The Thursday Report – Issue 308

|

|

|

Thursday, July 22, 2021 – Issue 308 Having trouble viewing this? Use this link ALWAYS FREE, SOMETIMES PUBLISHED ON THURSDAYS

|

|

|

Table of ContentsFlorida’s New Directed Trust Statute – Finally an Article Worth Reading By: Alan Gassman and Ian Sanford Michael Geeraerts & Jim Magner: Will the FTC Ban Non-Competes By: Michael Geeraerts & Jim Magner New York Ethics Opinion States that Lawyers May Provide Legal Services to Clients and Use Marijuana Under NY Law By: Joseph Corsmeier Update – The “Kearney patch” Bill Did Not Pass into Law, Which Means that a Blanket UCC Filing Can Still Obliterate Protection of Pension Plans, IRAs, and Other Qualified Retirement Plans By Christopher Dinecolo and Brock Exline Charitable Contributions of Inventory: Is Your Business Feeling Generous? By: Grace Paul and Brock Exline Social Distancing in the Business – Here’s What You Can Do Right Now to Make a Difference By: David Finkel

|

Article 1Florida’s New Directed Trust Statute –Finally an Article Worth ReadingBy Alan Gassman and Ian Sanford Florida Statute §736.1401 through §736.1416 was enacted by the legislature and signed into law by Governor DeSantis effective July 1, 2021, titled the Florida Uniform Directed Trust Act (“the Act”). This new Act expands upon the law governing non-trustee persons who are empowered to give directions to a trustee (“trust directors”). Second to the new Community Property Trust Act in importance to most planners, the new Directed Trust Act is an improvement to the prior law, which recognizes that the dutiesof Trusteeship of a Trust can be divided in order to limit the responsibility and potential liability of separate Trustees, and to also have a Trust sitused in a state where a director resides. The director trustee, or trust protector is employed for the purpose of assuring that the law of the jurisdiction where the director is located can apply to the Trust, and directing trustees to fulfill administrative functions that can vary from managing investments to paying distributions to beneficiaries. The precise title of the trust director isn’t considered when determining if the Act applies that person. The trust director is a non-trustee with a power to direct as granted by the terms of the trust. Some powers are excluded from power of direction, such as a power of appointment, the power to appoint or remove a trustee or trust director, and a power that a settlor might reserve over a trust that is revocable by that settlor. A trust director who holds rights of authority has an affirmative duty to act, and failure to do so will result in a breach of trust. It is worth noting that the trust director does not need to be a single person. A group of people can serve as “the director”. A plurality of directors must act by majority decision, unless otherwise stipulated by the terms of the trust. For example, an individual residing in New York, which has a 21-year plus life in being Rule Against Perpetuities for irrevocable trusts formed there, may wish to take advantage of Florida’s 360-year Rule Against Perpetuity by forming a Dynasty Trust that will provide educational benefits and living expenses for family members who are pursuing education for 360 years. Please note that South Dakota has a 999-year statute and a good many trust companies that are ready, willing, and able to serve as Administrative Trustee of a South Dakota Trust. The clients in this situation have a close friend who is a CPA and resides in Florida. (c) Related or subordinate party For purposes of this subpart, the term “related or subordinate party” means any nonadverse party who is— (1) the grantor’s spouse if living with the grantor; (2) any one of the following: The grantor’s father, mother, issue, brother or sister; an employee of the grantor; a corporation or any employee of a corporation in which the stock holdings of the grantor and the trust are significant from the viewpoint of voting control; a subordinate employee of a corporation in which the grantor is an executive. For purposes of subsection (f) and sections 674 and 675, a related or subordinate party shall be presumed to be subservient to the grantor in respect of the exercise or nonexercise of the powers conferred on him unless such party is shown not to be subservient by a preponderance of the evidence. The following applies for purposes of the above: (a)Adverse party For purposes of this subpart, the term “adverse party” means any person having a substantial beneficial interest in the trust which would be adversely affected by the exercise or nonexercise of the power which he possesses respecting the trust. A person having a general power of appointment over the trust property shall be deemed to have a beneficial interest in the trust. (b)Nonadverse party For purposes of this subpart, the term “nonadverse party” means any person who is not an adverse party. The clients appoint their lawyer in New York to be the Distribution Trustee to make the decisions as to distributions to be made for educational benefits for the beneficiaries of the Trust, with the Alternate Trustee being a Trust Company affiliated advisor that is sitused in Delaware. The clients retain the right to change the identity of the Distribution Trustee and the Investment Trustee at any time and for any reason, subject to the limitations provided under Revenue Ruling 95-58. Florida Statute Section 736.1403 recognizes that this will be considered to be a Florida Trust, even though the settlors reside in New York. In addition, the Trustees may establish an account with a financial institution (a bank or brokerage firm) at a Florida office in order to establish a firm financial situs in Florida. Under Florida law, the Distribution Trustee should have no responsibility if there is malpractice or malfeasance on the part of the Investment Trustee, and the Investment Trustee should have no liability or responsibility for the negligence or malfeasance of the Distribution Trustee. It is important to note that the Act differs from the Uniform Directed Trust Act by requiring the directed trustee to assess whether a trust director’s instructions are within the scope of the trust director’s power of direction prior to following the instructions. This assumes that a Trustee who is not responsible for the negligence or malfeasance of the other Trustees did not “actively conspire” or assist in or participate in such negligence or malfeasance. How sure can we be that Florida law will apply with respect to the Rule Against Perpetuities and the insulation from liability under the Florida Directed Trust statute, assuming that the State of New York has no such statute? Our answer is “pretty darned sure” because of the 1958 U.S. Supreme Court case of Hanson v. Denckla which indicated that Delaware law would apply to a Florida Trust. Under the facts of Hanson v. Denckla, which are reviewed before, the U.S Supreme Court determined that there was no “connection” between Florida and the Trustees, who were all located in Delaware. The Court used the following language in its holding: The execution in Florida of the powers of appointment under which the beneficiaries and appointees claim does not give Florida a substantial connection with the contract on which this suit is based. It is the validity of the trust agreement, not the appointment, that is at issue here. For the purpose of applying its rule that the validity of a trust is determined by the law of the State of its creation… While living in Pennsylvania, Mrs. Donner visited Delaware and signed a revocable trust, appointing a Delaware trust company to serve as Trustee for certain investments. The Trust Agreement provided that she would receive income for life and that the remainder of assets after her death would be paid based upon her instructions under a “lifetime or testamentary power of appointment.” Mrs. Donner then moved to Florida where she lived until she died. After she moved to Florida, she signed valid instructions to provide that certain beneficiaries would receive $400,000, with the remaining assets passing by an attempted exercise of the power of appointment that was claimed not to be effective because of vague language. A suit was filed in Florida, without the participation of the Delaware trust company, which was only given notice by mail and not by traditional required physical service of a registered agent. The Florida court and the Supreme Court ruled that the attempted exercise of the power of appointment by Mrs. Donner was ineffective. The Florida Supreme Court also held that the Florida court had jurisdiction over the Delaware Trust company. The Delaware Trust company appealed the decision to a Delaware court, which found that the power of appointment had been properly exercised, therefore disagreeing with the Florida courts. This Delaware court decision was sustained by the Supreme Court of Delaware. The U.S. Supreme Court overruled the Florida court, finding that the Florida court did not have in rem jurisdiction over the assets of the Trust or personal jurisdiction over the Trust company, and therefore had no power under Florida law to pass on the validity of the Trust. Its judgment was therefore determined to be invalid and Delaware was under no obligation to give full faith and credit to an invalid Florida judgment. Subsequent cases have recognized that a settlor beneficiary’s retention of control over certain aspects of a Trust operation have been insufficient to enable a court to exercise jurisdiction over the Trust where no Trustee purposefully availed itself in the jurisdiction where the lawsuit was filed. Most legal scholars believe that in determining whether the Rule Against Perpetuities applies to a Trust Agreement will be determined by the law of the jurisdiction designated in the Trust Agreement unless that jurisdiction’s law is contrary to a mandatory rule of law of the jurisdiction having the most appropriate relationship to the matter at issue. This new legislation will undoubtedly make Florida a competitive market for both trusts and trust directors. For further reading on the topic, see LISI Estate Planning Newsletter #2884 (May 17, 2021).

|

|||||||||||||||||||||||||||||||||||||||

Article 2Prepared for Alan S. GassmanSteve Leimberg’s Employee Benefits and Retirement Planning Email Newsletter – Archive Message #765Date: 12-Jul-21From: Steve Leimberg’s Employee Benefits and Retirement Planning Newsletter

|

|||||||||||||||||||||||||||||||||||||||

Article 3JACPA Ethics AlertNew York Ethics Opinion States that Lawyers May Provide Legal Services to Clients and Use Marijuana Under NY LawBy: Joseph Corsmeier Hello everyone and welcome to this Ethics Alert, which will discuss the July 8, 2021 New York Ethics opinion which states that NY lawyers may provide legal services to clients in compliance with New York’s recreational marijuana law, own marijuana businesses, and personally consume marijuana. NYSBA Opinion 1225 is here: https://nysba.org/app/uploads/2021/07/Opn-1225-with-letterhead.pdf. The NYSBA ethics opinion pointed out that, although marijuana remains illegal under federal law, 17 states, Washington, D.C., and Guam have legalized its recreational use since 2012. The opinion states: “It seems fair to say that for nearly a decade federal forbearance in the enforcement of federal narcotics laws has been equally applied to state laws legalizing recreational marijuana and to state laws legalizing medical marijuana.” The ethics opinion further stated that lawyers must ensure compliance with the regulatory requirements in New York’s medical marijuana industry applies equally if not more to its recreational marijuana industry. “In a complex regulatory system where cultivation, distribution, possession, sale and use of a product are tightly regulated, legal advice and guidance has immense value…Without the aid of lawyers, the recreational marijuana regulatory system would, in our view, likely break down or grind to a halt.” The opinion reviewed Rule 8.4(b) and (h) of the New York Rules of Professional Conduct, which states that a lawyer cannot “engage in illegal conduct that adversely reflects on the lawyer’s honesty, trustworthiness or fitness as a lawyer” or “engage in any other conduct that adversely reflects on the lawyer’s fitness as a lawyer”; however, Comment 2 to the New York Rule states that: “Many kinds of illegal conduct reflect adversely on fitness to practice law. Illegal conduct involving violence, dishonesty, fraud, breach of trust, or serious interference with the administration of justice is illustrative of conduct that reflects adversely on fitness to practice law.” “Nothing the inquirer proposes to do involves acts of violence. Moreover, if the inquirer’s ownership interest in a cannabis business, her home cultivation of marijuana plants, and her personal recreational use of marijuana comply with the Recreational Marijuana Law, they will fall within the scope of federal forbearance. For that reason, although those activities are technically illegal under federal law, they will not constitute illegal conduct that involves “dishonesty, fraud, breach of trust, or serious interference with the administration of justice.” Accordingly, without more, such conduct would not adversely reflect on the inquirer’s “honesty, trustworthiness or fitness as a lawyer” within the meaning of Rule 8.4(b).” The opinion cautioned that excessive use of marijuana could negatively impact a lawyer’s ability to represent his or her clients. According to the opinion: “(n)othing we say here connotes approval of such excessive use or establishes a protective shield for a lawyer who is facing disciplinary charges, malpractice claims or other adverse consequences arising out of marijuana use.” The opinion concluded: “In light of current federal enforcement policy, the New York Rules of Professional Conduct permit a lawyer to assist a client in conduct designed to comply with New York’s Recreational Marijuana Law and its implementing regulations, notwithstanding that federal narcotics law prohibits the activities authorized by that law. A lawyer may also use marijuana for recreational purposes and may, when the law becomes fully effective, cultivate an authorized amount of marijuana plants at home for personal use. Finally, subject to compliance with Rules 1.7 and 1.8(a), an attorney may accept an equity ownership interest in a cannabis business in exchange for legal services.” Bottom line: This New York ethics opinion wades into the continuing trend toward legalization of marijuana and the lawyer’s duties and obligations related to same. New York lawyers now have an ethics opinion which authorizes them to advise clients on the marijuana laws, own marijuana businesses, and legally use marijuana without violating New York’s ethics rules. Be careful out there. As always, if you have any questions about this Ethics Alert or need assistance, analysis, and guidance regarding ethics, risk management, or other issues, please do not hesitate to contact me. My law firm focuses on review, analysis, and interpretation of the Rules Regulating The Florida Bar, advice and representation of lawyers in Bar disciplinary matters, advice and representation of applicants for admission to The Florida Bar before the Board of Bar Examiners, defense of all Florida licensed professionals in discipline and admission matters before all state agencies and boards, expert ethics opinions, and practice management for lawyers and law firms. If there is a lawyer or other Florida professional license involved, I can defend the complaint or help you get your license. If you have any questions or comments, please call me at (727) 799-1688 or e-mail me at jcorsmeier@jac-law.com. You can find my law firm on the web at www.jac-law.com. In addition to handling individual cases, matters, problems and issues for my clients, I also am on retainer to provide ethics advice to numerous lawyers and law firms throughout the state of Florida. I also provide legal assistance and advice to numerous individuals and non-legal entities to help insure compliance with the law and rules related to UPL and other issues.

|

|||||||||||||||||||||||||||||||||||||||

Article 4Update – The “Kearney patch” Bill Did Not Pass into Law, Which Means that a Blanket UCC Filing Can Still Obliterate Protection of Pension Plans, IRAs, and Other Qualified Retirement Plans.By: Christopher Denicolo and Brock Exline Last year, the Thursday Report featured an article on the interesting 2019 United States Eleventh Circuit case of Kearney Construction Company, LLC, v. Travelers Casualty and Surety Company of America, which caused uncertainty regarding whether “boilerplate language” providing for the pledging of “all assets and rights, wherever located,” as collateral for a loan would eliminate the creditor protection provided by Florida Statute Section 222.21 relating to IRAs and other qualified plans. The court found that the lien attached to Mr. Kearney’s IRA accounts at the time it was executed and that this constituted a Prohibited Transaction under Internal Revenue Code Sections 408 and 4975, which penalizes taxpayers who make personal use of their IRA accounts by pledging them as collateral for a personal loan. Florida Statute Section 222.21(2) generally requires that an IRA must be properly qualified under Code Section 408, to be exempt from creditors. Code Section 408 states that “[a]ny individual retirement account is exempt from taxation,” but this status can be lost if the owner “engages in any transaction prohibited by section 4975.” As a result, the Court found that Mr. Kearney’s IRA accounts were not afforded exemption from creditors under Florida Statute Section 222.21. Because the Court did not cite the fact that the LLC was owned by Mr. Kearney’s son as determinative on the outcome, the holding likely would have been the same if the lender were an entirely unrelated third party. Mr. Kearney asserted that there was no intent to pledge the IRAs as collateral, but the “boilerplate language” of the security agreement and the Form UCC-1 Financing Statement that was filed nevertheless attached the IRAs, according to the Eleventh Circuit Court of Appeals, and this caused loss of the creditor-proof nature of the IRA, even though the creditor that had the lien did not attempt to garnish the IRA and was apparently paid in full. The court in Kearney held that the plain language of the UCC-1 agreement signed was sufficient to implement a lien on six of Mr. Kearney’s accounts including his IRA. The plain language of the UCC-1 agreement was as follows: Grant of Security Interest. As security for any and all Indebtedness (as defined below), the Pledgor hereby irrevocably and unconditionally grants a security interest in the collateral described in the following properties[:] all assets and rights of the Pledgor, wherever located, whether now owned or hereafter acquired or arising, and all proceeds and products thereof, all goods (including inventory, equipment and any accessories thereto), instruments (including promissory notes)[,] documents, accounts, chattel paper, deposit accounts, letters of credit, rights, securities and all other investment property, supporting obligation[s], any contract or contract rights or rights to the payment of money, insurance claims, and proceeds, and general intangibles (the “Collateral”). The court stated that “the above language constitutes an unambiguous pledge of ‘all assets and rights of the Pledgor,’ including his IRA Account.” The Kearney decision caught many by surprise, as the prevailing thought was that the creditor protection afforded by Florida Statute Section 222.21 was not considered to be waived as a result of boilerplate language in a pledge agreement or security agreement, which is often found in substantially all consumer loan and mortgage documents. The decision therefore has wide-ranging effects in that it could cause many unsuspecting individuals to be considered to have received a deemed distribution of the assets in his or her pension plans, IRAs or qualified retirement plans, which could subject the individual to taxes, interest and penalties, and also could subject such assets to creditor claims of Floridians. In the 2021 Florida Legislative Session, efforts were made to introduce a new bill that would fix the uncertainties created by the Kearney decision. The bill, titled “Waivers of Exemptions of Applicable Assets,” spearheaded by Senator Lori Berman, first took form as Senate Bill 688, and later transformed into House Bill 715. The bill sought the implementation of a new statute, Florida Statute Section 222.105, which would provide the following: 222.105 Waiver of exemptions; requirements.– (1) The exemptions set forth in this chapter with respect to applicable assets may not be waived unless the person who is entitled to the exemption has specifically pledged a security interest in the applicable asset in a security agreement, as defined in s. 679.1021, that identifies the applicable asset by specific reference. (2) The following references in a security agreement purporting to pledge a security interest are insufficient to pledge applicable assets or to waive the protections afforded to applicable assets by this chapter: (a) All of a person’s “assets and rights, wherever located, whether now owned or after acquired, and all proceeds thereof,” or other words of similar import, including, but not limited to, those described in s. 679.1081(3); or (b) References only to the type of collateral, as described in s. 679.1081(5). (3) For purposes of this section, the term “applicable assets” means those assets described in ss. 222.13-222.16, s. 222.18, and ss. 222.201-222.22. Unfortunately, the bill died in appropriations, never making it to the Governor’s desk. It remains to be seen whether the legislature will take action on this. Nevertheless, the Tax Section of the Florida Bar has indicated that a “Kearney patch” bill is not forever discarded, and that interested Sections of the Florida Bar will convene at some point in the near future to work out a solution. It is anticipated that a proposed “Kearney patch” bill will be released at some point in 2022. Unless or until a “Kearney patch” bill is enacted into law, readers need to be aware that as the state of the law currently treats pledge agreements and security agreements providing for a pledge of all of a person’s “assets and rights, wherever located” as a pledge of IRAs, qualified plans, and possibly other tax-advantaged assets. Accordingly, any such pledge agreements, security agreements, or agreements of similar effect should be closely reviewed and should provide for language specifically carving out such tax-advantaged assets from being pledged under the applicable agreement. The prudent investor will pledge which assets he or she is using as security with great specificity.

|

|||||||||||||||||||||||||||||||||||||||

Article 5Charitable Contributions of Inventory: Is Your Business Feeling Generous?By: Grace Paul and Brock Exline For businesses that are looking to give back to the community and enhance their goodwill by reducing excess inventory, a charitable donation of inventory can be a great way for a business to 1) contribute to a good cause and 2) get rid of unused or unwanted inventory while receiving a tax deduction. Sometimes giving truly is receiving! Specifically, the CARES Act enhanced the federal income tax deduction for charitable contributions in 2020, and the Consolidated Appropriations Act extended these enhancements through 2021. Charitable Inventory Contributions In General There are requirements that business owners should be aware of when seeking to make a charitable contribution of inventory in order to ensure that the donation is tax deductible. IRS Publication 526 (2020) broadly defines inventory as “property sold in the course of business.” The general rule according to IRS Publication 526 (2020) is that businesses “can deduct… the smaller of [the inventory’s] fair market value on the day it was contributed or its basis. The basis of contributed inventory is any cost incurred for the inventory in an earlier year that you would otherwise include in your opening inventory for the year of the contribution.” Many business owners may think that an inventory unit’s “basis” is simply its cost, but a business may also consider the additional allocated costs that the business has incurred in calculating an inventory unit’s basis. These costs may include shipping, storage, and depreciation. IRS Publication 526 (2020) defines fair market value consistent with general tax law principles as follows: “the price at which the property would change hands between a willing buyer and a willing seller, neither having to buy or sell, and both having reasonable knowledge of all the relevant facts.” In addition, for purposes of ensuring that your contribution is eligible for a tax deduction, business owners should also make sure that their chosen charitable organization is a qualified organization under the Internal Revenue Code. IRS Publication 526 (2020) defines qualified organizations to include “nonprofit groups that are religious, charitable, educational, scientific, or literary in purpose, or that work to prevent cruelty to children or animals.” Such qualified organizations must have tax exempt status under Section 501(c)(3) of the Internal Revenue Code or similar sections providing for an entity to be tax exempt for charitable purposes. Further, IRS Publication 526 (2020) provides Table.1 as guidance for determining whether contributions made to an organization are tax deductible. Contributions of Food Inventory Prior to the CARES Act, all businesses could receive tax deductions for up to 15% of their taxable income for charitable donations of food inventory, but the CARES Act increased this limit to 25% for donations made in 2020 to 2021. Internal Revenue Code 170(e)(3)(C)provides the following guidance on the charitable donation of food inventory: (C) Special rule for contributions of food inventory (i) General rule In the case of a charitable contribution of food from any trade or business of the taxpayer, this paragraph shall be applied— (I)without regard to whether the contribution is made by a C corporation, and (II)only to food that is apparently wholesome food. (ii) Limitation The aggregate amount of such contributions for any taxable year which may be taken into account under this section shall not exceed— (I)in the case of any taxpayer other than a C corporation, 15 percent of the taxpayer’s aggregate net income for such taxable year from all trades or businesses from which such contributions were made for such year; computed without regard to this section, and (II)in the case of a C corporation, 15 percent of taxable income (as defined in subsection (b)(2)(D)). C Corporations C corporations have received the most benefits and incentives to donate inventory during the Coronavirus pandemic. Under the CARES Act, C corporations may deduct all charitable gifts of inventory made between January 1, 2020 and December 31, 2021 up to 25% of taxable income, while other types of businesses only saw an increase in the amount of taxable deductions for donation of food inventory. Prior to the CARES Act, C corporations could only deduct 15% of charitable contributions of food inventory and 10% of all other inventory. Nevertheless, if a business or client did not take advantage of the 2020 CARES Act provisions all is not lost! The Consolidated Appropriations Act of 2021 extended these provisions through the end of the 2021 calendar year. Another advantage that C corporations have is the ability to receive an additional deduction under Internal Revenue Code 170(e)(3)(A) if the contribution is used for the care of the ill, the needy, or infants and certain recordkeeping regulations are adhered to. If the requirements are met, a corporation can receive up to twice the basis of the donated inventory. The statutory language is as follows: (3) Special rule for certain contributions of inventory and other property (A) Qualified contributions For purposes of this paragraph, a qualified contribution shall mean a charitable contribution of property described in paragraph (1) or (2) of section 1221(a), by a corporation (other than a corporation which is an S corporation) to an organization which is described in section 501(c)(3) and is exempt under section 501(a) (other than a private foundation, as defined in section 509(a), which is not an operating foundation, as defined in section 4942(j)(3)), but only if— (i)the use of the property by the donee is related to the purpose or function constituting the basis for its exemption under section 501 and the property is to be used by the donee solely for the care of the ill, the needy, or infants; (ii)the property is not transferred by the donee in exchange for money, other property, or services; (iii)the taxpayer receives from the donee a written statement representing that its use and disposition of the property will be in accordance with the provisions of clauses (i) and (ii); and (iv)in the case where the property is subject to regulation under the Federal Food, Drug, and Cosmetic Act, as amended, such property must fully satisfy the applicable requirements of such Act and regulations promulgated thereunder on the date of transfer and for one hundred and eighty days prior thereto. (B) Amount of reduction The reduction under paragraph (1)(A) for any qualified contribution (a defined in subparagraph (A)) shall be no greater than the sum of— (i)one-half of the amount computed under paragraph (1)(A) (computed without regard to this paragraph), and (ii)the amount (if any) by which the charitable contribution deduction under this section for any qualified contribution (computed by taking into account the amount determined in clause (i), but without regard to this clause) exceeds twice the basis of such property. S Corporations Under the CARES Act, S Corporations are afforded similar increased deductibility with respect to charitable contributions of food inventory that apply to C Corporations, Accordingly, S Corporations can deduct contributions of food inventory to charitable organizations of up to 25% of its taxable income, but can only deduct up to 10% of all other inventory contributions. S Corporations are “pass-through” entities, Meaning that the income of the entity is considered as the income of the shareholders. As such, the charitable contributions of S corporations pass through to the personal income tax returns of the shareholders. Each shareholder can then claim a pro rata share of the corporation’s charitable donations on their personal income tax returns, as an itemized deduction. A corporation is allowed to deduct charitable contributions to qualifying organizations as long as the contribution is to be “used within the United States or its possessions,” however, shareholders of an S corporation can claim a charitable deduction regardless if a portion of the contribution is used outside of “the United States or its possessions.” This result is warranted because as a “pass-through” entity, the S corporation’s shareholders take the charitable deduction into account separately on their personal income tax returns. Partnerships Under the CARES Act, partnerships can deduct up to 25% of taxable income for charitable food inventory contributions, but can only deduct up to 10% of all other inventory contributions, because they are not “corporations” under the Internal Revenue Code. A partnership is similar to S Corporations in that they are both “pass-through” entities. As a result, the partners of a partnership deduct charitable contributions made by their business on their personal tax returns. If a partnership makes a charitable contribution, each partner takes a pro rata percentage share of the deduction on their personal tax return, or is otherwise provided in the partnership agreement. For example, assume a partnership has three equal partners and donates a total of $6,000 in inventory in the year, the partners will receive $2,000 in charitable deductions that will pass through to their personal income tax returns. A charitable contribution of property by a partnership reduces each partner’s basis in the partnership by the amount of the partner’s share of the partnership’s basis in the property contributed. It is worth noting that multi-member LLC’s that are taxed as a partnerships for federal income tax purposes are subject to the rules described above for partnerships, such rules do not necessarily apply only to state law partnerships. As mentioned above, the CARES Act temporarily increased the deduction limitation for charitable contributions of food inventory for contributions made during calendar year 2020 from 10% to 25% for corporations to provide increased deduction opportunities for certain businesses that are increasing their charitable activity in response to COVID-19. The CARES Act also increased the limit on all charitable contributions from C corporations to 25% of taxable income, including donations of qualified inventory that is not “qualified food inventory.” Another significant advantage provided by the CARES Act is that if the aggregate amount of qualified contributions made by a business entity exceeds the 25% limit, the entity may deduct the amount of its qualified contributions exceeding the 25% limit over the next five years. The Consolidated Appropriations Act extended the CARES Act charitable contribution provisions through 2021. The extension offers those who did not capitalize on the increases of charitable contribution deductions in 2020 a second chance to contribute to qualifying organizations at a higher level, thus lowering taxable income. Businesses and clients need to be well aware that although some things have changed regarding charitable contributions deductions, much remains the same. Deducting donations made directly to an individual, no matter how needy, is still not permitted. Moreover, it remains imperative to obtain required substantiation for donations of $250 or more. Without a written acknowledgment from the charity or qualified organization, legitimate contributions may be nondeductible. |

|||||||||||||||||||||||||||||||||||||||

Forbes Corner

How To Protect Your Wealth From The Lions, Tigers And Bears Waiting To Pounce In The Washington Tax ForestBy: Martin Shenkman Biden, Van Hollen and Sanders have all proposed dramatic tax changes. What should taxpayers do now? Continue Reading on Forbes

|

|||||||||||||||||||||||||||||||||||||||

For Finkel’s FollowersSocial Distancing in the Business – Here’s What You Can Do Right Now to Make a Difference

By: David Finkel For many business owners, having a remote workforce has been a very personal decision. Some owners prefer their team to collaborate face-to-face, while others prefer to use technology and give their team the opportunity to work from home or while on the road. Unfortunately, with the recent Coronavirus pandemic many business owners have been faced with some tough decisions regarding their businesses and their team in terms of social distancing. Which has led to some very important discussions between you and your staff. So where do we go from here? Maybe you want to start building up your systems and controls to give your team members the ability to work from home or adjust their work schedules during an emergency? Maybe the majority of your staff is already working remotely, and you want to get a better grasp on what they are doing and how best to serve them during this transition period. Time Is Of The Essence The worst time to have a discussion about contingency planning is when the building is on fire. Ideally, you want to think and plan ahead to decide how your team will handle various emergencies. Now, the specifics will of course vary from case to case but having a system in place to allow employees to work from home is always a good starting point. If your employees must come into the office, consider creating an alternative scheduling option that can be put into place should the need for social distancing arise. You might also take the opportunity to think about things like stock levels and supply chains interruptions when working on your contingency planning. Can you say toilet paper shortage? Tip #1. Communicate With Your Team Hiding your head in the sand, and thinking that the current situation won’t affect your business isn’t the way to go. Instead sit down with your management team or other key employees and discuss ways to handle the task at hand. Be prepared to listen and ask questions. Once you have these key points worked out, sit down with your workers and make sure that you both understand what is expected of each other. Only then will you have the freedom to really do your best work. Tip #2. Have Solid Reports One of the big stressors to having a remote workforce (or in times of crisis) is not knowing the status of projects and deliverables. Thankfully with a little planning, you can both relax and focus on getting your most valuable tasks completed during uncertain times. Ask Yourself: What “Key Performance Indicators” (KPIs) should they report on? How often? What updates should they submit? How frequently? In my company, our remote workers check in once a week through our “Big Rock app.” There we document our big tasks completed for the week, key victories and tasks for the following week. You can also use a spreadsheet, task manager or even email to document your victories and to-do lists. If your team is new to remote work, you want to help encourage weekly check ins until it becomes part of the company culture. Tip #3: Social Distancing Doesn’t Mean You Can’t Check In Face to Face There is a lot to be said for remote work and social distancing during times of crisis, but when it comes to brainstorming and creative projects there is nothing that competes with facetime together. So explore using conference lines, video meetings and other tools to keep your team connected when working remote. We get together once a week as a team virtually to stave off feelings of isolation. It is usually a 15-minute quick huddle via conference line. Once a month we upgrade this huddle to a video conference for 30 minutes. One of the best parts of the video huddle is the chance to see our team in their home offices and make a connection. Changing the way you do business is stressful, but with a little communication and teamwork the transition doesn’t have to be a painful one. How does your business handle social distancing in times of crisis?

|

|||||||||||||||||||||||||||||||||||||||

Featured EventThis event does not qualify for CLE Credit. Please pre-email your webinar questions to info@gassmanpa.com. They may be featured on the Power Point slides. The video recording will be emailed to all registrants approximately 1-3 hours after the program – whether you attend live or not. REGISTER for Estate Planning for Business Owners

|

|||||||||||||||||||||||||||||||||||||||

|

CHECK OUT THIS NEW SATURDAY MORNING SERIES!Toast, Trusts and Taxes with Alan Gassman and FriendsPlease consider your Saturday mornings booked for the foreseeable future… Join Alan and his guests for these Saturday morning conversations featuring live attendee interaction for Q and A! Please pre-email your questions to info@gassmanpa.com. Click to Register for all upcoming Saturday Morning webinars

The video recording will be emailed to all registrants approximately 1-3 hours after the program – whether you attend live or not. This series does not qualify for CLE Credit. |

|||||||||||||||||||||||||||||||||||||||

|

SATURDAY MORNING SERIES PROGRAM DETAILSClick to Register for all upcoming Saturday Morning webinars

|

|||||||||||||||||||||||||||||||||||||||

|

All Upcoming EventsRegister for all future free webinars from Gassman, Denicolo & Ketron, P.A. using this link

|

|||||||||||||||||||||||||||||||||||||||

|

You Tube ChannelVisit our You Tube Channel for featured webinars and more. Did you miss a past webinar event? Don’t worry! Watch our webinar recordings to Alan Gassman’s You Tube Library. What is everyone watching? Click on the playlists below to find out!

|

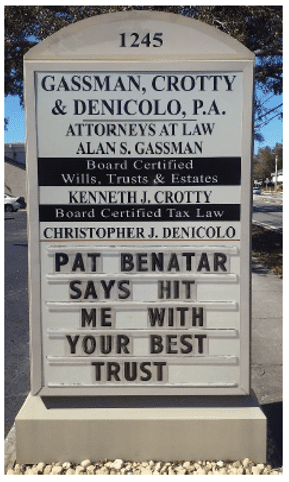

Humor

|

|

|

Gassman, Denicolo & Ketron, P.A.

1245 Court Street

Clearwater, FL 33756

(727) 442-1200