiple. Thus, while it is unlikely that the average homeowner would be a beneficial owner, any involvement in the governance of an HOA makes it far more likely they would exercise substantial control over the HOA. FAQ D.13. describes that any individual who is a senior officer, an important decision-maker, or has the authority to appoint or remove certain officers or a majority of directors of the HOA qualifies as exercising substantial control.

These new FAQs on homeowners associations are as follows: C.10. Are homeowners associations reporting companies? It depends. Homeowners associations (HOAs) can take different corporate forms. As with any entity, if an HOA was not created by the filing of a document with a secretary of state or similar office, then it is not a domestic reporting company. An incorporated HOA or other HOA that was created by such a filing also may qualify for an exemption from the reporting requirements. For example, HOAs designated as 501(c)(4) social welfare organizations may qualify for the tax-exempt entity exemption. An incorporated HOA that is not designated as a 501(c)(4) organization, however, may fall within the reporting company definition and therefore be required to report BOI to FinCEN. D. 13. Who is the beneficial owner of a homeowners association? A homeowners association (HOA) that meets the reporting company definition and does not qualify for any exemptions must report its beneficial owner(s). A beneficial owner is any individual who, directly or indirectly, exercises substantial control over a reporting company, or owns or controls at least 25 percent of the ownership interests of a reporting company. There may be instances in which no individuals own or control at least 25 percent of the ownership interests of an HOA that is a reporting company. However, FinCEN expects that at least one individual exercises substantial control over each reporting company. Individuals who meet one of the following criteria are considered to exercise substantial control over the HOA:

5) Trusts Trusts are creatures of contract law and all are unique, which means it could be dangerous to try to make assumptions about how any trust will have to comply with the CTA. However, the Treasury Department released three FAQs addressing how trusts interact with and can comply with the CTA. The FAQs indicate that the CTA looks through trusts and trust arrangements to find beneficial owners. Settlors, beneficiaries, and trustees (including owners of corporate trustees) can be beneficial owners of reporting companies through trust arrangements if they meet one of the two prongs for the beneficial ownership test. The FinCEN Small Business Guide provides that “[a] beneficiary who is the sole permissible recipient of trust income and principal or who has the right to demand a distribution of or withdraw substantially all of the trust assets” has to file as a Beneficial Owner. If the beneficiary does not meet the above test, then it appears that they do not have to file, and only the trustee would be a Beneficial Owner and required to file. New FAQ D.15 is entitled “Who are a reporting company’s beneficial owners when individuals own or control the company through a trust?” Trust situations can be complicated given that the CTA requires that individuals with control and individuals with at least 25% of direct and indirect ownership are to register. Multiple tier ownership entities generally do not register separate and apart or as part of the registration of a “reporting company.” For example, if ABC Company is owned 26% by a trust company and acting as trustee for the benefit of a primary beneficiary of the trust then it would be the primary beneficiary’s BOI number or personal information that would be provided, and not the information of the trustee. On the other hand, if the trustee of a trust that controls a company, then the regulations seem to indicate that any individual who controls the trust company itself or owns at least 25% by reason of the trust company owning a percentage of the reporting company (such as if the trust company itself owns 50% of a reporting company and an individual owns 50% or more of the applicable trust company). While a small trust company may be controlled by one or more individuals who, therefore, indirectly control a reporting company, most trust companies are not controlled by one, two, three, or even four individuals, so registration as an owner or controlling party will typically not be required. The new FAQs that were released on April 18, 2024 have language that is found to be confusing by many readers. For example, FAQ D.15 indicates that “the trustee of a trust may be a beneficial owner of a reporting company either by exercising substantial control over the reporting company, or by owning or controlling at least 25% of the ownership interests in that company through a trust or similar arrangement.” The words “owning or controlling at least 25% of the ownership interests in that company” are confusing. The CTA applies to the beneficial owner of a direct or indirect 25% interest, or a person who is in control over a reporting company, but it doesn’t make sense to indicate that someone would be “controlling at least 25% of the ownership interest.” As opposed to either controlling the company or not controlling the company. FAQ D.15 further indicates that an individual “owns or controls ownership interests” in a company through a trust:

This would imply that a trustee that is a trust company (not an individual) would have to register, although the law does not appear to require this.

The FAQ goes on to indicate that this “may not be an exhaustive list of conditions under which an individual owns or controls ownership interest in a reporting company through a trust.” To say that this “may not be an exhaustive list” is an understatement. There can be many situations in a trust context that would cause registration requirements. Any drafter of the FAQs who were not sure whether the three items above are an exhaustive list, then how can we rely on the FAQs when it is clear that it is not an exhaustive list. FAQ D.16 is entitled “How does a reporting company report a corporate trustee as a beneficial owner?” This FAQ indicates that a reporting company “may, but is not required to, report the name of the corporate trustee in lieu of information about an individual beneficial owner only if all of the three following conditions are met:”

The above second requirement can make sense if a person owns at least 25% of the reporting company through ownership interest of the trustee, which assumes that the trustee actually is the owner in the company. The above language, however, seems to indicate that it would be not only ownership of at least 25% but could also be “controls at least 25%” which does not seem to be supported by the statute.

The example here would be where a trust company having 30 employees is owned 25% or more by a single individual who does not have control over the reporting company, and the indirect see-through ownership of this trust company owner constitutes at least 25% of the reporting company. D.16 goes on to indicate that “in addition to considering whether the beneficial owners of a corporate trustee own or control the ownership interest of a reporting company … it may be necessary to consider whether any owners [of the corporate trustee] exercise substantial control over a reporting company. Does an individual trust officer who handles a particular trust account constitute a person having substantial control? Typically, a trust officer follows the rules of the trust agreement and receives permission from investment committees, distributions committees, and tax compliance personnel within the trust company as opposed to actually controlling companies underneath the trust company. Trust companies may need to insist upon receiving non-voting stock or trade into arrangements where there is clearly not control by the trustee of a reporting company.

The specific language of the FAQs is as follows: D. 14. Can beneficial owners own or control reporting companies through trusts? Yes, beneficial owners can own or control a reporting company through trusts. They can do so by either exercising substantial control over a reporting company through a trust arrangement or by owning or controlling the ownership interests of a reporting company that are held in a trust.

D. 15. Who are a reporting company’s beneficial owners when individuals own or control the company through a trust? A beneficial owner is any individual who either: (1) exercises substantial control over a reporting company, or (2) owns or controls at least 25 percent of a reporting company’s ownership interests. Exercising substantial control or owning or controlling ownership interests may be direct or indirect, including through any contract, arrangement, understanding, relationship, or otherwise. Trust arrangements vary. Particular facts and circumstances determine whether specific trustees, beneficiaries, grantors, settlors, and other individuals with roles in a particular trust are beneficial owners of a reporting company whose ownership interests are held through that trust. For instance, the trustee of a trust may be a beneficial owner of a reporting company either by exercising substantial control over the reporting company, or by owning or controlling at least 25 percent of the ownership interests in that company through a trust or similar arrangement. Certain beneficiaries and grantors or settlors may also own or control ownership interests in a reporting company through a trust. The following conditions indicate that an individual owns or controls ownership interests in a reporting company through a trust:

This may not be an exhaustive list of the conditions under which an individual owns or controls ownership interests in a reporting company through a trust. Because facts and circumstances vary, there may be other arrangements under which individuals associated with a trust may be beneficial owners of any reporting company in which that trust holds interests.

D. 16. How does a reporting company report a corporate trustee as a beneficial owner? For purposes of this question, “corporate trustee” means a legal entity rather than an individual exercising the powers of a trustee in a trust arrangement. If a reporting company’s ownership interests are owned or controlled through a trust arrangement with a corporate trustee, the reporting company should determine whether any of the corporate trustee’s individual beneficial owners indirectly own or control at least 25 percent of the ownership interests of the reporting company through their ownership interests in the corporate trustee.

The reporting company may, but is not required to, report the name of the corporate trustee in lieu of information about an individual beneficial owner only if all of the following three conditions are met:

In addition to considering whether the beneficial owners of a corporate trustee own or control the ownership interests of a reporting company whose ownership interests are held in trust, it may be necessary to consider whether any owners of, or individuals employed or engaged by, the corporate trustee exercise substantial control over a reporting company. The factors for determining substantial control by an individual connected with a corporate trustee are the same as for any beneficial owner. Please see Chapter 2.1 of FinCEN’s Small Entity Compliance Guide, “What is substantial control?” for additional information on how to determine whether an individual has substantial control over a reporting company.

6) Address of Reporting Companies without a United States Place of Business. Companies must include their principal place of business in their FinCEN reporting. This FAQ clarified what address reporting companies without a United States-based principal place of business should include on their FinCEN reports. If a company with no principal place of business in the United States has locations in the United States where it conducts business, the company can use any one of those locations as its address for FinCEN reporting. If such a company does not have any locations in the United States where it conducts business, then it must use the address of the person designated to accept service legal service in the United States on behalf of the company.

The specific language of the FAQ is as follows: F. 12. What address should a reporting company report if it lacks a principal place of business in the United States? If a reporting company does not have a principal place of business in the United States, then the company must report to FinCEN as its address the primary location in the United States where it conducts business. If a reporting company has no principal place of business in the United States and conducts business at more than one location within the United States, then the reporting company may report as its primary location the address of any of those locations where the reporting company receives important correspondence. If a reporting company has no principal place of business in the United States and does not conduct business functions at any location in the United States, then its primary location is the address in the United States of the person that the reporting company, under State or other applicable law, has designated to accept service of legal process on its behalf. In some jurisdictions, this person is referred to as the reporting company’s registered agent, or the address is referred to as the registered office. Such a reporting company should report this address to FinCEN as its address.

7) Companies that Lose Exempt Status Two FAQs address the proper procedure for companies that lose exemption status. Companies have 30 days from the loss of exemption status to file the BOI report. In cases where the company qualifies for the extended initial filing window for entities existing prior to 2024 and loses exempt status, the company will have the benefit of the longer of 30-days or the January 1, 2025 deadline. Companies that fluctuate between being exempt and losing exemption status must file updated BOI reports every time they lose exemption status. Companies that become exempt should file a “newly exempt entity” BOI report with FinCEN to indicate that the company is now exempt.

The specific language of the FAQs is as follows: G. 6. A company that was created or registered before January 1, 2024, and was exempt from the BOI reporting requirements loses its exempt status between January 1, 2024, and January 1, 2025. How long does the reporting company have to file its initial BOI report? Normally, a company that loses its exempt status must file a BOI report with FinCEN within 30 calendar days after the date that it no longer meets the criteria for any exemption. A reporting company created or registered to do business before January 1, 2024, however, has until January 1, 2025, to file its initial BOI report. FinCEN has determined that previously exempt entities that existed before 2024 and lose their exempt status in 2024 will receive the benefit of whichever of these two timeframes is longer: (1) the remaining days left in the one-year filing period for existing companies; or (2) the 30-calendar-day period for companies that lose their exempt status. Thus, for example, if an existing reporting company ceases to be exempt on February 1, 2024, the company will have until January 1, 2025, to file its initial BOI report. If the company ceases to be exempt on December 15, 2024, the company will have until January 14, 2025, to file its initial BOI report.

L. 7. If the size of a reporting company fluctuates above and below one of the thresholds for the large operating company exemption, does the reporting company need to file a BOI report? Yes. The company will need to file a BOI report if it otherwise meets the definition of a reporting company and does not meet the criteria for the large operating company exemption (or any other exemption). If the company files a BOI report and then becomes exempt as a large operating company, the company should file a “newly exempt entity” BOI report with FinCEN noting that the company is now exempt. If at a later date the company no longer meets the criteria for the large operating company exemption or any other exemption, the reporting company should file an updated BOI report with FinCEN. Updated reports should be submitted to FinCEN within 30 calendar days of the occurrence of the change. To qualify for the large operating company exemption, an entity must have more than 20 full-time employees in the United States, must have filed a Federal income tax or information return in the United States in the previous year demonstrating more than $5,000,000 in gross receipts or sales, and must have an operating presence at a physical office in the United States.

8) Civil Penalty Annual Inflation Adjustments. FAQ K.2. was updated to provide a reminder that the $500 per day penalty for failing to properly comply will be adjusted annually for inflation. As required by the Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015 and Office of Management and Budget guidance, such inflation adjustment is based on the change between the Consumer Price Index for all Urban Consumers (CPI-U) for the month of October preceding the adjustment date and the prior year’s October CPI-U. As of April 18, 2024, the $500 per day civil penalty has increased to $591. The $10,000 criminal penalty that can apply in addition to the $500 penalty for “willful violations” is not indexed for inflation. We receive many questions about whether the “willful” failure to register or comply section of the statute allows an excuse for reasonable cause. Some experts believe that there is no reasonable cause exception because there is no reasonable cause provision in the statute or the regulations. Other experts believe that “willful” means that the violation cannot be “willful” if someone accidentally does not register correctly or is not aware of the requirements. For example, if someone accidentally shoots another by pulling the trigger of a gun, the action of pulling the trigger was “willful.” Even though the shooter did not mean to hit the other person, they did intentionally pull the trigger, which satisfies the willful standard. Internal Revenue Code Section 6651 addresses failure to file a tax return or to pay a tax and includes a reasonable cause exception for penalties. Each time the statute describes this exception as “reasonable cause and not due to willful neglect.” As explored in the below case, willful neglect is a separate standard from willful. “[T]he term “reasonable cause” is not defined in the Code, but the relevant Treasury Regulation calls on the taxpayer to demonstrate that he exercised “ordinary business care and prudence” but nevertheless was “unable to file the return within the prescribed time.”” United States v. Boyle, 469 U.S. 241, 246, (1985). In the Boyle case, the Supreme Court found the taxpayer did not have a reasonable cause to fail to meet a filing deadline from relying on the advice from estate’s attorney because understanding and respecting deadlines “requires no special training or effort.” Id., at 252. While the Supreme Court did examine the statutory term “willful neglect,” it did not analyze “willful” alone, instead noting that “[t]he Commissioner does not contend that respondent’s failure to file the estate tax return on time was willful or reckless.” Id., at 246. This highlights the difference in the standards and supports the argument that reasonable cause may not be available since it is not specifically mentioned in the statute and neither is willful neglect, only willful as a separate and distinct standard.

The specific language of the FAQ is as follows: K. 2. What penalties do individuals face for violating BOI reporting requirements? As specified in the Corporate Transparency Act, a person who willfully violates the BOI reporting requirements may be subject to civil penalties of up to $500 for each day that the violation continues. However, this civil penalty amount is adjusted annually for inflation. As of the time of publication of this FAQ, this amount is $591. A person who willfully violates the BOI reporting requirements may also be subject to criminal penalties of up to two years imprisonment and a fine of up to $10,000. Potential violations include willfully failing to file a beneficial ownership information report, willfully filing false beneficial ownership information, or willfully failing to correct or update previously reported beneficial ownership information.

9) The Rollout of Federal Agencies’ Access to the BOI Information. The FAQs are clear in this regard and state as follows: O.1. When will authorized recipients have access to beneficial ownership information? FinCEN will take a phased approach to providing access to beneficial ownership information.

FinCEN is not currently accepting requests for access to beneficial ownership information. FinCEN will provide further guidance on how to request access in the future.

O.2. I work at a Federal agency. How can I request beneficial ownership information from FinCEN? FinCEN is authorized to disclose beneficial ownership information to Federal agencies engaged in national security, intelligence, or law enforcement activities as well as Federal regulatory agencies that supervise financial institutions for compliance with customer due diligence requirements. To request beneficial ownership information from FinCEN, such Federal agencies will first need to enter into a memorandum of understanding with FinCEN describing how the agency will protect the security and confidentiality of the information. Additional information about entering into such a memorandum will be available when your agency becomes eligible to obtain access to beneficial ownership information under the phased implementation timeline (see Question O.1). In the meantime, we encourage agencies interested in access to beneficial ownership information to review the Beneficial Ownership Information Access and Safeguards Rule and become familiar with this rule’s requirements for agencies accessing beneficial ownership information. Please see Question O.5 for more information.

O.3. Which state agencies can request beneficial ownership information from FinCEN? State, local, and Tribal law enforcement agencies—i.e., government agencies authorized by law to engage in the investigation or enforcement of civil or criminal violations of law—will be able to request beneficial ownership information from FinCEN in certain circumstances. A State, local, or Tribal law enforcement agency, however, can only request beneficial ownership information from FinCEN if authorized by a “court of competent jurisdiction” to seek the information in a criminal or civil investigation. The state, local, or Tribal law enforcement agency also must meet certain other access requirements, including entering into a memorandum of understanding with FinCEN that describes how the agency will protect the security and confidentiality of the information. Additionally, state regulatory agencies that supervise financial institutions for compliance with customer due diligence requirements may also request beneficial ownership information from FinCEN to conduct such supervision. Like other domestic government agencies, to receive beneficial ownership information from FinCEN, state regulatory agencies must also enter into a memorandum of understanding with FinCEN that describes how the agency will protect the security and confidentiality of the information.

O.4. Can foreign governments access beneficial ownership information? Foreign governments cannot directly access the beneficial ownership IT system—the secure system that FinCEN uses to receive and store BOI—but will be able to request beneficial ownership information through intermediary Federal agencies. Foreign governments may request beneficial ownership information for a law enforcement investigation or prosecution, or for a national security or intelligence activity, that is authorized under the laws of the foreign country. There are two different request channels available to foreign governments: 1. requests made under an international treaty, agreement, or convention; or 2. requests made, when no such treaty, agreement, or convention is available, by a law enforcement, judicial, or prosecutorial authority of a foreign country determined by FinCEN, with the concurrence of the Secretary of State and in consultation with the Attorney General or other agencies as necessary and appropriate, to be a trusted foreign country. Foreign requests for beneficial ownership information are not yet being processed.

CONCLUSION The Treasury Department’s new FAQs on the CTA have provided valuable insight into many issues professionals and laymen alike have been wrestling with since the CTA was passed. As the year progresses and the 2025 deadline approaches, questions will continue to arise and one can only hope the Treasury Department will continue to provide answers and guidance in navigating the uncharted waters of CTA compliance. Back to Top |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Sea Trials Of The CTA

Written By: Elizabeth Holloway & David Barrow The Corporate Transparency Act is the new federal law that requires all companies and other state filed entities to register ownership, control, and address information with the treasury department within 90 days of formation for any entities formed before 2024. New FAQs released by the treasury department indicated the penalty for not being in compliance for the act is now $591 per day and will continue to increase with inflation. Our recent article on the FAQ’s as published by Leimberg Information Services on May 2nd is set forth below. Important definitions and rules relating to the CTA are as follows: REPORTING COMPANIES Companies required to file Beneficial Owner Information (“BOI”) Reports are referred to as “reporting companies” and may be either domestic or foreign. Domestic reporting companies are those created within the United States by the filing of a document with a secretary of state or similar office, such as corporations, limited liability companies, and limited partnerships. Foreign reporting companies are similar such entities which are formed under the laws of a foreign country and then registered to do business in any state. If a domestic corporation or LLC was validly created without filing documents with the secretary of state or similar office, then that entity is not subject to the BOI reporting rules. The new rule requires reporting companies to file reports with the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury, that identify two categories of individuals: (1) the beneficial owners of the entity; and (2) the company applicants of the entity. Reports are free of charge, secure, and only need to be submitted once, unless updates or corrections are needed. 1. Securities reporting issuer BENEFICIAL OWNERS A Beneficial Owner is defined as any individual who, directly or indirectly, either: 1. Exercises substantial control over a reporting company; or 2. Owns or controls at least 25% of the ownership interest of such reporting company. Only individuals can be beneficial owners, which excludes trusts, corporations, or other entities that are not natural persons. COMPANY APPLICANTS Company applicants are either: 1. the individual who directly files the document that creates the entity; or 2. the individual who is primarily responsible for directing or controlling the filing of the relevant document by another. Company applicants will often include the attorney and paralegal who worked to set up the entity. All company applicants must be individuals. REPORTING REQUIREMENTS Four items of information are required for each beneficial owner and reporting company: 1. full legal name; 3. complete current street address (this cannot be a Post Office box or in the care of a CPA); and 4. a unique identifying number. This may be the entities Federal Employee Identification Number or social security number. Note that the filing PDF has a pull-down menu under Part I. Reporting Company Information that offers SSN as an option for Tax Identification type, along with EIN/TIN. The entity’s state of formation or Indian tribe jurisdiction needs to be listed, and reporting companies must indicate if they are filing an initial report or a correction or an update of a prior report. Any trade names, “doing business as” (d/b/a), or “trading as” names should also be included. For a reporting company filed with its secretary of state after January 1, 2024, the company applicants must be identified. The Small Entity Compliance Guide, December 2023 – Version 1.1 indicates reporting companies formed after January 1, 2024 are required to report at least one company applicant and at most two. WHEN TO REPORT Reporting Companies created or registered to do business in the United State before January 1, 2024 will have one year (until January 1, 2025) to file initial reports. Reporting Companies created or registered in 2024 will have 90 calendar days after receiving notice of their creation or registration to file their initial reports. Reporting companies created or registered after January 1, 2025 will have 30 days after receiving notice of their creation or registration to file their initial reports. Reporting companies have 30 days to report changes to the information in their previously filed reports, such as changes through sale of the business, merger, acquisition, or death, and must correct inaccurate information in previously filed reports within 30 days of when the reporting company becomes aware or has reason to know of the inaccuracy of information in earlier reports. As noted above, persons who willfully violate the BOI Reporting Requirements are subject to civil penalties of up to $500 per day. This amount is adjusted for inflation, and as of April 18, 2024, it is $591 per day. Reporting violations that are subject to penalties include willfully failing to file a report, providing false information, or disclosing information that is unauthorized. Individuals in violation of the reporting requirements could be subject to fines of $500 per day, up to $10,000, and up to 2 years in prison. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

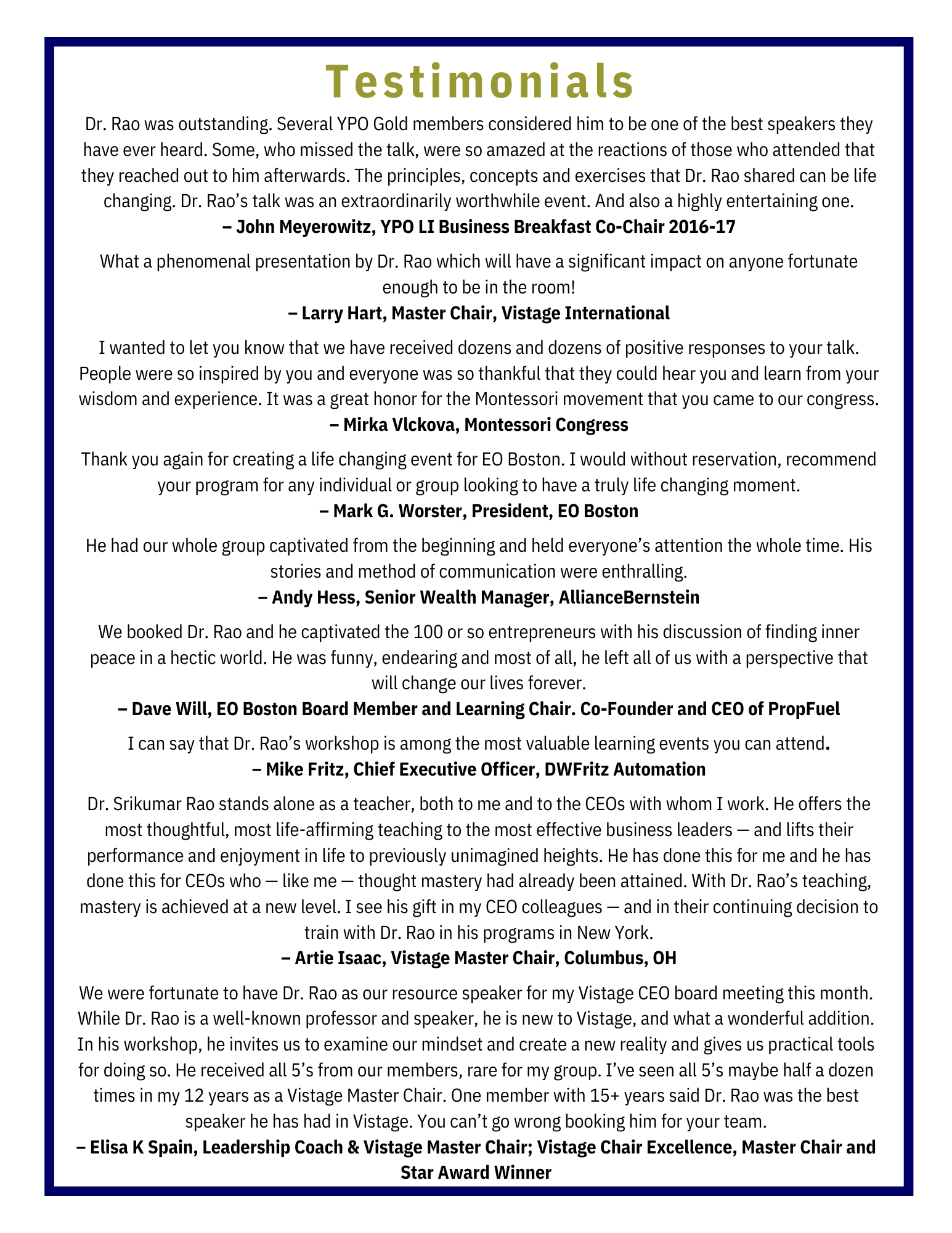

Article 3State Sales Tax Rate Imposed On Rentals, Leases, or Licenses To Use Real Property Reduced to 2.0%

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Forbes Corner

Your CPA’s Guide to the New ERC CrisisWritten By: Alan Gassman, JD, LL.M, AEP (Distinguished) The expansion and strong marketing tactics of good-for-nothing “accounting advisors” who encouraged taxpayers to qualify for the Employee Retention Credit (“ERC”) when… Continue Reading on Forbes. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

For Finkel’s Followers7 Things You Should Consider When Reviewing Your Marketing Strategy |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Upcoming WebinarRunning the Numbers on Estate Tax Planning – Don’t Sale Without A Compass

Date: Thursday, May 16, 2024 Time: 3:45 PM to 4:45 PM EST (60 minutes) Presented by: Alan Gassman, JD, LL.M, AEP (Distinguished) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

ALL UPCOMING EVENTS

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

YouTube Library

Visit Alan Gassman’s YouTube Channel for complimentary webinars and more! The PowerPoint materials can be found in the description box located at the bottom of the YouTube recording. Click here or on the image of the playlists below to go to Alan Gassman’s YouTube Library.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

HUMOR

Imagine if Maxwell Smart used the Corporates Transparency Act to uncover hidden secrets instead of chasing down spies. Maybe then, his missions would involve more paperwork and fewer exploding underpants! “The Nude Bomb” had Maxwell Smart chasing down invisible threats, but now he’d be busy uncovering invisible finances with the Corporates Transparency Act. Who knew his antics would transition from invisible bombs to transparent balance sheets? In “The Nude Bomb,” Maxwell Smart fought invisible foes. Today, he’d be fighting invisible corruption with the Corporates Transparency Act. It’s like he traded his trench coat for a spreadsheet!

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Gassman, Crotty & Denicolo, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2023 Gassman, Crotty & Denicolo, P.A |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||