Annuity Traps, Same Gender TBE, Avoid Vehicle Probate, and Team Enhancement Strategies

Same Gender Married Couples Living in Florida – Why Not Place Their Assets as Tenants by the Entireties

Planning with Variable Annuities

Phil Rarick’s Informative Blog: Transfer of Motor Vehicles After

Owner’s Death: How to Avoid Probate in Florida

Making Your Professional Firm a Great Workplace

Phil McLeod’s Daughter Gets Married!

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Same Gender Married Couples Living in Florida – Why Not Place Their Assets as Tenants by the Entireties by Alan Gassman, Travis Arango and Scott Callin

Travis Arango and Scott Callin are Stetson Law students who are clerking for Gassman, Crotty & Denicolo, P.A.

On April 19th and 20th, Oregon and Pennsylvania became the 18th and 19th states to recognize same-gender marriages, respectively. These are just the two most recent decisions furthering same-gender marriages since the landmark Supreme Court Windsor decision, issued in June of 2013. Windsor struck down part of the Defense of Marriage Act (DOMA) and forced the federal government to recognize same-gender marriages. The Court did not address Section 2 of DOMA, which allows states to ignore marriages legitimately performed in other states. However, using the logic set forth in Windsor many states, including Kentucky, Ohio, Indiana and Tennessee, have ordered same-gender marriages from other states be recognized.

As the gay rights movement pushes forward, with marriage as the hot topic, other issues remain unanswered. In Florida and a number of other states, tenancy by the entireties (TBE) is utilized as a favorable type of property ownership, but is only available to those who are married. TBE gives both parties an equal and undivided interest in the property and provides advantages like the right of survivorship and protection from creditors. Florida has traditionally had a strong stance against giving any marital rights to same-gender couples, however, with this tidal wave of change moving across the nation, and even in Florida, we may see the end of that repressive era.

So why not attempt to title their assets as TBE if state law may protect such assets from the creditors of either partner? TBE provides obvious advantages, and Equal Protection is the constitutional guarantee that no person or class is denied the same protection of the laws that is enjoyed by other classes. Under this definition of Equal Protection, one would assume the class of same-gender people could not be discriminated against for sexual orientation. However, the same-gender marriage debate has been raging for years so it obviously is not this cut-and-dry. In the recently decided Obergfell v. Kasich case, which forced Ohio to recognize legitimate out of state same-gender marriages, U.S. District Judge John G. Heyburn II said that Ohio’s refusal to recognize gay marriage is “unenforceable in all circumstances.” Also within the ruling was the acknowledgment that once the government attaches benefits to marriage, it must constitutionally grant equal protection to all. With TBE undeniably being one of those benefits to heterosexual married couples, logically courts should extend that line of reasoning to recognize same-gender TBE as well. There is a recent Florida decision that sheds some light on the topic as well.

D.M.T. v. T.M.H., decided in late 2013 by the Florida Supreme Court, held that Florida Statute 742.14 was unconstitutional as it only allowed legally married heterosexual couples to retain parental rights to children born from donated genetic material from one party to the other. The Court said that the statute, defining a “commissioning couple” as a heterosexual married couple, did not provide equal protection to same-gender couples. The case involved a lesbian couple where one woman donated her egg (“biological mother”) to her partner (“birth mother”) to carry the child. Years after the birth of the child, the birth mother refused to give the biological mother parental rights and asserted the biological mother was only a donor of the egg with no parental rights. Under Florida’s donation statute, since they were not a legally married couple, when the biological mother donated her egg, she was viewed as an egg donor and did not retain any rights to the resulting child. This case relied heavily on Windsor and could be a sign of things to come in Florida law.

Same-gender marriage is often a topic that creates division between the political parties, but that did not hold true in D.M.T. The Court currently has only two justices appointed by a Democratic governor (Pariente and Lewis), four by a Republican (Canady, Polston, Labarga, and Perry), and Justice Quince was appointed by Jeb Bush and Lawton Chiles by a joint agreement as Bush assumed office. In D.M.T., the majority comprised of Pariente, Quince, Labarga, and Perry, while the dissent was Polston, Lewis and Canady. This makes forecasting the outcome of subsequent same-gender appeals all the more unpredictable in Florida. With 10 states lifting bans in the last year, the question is no longer IF Florida will recognize same-gender TBE, and marriages in general, but WHEN it will do so.

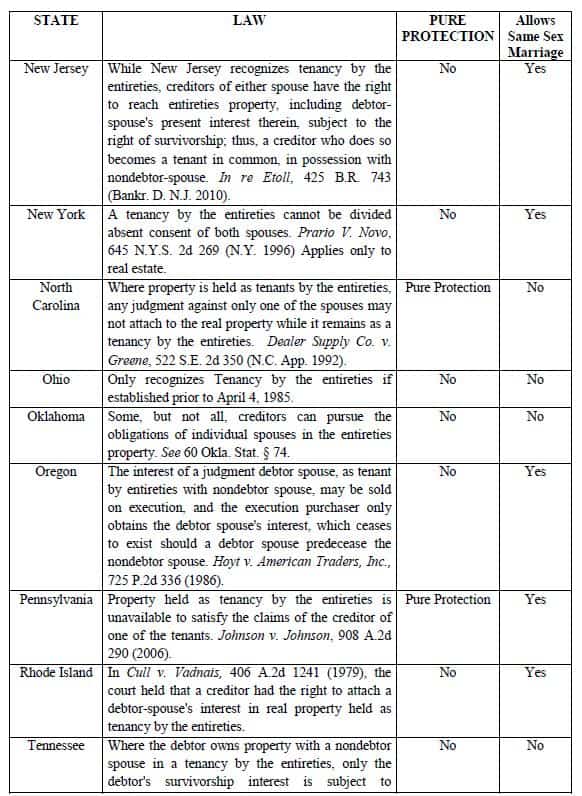

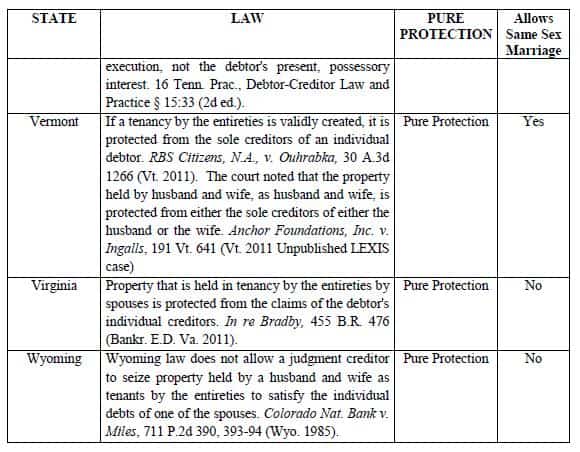

Florida, along with Indiana, Michigan, Mississippi, Missouri, North Carolina, Virginia, and Wyoming, provide significant creditor protection, but not same-gender marriage recognition. Considering how quickly the political landscape is shifting, estate planners representing same-gender couples who reside in these state should strongly consider continuing to push the envelope and title their assets as TBE. Since the 2013 Windsor decision, courts have been far more willing to recognize marriage, and the rights that go along with it, as a fundamental right to same-gender couples.

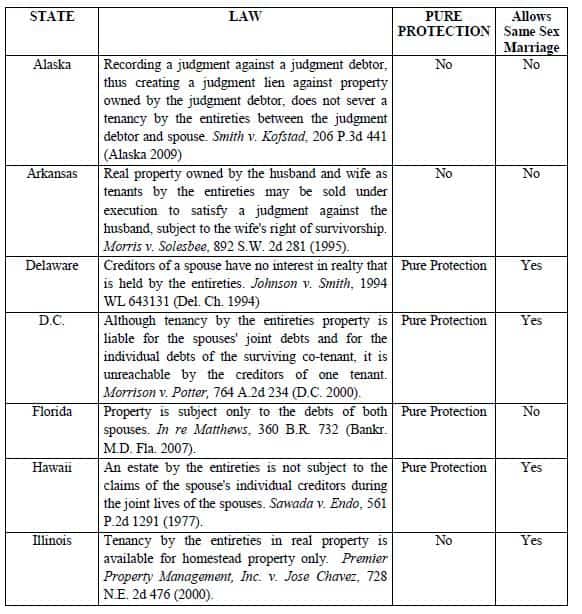

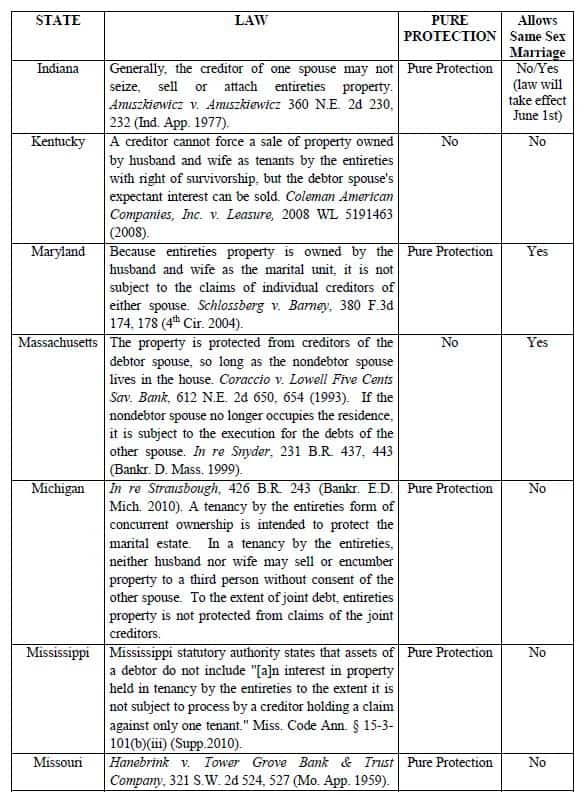

The chart below shows the states that recognize tenancy by the entireties, and the degree of creditor protection associated with it.

Advisors representing same-gender couples who reside in tenancy by the entireties states that offer creditor protection attributes should consider advising their clients to title assets and entities between them as tenants by the entireties, and advise on the possible impact of such titling. The creditor protection aspects may be very important for medical or other professionals who work in areas of high risk or for business people who guarantee debts or have other possible obligations that their same gender spouse would not be responsible for.

Planning with Variable Annuities

When planning with variable annuities the first question is whether you should be doing this.

A great many clients come to us with variable annuities that they do not understand and are possibly not well suited for.

The following excerpts from our recent live webinar entitled Planning with Variable and Other Annuity Products may be of interest.

If you would like to view the webinar please email agassman@gassmanpa.com We welcome any and all questions, comments and suggestions for variable annuity planning.

We are working on a book with respect to this.

Commercial annuities are contracts issued by insurance carriers and annuity companies to individuals, trusts, and other entities. These contracts are designed to qualify for tax deferral and/or basis (cost) allocation rules which are found in Internal Revenue Code Section 72 and the Treasury Regulations issued thereunder. Internal Revenue Code Section 72 has been around for decades. It purports to control the taxation of annuity contracts. Nevertheless, there are many gray areas, uncertainties, and draconian rules presented under Code Section 72.

Some of these tax rules may also apply to private annuities, but private annuity structuring is beyond the scope of this book. In a commercial annuity, an individual or some other entity goes to a registered insurance company, or possibly an offshore insurance company, and says “Here’s some money, give me a return on my money based upon the terms of an annuity contract.” This commences a contractual relationship between a client, whether an individual or an entity, and an insurance company.

In the interest of full disclosure, I must first state that many of our clients have come to us with variable annuity contracts which they entered into without understanding (a) the tax treatment, (b) the costs, and (c) the rate of return calculations.

In the Forbes.com article “9 Reasons You Need To Avoid Variable Annuities” author Eve Kaplan says “[t]here are unusual situations when a variable annuity may make sense – e.g. doctors who are concerned about malpractice suits. Three-quarters of US states protect variable annuity assets from creditors – regular IRAs do not benefit from ERISA protection and may be more vulnerable to creditors. There are a few other instances when variable annuities may make sense – but they’re few and far between. More often than not, it’s clear that variable annuities always benefit the seller, and only infrequently benefit the buyer.”

Our law firm does not sell annuities, nor do we receive any kickbacks or have any financial relationship with any companies that sell annuities. Our only priority is to come up with the best planning possible for our clients.

I would like to thank my partner, Christopher Denicolo, for countless hours spent researching and outlining materials, and also Christopher Price of Lincoln Financial Group, who spent dozens of hours explaining the labyrinth of complex rules and regulations that apply to annuities.

In addition, Michael Morrissey of Vanguard, John Prizer in Orlando, Nathan West, J.D., L.L.M. at KPMG, and Ryan Chaplinski of Dimensional Fund Advisors have spent time assisting me with policy specifics.

12 Reasons to be Cautious About Variable, “Index” and “Guaranteed Income” Annuities That Your Clients May Own or Consider Purchasing

While vast amounts of literature exist expounding the virtues of annuities, it is important to remember that these are most often marketing materials that are paid for by insurance companies to promote their products. In order to best protect your clients, it is important to understand the practical results of these arrangements, and to consider the following limitations, obstacles and issues:

1. Converting Long Term Gains for Ordinary Income. Annuities convert long-term capital gains that would otherwise be dividends taxed at a maximum of 20% into ordinary income.

They would be best suited as a tax deferral devise for high ordinary income investments like REITs (“Real Estate Investment Trusts”) is and hedge funds that throw off short term capital gains.

Converting long-term gains into ordinary income typically raises the tax rate for a client’s assets. Suppose you give an insurance company $100,000. The company places the investment into clone accounts, mutual fund arrangements, and index arrangements. The company is going to give you a rate of return based on how the various funds perform. A mutual fund will typically receive dividend income, which is taxed at 15% to 23.8%, and capital gains income, which is taxed at 15% to 23.8%. With a variable annuity, the good news is that you do not have to pay tax until you make a withdrawal or trigger income; the bad news is when you do have to pay taxes, it is at ordinary income rates. This bumps up the tax rate to 39.6% at most, but there may be an extra 10% tax rate based upon an excise tax that applies in certain situations when distributions are made from variable annuities, and possibly the 3.8% Medicare tax. Many clients are not aware of this distinction with a variable annuity.

Forbes Magazine recently cited study by Richard Toolson (who is an Accounting Professor at Washington State University) that looked at the break-even points for variable annuities and investments in the same funds through a low-turnover stock index mutual fund in lieu of the annuity wrapper, based on the assumption that both investments earn the same pretax return. The study indicated that an individual in a 36% tax bracket will never come out ahead by investing in a variable annuity because of the continued drag of fees and tax issues related to the variable annuity product.”

In her article, “9 Reasons You Need To Avoid Variable Annuities”, Eve Kaplan further states that “[i]f you truly want to convert after-tax dollars and gains to tax-deferred gains, you can pour money into a variable annuity but be aware you do NOT receive a tax deduction since annuities are not qualified retirement products.” Kaplan further explains that “[v]ariable annuities convert lower capital gains rates on taxable income (if the annuity is purchased with after-tax dollars) into a higher tax rate levied on ordinary income. This can cost consumers significant tax dollars down the road.”

2. No Step-Up In Basis on Death. Annuities do not get a step up in basis when the owner dies – the income has to come out eventually and will be taxed at ordinary rates.

For example, if I own an annuity with an $80,000 cost and a $200,000 value and I die, then my family is going to eventually pay tax on that $120,000 of gain when they pull it out. There is absolutely no way around this unless the client has net operating losses or huge nursing care costs in their later years so that they have losses to offset the ordinary income. This is important to keep in mind.

Eve Kaplan also addresses this in her above referenced article, where she states that “[a]nnuities are disadvantageous to inherit if they don’t go to a spouse. If the money formerly was after-tax dollars, the heir receives no step-up in basis on accounts with gains. If you invest the same dollars (after-tax) in a stock fund, your heirs benefit from a step-up on basis at the date of death or 6 months later. This is hard to quantify but a step-up in basis is a powerful tool to reduce capital gains taxes.”

3. Guarantees are Complicated and May Be Deceiving. Most commercial annuities with “guaranteed income” or “market protection” features are extremely complicated and difficult to understand. The sales materials for these products may be confusing at best and intentionally misleading at worst. In many cases even the salespeople for annuity products do not seem to have a firm grasp on what exactly the product does and the financial mechanics of it. Most elderly clients have no hope of truly understanding how the products work, and illustrations only serve to further muddy the waters. The guarantees in annuities are complicated and they may even be deceiving.

If you analyze an annuity with a guarantee feature and reach the conclusion that a majority of the policy owners can expect to come out ahead, you do not understand the product because that cannot be so. It is, however, theoretically possible that an annuity contract could be constructed with a guarantee that would increase the probability of achieving certain goals.

4. 10% Excise Tax. A 10% excise tax on built-up income will apply when withdrawals come out to any individual (or possibly a trust) who has not reached age 59 ½. The excise tax may apply to trusts for generation skipping or creditor protection, even where the monies will eventually make their way to beneficiaries who have reached age 59 ½. Further, making annuities payable directly to individuals can open wealth up to mismanagement, divorce exposure, and other issues. The 10% excise tax will apply on funds withdrawn from an annuity to the extent that there is income under the annuity.

5. Must Pay Out Ordinary Income Shortly After Death (Unless Payable to the Spouse).

Although the Internal Revenue Code has “stretch IRA like rules” that are to apply to non-qualified annuities, the IRS has never issued regulations or other guidance on this topic, so most carriers will not allow annuities to continue in trust after the death of the policy holder or annuitant. Therefore, funding of credit shelter trusts and/or GST exempt trusts with variable annuities will normally not work.

When somebody dies owning an annuity, Congress is essentially saying through Code Section 72 that because of the deferral of income under annuity products, taxpayers will need to take monies out of the annuity and pay tax on the distributions in a manner similar to IRAs and other retirement plans. But unlike IRAs and pensions, which have very complicated but manageable rules that allow taxpayers to make IRAs and other retirement accounts payable to trusts that will make distributions over the life expectancies of the beneficiary to the trust, this is not the case with respect to non-qualified annuity contracts.

Code Section 72(s) provides the general rules that a contract must satisfy in order to be treated as an annuity contract for income tax purposes (and therefore be afforded tax deferral advantages). If a contract does not satisfy these rules, then all payments received under the contract after the holder’s death will be included as gross income.

In order to use an exclusion ratio to exclude a portion of each payment received from gross income, an annuity contract must provide both of the following:

1. If the holder of the contract dies on or after the annuity’s starting date and before the entire interest in the contract has been distributed, then the remaining portion of such interest must be distributed at least as rapidly as under the method of distributions being used as of the date of the holder’s death (the “at least as rapidly” rule). When the annuitization is based on a life or certain period and the holder dies, the exclusion ratio is replaced with a FIFO payment scheme so that the first payments made will be tax-free to the extent of the holder’s unrecovered investment in the contract.

2. If the holder of the contract dies before the annuity’s starting date, the entire interest in such contract must be distributed within 5 years after the death of such holder. This is referred to as the “5-year rule”.

If the above requirements are not satisfied, then all monies paid from an annuity will constitute income to the extent that the value of the annuity contract exceeds the investment in the contract, unless one of the broad exceptions to this general rule applies. If one of the following exceptions applies, then the exclusion ratio will apply to defer the income taxes applicable to the amounts received from the annuity contract after the holder’s death. These exceptions are as follows:

1. If (a) the annuity contract allows any portion of the holder’s interest in the contract to be payable to (or for the benefit of) a “designated beneficiary,” (b) such portion will be distributed over the life expectancy of such designated beneficiary, and (c) such distributions begin no later than 1 year following the holder’s death, then such portion shall be treated as distributed on the day on which such distribution began. This exception is often referred to as the “Life Expectancy Rule.”

For example, if I leave my annuity to my two children equally, they can stretch payments out over their life expectancies if I die after the annuity has begun annuitizing.

Suppose that I want to leave the annuity to my two children equally in trust for a variety of reasons. In the IRA and pension plan area I can certainly do that, and there are rules that will look through the trust to the life expectancies of my children and use those life expectancies to govern the period of time over which the distributions must be made. There are no similar rules or guidance in the area of annuities, even though the statutes are very much similar in Code Section 72(s) and Code Section 401(a)(9). This gray area leaves advisors without much guidance, and a lot of commentators are really unsure of what the result would be if an annuity contract is payable to a trust with only individuals as beneficiaries.

2. If the holder’s surviving spouse is the designated beneficiary, then the surviving spouse is treated as the holder of the contract, which will allow for the continued deferral of income taxes as if the holder had been receiving the scheduled payments under the contract.

You can have an annuity payable to a spouse, and the spouse can pretty much roll it into a substitute annuity, that is never going to be a problem.

3. If the annuity contract is held under a qualified plan described in Chapter 401(a), 403(a) or 403(b), is an IRA or held under an IRA, or is a qualified funding asset that is defined in Chapter 130(d), then the “at least as rapidly” and “5-year” rule described above do not apply and the income taxation of the contract is controlled by the rules applicable to qualified plans or qualified funding assets.

It is also possible to have an IRA or a pension held by an annuity contract, and in that case the minimum distribution rules under the IRA rules apply rather than the annuity rules. This can often create confusion as to which set of rules apply. If the client dies and you have to pay the required minimum distributions, or it is payable to a trust and the IRS does not recognize the trust as being a person, then you may have a lot of taxable income and unhappy clients.

6. Discounting is Difficult. Discounting values for estate and gift tax purposes normally involves placing investments in FLP’s, Family LLC’s and similar arrangement to facilitate partial interest gifting and “discount on death” planning. While it would make sense that an annuity contract could be held by a “disregarded discount entity” with special design and drafting, most carriers will consider the transfer of a product to an FLP or LLC as a taxable transfer, and will issue a 1099 as if the contract proceeds were paid out. Also, can you compress the value of a variable annuity without compressing the tax basis (investment in the contract) or other characteristics?

We had a client who was on her death bed about 5 months ago. Her net estate was about $7 million, a lot of which was in variable annuities. We decided to put the variable annuities into a family limited partnership. However, we discovered that if you transfer an annuity from a person to a partnership, it will trigger all of the income as taxable.

So we went to the next step and we structured an LLC as a disregarded entity owned by the client, but irrevocably managed by her children. We were going to put the annuity in the LLC, take the discount out on death, and avoid paying the tax. When we went to register the change of ownership to the disregarded LLC, the carrier called and said “don’t do this or we are going to issue a 1099 for all the income.” We said, “but wait a minute, the LLC is a disregarded entity that is considered as owned by the client for federal income tax purposes.” However, the carrier responded by saying, “we don’t have any letter rulings, we have not been able to get the IRS to recognize disregarded entities for purposes of the triggers. You’re probably right, Mr. Gassman, but if you do this we’re going to issue a 1099.”

So remember, discounting with annuities will probably not work, and should not be considered as a reliable planning option.

Next week we will continue our discussion on the 12 reasons to be cautious about annuities.

Phil Rarick’s Informative Blog: Transfer of Motor Vehicles After Owner’s Death: How to Avoid Probate in Florida, an article by Christina M. Fernandez, Esq.

A. The Question

A common question we encounter is how to transfer the title of a motor vehicle upon the death of its owner.

B. Law Summary

Florida law allows the beneficiaries or heirs of a deceased person to transfer a motor vehicle title without the need of a formal court proceeding. To avoid court intervention, the beneficiary/heir or personal representative must apply for a new certificate of title to the Department of Highway Safety and Motor Vehicles and that application must be accompanied by an affidavit – a statement attesting to certain facts. The tax collector’s office in the county in which the deceased person resided will generally take the applications and also supply the appropriate forms upon request. They will process the application and accompanying documents with the Department of Highway Safety and Motor Vehicles. See, Fla. Stat. §319.28

C. Intestate

If the deceased person died intestate (without a Last Will), the required documentation includes:

• The completed application for the certificate of title;

- This can be found on the Florida Department of Highway Safety and Motor Vehicles (FLHSMV) website

• The certificate of title or other satisfactory proof of ownership or possession;

• An affidavit that the estate is not indebted; and. . .

Making Your Professional Firm a Great Workplace by Alan S. Gassman, Esq.

Have you ever been to a business or resort that provided exemplary services and made these look easy and enjoyable for the team serving you? We all know that it takes a lot more than just hiring qualified people and giving them policy and procedure manuals to put together a great team that can make everything look easy.

The Gallup organization surveyed over 80,000 successful managers. Some of their conclusions make great sense, and others might surprise you.

Here is our summary of their report:

The team at the Gallup organization, and in particular Gary Buckingham of Gallup, Inc., have put together a fantastic book called 12: The Elements of Great Managing by Rodd Wagner, Ph.D. and James K. Harter based upon comprehensive surveys of what it takes to create, have, and maintain a great workplace.

Their first discovery was that, “There are no great companies, there are only great workgroups,” and that “there appear to be 12 characteristics that will consistently describe great workgroups.”

While many of these are well-known and based on common sense or intuition, a few of them may come as a surprise.

Item 1: Knowing what is expected. Confusion over expectations and desired outcomes can be extremely frustrating and cause loss of effectiveness and morale.

Do your team members know exactly what is expected, or is that a nebulous situation?

Item 2: Lack of frustration by having all of the necessary workplace tools needed to do the job right.

Confusing or poorly working computer systems, forms that are inappropriate, and other systems that get in the way as opposed to help can be the downfall of what might otherwise be an effective and positive team member.

Item 3: Doing what the person does best.

“Frank Sinatra never moved pianos.”

– Dan Sullivan, Strategic Coach –

Everyone has an innate instinct as to what he or she does best, but in our law firm we test talents using OMNIA profile and Kolbe A personality testing and are very mindful as to what the team member can do best, and what they can develop to be better at.

If the team member is not in a job that allows them to be their very best, then it may be time to change the job or the person.

Remember the recurrent theme from the book Outlyers” by Malcolm Gladwell – once you find somebody who is a good fit for what they do, and they do it for 10,000 hours they can be at the genius level and lead the world.

That only takes 5 years if everything is properly situated.

Item 4: Praise and recognition are completely essential in a great workplace. A study of more than 80,000 managers found that there is a significant difference between “don’t complain if the team member does a good job” versus giving consistent and well directed praise.

Item 5: My immediate supervisor or boss cares about me.

The Gallup Poll study showed that the fifth most important item with reference to a good workplace relationship is that the person with supervisory or mentorship authority sincerely cares about the welfare of the team member.

Item 6: Does someone on the team encourage the employee’s development.

Good team members want to get better, that is part of the human psychological makeup for successful and positive people.

Knowing that someone is there to help make this occur is an important component.

Item 7: The opinion of the team member counts. Team members each have a unique view and ability to contribute to improve ideas, systems, and services. If they think that their opinion doesn’t count, then you may be counting them out for helping you to maintain and grow your business.

Item 8: The link between the team member and the company’s mission or purpose. Team members at every level like to know that they are integral part of an organization that has a purpose and mission.

Everyone on the team should contribute directly to that mission in their own unique way.

Item 9: Doing quality work. Team members like to know that they are provided good quality work that need not be criticized or cause stress that would result from errors. “Pride in workmanship” is an important part of the work experience that each team member should have the opportunity to thrive with.

Item 10: Having a best friend at work (BFW). Gallup found in their 80,000 manager study that employees who report having a best friend at work achieved as follows:

• 43% more likely to report having received praise and recognition for their work in the last seven days.

• 37% more likely to report that someone at work encourages their development.

• 35% more likely to report co-worker commitment to quality.

• 28% more likely to report that in the last six months, someone at work has talked to them about their progress.

• 27% more likely to report that the mission of their company makes them feel their job is important.

• 27% more likely to report that their opinions seem to count at work.

• 21% more likely to report that at work, they have the opportunity to do what they do best every day.

What are you doing in your company to help make sure that good team members are properly introduced to good influence co-workers, are able to socialize and meet each other’s families in simple but enjoyable “company picnic” and happy hour events? Employees don’t need expensive and fancy parties and events – simple and relaxed low-key after-hours opportunities to mingle can have a significantly positive impact on all team relationships.

By the way, the best friend at work cannot be Colonel Sanders. If you think he works at your office get professional help!

Item 11: Team members like to discuss their progress. Gallup reports that great managers are always encouraging employees to know themselves and the roles that they are likely to succeed in. Gallup recommends that feedback be specific and given in the context of a positive employee/manager relationship.

Item 12: Are there opportunities to learn and grow?

Good team members are always interested in learning new things and growing as team members. An appropriate atmosphere and methodology can advance this.

Phil McLeod’s Daughter Gets Married!

St. Petersburg collaborative family lawyer Phil McLeod’s daughter was recent married to a daring young man who was apparently not represented at the wedding or at the honeymoon thereafter. Mr. McLeod is pictured here with his wife and daughter during a discussion of post-marital injunctions.

Humor! (or Lack Thereof!)

Incredibly strict waiver limits daredevil Evil Kneivel, Jr. to jumping over two ottomans covered in rugs at an elevation slightly higher than the floor.

Upcoming Seminars and Webinars

FREE WEBINAR:

WILL THE SUPREMES TAKE BP CLAIMS ON A MIDNIGHT TRAIN TO GEORGIA?

Date: Friday, May 30, 2014 | 12:30 p.m. (20-30 Minutes)

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE OHIO PRESENTATION:

THE JOINT EXEMPT STEP-UP TRUST AND PLANNING WITH COMMERCIAL ANNUITIES

Alan Gassman will be speaking at the annual Ohio Conference on Wealth Transfer on June 4, 2014 on two different topics:

1) Wealth Transfer on Structuring Joint Exempt Step-Up Trusts (“JESTs”): Maximizing Stepped-Up Basis Planning, Fully Funding Credit Shelter Trusts with Joint Assets and Practical and Technical Aspects Thereof – With Forms

With the increased federal estate tax exclusion, it may be time to reconsider “joint” trusts for married couples. Alan co-authored two articles in the October and November issues of Estate Planning Magazine about Joint Exempt Step-Up Trusts (JESTs), and will talk about maximizing stepped-up basis planning, fully funding Credit Shelter Trusts with joint assets, and other practical aspects of JESTs with forms.

2) Planning with Commercial and Charitable Annuities. Mr. Gassman will also be participating in a panel discussion the evening before hosted by Johnson Investment Counsel and The Ohio State University.

This session will discuss planning with fixed and variable annuities, covering common policy features, misunderstandings about “guaranteed” rates of return, the minimum distribution rules akin to the IRA rules, income taxation of annuities on the death of the owner or annuitant, and trusts as holders of annuity contracts.

Skip Fox will be speaking on the following:

1) Recent Developments.

This session will include commentary on marital planning, gifts, grantor trusts, asset protection, portability, generation skipping tax and charitable planning.

2) Must We Trust a Trust That’s Just a Crust That Was a Trust?

What some view as “un-trust-like” notions – protectors, selectors, advisors, appointers, special trustees, directed trusts, secret trusts, virtual representation, in terrorem forfeitures, perpetual trusts and decanting – will be examined with some forms included.

Date: June 4, 2014

Location: Hilton at Easton, Columbus, Ohio

Additional Information: For more information on the conference and to register for the conference please contact agassman@gassmanpa.com

********************************************************

FREE WEBINAR:

VERSION 226.3 OF OUR ESTATEVIEW ESTATE TAX PROJECTION AND ILLUSTRATION SOFTWARE – A FREE WEBINAR

Alan Gassman, Ken Crotty and David Archer will be presenting a free 30 minute webinar on what is new with our EstateView software which will be featured later this year in Jason Havens’ excellent American Bar Association RPTE Probate and Property column.

Speakers: Alan Gassman, Ken Crotty and David Archer

Date: Monday, June 9, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

FREE WEBINAR:

CREDITOR AND OTHER PLANNING FOR SAME GENDER COUPLES

Date: Tuesday, June 10, 2014 | 7:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

BLOOMBERG BNA WEBINAR:

HIRING AND TERMINATING EMPLOYEES; WHAT TO DO, WHAT TO AVOID

Speaker: Alan S. Gassman, Esq., Colleen Flynn, Esq. and Dr. Stephanie Thomason

This is a very practical guide that your office manager is sure to enjoy. Let us know if you would like to see Alan Gassman’s slides for this presentation.

Date: Wednesday, June 18, 2014 | 2:00 – 3:00 p.m.

Location: Bloomberg BNA Tax & Accounting Online webinar

Additional Information: For more information, to register and a discount code please email agassman@gassmanpa.com

********************************************************

LIVE CLEARWATER PRESENTATION:

FICPA SUNCOAST CHAPTER MONTHLY MEETING

Alan S. Gassman will be speaking at the FICPA Suncoast Chapter’s monthly meeting on HOW TO PLAN, STRUCTURE, AND PROTECT WEALTH USING REVOCABLE AND IRREVOCABLE TRUSTS AND TRUST SYSTEMS. A COMPREHENSIVE OVERVIEW WITH A PRACTICAL PLANNING CHECKLIST AND PRACTITIONER TAX COMPLIANCE GUIDE.

Speaker: Alan S. Gassman

Date: Thursday, June 19, 2014 | 4:00 p.m. (100 minute presentation)

Location: Feather Sound Country Club, Clearwater, Florida

Additional Information: For more information, to register and a discount code please email agassman@gassmanpa.com

********************************************************

LIVE FT. LAUDERDALE PRESENATION:

FICPA ANNUAL ACCOUNTING SHOW

Alan Gassman will be speaking at the FICPA Annual Accounting Show on Thursday, September 18, 2014 on the topic of ESSENTIAL GUIDE TO BASIC TRUST PLANNING for 50 minutes.

This presentation will introduce basic and intermediate trust planning background and provide attendees with an orderly list of the most commonly used trusts, practical features and traps for the unwary, including revocable, irrevocable and hybrid. The discussion will include tax, creditor protection and probate and guardian considerations.

Date: Wednesday, September 17 through Friday, September 19, 2014

Location: Fort Lauderdale, Florida

Additional Information: For more information about this program please contact Stephanie Thomas at ThomasS@ficpa.org

********************************************************

LIVE NEW JERSEY PRESENTATION:

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE)_SPECIAL 3 HOUR SESSION

Alan Gassman will be the sole speaker for this informative 3 hour program entitled WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Here is some of what the New Jersey Bar Invitation for this program provides:

New Jersey residents have always had a strong connection to Florida. We vacation there (it=s our second shore). Own Florida property (or have favored relatives that do) and have family and friends living there. Sometimes our wealthiest clients move to Florida and need guidance, and you need background in order to continue representation.

There are real and significant differences between the two states that every lawyer should be cognizant of. For example, holographic wills are perfectly legitimate in New Jersey and anyone can serve as an executor of an estate, which is not the case in Florida. Also, Florida=s new rules regarding LLCs are different, and if you are handling estates of New Jersey decedents who owned Florida property, there are Florida law issues that must be addressed. Asset protection differs significantly in Florida too.

Attendees will receive Mr. Gassman’s book entitled “Florida Law for Tax, Business and Financial Planning Advisors,” which has a retail value of $34.95.

Our informative seminar, presented by Clearwater attorney Alan Gassman, highlights issues New Jersey lawyers should be aware of when handling matters for New Jersey residents who own Florida property, reside there part time, have interest in Florida businesses, or who are considering a move to Florida. The Florida Bar rules permit out of state lawyers to continue representation of Florida residents under rules that will be discussed.

Gain the knowledge you need to assist your clients with Florida matters, including:

- Florida specific laws involving businesses, trusts, and estates

- Florida tax planning

- Elective share and homestead rules

- Liability Insulation and Planning

- Creditor Protection and Strategies

- Medical Practice Laws

- Staying within Florida Bar Guidelines that allow representation of Florida clients

Comments from past attendees of this program:

- Excellent seminar and materials!!!

- This was one of the best ICLE seminars yet!

- One of the best seminars I have attended.

- Better than mashed potatoes and gravy. Glad he didn’t serve grits!

Date: Saturday, October 4, 2014

Location: TBD

Additional Information: This is a repeat of the same program that we gave last year, but our book is now updated for the new Florida LLC law and changes in estate and trust law. Please tell all of your friends, neighbors and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information please email agassman@gassmanpa.com ********************************************************

LIVE SOUTH BEND, INDIANA PRESENATION:

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Please send us your questions, comments and suggestions for Alan Gassman’s talk on Planning with Variable Annuities and Analyzing Reverse Mortgages. This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities, and provide estate and tax planners with a number of strategies for understanding and planning with existing and contemplated contracts. With over One Trillion Dollars of US taxpayer money invested in annuity contracts, more and more clients are showing up in their estate planners’ offices with large annuity contracts and common misunderstandings about “guaranteed income” and “guaranteed rates of return” features. The presentation will cover common policy features, what is actually happening inside of a policy, illustration techniques, and changes that can be made to defer income tax and reduce overall tax liability. Minimum distribution rules that apply to variable annuity contracts will also be discussed.

Date: November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman will once again be speaking at the Ave Maria School of Law Estate Planning Conference in Naples, Florida, whether he is invited or not!

Hats off to Jonathan Gopman, Karen Grebing, Northern Trust and many others for having hosted one of the most enjoyable conferences in 2014.

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, Naples, Florida

Additional Information: Please contact Karen Grebing at kgrebing@avemarialaw.edu for more information.

NOTABLE SEMINARS BY OTHERS (WE WERE NOT INVITED, BUT WILL ATTEND AND ARE STILL EXCITED)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: St. Petersburg, FL

Additional Information: Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: TBD

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

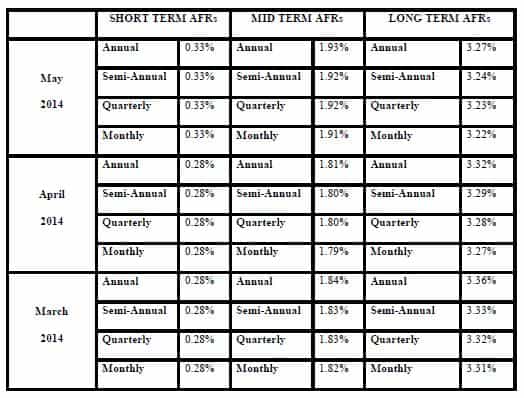

Applicable Federal Rates Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.

The 7520 rate for May is 2.4% and for April was 2.2%