The Thursday Report – Issue 306

|

|

|

Thursday, June 17th, 2021 – Issue 306Having trouble viewing this? Use this link ALWAYS FREE, SOMETIMES PUBLISHED ON THURSDAYS

|

|

Dear Thursday Report readers: You may have noticed that we missed two weeks of Thursday Reports. To be candid, a great deal of time has gone into this month’s articles, and we are very thankful to have extremely talented and articulate law clerks who are helping us to make sure that what we are writing is both thorough and accurate. We welcome any question, comments and suggestions for future issues, as well as valuable gifts and invitations to fly on private jet airplanes to exclusive resorts or gift cards to Wendy’s or McDonald’s. As we are working to finalize derivative articles for national publications, we greatly enjoy and appreciate the opportunity to have feedback and advice from our Thursday Report readers. Without the Thursday Report we would probably not even know what day of the week it was. Best personal regards, Alan S. Gassman

|

|

Table of Contents

Article 1Florida Community Property TrustsBy: Alan Gassman and Brock Exline Article 2The Demise of Equity Split Dollar in Estate PlanningBy: Alan Gassman and Professor Jerry Hesch Article 3Florida Supreme Court Tells The American Bar Association What To DoBy: Alan Gassman Article 4President Biden’s Budget Includes Big Tax Increases That Will Rock Your Tax WorldBy: Martin Shenkman Featured EventsAll Upcoming EventsForbes CornerFor Finkel’s Followers3 Ways You Are Personally Sabotaging Your Company CultureBy: David Finkel You Tube ChannelHumorReviews

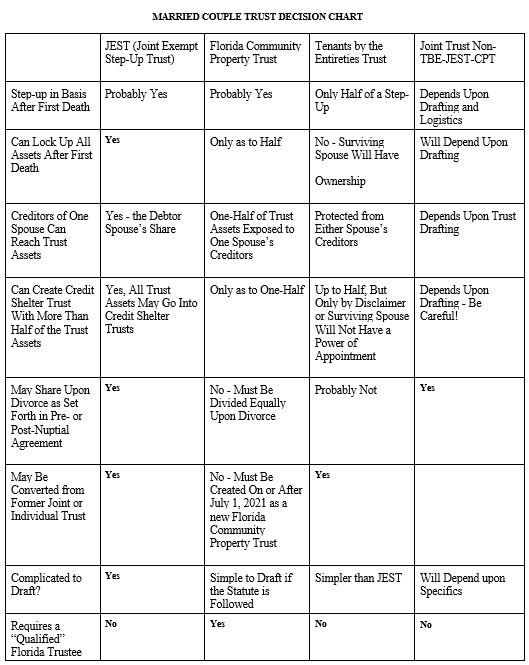

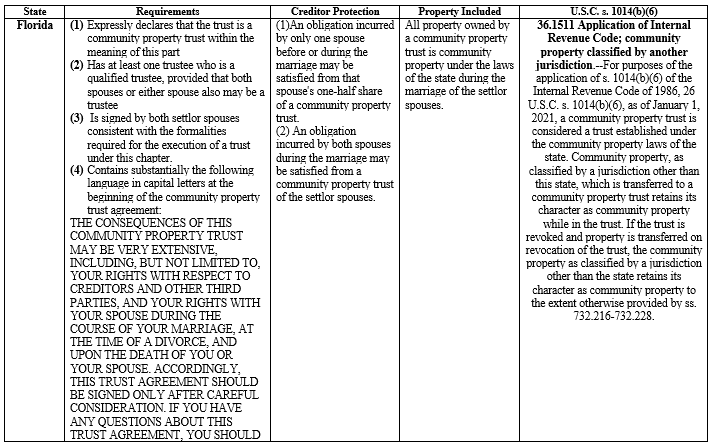

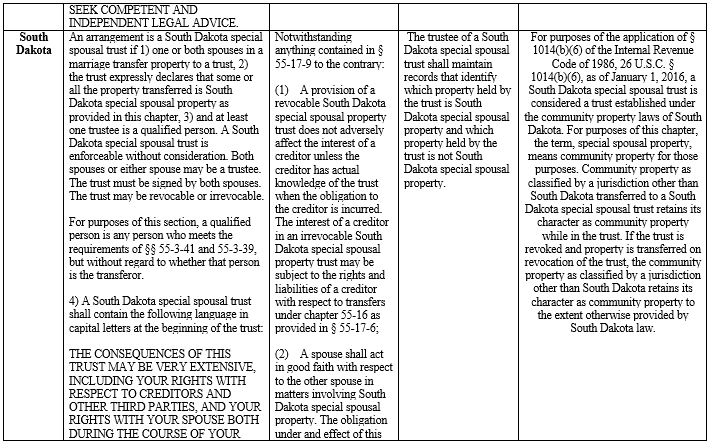

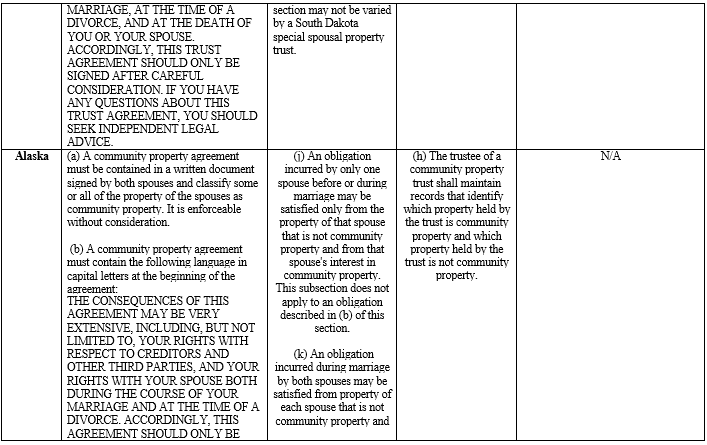

|

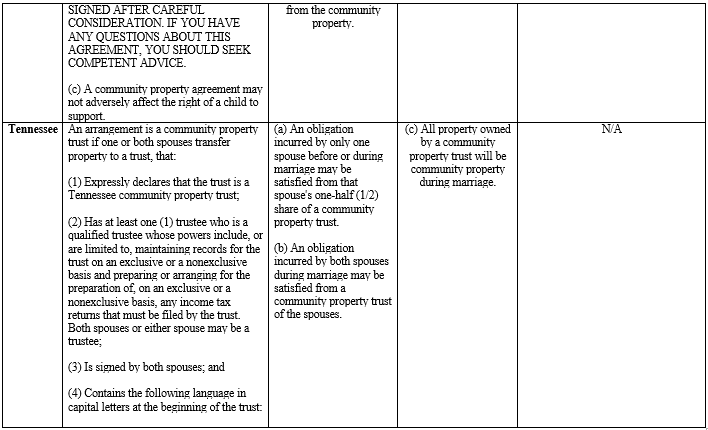

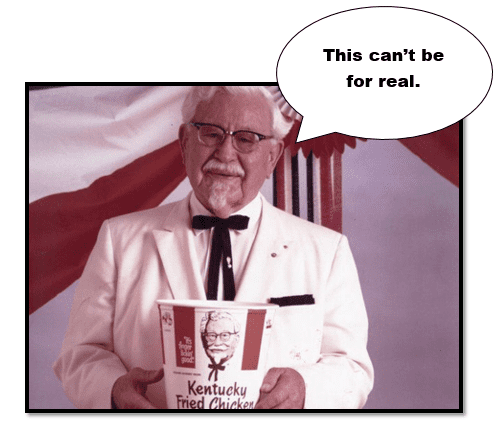

Article 1Florida Community Property TrustsRethinking client trust logistics with a new powerful catalyst.By: Alan Gassman and Brock ExlineHats off to the members of the Probate and Trust Tax Law Section of the Florida Bar for working with State Senator Berman and State Representative Diamond to design, draft, and implement what we believe to be the best community property trust legislation in the country. The statute will hopefully go into effect July 1, 2021, a mere 28 days before Alan’s birthday, and there could be no better present. Advantages of Community Property Trusts The reason that we believe Florida’s Community Property Trust Act is the best legislation is that the statutes indicate that creditors of one spouse can only reach that spouse’s one-half of the assets held in a Florida community property trust. In all other states with community property trust laws, except Tennessee, creditors of one spouse can reach all of a married couple’s assets held in a community property trust. Another advantage of the Community Property Trust Act is that any person residing in the State of Florida can serve as the trustee or a co-trustee under a Florida community property trust. Before the enactment of these new statutes, which will become effective on July 1st, married couples who wanted to enter into a community property trust had to use a trust company dually registered with Alaska, South Dakota, or Tennessee, or an individual residing in one of those states. The Community Property Trust Act works the same way by permitting any Floridian or a dually-registered trust company to act as a trustee of a Florida community property trust. Florida has 2.5 times the population of the states of Alaska, South Dakota, and Tennessee combined, and Florida married couples can serve as trustees for themselves. Furthermore, a great many individuals who reside in the Northeast or the Midwest have close friends, relatives, or advisors in Florida that can serve as trustee of a community property trust. For most married couples, the sole benefit of having a community property trust is that all assets under a community property trust will receive a fair-market value date of death basis for federal income tax purposes if the Community Property Act works, which is an issue described below. For example, Harry and Sally Deli live in New York and are in their 70s. They have $3 million worth of stock for which they paid approximately $500,000. If they sell them now, they will have a $2.5 million capital gain and may have to pay a 23.8% combined federal income tax and Medicare tax, not to mention a 37% New York state tax. The federal income and Medicare tax would be $595,000, and the New York capital gains tax would be $925,000, if they are in the highest brackets. If one of them dies and these assets are held in joint names, then the surviving spouse will have the ability to sell $1.5 million worth of these holdings immediately after the sale without paying state, federal, or Medicare tax, if values stay stable, but would pay one-half of the tax amounts described above if rates stay the same and the surviving spouse sells the other half of the investments while living. Instead of holding these investments jointly or placing them into the name of the spouse that might be expected to die first, Harry and Sally can establish a Florida community property trust and have it drafted by the estate planning lawyer for their daughter, who lives in Boca Raton, Florida, and their daughter can serve as trustee. On the first death, the surviving spouse can claim a $3 million basis in the stocks and pay no state, federal, or Medicare tax on the sale. The second advantage of a community property trust, or community property ownership in general, is that on the death of one spouse, all community property can be used to fund a credit shelter trust that can benefit the surviving spouse without being subject to federal estate tax in his or her estate. While the estate tax exemption of $11,700,000 per decedent has made estate tax planning less of a concern for most taxpayers, many factors have caused a greater number of married couples to have the need for and interest in estate tax planning. The scheduled reduction in the estate tax exemption to one-half of its otherwise inflation-adjusted amount in 2026, and Bernie Sanders’ proposed plan that would reduce the estate tax exemption to $3.5 million and the gift tax exemption to $1 million stand to affect more taxpayers. These potential legislative changes along with significant increases in net-worth that have occurred as the result of the recent stock market run-up and rising real estate prices are incentivizing many married couples to learn about and engage in estate tax planning. One challenge for many couples is how to lock up as much in assets as possible under a credit shelter trust on the first death, when the surviving spouse may have significant estate tax challenges, but only approximately half of the assets that can be used to fund a credit shelter trust are far less than the exemption amount. For example, let us assume that Harry and Sally have $7 million in personally owned investment assets, a $1 million home, and $3 million in IRAs. They also receive approximately $150,000 in pension income, and their assets are expected to grow at approximately 7.25% a year after taxes. They have a 20-year life expectancy, despite eating a lot of deli food, including corned beef, potato knishes, and egg creams almost every day. In 20 years, their net-worth will be approximately $47,338,199 so they would like to not only avoid capital gains tax for the surviving spouse but also place as much as possible into a credit shelter trust on the first death. If Harry and Sally each presently has approximately $4,000,000 worth of assets in a separate revocable trust, or $8,000,000 worth of assets in a joint trust that only has half of the assets locked up under a credit shelter trust on the first death, then there can be a significantly higher estate tax on the second death. Harry and Sally may therefore consider a JEST (“Joint Exempt Step-up Trust”) in lieu of a Community Property Trust for their planning. But, is the JEST Trust Better – We’re Not Jesting Under a JEST Trust, the first dying spouse has the power to direct trust assets to creditors of his or her estate, which attracts the assets to his or her estate so that they may receive a new income tax basis under Code Section 1014(e), and be considered to be the assets of the first dying spouse for purposes of funding a Credit Shelter Trust. Three Private Letter rulings and a Technical Advisory Memorandum (“TAM”) published in 1999 and 2000 support this proposition, although there is some risk that the IRS might not follow these non-precedential pronouncements and take the position that the transfer of assets considered as owned by the surviving spouse to a credit shelter trust might be characterized as a gift by the surviving spouse. This risk is ameliorated by the design of the JEST trust, which contains provisions that would make any credit shelter trust funded by the surviving spouse considered to be an incomplete gift for gift tax purposes by giving the surviving spouse a power to direct how assets may pass among common descendants or otherwise upon death, and requiring the surviving spouse’s consent to any distribution. The same Private Letter rulings and TAM that concluded that a credit shelter trust could be funded with assets considered as owned by the surviving spouse also concluded that those assets would not receive a new income tax basis, based upon the assertion that the arrangement constitutes a gift by the surviving spouse to the first dying spouse, that is then inherited by the surviving spouse, thus triggering Internal Revenue Code Section 1014(e). The Private Letter Rulings and TAM, however, failed to point out that the Statute applies when an asset is gifted to a decedent who devises it back to the donor upon death, and not a situation where the assets are left to an irrevocable trust that may benefit the donor. A properly drafted JEST trust may therefore contain provisions that would make it unlikely or potentially even impossible for the surviving spouse to benefit from the credit shelter trust that is funded with the assets considered to have been held by the surviving spouse. The provisions would accomplish this by providing that a separate credit shelter trust funded from the assets from the first dying spouse would be used before any distributions would be made to the surviving spouse from the second credit shelter trust and that the surviving spouse will not even be a beneficiary of the second credit shelter trust unless or until trust protectors who are serving in a non-fiduciary capacity would add the surviving spouse as a beneficiary. As a practical matter, assets might be sold to avoid capital gains taxes shortly after the death of the first spouse, and the surviving spouse would not be added to or considered to be a beneficiary of the JEST credit shelter trust unless or until it is clear that the income tax return for the tax year of the sale would not be audited, or that the audit would not be complete. The JEST trust is clearly more complicated than the community property trust from the point of view of the drafter, but should allow for the funding of a credit shelter trust from all assets of the JEST. Will a Community Property Trust Work? Regarding possible concerns about the Florida Community Property Trust Act, credible articles have been written which indicates that the IRS may not allow for a full step-up in basis for a trust which provides community property treatment for individuals who do not live in a community property state. Westfall & Mair discuss the 1944 Supreme Court case which creates uncertainty regarding whether community property trusts settled in a non-community property state (such as Florida) are entitled to the 1014(b)(6) double step-up in basis. In Commissioner v. Harmon, 323 U.S 44, the Supreme Court held that an Oklahoma statute that allowed couples to opt-in to a community property regime was not recognized for the purpose of federal income taxes. Moreover, the IRS takes the position that the Harmon decision ought to apply to the Alaska trust scheme for income reporting purposes. However, a number of commentators argue that 1014(b)(6) will apply to community property trusts settled in a consensual community property state. Stay tuned for a more in depth discussion on the Harmon decision and uncertainties regarding the application of 1014(b)(6) to community property trusts settled in non-community property states in Part II of this article. The Almost Ready for Prime Time Charts – Use at your own wrist.

Charts Comparing the 4 States with Community Property Trust Statutes:

|

|||||||||||||||||||||||

Article 2The Demise of Equity Split Dollar in Estate Planning |

|||||||||||||||||||||||

Article 3Florida Supreme Court Tells The American Bar Association What To DoDifferences in Opinion on Racism and Diversity- Florida Lawyers Caught in the Middle

By: Alan GassmanAlthough “[a] simple letter to the Business Law Section…would have sufficed”, the Florida Supreme Court has, on its own motion, made law that denies continuing legal education credit to Florida lawyers for programs presented after April 15 that require diversity among course faculty or participants. In re: Amendment to Rule Regulating The Florida Bar 6-10 (Labarga, J., dissenting). I have been a member of the Florida Bar since 1984, and have been proud for what it does and what it stands for. During these years I have been the chairman or co-chairman of over 45 continuing legal education programs, and I have spoken for many more than that. Some years ago I was informed by the Bar employees who managed these programs that we had to have diversity speakers, meaning women and/or racial minorities for each program. My initial reaction was that this was an inconvenience in situations where my top picks were not women or racial minorities, but I quickly understood the importance of this edict, and was more than willing to follow it. As a result of this, speaking and writing opportunities became available to a number of lawyers who would have not otherwise participated as presenters in our programs. Most of them did a great job, and many grew professionally in part because of the recognition and career development that comes with the dozens if not hundreds of hours of preparation that can go into a good one hour talk. I have also been on the board of advisors for non Florida Bar conferences, including law school sponsored conferences. While serving on these boards the same rule generally applies, whether it is written or not. Quite candidly, many people who take the time and trouble to be on an advisory board for a conference want to see diversity and actually insist upon it when the first draft roster has none. MORE FOR YOU The origin of this horrific notice was that the Business Law Section of the Florida Bar had imposed a similar rule, and this was found by the Florida Supreme Court, on its own motion, to violate the law by discriminating against white males who would not have speaking opportunities because they were being replaced by non-white males or by females. The ABA implemented its Diversity & Inclusion CLE Policy back in March of 2017. The policy requires its sponsored CLE programs with three or more panelists to have at least one diverse member, programs with five to eight panelists must have at least two diverse members and programs with nine or more panelists must have at least three diverse members. Following the April 15th ruling ABA President Patricia Lee Refo stated “We are reviewing our CLE requirements in light of the Florida Supreme Court opinion while maintaining our unwavering commitment to diversity and inclusion in the legal profession.” The Florida Bar’s spokeswoman, Jennifer Krell Davis, told the ABA Journal “The Florida Bar is complying with last week’s order from the Florida Supreme Court and will not be certifying CLE credit for courses that come from sponsors with speaker quotas as described in the order.” The specific finding of the Florida Supreme Court is as follows: In re: Amendment to Rule Regulating The Florida Bar 6-10, Case No. SC21-284 prohibits The Florida Bar from approving continuing legal education programs that use “quotas based on race, ethnicity, gender, religion, national origin, disability, or sexual orientation in the selection of course faculty or participants.” To support its position the Florida Supreme Court cited two seminal affirmative action cases; Grutter v. Bollinger, 539 U.S. 306 (2003) (5-4 decision) and Regents of University of Cal. v. Bakke, 438 U.S. 265 (1978) (plurality opinion). Both of these cases held, among other things, that race-conscious university admissions programs cannot use quota systems. “Quotas based on characteristics like the ones in this policy are antithetical to basic American principles of nondiscrimination,” the Court said. As Justices Brennan, White, Marshall, and Blackmun stated so eloquently in their concurrence in Bakke, “Candor requires acknowledgment that the Framers of our Constitution, to forge the 13 Colonies into one Nation, openly compromised this principle of equality with its antithesis: slavery. The consequences of this compromise are well known and have aptly been called our ‘American Dilemma’. Still, it is well to recount how recent the time has been, if it has yet come, when the promise of our principles has flowered into the actuality of equal opportunity for all regardless of race or color.” Furthermore, the justices go on to explain that “claims that law must be ‘color-blind’…must be seen as aspiration rather than as description of reality.” For “we cannot…let color blindness become myopia which masks the reality that many ‘created equal’ have been treated within our lifetimes as inferior both by the law and by their fellow citizens.” Regents of U. of California v. Bakke, 438 U.S. 265, 327 (1978) I am scheduled to speak and commonly speak for a number of not for profit educational organizations, but should I speak or assist with a program that is determined to be racist in nature by one Supreme Court or the other? Recently I volunteered to donate money and go to law schools to speak to law students about how to be successful tax lawyers. I was told point blank that one law school would not permit me to do this unless I was a woman or a minority. I respect that decision but kept my money in my wallet. When I took my Florida Bar oath I agreed to “never reject, from any consideration personal to myself, the cause of the defenseless or oppressed…” Am I to support a Florida Supreme Court rule that punishes organizations that support diversity and inclusion? The new Florida Supreme Court ruling creates a Catch-22 for many educational organizations. Universities work on grants and other enterprises which require diversity and now will be forced to choose between falling in line with grant requirements or receiving Florida Bar approval for CLE programs. Other organizations that provide continuing legal education must now make a concerted effort to not have diversity speakers, or at least to not require diversity speakers. Sadly, the safest route for these organizations will be to have only white male speakers to prove there is no diversity requirement at play. |

|||||||||||||||||||||||

Article 4President Biden’s Budget Includes Big Tax Increases That Will Rock Your Tax WorldSome of the significant tax changes that many taxpayers hoped wouldn’t happen, like Senator Van Hollen’s taxation on transfers and death, are included. |

|||||||||||||||||||||||

Featured Events

Please Don’t Register for this Event “Trust Structures and Strategies” HEREThe video recording will be emailed to all registrants – whether you attend live or not. Saturday, June 19th at noon. Please don’t watch it. This event does not qualify for continuing education credit.

NEW SATURDAY SERIESPlease consider your Saturday mornings booked for the foreseeable future…

“Toast, Trusts, and Taxes with Alan Gassman and Friends”A Sometimes “Maybe” Discussion Illustrating Important Planning Ideas and Information

Join Alan and his guests for these Saturday morning conversations. Please send Alan questions and ideas for discussion. For mature audiences only.

Click to Register for all upcoming Saturday webinars

Click to Register for all upcoming Saturday webinars

|

|||||||||||||||||||||||

All Upcoming EventsRegister for all future free webinars from Gassman, Denicolo & Ketron, P.A. using this link |

|||||||||||||||||||||||

|

|||||||||||||||||||||||

Forbes Corner |

For Finkel’s Followers3 Ways You Are Personally Sabotaging Your Company Culture |

You Tube Channel

Visit our You Tube Channel for featured webinars and more.What is everyone watching?Click on the playlists below to find out! |

Humor

|

Today in HistoryBy: Wesley Dickson |

5 Star Reviews from Readers like You!

Great newsletter and courses. I’m not always able to attend but it looks like you’re having fun! – Anonymous

As always, Alan is entertaining and generous with his knowledge. I’m happy to be able to call him my friend! – Sandy

Did you enjoy reading the Thursday Report? Send your thoughts and comments to info@gassmanpa.com for a chance to be our next featured 5 star review!

|

|

Gassman, Denicolo & Ketron, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200

|